Introduction

The United Arab Emirates is without doubt the fastest growing region in the global economy and investment opportunities. It attracts people from all regions in the world, and this explains why there is an increase in demand for consumer goods and services. The investment climate available in this region is favourable for all types of businesses, and that is why people are flocking to this country to try their luck.

The 2013 economic survey index showed that Dubai is the fastest growing country in the world with a 27% growth rate (Dubai Cars 2014). The automobile industry has also expanded, and the trend is set to improve in the coming years. In 2013, 310,304 vehicles were traded in this country. Therefore, as the world grows at 1.5%, while Dubai’s rate is 19%, and this means that this region is experiencing rapid growth in the automotive industry.

Dubai’s Automotive Market Overview

Dubai region has a unique trend in car manufacturing and purchasing. There is no specific culture in the automobile industry because of the differentiation of the population of this region. Therefore, there are various factors that affect the production and demand of automobiles in this region. First, the average income of most people in this region is AED18, 248.60 which is about 4927.12US dollars. Most people earn good salaries that can afford them better lives.

Therefore, most people have cars, and some even two or three of them because they can afford (Dubai Cars 2014). The issue of high fuel cost cannot stop people from owning or driving their cars because they are rich.

Secondly, Dubai is a developed country and thus its citizens believe that they should drive better cars. The demand for classic cars like SUVs and MUVs is high. Car manufacturing companies like Toyota, Mitsubishi, Volkswagen and Mercedes Benz amongst others have taken advantage of this situation and continue to manufacture expensive cars that meet the demands of the locals. Thirdly, the level of education of most people in this country is high, and this affects their choice of cars.

Most educated people believe that they should drive expensive cars (Dubai Cars 2014). They want to identify with their peers, and this makes them to get attracted to latest brands of cars and that is why it is not easy to see them driving old ones. In addition, they believe that the cars they drive says a lot about their levels of education, and that is why most of them do not want to be seen in old cars or those that have poor interior designs. The issue of fuel consumption is least amongst their worries and choice of cars. They believe that their level of education and jobs should be proportional to the type of car they drive.

The age of individuals in Dubai affects their choice of cars. Most old people do not like expensive cars; therefore, they do not offer market for the new models supplied by manufacturing companies. However, the population of old people in Dubai is less that an eighth of the entire county. The taste and demand of cars by old people does not in any way affect the latest trends in this industry.

Most car owners are youths and people aged less than 40 years (Dubai Cars 2014). Their tastes of cars vary depending on their personal preferences. In addition, most old people in Dubai do not pay attention to the interior design and driving comfort of vehicles.

On the other hand, most car owners (more than 60 % are aged below 40 years) prefer cars that have sophisticated interior designs and offer driving comfort and that are why they go for SUVs and MUVs. In addition, the purpose of a car determines the choice and model that individuals buy. Most people use cars for going to work, holidays and family visits (Drive Arabia 2014).

They do not have to own cars that have large carrying capacities. Therefore, they prefer to buy cars that carry four passengers because their families are small, and they do not carry huge luggage when travelling. However, they prefer cars that have huge carriers or boots that may carry small luggage picked on their way home. Most of them use their vehicles to go to offices, and this means that they do not need to have sophisticated luggage cabins. Therefore, car manufacturers do not place a lot of emphasis on the carrying capacities of vehicles because this is not an issue of serious concern to buyers.

The tourism industry in Dubai has expanded, and tourists have realised that this region offers various attractions that are unique. The public transport system has also transformed with the introduction of city tour buses that enable passengers to have a clear view of their surroundings (Dubai Cars 2014). These are double Decker buses with the top roof open and all windows enlarged to enable viewers to have enough space to see various things and take photographs without interference.

Car manufacturing companies get orders and specifications for these buses, and this means that buyers are willing to pay more to get vehicles of their desired qualities. It is necessary to explain that these buses and vans made in this design are pre-ordered, and this means that their prices are higher than those of ready-made ones.

