Dairying is one of the most important industries in Australia. It is the third largest industry and a major rural employer. Its employment ventures include on – farm, processing, manufacturing and in the transport sector through distribution of various milk products. There are about forty thousands employees employed in the dairy farms to cater for the labor needs in the farms. Others are employed with the processing sector. The industry is well developed in the temperate region and sub tropical areas. These areas have rich soils and receive adequate rainfall, factors that highly favour natural growth of pastures. The dairy industry is well spread across the country with each state having a dairy industry that supplies milk to the neighbourhood. The bulk of the milk comes from the south west state of Victoria region of the country which produces about 65% of the total milk (Shaw, John & Collins, 1984 p. 47).

Before distributing the milk to the consumers, it is converted to different products so that it acquires more value and meets the needs of different customers. Various other products such as powdered milk are also produced in huge volumes. About 55% of Australian milk is consumed locally either in fresh state or dairy products such as butter, cheese, creams and yoghurts. The Australian dairy industry has been growing gradually. In 2007/08 the total milk produced was approximately 9.3 billion litres. Most of it was produced by 7950 dairy farms all over Australia. The industry contains approximately 1,600,000 dairy cows that produce roughly 5,250 litres of milk each yearly. The commonest breed is the Holstein Friesian. Close to forty five percent of the total milk produced in Australia is exported. Much of it is exported to the Asian continent. The industry mainly exports cheese and skimmed milk powder. This represents about 9% of the total world dairy trade and makes Australia a key player in the global dairy sector. Australian dairy products are always in high demand across the world. The products have competitive advantage in international market and hence demand due to high quality, clean image, product safety and product reliability (Rodriguez & Boero. 2003 pp. 1447-1451).

The table below shows some key features and the average contribution of the dairy industry to the Australian social and economic performance.

Australian Data on Dairy production (2008/09):

Two major challenges facing the milk industry in Australia

Dairy industry in Australia has suffered adversely for the last one decade due to prolonged drought. Due to climate change, and acute shortages of water, many farmers from relatively dry regions have been forced to relocate into areas with adequate rainfall or to change from pasture reliance to lot feeding. The high global general demand for dairy products has dictated the use of more energy efficient production. This in effect has necessitated constant review in the way dairy products are being processed. The rising value of land in dairying farms has caused high farm debts. This is as a result of the increase in total value capital. The has in effect increased the farm equity ratio to an annual average level of 83% between year 2001 and 2002/03 and to 85% between 2004 and 2005 (Preston & Jones, 2006pp.169-132).

The revenue obtained from the sale of the dairy products has failed to match the expenditure on farm inputs for the last three decades. To counter the move the need for increased productivity has become mandatory in order to provide favourable terms of trade and to keep the dairy industry viable. Due to climatic change and consequent droughts the industry has contracted due to restructuring or movement by farms to areas with less local pasture. Due to these factors the ratio of dairy farms with natural local pastures has declined since year 2000 by 12 percent points from 64 percent to 52 percent, although the rate is a bit less for the Victoria State. This is due to deficiency of pasture and water brought about by the occasional droughts lack of clean water for domestic and animal use has been a drawback to the industry. The industry has developed administration practices to improve water quality and water use through various ways such as use of improved irrigation technology through automation, construction of weather stations to monitor soil moisture, scheduling of irrigation (Jobber 2000pp. 98-101).

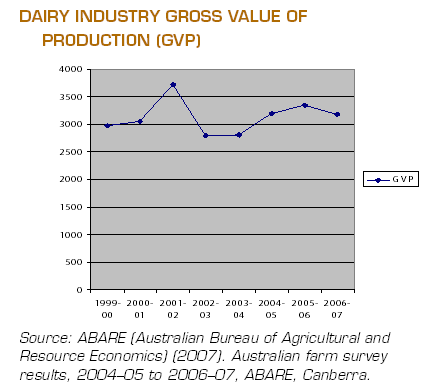

Due to the blow of the drought, the gross value of production (GVP) in daily products declined to $3.2 billion in 2006-07 which was 5% drop from the previous year 2005-06.

Although the decline in gross value of production, the trend has been an upward one for the last 20 years. The industry has grown in terms of assets, increased technology in on-farm processing and advance in marketing skills. This has made the industry increase milk production and produce more dairy products than ever before (Kidane & Gunawardana 2000pp. 69-90).

