This study’s main objective is to evaluate strategic management’s impact on mergers and acquisitions. In the modern world, mergers and acquisitions have become more critical. Still, the process of their realization is rather complex, which generates questions about the necessity of following an effective strategy. The financial sector of China, as one of the fastest growing industries of the progressive country, was chosen as the object of the study. The focus of the research is to characterize the features of the process of mergers and acquisitions and to describe its possible barriers. Based on the data obtained, it can be concluded that any company has significant risks in acquiring or becoming part of another organization. Due to the conducted qualitative and quantitative studies, it is possible to point out the noted simplification of the process due to the work of strategic managers. The study emphasizes the need for their involvement in internal organizational processes. Obtained findings can provide a qualitative theoretical basis for improvements and further research.

Introduction

In the context of globalization and financial instability, mergers and acquisitions (M&A) are an integral element of corporate strategies for numerous companies. Business growth through internal sources of accumulation is sometimes slow and uncertain. A company can acquire a powerful impetus for development through mergers and acquisitions. On the other hand, mergers and acquisitions act as an instrument of a competitive contest for resources, sales markets, distribution channels, technology, and know-how. The competitiveness and stability of the company’s position in the market depend on how effectively it uses external opportunities to solve its internal strategic tasks.

To date, the activity of mergers and acquisitions as one of the primary elements of restructuring, and its final link, aimed at changing the ownership structure, deserves particular study. The relevance of research on any economic phenomenon is mainly defined by its role in the development of the economy as a whole. The relevance of the research topic is that for global and Chinese enterprises carrying out their production activities in a competitive manner, it is necessary to adapt effectively to the rapidly changing market conditions. It is mergers and acquisitions that become the growth strategy that allows an enterprise to maintain its position in the market and become a leader. They are one of the most widespread techniques of development, which is resorted to even by very successful companies, allowing them to maintain their position in the market and take a leading role. Every day, more and more companies and enterprises choose the strategy of mergers and acquisitions to increase their scale, save costs, and obtain the effect of synergy.

Data from reputable institutions in China and abroad showed that despite the weakening of the mergers and acquisitions market in the world, China’s mergers and acquisitions of foreign enterprises are only increasing. At the same time, there is a change in the trend of mergers and acquisitions by Chinese enterprises abroad. Chinese private companies have already overtaken state-owned companies, becoming the main force of Chinese overseas acquisitions and mergers. The M&A targets of Chinese enterprises abroad are also shifting from traditional natural energy sources to high technology and brands.

Compared to previous overseas investments, Chinese companies began investigating more long-term investment patterns rather than just emphasizing immediate return on investment. Chinese enterprises started looking for new industries, technology acquisitions and mergers, resources, and brands. Despite the rapid growth, many entities have warned Chinese enterprises, believing that acquisitions and mergers of foreign companies by Chinese enterprises bring many foreign policy challenges. From a foreign perspective, China’s fast-growing overseas investments may face significant obstacles because although foreign companies have a tremendous demand for term funds in China, they simultaneously receive anxiety when they take possession of Chinese funds. From the perspective of foreign governments, the EU’s urgent need for investment faces difficult political obstacles and pickiness over Chinese investment. Foreign government policy restrictions remain one of the most significant risks facing mergers and acquisitions by Chinese companies of foreign enterprises.

Presently, countries regulate conflicts that arise between them through various agreements and the organization of alliance groupings and alliances. However, to realize the invasive instinct, people have found new ways of mergers and acquisitions, which are reflected in inter-organizational interactions at the present stage. The openness of social systems was first noted in the theory of K. Popper, who highlighted this feature of modern society in contrast to previous types of organizations. K. Popper was the first to point out that at the present stage, the borders between different social subsystems are gradually erased, so the penetration of “alien” elements becomes unhindered. Initially, the openness of the social system was reflected in the basic unit of society – the family. In the Middle Ages and the history of modern society, entry into the family was conditioned by belonging to a particular closed system (clan, caste, class), but in the twentieth-century young people of different social statuses could form a family; origin ceased to be a limiting factor when entering into marriage.

A similar trend of openness has spread to countries from the microsystem to the macro system. Borders between states are becoming more transparent, as evidenced by increased migration, international trade, and cultural exchanges. The openness of macro-level social systems has facilitated the unification processes to find synergies in the efforts of the peoples of several countries (Welch et al., 2020, p. 123). This led to changes in management, which subsequently led to greater openness and made organizations “more transparent to the outside world. And nowadays, this trend of organizational openness has contributed to the development of mergers and acquisitions taking place at the corporate level. The expansion of companies’ international activities has resulted in a more complex internal corporate environment and has been an important prerequisite for the pluralization of forms of conflict.

For managers in the corporation, the “activists” of socio-cultural conflicts are in a blind cultural zone, which leads to the difficulty of diagnosing these conflicts in the early stages of emergence. Due to the uniqueness mergers and acquisitions, it is almost impossible to standardize company integration procedures. It is connected with the lack of a unified concept of the mechanism of implementation of such transactions. Lack of comprehensiveness and consistency in the management of mergers and acquisitions leads to 50 to 80% of M&A transactions failing to achieve their goals and do not recoup the funds invested (Christofi et al., 2019, p. 48). Insufficient development of methods, technologies of integration management, and evaluation of economic efficiency of mergers and acquisitions led to the choice of the theme of this work and determined its relevance.

Strategic management is capable of becoming that link that will help the development of the company and will simplify the process of merges and absorptions. To prove this hypothesis, a study will be conducted that aims to identify the interdependence of strategic managers and the possibility of their influence on the process of mergers and acquisitions. SHRM plays a crucial role in achieving organizational development through M&As since it avails ample ground for aligning and integrating competitive strategies with human capital and strategic management resources. Besides, the rationale behind selecting the topic lies in the growing popularity of SHRM tools in driving business efficiency and performance. The trend indicates that SHRM integrates the skills and talents of human capital in creating and attaining the business goals, mission, strategy, or vision.

The topic is indispensable in helping organizations plan or executes M&As by considering the role that SHRM would play in driving the various goals of business growth, including accessing new markets, increasing shareholders’ value, expanding market share, and implementing strategic alliances (Bailey et al. 313-328). Therefore, an in-depth understanding of the link between M&As processes and SHRM would help organizations address performance management issues in the planning, execution, and appraisal stages of M&As in the financial sector.

The following are suggested as research questions:

- What is the current state of the financial merger and acquisition process in China’s financial sector?

