Introduction

Aluminum fluoride (AlF3) is a white crystalline powder which is largely used as an additive in metallic Aluminum production. In principle, AlF3 descends the melting point of the of the alumina feedstock leading to lower operating cost while boosting the conductivity of the emulsion. As a result of the aforementioned characteristics, 92% of AlF3 production is consumed in Aluminum applications and the remaining portion is employed in other industries. Over the past few years, the global market has witnessed a steep rise in demand driven by the increase in downstream production of Aluminum. On a regional level, the kingdom holds a smelting capacity of 1.2MMT while the rest of the GCC states possess a capacity of 6.0MMT and projected to grow in the short-medium term.

Economics

The market growth is fueled by the mounting demand for the aluminum fluoride in smelting, ceramics, pharmaceutical and construction industries as a result of its superior chemical and physical properties. In addition, the rigorous environmental mandates on the food and beverage industry enforced the usage of AlF3 in manufacturing cans owing to its swift recycling rate. Moreover, recent bilateral initiatives between developed countries for the removal of tariffs for steel and aluminum imports is driving further progress. An epitome of such was the United States waiving section 232 in May 2019 on The North America Free Trade Agreement (NAFTA), members and in return, all retaliatory tariffs imposed on American goods were dropped.

Economics Analysis

Numerous local and international players are conducting research and development activities for improving the operational efficiency and patent threatened technologies for aluminum fluoride. Competition in the market is expected to increase with the rising price sensitivity among the players. Do-Fluoride Chemicals Co., Ltd., Gulf Fluor, DuPont, and Alfa Aesar are examples of key companies with significant market shares.

In order to sustain a profitable business in this industry, AlF3 producers must have access to affordable raw material specifically fluorspar and have an efficient technology unlike the aging manufactures who are shutting down due to swelling operating cost. Furthermore, anchoring stable diverse clients is as crucial as the previous factors.

Focusing on Saudi Arabia, it is possible to state that the country’s economic environment is positive. The state has the second most valuable natural resources in the world, being the largest exporter of petroleum globally (Invest Saudi, 2020). The country also has large natural gas reserves allowing it to gain income from its distribution (“National Industrial Development and Logistics Program,” n.d.). At the same time, Saudi Arabia recognizes the need for diversification, meaning it is ready to invest in new projects (Invest Saudi, 2020). Under these conditions, it can import the necessary technology. At the same time, Alumina is available abundantly in Saudi Arabia, meaning it can be used to support the development of the industry. Economic benefits also come from the fact that in 2018 100% of the state’s demand in AlF3 was met by import (Invest Saudi, 2020). Becoming a manufacturer will ensure Saudi Arabia’s decreased dependence.

Demand Analysis

Companies are entering into collaborations, mergers, and acquisitions to increase the demand for aluminum fluoride, and their reach across the globe. Early 2020, Jordan Chemicals Company (a subsidiary of Jordan Phosphate Mines Company (JPMC)) had entered into an agreement with Alufluoride for setting up aluminum fluoride factory. Under the agreement, the first phase of the project includes building the factory, worth USD 25 million, in Al Shidiyeh region in Maan and the modernization of the JPMC’s aluminum fluoride plant in Aqaba for producing aluminum fluoride. The JPMC would also supply the new factory with 20,000 tonnes of fluosilic acid annually, a secondary product of the extraction of phosphate in the Shidiyeh mines.

In February 2019, Alufluoride Ltd had entered into non-binding Memorandum of Undertakings (MOUs) with Jordan Phosphate Mining Company (JPMC), Jordan for production and marketing of Aluminum Fluoride.

Global Experience with Aluminum Fluoride

SWOT Analysis

Production, Operation and Technology

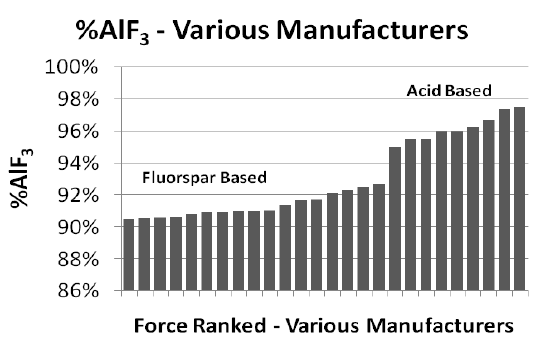

Intrinsically, commercial aluminum fluoride is manufactured by two main methods: dry and wet. The former utilizes fluorspar as the origin of fluoride, while the latter utilizes fluosilicic acid as the source. The dry process results in a denser product, yet higher impurities unlike the wet process. Hence, it’s imperative to consider which way to go based on the targeted market specifications and standards due to the change in the properties of the final product of AlF3. The below figure illustrates the span of purity AlF3 in the final product.