The tourism industry has also increased the demand for SUVs and MUVs because some people prefer to travel in family vehicles that can carry their luggage. Tourists usually travel in sets of two or four but sometimes these groups may be larger, and that is why there are vans to serve them. Some couples may decide to travel together in groups; therefore, they will hire buses that will enable them to travel and share similar experiences together.

Lastly, government policy in Dubai determines the choice and model of cars manufactured or imported into this country. Dubai has faced a lot of criticism from other countries and world organisations for environmental degradation. The increase in the number of industries and clearance of vegetation to construct buildings has destroyed the environment. Today, Dubai is struggling to maintain the minimum pollution effects on the environment even though this is not easy because of the increased demand for consumer goods that are produced in industries.

The efforts by this country to protect and conserve the environment have led to the establishment of strict policies that ensure car manufacturing companies produce fuel efficient vehicles. This country prohibits the importation of used cars to ensure those that are bought are in good conditions that will not pollute the environment. In addition, this country is offering subsidies to companies that manufacture vehicles that are environment friendly (Drive Arabia 2014).

Companies like Toyota and Volkswagen have benefitted because of the reduced levy charged on electric and solar powered cars they produce in Dubai. Moreover, this country has imposed huge taxes on automobile spares to ensure people buy new vehicles instead of repairing old ones. This effort is aimed at ensuring that there are fewer wastes in this industry. The construction of good roads reduced the costs of repairing vehicles because it is not easy for them to breakdown.

Most car owners hardly take their vehicles for repairs because the roads in this country are smooth, and there are no potholes or other inconveniences that cause car breakdowns. The government allows its citizens to have driving licenses at the age of 18 years, and there are no restrictions as to the number of vehicles a person or family can have. In addition, financial institutions offer ready loans to people willing to buy vehicles and this means that it is easy to drive in this country.

This has increased the demand and availability of many cars on the roads. Therefore, the demand for automobiles in Dubai will never stop to increase, and car manufacturers are gearing up for a stiff competition for this market.

Research Plan

Research Purpose

The purpose of this research is to investigate the current and possibly future customer preferences of motorists in Dubai while making car purchase decisions. The research will examine various demographic (nationality, gender, age, educational level, occupation and monthly income) and non-demographic (car related features) categories that affect the preferences and abilities of people to buy cars. In addition, the findings of this research will form a report to show the relationship between the car retail price and mileage in Dubai market for the purpose of cars pricing.

Research Objectives

This research aims at establishing the truth about issues that affect the car preference of clients in Dubai. In addition, it aims to explain the significance of consumer trends, characteristic and expectations regarding the choice of their cars. The information obtained will help car manufacturers to identify issues that affect the purchasing ability and preference of clients. This will enable them to pay attention to relevant issues that affect the car market in Dubai, especially its retail price and mileage. Car dealers in Dubai face stiff competition and there is the need for them to ensure that they understand consumer trends, tastes and abilities to stand higher chances of dominating their competitors.

Literature Review

Dubai opened the gates to the Arab Region, and there is no doubt that there is a healthy interaction between these countries and others in different parts of the world despite the political and ideological differences that exist. The following authors discussed the opportunities and challenges facing Dubai in the wake of a new political and economic era.

UAE Car Market rose 16%. Toyota Posted 5 Models in Top 5 by Focus2move

This article explains that the global financial crisis of 2009 saw Dubai’s market for light passenger vehicles hit a low of 8%. However, the data obtained presented by this article in 2013 shows that there was an improvement of more than double the volume of automobiles traded in 2009. There was an increase in demand for light passenger vehicles with a record volume of 362.838 sales (Drive Arabia 2014). Toyota brand presented five of its model in the top five positions (volume of 122k) with BMW coming a distant second.

This article notes that local car dealers fixed higher prices for their automobiles compared with what was offered by their counterparts in other countries in the gulf region. It is believed that most Dubai car dealers engage in unofficial markets that account for a huge proportion of gray market in this industry that is estimated to be 90K per year.

