Introduction

Melbourne, the 2nd inhabited city in Australia, had been named the “World’s Most Liveable City” seven times before the COVID-19 epidemic. It gained notoriety as the “most shutdown city in the world” by mid-October 2021 due to numerous government lockdown orders that lasted 262 days over 19 months (Kim, Lee, and Ku, 2021). The Australian government shut the nation’s border, prohibiting incoming travel and preventing citizens from leaving, is using the nation’s natural geographic defense as an island. Internal borders quickly closed as city governments balanced their inhabitants’ health concerns with political, economic, and other concerns.

The tremendous financial and social impacts of the State and federal governments’ COVID-19 pandemic reaction on the country’s more significant arts industry are partially explained by Melbourne’s degrading name change. The paradox significantly aided a surge in the Australian art market (Bernardi, 2021). Overall, Australia’s capacity to isolate itself from the rest of the world led to significantly fewer COVID-19 deaths than in other industrialized nations, such as the USA and Western Europe, validating the country’s description of itself as a lucky nation (Hildebrandt, 2020). However, as this article will demonstrate, the Australian art market has a terrain where some participants have been luckier than others during the COVID-19 pandemic.

The Wider Australian Arts Economy’s Effects

The foundational elements of the Australian arts economy were already unstable when the COVID-19 epidemic began in February 2020. This was partly due to a pronounced trend of decreased financing for the arts industry that the federal government level has developed over the past ten years. Australia ranks 23 out of the 34 nations in the Organization for Economic Cooperation and Development (OECD) regarding overall government support for cultural institutions. The Australian art market comprises only a tiny portion of the global art business. Demand for fine art has historically been firmly centered on domestic art creation. Despite Australia’s gross domestic product ranking it among the top fifteen economies in the world, the country’s art sales represent less than 1% of global sales.

The already fragile arts economy was instantly and badly hit by the Federal and State governments’ limitations on movement and crowd sizes in early 2020 in response to the mounting pandemic danger. The prevention of professional artists from generating direct revenue from live concerts and commercial art exhibitions because these were some of the first occasions rescheduled or abandoned. Losses in arts-related companies in both the commercial and public sectors soon accumulated once all museums, festivals, and other cultural events were shut down. The Australian Bureau of Statistics (ABS) discovered that those in the arts industry had the highest likelihood of reporting trouble meeting their financial obligations. At the same time, the pandemic and associated restrictions persisted throughout 2021.

The Paradox of the Art Market

Over 2020–2021, sales at well-established commercial galleries with devoted patrons and a stable of well-known artists unexpectedly increased. In the twenty-eight-year history of one gallery, these years were among their best (DiCindio, 2021). Younger commercial galleries, on the other hand, found the pandemic atmosphere to be very stressful and financially problematic. In different situations, this was made worse by the loss of artists from their stable to more extensive galleries that could provide higher chances of earning sales. According to research, emerging artists, who newer galleries frequently sponsor, had their careers halted in the 2020–2021 time frames because collectors stuck with well-known performers and establishment galleries (DiCindio, 2021). More reliance on art exhibitions, which were unable to run as usual and were instead obliged to transfer their business models online, affected galleries with less established customers. This turn proved successful in certain circumstances, as evidenced by the news that the Darwin Aboriginal Art Fair had record sales of AUD 3.12 million in 2021 (Davenport, 2022). According to the Sydney Contemporary Art Fair, they sold twice as much art in 2021 as they did online in 2020.

However, as the pandemic progressed, some gallery owners reported feeling a little digital weariness and expressed a desire to return to the networking possibilities that sales provided. In certain situations, the number of collectors interested in purchasing new artwork increased by as much as 50%, according to all owners of auction houses, commercial galleries, and art fairs (Davenport, 2022). The greater interest was justified almost universally by the limitations on mobility. Australian collectors’ discretionary funds increased since they were compelled to delay or cancel all international travel due to the high cost of tickets, accommodations, and other expenses (Ackermann and Harlow, 2021). People naturally focused on enhancing the built environment as they spent more time in their homes. It has sparked a rush of furniture purchases, home renovations, and an interest in collecting great art. One gallery owner cited an instance of a presentation for a well-known Sydney-based artist in whom 90% of the available works were soon purchased (Ackermann and Harlow, 2021). More than half of the purchasers said they were forgoing overseas trips to buy art.

