Introduction

Economic downfall indicates a declining aggregate demand in the economy. As there is less production and consequently less income, consumer spending falls sharply. This decline in the aggregate demand affects the gross domestic production and thus the whole economy slows down. In other words, a slower rate of growth than the estimated trend of recent past indicates an economic downfall. Now the question arises is that if the US economy is in a recession or is experiencing a downfall?

In order to understand the nature of the economic slowdown we need to see the difference (if any) between a recession, economic slowdown and depression. An economic downfall is a situation when the overall production of the economy tends to be sluggish. An economic downturn is an indication of an impending recession. A recession is a period of general economic decline which is a part of the usual business cycle. A depression is a severe economic downturn that lasts several years.

Main body

If the economic growth of UK and US since 2000 is studies, we see that there are definite indications of a slowdown in the economic growth but the warning bells do not indicate a recessionary or a phase of depression. As exhibit 1 show, the US economy has been experiencing a slowdown of GDP growth rate since 2000. The growth rate started falling since 2001 when the rate fell from 4 percent in 2000 to 1 percent in 2001 (World Bank). The rate started rising but there was a decline again in 2005 and since then there was a decline in growth rate till 2007. There is market stagnation in the growth rate of the export rate too experienced a stagnation. The industries in the US economy saw a decline and there was a rise in inflation.

Exhibit 1: Us Economic Indicators

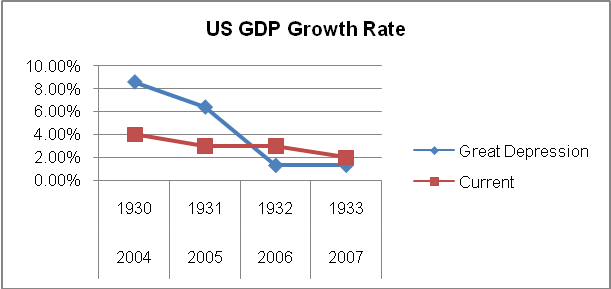

The comparison now arises is that if the slowdown that the US economy similar to that of the Great Depression. The depression marked an era of bank failures, rising inflation and a mammoth fall in GDP growth rate. Now if we compare the GDP growth rates during the Great Depression (we consider the figures for four years from 1930 to 1933 and that of 2004 to 2007) we see that the growth rate fell from over 8 percent I 1930 to 1.3 percent in 1933 (US Census Bureau). But the fall in the current phase do not similar trend. Currently it is a position of stagnated growth rate with the red line showing the current growth rate almost a straight line.

But are the indications similar, like that of huge crashes in the stock market, crippling of the financial and banking system (current bankruptcy of Lehman Brothers, and many others following suit), rising inflations, etc. But the comparison is futile for the statistical data is not comparable. According to the National Bureau of Economic Research data, the third quarter the US economy experienced an increase of GDP growth of 2.8 percent in 2008 (NBER). The government agencies are not declaring a recession yet. And a further analysis will confirm that depression is not impending, as there have been massive interventions by the world’s central banks to maintain liquidity in the market so that the economy could grow. This did not happen during the Great Depression when the Federal Reserve raised interest rates and banks stopped lending to avoid further failures. This led to a further deceleration of economic growth. Presently the monetary policies adopted by various centrals banks around the world is to keep the liquidity in the market to allow business run as earlier in order to maintain the growth momentum.

The US economy is undergoing a recessionary phase which is majorly due to the breakdown of the financial machinery of the country. The slowdown has affected the rest of the world due to increased linkages due to globalization. The GDP growth of the world was 3.8 percent n 2007 which fell from 4.1 percent in 2000 (World Bank). Though the growth rate shows a decline but the fear of a looming depression is far away.

References

NBER. National Bureau of Economic Research. 2008.

US Census Bureau. Historical Economic Data. 2008.

World Bank. Data – Key Development Data & Statistics. 2008. Web.