- What are the characteristics of the merger and acquisition process experienced by the company?

- What barriers to the merger and acquisition process of companies in China should be removed?

- Does strategic management have a positive impact on the merger and acquisition process?

- How can strategic managers improve the organization of the merger and acquisition process of companies in the financial sector in China?

- Can strategic managers’ decisions facilitate the takeover process of companies?

Based on the fact that each sector has its characteristics and development, the financial industry will be studied as one of the most actively developing in China. Thus, an analysis of the process of mergers and acquisitions in the financial sector in China will be conducted. The influence of strategic managers on the peculiarities of this process and the possible consequences will be analyzed. The first section will focus on interpreting the concepts of mergers and acquisitions as some of the main elements of any company’s strategies. It is equally critical to focus on the types and purposes of mergers and acquisitions in the Chinese financial sector to comprehend its possible perspectives and barriers. Based on the theoretical study, it will be possible to suggest the weaknesses of the merger process and therefore characterize its possible improvements after the activities of strategic managers. Thus, it can be assumed that strategic management directly and positively impacts the process of mergers and acquisitions in China.

The following sections will prove this hypothesis using qualitative and quantitative methods. The quantitative approach will serve as the leading indicator demonstrating the current state of the financial market of mergers and acquisitions in China. At the same time, the qualitative method will show the honest feedback of directors and employees of companies that have experienced the process of mergers and acquisitions through strategic management and other methods. Founded on the results, it will be possible to get answers to the questions of interest and prove or disprove the hypothesis. After that, the obtained data will be discussed with recommendations for companies to improve their performance. All received data will be summarized, resulting in a conclusion reflecting all the main aspects of the study.

Literature Review

One of the primary goals of any enterprise is to increase its profitability and competitiveness. Organizations are constantly searching for unique methods to achieve the aims mentioned above. Due to the integration processes worldwide and in all sectors of economic activity, Chinese companies have the opportunity to adopt diverse experiences, introduce the latest technologies, and build new levels of economic relations (Feldman, 2021). The strategy of mergers and acquisitions is one of the forms of development and reorganization of organizations. According to Chinese law, following the act on joint-stock companies, the consolidation of organizations recognizes the emergence of a new company by transferring all the rights and obligations of two or more companies with the latter’s termination. The prerequisite of such a transaction is the emergence of a new legal entity, at which all others (two or more) are liquidated (Feldman, 2021). The process of merger implies the transfer of control over the enterprise. A union can take several procedural forms: the merger of companies, acquisition, consolidation, economic concentration, and takeover.

Regarding terminology, when the merging firms are approximately the same size, the term merger is more commonly used in the scientific literature. When two firms differ significantly in size, the term merger is more appropriate (Zhang et al., 2018, p. 208). In practice, however, the terminology distinction is often blurred, and the term merger is applied to unions involving firms of the same and different sizes. At the same time, the term acquisition is distinct. It reflects the process of one organization taking control of another with the asset of absolute or partial ownership. If one organization absorbs other firms, they stop their activities, transferring all the duties and rights to the organization that has joined them (Zhang et al., 2018, p. 208). Thus, the merger, being a particular acquisition, is the process in which several companies are united to create a new legal entity. However, the concept of acquisition is appropriate when one or several organizations become a part of another institution.

Companies resort to merger and acquisition strategies to achieve their primary outcome – the synergy effect of the trade when the value of the merged companies exceeds the value of the organizations separately. The synergy effect is achieved since duplicate functions are eliminated, access to new resources and technologies, and new markets are opened. Improving the organizational and production cycle is one of the most critical roles in increasing the merged companies’ effectiveness (Zhang et al., 2018, p. 208). The synergy effect is one of the crucial moments of M&A transactions. Operational synergy demonstrates the benefits that affect the primary activities of the organizations that are components of the newly formed company.

In this case, it is customary to talk about economies of scale and an increase in the ability to influence prices. Financial synergy consists of obtaining tax advantages, diversification, and increased creditworthiness (Zhang et al., 2018, p. 208). It manifests itself in increasing cash flows and reducing business risks. The trend of companies’ consolidation is formed precisely due to significant competition in the market, liberalization, and globalization of markets. The bundling of organizations, as a rule, is observed under the control of some large firms with enough resources and funds to carry out transactions (Zhang et al., 2018, p. 208). Moreover, the unification of organizations can take place at different levels of management: vertical and horizontal. Their differences are significant, and it is vital to describe each in detail.

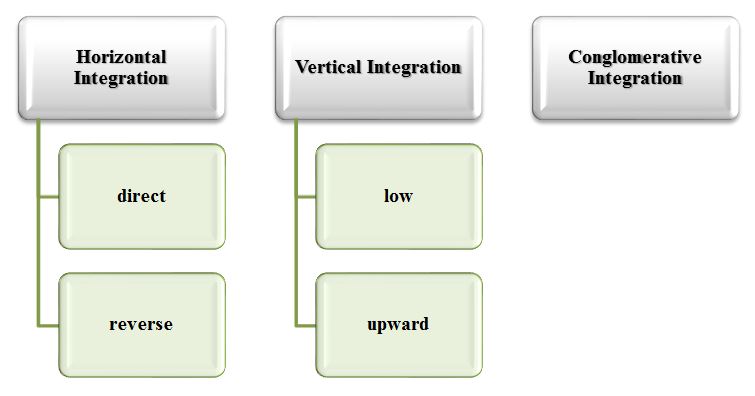

There are a few types of integration, and each of them has specific features. Horizontal integration is characterized by the association of organizations of one industry, that is, those firms that produce identical products or implement the same stages of production (Figure 1). The primary purpose of this type of integration is to obtain the effect of synergy from a scale by reducing total costs, increasing market share, and strengthening the firm’s position (Wilkinson and Marchington, 2021, p. 269). It is possible by absorbing specific competitors, establishing control over them, and providing access to new territories and customers. Horizontal integration can be direct and reverse: direct is the association of organizations in which the production process is interrelated and extends to the subsequent processing stages of the main product (Wright and Dyer, 2022). However, reverse integration occurs when the production process advances to the preceding stages of processing the primary outcome.

It is common to speak about vertical integration when the organizations that produce different components of one product are united. At the same time, their production process is interrelated and covers various stages of processing the main product. The primary purpose of the vertical integration of enterprises is to create a value chain (Sansa, 2020). A distinction is made between downward and upward vertical integration: low is established with a supplier enterprise while upward with an enterprise-consumer. It is possible to distinguish conglomerative integration, which is the process of combining firms not directly related to the company’s core business. This type of integration is justified when an enterprise has no or minimal horizontal or vertical integration opportunities (Shen et al., 2021, p. 23). Conglomerative integration likewise occurs when the organization’s competitors are powerful or the market of the primary products is in decline.

