- Executive summary

- Introduction and company background

- The strategic planning and the processes of accor group

- The financial strategy of accor

- The global market positioning of accor

- Accor’s strategic investment patterns across asia pacific and middle east

- The new category focus on sustainable tourism and development

- Conclusion

- References

- Appendix

Executive summary

Accor is a market leader in the hotel, hospitality and tourism industries, at Europe and internationally. The company’s operations are spread across more than 100 countries, and the company employs a labor force of 150,000 employees. The company has 15 complementary brands, including Sofitel and MGallery among others.

The strategic programs and processes of the company that have worked effectively include its efforts to become the market leader in Europe. The company has also employed the strategy of investing in emerging markets, which has worked well in different markets including Asia Pacific and the Middle East. The financial strategy of the company has been effectively deployed. The strategy entailed the asset-light approach, shifting investment towards budget and mid-scale service provision and targeting high potential markets.

The company has employed a strategy of cultivating its major areas of strengths, including its wide brand portfolio, the pipeline development model, and its relatively high market presence. The global market positioning of the company was another effective strategy. This led to an increase in the company’s presence at different markets.

Accor has employed a strategy of selective investing in emerging markets, placing focus on high potential markets in the Middle East and Asia Pacific. The strategy has worked effectively for the company, indicating the need for further expansion. These markets include India, China, and Indonesia. Accor has also benefited from the strategy of investing in environmentally-friendly operation models at its hotels, which has worked during a pilot testing program in 10 hotels. The program is expected to increase market presence.

Introduction and company background

Accor is a the leading hotel company in Europe and is claimed to be the third-largest hotel services company. For over forty years, the company has reinvented its major areas of competency, towards keeping pace with the competition (Ramboll management, 2002). With the company’s established brands, it emphasizes on the development of interpersonal relations and unique ways of service delivery to their customers.

The company operates in about 100 countries and employs labor force of 150,000 (Accor, 2010a). The company operates about 15 complementary brands, ranging from budget to luxury centers, which are famed for their delivery of high quality services and products, across the globe.

The group offers services to business and leisure travelers (Accor, 2010a). The Groups’ major brands include Pullman, Sofitel, Novotel, MGallery, Suitehotel, Mercure, All Seasons, Ibis, Formulae 1, Etap Hotel, Motel 6 and HotelF1 (Ramboll management, 2002). As of June 2010, the Group had more than 4100 hotels across the 100 countries covered, and a room capacity of more than 500,000 rooms.

The strategic planning and the processes of accor group

The company’s aspirations to become a market leader in Europe

The demerger of the company’s voucher service business in 2010 was among the strategic actions that opened the way for the company to concentrate on its hospitality sector. Through the demerger, the company shifted its attention to cash flow generation and deleveraging. The demerger was strategically planned, so it could pave the way for the company’s involvement in asset development and consolidating its corporate leadership.

By the end of the year 2009, the company had 814 hotels under its ownership structure (Higgins, 2010). However, during its deleveraging phase of between 2010 and 2013, the company strategized on disposing 450 of the hotels under its control, for cash returns of $ 1.97 billion, at an attuned debt impact of $ 2.5 million.

By April of 2010, the company had already realized above half of the target amount of the 2010 program, at $ 552.6 million. According to Olivier Poirot, the CEO of Accor NA, the Company anticipated that, by the year 2011-2012, it will have cleared its debts. The company will still have many properties in its portfolio (Higgins, 2010).

Through the strategy, the company expected to invest approximately $ 245.6 million towards the development of between 35,000 and 40,000 new rooms-openings annually. For instance, the strategy streamlines on Ibid and Etap brands, which will form the core of expansion in Europe. In line with the strategic projections, the company anticipates having 20 percent of its holdings of fixed-leased or owned properties.

The remainder will fall under management, franchising, and variable lease plans (Higgins, 2010). About 58 percent of the company’s guestrooms should fall under budget and the economy classes. The company expects to control 700,000 rooms globally; 48% of the room portfolio being in Europe, 20% in the Asia/Pacific market and 19% of the North American territory (Higgins, 2010).

Accor’s interest in emerging markets

This strategic market positioning was started through the aggressive development by investing in China, Brazil, UK and India, throughout 2010. Accor has successfully developed characteristic brands, all of which are differentiated from one another, and from a competitor’s brand.

Through the strategy, the company has increased its presence internationally (Viladon, 2013). In ensuring that the strategic improvement of its market presence is realized, the company has developed a department dedicated towards increasing the visibility of the company’s brands, and making the brands easily noticeable. Accor does that through the strengthening of customer loyalty programs. It also enhances the knowledge of customers about their services (Viladon, 2013).

