Introduction

The world’s economy, and indeed that of United States of America, underwent one of its worst performances in recent times. This recession period started in December 2007. Economists christened it as the great economic downturn or simply the Great Recession (National Bureau of Economic Research).

America, being the biggest economy in the world, felt the biggest effects and aftershocks of the same. Various aspects of the economy were greatly affected. In fact, some economists believed that the phenomenon actually originated from the United States of America. As a result, there was need for the government and the U. S. Federal Reserve to come up with measures to cushion these effects as well as set up mechanisms to restore the economy to its normal stature.

These measures’ aim is to protect the same economy from risks of similar nature in future. For the years 2009 and 2010, the measures put in place by these two institutions have had an effect of some sort on the general economy. This is given the fact that the adopted policies and rescue plans averted what could have been an economic disaster for the U. S. A. (Warwick, 2009).

State of the Economy by 2009

President Barack Obama’s administration inherited an ailing economy that had bulged to the pressures of uncertainty and instability. This, slowly but significantly, formed cracks in such cores areas as the credit market and the stock exchange markets. The issues that came along with it- such as unemployment, trade imbalances, tax responsibilities and policy changes posed an immediate challenge to this new administration (Warwick, 2009).

Economic Growth

The Great recession had adverse effects on the general economic growth in the United States of America since it began manifesting the magnitude of its prevalence as early as 2008. Before this period, both the nominal and the real GDP of America enjoyed a steady growth over the years, with its per capita income also showing favorable trends that emphasized the country’s established stature as the leading economy in the world.

For the first time in many years, the country experienced negative growth figures in real GDP between 2008 all through to 2009. The third quarter of that year was particularly poor, with figures of real GDP falling to as low as -3.0%. However, this trend began changing in the fourth quarter of the year, and the growth rate of the nominal and real GDP as well as the per capita income began to take a positive direction.

This was in response to the intensive economic rescue strategies and measures adopted by the government of the U. S. A aimed at stimulating the economy (Warwick, 2009). This carefully crafted package by the Obama administration aimed at restoration of the country’s economic lifeline in such a way that the benefits accrue both in the short run and in the end. Among the areas, it covered were tax reliefs and provisions for special benefits for special categories of the citizens.

Its effectiveness saw the restoration of investor confidence, ultimately boosting prospects of economic growth all rounded, including creation of employment, which had proven the most significant cause for concern by the American public (Warwick, 2009).

Unemployment

The rate of unemployment in the U. S. A. has been relatively low prior to the disastrous period of the economic recession, succumbing to a 26-year-old low record of 10.1 in October 2009 (Bureau of Labor Statistics). This is because the unfolding difficult financial positions that companies in the various industries in the economy found themselves in did not only threaten their existence, but also prompted them to adopt measures to ensure their survival.

A common step taken by a majority of these companies was cutting down the size of their staff, thus leading to the rise in the number of people with necessary labor requirements and skills but without jobs. Moreover, the rate of absorption of people looking for jobs and did not have those jobs in the first place fell significantly for the various sectors of the economy.

The government sought to address this problem by creating jobs mainly in the private sector and partly in public institution, while at the same time enable those that had lost their jobs regain their employment status. Investment in business supporting ventures as well as such sectors as public health provided a platform for attainment of this objective. Capacity building and improvement of government service delivery in the same over the past two years has been aggressive in a bid to address this challenge (Woods, 2009).

The rate of unemployment was on the rise in 2009 as the economy still bowed to the difficult conditions that prevailed then. The measures that the government put in place did not have an instantaneous effect due to the reflexive nature of the prevailing circumstances, which despite having short-term objectives is not realizable within such a short time. The high rates that included the record high rate as at October that year was but a reflection of the extent of the damage the recession had on the country’s economy.

This trend continued through to 2010, although there was a slight decrease for this particular year. By December that year, this rate had fallen to 9.4%. This decrease in the unemployment rate, however small, is attributable to the stimulation package adopted by the government. Over six hundred thousand jobs were saved by the beginning of November 2009 (Lightman, 2009).

