Structure of the Ethiopian economy

The structure and driving force of the Ethiopian economy is based on geographic locations of the economic activities, the kind of technology, and the behavioral characteristics of the factors of production. Geographic locations are classified into either rural or urban areas. In addition to that, the economy of the country is further influenced by factors of production which incorporate inputs, investment capital, and the level of expenditure (Taffesse & Ferede, 9).

The economic structure is also influenced by a social accounting matrix which is variably influenced by the above factors, commonly referred to as the social accounting matrix. A social accounting matrix typically constitutes the economic agents such as institutions and firms, and the distribution channel of the country. All these factors reflect the strength and the level to which an economy is vibrant.

Typically, the number of economic variables that includes the economic activities and resulting commodities, their contribution to the economy is discussed below. Among the elements to be considered include factors of production. Typically, factors of production are categorized into capital, land, and labor (Taffesse & Ferede, 5).

Typical of the economic framework is the agricultural sector. The economic framework of the Ethiopian economy is dependent on the agricultural, industrial, and services sector industries. However, each sector of the economy makes different contributions to the economic growth of the country. Studies indicate that the agricultural sector has been the predominant driver of the economy until the recent past when the services industry has overtaken the agricultural sector (Taffesse & Ferede, 13).

A critical analysis of the Ethiopian economy indicates the country to be overly dependent on agriculture with an 85 % of the population relying on agriculture as the sole income earner into the households. However, developments in other sectors of the economy indicate other competitive industries to be on the rise (Taffesse & Ferede, 2).

Recent estimates of the economic performance of the country indicate the services sector to register a significant growth when compared with the agricultural sector. A comparative study of the growth rate is graphically compared below.

Services Sector

Based on a graphical analysis of both the services and the agricultural sector, the economic structure of the Ethiopian economy has been strongly influenced by income from the services sector. Some authors argue that the services sector has overtaken the agricultural sector by basing their arguments on the GDP of the services sector compared with the agricultural sector.

The services sector has an estimated GDP of 45.3 while that of the agricultural sector is estimated to be 43.1. On the other hand, the GDP of the industry sector contributes only 13.0 percent of the aggregate GDP of the Ethiopian economy showing the services sector to override the agricultural sector (Sisay, 5). A typical illustration of the services sector, its sub-sectors, and their contributions to the economy are illustrated in the table below.

The above table shows financial intermediation to constitute a 2.7 GDP contribution to the economy. On the other hand, the hotels and restaurants sub-sector contributes a 3.4 GDP to the economy. In the above statistical GDP estimates, real estate, whole sale and retail trade, and the transport and communications sector constitute the largest percentage contribution to the GDP of the Ethiopian economy.

It is important to evaluate the rise in the services sector with respect to exports from the services sector. Estimates indicate a significant contribution of the services sector to the economy particularly the airlines and shipping industry services. However, it has been argued that the services sector has faced fierce competition from rival countries offering similar and better quality services (Torbat, 3).

Energy Sector

One of the sectors that are under development is the energy sector. A study of the different sectors of the economy indicates a strong need for electricity, which is the driving force behind the growth of many industries. Of greater importance, domestically produced electricity plays a significant role in the supply of cheap energy. That in mind, the Ethiopian government has undertaken to construct a dam for the production of the much needed electricity (International Rivers, 4).

It is projected that, the much needed electricity could be made available for export and projected estimates indicate export earnings from electricity generation to be in the range of U.S $ 407 by 2012. Earnings from the export of electricity are therefore projected to surpass earnings from the export of coffee, which is by far the greatest export commodity of the country (Teshome, 5).

A significant market for the electricity has been projected to be southern African countries, Yemen, Egypt, Sudan, and Kenya. It has been estimated that up to 900 mw of electricity could be produced from the power project (International Rivers, 4).

Export Commodities

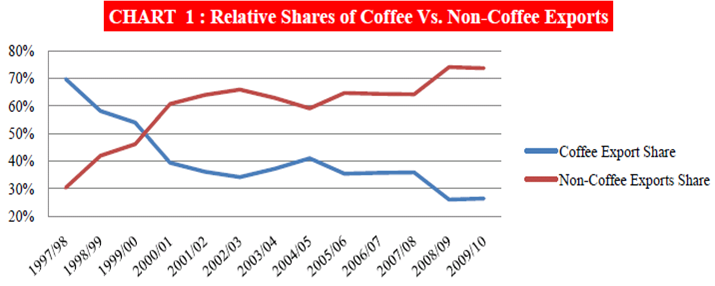

A comparative study of Ethiopian export commodities indicates coffee to be the predominant export among other export commodities, showing a significant improvement over other export commodities in the period between 1978 and 20010. Growth in export earnings from different commodities indicates a rising trend in their contribution to the Ethiopian economy.

