The main prerequisites for an increase in cement consumption in Saudi Arabia include the demographic rates, the crucial of which is growth of urbanization, governmental impact, as well as the saturation of the Saudi Arabian cement market compared to global indicators. These indicators are to be presented and analyzed properly in order to get an in-depth understanding of the industry.

Governmental Impact

The economy of Saudi Arabia considerably depends on oil-driven revenues. The oil – as well as gas – industry contributes about half of the country’s GDP. Nevertheless, given the unstable essence of the sector, the Saudi authorities aim to diversify its economic significance from oil. In 2016, the Saudi Arabian authorities provided the Saudi Vision 2030 in order to enhance economic growth by reducing over-dependence on oil (Business Wire, 2020). Saudi Arabia develops a number of economic cities in order to strengthen the country’s competitiveness, as well as attract investments into other sectors. The Saudi Vision 2030 is about stimulating the progress of these sectors – starting from healthcare and ending with real estate. “This will increase the number of residential and non-residential construction projects in the country” (Business Wire, 2020, para. 3). The mentioned factors should be considered critical in the framework of stimulation of the cement market growing.

Demographics

Currently, Saudi Arabia population is 34,813,871, with a yearly change +1.59% (Worldometer, 2020). The population in the country tends to demonstrate growth and it proceeds to be 0.295% higher than the related rate in the Middle East. Then, infant mortality rates have dropped substantially over the last twenty years – this indicator was about 25 deaths per 1000 infants in the year 1995, and in 2017, it was 6.3 deaths (Worldometer, 2020). Generally, Saudi Arabia might be perceived significant within the scope of demographic indicators, the most critical of which are presented above. It has a positive influence of the industry as there are more and more citizens who require cement for various needs – starting from building accommodation and ending with premises for a business. Such a tendency is accompanied by the one of growing urbanization rates, which implies increased demand in the cement industry.

Since the middle of the 20th century, Saudi Arabia has been facing a substantial extent of urbanization processes. The rate of people living in the country’s urban areas has risen “from 21% in 1950, through 58% in 1975, to 83% in 2015, and is estimated to reach 86% by 2030 and 90% by 2050” (Alahmadi & Atkinson, 2019). This essential indicator depicts that the population requires more accommodations from year to year, which stimulates the construction industry that is dependent on cement supplies considerably. Such a state of affairs – accompanied by the aspects above – contributes to the increased demand for cement. “Cement demand witnessed a slight increase during 2019 after a three-year drop in market demand to reach 42.3 million tons in comparison to 40.9 million tons during 2018” (Saudi Cement, 2019, p. 11).

Competitive positioning

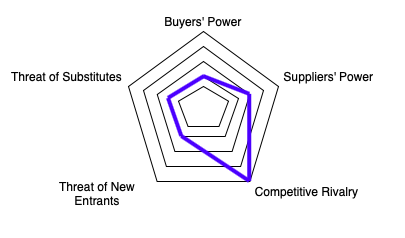

Porter’s Five Forces

Based on the degree of influence of threats on participants in the cement market in Saudi Arabia, the level of investment attractiveness of this industry is presented in the form of Porter’s five forces scheme. The high investment costs of setting up a business and the mandatory certification procedure are obstacles to entering the cement market. However, the fact that the extent of threats from suppliers and substitute products is not peaking makes it easier for current market participants. Moreover, taking into account the improvement in the macroeconomic situation and the increase in demand for cement in 2019, the expected growth in demand for housing and infrastructure construction in the country significantly strengthens the development potential of the cement industry in the long term, which is beneficial for Saudi Cement.

Threat of Substitutes – Low

Cement production is a resource-intensive process associated with the release of large volumes of carbon dioxide. As a result, research is constantly being carried out aimed at creating substances with similar properties. At home, substitutes can be substances such as alabaster, gypsum mixtures, mineral substitutes, which are cheaper and easier to use materials. In housing construction, the arrival of new technologies, as well as the displacement of brick by frame and steel structures, will reduce the need for cement.

Nevertheless, in the medium term, the construction industry is not expected to massively replace cement with other materials due to insufficient practice of using these materials in construction, along with high research and development and investment costs. In the adjacent market of dry building mixtures, the share of cement-based mixtures is the highest. In the medium term, cement as a base for these mixtures will maintain its leadership in the dry building mixtures market. This is due to its versatility, as well as the strength and solidity of the coating formed. In the context of large-scale construction work, there are currently no alternatives that could displace cement from the market, and therefore the threat of the emergence of substitute goods is unlikely.

