Introduction

Politics and economics have become interlinked in the recent times to an extent that It has become difficult to identify which between them has more weight especially when put in the perspectives of international trade and relations. How countries interact and inter-relate has ability to influence the trade patterns, decisions and prospect both in domestic and international arena.

One international aspect that has characterized nation’s bilateral trade relations has to do with military arms. Key suppliers of military arms especially from developed nations to developing nations have established trade relations based on military arms in that, all economic aspects and principles are fully in operation and any form of destabilization has the capability of affecting both the domestic and international trade of the involved countries.

However, how does the effect of either stability or instability of international arms trade between different countries able to affect the domestic market environment in terms of exchange rates, interest rates, trading volume or composition, exports, imports, travel, government revenue, or impacts on specific industries.

At the same time, what is evident is that some countries specifically the chief suppliers have consistently participated in providing assistance to efforts by domestic exporters of arms especially with regard to increasing competition in the international arms market.

Therefore, this paper will investigate, analyze, and recommend on the recent threats of China to institute trade embargos on American exports to the country because of America selling military arms to Taiwan. The essence will be to find out how such trade embargos can affect the domestic market, arms industry and even trade volume of the country into China’s market.

Political-economic relation of international arms trade

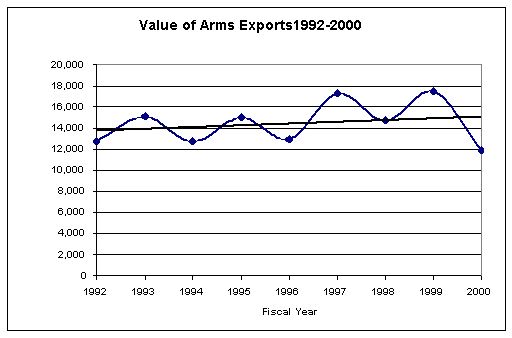

International trade of arms increased especially after the Second World War and reached climax in 1982. During the Cold war, numerous efforts by nations saw arms trade go up but the opposite of this was to be experienced in post-Cold War era as decline in arms trade was great. Arms trade decline ebbed in 2002 but starting from 2005-2009, the world again experienced one of the biggest arms trade between the major suppliers and their consumers chiefly in developing countries.

International arms trade continues to be dominated by five chief suppliers, who again happen to be the permanent members of Security Council. They include USA, the former Soviet Union, France, United Kingdom, and the Federal Republic of Germany.

Today, USA has become the major and leading arms supplier in the world where its trade accounts for almost 30 per cent of all arms trade in the world, followed by Russia at 23 per cent, Germany 11 per cent, France 8 per cent and United Kingdom at 4 per cent which when totaled comes to 76per cent of all world’s arms trade.

Developing a political-economic model of USA bilateral trade, Rebecca in 1989 noted that there exists an interrelationship between politics and economics and that numerous factors exist, which affect the bilateral trade flows between countries.

According to the author, the profound interrelationship between politics and economics was widely evident in international relations where it was clear that some countries adopt certain and specific international strategic and diplomatic interest which in turn had the capacity to affect their international economic policy. For instance, when a country initiates certain sanctions, this aspect of international politics has the ability to affect international trade policy.

In accordance to this, one question postulated by Frey in 1984 continue to perplex if not to guide the international economists, the author noted then that, “are international political considerations transient and random in nature whereby they are able to affect international economics and can they be ignored when compared to long-run market factors?”.

USA as the biggest world’s arms supplier

By the year 2009, USA total arms trade was estimated to be $166.278 for both the developing and industrialized markets and when compared with other key suppliers, USA was seen to account for almost 40per cent. The developing countries remain to be one of the best arms market for USA and even with the pangs of recession countries such as China, Saudi Arabia, Middle East and India have remained as the biggest consumers of arms from USA.

In terms of arms that are sold by USA to its partners, different items are transacted such as “tanks and self-propelled guns, artillery, armored personnel carriers and armored cars, major surface combatants, minor surface combatants, submarines, guided missile patrol boats, supersonic combat aircraft, subsonic combat aircraft, other aircraft, helicopters, surface-to-surface missiles, and anti-ship missiles”.

