This report focuses on the investment behavior of the client, and analyzing his current portfolio of investments. The findings would help to make new strategies in order to gain more from investments and balancing out the risk appetite of the client. The report will have the recommendations at the end.

Introduction about the Client

Philip, who is currently, aged 32 years and single, graduated five years ago in Electrical Engineering. He is currently living with his family which includes his father who is soon to retire in five years, his mother who is a teacher and still have seven years left before the retirement and a sister who is well-educated and seeking a job. With Annual Income of £34,600 (after tax), has annual expenses of approximately £31,000. With £53,600 in his bank account, has a very cautious approach to investments. He recently inherited £50,000 from a close relative. He has total credit over him of £9,930.

Client’s current Investments

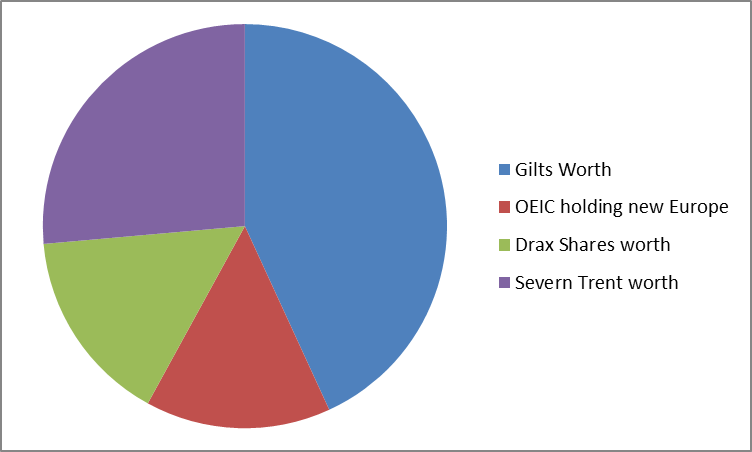

Currently, the portfolio of investments of Mr. Lewis includes Gilts and a range of shares. The holdings include Treasury bonds (2028) with a face value of £2,500 which gives 6 per cent annual interest, which he purchased soon after his graduation due to its low riskiness. His OEIC holdings which were purchased 3 years ago on a friend’s recommendation, contains 700 shares managed by JP Morgan Asset Management New Europe. The client has not kept a regular check on the stock’s performance and unsure whether to continue with the stock. The client also purchased shares in utility companies in September 2008. His aim was to invest in stocks which are very less risky and recession resilient. His holdings include 250 shares of Drax and 150 shares of Severn Trent. The table below shows a summary of various investments.