The Ministry of Economy had to intervene and establish a committee to determine how UAE car dealers can reduce the prices of their automobiles to ensure there is a level ground. The article argues that the price differences can be as large as Dh29, 000, and this gives some car dealers an unhealthy advantage over others.

Unauthorised vehicle import agencies enjoy the freedom of fixing car prices as they wish because there are no standard policies to regulate this market. This article confirms that there is a huge demand for vehicles in Dubai and unscrupulous traders are taking advantage of this situation to exploit consumers.

The author argues that if the directive by the ministry succeeds Dubai may register sales as high as 450k within a short time. The demand for Toyota cars in Dubai dominated the market with a volume sale of 120K, which means that its share rose to 33%. However, this has attracted competition from other manufacturers and Nissan, Mitsubishi and Hyundai following from a distant.

The best Toyota models that dominated the market include Corolla, Land Cruiser, Prado, Hilux and Camry with 19k, 18k, 16k, 16k and 13k respectively. Land Rover and Audi made poor sales because these vehicles are designed for rough terrain; however, most roads in Dubai are world-class, and there is no need for four wheels.

In addition, people that live in the rural areas where these vehicles may be required earn less income that cannot buy them. This article confirms that there is no regulation in the car industry in Dubai, and this means that this sector may be out of control in the future of the government does not act quickly. There is concern that consumers may start buying vehicles of low quality if unlicensed car dealers continue to operate freely. The car trade in Dubai is a free business, and that is why it has attracted a lot of investors from different parts of the world.

City of Gold: Dubai and the Dream of Capitalism by Jim Krane

This author believes that the rise of Dubai and the many investment opportunities available here are courtesy of the efforts of Sheikh Rashid and his son Sheikh Mohammed. He believes that these rules created a prescient investment of resources and freedom of absolute rule that enabled local investors to transform their country from a backwater village into a global economic powerhouse. Krane believes that the creation of Dubai’s magnificent structures (world’s tallest building, first indoor ski slope and world’s largest footprint) shows that its citizens are creative and can create opportunities that may shake the world regardless of the age of this country (Krane 2010).

He explains that a majority of Dubai residents (95%) are foreigners who risked their capital to invest in a country that had “nothing”. This author presents a dark side of modernisation and capitalism that have led to environmental degradation and abuse of human rights. He argues that the demand to for investment opportunities in Dubai surpass that of all other countries combined. This country continues to attract foreigners to settle there, and the government has lessened restrictions for requesting citizenship (Krane 2010).

However, the cost of capitalism and modernisation has impacted negatively on the economy of this country. The increase in demand for vehicles that are fuel guzzlers has led to higher pollution rate in this country. The high salaries offered by the government and the good returns on private investments make it easy for people to own vehicles, and this increases the volume of smoke released into the atmosphere.

However, the government has established policies that ensure old vehicles and those that are un-roadworthy are prohibited from using public roads. This policy means that those with old vehicles must sell them and acquire new ones. Therefore, this approach solves and creates problems at the same time. Dumping of vehicles and their parts has tarnished the scenic beauty of this country, and there is concern that the government should limit and reduce the number of car manufacturing companies in Dubai (Krane 2010).

He believes that its leaders are in a better position to solve the problem of environmental pollution and human rights abuse caused by increased modernisation and capitalism.

Methodology

The research used three data collection methods that include questionnaire, interviews, observation. The survey questions were developed by the researcher and given to 50 non-random quotas that were asked to provide answers. The questionnaire and interview questions had different demographical categories related to the car price range, purpose, level of satisfaction and factors influencing their purchase. This survey was conducted within two weeks and respondents were supposed to respond to the questionnaires before the end of the 10th day to ensure there was adequate time to analyse the data collected.

The respondents were supposed to provide answers to questions about the following issues. First, most Dubai residents are foreigners, and this means that there was the need for respondents to state their nationalities. Research conducted and data obtained from secondary sources show that most rich people in Dubai (95%) are foreigners. Therefore, it was important to investigate the number of foreigners versus that of locals in terms of car ownership.