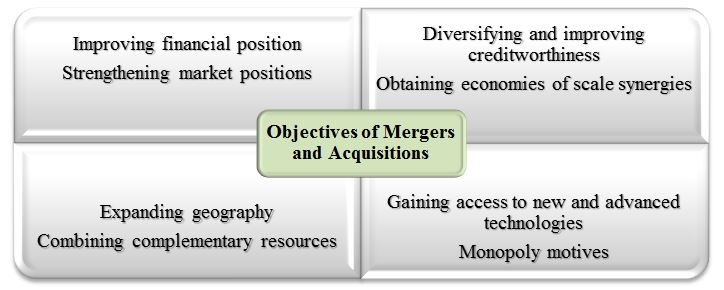

A merger or acquisition is often the only way for the seller to continue operating in the financial marketplace. Nevertheless, businesses may have distinct goals and motivations for pursuing a merger or acquisition (Figure 2). Companies may pursue the goals of strengthening their position, sustainable enterprise development, and effective resource management. As Lodge and Wood (2018) state, large firms absorb small businesses in the financial market, and numerous extensive organizations merge to expand their business to achieve better results by improving efficiency in company processes. Thus, mergers and acquisitions are not solely a tool to reorganize companies as they allow to solve numerous strategic objectives.

A merger or acquisition may come from tax considerations, from contemplations of increased interest in the company from potential investors to secure additional funding sources. Identifying the reasons that guide companies in their M&A decisions is critical, as it reflects why two or more companies, when combined, are worth more than they are individual. China’s financial sector is especially multi-stage, and it takes dexterity and resources to take the lead (Zhu et al., 2020). It is often impossible for small companies; therefore, they resort to mergers or acquisitions, bringing them a competitive advantage. This way, businesses get the opportunity to develop on the market because they receive the necessary funds.

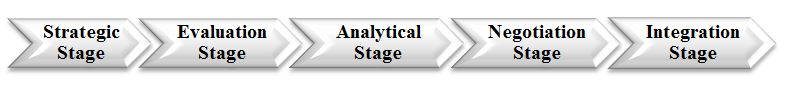

Mergers and acquisitions are complex processes, and the expected synergies may not be accomplished due to several reasons, which may include: different strategies of companies, cultural and social differences, poorly organized integration, and others (Kirkman, 2018). To achieve the most effective synergies, it is necessary to use the methods relevant to companies to assess the transaction and properly plan and organize the entire merger and acquisition process. Therefore, the M&A process can be broken down into several phases. Based on the figure 3, it is possible to judge the actions companies that decide to undergo reorganization by merger should take.

Analysis of the applicability of the merger and acquisition strategy is the strategic stage. The organization’s strategy should contain all types of change in its business, starting with internal development and ending with mergers and acquisitions. Strategic M&A planning objectively compares existing firms to those that can be pursued with the available resources (Beaulieu et al., 2020). If new industries promise higher profits, it makes more sense to merge or absorb to expand the business and move resources to more efficient business areas. The search for a suitable company is the evaluation stage. During this step, based on the developed strategy and previously selected criteria, the search for a potential merger or acquisition object, that is, the company target.

It is essential to adequately determine the range of possible target companies to avoid wasting unnecessary time and money on negotiations. The analytical stage analyzes financial, operational, legal, environmental, cultural, and strategic aspects (Beaulieu et al., 2020). Since not all of the necessary and reliable information to assess the company’s value is often available, several ways of determining the company are used in parallel. The critical element of the process is Due Diligence – a procedure that provides potential buyers with a qualitative analysis of the target company through a review of several details.

The primary reason for the failure of the strategy is the lack of understanding that it is essential not only to have a clear intention and vision of the future but furthermore to build a bridge to it. Therefore, it is the most time-consuming and critical stage in strategic planning, which means extending the strategy to all organizational levels and defining the roles and goals of each group. It is vital to clearly state the course of further development of the company and make sure that the management, by its actions, actively contributes to the movement in this direction.

Moreover, it is necessary to communicate the organization’s mission and long-term development plan to all employees to manage corporate activities more effectively and help employees contribute to the organization’s future. However, despite the growing interest in high-performance business, in today’s business world, there is a severe problem for many companies to bridge the strategic gap, understood as the company’s inability to implement the developed strategy (Williams, 2020). Most companies today are characterized by a situation where the approved strategic vision has almost no impact on the activities of the actual business units, and the day-to-day operations of the organization are virtually unrelated to its long-term plans.

Making a management decision on mergers or acquisitions is based primarily on the strategic aspects of the company’s development. Adapting to macroeconomic conditions and the ever-changing and increasingly complex needs of customers is a prerequisite for the survival and growth of the modern business. Various strategies imply distinct types of transactions perceived differently by the market (Wilkinson and Dudon, 2020). Despite the variety of value creation mechanisms, all mergers and acquisitions have one thing in common: the need to extract value from the acquired asset more effectively than others.

It can be accomplished if the deal is within the framework of an overall corporate strategy: it allows the company to use its assets and skills sufficiently. The most successful companies do not formulate an M&A value creation strategy once and for all but revise it depending on the stage of the company’s life cycle (Wilkinson and Dudon, 2020).

The general strategy is a formulation of the long-term direction of the firm’s development, defining the scope, means, and forms of activity, the system of relationships within the company based on its market position. Accordingly, the company’s plan of mergers and acquisitions should be formed first from its strategic plan (Kessler, 2020). Therefore, it is necessary to provide a combination of the company objectives and the pursuit of mergers or acquisitions.

Strategic management is one of the most dynamically developing areas of scientific knowledge about companies and their market behavior. However, more often in management publications, there are thoughts that in the era of innovative economy and non-linear development the strategies of companies should become different (Dundon and Rollinson, 2021). At one time, the economy made a revolutionary transition from artisanal production to industrial corporations.

There is a need for new extreme growth from traditional corporations to postindustrial companies, for which several established organizational and managerial concepts will lose their effectiveness. Developing techniques and methods for forming effective strategies for companies in the XXI century should be based on knowledge and practical experience accumulated within the 40-year history of developing strategic management theory and practice (Lavelle et al., 2020). Hence, it is necessary to systematize and generalize the results, hypotheses, and problems, which stimulates research on the methodology and periodization of the strategic management theory.