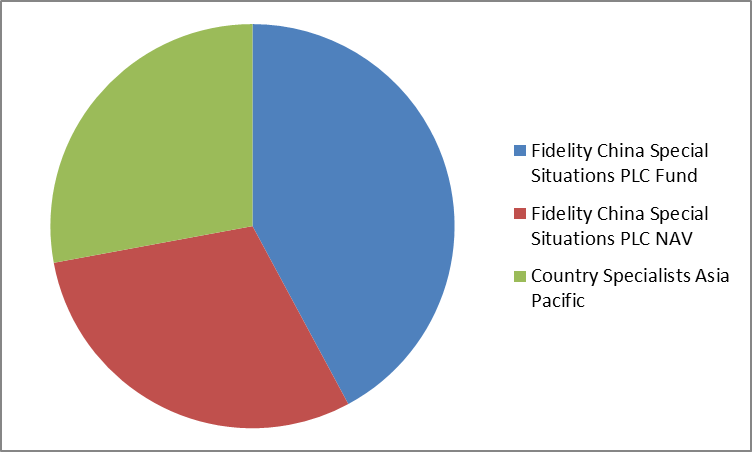

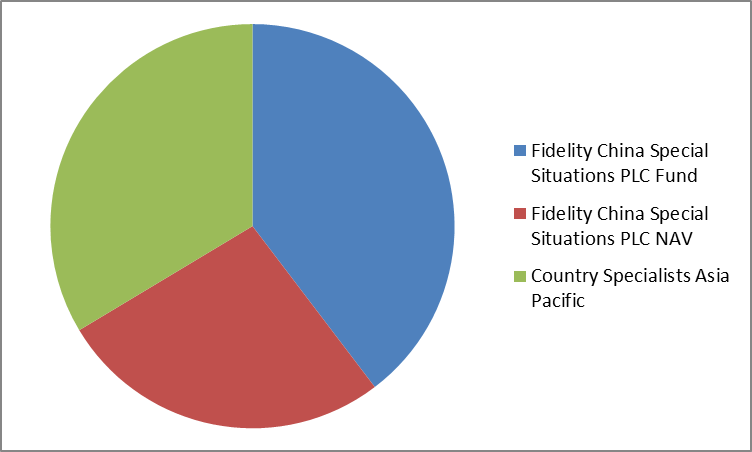

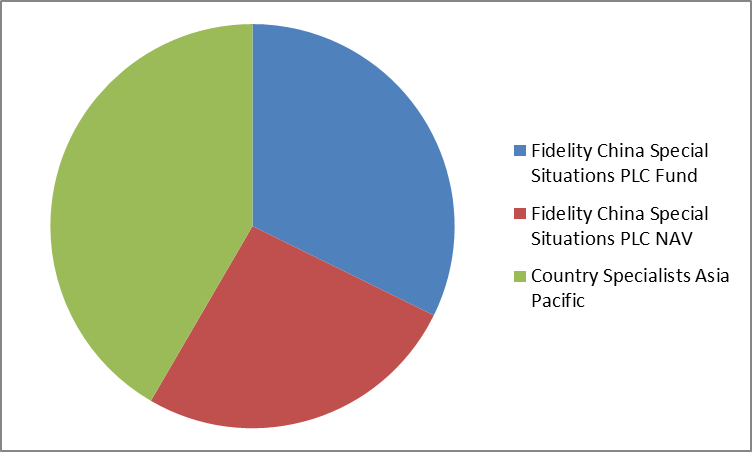

The pie chart below represent ths share of investments

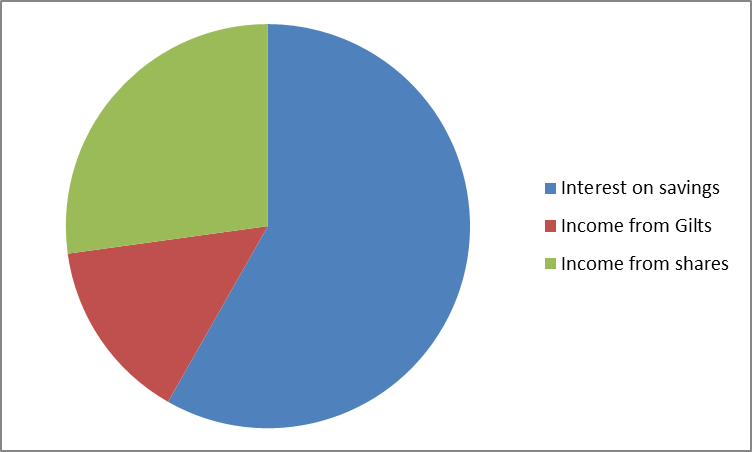

After the death of his close relative, he inherited £50,000, which he retained it in a building society savings account. He is concerned about the low return from the savings account. The table below shows a summary of various interest income.

The pie chart below represent ths share of income

The table below shows the net worth statement of Lewis.

Goals of and Objectives Philip

- Philip expects to retire at the age of 60.

- The monthly after tax income needed after retirement is 60% of his current net income (60% * €65,000). This amounts to €39,000 at current prices.

- Philip requires the 60% income until the last expectancy age of 90.

Analyzing other qualitative details

- When it comes to asset allocation, Philip portrays a passive investor. It is shown by the ratio of assets and debt or net worth. Most resources are allocated to assets hence a high net worth.

- The total value of long term care assets at risk amounts to €55,650.

- The net estimated Life Insurance Needs Shortage for Philip amounts to €93,000.

- Philip do not have wills.

- Philip has Durable Powers of Attorney.

Client’s current behavior towards risk and what would favor him

Presently, Mr. Philip falls under the category of a low-medium risk taker. He does not have goals for a long-term period such as more than 10 years (Weiss 1998). He has a behavior which would tend to disappoint him if he incurs a loss on any investment (Vandyck 2006). His investments in Gilts indicate that he is not willing to take more risk but want to ensure his money is not lying in a bank account with a low interest rate on savings (Shefrin and Statman 1985). He is a type of investor investors with portfolio with a majority of bonds and cash, but with some exposure to equities (Bailey and Kinerson 2005).

There are three foremost components that determine an investor’s risk profile. His willingness plays an important role in the behavior to invest in different assets (Vance 2003). If an investor is willing to take a higher risk, he would aim a higher return. Similarly an investor is like Mr. Philip who is very cautious towards taking risk would mean that he is not willing to earn higher returns from risky assets. The next component is the ability of an investor to take risks, which refers to the current financial position of the investor (William 1997). He must have money to invest and take risks to earn profits (Rust and Golombok 1989). The last main component is the need of an investor which refers to the depended ability of the investor on the income from his investments (Roszkowski, Delaney and Cordell 2004).