Gender was also another important aspect that the research used to determine the differences in tastes of cars between men and women. The use of age and educational level survey was supposed to identify the differences they create in clients’ tastes and preferences. The type of jobs of individuals determined their choices of cars and thus it was necessary to use this factor to examine how it affects the marketing trends of automobiles in Dubai.

Lastly, it was necessary to investigate how the income levels of individuals affected their choice, use and purpose of cars and the differences in their tastes. Other non-demographic factors include car purpose, purchase status, present and future price ranges, future use, resale value, fuel consumption and mileage. The results obtained were recorded and presented in tables, graphs and pie charts.

Findings and Data Analysis

The methodology used ensured respondents provided answers for 16 questions that sought to collect qualitative, quantitative and demographic data. All answers were grouped depending on their classes.

Demographics

It is necessary to explain that secondary data shows that majority of the population of Dubai citizens are foreigners. The original local population forms a small portion that cannot dictate the social, economic and political trends in this country. Emirati nationals formed the largest number of people interviewed, and this was equivalent to 44% of the entire sample used (Drive Arabia 2014). The Arabs, Indians, Pakistani and members of other nationals formed the remaining percentage with each constituting 30%, 10%, 2% and 14% respectively.

The results obtained were recorded as shown in the chart below. It is important to note that most foreigners than locals owned vehicles. In addition, they own high-class vehicles and are ready to sell them and acquire new ones compared to locals.

Gender

It was not easy to get responses from most men, and this means that the majority of women were ready and willing to take time to fill questionnaires or respond to interview questions. The sample population selected 50 participants of whom 34 were females while 16 were male. However, it was not easy to persuade men to participate in this survey because most of them believed that it was a waste of time and that the results did not have any impacts on their lives. Male participants were rude and arrogant, and it was very difficult to obtain answers from them. The table below shows the participation of the selected sample population.

Age

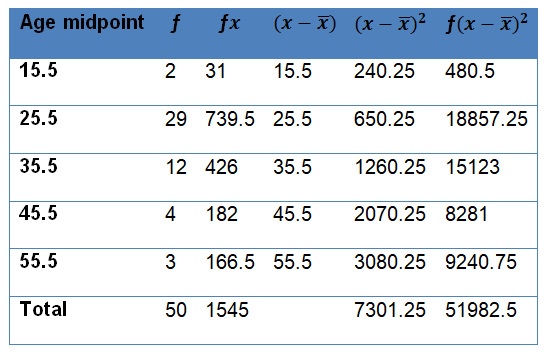

The survey involved participants that were aged above 18 years because this is the minimum age for driving a vehicle in this country. The age of respondents ranged from 21-30 years because it was easy to locate and involve them in the survey. The results show that a majority of motorists in Dubai are youths. There were only 2 and 3 people aged below 20 years and above 51 years respectively as shown in the table below.

The table above shows that the mean average age of the respondents is 31 years. This can be calculated by dividing the number of ages of participants with the population sample using the formula shown below.

In addition, the variance and standard deviation of the population were about 146.025 and 12.084 respectively. The formulas for arriving at these figures are shown below

Variance ![]()

Standard Deviation ![]()

Occupation

Owning a car is not an easy thing to do, and this means that most motorists were in jobs that paid them well. Dubai is a developed country, and this means that there is high demand for labour. The survey showed that 87% of the respondents were in full time employment. In addition, it was discovered that housewives (8%) owned cars, or their husbands allowed them to drive (Drive Arabia 2014). Students (4%) and the unemployed population (4%) also owned cars that were acquired through savings, inheritance or previous loans.

These results show that some families owned more than one car because there is no way a student or housewife will have one while men in those families walk to work or use public means. The results showed that retired people also owned cars for use in domestic activities while others had invested in the private sector; therefore, they needed reliable means of transport to and from work.

Educational Level

Most people in Dubai are educated with university or college educational level qualifications. The demand for professional employees motivates people to pursue higher education to ensure they have higher chances of getting good jobs. In addition, there is stiff competition for the available jobs in Dubai; therefore, people enrol for evening and weekend classes to ensure they have higher academic qualifications to stand high chances of getting employed.

