Introduction

In nations where research is restricted by economic or political reasons and where the cost of printed material far exceeds any commercial benefit, the most effective method to transfer thoughts, technical expertise and ideas is through the open grassroots educational system that Dickins, 2006 calls the invisible college (Dickins, 2006).

Topic Overview

Capital Golondrina is an economic concept developed in the educational institutes of South America. This concept has been developed in the Spanish language (Dickins, 2006). Capital Golondrina is an expression of cultural and vernacular imagery to draw similarities between the impact that fleeting bands of birds have on small communities and the effect that high yielding short-term direct private investments have on the economies of developing nations.

This paper translates the conceptual meaning of the Capital Golondrina concept to that of the English language and culture, adding academic legitimacy to the understanding of the economic consequences that high yielding short-term direct private investments have on developing economies. High yielding short-term direct private investments include government securities, commercial paper maturing in 28, 60 and 90 days (Ffrench-Davis, 2006) and Import-Letters of Credit as these have high effective interest rates and are valid for periods that do not exceed 180 days.

Many researchers have attempted to examine the relationship between short-term direct private investment and consumption noting that there is a positive correlation but a substantial gap in the magnitudes of both (Kose, Prasad, Rogoff and Weii, 2003). This study expands the definition of Capital Golondrina to include Import Letters of Credit and correlates consumption with capital Golondrina or the translated term Fleeting Capital. Therefore, this quantitative research focuses on measuring the correlation between Fleeting Capital and Consumption volatility.

Statement of the Research Problem

The economic implications of Fleeting Capital have been perplexing for economic researchers for quite long. For past 25 years researchers have not been able to explain the relationship between Fleeting Capital and Consumption volatility. Kose, Prasad, Rogoff and Wei (2003) demonstrated through empirical research that there is not a causal relationship between short-term direct private investment and consumption volatility. In effect, the most recent acquiescence that the free flow of merchandise and funds are negatively associated with economic growth, is documented by Kose, Prasad and Terrones (2005) as a result of over 40 years of research:

“We extend the analysis in Kose, Prasad, and Terrones (2005) to provide a comprehensive examination of the cross-sectional relationship between growth and macroeconomic volatility over the past four decades. We also document that while there has generally been a negative relationship between volatility and growth during this period, the nature of this relationship has been changing over time and across different country groups. In particular, we detect major shifts in this relationship after trade and financial liberalizations. In addition, our results show that volatility stemming from the main components of domestic demand is negatively associated with economic growth.” (p. 1)

Statement of the Problem

The problem to be addressed within the proposed study is to measure the correlation between Fleeting Capital and Consumption during the past 20 years. A number of studies have addressed the correlation between Fleeting Capital and Consumption, however, short-term direct private investments and high levels of consumption have not been addressed before.

Due to scarcity of literature on this issue the current study aims at finding relation between short-term direct private investment and high levels of consumption. The paper names and justifies the designation of Fleeting Capital as the addition of cash short-term direct private investment and Import Letters of Credit, based on the definitive similarities of both. Import Letters of Credit yield the same high effective interest rates; have the same maturity periods and the same economic impact as direct private investments have on developing economies.

Purpose of the Study

The purpose of this quantitative research study will be to determine the degree of correlation between Fleeting Capital and Consumption in South America. Other investigators have measured the correlation between cash short-term private direct investments and consumption. Their findings demonstrated that although there is a high degree of correlation, the magnitude of short-term direct private investments cash flows is not sufficient to justify the high levels of consumption. The purpose of this quantitative study is to measure the correlation between the addition of cash short-term direct private investment and Import Letters of Credit to Consumption.

The impact of high yielding cash short-term direct private investments on the economies of emerging and developing nations has been a topic of increasing interest for academics, economists; central bankers; commercial and investment bankers as well as businesspersons of emerging nations of the world (Ramirez & Flores, 2006). According to Safran (2006), the effect of short-term direct private cash investment in these economies is highly important as it affects every aspect of human endeavor.

Many studies have pointed out the negative relationship between consumption or domestic demand and economic growth (Kose, Prasad and Terrones, 2005) but after the liberalization of trade and financial flows the relationship between consumption and economic growth became increasingly volatile to the point where Argentina, Bolivia, Brazil, Chile, Colombia, Paraguay, Peru, Uruguay and Venezuela enacted legislation limiting financial flows. Despite the limitations imposed on short-term direct private investment and very limited increases in domestic production, volatility of the consumption function continues to increase.

Therefore, the inquiry is directed to find a correlation between the funding sources that sustain the high levels of consumption; finding that remittances are one unrestrained source of cash inflow and Letters of Credit, by their capacity to increase inventories, are another source of capital inflow. Therefore, the purpose of this paper is to name, describe, measure and correlate the addition of short-tern private direct investment in cash and the value of reconfirmed Letters of Credit issued by global money center banks.

This study on Fleeting Capital attempts to contribute knowledge to the English speaking academia by describing the characteristics of Fleeting Capital as identified by scholars, entrepreneurs, bankers and reporters of South American nations.

Research Questions

The central research question focuses on determining the correlation between Fleeting Capital, defined as the addition of short-term private direct investment in cash and in Import Letters of Credit and Consumption. To answer the central research question, two sub-questions will be examined:

- Q1: What is the correlation, if any, between cash short-term private direct investments and Consumption?

- Q2: What is the correlation, if any, between Import Letters of Credit and Consumption?

- Q3: What is the correlation, if any, between the interaction of Import Letters of Credit plus cash short-term private direct investments and Consumption?

Significance of Research

Since the 1500s, academia has believed that the most expeditious way to develop a nation is to remove all restrictions to trade and financial flows, but after 40 years of liberalization, economic development has eluded the nations that removed all barriers to trade and financial flows, but have experienced the development of a high level of volatility in consumption. Researchers have documented this misconception very clearly, but what remains unexplained is the source of funds to finance such high levels of imports that fuel consumption in view of the small magnitude of short-term direct private investments (Kose, Prasat and Terrones, 2006).

This theory advocates the liberalization of the current account, the creation of securities markets, the removal of restrictions to cross border trade and to the flow of short-term as well as long-term private direct investment capital. There is sufficient literature endorsing this theory (Kose, Prasat, and Terrones, 2007; Sorensen, et al 2006; Artis and Hoffman, 2006; Giannone and Reichlin, 2006; Moser, Pointner and Scharler, 2004).

However, evidence obtained through research is unable to support any of the economic development theories from as far back as 1752 when David Hume proposed the removal of trade restrictions as an instrument of economic development (Rotwein, 1970). The re-allocation of resources by re-organizing markets where lower priced higher quality foreign products would replace inefficient domestic production, and domestic efficient production would find expansive foreign markets and attractive opportunities is not supported by empirical research (Ffrench, 2006).

Likewise, high interest rates prevailing in the capital markets of emerging nations dissuade entrepreneurs from investing in projects that have a long maturation process, but entice them into speculative ventures with high demand, such as imported merchandise. The high degree of dissemination of information regarding the lifestyles of consumers in developed nations through the global news media increases the demand for goods that can be easily imported. The removal of trade restrictions creates further entrepreneurial interest in the importation of goods for the markets of emerging and developing nations.

Academics, legislators and the South American media have termed the concept of high yielding short-term direct private foreign investments as Capital Golondrina (Ffrech, 2006), a Spanish term that literally translated into English is meaningless. However, using Larson’s rules for meaning based translations, the word Capital is a “shared lexical equivalent in the source language, Spanish and in the receptor language, English” (Larson, 1998, p. 23). Therefore, the concept of Capital is the same in both languages. However, the word Golondrina is an “adverbial concept that modifies the noun concept” Capital (Larson, 1998).

The “surface structure of the meaning components” (Larson, 1998) is based on the modifying meaning of the word Golondrina that translates to swallow “a small long-winged songbird noted for its swift graceful flight” (Komar, 1997), but Swallow Capital would translate into yet another meaningless concept.

Therefore, it is necessary to consider the “deep structure” (Larson, 1998) of the concept where the implicit information conveyed by the word Golondrina indicates a series of attributes. The first attribute associates the attractive quality of the bird’s song and its swift graceful flight with that of capital. The second attribute attaches the fleeting residence of these birds and their capricious ready to escape attitude to the short-lived disposition of short-term direct investments.

The translation based on the “surface and deep structures” (Larson, 1998) would yield the term Wandering Capital, but adding the “secondary sense of the lexical item” (Larson, 1998) transposes the messy natural consequences left behind by a flock of birds to direct short-term private investment capital. The English term that emerges from this rigorous meaning based translation methodology, as a culturally relative term that most appropriately illustrates the attractive characteristics, fleeting features and detrimental economic characteristics of high yielding short-term investments is contained in the expression Fleeting Capital also called capital Golondrina.

However, regulations limiting the exposure of global commercial banks in Contingent Liabilities, such as Reconfirmed Letters of Credit (Federal Depository Insurance Corporation, 1999) are relaxed and discretionarily followed by international commercial bankers. Internal and external auditors limit the reporting of Letters of Credit to Auditor’s Notes to the Financial Statements (Financial Accounting Standards Board, 2002) but not entering into the determination of risk. Consequently, in the profit maximization pursuit, commercial banks circumvent legislation that limits short-term direct investments by using Letters of Credit to capture the high interest rates prevailing in the economies of South America.