If we analyze Mr. Philip’s position according to the theory, he is willing to invest his money but wants to ensure that he does not incur losses which makes him a low risk taking investor. His ability to invest in terms of financial position is stable for a large amount is kept in a bank which could be utilized for investments and also the amount of his current portfolio of assets (Thomas 2006). He does not have a very obvious need to earn money so that he may be able to meet his financial obligations at home, so he can afford to take higher risks for better returns (Maginn, Tuttle, McLeavey and Pinto 2005).

Since Mr. Philip is working in a firm which pays him a fixed salary, this ensures that whatever the situation from his other investments would be, he would have something in his pocket to meet his financial obligations at home (Meir 2000). Generally, an investor of his age is considered to be a high risk taker, and invest in various assets to minimize the risk. It is commonly quoted that “all eggs should not be kept in one basket” (Bailey and Kinerson 2005). This means that an investor should have a diversified portfolio, so that even if he incurs a loss in one asset, it is backed by the gain from other assets (Randolph 2006). Another component that determines the behavior of an investor is the tax concerns (Roger and Paul 2000). No investor would want to make profit on investments only to give a major portion to a third person that could be taxed to the government as well (James 2003).

Analysis and recommendations on current portfolio

Treasury Bonds

My recommendation to Mr. Philip would be to withdraw his money from the Treasury bonds that he invested at 6 percent after his graduation and invest in a more risky asset that could give better returns than he is earning presently (Randolph 2005). He can surely bear the risk involved in the stocks by diversifying his portfolio and not to stick himself with just the treasury bonds (Roszkowski, Davey and Grable 2005: Snelbecker, Roszkowski, and Cutler 1990).

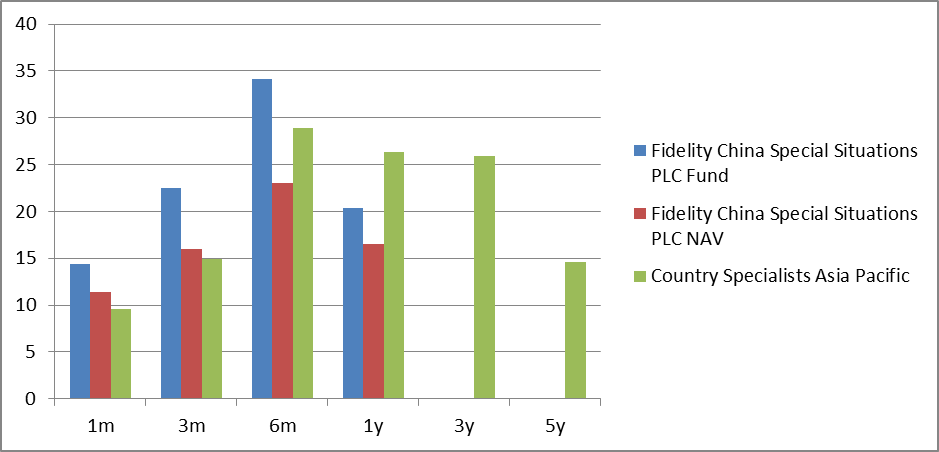

OEIC holdings and Fidelity China Special Situations Investment Trust

The holdings in an OEIC in which he purchased 700 shares in New Europe A Acc, has so far given positive gains to Mr. Philip. The current performance shows a good picture of growth in 3 years. The Net Asset Value (NAV) shows the addition of 188.40p that means 1.88% and the total 3 year growth is 12.54 per cent. The graph and performance chart indicate positive returns are indicated below.

The bar graph below further illustrates returns of the various investment

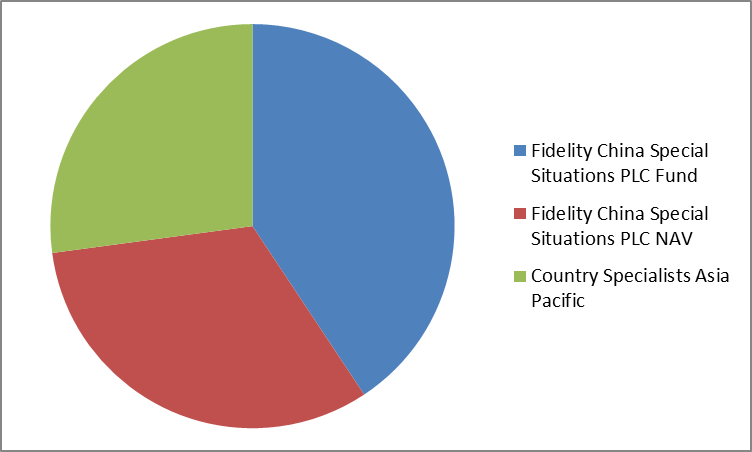

The pie charts below shows proportion of returns for each investment in;

One month

Three month

Six months

One year

Alternatively, if we analyze Fidelity China Special Situations Investment Trust which is single handily managed by the approaches of Anthony Bolton, does not give a positive response in the market. The report also suggests that the liquidity in the Hong Kong market had dried up and many of Bolton’s holdings in the Fidelity Trust went down 10 percent overnight. Thus this option is not safe to be invested and I will not recommend opting for this option.

