The recent economic crisis that originated in the US has now come to take its toll on the rest of the world. All over the world, the effects of decreased commodity prices, increased inflation, higher inflation and decrease credit availability are impacting all the major and minor economies alike. The decline in the trade that resulted has seen manufacturing and service sectors targeting both internal and external markets suffer. This ultimately affects the health of the economy.

The car industry in the UK has been one of the key economic players in this world’s respected economy. In 2007, the car industry was exporting an average of 103,000 cars and making 28,000 units for the local economy per month. This was within three months in the three months to July (national statistics, 2007). However, the effect of the world financial crisis has reversed this trend. Williams notes with concern that there has been a whopping 59% decrease in car production bringing the monthly average to 59,777 units for February 2009. Indications that the internal economy is in trouble are high with a recording of dropping car registration for the same year (Williams, 2009).

The UK car industry has not suffered in isolation; the effects have been internationally felt in the car sales worldwide. GM motors, America’s largest car producer and one of its biggest employers also got bitten hard. It was already riding on a negative wave of foreign competition and had just started to effectively adjust to the same when the catastrophe manifested. Now GM had to seek government aid to stay alive. In the third quarter of 2008, GM reported a resounding loss of 2.5 billion dollars. It has had to close down several factories, cut down on several of its models, and declare numerous of its employees redundant. Its rival Ford has also faced immense financial stress due to increased costs and fast dropping sales. Even world giants, Toyota, have recorded losses as a result of this financial problem.

There have been a few economic forces behind the sales decline witnessed. The major one is reduced consumption expenditure, resulting from increased job loss and increased credit tightening. The financial crisis has resulted in the biggest international lay-offs witnessed in this modern world. With multinationals cutting down on staff, downsizing in the private sector is today a norm. This loss of job service means that the household unit has less money to spend. Therefore, the reduced consumption due to loss of income would also affect car sales. Another factor that would have led to the reduction is the increased credit crunch. Since there is no longer available ready credit to finance expenditure, consumption of large commodities, including cars would drop (Deepashree, 2.3-.2.7, 2006).

Let us examine what the impacts are to the economy starting with the car industry and its affiliates. The drop in sales has resulted in reduced revenues. No sector of the car industry is spared from this drop; even luxury cars are feeling the effect. The dropping revenue must either be reflected in its price or reflected in its expenses. Getting rid of fixed costs would be the first step toward restoring balance to the books. The biggest fixed cost traditionally has always been waged, therefore layoffs would be inevitable. Besides, reduced sales mean reduced workloads and therefore less work in general. It would not be economically sane to pay the price of an economic tool that is not in use.

Already, as of March this year, the economy has recorded over 100,000 job losses worldwide directly linked to the car industry. The car industry also has less money to invest in other areas of the economy, thus the donations, transfer earnings, and research findings would dry up. Another effect of lower sales and revenue is the reduced tax measures that are recorded. The government earns less from this industry, a painful reality especially when you factor in reduced export earnings. There are also capital losses recorded as a result of the dismal performance. The value of stocks and other financial assets and even physical property declines in value. This decline would cause a loss of investments and investment savings. Other industries kept alive by the car industry will be poised to decline e.g. spare part suppliers, raw material for the car manufacture suppliers, and car dealers (William, 2009).

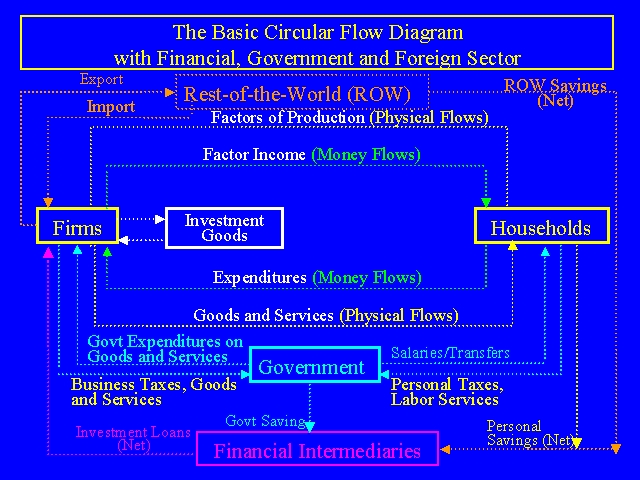

In examining the effect on the economy I will make use of the multiplier concept. This concept is used to measure the effect of a variable on a certain factor. This means that the multiplier states how much a value changes due to a change in one of its variable components. In economics, the variable commonly used is national income. The variables in the economy that affect the output and thus the income of the country are very important. Another tool of analysis we will use is the circular flow diagram. This diagram shows how the income circulates within the economy between the various institutions, usually the household, the firm, and the government, and the inclusion on the foreign sector for open economies. It classifies the incomes that the various institutions interchange and shows how the economic gains and loses income through injections and leakages. Through these two we will examine how the decline of the car industry is set to harm the economy of the UK (Riley, 2006; Shaw).