When analysis of trade reports from arms is made, it becomes clear that the five chief suppliers of arms accrue more income from the arms sales to developing or third world countries than they are able to give in aid.

For a long time, the arms industry unlike other convectional industries has operated without regulation making a lucrative business for the chief suppliers. Since the domestic market has less demand for the manufactured arms there are always constant efforts of searching for new markets elsewhere as more arms corporations and contractors become more involved in order to stay relevant in the industry.

Further, these arms corporation are always involved in seeking government subsidies in order to make their trade more profitable. Such a case can be cited from USA and other European corporations, which in the recent past have been awarded enormous tax breaks by their respective countries, and of interest is the fact that they even lend money to developing countries in order for the countries to purchase arms from them hence leading to subsidies of arms sales.

According to Holtom and Bromley, USA since 2001 has accelerated its foreign military aid specifically to its allies in regions perceived to be of great tension and conflict. And as a gesture to continue with Bush’s administration policy on international arms trade, Obama’s administration has in the recent time increased its foreign military financing to its key Middle East ally, Israel which has been estimated to reach $3 billion by the year 2012.

The role of arms trade in mainstream economy

Nations that have been involved in arms trade cite different reasons for their activities. Although many have cited increasing security instability as the motive issue, what is evident is that most of these trades are being motivated by economic factors. For instance, supplier countries have continued to experience economic growth as a result of arms trade.

Sale of arms generates revenue and in some instances offset the cost of imports to rectify the trade imbalances being experienced of a particular country. Furthermore, arms trade involves private investors who largely are motivated by profit both in national and international business deals. Sale of arms to foreign markets has also been motivated by the fact that such sales are able to support producers especially when their domestic market reduces.

More so, the sale of arms involves employees normally located and based at the prime defense contractors together with laborers at second and third-tier contractors who assume the role of supplying the major contractors with vital sub-components. Especially in USA, elected representatives from some of the communities that benefit from arms sales and transacting activities have been at forefront in supporting and pushing for foreign arms sales in order for their constituencies or regions to continue benefiting.

In terms of providing connectivity, international arms trade has promoted this kind of relationship between the seller and buyer providing a chance for inter-operability that benefits other businesses between the two countries. Lastly, international arms trade makes it possible for production lines to remain open and operating even in circumstances of decline in domestic market.

USA historical economic role of international arms trade

USA as its history has maintained and pursued its security assistance program that has been critical in promoting USA’s foreign policy and national security interests. During the Cold War, USA arms industry realized tremendous growth as anticipation of potential war loomed.

However, with the end of Cold War USA military experienced a major downsizing until 1991 when Gulf War presented another opportunity for the military arms industry to flourish. Again, history was to repeat itself after the conclusion of Gulf War with subsequent downsizing taking place, this round at an alarming rate of 25 per cent rate.

The reduction also caused ripples among the defense contractors and other government officials as contractors profits reduced due to fallen government procurements. Faced with no reduced procurements from the government and little investment in the industry, military arms investors were faced with only two options: to seek new markets or close down their facilities. The later case proved to be a lethal decision to security of the country especially in long-term due to its associative negative impacts.

Therefore, a succinct question asked is, how has the USA economy been linked to arms trade especially in foreign countries? Christopher Akins notes that in the absence of defense exports, the USA leadership in the international aerospace industry would be seriously compromised. The author observes the importance of the aerospace exports to USA economy which he ascertain that during 1997 it accounted for almost $50 billion and which in turn contributed to reduction of USA trade deficit by 18 per cent.

Accordingly, if the aerospace exports were absent, then the country would have realized a deficit accumulation of about $214 billion in the year 1997. Hence, according to the author, UISA cannot afford or accept foreign competition to usurp its leading role in the aerospace industry since aerospace companies offered competitive edge in the global industry for USA.