Definition of Key Terms

- Confirmed Letter of Credit. A Letter of Credit where the guarantee for payment is the responsibility of a bank in the exporter’s (seller’s) nation. According to the Federal Reserve Board:

Letter of credit—confirmed. A letter of credit issued by the local bank of the importer and to which a bank, usually in the country of the exporter, has added its commitment to honor drafts and documents presented in accordance with the terms of the credit. Thus, the beneficiary has the unconditional assurance that, if the issuing bank refuses to honor the draft against the credit, the confirming bank will pay (or accept) it.

In many instances, the seller (exporter) may ask that the letter of credit be confirmed by another bank when the seller is not familiar with the foreign issuing bank or as a precaution against unfavorable exchange regulations, foreign-currency shortages, political upheavals, or other situations. (Federal Reserve Board, 2007).

- Contingent Liability. According to the Financial Accounting Standards Board, 2002, a contingent liability is defined as:

“A contingent liability is a present obligation that arises from past events that may require a future cash outflow (or other sacrifice of economic benefits) based on the occurrence or nonoccurrence of one or more uncertain future events not wholly within the control of the enterprise.” (Financial Accounting Standards Board, 2002)

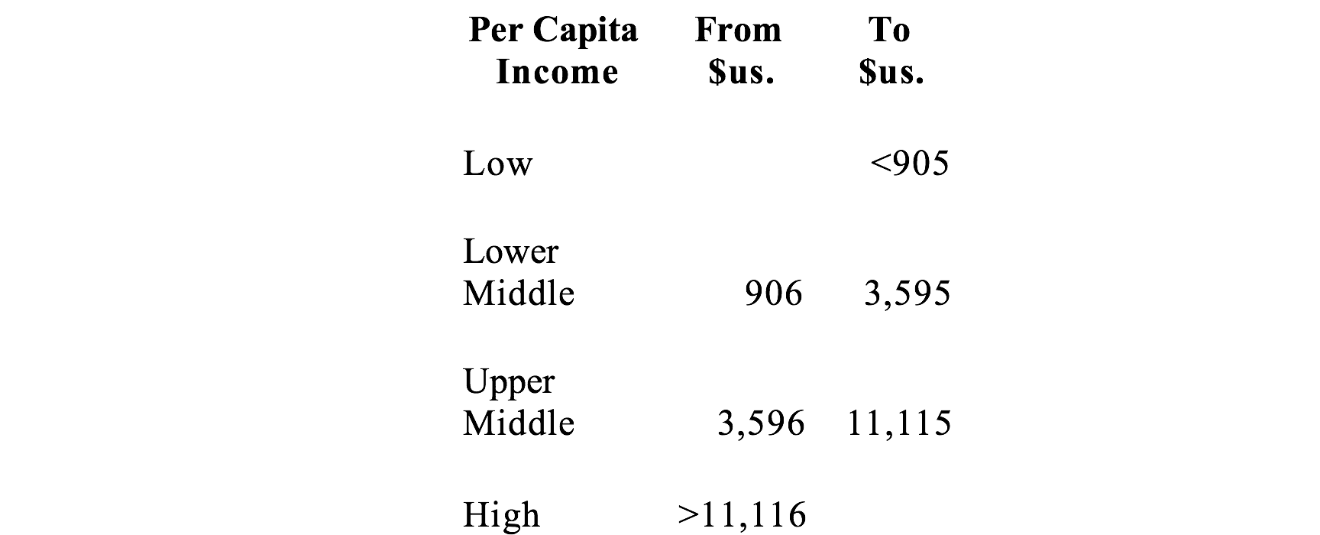

Table 1

- Developing Nation. Also called Developing Economy, Emerging Market Economy, Emerging Country. This dynamic concept changes every year due to the various degrees of economic development. The World Bank classifies economies by Per Capita Gross National Income (GNI) using the Atlas factor the categories are periodically revised into the following categories:

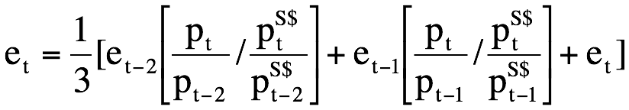

“The Atlas conversion factor for any year is the average of a country’s exchange rate for that year and its exchange rates for the two preceding years, adjusted for the difference between the rate of inflation in the country. Weights vary over time because both the composition of the SDR and the relative exchange rates for each currency change.

The SDR deflator is calculated in SDR terms first and then converted to U.S. dollars using the SDR to dollar Atlas conversion factor. The Atlas conversion factor is then applied to a country’s GNI. The resulting GNI in U.S. dollars is divided by the mid-year population to derive GNI per capita. The following formulas describe the calculation of the Atlas conversion factor for year t:

and the calculation of GNI per capita in U.S. dollars for year t:

where et* is the Atlas conversion factor (national currency to the U.S. dollar) for year t, et is the average annual exchange rate (national currency to the U.S. dollar) for year t, pt is the GDP deflator for year t, pt S$ is the SDR deflator in U.S. dollar terms for year t, Yt $ is the Atlas GNI per capita in U.S. dollars in year t, Yt is current GNI (local currency) for year t, and Nt is the midyear population for year t.” (World Bank, 2008).

- Economic Openness. Exports plus Imports divided by GDP is the total trade as a percentage of GDP (University of Pennsylvania, 2008).

- Human Development Index (HDI). According to the United Nations Development Programme, the keepers of the Human Development Index, through their agency Human Development Reports:

“The Human Development Index measures the average achievements in a country in three basic dimensions of human development: a long and healthy life, knowledge and a decent standard of living. It is calculated for 177 countries and areas for which data is available. The HDI – human development index – is a summary composite index that measures a country’s average achievements in three basic aspects of human development: health, knowledge, and a decent standard of living.

Health is measured by life expectancy at birth; knowledge is measured by a combination of the adult literacy rate and the combined primary, secondary, and tertiary gross enrolment ratio; and standard of living by GDP per capita (PPP US$). Before the HDI itself can be calculated, an index needs to be created for each of these dimensions. To calculate these indices – the life expectancy, education and GDP indices – minimum and maximum values (goalposts) are chosen for each underlying indicator. Performance in each dimension is expressed as a value between 0 and 1 by applying the following general formula:

The HDI is then calculated as a simple average of the dimension indices.

Table 2

The goalpost for calculating adult literacy rate is 100%. In practice, the HDI is calculated using an upper bound of 99%. The life expectancy index measures the relative achievement of a country in life expectancy at birth. The education index measures a country’s relative achievement in both adult literacy and combined primary, secondary and tertiary gross enrollment.

First, an index for adult literacy and one for combined gross enrollment are calculated. Then these two indices are combined to create the education index, with two-thirds weight given to adult literacy and one-third weight to combined gross enrollment. The GDP index is calculated using adjusted GDP per capita (PPP US$). In the HDI income serves as a surrogate for all the dimensions of human development not reflected in a long and healthy life and in knowledge. Income is adjusted because achieving a respectable level of human development does not require unlimited income. Accordingly, the logarithm of income is used:

Once the dimension indices have been calculated, determining the HDI is straightforward:

It is a simple average of the three dimension indices.” (United Nations Development Program, p. 29).

- Index of Economic Well-Being (IEWB). According to the Center for the Study of Living Standards, the variables in the Index of Economic Well-Being are “per capita market consumption, government spending, capital stock, net foreign debt, natural resources research and development, along with variation in work hours, human capital, social cost of environmental degradation, poverty intensity, the Gini coefficient including risks from unemployment, illness, single parent poverty and poverty in old age. The derivational index is complementary to the conglomerative index and both indices use the same variables, but emphasizing the well-being of the worst-off.” (Saltzman, 2003).

- Letter of Credit. Also known as Commercial Letters of Credit, this paper only refers to Import Letters of Credit. These are binding documents often used in international trade to legally transfer cross-border ownership and possession of merchandise from the seller to the buyer minimizing the risks involved in transporting and handling the underlying products. According to the Federal Reserve Board, Letters of Credit are instruments issued by a bank serving as an intermediary between a buyer and a seller of goods to assure payment for the goods. (Federal Reserve Board, 2007).

- Reconfirmed Letter of Credit. A Letter of Credit issued by the importer’s local bank in the country of the importer in favor of the exporter, transmitted to the exporter’s bank but confirmed by a global money center bank.

- Remittances. According to the United Nations “Personal remittances are calculated, taking the perspective of the receiving country, as follows:

Personal remittances = compensation of employees – social contributions + personal transfers + social benefits + capital transfers

Personal remittances thus include all current transfers, except for net non-life insurance premiums and nonlife insurance claims3, paid or received by resident households, capital transfers received by households and compensation of employees from persons working abroad for short periods of time. Part of the gross compensation of employees (COE) receivable by households is sent back to the country where the short term employment took place.

The part of COE which goes back to the country of employment includes social contributions, taxes on income and travel and passengers transportation related to short term employment. While social contribution is part of the BOP standard presentation, the other components – taxes on income and travel and passengers transportation related to short-term employment – are not.”

- Underdeveloped Nation. According to Rajan, a nation is underdeveloped when it has a privileged elite entrenched in maintain their rents by forcing suboptimal policies on the rest of the population through oppressive political institutions. (Rajan, 2007). According to the World Bank, these nations face an unsustainable debt situation or a debt-to-export ratio higher than 150%, or in case of very open economies that exclusively rely on external indicators with a debt-to-government revenues ratio higher than 250%, after the full application of traditional debt relief mechanisms (The World Bank, 2008).

Brief Review of the Literature

The literature reviewed for this paper includes readings in economic development, empirical research studies, enacted legislation, accounts of economic historians, manuals published by governmental institutions, texts on statistical techniques and authoritative publications on meaning based translations.