The number of institutions of higher learning in Dubai has increased, and universities and colleges are expanding their courses to ensure they register many students. A small percentage (less than 5%) has professional school qualifications while 10% and 7% have high school and post-graduate certificates respectively. The table below shows the academic level data obtained from the sample population.

Monthly Income

The monthly income of the Dubai population is highly structured, and there are huge variations between the highest and lowest earners. Majority of the population earns less than AED 10,000 while a handful of the respondents have an income that is more than AED 30,000. This data shows that most people cannot afford to buy luxury vehicles like SUVs and MUVs, and that is why the market for Toyota Corollas surpasses that of other models and brands.

In addition, Toyota produces cheap vehicles that most Dubai residents cannot afford without struggling. The cost of living in Dubai is high, and that is why most people spend very little on cars than food and other basic needs. The table below shows the differences between the earnings of the population used in the survey.

The midpoints of their earnings can be calculated and presented in the table below to show the mean, mode and modal of the data obtained.

In addition, the mean income of the sample population is AED 13600.5, and this can be calculated by using the formula below.

The table below shows the cumulative frequency of the data obtained and the results are used to calculate the median class.

It is necessary to explain that the total sample is an even number (n=50) the median will fall between 25 and 26, and this corresponds to the range of 10.001. In addition, the formula below can be used to calculate the median income (AED 11,765).

The mode of this data is the most frequently occurring value that is 10,001-21,000. These figures can be substituted in the formula below to arrive at AED 8, 1467 as the modal income.

These results show that the first and third quartiles of the monthly incomes equal AED 5681.25 and AED 19,117.73 using the following formulas respectively.

Non-Demographics Statistics

These are personal issues that affected the outcome of the research. Non-demographic statistics involves aspects that make individuals to make choices and prefer some vehicles or lifestyles to others.

Owning a Vehicle

Most Dubai residents prefer to own a car to using public transport vehicles because of the conveniences created by the former option. The majority of the respondents (39%) in the survey owned a car while only a handful of them do not have. Most people believe that having a car gives them the convenience they require to move from work to their homes and vice versa. In addition, car ownership, especially in the rural areas is a sign of wealth but most Dubai residents do not pay attention to this belief. Some people owned more than one car because they believed that not all vehicles are manufactured for all purposes. The table below shows the results obtained regarding the number of respondents that own cars.

Current Car Purpose

Vehicles are used for different purposes, and the results obtained from the survey show most respondents (39) use cars for personal and family purposes. Most light and fuel efficient vehicles are used for travelling to and from work. However, people planning to go on holidays or those that do business that involves long travelling have classic cars like SUVS and MUVS to ensure they are comfortable during their trips.

Those that use vehicles for business and other purposes are very few and constitute about 7% and 3% respectively. Therefore, Dubai residents believe that cars are supposed to be used for personal purposes and this explains why there is an increase in demand for light passenger vehicles. The graph below shows how the respondents use their vehicles.

Car Purchase Status

The demand for fuel efficient and environment friendly vehicles motivates most people in Dubai to buy new cars. The data obtained from the respondents show that a majority of them (62%) bought new cars while the rest (38%) acquired them from other people.

Current Car Price Range

Most respondents had cars that do not cost more than AED 70, 000. Respondents that had cars that ranged from AED 70,000 to AED 140,000 and AED 140,000 to AED 210,000 had nine similar responses. A handful of the respondents had cars that valued at more than AED 210,000. The table below shows the disparities in the value f the present cars of the respondents.

Therefore, the mean of the car prices is AED 119, 359.47 and the car price modal class is 69,999. The modal value is below AED 70,000. The figure below shows the car price median which is between AED 70,001 and AED 140,000. The formula below helps to arrive at the median class as AED 108,889.30. The mean of the car price equals to AED 119,359.47 by using formula 1 and the data from table 10 below.

In addition, the first and third quartiles are AED 45,499.35 and AED 180,833.75 respectively. These figures are obtained using the formula below.