In 2011, export earnings from coffee were estimated to hit the $525 million mark. However, the significant rise in earnings from the export of coffee has been estimated to constitute only 26 percent of the total value of Ethiopian exports. Other export commodities which include gold, flowers, oil seeds, and chat among other commodities constitute the rest 74 % of export earnings for the Ethiopian economy, showing a rising trend and importance to the Ethiopian economy.

To clearly demonstrate the relative amounts of export commodities and the relative earnings, each of the export commodities is tabulated below (Investing in Ethiopia, 5).

Source: Investing in Ethiopia

Tabulated figures indicate coffee to be the predominant export commodity followed by other commodities in their order of earned value in US $. According to a report from the country’s revenue authority, the estimated growth of different export commodities compared with coffee is illustrated below.

A critical evaluation of the growth in commodity exports and contribution to the economy indicates export earnings from gold to significantly contribute to the earnings in the growth of the economy than coffee. Typically, the argument placing gold ahead of coffee is based on a comparative analysis of the export performance and growth in commodity exports.

Typically, god registered, within the 1978/2010 period, the highest growth rate compared with all other export commodities. Within the period under observation, gold registered a growth rate of 188%, followed by live animals which registered a growth rate of 72 %. On the other hand, 67% growth rate was registered by the clothing and textiles industry (African Development Bank, 4).

It is important to consider the fact that export plays a significant to the income of the country. According to research reports, Ethiopia enjoys a number of destinations for its export products which provides a significant income as a foreign exchange earner to the country. Among the export destinations for its products include Switzerland, Germany, Sudan, China, and a number of other export destinations.

However, it is also important to consider the fact that the export destinations vary in the volume of exports to the respective countries. In the export period of 2009/2010, Switzerland registered the highest percentage share in exports from Ethiopia with an 11.2 % share. Other countries that registered a significant amount of exports include China, Germany, and the Netherlands, among others (The Ethiopia Macroeconomic Handbook 2 0 1 0, 7).

However, it is important to consider the fact that the country has faced a series of challenges in its export business. Among the challenges include low value products, little diversification of exports, ad little linkage to other countries.

Overcoming Challenges

To overcome the challenges faced to its exports, it is suggested that the country invest in the enhancement of its exports by improving the value addition of its exports. Typically, areas to target include leather products where value addition enhances the value of a product and the actual product price. On the other hand, the country should also focus on manufactured exports as a source of income.

A typical example is the recent rise of the flower industry. That is in addition to the fact that he flower industry is technology intensive, indicating the movement of the economy towards the technological enhancements. On the other hand, it has been observed that a number of private investors have already invested in the running of the flower manufacturing industry, showing a greater involvement as it is a technologically intensive sector of the economy (African Development Bank, 11).

Another area of importance is the export destinations. It is recommended that the country widen its external market destinations for its products, expanding further south and North of the country. Typically, the countries include the European Union countries, America, and African markets. Thus, importance and the potential of African markets particularly Ethiopia’s neighboring markets should be emphasized on.

On the other hand, the country should conduct other aggressive market research for its products to expand the market for its products (The Ethiopia Macroeconomic Handbook 2 0 1 0, 5). Another challenge to the Ethiopian economy has been an excess of the balance of import demand in face of limited foreign currency reserves. To categorically handle the problems, the Ethiopian government has undertaken various measures that are discussed elsewhere to overcome the problems (African Development Bank, 10).

Other challenges include falling commodity prices in the global market particularly for the 2008 period. An IMF report indicates the 2008 commodity price index to have dropped to the 2005 levels. A fall in commodity prices has caused a decline in the volume of imports, typically dropping by a significant percentage for all the quarters indicated above.

Other challenges to the economy include a drastic decline in remittances from developed countries. Remittances have been positively viewed as a foreign currency earner particularly for developing countries like Ethiopia. Ethiopia has experienced a significant rise in remittances, registering of an up to 14 times rise in foreign earnings for the period 2008 up, compared with earnings registered in the 1997 period.