The need for increased milk products in the domestic market is a great challenge to the milk industry. The awareness by the Australian people about nutritional value and health concerns has become a key factor in determining the eating habits of the people. Increased awareness of the role and influence of food consumed in their body immune and the general status of their health, many people have started taking a lot of concern on their feeding habit. Milk products are known to boost body immune and to provide protein supplements needed for proper body growth. This has increased the demand for milk and its product to a higher level. The dairy companies through the Geoffrey Gardiner Foundation and the Dairy Innovation Australia Ltd formed a body known as The Dairy Health and Nutrition Consortium in 2008 to undertake five year research concerning health and nutrition. The body is supposed to validate health benefits of consuming dairy products. The companies through the research aims at increasing their domestic market which in turn will result to increased productivity and consecutively contribute to increase the well being of the Australian people. In order to maintain a healthy dairy industry, the dairy industry has set up a body known as Dairy Australia which runs a complicated set of natural resource management and green matters. There are measures set to protect and maintain soil fertility, undertake irrigation encouraged soil salinity and acidity, local vegetation protection, control of green house gases emissions and maintenance of proper water use and water quality. The body is also concerned with installing measures aimed at improving nutrient of the native pasture and improved grazing management and provision of sufficient share in summer to reduce cattle expenditure. The body has put in place Regional Development Programs (RDPs) in the eight regions leading in dairy production in Australia to stimulate innovation in research and provide extension services through exploitation of the available regional knowledge and skills. The body is required to provide the farmers with technical skills that are necessary for increased production. These skills are taught through formal training, consultations with experts and advisers and through extension activities. In order to effectively achieve its objectives, Dairy Australia has developed key programs such as Dairying for tomorrow, DairySAT, Feed, Fibre, Future, National Centre for Dairy Education, The people in Dairy Program and Subtropical Dairy (Harcourt 2005 pp 258-261).

The response of the marketers to the above challenges

One of the major challenges affecting the dairy industry in Australia is high domestic as well as international demand for milk and milk products. However there is market competition in the international market from other well developed economies such as Holland and the United States of America. The Australian export market is largely the Asian continent. The high population in this market and the superiority of the Australian dairy products maintains a higher command of the market. To meet the ever raising domestic market, meet the demand of the diverse market and continue creating new opportunities in the global dairy market, Australian dairy firms strive to increase their production in a drastically changing production environment. In order to succeed in increasing production, there is need to develop new production ideas, develop new technologies and increased innovations. The Australian dairy manufacturing companies and the dairy industry organisations jointly founded the Dairy Innovation Australia Ltd in January 2007 to be the Australia leading centre for daily manufacturing, develop science and technology and spearhead innovation in the dairy sector as a whole (Knopke 1988 pp. 02-03).

Daily innovation Australia carries out commercial research in order to improve and increase international competitiveness of the entire dairy manufacturing industry. The firm is located in Melbourne at the heart of Victoria State. The reason behind the location is the high productivity of the region in dairy production. With the research carried out by the firm, the State government of Victoria supports and rates the milk industry as the most innovative industry in the entire agricultural sector. Some of the key players in the milk industry include Bega/Tatura Milk Industries, Dairy Farmers, National Foods, Parmalat Australia, warrnambool cheese and butter and others. These are also the member companies of Dairy Innovative Australia Ltd. Dairy Innovation Australia Ltd is funded by the member companies through their two main bodies, the Australian dairy manufacturing companies and the industry organisations.The funding by the member companies is based on the amount of milk they produce yearly. They have jointly contributed Aus$ 15 million towards funding its activities for a three year period between 2007 and 2009. The funding is boosted by donations from Dairy Innovation’s extensive network for joint research on behalf of the member institutions. These institutions include Australian National University, the Food Science Australia, the university of Melbourne, and international partners such as INRA of France and Moorepark of Ireland. The Australian’s milk industry is controlled by two main bodies, the Daily Australia and the Gardiner Foundation which is based in Victoria. They both contribute to the funding of the dairy technology through membership (Pitts & Krijger, 2001pp 360-366).