If you look at the diagram, you will notice that the economy receives a boost through the increase of the export. Therefore, by selling more output toeconomyinto receive more income from outside, the economy gains more income in circulation. The income gained from the export sector undergoes the effect of the multiplier. When the multiplier effect is factored in to the receipt, the economy improves, even more, depending on the multiplier factor. The multiplier makes the effect of the injection more profound. It is dependant on several factors, but the major factor effect is consumption. The amount of money consumed stimulates an increase in the aggregate demand, leading to increased output and thus economic growth. The greater the amount of money consumed, the greater the effect of the multiplier. Therefore, anything that cuts consumption will reduce the effect of the increase. This includes savings and taxes, among others (Riley, 2006; Shaw).

Reflecting on the decreased car sales, this means that there is reduced export. Reduced export results in the reduction of injections. This is not good for any economy. The economy in this case responds negatively. This is caused by a reduction in the income from outside the economy and from a loss in the multiplier effect. The job losses also have a significant effect on the multiplier. With a loss of a job, the circular flow is interrupted. Since the flow of money is interrupted, consumption is also inevitably interrupted. With a reduction in spending due to lack of money, the effect of the multiplier cannot continue to manifest. The multiplier effect depends on how much is consumed and in such situations, there is little or nothing to consume.

There is also another interesting economic phenomenon that occurs with general job loss in the economy. The consumption level reduces not only due to the loss of income but also due to its conservation. Psychologically, people will not be willing to spend in times of job insecurity. They will instead try and save more in case of redundancy. This partly accounts for the decrease in car sales, and more generally consumption in the economy. People will just not feel safe consuming and incurring liability for consumption if they are not sure that they will be able to pay. The effect of increased savings on the multiplier is negative. The growth effect is reduced and in the end, the economy does not experience the growth rates found in periods of relative economic safety (Shaw; William, 2009).

The effect of this on other economic indicators is inevitable due to the inter-related nature of the economy. Inflation and unemployment indicate whether the economy is performing well or the economy is stalling. Inflation is the persistent increase in the price level. It is measured against the prices of a representative sample of goods and services that usually indicate the economic performance of the economy. There is also the unemployment indicator. In general economic definitions, unemployment is the non-utilization of available resources in the economy. When applied to humans, it merely means the under-utilization of human labor that a worker is qualified for, not just the traditional unemployment meaning of no participation in economic activity. Therefore, if a doctor is employed as assistant medical personnel, some form of unemployment occurs. So how has the decline in the car industry contributed to these two indicators (Deepashree, 6, 2006)?

First and foremost, the car industry has contributed to inflation most strangely. Instead of reducing the prices of its products, the companies have resorted to increasing the prices, maybe in a bid to cover costs not covered due to decreased sales. The effect is retrogressive for the economy since the sales decline would continue. A continued drop in sales would lead to a drop in economic growth. Unemployment also works negatively for the industry and the economy as a whole. First, with increased redundancy come increased costs of redundancy. These costs are incurred with no increase or benefit to production. The economy, therefore, pays for no production. A second effect is the idle lying of resources. This is not good for the economy as there is no output from this idle capacity. In some terms, it is expensive as these resources may at times need to be maintained even when there is no production (Deepashree, 6, 2006).

In summary, this industry has contributed to the economic upset experienced by the UK. The effects sometimes may not be easily seen on the surface, such as the costs of maintaining idle capacity. However, the truth is that there need to have in place emergency measures to creatively stimulate the economy to prevent further losses to the economy.

References

Deepashree, Agarwal V & Timothy D. Tregarthen (2006) “Macroeconomics” Tata McGraw-Hill.

National Statistics “Motor Vehicles: Car Production rises in the 3 months to July”, National Statistics, 2009, Web.

Riley G (2006) “The multiplier process”, tutor2u, Web.

Ryan J (2008), “UK inflation hits 11 year high“, Independent: Financial Crisis, Web.

Shaw (n.d.) “Macroeconomics”, Elemental Economics, Web.

Williams O (2009) “The plight of the UK’s motor industry”, BBC News, Web.

Zaheer M (n.d.) “Circular Flow With All The Components”, The Red Carpet Broadcast, Web.