Monopolistic competition is a situation in the market where there are multiple sellers with similar but differentiated products. These products are substitutes as they perform similar functions with the point of difference manifested in terms of branding, packaging, or any other form of differentiation capable of attracting consumers.

This type of competition in the market is also characterized by easier market entry and exit for operators. The existing operators have cut their own niches and do not resort to restrict new market entries as they in no way present challenges to their market shares. The operators are also free to set the prices of their products irrespective of the competitors’ moves or reaction as the competition is based on non-price related factors (Deneckere and Michael, 1992).

Monopolistic competition is best represented by the motor vehicle market. In a situation where there are many manufacturer selling cars, they will each have their own market segments depending on the nature of the differentiating factors they have incorporated into their products. The basic function performed by these cars is to move the users from one point to another. However, there are users who will prefer either fast, comfortable, four wheel drive, or even different colors for their cars. The manufacturers will differentiate the cars according to these factors in order to gain competitive edges to attract particular customers.

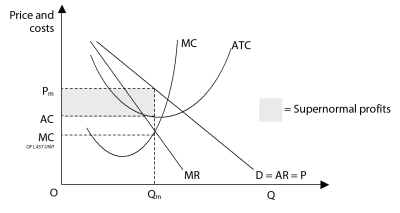

In figure one above; the operator is initially experiencing high demand which is represented by the average revenue curve. As more competitors gain market entry, they will offer substitutes to the operator’s goods. Assuming the operator’s product is not differentiated further the new demand will now be at the marginal revenue curve showing a decrease in demand due to loss of customers to competitors.

External costs and benefits

These are the third party effects that arise in the course of production and consumption of output and which are not accounted for. This is simply because they are felt by individuals outside the market in terms of the spill over effects. External costs are those that are incurred by parties outside the market for which they are not compensated for. On the other hand external benefits are those that are enjoyed by parties outside market and for which they do not pay for (Murty and Robert, 2005).

External costs can take the form of pollution by an industry caused by emission of toxic gases into the atmosphere. When this happens, there are various consequences that are felt by third parties. The toxic gases lead to acidic rain which corrodes iron roofs as well as destroying forests. Furthermore they also harm the ozone layer which leads to exposure to direct sun rays that can result in skin cancer. These costs are incurred by parties that did not participate in the initial activity that caused them (Pannell, 2008).

On the other hand, external benefits can best be explained by the effects that research and development programs have on people’s lives. Normally very few people engage in or contribute to research programs. In the event that these programs yield quality innovations, the effects will be felt by the entire market should the researchers chose to make them public or decide to capitalize on them. A research program that introduces an energy saving electrical appliance presents benefits to third parties that were not involved in the program.

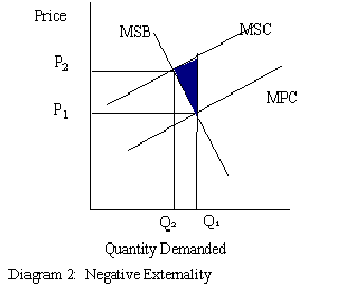

In the above diagram, the price of the commodity in the market is represented by P1 and quantity consumed is Q1. at this level, the market mechanism fails to recognize the extra costs that are not charged to consumers but passed to society in terms of pollution. The optimal price should be at P2 to acknowledge these costs to society. At this level the quantity consumed ought to be Q2 which is less than what is consumed. The shaded region represents the total loss to society.

A mixed economic system

Mixed economies also known as dual economies are those that have blended the functioning of private enterprise with control by the government. The private entrepreneurs are free to engage in activities in the market at their own discretion. Their actions are however controlled, and not coerced, by the government to ensure the efficient functioning of the system in the form of regulations and taxes (Mixed economy a failure, 2011). In such economies the government might also have the monopoly in some areas that are essential for the public good but not profitable for private entrepreneurs such as conventional education, health care, and postal services.

Like many other developed economies, the US is a perfect example of a mixed economy system. There is the spirit of free enterprise with many multinationals such as Apple Inc, the Coca Cola Company, PepsiCo, and Intel based in the country. The production capacities are mainly owned by the private sector individuals. Furthermore these individuals’ activities are governed by the government through its various agencies that are concerned with upholding regulations and collecting taxes.

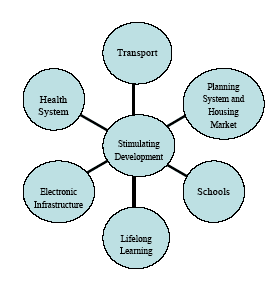

In fig. 3 the government is represented by the central circle. This shows its regulatory efforts to the other activities such as infrastructure, transport, health, education, and house market which are undertaken by the private entrepreneurs. The government oversees all these activities are well undertaken to ensure that they are functioning well.

Price elasticity of demand and supply

Price elasticity of demand and supply can generally be defined as the market reactions to the changes in commodity prices. It is categorized mainly into two price elasticity of demand and price elasticity of supply.

Price elasticity of demand is the buyers’ reaction to changes in the price of commodities. Generally price of commodities and demand are inversely related except for luxuries and necessities. When the percentage changes in demand are larger than the changes in price the demand is elastic (Graves and Robert, 2006). When they are less that the percentage change in price, the demand is inelastic. The nature of the buyers’ reactions or changes in demand will mainly depend on the type of good in question. Luxurious items have inelastic demand simply because their consumers have high disposable income which can accommodate the changes. Necessities also have inelastic demand as they are crucial in life and consumers cannot do without them, changes in prices cannot deter their consumption. On the other hand normal goods have elastic demand as they are not important for survival and consumers can do without them if not seek substitutes.