Effects of the Global Financial Crisis

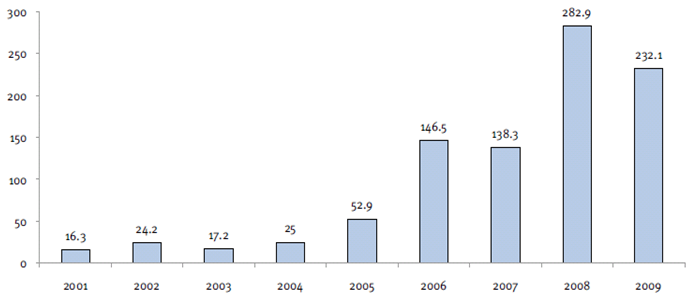

A number of challenges have affected the growth rate and performance of the Ethiopian economy. The global financial crisis is one of the critical factors that have strongly influenced the economic performance of the Ethiopian economy. Close studies indicate that the global financial crisis has strongly affected private capital flow. A critical analysis of the flow of private capital into the Ethiopian economy indicates that a decline was experienced in the 2008 period (Alemu, 28).

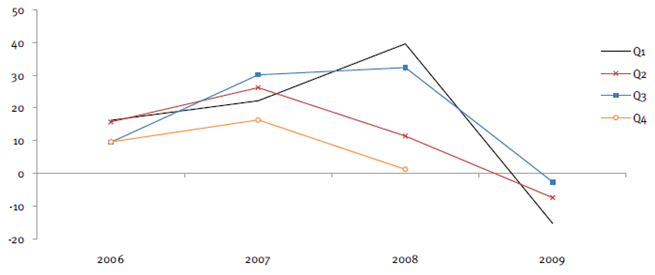

That caused a reduction in trade and investment with the investing countries hard hit by the crisis including France, USA, and other destination market countries. A graphical representation of a reduction in the invested flow of capital is illustrated below.

Source: The Ethiopia Macroeconomic Handbook 2 0 1 0.

The above graphical representation shows a sudden decline in the 2009 period of the inflow of private capital into the Ethiopian economy. A decline in the inflow of capital has been projected to affect a number of investment projects such as the production of electricity (African Development Bank, 19).

However, the Ethiopian government has factored strong measures to cushion important projects from the effects of the financial crisis. Among the projects to be cushioned include an investment in the production of electricity (African Development Bank, 16).

Trade

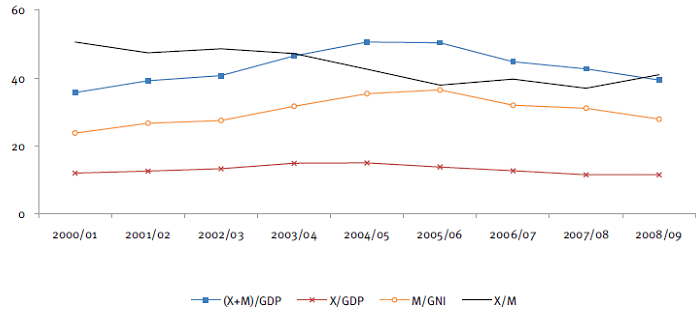

Both areas of trade including the export and import sectors are area strongly affected by the global financial crisis. Trade deficits affecting import and exports, the GDP, and the GNI (gross national income) are compared in the table below for a 2000/2009 period.

Typically, both imports and exports have registered a decline as shown below.

One of the commodities that have contributed to the decline in of exports includes a decline in the export of coffee. Typically, the impact on exports has been significant due to coffee being a dominant agricultural component contributing a significant income into the Ethiopian economy (Dorosh, Robinson & Ahmed, 2).

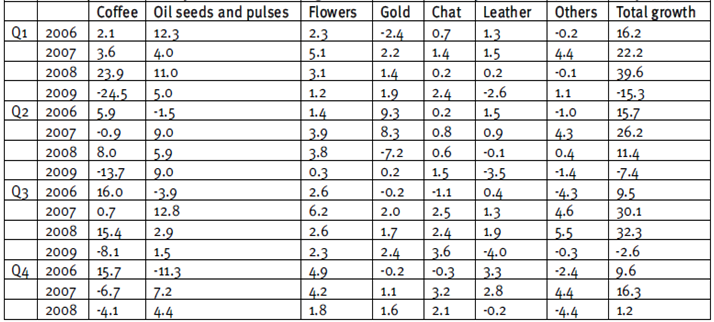

To critically and clearly understand the effects of Ethiopian exports and their contributions to the Ethiopian economy, the following data provides a detailed summary of the contributions of exported commodities to the Ethiopian economy.

The above tabulations indicate variations with respect to different quarters for the period 2006/2008. The contributions are reflective of incomes from different sectors of the economy and the fluctuations that have been experienced due to varied economic capital inflow shocks. In addition to that, an observation about the volume of exports indicates a decline when the 2009 period is approached that is in the fourth quarter (Alemu, 15).