The expansion into emerging markets has entailed increasing the company’s budget and mid-range accommodation, which offers the company a platform, from which to present more options for customers (Hill and Jones, 2010). The strategy is aimed to serve leisure tourists from the different markets and focal destinations, changing their market positioning from a company dominated by 5-star services, to a wider market player, serving mid-range customer groups (Viladon, 2013).

In the emerging markets, Accor is increasing its presence, focusing on high potential markets, including China, Brazil and India. According to the strategic projections of the company, as of 2015, it anticipates enhanced coverage of its market network (Accor, 2011). The company plans to engage in selective investing, where the focus is channeled towards high-margin projects. These projects cover the prime locations of the market, particularly at the European segment of the emerging markets.

The strategy of the company entails expanding business in the development of franchising deals (Accor, 2011). In pursuit of the 2015 strategic goals, the company plans to embrace external growth opportunities through entering into strategic acquisitions and partnerships.

The strategic expansion modules are expected to strengthen the company’s leadership in the target markets, particularly at attractive, emerging markets (Hill and Jones, 2010). The focus of this strategy is channeling a larger part of the company’s business into the asset-light structure of the business (Accor, 2011).

Towards the pursuit of the strategy, Accor exceeded the set target for openings in 2011. It increased its room offering by 37,800 bedrooms (Accor, 2011). The company planned to acquire 40,000 bedrooms annually, for the years 2012 and 2013. The larger aspect of increasing the company’s room holding will be done through expanding their franchises and management contracts (Accor, 2011).

Table 1: Accor Group’s Brand Portfolio in 2010.

Source: (Viladon, 2013)

The financial strategy of accor

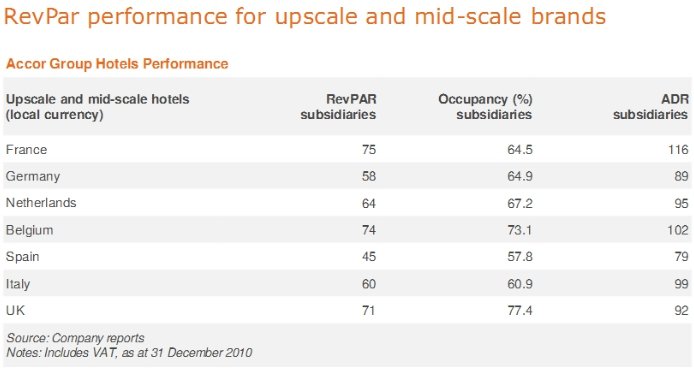

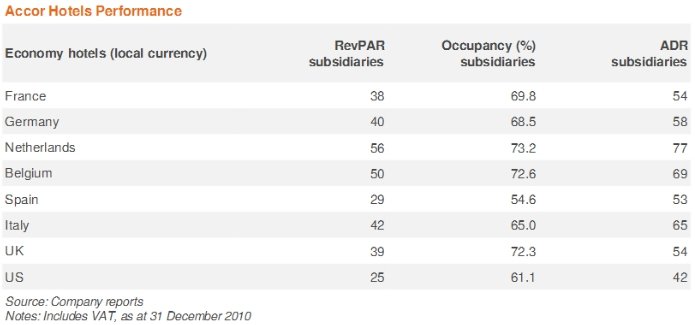

The financial returns for the year ended 31 December in 2010 depicted that the company was improving financially. The hotel revenues stood at EUR 5,693 million, which marked a 10 percent increase from the same financial period for the previous year (Accor, 2010a). The strategic changes that caused the 10 percent increment included the expansion of development programs, which increased the company’s revenues by EUR 75 million, the focus on mid-priced and budget customer-bases, and the company’s focus on the asset-light outlook.

The asset-light outlook reduced the company’s corporate debt significantly (Accor, 2010a). The mid-scale and upscale segments were among the major performers of the company, leading to financial progress in the European territory, particularly in Germany, France, and the UK. The three markets saw increases in occupancy rates, leading to an increase in the standard room rates (Accor, 2010a).

The French market was characterized by a principally strong performance, which resulted from an increase in the flow of inbound tourism, and business-related tours in the country (Accor, 2010a). Hotel sales were also expected to increase, at a level of more than 3.6 percent between the years 2010 and 2015.

The financial strategy of Accor, also benefited from the cost-saving model introduced in 2009, as well as the continued increase in the economy class hotels in markets outside the US, which added to the operational financial results (Accor, 2010a).

Table 2: Accor Group’s key financial Indicators for year 2009/2010.

Source: (Accor, 2010a) Revenue consolidated and restated, accounting for disposals and demerger.