Nonetheless, anhydrous aluminum fluoride has emerged in recent years as a third production process which is considered environmentally friendly due to the lack of liquid waste emission. This change in production and operation is vital for the whole industry as it offers additional benefits for manufacturers and countries interested in the development of the given industry. Following Saudi Arabia’s existing plan, the plant with the high capacity should be constructed, and the recent alterations in the environmental impact make this project feasible (Invest Saudi, 2020). The operations and value chain presuppose four phases, such as acquisition and refining of alumina, its treatment with hexafluorosilicic acid, crystallization phase, and getting the final product used as the additive (Invest Saudi, 2020). Due to the recent technological advances, the harm to the environment and risks emerging during the main operations can be minimized (Invest Saudi, 2020). This leads to the increased attractiveness of the sphere for the potential investors and their readiness to participate in projects.

In light of the intention of the project to serve the local market. primarily Maa’den, prior to expanding the footprint regionally and globally, the current value chain becomes vital for Saudi Arabia’s project. First, following the proposed technology, the state can construct a plant capable of producing the planned amounts of AlF3, which increases the feasibility of business in the region. The technology also allows to increase the production capacity and ensure Saudi Arabia becomes a GCC leader and enters the international level (Invest Saudi, 2020). Under these conditions, the recent advances in technology along with the minimization of the environmental impact offers multiple opportunities for partners and stakeholders.

Altogether, the existing technologies and operations allow Saudi Arabia to invest in the sector. Meeting the local needs, the country also can increase the production of AlF3 and reach desired export numbers, such as 60,000 tonnes in Ras Alkhair next to Ma’aden (“National Industrial Development and Logistics Program,” n.d.). The profitability of the project is justified by the accessibility and allowability of technologies and their use by KSA to achieve the desired goal.

Environment

Considering the lethal effects of Aluminum fluoride in trivial does where it could cause neurotoxic diseases impacting the bone and the nervous system, it should be warehoused in a firmly closed environment away from air, moisture, and heat. Protective gloves, clothing, and eye protection must be worn when handling the chemical.

However, the rising concerns of the lethal effects of AlF3 due to the penetration of aluminum fluoride into the human body through the air or absorbed by the skin is clogging the market growth.

A high level of fluoride in the air or drinking water might also have a negative influence on the health and environment. For this reason, the development of the AlF3 industry should be aligned with the existing regulations regarding hazardous substances. Producers should ensure their plants have specific equipment to prevent leakages, monitor the state of the environment, and protect local communities from the pernicious impact of the substance (Kingdom of Saudi Arabia Presidency of Meteorology and Environment, 2001). It is another factor influencing the industry; however, it does not reduce the attractiveness or profitability for potential actors. Instead, it outlines the demands for successful functioning in different regions.

Political

The political factors regarding the rise of Aluminum fluoride globally and in Saudi Arabia should also be considered when analyzing the business feasibility in the country. At the moment, the states of the Gulf region focus on improving trade relations within the area by introducing additional regulations and tariffs, helping to revitalize the economy. For instance, as a member of the Gulf Cooperation Council (GCC), Saudi Arabia uses the GCC common external tariff (“National Industrial Development and Logistics Program,” n.d.). It constitutes 5 percent that should be levied on most goods imported from states outside the Gulf region (“National Industrial Development and Logistics Program,” n.d.). For this reason, it means that the existing political regulations influence the Aluminum fluoride trade in the region and can be viewed as beneficial ones. Saudi Arabia National Industrial Development and Logistics Program implies working AlF3 plant with the capacity of 20k tons annually (“National Industrial Development and Logistics Program,” n.d.). It can also be achieved by establishing a favorable political environment stimulating the rise of the sector.

Moreover, Saudi Arabia is viewed as a stable country with strong ties with many countries worldwide. It focuses on the development of its international relations with partners in different parts of the globe. First, the country enters trade relations with the Western states to remain an active member of the discourse and diversify its economy. It also presupposes the focus on producing and selling AlF3 as the part of the current plan. Second, Saudi Arabia cultivates trade relations within the GCC as the element of its strategy focused on revitalizing relations within the given region. In such a way, this political factor should also be viewed as a relevant one and justifying the beneficial nature of this business in the area.

Finally, the last important political factor is Saudi Arabia’s membership in WTO. It is a strong factor with multiple long-term effects vital for the economy of the state. The state’s exporters will gain equal and non-discriminatory access to all countries belonging to the organization, which is critical regarding its plans to increase the production and distribution of AlF3 in short terms (World Trade Organization, n.d.). Additionally, the increased transparency peculiar to all spheres will help to simplify relations with other companies vital for supporting the rise of the given sector. Under these conditions, it is possible to conclude that the existing political factors are favorable for the development of the AlF3 industry and justify growing Saudi Arabia’s interest in the production and distribution of this product to other countries. Membership in WTO is a potent facilitator of the global trade vital for the existing plans.

