Foreign Exchange Exposure

The current challenges facing Baker Adhesives are foreign exchange exposure risk. The risk arises when a company trades with another company that settles the payment in foreign denominated currencies. Due to fluctuations in foreign currency, Baker Adhesives may gain or lose on translating the foreign-denominated payment into local currency. If the dollar has strengthened against the Brazilian Real the company will get more dollars and if the dollar rate is lower than the current rate in the future the company will get fewer dollars incurring a loss. The company, therefore, needs to have hedging strategies to counter the foreign exchange exposure (Bokhonok, 2010)

Loss/Profit on Baker Adhesive’s Original Sale

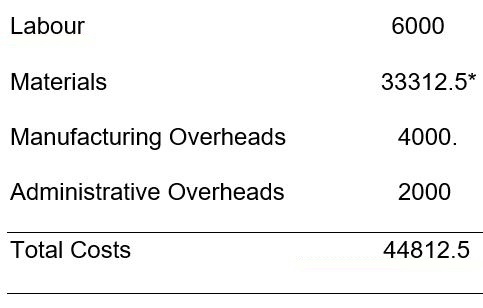

The costs of original order

The company will receive BRL 104,338.30. The current exchange rate is 0.4368($/BRL) therefore BRL 104,338.30*0.4368= $ 45,574.The profit the company gets is $45,574-$44812.5=$761.5. This is a loss. Baker Adhesives should have gotten BRL 104,338.30*0.4636(If the exchange rate had remained constant) = $48,370.The loss due to foreign exchange risk exposure is $48,370-$45,574=$2,796.

Overall the company will receive a profit of $887.5 however in terms of the anticipated profit the loss incurred is $2,796 as this is the amount their profit has been reduced with. The firm could have avoided the loss by hedging strategies. They should have entered into a forward contract with the Novo Company by ensuring the invoice is denominated in dollars at the current rate of 0.4636.

*1/4 *$32,500=$8,125. The cost of raw materials increased by 10% and they had to purchase a quarter of the raw materials. The new cost of the raw materials, therefore, is $8,125*110/100=$8,937.5. Total costs= $8,937.5+ ($32,500-$8,125) =$ 33, 312.5

Revenue streams for the new sale

Without any hedge

The company may choose not to hedge against any foreign exchange exposure. This means the sale will be settled at the existing spot rate in September 2006. The cost of 1,210 gallons as calculated above is $44,812.5. The Novo Company wants 50% more gallons above the original order so the new order is for 1.5*1,210=1,815 gallons. The cost of the 1,815 gallons will therefore be 1,815*$44812.5/1210=$67,219.The company’s markup is at 8% therefore the invoice price will be at $67,219+($67,219*8/92) =$73,064.The current exchange rate for Brazilian Real is 0.4368. The Novo company will pay=$73,064/0.4368=167,271Real. However, due to changes in the currency exchange rates, the amount they pay on conversion will be fewer dollars as follows Real 167,271*0.4232=$ 70,789.

Hedge in the forward market

The company may choose to enter into a forward contract with the Novo Company where it will be obligated to pay the invoice in the forecasted forward rate at September 2006. The expected revenue streams will therefore be set to the sales price at the forward exchange rate of $73,064/0.4232=172,646.50 Real. This method ensures that Baker Adhesives is sure of the amount it will receive in the Real currency as the Novo Company is obligated to pay the specified amount.

Hedge in the Money Markets

The strategy is used where a company hopes to make a profit due to the changes in the exchange rates of the currencies. In this strategy, Baker Adhesive will borrow money from the Brazilian bank Real 172,646.50 at the rate of 26.5% interest per annum. This loan will be offset in the future by the expected cash inflow of the Novo Company. Baker will then convert the Real currency into dollars and invest the money in a fixed deposit for the next three months to earn an interest of 5% per annum as follows: Amount to be borrowed=Real 172,646.50/6.625%= Real 161,209. (Interest rate for three months= 26.5/4=6.625%)

Convert the Real into dollars at the current spot rate=0.4368 Therefore Real 160,677.25*0.4368=$70,183. The dollars will be invested in a fixed deposit for three months at 1.25(interest rates for three months will be 5%/4 =1.25%). The total money (principal and interest earned) after 3 months will be $70183+ (1.25%*$70183) = $71,060. Convert the dollars to real at the forward rate (agreed by Baker’s bank)=$71060/0.4227=Real 168,110. Receive Real 172,646.50.25 from the Novo Company and settle the debt. The company however has not been able to earn a profit since Real 168, 110 is less than Real 172,077.25. The revenues received in the money market and forward contract strategies are therefore the same in these scenarios as there is no arbitrage profit made in the money market.

Revenue streams for the follow-on sale

The forward rates for the month of December 2006 have to be forecasted or calculated to set the terms of the sale price.

Spot rate 0.4368 the forward rate 0.4232. Where the spot rate is 0.4232 the forward rate will be 0.4232*0.4232/0.4368 = 0.4089. The company may however choose not to hedge against any foreign exchange exposure. This means the sale will be settled at the existing spot rate in December 2006. The cost of 1,815 gallons as calculated above is $73,064. The Novo Company will pay *73064/0.4232=Real 172,647. However, due to changes in the currency exchange rates, the amount they pay on conversion will be fewer dollars as follows Real 172,647*0.4089=$ 70,595.

The company may choose to enter into a forward contract with the Novo Company where it will be obligated to pay the invoice in the forecasted forward rate in December 2006. The expected revenue streams will therefore be set at $73,064/0.4089=178,684 Real. This method ensures that Baker Adhesives is sure of the amount it will receive in the Real currency as the Novo Company is obligated to pay the specified amount.The strategy is used where a company hopes to make a profit due to the changes in the exchange rates of the currencies. In this strategy, Baker Adhesive will borrow money from the Brazilian bank Real 178,684 at the rate of 26.5% interest per annum. This loan will be offset in the future by the expected cash inflow of the Novo Company. Baker will then convert the Real currency into dollars and invest the money in a fixed deposit for the next three months to earn an interest of 5% per annum as follows:

Amount to be borrowed=Real 178,684/ (100%-6.625%)= Real 166,846.(Interest rate for three months= 26.5/4=6.625%) Convert the Real into dollars at the current spot rate=0.4232. Therefore Real 166,846*0.4232=$70,609.

The dollars will be invested in a fixed deposit for three months at 1.25(interest rates for three months will be 5%/4 =1.25%). The total money (principal and interest earned) after 3 months will be $70609+ (1.25%*$70609) = $71,492.

Convert the dollars to real at the forward rate= of $71,257/0.4227=Real 168,576.

Receive Real 178,684 from the Novo Company and settle the debt. The company however has not been able to earn any profit since Real 168,576 is less than Real 178,684.

Conclusion

For both the new sale and the follow-on sale the company should hedge using the forward contract strategy.

Reference List

Bokhonok, Nickolay. (2010). Hedging Strategies for the Foreign Market. Ezine Articles. Web.