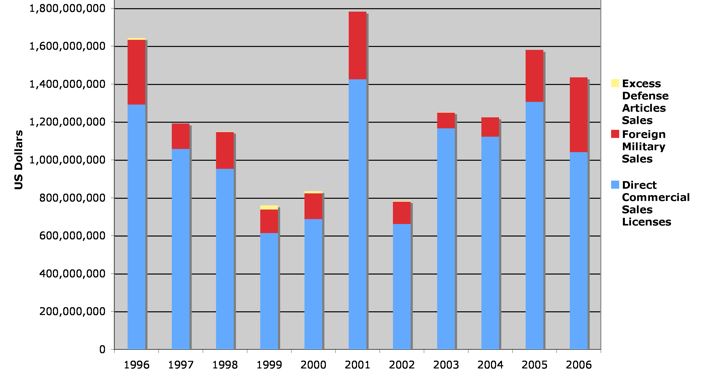

During the 1996, RAND National Defense Research Institute carried out a research, which indicated that foreign military sales (FMS) created 300,000 jobs in the whole of USA, and 67 per cent of these jobs were as a result of direct involvement in international arms trade while 37 per cent accounted for indirect jobs.

Although the layoffs in such industry would pose insignificant effect to the overall national economy, the evidence and facts are that such layoffs would have significant impact on the local economy that heavily depends on defense industry.

The consequences of closing down critical defense production lines, research has sworn that it adversely affects the local economy in many ways. For instances studies shows that layoffs generally remain unemployed for a relative longer period as compared to workers in other production lines.

Such high unemployment rates in turn results into stagnation of the local economy. Further, when a major defense production line shuts down, multiplier effect comes into force, as dependent industries become affected. When workers are laid off, they reduce their consumption of goods and services or relocate to other areas thereby affecting industries within the area of the closed military line.

Current event involving international arms trade: USA sale of arms to Taiwan angers China prompting it to ‘threatens’ trade sanctions against USA firms.

On 30 January 2010, USA and China engaged in one fierce politico-economy quarry after USA made it reality its earlier intention to sell arms to Taiwan. Writing about the relationship between the two countries, Emmanuel, observed that, ”USA and China squabbles are legion: unbalanced trade; the renminbi’s value; the internet; human rights; Tibet; freedom of speech; the environment; global warming; and coddling of despotic regimes”.

China has regarded its relation with Taiwan an ‘internal issue’ that does not need external involvement. Therefore when the news came in about USA sale of arms to Taiwan China immediately announced that it would henceforth postpone and suspend the current bilateral military programs and even security talks with USA.

As to further detail, its punishment measures China also indicated that it would punish ‘certain’ USA companies as a direct response to the actions by the American government to sell sophisticated and advanced weapons to Taiwan. The punishment for the USA industries was to involve imposition of sanctions on the identified companies as a result of, “incurred severe damage to USA-China Relations”.

China went ahead to claim that USA’s decision, “constitutes a gross intervention into China’s internal affairs, seriously endangers China’s national security and also harms China’s peaceful reunifications efforts”. China noted that USA was still ambitious to promote and implement Bush’s policy of arms sales to Taiwan while at the same time fostering trade protectionism measures against China.

One company to suffer the China’s wrath and furry was Boeing which alongside United Technologies, Lockheed Martin together with Martin was identified to have participated in the sale of military weapons to Taiwan. The company is an aerospace company that operates from its base in Chicago and as a result of China threats of trade sanctions; it became inevitable that Boeing would incur massive loss. Boeing continues to be the major exporter into China’s market supplying almost half of the airline system equipment in China.

Analysis: what likely impacts can result from China’s threat?

Professor Wu Xinbo was one scholar who captures the UA-China political-cum-economic melee when he observed that this time round China could live up to its threat since it was the government issuing the statement.

First, Xinbo observed that Boeing Company apart from selling weapons to Taiwan had massive commercial interests in the China’s market which if sabotaged would have adverse effects both to the company and to the government of China. By sanctioning the company, China would be risking its efforts to recover from the pangs of global recession and that it would be putting its ten of thousands citizens employed by Boeing at economic risk.

Since most Chinese market have discriminated USA companies from operating in the domestic market, may be Boeing with success story in China’s market could act as a politico—economy retaliatory ground for China to ‘punish’ USA, but again China would have to weigh the impacts of such actions on its overall economy.