Despite the grave circumstances affecting artists and businesses that support the arts, several gallery owners observed a strong desire to promote the local Australian art scene. Collectors demonstrated a stronger sense of community devotion and perhaps even a sense of civic nationalism by purchasing locally made artwork (Ackermann and Harlow, 2021). There were also allegations that home-based collectors were resuming cultural pursuits that had previously been put on hold due to hectic job schedules and overseas travel. Wealthy Australians had more time to look into and buy artwork because of the pandemic’s slower pace, as they were either too busy or distracted to do so in the past.

Another factor that fueled demand for Australian art during the COVID-19 pandemic period is more visibly embedded in established art market systems. The fact that essential shows at important public art institutions came before the current demand for works by artists like Sally Gabori, Arthur Streeton, Bessie Davidson, and Clarice Beckett on the art market was not merely a coincidence (Snels, 2021). It has long been understood that an artist’s high status due to having their work recognized by public art organizations translates to greater symbolic worth and cultural capital. Therefore, as collectors compete to own works of art that have been acknowledged as canonical by institutions, curators, and art historians, it is only a tiny leap to increased retail prices (Snels, 2021). In 2020 and early 2021, the Art Gallery of New South Wales hosted the Arthur Streeton exhibition to remind older collectors of his work’s exceptional quality while also introducing many newer collectors to his significant role in Australian art history.

Coping Mechanism Adapted by Art Organization during COVID-19

The Australian art market, a crucial component of the more significant arts industry, was impacted by the COVID-19 epidemic in early 2020. Numerous private art galleries in 2020 saw a severe decline in sales in the first and second quarters, and others were forced to think about permanently closing (Ogbeide, 2020). When significant auctions were rescheduled or called off during this time, auction houses experienced similar disruptions. These businesses relied heavily on the Job Keeper program and the accessibility of government-backed small-business overdrafts to sustain employee employment and deal with the revenue loss caused by the epidemic and related restrictions.

The effectiveness of government stimulus initiatives implemented during the epidemic was further hampered by the intricate nature of employment agreements in the arts economy. 70% or AUD 3.06 billion, of the AUD 4.32 billion in authority payments to the industry in the 2019–2020 fiscal years came from the Job Keeper program, which paid companies for keeping furloughed workers on the payroll. However, many employees in the arts industry were not eligible for the advantages of this program since they had not worked for their present business in more than a year or were on short-term contracts. These workers were made to accept the lower, less reliable Jobseeker payments, which were merely a repackaging of the prior unemployment compensation program (Krauss and LaRiviere, 2022). The federal government also provided 15 more funding packages totaling AUD 1093 million to the arts industry. Unfortunately, the planning and direction of these funding projects were not always excellent. Several packages drew criticism for being difficult to use and slow to activate, favoring huge arts organizations over lone artists.