Level of Satisfaction of the Current Car

Most respondents that own a car were satisfied with them. However, a small population was neutral, very satisfied or very unsatisfied. A handful (less than 5%) was unsatisfied with their current vehicles. This information is shown in the figure below.

Future Car Purchase

Most respondents (36 out of 50) would like to buy another car and keep or sell the ones they had. However, 14 of them were very satisfied with their cars and had no intentions of replacing them or buying new ones.

Future Car Price Range

The survey showed that most people would like to buy cars in the future. This number planned to buy cars whose values were below AED 70,000 and between AED 70,000 and AED 140,000. Therefore, very few of them were ready to spend more money on cars, and that is why they were satisfied with their current ones and had no plans of buying new vehicles. The figure below summarises this information.

The information shown in the figure above shows that the mean price of a car is AED138, 056.06, median class AED 70,001–AED 140,000. The first quartile equals to AED 62,999.1 while the third one is AED 201,250. The mean prices were below AED 70,000 and AED 70,001-AED 140,000 for the modal classes that equal to AED 69,999 and AED 70,001.

Main Purpose of the Future Car

The results obtained from the survey about the purposes of the present cars used by respondents do not differ from what they expect to do with them in the future. The bar graph below shows that most people would still use their future cars for personal use and least for other purposes.

Future Car Type

Most respondents would buy a sports car if they get money in the future. Latest models of sports cars are very comfortable and have superior interior designs with large spaces for luggage, and that is why most people are attracted to them. In addition, these vehicles can be used for different purposes apart from going to and from the office.

A third of the respondents chose the sports car and half of the sample plan to buy sedan and SUV cars, only 6% preferred a van to other models. The pie chart below shows the percentage of respondents and the type of cars they would wish to buy in the future.

Factors Influencing Car Purchasing

Most respondents believed that the safety of a car is important in determining the choice of cars they bought. The number decreased from those that paid attention to the quality, interior, resale value, design and engine performance respectively. Most people bought cars that were safe regardless of their environmental impacts. The table below shows what the respondents considered most important when buying a car.

Price and Mileage

Toyota Camry 2011 Model was considered by most respondents from a secondary source (Drive Arabia 2014 and Dubai Cars, 2014) as the most fuel efficient vehicle. The data presented in the table below shows the price versus mileage comparison that determines the choice of cars for most residents in Dubai. The information was used to find the correlation and regression of ten pairs of observations for x and y where x=Km’000 and Y=AED ‘000. The data was then plotted in a graph as shown in the next figure.

The Excel Scatter Graph above shows that the coefficient of the data is equal to 0.8308, and this is calculated using a linear regression equation shown below.

y=-0.5226 x + 84.436

Conclusions and Limitations

Most of the sample used was female Emiratis that aged between 21-30 years. Less than half of the respondents were satisfied with their current cars while a majority is planning to purchase new ones in the next 1 to 2 years. Cars in Dubai are mainly used for personal or family purposes. Most people prefer to have a sports car if they had the money to buy it.

The number of those that wanted to buy SUV and Sedan cars were equal at 25% each. However, their preferred price ranges were below AED 70,000 and between AED 70,001 and AED 140,000. This is a serious limitation identified in the research because SUVs, Sedans and sport cars cost very expensive. Therefore, this means that these respondents cannot afford to buy them at their desired prices. Most respondents considered the safety of a car to be more important than any other feature while a vehicle’s popularity did not affect their preferences.

In addition, the research established that car mileage has a negative correlation with their resale values. Cars that had travelled long distances had very low resale values because most people believed that they were old; therefore, they have weak engine power. However, the research findings (secondary data) cannot be relied on to predict the actual prices of cars because the survey used ten pairs, and this cannot be taken to be the correct representation of the entire population.

References

Drive Arabia, 2014, Toyota Camry Prices and Reviews. Web.

Dubai Cars, 2014, Used Toyota Camry 2011. Web.

Krane, J 2010, City of gold: Dubai and the Dream of Capitalism, Picador, New York.