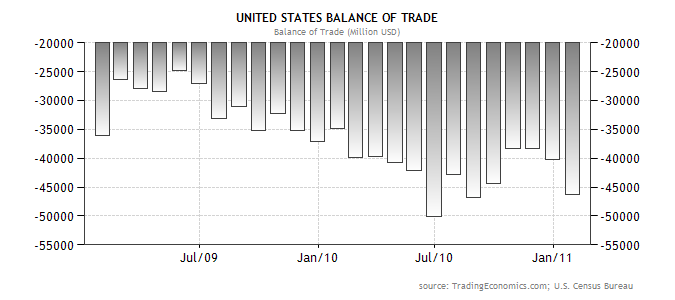

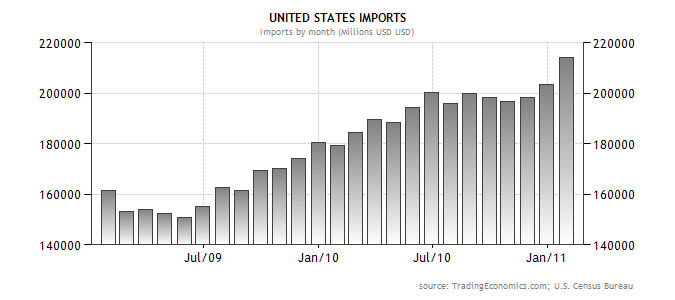

International Trade and Balance of Trade

Over the years, America has had to do with deficits in its balance of trade with respect to foreign trade, despite the dollar holding its ground as the worlds’ leading currency and the most widely acceptable measure of trade among many countries. As a major industrial economy of the world, America exports significant volumes of its output to various countries all over the world.

However, the country is also one of the biggest importers especially of raw materials and other consumables such as petroleum. The recession period saw a momentary decrease of imports that was followed by a gradual increase of the same, with 2009 recording imports worth about 180,000 million dollars. Import figures continued through 2010 and beyond (Lightman, 2009).

Similarly, exports experienced a slight slump, especially in 2009, particularly due to the damaged purchasing power of other economies as well. The financial crunches’’ chocking effect on major economy players that form the bulk of exporters in the U. S also caused this decrease because it hampered their production capacities. The willingness and ability of potential and existing markets was also greatly compromised, further denting the prospects of having larger volumes in terms of exports.

Although this trend gradually responded to the measures put in place to counter the recession by eventually increasing in export volumes, the balance of trade for the country still remain in the negative. The effect of the government’s intervention for the period further increased the deficit levels for the country, with 2010 posing figures of -50130.0 Million dollars (Wessel, 2010).

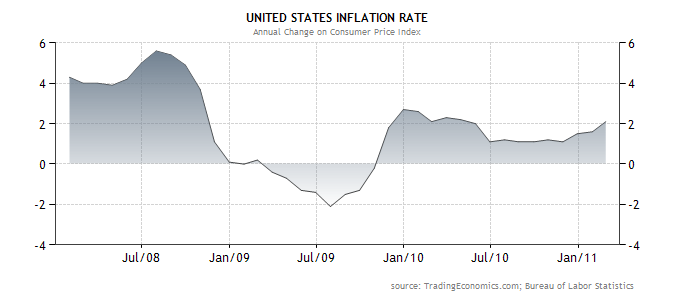

Inflation

The general rise in price of commodities within the United States in 2009 and 2010 does not show a different trend from the previous years, where it can be observed that there is a fluctuating pattern. 2009 for example saw inflation rate fall from 4.1% the previous year to an all time low average of 0.1%.

This can be attributed to the economy’s immediate response to the crisis that was the recession and efforts by the relevant authority to respond to the same vigorously and with particular attention. The following year sees the level of inflation rate rise to 2.1% as the economy tries to pull itself out of its misery due to the level of attention it receives from the government and the Federal Reserve. Inflation is thus contained to its acceptable range for the two years after having spun beyond those limits (Isidore, 2008).

Macro Economic Policies Applied

The government of the United States of America in conjunction with the Federal Reserve Bank played a pivotal role to ensure that the crumbling economy of the country and as thus of the world was given a lifeline. This was done through the adoption of crucial policies and measures that were specially designed to avert the whole situation (Wessel, 2010).

Expansionary Policies

The policies that were put I place by the government were centered on supporting the citizens, who are the drivers of the economy, to play an active role in the realization of a sound economy not only for their own welfare but also to secure the economic security of the future generation.