In modern understanding, the subject of the theory of strategic management as a scientific discipline is the study of the nature and mechanisms of creating competitive advantages for companies, which provide them with the opportunity to assign economic benefits. Strategic management began to develop in the mid-60s of the last century in university business schools in the United States with analytical commentaries on cases (Lavelle et al., 2020). Further development of the theory was stimulated, on the one hand, by changes in the business environment. On the other hand, the interaction of management with such economic disciplines as microeconomics, branch organization theory, firm theory, and economic sociology was expanding.

The concept of dynamic capabilities proceeds from the fact that the critical resource for successful companies is their intellectual capital, which provides the ability to take faster and more unconventional proactive actions to create new markets, recognize new business opportunities, and achieve organizational renewal, sustainable competitive advantages for companies. G. Armstad (2020) promotes the idea of revolutionary changes, believing that a modern company should become economical and efficient on the one hand and rampantly creative and innovative on the other. In his opinion, companies must develop the ability to innovate, continuously grow new business concepts (and hence strategies, a note of the authors), and significantly revise the old ones (Armstad et al., 2020). This goal is to make the company resilient and resistant to external perturbations, and the means is innovation.

Strategic management is a rapidly developing field of science and management practice that has emerged in response to the increasing dynamism of the external business environment. American business researchers and consulting firms developed the theory of strategic planning and management. Then this apparatus entered the arsenal of methods of internal corporate planning of all developed countries. Nowadays, there are many definitions of strategy. Still, all of them share the notion of strategy as a conscious and thought-out set of norms and rules underlying the development and making of strategic decisions, influencing the future condition of the enterprise, as a means of connecting the enterprise with the external environment (González-Torres et al., 2020). Strategy is a general program of actions that identifies priorities of problems and resources to achieve the primary goal. It formulates the main goals and ways of their achievement so that the enterprise gets a unified direction of movement (González-Torres et al., 2020). Strategic management is a process of making and implementing strategic decisions, the central element of which is strategic choice, based on the comparison of the enterprise’s own resource potential with the opportunities and threats of the external environment in which it operates (Chen and Xiaohui, 2021). Strategy can be seen as the main link between what the organization wants to achieve: its goals and the line of behavior chosen to achieve these goals”. Strategic management was introduced at the turn of the 1960s and 70s to distinguish between current management at the production level and management at the top (González-Torres et al., 2020). This distinction was necessitated by transitioning to a new model of managing organizational development in a changing environment. Four factors-conditions that determine the relevance of strategic management are distinguished:

- In the second half of the 20th century, the number of problems caused by internal and external changes was constantly growing. Many were principally new and could not be solved based on the experience of the first half of the XXth century.

- The diversity of tasks and the expansion of the geographic scope of national economies led to further complications of management problems.

- The role of top management was growing, while the set of managerial skills developed in the first half of the century was less and less suitable for solving emerging problems.

- The external environment was becoming more unstable, which increased the probability of sudden strategic changes and their unpredictability.

Using flexible management, which would adapt the enterprise to the rapidly changing environment, became extremely important. Timely response to emerging changes was achieved through the strategic direction of enterprise development (Dziawgo, 2121, p. 1110). Rapid changes in the external environment of domestic enterprises also stimulate the emergence of new methods, systems, and approaches to management. If the external environment is practically stable, there is little need to engage in strategic management. However, most Chinese enterprises currently operate in a rapidly changing and challenging to predict environment. Hence, they need strategic management methods.

The essence of strategic managers in China now is to offer high technology, various goods and services, and specialized goods at a low price. Such strategies are based on the process of benchmarking, reliance on cheap disruptive technology and cheap labor, attention to peripheral markets and problematic customers, reinvention of the experience curve, and support from the state (Dziawgo, 2121, p. 1110). There are other views on the strategy of companies that develop similar thoughts – leaving the competition and creating uniqueness through innovation and creativity.

A distinctive feature of strategy as the primary weapon of companies is that it deals not with any one direction (function) of the company but with the business as a holistic phenomenon in its relationship with the external environment (Sergi et al., 2019, p. 15). The contradiction between the endless pursuit of ideal and attainable goals, and the long-term and short-term prospects, forms the most well-known and discussed in the literature dilemma of strategic management. The paradox is simultaneously pursuing change and staying true to the past (Wekch et al., 2020). On the one hand, top managers must ensure that the company is running steadily and generating the expected profits. On the other hand, the modern SRM must ensure that the company develops over the long term, making quick maneuvers under the influence of external threats and emerging opportunities. Unfortunately, many managers who excel at ensuring the effective current functioning of the company end up being more passive and less prepared for changes in the external environment.

On the contrary, managers who focus on development strategy, who have achieved flexibility and adaptability of their companies to changes in the background, are unlikely to ensure the company’s success in competition if they ignore the problems of its current functioning. For successful company management, these two aspects – strategy and tactics – must be balanced. Successful companies show that substantial strategic foresight increases rather than decreases a company’s ability to act flexibly (Christofl et al., 2019). A clear understanding of where the company ultimately wants to finish helps managers determine the appropriate course of action in the current situation. In accomplishing that, viable foresight must be flexible, and managers must be willing to respond to changes and adjust to new demands in the environment.

Sha and Zilong (2018) indicate that the growth of M&As globally, together with other strategic alliances, has made SHRM the most preferred approach to implementing new initiatives of enhancing competitive advantage. Szierbowski-Seibel (2018) studied SHRM and discovered that Chinese firms are imitating the methods used by the United States and European ones, which directly adds value and enhances the performance of these organizations. HRM was conceptualized in the United States around the 1970s, spreading worldwide and later incorporating strategic methods (Sha and Zilong, 2020). Human resources are significant in achieving business goals; thus, companies need to identify the best methods of creating HRM synergies in acquired and merged operations. Many models of SHRM that companies can implement exist today. Managers should discover the best processes for their enterprises, with such activities as M&As requiring close attention due to the challenges encountered. Therefore, a research on how SHRM impacts Chinese firms during M&As and the subsequent management of emerging issues should be made.