The demand for normal goods such as televisions can be used to show this relationship. When the prices of televisions decrease consumers will increase their levels of consumption while on the other hand they will decrease their consumption when the prices increase. The demand for food which is a necessity will remain unchanged when the prices change which signals their inelasticity.

Price elasticity of supply shows the reaction of output to the changes in prices of commodities (Tom, n.d.). The level of output and price of commodities are directly related as suppliers often increase their output level in the market when the commodity prices are high. Therefore price elasticity of supply is elastic as the price changes lead to changes in output level. When the prices of cars increase in the market, motor companies such as Toyota and General Motors will increase their supply in the market in order to satisfy this high level of demand as well as make higher profits. On the other hand when the prices decrease, they will reduce their supplies into the market as the demand can be satisfied by the available if not less supply.

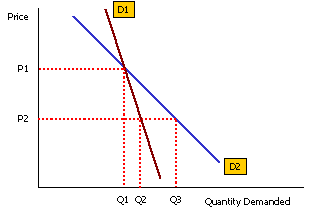

In fig. 4, D1 represents the P1Q1 which are the price and quantity respectively at the initial price level. When the price drops to P2 the quantity demanded on the resultant demand curve increases to Q2. At the initial demand curve the quantity consumed could have been Q3 which represents equal percentage change in demanded. But at Q2 the change in price has caused less change in quantity which shows inelastic demand for the product.

Opportunity cost

Opportunity cost in economics refers to the value of the foregone alternative (Magni, 2009). It is not regarded in the financial statement but is used in the decision making process. In a majority of cases relating to choice, there are often numerous alternatives that can be selected. In the event that they are mutually exclusive one has to settle on only one of them. By selecting a particular alternative, one has to let go of the others that are available. Therefore a rationale decision maker is one who will reduce the value of opportunity costs when settling on an alternative.

This can be shown in a farmer who has one acre of land and has two crops in mind; wheat and corn. The one acre of land can produce 500 sacks of wheat or 700 sacks of corn if he decided to grow the latter. Assuming that the price of a sack of wheat and that of corn is same, the farmer will rely on opportunity cost to make a decision. His profits will be much higher when he decides to grow corn as opposed to wheat. A decision to grow corn will have a low opportunity cost which is the value of wheat whereas a decision to grow wheat will have a high opportunity cost which is the price of corn.

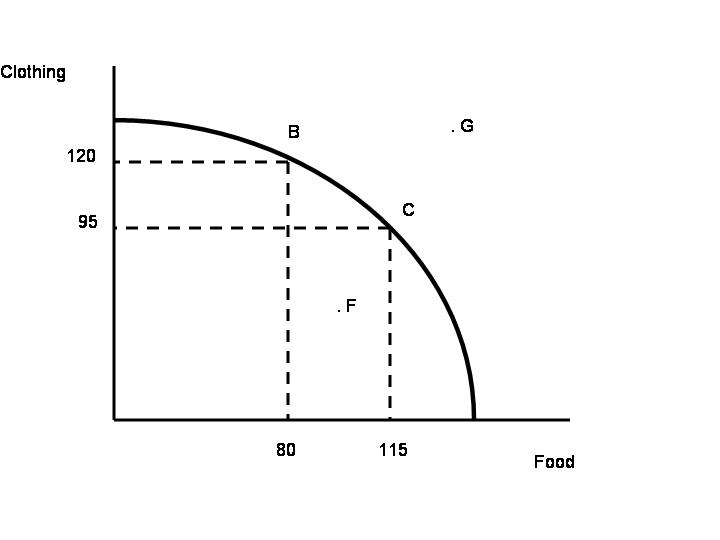

Fig. 5 shows the relationship between two commodities, food and clothing. Their consumption is mutually inclusive which implies a trade off between the two products. When the consumer settles for point B, the food is 80 units whereas clothing is 120 units. In the event that the consumer could have instead opted to choose point C he would have consumed 115 units of food and 95 units of clothing. The difference between these two points is 35 units for and 25 units of clothing. This shows a 7:5 trade off respectively. The opportunity cost for increasing food consumption is therefore 7/5 whereas that of clothing is 5/7. It is therefore more economical to consume more clothing than food as the opportunity cost is less.

Bibliography

Deneckere, Raymond, and Michael Rothschild. “Monopolistic Competition and Preference Diversity.” Review of Economic Studies 59.199 (1992): 361. Business Source Complete. EBSCO.

Graves, Philip E., and Robert L. Sexton. “Demand and Supply Curves: Rotations versus Shifts.” Atlantic Economic Journal 34.3 (2006): 361-364. Business Source Complete. EBSCO.

Magni, Carlo Alberto. “Opportunity Cost, Excess Profit, and Counterfactual Conditionals.” Frontiers in Finance & Economics 6.1 (2009): 118-154. Business Source Complete. EBSCO.

“Mixed economy a failure.” Gale: Opposing Viewpoints in Context. EBSCO.

Murty, Sushama, and R. Robert Russell. “Externality Policy Reform: A General Equilibrium Analysis.” Journal of Public Economic Theory 7.1 (2005): 117- 150. EconLit with Full Text. EBSCO.

Pannell, David J. “Public Benefits, Private Benefits, and Policy Mechanism Choice for Land-Use Change for Environmental Benefits.” Land Economics 84.2 (2008): 225-240. EconLit with Full Text. EBSCO.

Tom, Finkbiner. “Supply, Demand and Price Elasticity.” Journal of Commerce (n.d.): ProQuest: ABI/INFORM Complete (XML Gateway). EBSCO.