Analyzing the same sale of weapons to Taiwan, Canrong and Chunling, observe that USA apart from pursuing its foreign policy and spicing up its regular frost relationship with Beijing, USA would seem to have been motivated by economic reasons the pact brought. The author notes that, “the larger order provided by Taiwan is attractive to the United States in the context of the global financial crisis”.

However, even with this argument the author is at the same time able to dispute such motivation claiming that compared to China, Taiwan constitute a negligent market, which cannot arouse any international desire by a country such as USA.

The effect of decline of USA foreign military sales on domestic economy

Threats by China to sanctions USA Company would in effect have adverse effects on the domestic economy as far as foreign military trade is concerned. First, USA FMS program affect and impact heavily on USA domestic economy and this is evident in production, employment, price and so on.

FMS in essence represent demand by foreign countries for products produced in the USA and for services supplied by US companies and therefore the program represent a component of the total USA exports of goods and services. When demands for gods and services increase companies involved in producing the products or services will respond by increasing their output and as usual, this will require additional workers.

Further, the companies will need to increase the need for raw materials from the suppliers and again the suppliers respond by increasing the output. The numerous increases will move through the economy resulting into various kinds of ‘multiplier’ effects on employment, personal income, corporate profits and many more.

In addition to these other things to be witnessed include: an associated changes in international financial flows with effects being experienced in the balance of payments and exchange rates where as the country’s export continue to go up, the balance of payments (BOP) surplus increases. When the exchange rate become subjected to adjustment forces, the dollar respond by appreciating and hence BOP surplus will decrease.

The ‘financial’ effects will in mean time be modified in many ways as the income multiplier start to work, for instance, as increases in USA demand for imports goes up, the domestic interest rate will rise, and this will attract inflow of capital from foreign companies. However, when the opposite of these happens, the repercussion and behavior of the multipliers will exactly work opposite.

Conclusion

Foreign military sales have both positive and negative impacts on the global front. Positive in that, the supplier countries benefit economically while the recipient nations’ peace and stability become doubtful. USA relationship with China has been characterized as ‘ally-foe’ type with their battlegrounds being largely experienced in trade and diplomacy. As diplomacy may serve the political ends, trade sanctions usually act to ‘bilaterally suffocate’ the other partner manageable disciplined actions.

Trade sanctions by China on one of the USA Company involved in military sales would in great measure results into negative impacts on the domestic market, since FMS remains some of the key exports of USA. Therefore there role on the domestic economy is immense. Therefore, despite the misunderstanding between USA and China over FMS to Taiwan, the fact remain that when conducted responsibly FMS has the ability to serve the interest of United States in the best and economic way.

Works Cited

Akins, Christopher F. “Security Assistance and National Security in the Global Economy.” The DISAM Journal, 1999. Web.

Associated Press. “Can China carry out threat of sanctions?” Online Article by World Business, 2010. Web.

Canrong, Jin and Chunling, Dong. Tension on the Rise from Arms Sales. China’s National English News Weekly. 2010. Web.

Congress of the United States. The effect of foreign military sales on the USA economy. 1976. Web.

Emmanuel. “Fire Your Guns: Taiwan and US-China Relations.” Online Article by Internal Political Economy Zone, 2010. Web.

Holtom, Paul and Bromley, M. The International Arms Trade: Difficult to Define, Measure, and Control, 2010. Web.

Lubin, Gus. “China Threatens ‘Unprecedented Sanctions’ Against Boeing After US Arms Sales to Taiwan.” Online Article by Business Insider, 2010. Web.

Rebecca, M. The Review of Economics and Statistics. The MIT Press. 1989. Web.

Shah, Anup. The Arms Trade is Big Business. Online Article on Global Issues. 2010. Web.

Sorenson, David S. “Arming the Pacific Rim: Explaining Asian Arms Sales Patterns after the Cold War.” Paper presented at the IV Oceanic Conference on International Studies, Auckland, New Zealand. 2010. Web.