Readings in Meaning Based Translations

To fully understand the economic effect named by Ffrench in 2006 after a band of birds (Ffrench, 2006), it was important to understand the life cycle of Golondrinas or Swallows as described by Komar in1997 (Komar, 2007). Once the cultural and vernacular similarities were understood, Larson’s systematic and rigorous meaning based translation techniques (Larson, 1998) were used to transition this understanding into the English language.

Empirical Research Studies

In numerous research studies the investigative approach was shifted to the empirical research sponsored by the International Monetary Fund (IMF) and the World Bank. According to the IMF and World Bank the liberalization of trade and financial flows was the most important cause for economic development in underdeveloped nations but finding instead that such liberalization only accounted for an increase in consumption volatility (Ffrench, 2006).

Accounts of Economic Historians

Economic historians documented the events that led to the liberalization of trade and financial flows, their impact on the economies of South America and the reasons that lead to the enactment of legislation that severely curtailed economic openness (Rajan, 2007).

Examination of Enacted Legislation

It is important to note that without exception, all nations in South America identify the same economic consequences that high yielding short-term direct private investment has had on their economies (Carbonell de Torres, Atares, Rocha, Rico, 2005). Rampant unemployment, widespread bankruptcies of the private sector, ballooning debt of the public sector and the erosion of individual wealth justify the enacted legislation to deter the flow of short-term direct private investments.

Review of Manuals Published by Governmental institutions

The analysis of manuals published by the United States Securities and Exchange Commission, the Federal Depository Insurance Corporation and the United Nations Commission on Trade and Development revealed that Letters of Credit have the same financial characteristics as short-term direct private investments (Amoros, Cortes, Echecopar, Flores, 2006). Further analysis of the annual 10K Reports filed by commercial banks showed that Letters of Credit are ambivalent capital discretionarily used by commercial banks as high yielding short-term private direct investments.

Analysis of Statistical Series

The data bases of the International Monetary Fund, the World Bank, the United Nations Commission on Trade and Development and the United States Securities and Exchange Commission provided the accurate figures necessary to perform a time series analysis of consumption, short-term direct private investment in cash and in Letters of Credit ).

Summary

Most of the literature on economic development from David Hume in the 1500s up to the early 1970s, proclaims that the most expeditious way to develop any nation is to remove all barriers to trade and financial flows (Rotwein, 1970). However, empirical evidence demonstrates that the economic and social cost of such removal has been staggering and in many cases irreparable.

Similarly, although there is a high correlation between high yielding private direct investments and consumption, the gap between these two variables is huge and no explanation exists (Kose, Prasad, Rogoff and Weii, 2003). This paper suggests, that Import Letters of Credit can explain the gap between these two variables. However, it is important to note that this paper does not examine cause and effect it exclusively measures the correlation between the addition of high yielding short-term direct private investment and Import Letters of Credit with consumption.

Methodology

Approach to Research

The research questions attempt to measure short-term direct private investment and the amount of exposure in Letters of Credit to South America that global banks have. This study measures the magnitude of Fleeting Capital before determining the degree of the relationship between consumption, short-term direct private investment and Import Letters of Credit to the region. Therefore, this study will be a relationship study.

This research uses the correlational method to study the relationships between variables. According to Gall, Borg and Gall, 2006, the correlational methods allow the researcher to analyze how variables affect a pattern of behavior of the dependent variable (Gall, Borg and Gall, 2006) This study focuses on how Fleeting Capital correlates with consumption. Simple regression analysis was used to study the relationship between the dependent variable and one independent variable.

Research design bonds together all the elements of the research project to pivot them on procuring answers to the central research questions (Trochim, 2005). Research designs structure the research project into major elements classified by their relevance to the nature, measurement, time period and the way these observations are treated. (Trochim, 2005). Designs are typified according to the validity of the experiment conducted in search of the answers to the central research questions (Marshall and Rossman, 2007).

Research designs are patterned after true experimental research that seeks to establish a cause and effect by conducting a randomized experiment that duplicates the observed phenomena in a population. When a randomized experiment is not adequate, but multiple groups or multiple waves of measurement are adequate to evaluate the observed phenomena, as in the pre and post-tests used in education, then quasi-experimental research designs are used.

However, if the adequate measurements for the research project are cannot include the measurement of a control group, then a non-experiment design is adequate for the research project. All research projects are systematic in their approach, but qualitative research projects have holistic world-view of the topic under study, assuming that reality is not a unique but based on the changing perceptions of each person where meaning is subjected to situation and context. Qualitative research produces meaningful results by perceptually piecing together phenomena to leave it to the reader’s interpretation.

Conversely, quantitative research focuses on gathering information about the world through numeric data using a formal, objective and systematic process.

Hypotheses

- H10: There is a positive correlation between cash short-term private direct investments and Consumption

- H1a: There is no correlation between cash short-term private direct investments and Consumption.

- H20: There is a positive correlation between Import Letters of Credit and Consumption

- H2a: There is no correlation between Import Letters of Credit and Consumption

Constructs/Variables

All the variables to be used in the proposed paper are measured in current United States Dollars because it examines the flow of merchandise and the flow of currency for 28, 61, 89, 121, 150, and 180 days.

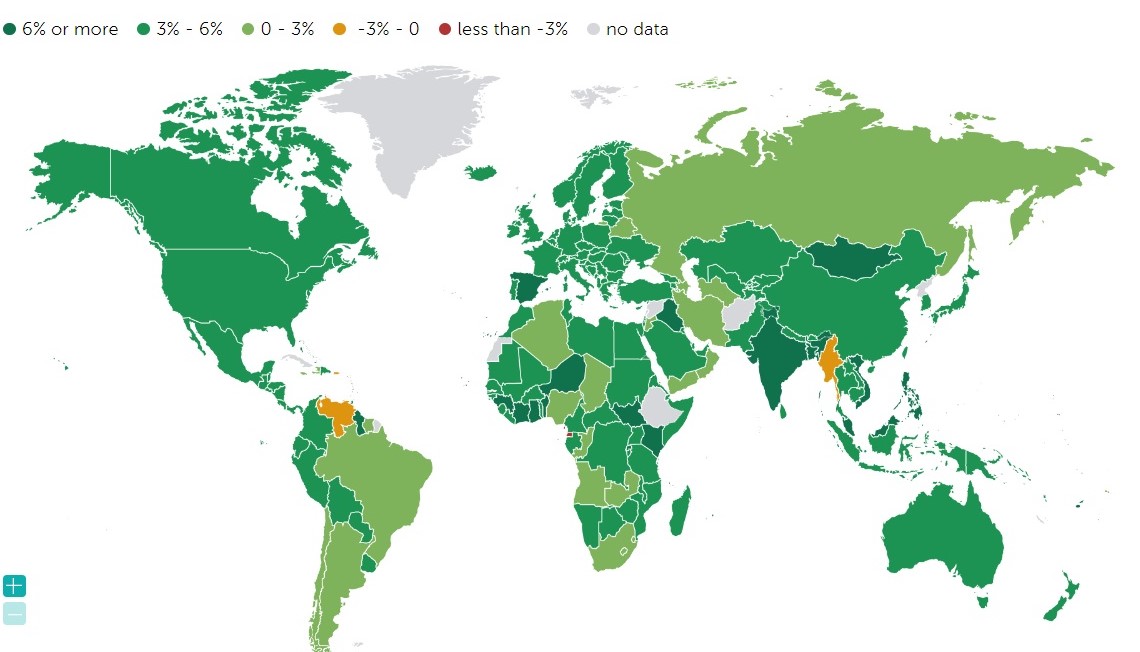

As illustrated in Figure 1, there is little relevance between Real GNP, short-term direct private investment and imports. However, a historical series of Real GNP is used only as an indicator of economic stability. Real GNP from 1983 to 1988 and again from 1990 to 1996 grew at positive rates that encouraged infrastructure development and the formation of new businesses, but during these same years short-term direct private investment flows were very low.

Their exponential increase until 1997 and Real GNP plummeted into negative growth. However, the substantial decline of short-term direct private investment in 1999 is coincidental with a substantial increase in Real GNP after 2002. Real GNP has no long-term coincidental positive correlation with either imports or short-term direct private investment; for these reasons only short-term direct private investment is one chosen variable.

It seems logical that nations that are contained in one large continent with the necessary infrastructure to facilitate trade, such as railroads, roads, pipelines, passenger and cargo ocean lines as well as airline services, similar banking systems, liberalized financial flows and trade restrictions; would actively trade with each other. However, despite these infrastructural, geographic, financial and cultural advantages, it is clear that openness has not increased the volume of trade between the economies of the South American continent.