Expansionary policies as they are economically referred to aim at encouraging economic growth by increasing the money supply within the economy. The 787.2 billion dollars Economic Stimulant Package of 2009 was mainly of this nature, and the policies that were put to force under this category include:

Fiscal Policies

This policy deals with control of taxes such that there is encouraged investment and increased purchasing power of the people that are the work force in an economy. The Economic Stimulus package as adopted by the U. S provided for significant tax cuts on investment ventures.

To be specific, tax cuts were allotted up to 288 billion dollars. This was to encourage the creation of employment opportunities in the private sector. The lower taxes so imposed would serve as an incentive. More investment in such areas as business would see the absorption of the unemployed, leading to higher output in production- thus increased GDP as well as higher per capita income distribution within the country (Cohan, 2009).

Furthermore, lower taxes on the citizens is also an incentive on its own, since it ensures that the workers in that particular economy get to remain more of their salaries and wages. This makes even more people without jobs to engage in meaningful efforts to secure employment of whatever nature. A greater workforce that is actually in employment with more spendable income translates to an empowered economy since the purchasing and investment power of these people is greatly enhanced (Trading Economics, 2010).

Monetary policies

The Federal Reserve was also involved in expansionary measures as it sought to boost the supply of the dollar in the economy to check the wary effects of the recession. This came in the form of financing of the major financial institutions that were massively hit by the waves and after shocks of the difficult financial conditions. Moreover, the monetary policies so employed also served to prop the institution’s course to increase money supply, thus spurning further economic growth (Wessel, 2010).

Controlling the interest rates in the economy for instance was vital to the resuscitation of the economy. By lowering the rates at which it lent money to banks during the recess period, the Reserve bank ensured that the cost of money in the economy was reasonable enough to encourage acquisition of the money by elements of the economy.

This would have the effect of increased investments in the end since all factors around investment would be favoring the investors- when considering the stimulus package is all about bringing out the best economic situation for the people.

The use of monetary supply tools such as availing lucrative open market operatives in the form of bumper short term, mid term and long term federal bonds and securities further cushioned the money supply in the economy. This contributed immensely towards ensuring that money is made available in as much quantity as possible to ensure that economic activities receive all the support they require as the recovery process takes shape (Borok et al. 2008).

Supply Policies

These policies go hand in hand with the demand policies since one is nondependent of the other. They mainly focus on further enhancing the supply of money within the economy in the quest to avoid deficiency, and ensure that the growth of the mainstream economic aspects of the system is not compromised.

As earlier noted, decreased taxes is an incentive that have a long-term positive effect on the economy. Such is an example of supply policies as well. Increased government expenditure is also another of these policies, and is widely effective since it entails infrastructural development and improvement besides creating employment opportunities in the public sector (Read, 2009).

Conclusion

The past two years have seen the economy of the U.S struggle to shake off the effects of the great recession that engulfed the world’s economy since the close of 2007. The government and the Federal Reserve took necessary steps to counter the effects of this economic down turn by implementing the policies in such a way that their success was imminent.

The response of the economy to the stimulus package that was pivotal to the realization of recovery has been promising, and there can only be optimism for success in the end, of the return to world economic leadership status as projected by the architects of the plans (Wessel, 2010).

Reference List

Borok, K. et al. (2008) Pattern of Macroeconomic Indicators Preceding the End of an American Economic Recession. Journal of Pattern Recognition Research, 3.1:1-50.

Cohan, W. (2009) House of Cards: A Tale of Hubris and Wretched Excess on Wall Street. New York: Doubleday.

Isidore, C. (2008) It’s official: Recession since Dec ’07. CNN Money. Web.

Lightman, D. (2009) Congressional Budget Office Compares Downturn to Great Depression. Washington: McClatchy Washington Bureau.

Read, C. (2009) Global Financial Meltdown: How we can avoid the next Economic Crisis. New York: Palgrave Macmillan.

Trading Economics. (2010) Indicators for United States. Trading Economics. Web.

Warwick, N. (2009) In Government We Trust: Market Failure and the Delusions of Privatization. Sydney: University of New South Wales Press.

Wessel, D. (2010) Did ‘Great Recession’ Live Up to the Name?The Wall Street Journal. Web.

Woods, E. (2009) Meltdown: A Free-Market Look at Why the Stock Market Collapsed, the Economy Tanked, and Government Bailouts Will Make Things Worse / Washington DC: Regnery Publishing.