Executive Summary

The report intends to provide a critical evaluation of the Intercontinental Hotel Group PLC’s strategic position and strategic directions. Also, the report will provide recommendations about possible future strategic directions. The report is drawn from the environmental analysis of the Intercontinental Hotel Group PLC. The increased growth of Intercontinental Hotel Group PLC is driven by its strong presence in the global market particularly in the developing economies.

The competitive leading positions as well as the growth of the hospitality industry particularly in the emerging economies have also contributed to the growth of the firm. The industry is increasingly becoming competitive with the entry of new firms. However, the firm is using its distinctive and threshold capabilities to increase its competitive advantage. In evaluating the strategic position of the firm, environmental analysis using various tools including SWOT and PESTLE are applied. The strategic directions are analyzed through the application of the Ansoff matrix and the BCG matrix.

Introduction

InterContinental Hotel Group PLC (IHG) is one of the largest hotel chains in the world. The firm operates hotel chains in over one hundred countries across the globe. In terms of geographical spread, North and Latin America comprise the largest segment accounting for the largest total revenue within the forecast period.

In terms of bed capacity, value, and market share, InterContinental Hotel Group is the largest in the world followed by Marriott International and Hilton Hotels. The Company operates hotel chains in different brand names ranging from InterContinental to Hotel Indigo. Also, the hotel chains are operated in different business models including franchising, management, and fully owned or leased subsidiaries.

Strategic Position

External Analysis

The PESTEL Framework

The PESTEL framework is critical in the understanding of the external environment and strategic decisions. First, the recent declines in economic situations on the operations of the firm. The economic declines suppress disposable income considerably resulting in few business transactions.

Moreover, the travel and tourism industry, which InterContinental Hotel Group PLC largely depends on, becomes adversely affected. The core business strategies of InterContinental Hotel Group PLC including supportive implementation of strategic initiatives, increased membership value, enhanced global membership support, and creating first-class relationships are geared towards increasing the firm’s presence amid depressed economic situations.

The integration of information technology in core business processes has put the firm in a strategic position. To achieve its objectives in a way that is effective and efficient, InterContinental Hotel Group PLC has to integrate technology into its sales, purchases, marketing, management, and operations.

PESTEL Analysis

Porter’s Five Forces

According to the framework, there is increased competitive rivalry in the industry. Numerous competitors reduced customer loyalty, and high cost of living exacerbate the increased competitive rivalry. However, the firm utilizes its strategic position in the market as well as other competencies to outperform its competitors. Besides, financial and managerial capabilities as well as increased infrastructural development have placed the firm in a better position amid increased cost of entry into the industry. Also, the capabilities have placed the firm in a strategic position to counter increased barriers to entry.

Porter Five Forces

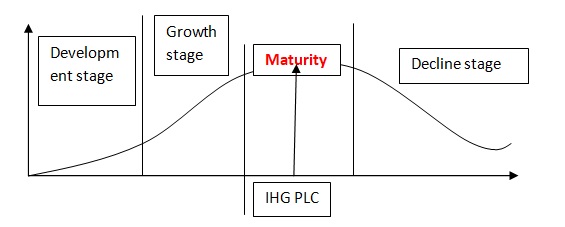

Industry Life Cycle

InterContinental Hotel Group PLC is in its maturity stage. The technological advancement, customer relations management, inventions that support the development of customer relations, and provide environmental solutions as well as the support of community development have placed InterContinental Hotel Group PLC in a strategic position in the global market. Moreover, the pursuit of a sustainable strategy is critical for the future growth and development of the firm.

Internal Environment Analysis

Strategic Capabilities

The threshold capabilities of the firm include a strong financial base that enables increased competitive advantage. The distinctive capabilities include technical skills, highly professional, and a skilled workforce.

Strategic Capabilities

VRIN Analysis

The VRIN model is used to analyze the competitiveness of the firm using its distinctive and threshold capabilities. According to the analysis, both the firm’s distinctive and threshold capabilities have increased the firm’s competitiveness. The temporary competitive advantages and the competitive disadvantages of the firm are very rare. However, the sustainable competitive advantage, competitive parity, and sustainable competitive offers are highly valuable.