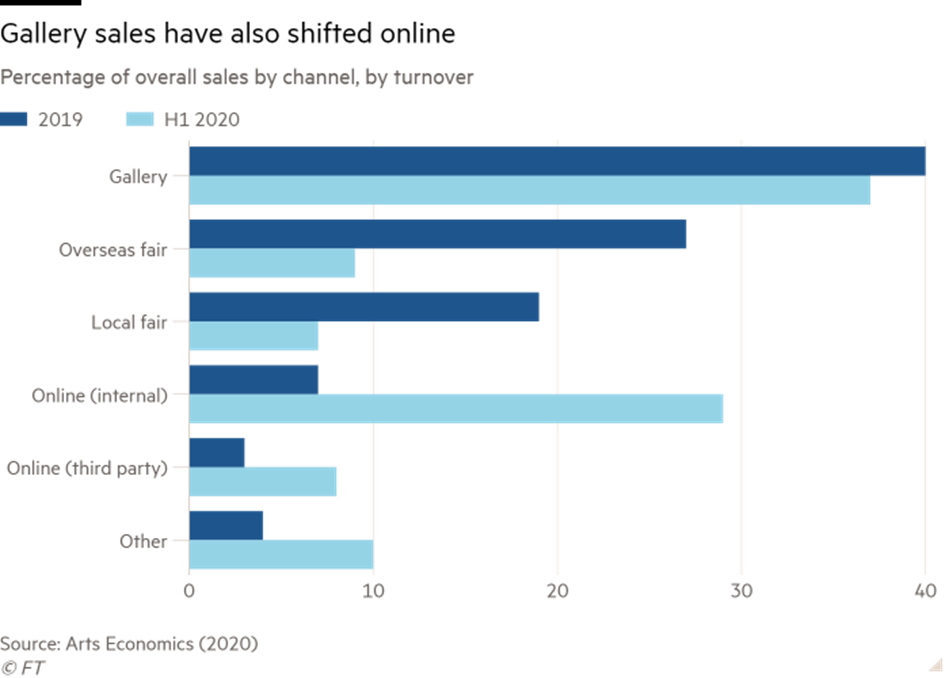

The global art market has been rebalanced due to the digital turn brought on by COVID-19 lockdowns. Since 2000, both primary and secondary markets have been digitizing their operations, using digital photos and PDFs as the de facto means of creating catalogs and price lists and illustrating artwork (Magliacani and Sorrentino, 2021). Online viewing rooms (OVRs) for corporate galleries and online auctions for established auction houses progressed the digitalization of the art market systems during the pandemic. Thus firms implicated the use of digitization as to sale their products online during the COVID-19 period.

The COVID-19 outbreak has negatively impacted the Australian art market’s art fair segment. The two critical fairs Melbourne Art Show and Sydney Contemporary—were compelled to shut down their physical manifestations for two years due to strict lockdowns and interstate border bans. (DiCindio, 2021). The Australian art fair scene was already challenging before the pandemic. Sydney Contemporary had emerged and had a complicated governance structure run by a not-for-profit company, causing problems for Melbourne Art Fair (MAF), a biennial event established in 1988. By the middle of 2020, MAF has teamed up with the online venue Ocula to carry out its 2020 iteration as scheduled. As a result, it decided against a 2021 offering and delayed its launch until a live event could be held. On the other side, Sydney Contemporary developed its software yearly and chose the OVR format in both pandemic years. (Ackermann and Harlow, 2021). Commercial galleries’ reactions to Sydney Contemporary’s success were mixed, which seemed to be consistent with each gallery’s online success. Art fair participation is just one part of a larger digital sales plan.

The Digital Pivot

The pandemic-driven digital transition had a more significant influence on the Australian art market because of a fast shift in consumer behavior more broadly. Before the outbreak, Australians were already thought to participate in internet shopping less frequently than their counterparts in Europe and the USA. Consumers were obliged to turn to internet options because of the severe restrictions on the population’s mobility caused by lockdowns, which were both widespread and localized (Krauss and LaRiviere, 2022). As a result, Australia’s art market expansion through digital technology was exacerbated as collectors quickly embraced this new form of interaction. The interaction between their online gallery presence and their shop window display allowed potential buyers to see the actual artworks while traveling within their lockdown-designated travel bounds. The government pandemic funds were used to purchase technology to enhance the quality of the digital presentation with devices like high-resolution video cameras. Most galleries who succeeded with their online displays said they would continue participating in their gallery presentations after the pandemic.

The prior digital knowledge of the gallery and the financial and human resources to take advantage of the multiple digital opportunities have been directly committed to the effectiveness of the digital shift for Australian corporate galleries. Before the pandemic, only a small number of the galleries had established contacts with OVRs, mainly made possible by involvement in global art exhibitions—using third-party software, several constructed online viewing spaces that matched how exhibitions were displayed in spaces (Ogbeide, 2020). The significance of the “physical,” or the actual or virtual look of a physical art-viewing experience, was acknowledged by several gallery respondents. Auction businesses were allowed to run during the COVID-19 pandemic but without customers. As a result, the “stigma” associated with online auctions in terms of value and quality was eliminated, and all collectors were forced to interact with auction houses digitally (Krauss and LaRiviere, 2022). As a result, auction houses experienced increased business across the board: increased buyer registration as more collectors accepted the idea of online shopping. Moreover, it led to increased lot volume as vendors realized the growing number of potential buyers, increased lot value as the stigma of online activity faded, and increased sales outcomes as multiple bidders competed over each lot.

The auction houses emphasized the value of the “phygital,” just like the commercial galleries. A live broadcast of an auctioneer in the auction house taking bids via internet platforms and phones was included in most large auctions, which were rarely held online. Some could schedule viewings in advance. The advantage of a captive audience with digital capabilities led to the development of a whole original format: the single-lot auction frequently referred to as a “masterpiece” possibility.

Throughout the COVID-19 epidemic, the secondary and primary Australian art market sectors observed specific changes in digital interaction, which were frequently in sync with the rhythm of lockdowns and openings. In a big country with many shifting interstate boundary laws throughout the pandemic, digital involvement has been especially crucial for overcoming the tyranny of distance. According to chronology, 2020 seems to have seen a rush of formerly cautious people into digital participation (Davenport, 2022). Australian consumers and a younger population that grew up with technology embraced digital media to engage with art.