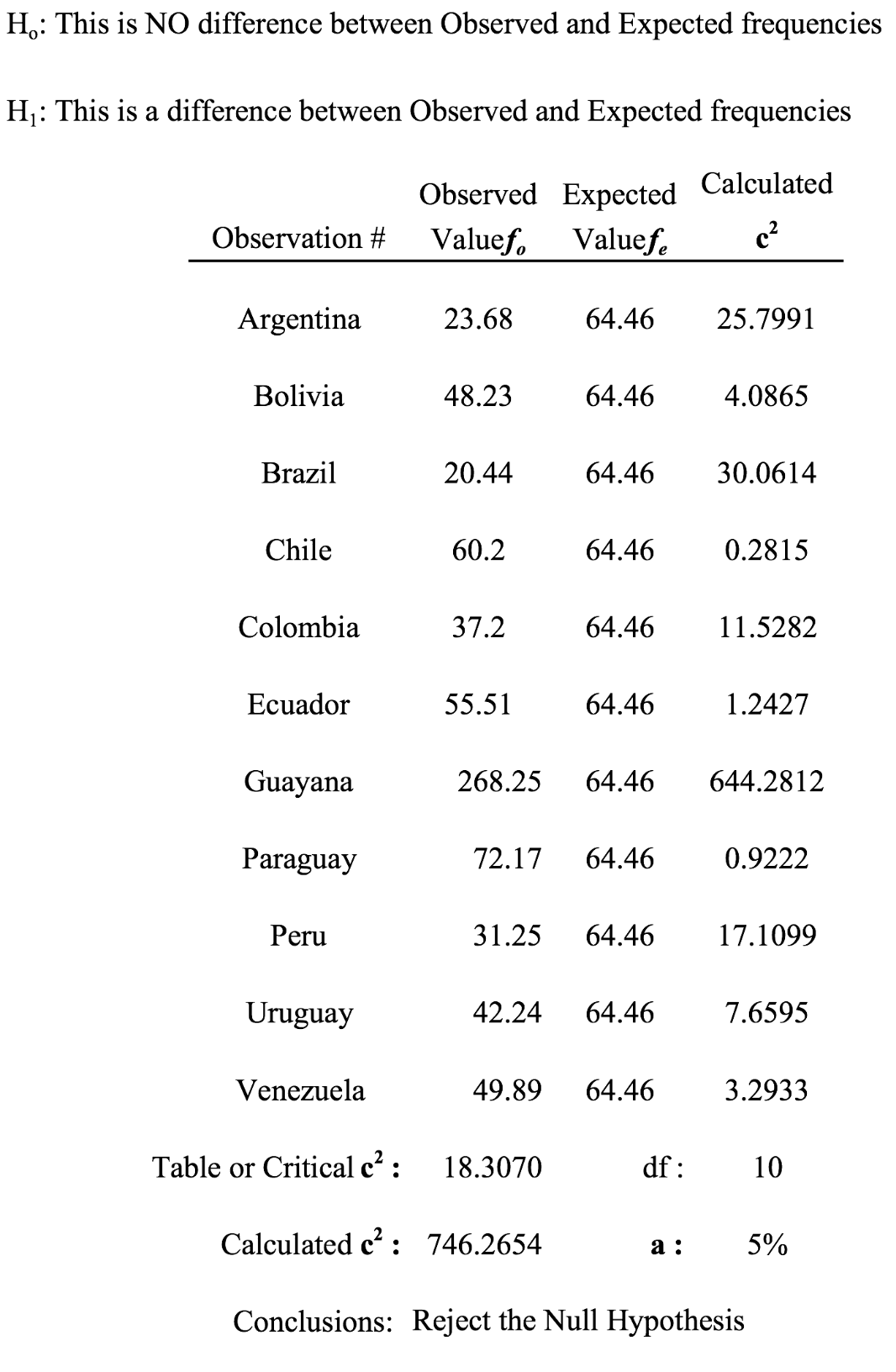

To test the hypothesis that there is no significant level of trade between the nations of South America, the Chi Square test of dependency is used to determine if the observed values of the degree of economic openness, as measured by the International Monetary Fund (OPENC), for each nation in South America and the expected value of the average economic openness of all nations in that region, would reveal that these economies are not statistically dependent.

The outcome of this examination is detailed in Figure 2, illustrating that there is no significant difference between the observed economic openness of each nation in South America and the average economic openness of all the nations in South American. Despite their proximity and the extraordinarily advantageous factors to facilitate trade in the region, intra-regional trade has remained low, only with small and sporadic increases in the volume of trade.

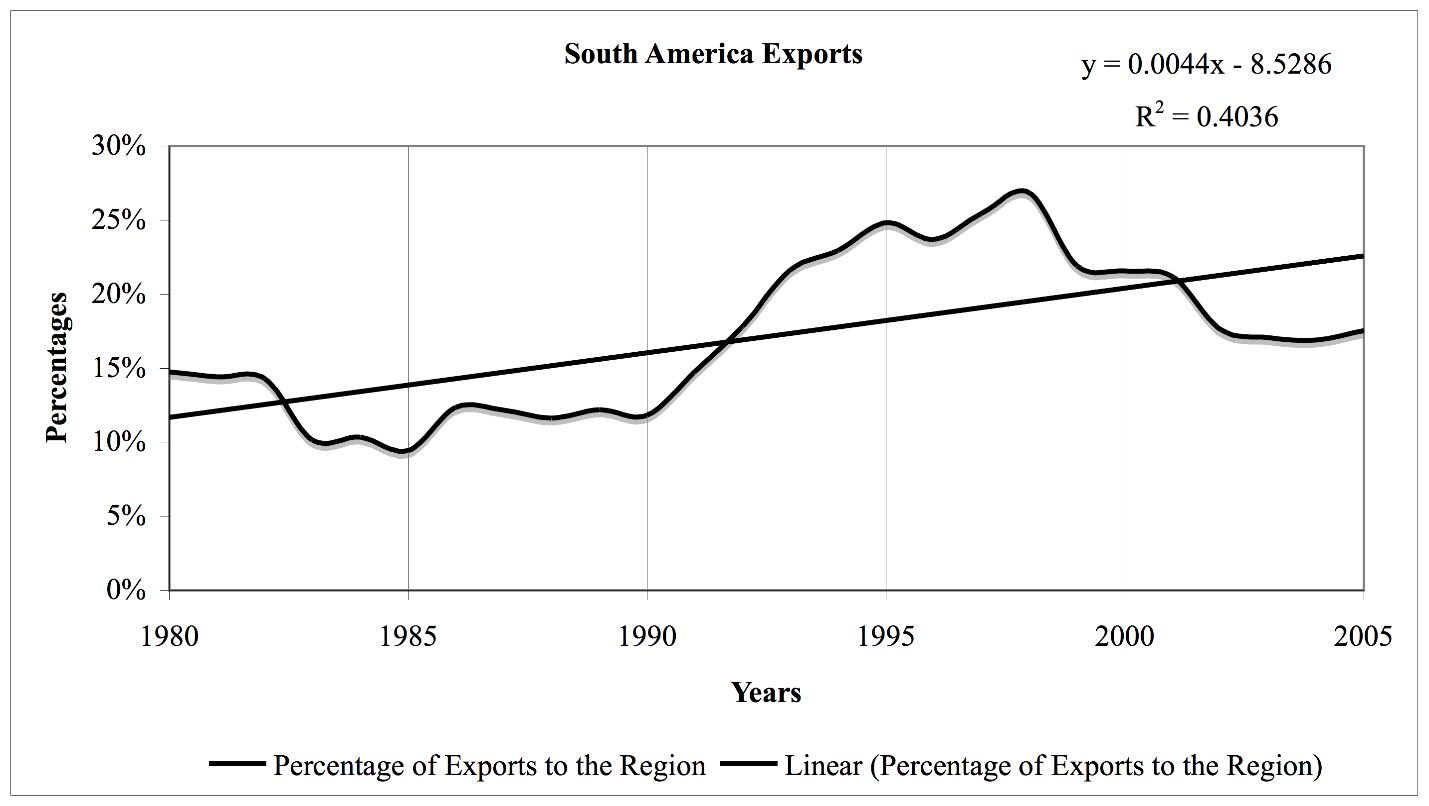

Intra-regional trade between South American nations over the past 24 years averaged only 17.53% or (5.26%) of total exports, growing at less than half of one percent per year, as illustrated in Figure 3.

Furthermore, South American nations have insignificant trade levels with other emerging nations of the world that are not in South America, due to the characteristics of the exportable supply of emerging nations and the absence of affordable transportation. Thus it is reasonable to assume that these nations trade more intensely with industrialized nations, especially after 1990 when subscriptions to global television services such as CNN, NBC and FOX became affordable and popular, dramatically increasing the Imitation Coefficient (Yaveroglu and Donthu, 2006) and the demand for consumer electronics medical equipment, pharmaceuticals and automobiles.

Finally, import statistics do not reflect the high level of undocumented shipments entering these nations. In most emerging nations, in addition to tariffs on imports, customs duties and various import fees, importers have to pay sales taxes before the merchandise can be sold. This translates into a very heavy financial burden on importers who seek cash flow savings by patronizing the well-organized circles of corruption (Mujumdar, 2000). Therefore, to increase the accuracy of this study, the focus is on Letters of Credit because these illustrate substantial imports to South America from their most active trading partners.

According to Alfieri and Havinga, remittances are personal amounts sent by U.S. based wage earners to their relatives in a host nation and although personal remittances are important cash inflows to the economies of developing nations, these do not flow out of these economies (Alfieri, Havinga,, 2005). For this reason remittances are not considered as a variable because this type of capital flow does not have the characteristics of Fleeting Capital as it does not capriciously flow out the host country.

The variables used for this research study are short-term direct private investment and Letters of Credit reconfirmed by global banks in favor of importers in the South American Region.