Legal

The rise of the AlF3 industry and the feasibility of business should also be analyzed regarding the existing environmental regulations and laws in the targeted countries. As stated previously, the substance might be dangerous for human beings and animals, meaning that it demands specific storage conditions. It means that the industry should follow the existing environmental regulations. Saudi Arabia’s existing environmental law states that the owner of the plant focusing on producing or working with hazardous substances should ensure necessary precautions and measures to avoid causing substantial harm to the environment (Kingdom of Saudi Arabia Presidency of Meteorology and Environment, 2001). For this reason, any operations involving AlF3 should be performed regarding the existing regulations meaning that additional equipment and measures are necessary to avoid violating current norms and causing damage to the environment. However, Saudi Arabia does not prohibit businesses focusing on AlF3, which makes it more attractive for potential investors.

Meeting the specifications and standards of the targeted markets is a central factor for calculating the profitability of AlF3 producing enterprises in the selected area. The International Organization for Standardization (IOS) is a worldwide federation of standard bodies offering specific regulations, demands, and normative references for different types of business. Consideration of these regulations might demand additional resources and influence the overall profitability of the industry in the area. Additionally, there are specific specifications in different areas that should be considered by producers to ensure the offered product meets the demands of quality. The current standards and specifications make AlF3 business in Saudi Arabia feasible and attractive as they do not introduce additional barriers for the production and sales of the given product. On the contrary, there is a growing opportunity for global cooperation because of the rising demand.

Dumping allegations still remain a significant issue in global trade and introduce additional barriers for cooperation. Dumping presupposes the export of products at less than their normal value, which is viewed as a discriminative policy (World Trade Organization, n.d.). For instance, in India’s market, the problem of dumping has allegations become more relevant because of the state’s policy focused on supporting the local producers (World Trade Organization, n.d.). This factor might also influence the AlF3 industry as its sales globally differ. However, today, dumping is managed by the continued regulation from the governments and global organizations, such as WTO, meaning that the AlF3 business might benefit from the standardized rules and prices meeting the standard level. For this reason, investors are attracted by the sector and the opportunities it offers to new actors.

The existence of strong law firms with anti-dumping policies can also be viewed as one of the vital factors promoting the growing interest in the industry. WTO offers anti-dumping regulations demanding all members of the organization to avoid unfair or discriminative practices aimed at changing the price to acquire additional benefits (World Trade Organization, n.d.). The given framework is employed by the strong law firms focusing on the attempts to resolve the issues with dumping and ensure fair trade conditions for all members of the international cooperation. For AlF3, the existing regulations establish a recommended price that cannot be dumped (World Trade Organization, n.d.). For the market, it means additional stability and the possibility of investing in the sector to acquire benefits. Saudi Arabia, as a member of WTO, might also appeal to the existing rules, which makes its position stronger.

Business Feasibility in Saudi Arabia

Impact of Global Factors

Altogether, the research shows that the global conditions are beneficial for investing in AlF3. First, there is a growing demand for the product in different markets. It means that Saudi Arabia’s business might enjoy favorable conditions and guarantee a stable level of income for potential stakeholders. Additionally, the political, economic, and legal factors also set the ground for the successful integration and cooperation between different partners to acquire benefits and create new channels. WTO regulations combined with the overall positive global experience with AlF3 mean the increased topicality of the product in the future and the constantly growing revenues linked to the sector. For this reason, considering the global factors, it is possible to predict the high business feasibility for the production and sales of AlF3 in Saudi Arabia. The country might join the international intercourse using existing facilitators.

Impact of Local Factors

Local factors also provide the potentially high feasibility of AlF3 business in Saudi Arabia. One of the central weaknesses is the lack of technology needed to establish and support production. However, following the National Industrial Development and Logistics Program, the country plans to create an AlF3 plant in terms of a long-term agreement with Maaden, which might demand 150 million SAR investment (“National Industrial Development and Logistics Program,” n.d.). It includes the development of infrastructure and focusing on eliminating the problems linked to technologies. The country also focuses on diversifying its economy, which is another factor proving the high feasibility of this business in the area. Substantial support from the government, combined with the growing global demand and the development of the sphere, justifies the necessity to create the basis for the rise of this industry and enjoy the first-mover advantage.

Conclusion

Altogether, AlF3 business gains momentum and becomes one of the attractive spheres for multiple investors. The global conditions also prove the growing importance of the sphere and its ability to guarantee stable revenues for investors. The analysis of both external and internal factors shows that Saudi Arabia has high business feasibility regarding the production and sales of AlF3. Its focus on supporting and diversifying the industry, along with the desire to enjoy the first-mover advantage and acquire multiple benefits associated with this sector. It might demand additional investment and cooperation to get technologies needed to align the production and create the plant; however, in a long-term perspective, the focus on developing the sphere might help to become one of the Gulf’s leaders and benefit from the strong international position. Under these conditions, the attractiveness of the sector for Saudi Arabia remains high.

References

Invest Saudi. (2020). Aluminum fluoride investment opportunity scorecard. Mining and Metals.

Kingdom of Saudi Arabia Presidency of Meteorology and Environment. (2001). General environmental regulations and rules for implementation. Elaw.

National Industrial Development and Logistics Program. (n.d.). Vision 2030.

World Trade Organization. (n.d.). Kingdom of Saudi Arabia and the WTO.