The year 2021 showed that internet trading had become the “new normal” but that it would take more work from market participants to maintain collectors’ interest and involvement. The digital shift brought on by the COVID-19 epidemic has been exceptionally advantageous for the Australian art market. The primary and secondary markets have been forced into digitalizing their systems with early investment from the government and, as a result, have witnessed economic growth through more digital participation (DiCindio, 2021). Future operations of Australian galleries, art fairs, and auction houses seem to be strengthened by a “phygital” approach, which integrates physical and digital parts of their enterprises.

Conclusion

Being an island nation helped Australia fight the COVID-19 outbreak and contain it. Australia saw fewer deaths and hospitalizations than many others due to its geographic advantage and stringent government controls on public gatherings and movement. But during the COVID-19 epidemic, these same variables created a conflicting and complex business environment for the Australian art market. On the one hand, home-based collectors have become a key force in the Australian art market and have contributed to the market’s robust sales performance. In many ways, this was made possible by Australia’s long overdue digital pivot, which allowed art fairs, commercial galleries, and auction houses to stay in touch with the expanding community of art collectors.

However, Australia’s geographic isolation and a greater appreciation of the value of supporting the country’s artistic community intensified the already elite nature of the country’s art market. As constraints on the actual mobility of persons and commodities were too onerous, plans to increase the demand for Australian art among overseas art buyers had to be shelved. The Australian art market underwent a structural change due to the COVID-19 epidemic, moving from an investment-driven boom to a revived expansion supported by stay-at-home collectors and more internet engagement. This digital pivot’s breadth may provide new hope for overcoming the barriers of distance and nationalism that have limited the commercialization of Australian art outside of its borders. That may thus enable this “Lucky Country” to forge a more substantial and lasting connection with the world’s art market.

Reference List

Ackermann, S. and Harlow, T. (2021) ‘the battle of COVID-19: Art teachers as an indestructible force’, Art Education, 74(6), pp.28-32.

Bernardi, M. (2021) ‘The Covid-19 pandemic and the inescapable challenge of the Anthropogenic for museums’, Museum International, 73(3-4), pp.146-155.

Davenport, A. (2022) ‘Art education in the age of COVID-19: The museum of contemporary art (2021)’, International Journal of Education through Art, 18(1), pp.129-131.

DiCindio, C. (2021) ‘Expressions of care in an art museum education course during COVID-19: Moving to an online class format’, Art Education, 74(6), pp.46-47.

Hildebrandt, M. (2020) ‘Creativity and resilience in art students during COVID-19’, Art Education, 74(1), pp.17-18.

Hoffman, S. (2020) ‘Online exhibitions during the COVID-19 Pandemic’, Museum Worlds, 8(1), pp.210-215.

Kim, S., Lee, H. and Ku, Y. (2021) ‘Future prospects of the converged textile and fashion exhibition industry according to COVID-19’, The Korean Society of Science & Art, 39(5), pp.49-61.

Krauss, S. and LaRiviere, M. (2022) ‘Unexpected gifts: Art teaching in the COVID-19 pandemic and authenticity in the classroom’, Art Education, 75(2), pp.56-58.

Magliacani, M. and Sorrentino, D. (2021) ‘Reinterpreting museums’ intended experience during the COVID-19 pandemic: Insights from Italian University Museums’, Museum Management and Curatorship, pp.1-15.

Ogbeide, G. (2020) ‘Pandemic (COVID-19) implications: Recommendations for the events and tourism industry, Events and Tourism Review, 3(2), pp.32-38.

Prnjat, D. (2021) ‘European museums: Surviving the COVID-19 pandemic’, Cultural Management: Science and Education, 5(2), pp.83-94.

Snels, J. (2021) ‘Virtual connectedness in times of crisis: Chinese online art exhibitions during the COVID-19 pandemic’, World Art, 12(1), pp.95-118.

Tan, M. and Tan, C. (2021) ‘Curating wellness during a pandemic in Singapore: COVID-19, museums, and digital imagination’, Public Health, 192, pp.68-71.

Tunnikmah, N. (2021) ‘Impact of Covid 19 on the world of fine arts; between online exhibitions, virtual exhibitions in cyberspace appreciation’, SSRN Electronic Journal.

Zollinger, R. (2021) ‘Being for somebody: Museum inclusion during COVID-19’, Art Education, 74(4), pp.10-12.