The Strategic Strengths cultivated by Accor

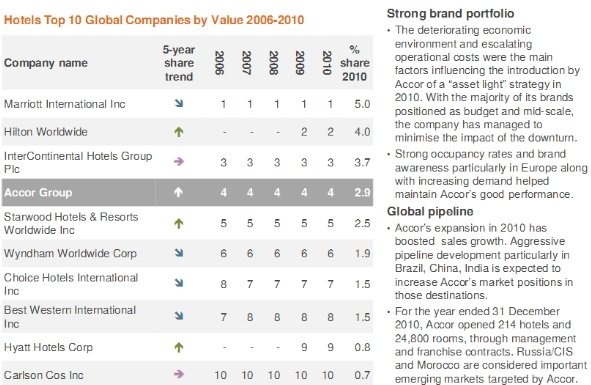

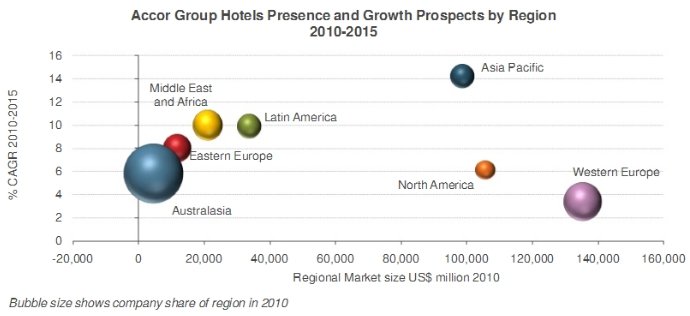

The company presents a wide brand portfolio, operating in varied market segments. This strategy offers the company a competitive advantage. Thus, it can attract a wider customer-base, and expand its product and services offering. The company uses the pipeline development model, which focuses on the available growth opportunities in the Middle East and Asia Pacific (Accor, 2010a). This has contributed to the company’s high-profile market presence and service offering in the emerging markets.

Through its strategy of expanding market presence in emerging markets, the company has realized 70 recent development contracts, at the Asia Pacific in 2010 (Accor, 2010b). The new developments added to the initial hotel rooms holding by 16,000 rooms, in the company’s offering portfolio. The company has the potential to expand its growth in these markets, particularly in Asia-Pacific. This is due to its increased market presence in these emerging markets (Higgins, 2010).

The global market positioning of accor

The company maintained a strong brand portfolio, despite the deteriorating economic conditions experienced during the crisis and conditions of increasing operational costs. The strategy was realized through the market positioning of many of the company’s brands as mid-scale and budget (Accor, 2010b).

Through the market conditions-guided approach, the company was able to minimize the effect of the downturn on its market performance. The high performance of the company was also fostered by the company’s brand awareness and the strong occupancy rates, especially in the European market. The increasing market demand helped maintain the performance of the company, regardless of the wavering market conditions (See Appendix 3: Accor’s Global ranking).

Regionally, the company focused on Western Europe, throughout 2010. Western Europe is the market from which it sources a larger component of its hotel services revenues. However, the company expanded into the Latin America and Asia Pacific, where it anticipates drawing major value growth.

As a result, the company kept increasing its hotel coverage in these target market regions (Accor, 2013). The company took advantage of the increasing consumer spending at some of the emerging markets, particularly Latin America.

The target population for this market was the emerging middle class in countries like Brazil, whose economy proved resilient to the impacts of the global recession. The company anticipates the benefits it expects to gain from the high financial flexibility of the market, as well as the improvements of commodity pricing, which left tourism and travel industries unaffected.

Accor’s strategic investment patterns across asia pacific and middle east

The company is investing its resources in emerging markets in a selective manner, based on a strategy aimed at committing resources in areas that present the best opportunity for revenue generation. The target markets in the Asia Pacific include India, China, and other Asia Pacific markets, including Padang, Kuta, and Bangka. The company plans to invest in the Middle East after it identified the region as an emerging market with a high potential for expansion (Accor, 2013).

China

Towards taking advantage of the Indian and Chinese markets, Accor entered into 25 new contracts in the mid-scale and luxury segments of the market in 2010. The company entered into these new deals through a few of its brands, including Mercure, Novotel, Sofitel, and Pullman (Accor, 2013).

The new company outlets are based at the following locations: Zhuhai, Guiyang, Huizhou, and Changsha. The new deals increased the company’s presence in the country, where it had 100 hotels and about 26,500 rooms spread across the 42 cities. The market portfolio of the company comprises of 15 upscale, 23 luxury, 44 economy hotels and 18 mid-scale hotels (Accor, 2013).

India

In India, the company projected investing $ 130 million, which were expected to cover 50 hotels, by the end of 2012. In India, the company is using three of its major brands, including Ibis, Novotel and Mercure. During early 2010, the company communicated its plans to develop 90 hotels in India, between the years 2010 and 2015 (Accor, 2013). As of Dec 2010, the company had entered into contracts, for the construction of the 90 hotels.