The various dairy companies though competitors have been able to collaborate to solve their technological and innovation problems together. This has been possible through a model developed by dairy innovation Ltd that makes it possible to focus its research on fields that are of common interest to the member countries and the industry in total. Dairy innovation Ltd provides a common research platform where the involved firms undertake joint research projects. The members of the Daily Innovation are equally represented at operational levels and they have a voting right on programme committees. They are further allowed to take part in selection and offer guidance on pre-competitive research projects. Joint research agenda are undertaken so as to build abilities as well as make sure that companies have admission to the same resources of data for their internal progress plan and making it easy to access innovative technologies that enable development of new processes and hence new products (Fulkerson 2006 pp. 89-92).

In order to develop products that are superior in quality than the competitors, a firm must manage the technological transformation and apply the knowledge got from research into commercial application. This is one of the key roles of the Dairy Innovation Ltd. To effectively achieve this role, the Dairy Innovation in association with its members jointly undertakes research with personnel drawn from the industry. In order to provide transparency and provide a level working ground to all the key players in the industry, all the firms are represented by their technical managers in all stakeholders meetings, industrial workshops, technical road shows and industry internships. New projects and pilot trials are always conducted at a commercial production environment. Any technology that seems to provide a viable outcome is discussed by the decision makers at a board level by the member companies through strategic planning (Kompas & Tuong 2003 pp. 256-258).

Australian dairy sector has also been faced by a challenge of acute financial conditions. Deregulation of the industry in year 2000 caused about eight per cent fall in the price of milk. Majority of farmers had incurred a lot of costs through borrowing of funds to restructure their production by increasing their herds and automating production in order to increase production and benefit from the so widely expected increase in prices. The drop was too significance for small milk producers and suppliers to accommodate. This forced them out of the industry resulting to a significance loss in milk production. As a result of sustained low milk gate prices, it is forecasted that milk production for the period 2009 to 2010 would be 9 billion. This represents a decline with 4% compared to 2008 to 2009 production. This decline is associated with continuous reduction in production over the past decade. The marginal decrease in overhead costs and the prices of major inputs such as fertilizer and animal feeds is minimal compared to the continued fall in general price levels. Majority of dairy farmers in Australia are prohibited by law to employ services of an agent of their choice who would negotiate a fair price on behalf of the farmers group who can produce a large volume of supply. In a number of States in Australia, local processors are concentrated in one geographical region and this has created a monopoly sought of market structure where those firms join hands to act as a monopoly and hence purchase milk at a very low price at the farm gate. The farmers have no choice but to accept the low price since they have no capacity to negotiate. The farmers are only allowed to sell their produce to the few processors in their region. These processors offer almost the same price for milk supplies. When the supplies falls, the processors do not necessarily increase prices at the farm gate to boost production but they rather use a milk waste product known as permeate to alleviate the shortage (Grant 1997 p 85).

In 2008, the processors increased the farm gate prices to boost production. In response to an increment in price, farmers increased milk production despite the high cost of inputs such as fertilizer, fodder and dairy repairs. The cost of these inputs was relatively high compared to the proceeds received from their produce. Dairy producers enjoyed high prices for only one year. In year 2009, the processors reduced the price of raw milk by approximately 20%. This left most dairy farmers worse of as they had to absorb the loss from the high costs they had incurred due to low returns of costs they had not budgeted for (Garcia & Fulkerson, 2005 p. 1041-1051).

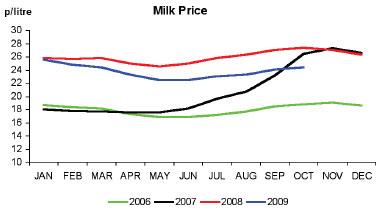

This fact can be observed from the graph below. A graph showing milk production between 2006 and 2009 by Australia dairy industry.

The Australian dairy sector is also under intense pressure from stiff competition in the domestic retail market both for fresh milk and fresh dairy products. Due to the weak status of the farmers as price takers in the market, many dairy farmers get very little from their commercial investments. For the last few years, dairy production have been subjected to various problems stemming from cost increases and in production and the unreliability of supply, difficulty in acquiring fodder, low farmer confidence and increased international competition by exported dairy products from developed economies like the United States of America. The Australian dairy farmers have been affected by the dumping of large amounts of cheap skim powder milk from the United States into the Asian market which serves as the largest milk product market of Australian dairy products (Davidson & Schwarzweller, 2001 pp. 321-326).