A close and critical evaluation of the export earnings and the volume of exports indicate a decline of all Ethiopian export destinations for all the quarterly periods. Another countermeasure includes devaluing the currency to counter the rate of at which exchange rates have appreciated. Typically, that reduces demand for imports while accelerating the need for more exports leading to an equilibrium condition.

It is difficult for one county like Ethiopia to tailor the global market conditions to stimulate the economic growth of different countries and spur an upward trend in the export and import of commodities. Therefore, one of the strategies to increase the volume of commodities exported to its traditional markets include lowering the cost of export commodities. In addition to that, the country may tailor its currency as a measure to make its export commodities cheaper for the destination market (Alemu, 17).

External sectors

One other response to global and local market conditions is for the government to enhance the import export environment. In particular, a flexibility of the exchange rates, increasing market premiums by reducing and cracking on illegal exchange market firms and individuals. Facts indicate a strong improvement in the flow income from exchange remittances (Alemu, 31).

AID

Ethiopia has been ranked in the category of one of the poorest countries in the world. Poverty comes with a lot of economic challenges particularly for financing development projects and financing other financial deficits that are inherent in the country’s budget. To overcome the challenges facing the country in its development projects, an economic aid to stimulate economic growth forms an important component to its economy.

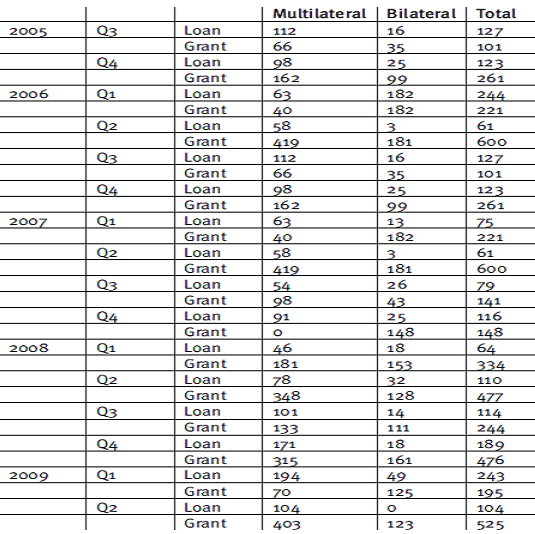

Typically, Ethiopia has relied on aid to finance deficits that are inherently chronic in its budgetary allocations. Financial aid comes from bilateral and multilateral financial donors to provide the necessary finance of development projects. Typically, the financial aid is strongly reflected the government account and a close examination of the financial aid are reflected in terms of loans and grants to the country.

Aid, therefore, forms the most significant source of financing Ethiopia’s economic growth. In addition to that, the economic aid given to the country plays a critical role in the running of the economy of the country with donor data illustrated below for the period 2005/2009 (African Development Bank, 26).

Policy Reforms

Policy reforms are the basis of countering a myriad of problems and challenges faced in the Ethiopian economy. Policy reforms are important in improving incentives for the development, enhancing economic efficiency, and appreciating the level of exports from Ethiopia. It is worth noting that carefully formulated policies could enable the country recover from the long term detrimental effects of capital inflow for the 2007/2008 period (Alemu, 28).

Fiscal Policy Formulations

One other response to the financial crisis and approaches to enhancing economic performance of the Ethiopian economy has been to improve revenue collection, improving expenditure on poverty eradication programs, minimizing borrowing from the domestic market such as the banking sector. In addition to that, the government has expanded revenue collection particularly VAT (value added tax) to cover more business sectors such as restaurants (Alemu, 24). On the other hand, the government has set up committees to closely monitor public enterprises by making monthly follow-ups to enhance government revenue.

Administrative and social approaches

Alemu, on the other hand argues that, the government has undertaken to minimize the effects of global financial crisis, endeavored to reduce inflation and its impact on micro-economy by importing grains for the poor (30). In addition to that, the government has endeavored to waive VAT on grains and the supply of commodities such as cement through government owned trade enterprises (Alemu, 32).

Sectoral Reforms Policies

The government has undertaken to implement reform policies specifically targeting foreign exchange problems. Organizing the product market, enhancing supply chain facilities, establishing a commodity exchange market, and establishing market oriented policies to strengthen the agricultural economy (Torbat, 2). On the other hand, the government of Ethiopia has formulated policies that target loan repayments particularly in the flower industry (Teshome, 2).