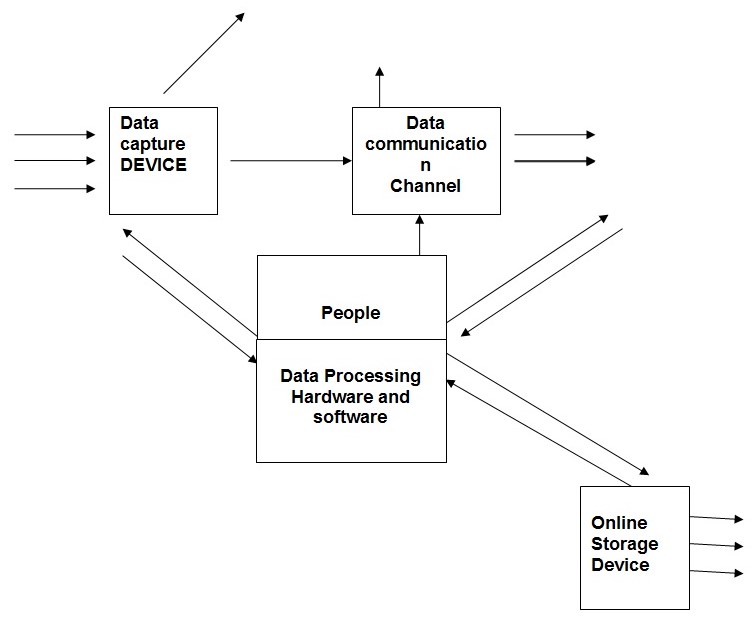

Data Collection and Analysis

Three steps are involved in the data collection process from previous studies. All data will be collected for the periods from 1990 to 2005 and it was population data where no sampling was done. The first step of the process involved the retrieval and analysis of population data from the United Nations Conference on Trade and Development database, for direct short-term investment flows to each nation in South America, these were sorted by year and nation and then aggregated to get a total for the region.

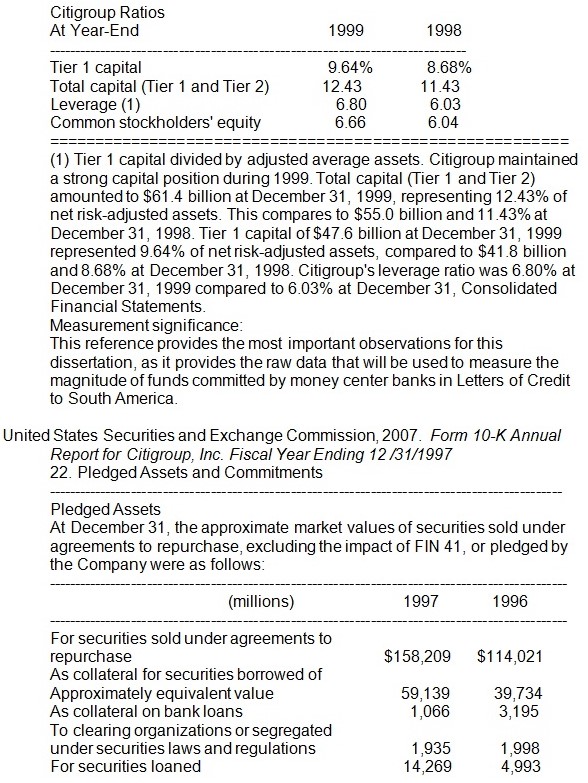

The second step involved the retrieval and analysis the annual 10K reports filed by Bank of America, Citibank and J.P. Morgan Chase Bank with the United States Securities and Exchange Commission. In the Auditor’s Notes to the Financial Statements, under the subheading of Contingent Liabilities the data relative to Letters of Credit provided either a specific figure for the region, or data for each South American country in which the bank operates, or a percentage of their global exposure for South America. Based on the data provided in the annual 10k Report, a total was calculated for the region and for each year.

The third step of the process involved the retrieval of consumption data from the database of the International Monetary Fund.

Ethical Assurances

The elaboration of this paper will follow the rigorous methodological guidelines typically used in studies that do not involve human subjects but use empirical observations of primary data. Accordingly, the paper on Fleeting Capital does not need to be registered under the Code of Federal Regulation of the Department of Health and Human Services Title 45 – Public Welfare – Part 46 – Protection of Human Subjects; neither does the author of this paper needs to be certified by the Institutional Research Board as Qualified Principal Investigator.

The data gathering process of this paper will adhere to the actual figures as stated in the documents published by the reporting agencies and commercial banks. It is also important to note that this paper is distant from the influence of Interpretism, a philosophical school that promotes the idea that reality is constructed by the subjective experiences of social agents (Crane, 1999).

Although the paper on Fleeting Capital is not a qualitative paper, the portion that translates the cultural concept from Spanish to English requires the use of qualitative techniques, as the research methodology systematically introduces the Fleeting Capital concepts to American academia. This portion of the paper will be highly rigorous leaving almost no room for the development of exaggerated, forced or convenient interpretations.

In the process of formulating and developing the paper on Fleeting Capital, it will be important to minimize the influence of positivism. Positivism assumes that logic is reflected in empirical findings and supports the belief that authentic knowledge can only be found in actual experiences to adequately explain reality (Crane, 1999). Intensive reliance on scientific methods in the social sciences including Economics, leads to an overabundant use of mathematics to explain economic phenomena that requires assumptions to derive a possible theory (Kidwell and Kidwell, 2008).

The most commonly used assumption in Economic research, ceteris paribus, states that a specific observable event will occur when all else is unchanged (Paelinck and Sarafoglou, 2006). Attempts to stretch the characteristics found in empirical research to portray a reality that may not necessarily exist is a frequent pitfall of positivism. While the paper relies on scientific methods to test its hypothesis and to explore the relationships between variables, the paper will make every attempt to avoid the excessive use of quantitative methods to explain the characteristics of Fleeting Capital.

Although the main purpose of empirical research is to engage in theory building and theory generation, clearly the ethical issue that is necessary to avoid is the temptation to propose theories that may not actually exist or that are real but require further proof beyond that which is provided in the paper (Crane, 1999).

Annotated Bibliography

Alfieri, A., Havinga, I. (2005) Remittances and movement of persons. Fourth Coordination Meeting on International Migration Population Division Department of Economic and Social Affairs, United Nations Secretariat, New York. Web.

Provides excellent definition of remittances.

Jeffery, S. (2007). The New UCP 600. Banking & Finance Law Review, 23(1), 189-210. Web.

This study describes the features of the new Uniform Customs and Practice for Documentary Credits passed by the International Chamber of Commerce, Commission on Banking Technique and Practice on October 25, 2006 and came into force on July 1, 2007. Provides a detailed explanation of the changes and comments on each change. It is a useful exploration about the new mandate that governs documentary credit loans specifically for International Letters of Credit.

Federal Depository Insurance Corporation. (1999). Checks & Balances Guidelines for preparing an error-free Call Report (For FFIEC 034 Report). Web.

This instructive publication is designed for internal auditors of commercial banks and all those involved in compliance with banking regulations and sound bank governance. The requirements for insurance against risks that pertain to the operations of commercial banks are clearly spelled out in this document. The most beneficial aspect of this document is the explanation regarding the limits to which a commercial bank can assume contingent liability risk as a percentage of total assets. The scope of this document is limited to describe the conditions under which the operations of a commercial bank are insurable risks for the Federal Depository Insurance Corporation. The relevance for my dissertation is in that it limits the amount that a bank can commit to contingent liabilities to no more than 10% of total assets.

Measurement significance: This reference specifies the maximum recommendable risk exposure that a commercial bank can assume in Letters of Credit. As such it sets the annual maximum limit for each observation and for the population of banks operating in South America.

Federal Reserve Board. (2007) Commercial Bank Examination Manual Supplement 27—May 2007. Web.

This manual defines Letters of Credit and sets issuing limitations.

Financial Accounting Standards Board. (2002). Action Alert No. NOTICE OF MEETINGS OPEN MEETING OF THE FINANCIAL ACCOUNTING STANDARDS BOARD. Web.

This document provides the definition of Contingent Assets and Liabilities.

Carbonell de Torres, S., Atares, G., Rocha, H., Rico, F. (2005). Argentina 2000 GEM National Report. Babson College U.S.A., London Business School., Kauffman Center for Entrepreneurial Leadership, Ewing Marion Kauffman Foundation. Spanish. Web.

This paper charts the birth of enterprises from 1997 to the year 2000 and it provides the result of an entrepreneurial diagnose of Argentina using a sample of 43,000 adults between the ages of 18 and 64 and 800 experts in entrepreneurship. The report is very comprehensive and it is used to validate the claim that the creation of new enterprises diminishes as the government increases its reliance on Fleeting Capital.

Measurement significance: This reference provides measurements of Short-term direct private capital flows only into Argentina.

Durante, Gary. (2005). “A Quantitative Analysis of the Leadership Behavior Styles of Leaders at a Naval Warfare Systems Center,” Northcentral University.

This dissertation is an example of a Descriptive Correlation Design that was well executed. The sole purpose of this study was to evaluate and characterize leadership behaviors of current first-line supervisors and employees in non-supervisory roles with aspirations of secession.

Pelosi, M., Sandifer, T., Sekaran, U. (2001) Research and Evaluation for Business. John Wiley and Sons, New York.

This book is an statistics textbook that explains very well the basic research methodology, its value for this dissertation is in the explanation about Simple Regression Analysis, Exponential Smoothing and Polynomial Approximation.

Parshley, Sherry J. (2005) “The Economics of Fraud-on-the-Market: At What Point Does Harm Occur in a Securities Fraud Case,” Northcentral University.

Prime example of a poorly executed study. The title suggest the exploration into a cause and effect relationship, yet it does not use any method designed to prove such relationship. The author uses an event study or case study method with a sample size of three companies, to study the relationship between a firm’s misleading announcement of stock value and the downfall of that firm’s stock price in the market. The most serious limitation of this study is that a sample size of one cannot be used to formulate any inferences about the possible outcome of an event where the observed firm publicly misstates its financial performance and the decline in the market price of its stock.

