Introduction

World financial markets conduct studies aimed at creating innovative strategies of regulating liabilities and assets. The studies help in responding to alterations of the current interest rates by providing alternative solutions. Business organizations explore new dimensions of surviving in the market and taking advantage of financial gain deviations. They can increase their interest rates at an exponential rate if they predict risks accurately. Business investors face challenges in projection of risks due to the existence of difficulties in ascertaining the appropriate strategies of mitigating future financial investments. This paper illustrates efficient strategies that business organizations can use to evaluate risks (Wehinger, 2010).

Re-pricing model

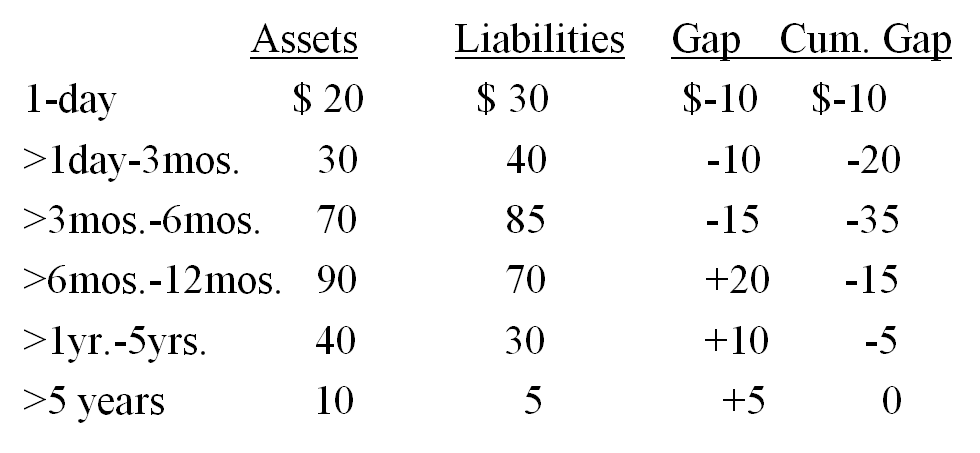

The first approach entails supporting the re-pricing model for assessment of the risk level exposure in business organizations. Economists rate the re-pricing model as one of the efficient techniques of evaluation of a financial organization’s interest rate risk vulnerability. The model configures the interest-sensitive liabilities, assets and OBS positions into “time bands” in accordance to the period remaining to the subsequent re-pricing. The subsequent re-pricing refers to the period of the next floating rate or its maturity. The re-pricing model produces projections of the interest rate risk sensitivity of economic value and financial gain in regard to interest rates. The re-pricing method underscores a gap analysis when its application measures the interest rate risk of current financial gains.

The evaluation of the impacts of transforming interest rates on financial institutions’ economic value can be measured through the re-pricing schedule. The approach applies sensitive weights to different time bands on the basis of estimates for the time of the liabilities and assets occuring within each time band. The duration can refer to a measure of the percentage deviation in the economic gain of a position that may happen in the event of a minor transformation in the amount of interest rates. Interest rates can be essential when combined with a re-pricing or maturity schedule on the basis of duration. They can outline an irregular estimate of the transformation in a financial institution’s financial value. This fact can happen in the event of transformations in the market interest rates (Heidari &Wu, 2009).

The rate sensitivity denotes the entire process of re-pricing. The re-pricing gap may account for the deviation between the rate sensitivity of each liability and asset. The re-pricing model of measuring interest rate risk contains certain demerits. The model ignores the effects of market values. The model disregards dollar value within the framework of interest sensitive losses and assets. The model may affect average re-pricing in the event of a subsequent decrease in interest rates. Therefore, the model may expose financial investments to re-investment risks. In addition, the re-pricing model ignores the challenge of runoffs. It does not account for premature prepayment of liabilities and assets. It also fails to account for financial benefits outside the frame of a balance sheet.

Financial institutions disregard re-pricing asset maturities that may be longer than liabilities because of their “sensitive risks”. Liabilities have a higher probability of re-pricing than assets. The financial gains of a liability-sensitive financial institution may arise when interest rates decrease and increase. In contrast, an asset-sensitive financial institution that has a shorter asset re-pricing may gain from an increase in rates or suffer from their decrease. The re-pricing approach of risk involves reflection of a financial institution’s current earning performance. However, this aspect does not occur in all instances. For instance, the institution may create re-pricing mismatches that cannot accrue financial gains until in the future. A bank may take increased interest rate risk through extension of maturities to increase gains on a compulsive mode because of over-reliance on short-term re-pricing. Any financial institution may evaluate long term and short term imbalances when assessing re-pricing risks. This concept may ensure that a bank’s future financial gains do not suffer from exposure to interest rate movements (Philip & Marshall, 1996).

A numerical illustration of a re-pricing model

Example

An application of the re-pricing Model DNIIi = (GAPi) Dri = (RSAi – RSLi) Dri

Example: In one day bucket, gap is -$10 million. If rates rise by 1%,

DNIIi = (-$10 million) ×.01 = -$100,000.

Example II: If we consider the cumulative 1-year gap,

DNIIi = (CGAPi) Dri = (-$15 million)(.01) = -$150,000.