Methodology

Modern research methods are techniques and operations for solving problems within any science. The study is used for in-depth analysis of the situation in a particular field of science and to establish new facts. Various methods of obtaining information can be used for research: survey, experiment, observation, interview, and questionnaire. A qualitative data assessment was chosen as the primary technique used in the thesis. It has opened the opportunity to obtain the data required to confirm or refute the hypothesis. An interview is the most reliable way to get information directly from the participant in an event or a specific person. It is defined as the answers to a particular person to journalists’ questions of public interest, as a conversation that is not limited to specific requests but comments on the interlocutor’s replies (Lorenzo, 2018, p. 8. Thus, an interview is a method of collecting research information based on a direct conversation between the interviewer and the respondent within the framework of a specific topic of discussion. As a data collection method, the interview is used in various fields of science: sociology, journalism, and psychology. This method’s use for different research purposes speaks of its versatility. Unlike other research methods, interviewing is a method of obtaining information from primary sources.

It is conducted with an interviewer trained in dialogue, and there is a more profound collection of data for further analysis and processing. It allows the researcher to study in more detail the inner world of the respondent, his attitude to reality, and the psychological characteristics of his personality (Wilkinson et al., 2020, p. 1279). During the dialogue, the resident not only asks questions for further processing of the answers but also brings the respondent’s interests to the level of awareness and understanding.

Thus, the interview combines the method of questioning and observation. During the study, questions were asked, and answers were received and recorded, observing the reactions and behavior of the respondent during the interview, which played an essential role in the processing and analysis of information. When conducting interviews, there is a risk of receiving inaccurate information and distorting the data collected (Lorenzo, 2018, p. 8). It depends on both the respondent and the resident. On the one hand, the respondent may deviate from the truth for some reason (susceptibility to possible pressure from the interviewer, a favorable opinion from the outside, a vague understanding of his position). On the other hand, a resident can also become the subject of data distortion, pursuing their own goals and motives.

To avoid this risk, the interview questions were prepared and thought out in such a way as not to cause inconvenience to the interviewees. The respondents were 20 people working in the financial sector in China, half of whom were senior managers and half ordinary workers. The primary survey focused on their experience of going through the M&A process and the role of strategy in it. Participants shared their experience of using the help of strategic management, as well as the experience of going through the process without the participation of strategic leaders. Moreover, they were asked about the barriers of M&A, and any positive and negative experiences concerning it.

An interview and other psychological research will give the highest results – by comparing information received from the respondent with observational data and documentation. You can also include material from discussions with other people. Thus, the interview is a method of obtaining reliable information, with its risks, advantages, and disadvantages (Wilkinson et al., 2020, p. 1279). The right choice of competent respondents and the topic of conversation leads to high results and obtaining data directly from primary sources for the target audience.

A group-focused interview was also conducted – a qualitative research method involving discussing a specific topic with several respondents. The focus group has the same goal as the interview – to get in-depth information about the target audience, its tasks and problems, expectations and preferences, and user behavior motives. It involves the ability to reveal more details of the issue under discussion through the interaction of people (Lorenzo, 2018, p. 8). Usually, the influence of focus group participants on each other is regarded as a harmful and even dangerous moment, but there is a solid side to this influence. People are more likely to share their opinions in a group than in a strict tête-à-tête interview (Lyns and Kuron, 2018, p. 157). The remark of one respondent evokes a response from another, prompts reflections and memories, the discussions turn out to be more lively and emotional, and essential and acute topics appear. Thus, a qualitative methodology proves its reliability through the use of various techniques and the comparison of information and its further analysis.

Moreover, the study used quantitative data analysis to establish the level of development of mergers and acquisitions in the financial sector in China. The scores were subtracted and analyzed to compare the stories of the development level of the financial industry compared to other traditional sectors in China. Moreover, the use of a quantitative method together with a qualitative one guarantees the validity of the methodology and makes it possible to compare information using different techniques. Quantitative analysis refers to the statistical analysis of Chinese companies’ financial reports to understand the specifics of mergers and acquisitions and its level of development. The data was compared with previous indicators, which made it possible to assess the level of improvement or deterioration of the financial sector.

Findings

It is possible to provide several findings based on the research. First of all, it is essential to note that the influence of Chinese enterprises on the world stage is constantly growing with the steady development of the national economy. It is especially evident in the M&A market, which has grown significantly from 2016 to 2021. The average growth was 16.69% per year, and the number of closed M&A deals involving Chinese companies increased accordingly by 12.22% (Lyns and Kuron, 2018, p. 157). Thus, today, China is one of the leading players in the global M&A market. At the end of 2021, the volume of international deals involving Chinese companies reached more than 340 billion dollars against 202 billion last year. It puts the country in second place behind the United States, leading to total M&A deals at just under $410 billion.

China is projected to seriously increase its international business activity over 2019-2027, with China spending more than $1.5 trillion on overseas investment projects and foreign asset acquisitions by the end of the decade. That’s two-thirds more than the nearly $900 billion China sent overseas between 2007 and 2019. As China’s GDP has grown, so has the country’s interest in foreign assets. Chinese investors have joined the global competition for technology companies that can develop a new economy based on exports and domestic demand. Whereas previously, most M&A deals with Chinese participation were in state corporations acquiring energy and commodity companies, now they have begun to seek entry into the capital of microprocessor manufacturers and companies engaged in the development of agro-technology and finance. It is also found that the share of state-owned enterprises in the structure of foreign M&A deals involving Chinese companies is becoming less noticeable.

The main obstacle to the activities of companies from China abroad is the opposition of some states in the admission of foreign investment in important projects, both on the part of national interests and national security, related to the fuel and energy complex, production with high costs. At the end of 2021, the total amount of canceled deals with Chinese companies reached an estimated $60-95 billion. The main reasons for the failure of already agreed values were the blocking of regulatory bodies and the cancellation by investors of the original plans. Another severe barrier for Chinese companies is the policy of the Chinese authorities regarding the processing of significant foreign deals. Often the Chinese government considers such transactions to be a potential threat to the country’s banking system (usually due to increased brrowing arising from the settlements of counterparties with recipient companies) and, consequently, the economic system as a whole. It is worth noting that the Chinese government is increasingly blocking transactions that are not core to Chinese companies (for example, those related to entertainment or real estate) and are “irrational” projects for investment.

Moreover, increasing regulatory scrutiny of remittances to stop their outflow abroad is a barrier to Chinese activity in the international market. For Chinese companies, approving transactions with foreign counterparties often requires a significant amount of time, which can be a reason to cancel already agreed-on deals. This problem was particularly acute when foreign firms began to prescribe substantial monetary penalties for late execution of contract terms. The consequence of an incomplete exchange is the significant losses incurred by a Chinese company in an M&A transaction. This state of affairs is unacceptable for the traditional Chinese approach, but cross-border deal cancellation fees have already become a trend in the international market. However, Chinese companies are showing a high level of adaptability to the new environment.