Gall, M. D., Gall, J. P., & Borg, W. R. (2006). Educational research: An introduction (8th ed.). Boston: Pearson Allyn & Bacon.

This book provides the correlational methodology for research.

Marshall, C., Rossman, G. (2007). Designing Qualitative Research. 4th. Edition. Sage Publications, Inc. 2455 Teller Road, Thousand Oaks, CA 91320

This book explains the methodology for quantitative research designs for the nursing profession and health care sciences.

Saltzamn, J. (2003). Methodological Choices Encountered in the Construction of Composite Indices of Economic and Social Well-Being. Center for the Study of Living Standards. Web.

This document provides the explanation of the type of index is the Index of Economic Well-Being and how it is calculated along with how it compares to other indices that measure well being.

Tomasic, D. (2002). Essentials of Nursing Research: Methods, Appraisal, and Utilization, 5th Edition. Web.

This book goes into extensive detail about experimental design for research.

Pelosi, M., Sandifer, T., and Sekaran, U. (2001). Research and Evaluation for Business. John Wiley and Sons, New York.

This book is a systematic, pedagogical and practical textbook that explains statistical concepts from a business perspective. It covers Descriptive, Inferential and Non-Parametric Statistics, analyzing the use of statistics in business applications emphasizing comparison and interpretation rather than numeric manipulation making intensive use of Excel to complete all calculations. The chapters on Regression Analysis and Time Series Analysis are very comprehensive and exhaustively explain the rational and the practical use of these two statistical tools; exhaustively analyzing the meaning and practical use of correlation coefficients to determine the reliability and consistency of the regression equation. The analysis of the value and practical use of the smoothing constant in exponential and polynomial approximations is also comprehensive and complete, exploring the trade off between high correlation coefficient and a low smoothing constant. Additionally, these chapters deal with the skills necessary to master the numeric manipulation necessary to understand and calculate the required results. This book abounds in practical applications and step-to-step tutorials on the essential steps for all computations using Excel. This book does not explain very well the similarities and differences between the Mean Square Error (MSE) and the Mean Absolute Deviation (MAD), especially explaining the practical use of these measurements. The book does not explain clearly the derivation of Confidence Intervals or their practical use.

Johnson, R., Kuby, P. (2007). Elementary Statistics[10. Thompson Brooks/Cole, California.

This book has a concise and objective explanation of Time Series Analysis

LoCasale, G and Villegas, H. (2008) Quantitative Business Decisions Using Simulations” Nu-Sigma LLC, Florida.

This book uses the Excel based simulations templates. These are very powerful templates designed to simulate a variety of business and economic scenarios dealing with descriptive and inferential statistics and other quantitative methods. This book provides a wide variety of examples to master the use of the software produced by Nu-Sigma LLC, STAT-APPS and MANAGED-ECON. This book, along with the Nu-Sigma software, provide unique and unequivocally clear explanations of how numeric processes affect the shape of graphical illustrations of otherwise difficult quantitative solutions. As the user introduces very data, the templates illustrate the shape of the calculations and in some instances it reaches the logical conclusions for the user. These templates remove the need for mathematical skills from quantitative analysis allowing the user to concentrate on exploring the validity of different scenarios. For this dissertation, the value of this book and the simulations templates is in the ability to explore literally thousands of different best-fit equations with their corresponding confidence intervals at any level of confidence reaching automated conclusions about the sensitive of each function.

Tsoulfidis, L., and Mariolis, T. (2007). Labour Values, Prices of Production and the Effects of Income Distribution: Evidence from the Greek Economy.” Economic Systems Research, Vol. 19, No. 4, 425–437.

This article explores the relationship between labor values, prices of production and changes in income distribution in the economy of Greece. This study uses many of the statistical techniques that are relevant to the Fleeting Capital dissertation because it endeavors to build a model using Steedman’s polynomial approximation to estimate labor values based on actual prices of production. The model is based on actual input and output values of the Greek economy. In the Greek economy, the labor values and prices of production are very closely related which justifies the use of MAD because the approximation of the historical data points of labor values and prices of production are very close. This model provides an interesting measurement that can be used to forecast prices of production based on labor values. Using five scenarios of probability about the estimated dependent variable, the paper explores the significance of the model to estimate prices of production in the Greek economy. The relationship depicted by the historical string of data points of the dependent and independent variables have minute dispersions, meaning that the each estimated point has a very high probability of accuracy, making the model highly reliable and consistent.

Hyun Hong, S. (2004). Modeling and Testing Nonlinearity with Nonstationary Time Series. Yale University. ProQuest, Ann Arbor, Michigan.

This dissertation is a rigorous investigation of the effect of nonlinear processes on linear regressions as well as the impact of nonlinear relationships between linear and nonlinear time series processes in economic forecasting.

The first chapter of this dissertation analyzes the spurious relationships found around deterministic trends with breaks in stationary processes and sets of independent variables. The demonstration that the asymptotic characteristics of the t and F statistics along with the R2 are the same as for the typical spurious regression using the Gegenbauer polynomials. This demonstration leads to the conclusion that the results of a simple regression analysis will not be significantly different from other time series approximations.

The second chapter applies the Regression Error Specification Test (RESET) or linearity test to co-integrating relations to demonstrate that when this test is applied to non-stationary time series, a combination of non-central Chi Square distribution results from severe size distortions. This test is applied to an empirical evaluation of Purchasing Power Parity data reflecting what happened after the Bretton Woods Agreement in the United States, Japan and Canada. The findings reveal mixed results leading to the rejection of the linear co-integration tests. After using the Augmented Dickey-Fuller (ADF) test results in high negative results rejecting the linear co-integration go the Purchasing Power Parity relationship.

The third chapter expands the examination of the linear validity of the relationship between exchange rates, price indices and the Purchasing Power Parity to eleven European nations. Few factors in the European region hinder arbitrage in the goods market, making exchange rates less volatile and price indices, based on the values of family baskets, less heterogeneous than in other nations. The application of the ADF and the Phillips Peron Unit Root (PP) test of co-integration reveal different results leading to conclude that there is a lack of significance in the analysis based on linear co-integration. However, the RESET test finds new linear co-integration relationships that the ADF and the PP tests did not find. The conclusion is that different tests demonstrate various degrees of co-integration, from an absolute lack of co-integration to nearly perfect co-integration, but regardless of the co-integration test used, there was a high correlation between exchange rates, price indices and Purchasing Power Parity in the European Union.

Gordon, S. (2005). Approximating Functions with Exponential Functions.” ProQuest Education Journal. Primus: Problems, Resources and Issues in Mathematics Undergraduate Studies.

This paper proposes a parallel development to Taylor’s polynomials by approximating a function with a linear combination of exponential functions based on ex, e2x and higher orders of e. This polynomial approximation uses the functions of sin x and cos x to assess goodness of fit of a given function. The article clearly explains the virtues of Taylor’s approximations as exponential functions.

Gordon, S. (2005). Taylor’s Theorem and Derivative Tests for Extrema and Inflection Points. Primus : Problems, Resources, and Issues in Mathematics Undergraduate Studies, 15(1), 86-94.

This paper provides an explanation of the derivative test for extrema and for inflections points in Taylor’s polynomial approximation. A clear and exhaustive explanation of the reasons for the limit problems is presented assuming that the function considered has derivatives of all orders in an open interval centered on x=a. The test for inflexions explores the point at which the inflection of a function happens when it reaches 0, becomes undefined and the point around x=a changes sign. The test for extrema explores the point at which a function being greater than zero has a relative minimum at x=a; or that a function that is less than zero has a relative maximum at x=a; and that the test is inconclusive. These two tests are very valuable in determining the validity of inflection points and extremas in a Taylor’s polynomial approximation function.

GEM Brazil Team (2006). Brazil GEM 2005 Complete National Report. Babson College U.S.A., London Business School., Kauffman Center for Entrepreneurial Leadership, Ewing Marion Kauffman Foundation. Brazilian Portuguese. Web.

This paper charts the birth of enterprises from 1999 to the year 2005 and it provides the result of an entrepreneurial diagnose of Brazil using a sample of 2,000 adults between 18 and 64 years of age and 36 experts in entrepreneurship. The report is very comprehensive and it is used to validate the claim that the creation of new enterprises diminishes as the government increases its reliance on Fleeting Capital.

Measurement significance: This reference provides measurements of the inverse relationship between the increase of short-term direct private investments in government securities and the decrease of the formation of small businesses in Brazil.

Amoros, J., Cortes, P., Echecopar, G., Flores, T. (2006). Chile 2005 GEM National Team Report. Babson College U.S.A., London Business School. Kauffman Center for Entrepreneurial Leadership, Ewing Marion Kauffman Foundation. Spanish. Web.

This paper charts the birth of enterprises from 1999 to the year 2005 and it provides the result of an entrepreneurial diagnose of Chile using a sample of 2,000 adults between 18 and 64 years of age and 30 experts in entrepreneurship. The report is very comprehensive and it is used to validate the claim that the creation of new enterprises diminishes as the government increases its reliance on Fleeting Capital.

Measurement significance: This reference provides measurements of the inverse relationship between the increase of short-term direct private investments in government securities and the decrease of the formation of small businesses in Chile.

Gómez, L., Varela, R., Correales, J., Jiménez, J. (2007). Colombia 2006 GEM National Report. Babson College U.S.A., London Business School., Kauffman Center for Entrepreneurial Leadership, Ewing Marion Kauffman Foundation.Spanish. Web.