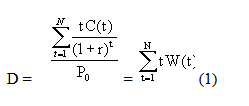

The benefits of utilizing duration for measurement of interest rate risk Financial investors take time to measure interest rate risks. This fact is common in management of financial institutions. Its application is regular primarily in fixed income funds where it works as an evaluation of interest rate sensitivity. The perspective may be relevant to regulatory and measurement criteria that investors use to determine interest rate risks. The approach can be essential in the measurement of the value-at-risk evaluation. It explains risk metrics. This idea helps to project the probable losses that may arise as a result of adverse interest changes. Financial market participants use the approach in assessment of bond price changes. The market tends to appreciate this approach. The technique acts as a tool for management of physical assets in government institutions (Houtpt & Embersit, 1991).

Numerical Illustration

C(t) is the cash flow received at time t, W(t) = C(t)/P0(1+ r)t is the weight attached to the time t cash flow, r is the discount rate for the cash flows, and P0 is the current price of the bond.

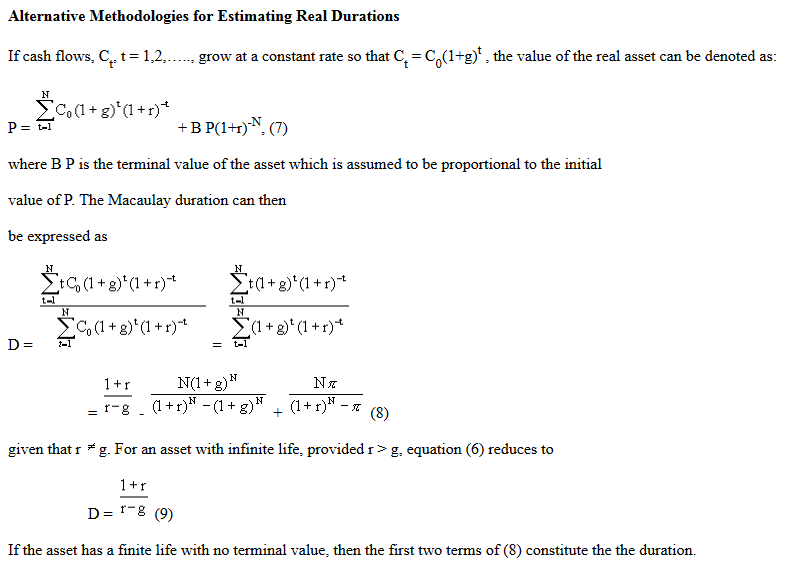

Alternative methodologies for estimating real durations

How US commercial banks manage interest rate risks

Financial transactions may have set effects on the interest rate risks of a bank. However, banks differ on the manner in which they manage their interest rate risks. Banking institutions reduce the interest rate risks through channels that conform to re-pricing and maturity aspects of their wealth and liabilities. Banks must ensure that material positions and cash flows have a linkage to the measurement system designated by the schedule. This principle applies to transactions within and outside the framework of a balance sheet. Financial institutions manage interest risks of their material positions by linking cash flows to a timely measurement basis. This process applies to transactions that happen within and outside the framework of a financial report.The data contains cash transactions that connect contracts to systems. Commercial banks in the United States use diverse strategies to manage interest rate risks.Financial institutions utilize money transfer pricing criteria to separate interest rate levels and the directorate of the treasury bureau of the business organization. Certain financial institutions may integrate a devolved system and give people business opportunities that involve regulating and managing units within set standards. Several banks may decide to limit their interest rate risks to their business ventures. Most commercial banking institutions may leave open the chance for interest rate in “non-trading”. Financial institutions seek to understand diverse assumptions in the measurement of interest rate risks.

A financial institution can change its interest rate risk vulnerability through transformation of investment, funding, pricing and lending approaches. The banks also manage the re-pricing and maturities of different portfolios to achieve an appropriate risk profile. United States’ banks utilize data outside the realm of balance sheets to regulate their interest rate risk portfolios.They may utilize interest margins to control their interest risk mechanisms. Appropriate control of interest rate risk involves an elaborate risk regulation process that promotes timely identification, measurement, monitoring and regulation of a risk. The procedure of this interest risk regulation may vary because of deviations of complexity and size of the financial institution. Financial institutions may decide to find out and communicate procedures and principles through a written notice. The risk management of financial institutions examines the accountability and authority for identification of potential interest rate risks. This procedure may arise as a result of new or existing products or services. The system of interest risk management may also encompass identification and quantification of significant sources of a bank’s interest risk within a given time schedule. The bank may also run a system of reporting and regulating risk vulnerabilities within set time schedules. Financial agencies,business organizations, institutions of learning, government ministries and other relevant stakeholders need to conduct adequate research in order to improve risk management practices for interest rates. The financial bodies can use experts to source for sustainable funding for research. They can also adopt monitoring and evaluation practices and comprehensive implementation policies to make their research successful.

References

Heidari, M., &Wu, L. (2009). Framework for Pricing Interest Rates and Interest Rate Tools. Financial and Quantitative Analysis Journal, 44(3), 517-550.

Houtpt, V., & Embersit, J. (1991). A Method for Evaluating Interest Rate Risk in Commercial Banks. Journal of Federal Reserve Bulletin, 77(1), 625-37.

Philip, D., & Marshall, J. (1996). Pricing Long Bonds: Pitfalls and Opportunities. Journal of Financial Analysts. 1(1), 32-39.

Wehinger, G. (2010). Risks Ahead for the Financial Industry in a Changing Interest Rate Environment. Journal of Financial Markets Trends, 2010(1), 67-85.