Threat of New Entrants – Low

A significant limitation for new entrants seeking to enter the cement market is the high cost of the initial investment. As a result, it has become more difficult for new entrants to enter the cement market over the past few years. In the cement industry, the threat of new entrants is limited by economic and geographic barriers, as well as the introduction of mandatory certification and complexities with the import of products. Then, there is also market dependence on the geographic component. Due to the uneven distribution of natural raw materials for cement production (such as clay, limestone quarries) and the local monopolization of the markets by some producers, the threat of new entrants to this market is unlikely. Dependence on geographic aspects leads to additional costs for transporting cement to other regions, which can make the prices of a third-party supplier uncompetitive compared to the merits of local monopolists.

Power of Buyers – Low

The sectoral structure of cement consumption is undergoing constant changes associated with fluctuations in the volume of production of consuming industries: the manufacture of reinforced concrete, ready-mixed concrete, aerated concrete, the production of dry building mixtures, cement-particle boards. Most of the final consumers of cement in the domestic market are represented by construction companies (carrying out housing and infrastructure construction/renovation), construction markets, and retail stores (where goods are purchased for the needs of private construction). The dynamics and seasonal nature of the construction market largely determine the development of the cement market in this region. Lacking full-fledged substitutes, cement as a building material satisfies the basic human need for housing, and therefore the price elasticity of demand is rather low.

Power of Suppliers – Moderate

Most of the cement producers have their own raw material base – a deposit of clay, limestone, or chalk, located in the immediate vicinity of the plant itself. The rest use the waste received after processing by other enterprises as raw material. Due to the fact that in the structure of the prime cost of raw materials, the share of independently produced raw materials is 90-95%, dependence on suppliers of other raw materials does not significantly affect the negotiating positions of cement producers. Nevertheless, there is still a dependence on powerful domestic suppliers. For instance, Saudi Aramco is a provider-monopolist of gas in the country, and the cement sector might be described as fuel-intensive – it takes approximately one-third of production costs. Hence – given these two relatively contradictable aspects – suppliers’ power may be considered moderate.

Competitive rivalry – High

The cement sector in the country operates in the conditions of the most significant gross margins, as well as net profit margins, within the global scope. In Saudi Arabia, there are relatively low expenses on production and affordable fuel at cheap rates, given the preferences provided by the national monopolies – such as Saudi Aramco – to domestic producers. These conditions inevitably contribute to the emergence of the industry’s giants that will dictate the market conditions and compete mostly with each other. However, there is a considerable number of these giants – starting from Yamama Cement and Yanbu Cement and ending with Saudi Cement itself. All of the competitors tend to demonstrate prominent profits, success, and development, which causes intense competition within the sector. This leads to the notable economic indicators of the industry; in particular, “Cement and clinker dispatches for the month of Jan-19 stood at 4.23mn tons (including exports), compared to 4.08mn tons in Jan-19, depicting an increase of 3.5%Y/Y primarily driven by exports” (Al-Jazira Capital, 2019, p. 1).

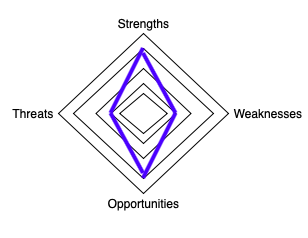

SWOT analysis

SWOT analysis shows that the company is a strong competitor within the industry. The firm’s annual grinding (capacity) tons is 11 500 000, which is the prominent indicator that allows the firm to be among the most powerful rivals (Saudi Cement, 2019, p. 8). Saudi Cement’s core values and actual operation also reveal that the corporation focuses on quality, implements advanced technologies, and tends to be profitable in the long run. In 2019, its profits demonstrated considerable growth – operating increased by 17.8% compared to 2018 (Saudi Cement, 2019, p. 7). Then, given the benefits from Vision 2030 and the tendency to soften export restriction for cement export, the company has exceptional opportunities as well. Nevertheless, Saudi Cement claims that it has no interest in short and middle term expansion, which may be perceived as a weakness because a big industry actor is to seize any opportunity for development continuously. Finally, there is also a number of threats for the firm, but given its capacity and possibilities, these threats cannot be considered crucial. Thus, the Porter’s five forces and SWOT analyses show that Saudi Cement takes a strong competitive position.

References

Al-Jazira Capital. Cement dispatches for January 2019 [PDF]. Web.

Alahmadi, M., & Atkinson, P. M. (2019). Three-fold urban expansion in Saudi Arabia from 1992 to 2013 observed using calibrated DMSP-OLS night-time lights imagery. Remote Sensing, 11, 1–19.

Business Wire. (2020). Cement market in Saudi Arabia 2018-2022 | 5% CAGR projection through 2022 | Technavio. Web.

Saudi Cement. (2020). Annual report 2019 [PDF]. Web.

Worldometer. (2020) Saudi Arabia demographics. Web.