Compensation for a failed deal is not the only practice that goes against Chinese traditions and customs or is contrary to Chinese business ethics. In overseas M&A transactions, Chinese companies may encounter differences in political attitudes and laws, market environments, norms of conduct, environmental standards, and other intellectual property and labor laws provisions. A significant factor affecting Chinese foreign business activity is the renminbi’s depreciation and the resulting increase in the value of overseas assets for Chinese buyers. Still, Chinese financial sector is expanding, and it raises many issues which is clear from the interview. One respondent gave an interesting answer that describes the difficulty of conducting a merger or acquisition.

“I think the government is not always interested in the transaction process, which makes it sometimes impossible.” – R1

Secondly, participants were asked if they had any experience with strategic management. Again, participants noted that they did not always involve a strategic manager, but they did not view such experience as positive. Moreover, they suggested that it is the lack of strategy that often leads to unsuccessful or unprofitable deals.

“Lack of strategy takes away the ultimate vision, and that’s why these people are now increasingly attracted to robotics. After all, an experienced pro facilitates the contract process and makes it mutually beneficial. – R2

Moreover, strategy is seen as a tool to increase transparency in the company and short and long term planning.

“I think that the main objective is a structured action plan that includes planning and risk assessment […]. I think that the organization must realize that it’s important to involve strategic managers in the process, not just management or partners.” – R3

Moreover, after analyzing and comparing the information obtained in the interview, it is possible to present some of the positive and negative aspects of the involvement of strategic managers in the process of mergers and acquisitions. It is important to note that all data is taken solely from the words of the leaders and employees of companies in China, so they are a reliable source of information based on which you can make a release. Thus, the advantages of a strategic approach to managing the process of mergers and acquisitions:

- Strategic management provides a common understanding of why the organization functions and makes certain management decisions. It allows you to betray a single focus on the activities of all departments and personnel of the organization to achieve its strategic goals;

- Strategic management is designed to ensure not the organization’s current success but its continuous development in conditions of the unstable external environment and fierce competition. In this way, not only a more straightforward process of transition to another form of organization is possible, but also its successful activity in the future;

- Strategic management allows you to combine the decision of the leaders of all levels of control associated with the strategy. It significantly reduces the amount of time and resources required to adopt a treaty;

- Strategic management provides an opportunity to evaluate alternative options for the use of resources; that is, it is reasonable to transfer resources to strategically sound and practical projects;

- Strategic management creates an environment that encourages active leadership of the organization rather than a passive response to changing situations;

- The latest and most progressive developments are used in strategic management. At the same time, after the interviews, one can also imagine some negative aspects of the involvement of strategic managers in the process of mergers and acquisitions in the Chinese financial sector. Disadvantages of strategic management:

- Strategic management, by its nature, cannot give an accurate and detailed picture of the future, which makes it challenging to develop strategic plans and implement them. It is a significant shortcoming in the financial industry, as it is built on accuracy, and any inaccurate forecast can cause substantial losses;

- Strategic management does not have a descriptive theory that prescribes what and how to do when solving certain problems and in specific situations. Each manager understands and implements strategic direction in their way, but not everyone has strategic foresight. It highlights the need to recruit personnel that are in line with the organizational culture of the organization;

- Huge efforts and large expenditures of time and resources are required for the organization to begin the process of strategic management. Not every company in China is willing to spend large amounts of resources on a strategy, and their persuasion is a severe challenge;

- At present, the negative consequences of errors in strategic foresight are sharply increasing.

In this way, it is possible to emphasize the existence of a clear relationship between strategic leadership and the internal processes and approaches of the organization. China is in an active M&A process, especially in the financial sector. At the same time, many barriers can be noted, the elimination of which without a strategy is impossible. It means that the involvement of strategic leaders, despite some shortcomings, still has the potential to become one of the decisive factors that affect the continuous simplification of the M&A process and the company’s efficiency.

Discussion

Thus, external and internal M&A activity in China’s financial sector reached its peak long ago but has now recovered again. While there are tremendous opportunities for foreign and domestic investors, there are also some lessons that foreign investors need to learn to gain access to M&A deals. Foreign investment into the country continues to double, with direct investment likely to hit the $100 billion mark this year. Given these numbers, it is clear that international and regional companies are watching China’s ongoing modernization and an ever-growing number of consumers, many of whom are part of China’s growing middle class. Foreign investors may be optimistic about China’s economic prospects (Renneboog and Vansteenkiste, 2019). However, despite creating a positive picture for investors, Beijing hopes to avoid an overly export-dependent economic model by increasing domestic consumption and the growth of Chinese businesses at home, thus making it more difficult for foreign investors.

The Chinese government views the foreign investment as a means to obtain foreign know-how, not just jobs and capital. Further, the Chinese government seeks to push foreign firms to form joint ventures, not just to acquire Chinese firms. In some areas, joint ventures cannot be avoided because of the government-imposed restriction on foreign ownership (Renneboog and Vansteenkiste, 2019). This rule applies to most financial services, such as life insurance, fund management, securities, and banking, where foreigners cannot own a controlling stake. Even in sectors where foreign firms are given greater freedom of action, joint ventures are usually formed to capture market share, gain quick access to distribution, and secure government support. The Chinese government’s regulation of cross-border transactions is nothing new, but their aspirations for continued economic growth are growing amid global financial problems.

Data from reputable institutions in China and abroad showed that despite the weakening of the global M&A market, China’s mergers and acquisitions of foreign enterprises have only increased. Compared to previous overseas investments, Chinese companies have begun investigating more long-term investment patterns rather than simply focusing on immediate return on investment. Chinese enterprises started looking for new industries, technology acquisitions and mergers, resources, and brands. Experts said that private enterprises would continue to lead the overseas M&A market in terms of the number of transactions (Westerman and Yamamura, 2017, p. 150). As for the volume of transactions, state-owned enterprises still dominate. From a foreign perspective, China’s fast-growing overseas investment may face significant obstacles because although foreign companies have a strong demand for term funds in China, they simultaneously receive anxiety when they take possession of Chinese funds. From the perspective of foreign countries, the European Union’s urgent need for investment faces difficult political obstacles and pickiness toward Chinese investment.