On the other hand, the government has further undertaken to look for new markets for its flower products to address a decrease in demand for its flower products in other destinations (African Development Bank, 15).

Drought

Ethiopia is a potential area of investment particularly in the agricultural sector. However, the potential for investment has over time been strongly and significantly negated by repeated occurrences of droughts. Typical of the challenging elements to the performance of the agricultural sector are environmental risks typically drought and related factors (Alemu, 5).

Research into the approaches that can be employed by the Ethiopian government to cushion its economy particularly the agricultural sector from the severe effects of drought and the consequences on the economy includes several measures. Typical suggestions include capacity building by developing flood and drought related measures to counter future risks to floods and droughts.

In addition to that, river basins form a significant component in the mapping of water resources and ensuring water related management and land policies to ensure rainwater is appropriately captured for future use (African Development Bank, 20).

Research

Typical approaches to face and handle the above challenges include ensuring research investments into enhanced agricultural methods with a bias into agricultural methods that are variably tolerant to climatic and weather variations. On the other hand, water management for agricultural development forms the basis of the success factors in the agricultural sector (African Development Bank, 2).

Communication network

Other areas to enhance the economy of the country are the communications infrastructure. It has been proposed that if the communications infrastructure and the road transport network is enhanced incorporating project designs reflecting the climatic vulnerabilities, enhanced communication could reduce the time for accessing the market and lead to the improvement of the economy (African Development Bank, 5) and (The Ethiopia Macroeconomic Handbook 2 0 1 0, 3)

Energy

Every successful economy enjoys a sustained supply of cheap sources of energy. To face the challenges presented by high energy costs and unreliable supplies, the government of Ethiopia should make big investments on the development of the electricity grid, tap into the availability of large amounts of water for the generation of hydroelectricity, enhance and accelerate the level of investment in the electricity sector.

In addition to that, the use of alternative sources of energy to discourage the use of wood as fuel should be enhanced (Taffesse & Ferede, 23). Therefore, sustained growth in the social sector, particularly targeting social issues such as population pressure should be addressed. In addition to that, environmental issues, institutional issues, economic development and the associated levels of economic growth should be evaluated (Alemu, 35).

Works Cited

African Development Bank. Impact of the Financial Crisis on African Economies: An Interim Assessment’. Prepared for the Meeting of the Committee of Finance Ministers and Central Bank Governors. Cape Town, 2009.

African Development Bank. Preventing a Credit Crunch in Africa: The Role of Financial Regulation: Briefing Note’. Prepared for the Meeting of the Committee of Finance Ministers and Central Bank Governors. Cape Town, 2009.

African Development Bank. Trade, Investment and Domestic Resource Mobilization’. Prepared for the Meeting of the Committee of Finance Ministers and Central Bank Governors. Cape Town. 2009.

African Development Bank. An Update on the Impact of the Financial Crisis on African Economies’. Issues Paper prepared for the C10 Meeting. Dar es-Salaam. 2009.

African Development Bank. Impact of the Crisis on African Economies: Sustaining Growth and Poverty Reduction, African Perspectives and Recommendations to the G20’. Report from the Committee of African Finance Ministers and Central Bank Governors established to monitor the crisis. 2009.

Alemu, Getnet. Global Financial crisis Discussion series. Paper 16: Ethiopia Phase 16. 2010. Web.

Dorosh, Paul, Robinson, Sherman & Ahmed, Hashim. Ethiopia strategic support Program II (ESSP-II). Economic Implications of Foreign Exchange Rationing in Ethiopia. Summary of ESSP-II Discussion Paper 9: Economic Implications of Foreign Exchange Rationing in Ethiopia. Dec. 2009. 10 Jun. 2011. Web.

International Rivers. Fact Sheet: Gibe III Dam, Ethiopia. 2009. Web.

Investing in Ethiopia. Ethiopia’s Export performance. 2010. Access Capital Investing in Ethiopia. 2010.

Sisay, Desalegn. Meles Zenawi Optimistic about Ethiopian Flower Industry, 2009. Web.

Taffesse, Seyoum, A & Ferede, Tadele. The Structure of the Ethiopian Economy – A SAM-based Characterisation. Addis Ababa. 2004.

Teshome, Amdissa The Impact of the Financial Crisis on Developing Countries: Ethiopia, in Voices from the South Report. Brighton: IDS. 2008.

Torbat, Akbar.E. Global Financial Meltdown and the Demise of Neoliberalism. Montreal: Center for Research on Globalization. 2008. Web.

The Ethiopia Macroeconomic Handbook 2010. Web.