This paper charts the birth of enterprises from 1999 to the year 2005 and it provides the result of an entrepreneurial diagnose of Colombia using a sample of 2,000 adults between 18 and 64 years of age and 30 experts in entrepreneurship. The report is very comprehensive and it is used to validate the claim that the creation of new enterprises diminishes as the government increases its reliance on Fleeting Capital.

Measurement significance: This reference provides measurements of the inverse relationship between the increase of short-term direct private investments in government securities and the decrease of the formation of small businesses in Colombia.

Saltzman, Julia. (2003). Methodological Choices Encountered in the Construction of Composite Indices of Economic and Social Well-Being. Center for the Study of Living Standards. Web.

This paper charts the birth of enterprises from 1999 to the year 2005 and it provides the result of an entrepreneurial diagnose of Peru using a sample of 2,000 adults between 18 and 64 years of age and 30 experts in entrepreneurship. The report is very comprehensive and it is used to validate the claim that the creation of new enterprises diminishes as the government increases its reliance on Fleeting Capital.

Measurement significance: This reference provides measurements of the inverse relationship between the increase of short-term direct private investments in government securities and the decrease of the formation of small businesses in Peru.

Fernandez, F., Rodriguez, A., Vidal, R. (2006). Venezuela GEM 2005 Report. Babson College U.S.A., London Business School., Kauffman Center for Entrepreneurial Leadership, Ewing Marion Kauffman Foundation. Spanish. Web.

This paper charts the birth of enterprises from 1999 to the year 2005 and it provides the result of an entrepreneurial diagnose of Venezuela using a sample of 2,000 adults between 18 and 64 years of age and 30 experts in entrepreneurship. The report is very comprehensive and it is used to validate the claim that the creation of new enterprises diminishes as the government increases its reliance on Fleeting Capital.

Measurement significance: This reference provides measurements of the inverse relationship between the increase of short-term direct private investments in government securities and the decrease of the formation of small businesses in Venezuela.

United States Securities and Exchange Commission, 2007. Bank of America Form 10-K Annual Report for the Fiscal Year Ending 1994. Web.

Provides financial data for 1992 revised and 1993. Letters of Credit are classified by length of commitment. The one that pertains to this dissertation is < 1 year.

Measurement significance: This reference provides the most important observations for this dissertation, as it provides the raw data that will be used to measure the magnitude of funds committed by money center banks in Letters of Credit to South America.

United States Securities and Exchange Commission, 2007. Bank of America Form 10-K Annual Report for the Fiscal Year Ending 1995. Web.

Provides financial data for revised 1993 and 1994.Letters of Credit are not classified by length of commitment.

Measurement significance: This reference provides the most important observations for this dissertation, as it provides the raw data that will be used to measure the magnitude of funds committed by money center banks in Letters of Credit to South America.

United States Securities and Exchange Commission, 2007. Bank of America Form 10-K Annual Report for the Fiscal Year Ending 1996. Web.

Provides financial data for revised 1994 and 1995. Letters of Credit are not classified by length of commitment.

Measurement significance: This reference provides the most important observations for this dissertation, as it provides the raw data that will be used to measure the magnitude of funds committed by money center banks in Letters of Credit to South America.

United States Securities and Exchange Commission, 2007. Bank of America Form 10-K Annual Report for the Fiscal Year Ending 1997. Web.

Provides financial data for revised 1995 and 1996. Letters of Credit are not classified by length of commitment.

Measurement significance: This reference provides the most important observations for this dissertation, as it provides the raw data that will be used to measure the magnitude of funds committed by money center banks in Letters of Credit to South America.

United States Securities and Exchange Commission, 2007. Bank of America Form 10-K Annual Report for the Fiscal Year Ending 1998. Web.

Provides financial data for 1996 revised and 1997. First year when exposure in L/C commitments to Latin America are specified.

Measurement significance: This reference provides the most important observations for this dissertation, as it provides the raw data that will be used to measure the magnitude of funds committed by money center banks in Letters of Credit to South America.

United States Securities and Exchange Commission, 2007. Bank of America Form 10-K Annual Report for the Fiscal Year Ending 1999. Web.

Provides financial data for 1997 revised and 1998.

Measurement significance: This reference provides the most important observations for this dissertation, as it provides the raw data that will be used to measure the magnitude of funds committed by money center banks in Letters of Credit to South America.

United States Securities and Exchange Commission, 2007. Bank of America Form 10-K Annual Report for the Fiscal Year Ending 2000. Web.

Provides financial data for 1998 Revised and 1999.

Measurement significance: This reference provides the most important observations for this dissertation, as it provides the raw data that will be used to measure the magnitude of funds committed by money center banks in Letters of Credit to South America.

United States Securities and Exchange Commission, 2007. Bank of America Form 10-K Annual Report for the Fiscal Year Ending 2001. Web.

Provides financial data for 1999 revised and 2000.

Measurement significance: This reference provides the most important observations for this dissertation, as it provides the raw data that will be used to measure the magnitude of funds committed by money center banks in Letters of Credit to South America.

United States Securities and Exchange Commission, 2007. Bank of America Form 10-K Annual Report for the Fiscal Year Ending 2002.Web.

Data for Latin America is no longer provided. L/C commitments that expire in < 1 year. Provides financial data for 2000 revised and 2001

Measurement significance: This reference provides the most important observations for this dissertation, as it provides the raw data that will be used to measure the magnitude of funds committed by money center banks in Letters of Credit to South America.

United States Securities and Exchange Commission, 2007. Bank of America Form 10-K Annual Report for the Fiscal Year Ending 2003.Web.

Provides financial data for 2001 revised and 2002.

Measurement significance: This reference provides the most important observations for this dissertation, as it provides the raw data that will be used to measure the magnitude of funds committed by money center banks in Letters of Credit to South America.

United States Securities and Exchange Commission, 2007. Bank of America Form 10-K Annual Report for the Fiscal Year Ending 2004. Web.

Measurement significance: This reference provides the most important observations for this dissertation, as it provides the raw data that will be used to measure the magnitude of funds committed by money center banks in Letters of Credit to South America.

United States Securities and Exchange Commission, 2007. Bank of America Form 10-K Annual Report for the Fiscal Year Ending 2005. Web.

Provides financial data for 2003 revised and 2004.

Measurement significance: This reference provides the most important observations for this dissertation, as it provides the raw data that will be used to measure the magnitude of funds committed by money center banks in Letters of Credit to South America.

United States Securities and Exchange Commission, 2007. Bank of America Form 10-K Annual Report for the Fiscal Year Ending 2006. Web.

Provides financial data for 2004 revised and 2005.

Measurement significance: This reference provides the most important observations for this dissertation, as it provides the raw data that will be used to measure the magnitude of funds committed by money center banks in Letters of Credit to South America.

United States Securities and Exchange Commission, 2007. Bank of America Form 10-K Annual Report for the Fiscal Year Ending 2006. Web.

Provides financial data for 2005 revised and 2006

Measurement significance: This reference provides the most important observations for this dissertation, as it provides the raw data that will be used to measure the magnitude of funds committed by money center banks in Letters of Credit to South America.

United States Securities and Exchange Commission, 2007. J.P. Morgan Chase Form 10-K Annual Report Chemical Bank, for the Fiscal Year Ending 1994. Web.

Provides financial data for 1991 and 1992 revised and 1993. Letter of Credit commitments to Latin America are specified.

Measurement significance: This reference provides the most important observations for this dissertation, as it provides the raw data that will be used to measure the magnitude of funds committed by money center banks in Letters of Credit to South America.

United States Securities and Exchange Commission, 2007. J.P. Morgan Chase Form 10-K Annual Report for Chemical Bank Fiscal Year Ending 1995. Web.

Provides financial data for 1994 revised and 1995. Letter of Credit commitments to Latin America are specified.

Measurement significance: This reference provides the most important observations for this dissertation, as it provides the raw data that will be used to measure the magnitude of funds committed by money center banks in Letters of Credit to South America.

United States Securities and Exchange Commission, 2007. J.P. Morgan Chase Form 10-K Annual Report for Chase Manhattan Bank. Fiscal Year Ending 1997. Web.

Provides financial data for 1994 and 1995 revised and 1996. Letter of Credit commitment information is provided in a lump sum.

Measurement significance: This reference provides the most important observations for this dissertation, as it provides the raw data that will be used to measure the magnitude of funds committed by money center banks in Letters of Credit to South America.

United States Securities and Exchange Commission, 2007. J.P. Morgan Chase Form 10-K Annual Report for Chase Manhattan Bank. Fiscal Year Ending 1998. Web.

Provides financial data for 1996 revised and 1997. Letter of Credit commitments to Latin America are specified by country.

Measurement significance: This reference provides the most important observations for this dissertation, as it provides the raw data that will be used to measure the magnitude of funds committed by money center banks in Letters of Credit to South America.

United States Securities and Exchange Commission, 2007. J.P. Morgan Chase Form 10-K Annual Report for Chase Manhattan Bank. Fiscal Year Ending 2000. Web.

Provides financial data for 1998 and 1999 revised and 2000. Letter of Credit commitments to Latin America are specified.

Measurement significance: This reference provides the most important observations for this dissertation, as it provides the raw data that will be used to measure the magnitude of funds committed by money center banks in Letters of Credit to South America.

United States Securities and Exchange Commission, 2007. J.P. Morgan Chase Form 10-K Annual Report for Chase Manhattan Bank. Fiscal Year Ending 2001. Web.