VRIN Analysis: Impacts on Intercontinental Hotel Group Performance.

Value Chain Analysis

The value chain for InterContinental Hotel Group. Though the value chain is similar to those of competitors, the InterContinental Hotel Group value chain is unique due to the application of its distinctive capabilities.

Value Chain Analysis

SWOT Analysis

InterContinental Hotel Group SWOT analysis can be developed. The fact that InterContinental Hotel Group holds the largest hotel chains in terms of value enables it to benefit from the leading competitive positioning. Furthermore, the firm has a strong presence in both developed and emerging economies (Kotler & Keller, 2012).

However, various factors contribute to the firm’s decreased competitiveness including the emphasis on middle and upscale luxury hotel and resort brands. Also, the single market focus on high-end travellers reduces the firm’s competitive edge. Conversely, the firm can utilize its financial capabilities to exploit new developments in the emerging markets given its size and brand positioning (Reid & Bojanic, 2009).

SWOT Analysis

Strategic Direction

Boston Consulting Group (BCG) Analysis

The BCG is an invaluable framework utilized in the appraisal of InterContinental Hotel Group PLC’s trademarks portfolio strategic position (Hansen & Birkinshaw, 2007). Further, the tool is important in comprehending the investment decisions that InterContinental Hotel Group PLC should undertake.

InterContinental Hotel Group PLC BCG MATRIX

Relative market share

High low

Stars

The stars entail the products and services that do better than the rivals in the market operations do (Shanahan, 2002). In InterContinental Hotel Group PLC, online services and operations are classified under stars since they provide greater prospects for increasing the firm’s proceeds. Therefore, the firm should increase investments and development of online services provision. Over 40% increase was realized in online vending in 2011. Therefore, online services provisions are invaluable in the lasting achievement of InterContinental Hotel Group PLC. In other words, the InterContinental Hotel Group PLC remains a star in the provision of services particularly in the application of information technology

Cash Cows

The sources of income represent the services that enable the InterContinental Hotel Group PLC to attain a leadership position in the market. InterContinental Hotel Group PLC continues to provide services through expansion strategies in countries in which the firm is not operating. Moreover, the firm continues to offer differentiated services that go beyond the customers’ satisfaction. However, the services bear minimal growth prospects in the future. The over 100 hotel chains spread across the globe to continue to provide a constant flow of services to the clients, which in turn enables the firm to get returns that can be ventured in Stars.

Question Marks

The services of InterContinental Hotel Group PLC with a low proportion of the market but have high prospects for growth in the market is accounted for by the Question marks (Langabeer, 2000). Privately labelled hotel brands have the potential of capturing the market share through the provision of innovative services that would make the InterContinental Hotel Group PLC brands attractive to the consumers.

Dogs

Dogs refer to the services of InterContinental Hotel Group PLC with a low proportion of the market and are not attractive as well as have low growth prospects (Porter, 2000). InterContinental Hotel Group PLC hotels in competitive countries fall under the Dogs category. In essence, the company should not invest further in countries considered highly competitive.

The Ansoff Matrix

Products and Services

InterContinental Hotel Group PLC Ansoff matrix

The InterContinental Hotel Group PLC’s recent expansion strategy into new markets such as China and India increases the firm’s capabilities in the provision of services to esteemed clients. The expansions into new markets increase the firm’s strategic capabilities and market share. Moreover, it means that the firm has increased economies of scale that are critical for its operations as well as market penetrations (Yu, 2012). However, increased competition in the new markets reduces the growth of the market share. Also, the gains the firm will make in the new markets will be at the expense of close competitors particularly newly created hotel chains from these countries.

Besides, the firm constantly creates new services depending on the demand and the needs of clients. The ever-changing customer needs to drive the services and product development of the firm. Moreover, the application of information technology has enabled the firm to has additional value on its products and services. The firms’ capabilities to develop new products as well as the application of information technology have added a competitive advantage to the firm.