In the goal-setting phase, the business’s mission translates into concrete results and outcomes that the organization seeks. Setting goals and monitoring their achievement helps track the organization’s progress. Managers of successful organizations know that plans must require hard work and serious effort from all employees. The organization must be resourceful, persistent, determined, and focused on achieving difficult goals. Challenging goals help avoid inertia and stagnation. The company needs to create an atmosphere of universal focus on results. To do this, general company goals are specified for each unit, and managers at all levels are responsible for achieving them (Westerman and Yamamura, 2017, p. 150). All this is impossible if there is at least minimal misunderstanding of implementing the set tasks. Ideally, a unified collective effort is created when each division of the organization strives to achieve goals in its area of activity and thereby contributes to the achievement of the company’s global goals and the realization of its strategic vision.

To accomplish the goal requires, firstly, thoughtful and purposeful actions; secondly, if necessary, reaction to unforeseen events, changing market conditions, and increased competition; and thirdly, continuous collective learning of the organization – intuition alone is not enough. The organization must constantly learn and improve its competitiveness. The strategy is adjusted by adding some parameters and giving up others in response to changes in the market, consumer needs and preferences, strategic maneuvers of competing companies, experience gained new opportunities and threats, unforeseen events, and fresh ideas (Qu and Zhenkai, 2021, p. 110). Business conditions in the future are pretty uncertain and unpredictable, so it makes no sense to plan every step; it is better to create a general plan and adjust it as necessary. Moreover, common sense suggests that any company’s intended and adaptive activities should not exceed the limits of the company’s competence and competitive capabilities.

Although strategic management as a determinant of the organization’s future is an essential function of the managerial staff, managers have other work to do. The role of the system’s methodological, informational, and legal support increases in strategic management because these problems need to be predicted and solved in the long term. Providing the system with material resources is simplified, but the requirements to provide the system with highly qualified specialists and managers increase (ChristofI et al., 2019). In a managed subsystem, instead of marketing functions, planning, organization of processes, accounting, and control, motivation and regulation are introduced as functions of strategic marketing and development of company strategy.

The managing subsystem will consist of two components: the result of a strategic management decision and personnel management for developing and implementing strategic plans. The components of the “external environment” of the strategic management system, affecting the efficiency and sustainability of its functioning, include the macro environment, the infrastructure of the region (meso environment), microenvironment of the firm. The strategic management system’s feedback components include new consumer requirements, claims, information in connection with recent scientific and technological progress, and other factors. The system’s output will be the firm’s strategy for a certain period in the form of a comprehensive strategic plan (program), strategic plans for individual sections, and the schedule of implementing strategic procedures.

When working out the system of strategic management, first, it is necessary to specify the output based on marketing research, then to analyze the influence on “process” in the system of “external environment,” and in the last turn to provide quality of “process” in the system at a level of quality of the input. Evaluations of quality by system components should be given in a single reference system. The optimal beginning of the strategic management process is a structured analysis of the market environment in which the company is located. The study helps the management team take a strategic approach without dealing with global and contradictory problems immediately. It helps structure their path to a problem, allowing them to see new aspects of a problem that seems well known. It forces managers to think deeper and helps them apply strategic management tools and techniques to the mergers and acquisitions process.

Conclusion

Economic science has developed many models, methods, and techniques to justify and conduct mergers and acquisitions for various situations and purposes. Despite the many differences, all mergers and acquisitions have typical stages and solve several common problems in their implementation. To solve them, standard methodologies are also applied. The purpose of the work was to study the settings, functions, and tasks corresponding to the basic principles and provisions of the theory of management in the implementation of mergers and acquisitions. Mergers and acquisitions are manageable processes and management processes in other areas of the economy. They must comply with the principles and provisions of management theory and management decision-making theory. Theoretical foundations of management: The approach of management and management process is considered to achieve a set goal, consistent solution, and performance of several management tasks, carried out within the framework of strictly defined stages of the management cycle. The general model of the process of mergers and acquisitions of companies implies the definition of strategic goals and objectives of the planned integration and divides this process into stages, and the goals and objectives of the tactical level of management implemented at each. The settings, functions, and tasks implemented in mergers and acquisitions should comply with management theory’s fundamental principles and provisions. In the above study, we can conclude that many mergers and acquisitions characterize China’s financial sector, but not all are equally successful.

When planning mergers and acquisitions, it is necessary to calculate the potential benefits and risks carefully. When formulating a strategy, it is possible to misidentify the target company. For example, underestimate the difficulty of obtaining regulatory approvals. Often the buyer misjudges the amount of investment needed to get the necessary synergies (ChristofI et al., 2019). There are cases when after the completion of the reorganization, the capitalization of the new company’s shares is lower than when adding up the capitalizations of the shares of legal entities before the merger.

The failures may vary, such as the inability to attract financing for the transaction, its high cost, and the need to buy back shares from minority shareholders. They are often associated with an inability to quickly combine technological processes with the resistance of management and labor. To avoid these risks, it is worth involving specialists in M&A transactions, who can assess possible risks and draft several stress scenarios of events. Further, it is necessary to carry out risk management measures, reducing the likelihood of realization and the severity of the consequences. The effectiveness of mergers and acquisitions always depends on the quality of risk assessment and the choice of a brilliant strategy. Thus, we can conclude that strategic managers are indispensable in the process of mergers and acquisitions, especially in the dynamic financial sector. Considering in aggregate features of the modern approach to the management of the organization, it is possible to conclude that it is the actions providing its steady development in the long term at the expense of the creation and strengthening of competitive advantages. Most likely strategic management will be the primary approach to company management in the XXI century.

Strategic management is such management of the organization which is based on human potential as the basis of organization, directs production activity to consumers’ demands, carries out flexible regulation and timely changes in the organization which meet the challenge of the environment and allow to achieve competitive advantages, as a result enabling the organization to survive and reach its goal in the long run. Finally, let us note that despite the importance of formal generic definitions, the essence of strategic management can best be revealed through a substantial operational report that describes strategic management as a structured process of action to achieve specific pre-defined goals based on known methodological principles.

Due to the uniqueness and uniqueness of mergers and acquisitions, it is almost impossible to standardize company integration procedures. This explains the lack of a unified concept of the mechanism for implementing such transactions. Intensification of competition between the most significant international corporations forced them to expand the scale of operations to acquire some companies, gain control over others, and implement joint investment projects with individual partners. Despite their diversity, the motives of mergers and acquisitions are considerably inferior to the variety of forms of their concrete realization. The result of ineffective management of the company may be its takeover by a company with a more effective management system. As a rule, the absorbed company is reorganized, and its management staff is reduced. Thus, an extension of quality management to the interested company and the use of better management technologies become essential in increasing the merged structure’s effectiveness.