Provides financial data for 1999 revised and 2000. Letter of Credit commitments to Latin America are specified.

Measurement significance: This reference provides the most important observations for this dissertation, as it provides the raw data that will be used to measure the magnitude of funds committed by money center banks in Letters of Credit to South America.

United States Securities and Exchange Commission, 2007. J.P. Morgan Chase Form 10-K Annual Report J.P. Morgan Chase. Fiscal Year Ending 2002. Web.

Provides financial data for 2001. Letter of Credit commitments to Latin America are not specified.

Measurement significance: This reference provides the most important observations for this dissertation, as it provides the raw data that will be used to measure the magnitude of funds committed by money center banks in Letters of Credit to South America.

United States Securities and Exchange Commission, 2007. J.P. Morgan Chase Form 10-K Annual Report for J.P. Morgan Chase. Fiscal Year Ending 2003. Web.

Provides financial data for 2002. Letter of Credit commitments to Latin America are not specified.

Measurement significance: This reference provides the most important observations for this dissertation, as it provides the raw data that will be used to measure the magnitude of funds committed by money center banks in Letters of Credit to South America.

United States Securities and Exchange Commission, 2007. J.P. Morgan Chase Form 10-K Annual Report J.P. Morgan Chase & Co. Fiscal Year Ending 2004. Web.

Provides financial data for 2003. Letter of Credit commitments to Latin America are specified.

Measurement significance: This reference provides the most important observations for this dissertation, as it provides the raw data that will be used to measure the magnitude of funds committed by money center banks in Letters of Credit to South America.

United States Securities and Exchange Commission, 2007. J.P. Morgan Chase Form 10-K Annual Report for J.P. Morgan Chase & Co. the Fiscal Year Ending 2005. Web.

Provides financial data for 2004. Letter of Credit commitments to Latin America are specified.

Measurement significance: This reference provides the most important observations for this dissertation, as it provides the raw data that will be used to measure the magnitude of funds committed by money center banks in Letters of Credit to South America.

United States Securities and Exchange Commission, 2007. J.P. Morgan Chase Form 10-K Annual Report for J.P. Morgan Chase & Co. Fiscal Year Ending 2006. Web.

Provides financial data for 2005. Letter of Credit commitments to Latin America are specified.

Measurement significance: This reference provides the most important observations for this dissertation, as it provides the raw data that will be used to measure the magnitude of funds committed by money center banks in Letters of Credit to South America.

United States Securities and Exchange Commission, 2007. J.P. Morgan Chase Form 10-K Annual Report for J.P. Morgan Chase & Co. Fiscal Year Ending 2007. Web.

Provides financial data for 2006. Letter of Credit commitments to Latin America are specified.

Measurement significance: This reference provides the most important observations for this dissertation, as it provides the raw data that will be used to measure the magnitude of funds committed by money center banks in Letters of Credit to South America.

United States Securities and Exchange Commission, 2007. Form 10-K Annual Report for Citigroup, Inc. Fiscal Year Ending 2006.

Provides financial data for 2006. Letter of Credit commitments to Latin America are specified.

Measurement significance: This reference provides the most important observations for this dissertation, as it provides the raw data that will be used to measure the magnitude of funds committed by money center banks in Letters of Credit to South America.

United States Securities and Exchange Commission, 2007. Form 10-K Annual Report for Citigroup, Inc. Fiscal Year Ending 2005

Provides financial data for 2005 and revised 2004. Letter of Credit commitments to Latin America are specified. 4 billion.

Measurement significance: This reference provides the most important observations for this dissertation, as it provides the raw data that will be used to measure the magnitude of funds committed by money center banks in Letters of Credit to South America.

United States Securities and Exchange Commission, 2007. Form 10-K Annual Report for Citigroup, Inc. Fiscal Year Ending 2004

Provides financial data for 2004 and revised data for 2000, 2001, 2002 and 2003. Letter of Credit commitments to Latin America are not specified.

Measurement significance: This reference provides the most important observations for this dissertation, as it provides the raw data that will be used to measure the magnitude of funds committed by money center banks in Letters of Credit to South America.

United States Securities and Exchange Commission, 2007. Form 10-K Annual Report for Fiscal Year Ending 1999

Provides financial data for 1999 and revised data for 1998 and 1997. Letter of Credit commitments for Mexico and Brazil are specified. Risk-based capital guidelines issued by the Board of Governors of the Federal Reserve System (FRB). These guidelines are used to evaluate capital adequacy based primarily on the perceived credit risk associated with balance sheet assets, as well as certain off-balance sheet exposures such as unused loan commitments, letters of credit, and derivative and foreign exchange contracts. The risk-based capital guidelines are supplemented by a leverage ratio requirement.

Empirical Secondary Research

Historical Recount of Fleeting Capital Sub-Topic

Ffrench-Davis, R., (2005). Capitales Golondrina: Estabilidad y Desarrollo. Economía Latinoamericana: La Globalización de los Desajustes. p. 51-63. Urriola, Rafael. Coordinator. Caracas: Instituto Latinoamericano de Investigaciones Sociales. ILDIS-Ecuador – Nueva Sociedad, 1996 Am.Econ.669. Instituto Frances de Estudios Andinos, Av. Arequipa 4595, Miraflores, Lima, Peru.

This paper compares the impact of Direct Investment during 1970s and 1980s to the 1990s and analyzes the Mexican economic crisis of 1994. It examines the reasons for Mexico’s, Chile’s and Brazil’s legislation limiting the inflow of short-term direct private investments. Points to the 1970s as the decade when direct private investments started flowing to emerging economies. Illustrates how investments should increase the exportable supply or substitute imports because the repayment of foreign investment is effected in hard currencies, not in local or soft currencies. Uses Real Exchange Rate and the Current Account Deficit to formulate the Fixed Capital bubble from 1987 to 1995. The author’s suggestion is to measure the need for Short-Term Direct Investments and to limit the entry of such investments.

Measurement significance: This reference provides measurements of the magnitude of the financial bubble created by short-term direct private capital flows in South America.

Kose, A., Prasad, E., Rogoff, K. and Wei, S (2003). Effects of Financial Globalization on Developing Countries: Some Empirical Evidence. International Monetary Fund. Web.

This paper provides a unified conceptual framework for organizing the literature about the benefits and costs of financial globalization for emerging economies. The paper also describes the wide variety of conflicting results that the literature provides. While there is robust evidence that broad capital account and equity market liberalizations significantly boost growth; other papers based on microeconomic (firm- or industry-level) data do not show conclusive macroeconomic evidence of growth. This paper provides a synthetic perspective on the macroeconomic effects of financial globalization in terms of growth and volatility. This paper attempts to show that the empirical literature provides some qualified support to the view that emerging nations can benefit from financial globalization, despite the many nuances. Conversely, there is some systematic evidence to support the claims that financial globalization leads to economic growth crises in emerging nations.

Measurement significance: This reference provides unclear measurements of short-term direct private investments in South America, the most important measurement that this reference provides is a measurements of the volatility of consumption in all developing nations.

Kose, A., Prasad, E., and Terrones, M. (2005). Growth and Volatility in an Era of Globalization. International Monetary Fund. Vol. 52, Special Issue. Web.

This paper comprehensively examines four decades of cross-sectional relationships between growth and macroeconomic volatility. The paper documents the negative relationship between volatility and growth and the changes in the nature of this relationship across country groups. The paper shows that the major shifts in this relationship occur after trade and financial liberalizations have been set in place. The most relevant portion of this study shows that volatility stemming from the main components of domestic aggregate demand is negatively associated with economic growth. It also documents that understanding the complex relationship between macroeconomic volatility and economic growth has been a challenge for economists for more than four decades. Drawing from the research by Ramey and Ramey, published in 1995 but with results based on a data set that ends in 1985, concluded that macroeconomic volatility actually reduced long-term growth. This paper puts to rest the generally accepted notion of the 1980s that the impact of volatility on economic growth and welfare were inconsequential. During the 1990s, research began to suggest that policies and economic shocks that increased volatility could have significant long-term negative effects on growth and economic welfare, thus changing the focus of economic research relative to economic development and globalization. The causes and consequences of macroeconomic volatility became interesting to researchers because the financial crises in many developing countries in the 1980s and 1990 revealed that macroeconomic volatility increased income inequality and poverty. Most of these crises were the result of hastily enacting policies that opened-up developing economies to global trade and to financial flows necessary for globalization. The group of nations experiencing high-output volatility as a result of these crises became known as “emerging markets,” on account of their better average growth rates. The paper references recent research about the negative relationship between growth and volatility such as Aizenman and Marion, 1999; and Martin and Rogers, 2000; Fatás, 2002; Aizenman and Pinto, 2005; and Hnatkovska and Loayza, 2005. It also references empirical studies that focus on how government spending and the terms of trade promote macroeconomic volatility and negatively affect growth such as Mendoza, 1997; Turnovsky and Chattopadhyay, 2002; and Fatás and Mihov, 2003.

Measurement significance: This reference provides unclear measurements of short-term direct private investments in South America, the most important measurement that this reference provides is a measurements of the volatility of consumption in all developing nations.

Mujumdar, N. (2000). Essays in International Trade and Corruption. University of Cincinnati, Cincinnati, Ohio. Web.

Explains how and why corruption exists in the customs agencies of South American nations.

Sorensen, B., and O. Yosha (1998), “International Risk Sharing and European Monetary Unification,” Journal of International Economics 45, 211-238.