The firm’s capability to increase its presence in diversified markets has also increased its competitive advantage. The diversifications of the market are in terms of both geographical and demographic segmentations. The InterContinental Hotel Group PLC hotels and resorts are spread in diverse countries and cultures. Besides, the firm target diversified customers ranging from low-income earners to high-end market segments.

Critical Evaluation of the Strategy

Suitability

About the analysis, product development is the most suitable strategy given the fact that it meets all the requirements observed in the environmental analysis. However, diversification is not suitable given the current economic situation, particularly in countries the firm intends to establish new hotels

Acceptability

The firm’s marketing and expansion strategies should enable its penetration into new markets and capture a sizeable market share. Moreover, the corporate core strategies should enable the firm to be easily accepted in areas it intends to operate particularly in developing countries. Also, the firm should utilize its financial capabilities to offer services to the communities in which it operates.

Feasibility

All the strategies of the firm are financially feasible given its financial capabilities. Moreover, the firm has recorded substantial returns in some of its geographical sectors thus increasing the financial abilities to fund the implementation of its strategies.

Sustainability

The firm should be socially sustainable towards the communities as well as governments. Besides, the firm’s strategies are environmentally sustainable (Johnson et al., 2011). Moreover, the strategies are market-oriented and socially sustainable to the clients.

Recommendations and Conclusion

Recommendations

The firm should focus on the implementation of the current strategies considering other factors such as the economic situation as well as other threats the firm is facing. Moreover, the firm should continue to pursue its expansionist strategies that are essential for its increased presence in the market.

However, given the InterContinental Hotel Group PLC’s current strategic position in the global tourism market and hospitality industry, the firm needs to enhance its brand performance to counter the threat posed by the upcoming economy hotel chains. In other words, the firm should ensure that its brand remains attractive and sustain market position leadership against competitors. Also, the firm should aim for excellent returns through increased operations efficiency and revenue delivery.

Moreover, the firm should continue to increase and utilize its threshold and distinctive capabilities to increase its competitive advantage. The firm should also be aggressive to ensure the realization of excellent returns, which are critical in augmenting its financial capabilities enabling the firm to operate efficiently and effectively.

Conclusion

InterContinental Hotel Group PLC has been successful in most of its operations. Also, the firm has continued to offer varied services through its hotel chains spread across the globe. The accomplishments of the firm have been attributed to the successful implementation of its core business and operations strategies. However, many factors influence the firm’s strategic operations. Overall, not only internal factors but also external environmental issues affect InterContinental Hotel Group PLC’s management and operations. Despite external environmental challenges, the firm has managed to sustain its competitiveness. However, the firm needs to ensure that its core strategies are implemented and core competencies are fully utilized to enhance its competitiveness in the market.

References

Hansen, T M & Birkinshaw, J 2007, The innovation value chain,” Harvard Business Review, vol.16 no.4, pp.121-130.

Johnson, G, Whittington, R & Scholes, K 2011, Exploring Strategy, Prentice-Hall, Upper Saddle River, NJ.

Kotler, P & Keller, KL 2012, Marketing Management, Prentice-Hall, Upper Saddle River, NJ.

Langabeer, JR 2000, “Aligning demand management with business strategy,” Supply Chain Management Review, vol.4 no.2, pp.10-22.

Porter, M 2000, “Location, competition, and economic development: local clusters in a global economy,” Economic Development Quarterly, vol.14 no.1, pp.15–35.

Reid, R & Bojanic, D 2009, Hospitality marketing management, John Wiley and Sons, Hoboken, NJ.

Shanahan, YP 2002, “A contingent examination of strategy-cost system alignment: customer retention and customer profitability analysis,” Managerial Auditing Journal, vol.13 no.7, pp.411 –18.

Yu, W 2012, “Business environment, employee competencies, and operations strategy: an empirical study of the hospitality industry,” Journal of Management and Mathematics, vol.6 no.1, pp.321-327.