The company planned to introduce more of its established brands in the Indian market, including Pullman, Softel and Formulae 1, during the financial year 2011-2012. The strategy paid off in India as the market was barely affected by the economic crisis. The impacts of the crisis were not felt by the Indian economy. In this case, the large, dynamic economy characterized by a high number of middle class consumers presents a major opportunity for business development (Accor, 2013).

Other Asia Pacific areas

The Accor company strategized on the opening of eight new hotels in Indonesia, by the end of 2012. The locations for the new hotels include, Padang, Manado, Surabatya, Kuta, Balikpapan, Jakarta, Denpasar, and Bangka (Accor, 2013).

The strategic expansion in the region was expected to increase the value share of the company, as well as to outweigh the business of the competition in the hospitality industry. The company strategized on expanding its coverage, by opening 12 other hotels in Vietnam, which will increase its room holding by 2000 rooms during the year 2013 (Accor, 2013).

Middle East

The company strategized on capturing the potential of the emerging market, through starting five Ibis hotels in the region. The company expects to reach 54 hotels, and coverage of more than 12,497 rooms by the end of 2014. As of 2011, the company had nine hotels opened in the region.

During 2012, the company had strategized on expansion by opening four hotels. Among the hotels, 2 were located in Bahrain, 2 in Saudi Arabia, 2 and 3 in Syria, which were to create about 1,500 jobs (Accor, 2010b). Further expansion was to be done through franchising locally, at locations like Damman, Jeddah, and Makkah. In Saudi Arabia, the company has strategized on the opening of nine hotels, with a longer-term plan to increase the number by 15 property investments, within 5 years (Accor, 2013).

The new category focus on sustainable tourism and development

The company has identified that, in a world with an increasing demand for authentic business experiences and greener means, new opportunities for expansion will be created. This will increase the sustainability of its eco-tourism and development (Accor, 2010b, p. 60-63).

Among the strategic positioning programs that have worked for the company include the Green Key eco-rating project. After pilot-testing the program, the Green Key Eco-rating model will be spread across the company’s studio 6 properties and Motel 6 centers. The program on green performance inspects the resorts and hotels, certifying them on the basis of carrying out their everyday operations in ways that depict commitment to sustainable practices (Accor, 2010ba, p. 63-65).

The areas checked before the hotels are certified include levels of operational costs, mainly in the areas of water, waste levels and energy consumption. Through the green operations platform project, the company will enhance its competitive advantage. In this case, it will earn the support and the strategic endorsement of green-operating players internationally (Accor, 2010b; Kaplan and Norton, 1996).

Conclusion

Accor is a leading hotel company in Europe, and a major industry player globally. The company has been in operation for more than forty years, employing strategic processes in its major areas of competency towards meeting the challenge of competition. The company employs its strategies towards the improvement of the quality of its services, positioning its products and services and maintaining an environment-friendly performance.

The strategies that work for Accor Company include positioning itself as a market leader within the European market, which entailed the demerger with Voucher Services to focus on the provision of hospitality and tourism services. The second effective strategic model was the company’s focus on emerging markets, and focusing its deployment on the provision of mid-scale and budget services.

The financial strategy of the company has been a highly successful one as it has increased the company’s revenues. The strategy entails expanding the company’s provision of budget and mid-scale services, adopting the asset-light approach and the expansion of development programs. The cultivation of strategic strengths has worked effectively for the company, which touched on different areas including increasing the company’s presence in the Middle East and Asia Pacific.

The global positioning of the company is another strategy that has worked effectively. It has focused on highly potent markets including Asia Pacific and the Middle East. Accor’s strategic development has focused on investing in sustainable development and tourism, where the company is streamlining its operations to eco-friendly standards, which will improve its competitive edge in the short and the long term.

References

Accor. (2010a). Accor: 2010 Annual Report. Web.

Accor. (2010b). Investor day 2010: Paris. Accor Group, 4-35. Web.

Accor. (2011). Accor: 2010 Annual Report: New frontiers in Hospitality. Web.

Accor. (2013). Accor’s strategic vision. Web.

Higgins, S. (2010). Accor demerger paves way for new strategy. Hotel News Now. Web.

Hill, C., & Jones, G. (2010). Strategic management: An integrated approach. Boston: Houghton-Mifflin.

Kaplan R., & Norton, D. (1996). The balance scorecard: translating strategy into Action. New York: Harvard Business School Press.

Ramboll management. (2002). Case Study: Accor Hotels, The European e-Business Watch, 1 (2), 2-3.

Viladon, D. (2013). Accor moves towards emerging markets and away from owning hotels. Web.

Appendix

The size of bubble shows the share of the market held by the Accor, during 2010.