Moreover, the study and the analysis of the words and thoughts of the respondents help to understand that strategic managers can significantly simplify the process of mergers and acquisitions in the financial sector in China. They can assess risks, think through a plan for the transition of companies and implement a strategy that will be the most profitable for all parties. Furthermore, strategic management allows for solving the problem of reducing personnel and using ineffective technologies. From this, we can conclude that the process of mergers and acquisitions in the financial sector of China can be improved by involving strategic managers who will eliminate possible barriers and facilitate the process of transactions for all interested parties.

This study substantiates the relationship between facilitating mergers and acquisitions and the involvement of strategic managers, but at the same time a more in-depth study is needed. Because there are no reliable sources to prove this relationship, the focus of the study was to establish it. At the same time, there are now many ways to go deeper into the subject. For example, it is possible to investigate which tactics and methods of strategic management are the most effective in mergers and acquisitions. This current topic has many aspects and focusing on them can be a significant step in the development of business and strategic management.

References

Amstad, Marlene, Guofeng Sun, and Wei Xiong. (2020) “The Handbook of China’s Financial System. Princeton University Press.

Beaulieu, Nancy D., et al. (2020) “Changes in quality of care after hospital mergers and acquisitions.” New England Journal of Medicine, 382, pp. 51-59.

Chen, Weidong, and Xiaohui Yuan. (2021) “Financial inclusion in China: an overview.” Frontiers of Business Research in China, 15(1), pp. 1-21.

Christofi, Michael, et al. (2019) “Triggering technological innovation through cross-border mergers and acquisitions: A micro-foundational perspective.” Technological Forecasting and Social Change, 146, pp.148-166.

Delery, J. and Doty, H. (2019). Modes of theorizing in strategic human resource management: Tests of universalistic, contingency, and configurational performance predictions. The Academy of Management Journal, 39(4), pp. 802-835.

Dundon, T. and Rollinson, D. (2021). Understanding employment relations. 2nd ed. London: McGraw-Hill Higher Education.

Dziawgo, Tomasz. (2021) “Big Tech Influence on China Financial Sector.” European Research Studies, 24(1), pp. 1110-1121.

Feldman, E. (2021) “Synergy in mergers and acquisitions: Typology, lifecycles, and value.” Academy of Management Review, 1(4), pp. 12-16.

González-Torres, Thais, et al. (2020) “A systematic review of research on sustainability in mergers and acquisitions.” Sustainability, 12(2), pp. 12-13.

Kessler, I. (2020). “Financial Participation”. In Wilkinson, A., Gollan, P., Marchington, M. and Lewin, D. (eds), The Oxford Handbook of Participation in Organizations, 3st ed. Oxford: Oxford University Press.

Kirkman, B. (2018). A quarter century of Culture’s Consequences: a review of empirical research incorporating Hofstede’s cultural values framework. Journal of International Business Studies, 37, pp. 285-320.

Lapoint, P. and Liprie-Spence, A. (2018). Employee Engagement: Generational Differences in the Workforce. Journal of Organizational Psychology, 17(5), pp. 118-128

Lavelle, J., Gunnigle, P. and McDonnell, A. (2020). Patterning employee voice in multinational companies. Human Relations, 63(3), pp. 395-418.

Lodge, D. and Wood, N. (2020) Modern criticism and theory: a reader. 2nd edn. Harlow: Longman.

Lyons, S., and Kuron, L. (2018). Generational differences in the workplace: A review of the evidence and directions for future research. Journal of Organizational Behavior, 35, pp. 139– 157.

Qu, C., and Zhenkai S. (2021) “Does financial agglomeration promote the increase of energy efficiency in China?” Energy Policy, 146, pp. 110-118.

Renneboog, Luc, and Cara Vansteenkiste. (2019) “Failure and success in mergers and acquisitions.” Journal of Corporate Finance 58, pp. 650-699.

Sha, Yezhou, and Zilong Wang. (2020) “Economic policy uncertainty and mergers and acquisitions: Evidence from China.” Economic Modelling, 89, pp. 590-600.

Shen, Huayu, et al. (2021) “Does geopolitical risk promote mergers and acquisitions of listed companies in energy and electric power industries.” Energy Economics, 95, pp. 105-115.

Sergi, Bruno S., et al. (2019) “Central Asia and China: financial development through cooperation with Russia.” Asia-Pacific contemporary finance and development. Emerald Publishing Limited.

Sansa, Nuhu A. (2020) “The Impact of the COVID-19 on the Financial Markets: Evidence from China and USA.” Electronic Research Journal of Social Sciences and Humanities, 2, pp. 1-10.

Welch, Xena, et al. (2020) “The pre-deal phase of mergers and acquisitions: A review and research agenda.” Journal of Management, 46(6), pp. 843-878.

Westerman, J. W., and Yamamura, J. H. (2017). Preferences for work environment in financial sector. Career Development International, 12(2), pp. 150–161.

Wilkinson, A. and Dundon, T. (2020). “Direct Employee Participation”. In Wilkinson, A., Gollan, P., Marchington, M. and Lewin, D. (eds), The Oxford Handbook of Participation in Organizations, 5st ed. Oxford: Oxford University Press, pp. 167-186.

Wilkinson, A, et al. (2020). Information but not consultation: exploring employee involvement in SMEs. The International Journal of Human Resource Management, 18(7), pp. 1279-1297.

Wilkinson, A., and Marchington, M. (2021). “Employee Involvement and Voice”. In Bach, S. and Edwards, M.R. (eds), Managing Human Resources: Human Resource Management in Transition, 8th ed. Chichester: John Wiley & Sons Ltd, pp. 268-289.

Williams, L. (2020) “Tools for achieving sustainable management strategies”, Planning Practice & Research, 15(3), pp.155–174.

Wright, O., and Dyer, L. (2022). New models of strategic HRM in a global context. The International Journal of Human Resource Management, 16(6), pp. 875–881.

Zhang, Weihong, et al. (2018) “The impact of firms’ mergers and acquisitions on their performance in emerging economies.” Technological Forecasting and Social Change, 135, pp. 208-216.

Zhu, Y., Xie, Y., Warner, M., and Guo, Y. (2020). Employee participation and the influence on job satisfaction of the ‘new generation’ of Chinese employees. The International Journal of Human Resource Management, 26(19), pp. 2395-2411.