To overcome the challenge of low producer price and consecutively increase milk production in the Australian dairy sector, the state needs to intervene through setting of milk prices. In order to increase demand for their products in the domestic and international market, it is paramount for the processors to incorporate high value. This will sustain the market by protecting it from challenges relating to commodity price cycles. In addition, it is important for the processors to pay relatively high prices to the suppliers. This will contribute towards an increment in the supplies they receive thus attaining product mix. The current milk prices offered to the farmers are inadequate to all-year production of the required amount of the total supplies. Poor milk prices and high cost of production forced the producers to turn to rain fed pastures in an effort to increase their profitability. This practice resulted to a drastic fall in milk production. In order to boost milk consumption, the industry has employed capital intensive, high producing processing plants. This is aimed at producing a variety of daily powders backed up by a range of concentrated liquid products such as caseinates, milk protein concentrates, bulk creams and whole milk powder. These products are further used as input in manufacture of formulated foods such as in confectionery and infant formula. The industry is undertaking dairy innovation research which is aimed at developing a better nutritional and physical functionality of dairy products through projects aimed at investigating the entire manufacturing process. The milk industry in Australia is structuring its dairy process engineering through continuous improvement of the unit operations through change of management strategies to improve operational efficiencies, process yields, and production flexibility and ensure environmental sustainability. Due to the growing need to address climatic factors and ensure environmental sustainability, the dairy industry is working closely with milk equipment manufacturers and government agencies to ensure the necessary concepts are taken into consideration by the dairy products manufacturers. This ensures that the processing and production of their products is done in line with the laid down international environmental conservation laws and hence their products are not prohibited in the international market (Schmidt & Vleck, 1998 pp 215-218).

Reference

Balcombe, K., Doucouliagos H. & Fraseer, I. (2006). “Input Usage, Ouput Mix and Industry Deregulation: An Analysis of the Australian Dairy Manufacturing Industry,” Economics Series 2006_27, Deakin University, Faculty of Business and Law, School of Accounting, Economics and Finance

Davidson, P. & Schwarzweller, H. (2001). Dairy Industry Restructuring, Research in Rural Sociology and Development Volume 8 JAI Press; 1st. Ed edition ISBN-10: 076230474X

Fulkerson W.J. (2006) Innovations for the future dairy farm. Proc. Dairy Innovators Forum, Mount Gambier, South Australia.

Garcia, C. & Fulkerson, J. (2005) Opportunities for future Australian dairy systems: a review. AJEA, 45, 1041-1051

Grant, W. (1997), The Common Agricultural Policy.

Harcourt, T. (2005). Closer Economic Relations. Australian Trade Commission Website

Jobber, D. (2000), ‘Principles and Practice of Marketing’. Published by McGraw Hill. Sixth Edition

Kidane, P.& Gunawardana J. (2000). Journal of Food Products Marketing, Volume 5,

Issue 4 Department of Applied Economics, Victoria University of Technology, Footscray Campus, Melbourne, Australia DOI: 10.1300/J038v05n04_05. pp. 69 – 90

Knopke, P, (1988). “Measuring Productivity Change Under Different Levels Of Assistance: The Australian Dairy Industry,” Australian Journal of Agricultural Economics, Australian Agricultural and Resource Economics Society, vol. 32(02-03).

Pitts, E. & Krijger, (2001) A. Case Studies of Internationalisation and Structural Change in the Dairy Sector – Synthesis. In: Structural Change in the Dairy Sector (Eds. IDF). Brussels, Bulletin of the International Dairy Federation 360.

Preston, B. & Jones, N. (2006). “Climate Change Impacts on Australia and the Benefits of Early Action to Reduce Global Greenhouse Gas Emissions”. CSIRO Marine and Atmospheric Research. Web.

Rodriguez & Boero V. (2003). Australian Farm Surveys Report: Financial Performance of Australian Farms, 19-21 ISSN: 1447-8366

Schmidt, G. & Vleck, D. (1998). Principles of Dairy Science. The Principles of Dairy Farming Kompas, T. & Tuong N, (2003). “Productivity in the Australian Dairy Industry,” International and Development Economics Working Papers idec03-8, International and Development Economics

Shaw, John H. & Collins, (1984) Australian Encyclopedia, Collins, Sydney.