Drax shares and Severn Trent shares

Mr. Philip’ investments in Drax shares also show very positive signs for the future. The news in the market suggests that “Drax would become the United Kingdom’s biggest source of producing renewable energy” (Dital look 2012). Chief Executive of Drax said: “This is a hugely exciting time for Drax and our shareholders. We now have the mandate, means and expertise to become a large renewable electricity generator. We will do this by transforming the largest coal plant in the UK into a power plant fuelled predominantly by sustainable biomass. The placing is one of the key building blocks in this transformation” (Digital look 2012). The performance of Drak’s shares over the five months is indicated below.

The current situation of the stock is negative 2.44 percent in share price. The stock price has continuously declined since September 2012. The interim report of the company suggests that the consumption through its calculated income base and expectations had fallen on a yearly basis. The bad debt level would increase to a level of 2.2 per cent of turnover for the accounting year. Also that Severn Trent is expected to deliver low growth revenue which would drop to single digit in percentage. But at the same time, a special dividend of £150 m was paid out to its shareholders in addition to ordinary final dividend of 42.06p (London South East, 2012). My recommendation would be to hold investments from Severn Trent stocks and invest more in Drax shares. Drax shares show a very positive sign to shareholders, thus this is time to buy the shares and hold them for a longer period for higher returns.

Tax Efficiency

Tax efficiency is a tool to determine that how much an investment’s return is left he pays the taxes. For instance, “if an investor is more reliable on investment income rather than generating returns by fluctuations in the share prices, the less tax-efficient the investor is” (Bhargava 2010). Convertible bonds are relatively tax-efficient. An investor after investing in assets can take advantage from tax deferrals by two methods:

- Buying and holding investments: Unless the gains are realized on investments, taxes on capital gains are not often payable. This gives a chance to defer or even lessen the taxes by choosing to sell those investments when the marginal tax rate is lower.

- Investing in tax privileged mutual funds: This type of fund structure allows an investor to earn profit while deferring capital gains on fund by manipulating assets freely among the structure share categories.

The aim of tax planning is to organize the financial resources of Philip with an intention of reducing tax liability. The net effect is an increase in disposal income of Philip. There are three ways Philip can reduce taxes these are, reducing income, increasing expenses and making use of the tax credits. Before retirement, Philip operates within a tax bracket of 28%. After retirement, Philip will be in a tax bracket of 25%. Further, Philip lives in a region where sales tax is 8.5%. As a measure to reduce taxes, Philip can increase the length of his investment so that they mature after retirement. This will enable Philip pay the lowest amount of tax.

Alignment of financial resources and goals

This section will give the financial forecasts for Philip for five years starting with 2012. The forecasts will take into considerations the goals of Philip.

Saving towards a deposit on a house or flat

It is the time when house prices in UK have gone very high and mortgages mostly needs an investor to pay at least 10 per cent as a deposit. This has made saving a deposit for a house or flat, a difficult task in UK. In fact, “the recent Halifax House Prices Index indicated that the average house price in UK by the end of July 2012 was £162,619, which means depositing about £16,000” (Digital look 2012).

It is important to carry out a comprehensive research on prices of houses in order to acquire the best deal out of an investment. This would give a clear view that how much needs to be saved and put in to the deposit. It is not only depositing. There might be consultation fees too, while consulting a real estate agent. There is a strong need of making a proper budget before depositing for a house. This would also check the risk behaviour of the investor. Mr. Philip, can currently afford a high risk strategy which could prove to be fruitful in future.

Some amount needs to be deposited in savings account such as saving into a cash ISA. On can save more in the tax year 2012-2013, since all the interest that an investor earns is tax free. Also reviewing the account is necessary if in case it is not productive, the account needs to be changed (Bailey & Kinerson 2005: Barber and Odeon1999: Bekkers, Doeswijk and Lam 2009). He should be patient and prepared to be flexible since the house prices can regularly fluctuate (Bhargava 2010: Bhargava 2011).

The right time to switch to safe investments

For every investor, the right time to switch to safe investments like risk free Treasury Bills or others, is on a pre-decided plan so that the time when the investor reaches retirement age, he has sufficient wealth in safe investments to meet his income and other financial obligations for many years ahead. The right strategy is when the risky investments like real estate and equities give above returns that are above average, the investor must reallocate the profits and increase them by putting them into safe investments alongside (Hanna, Gutter and Fan 2001: Cordell 2002: Grable and Joo 2000: Kline 1993).

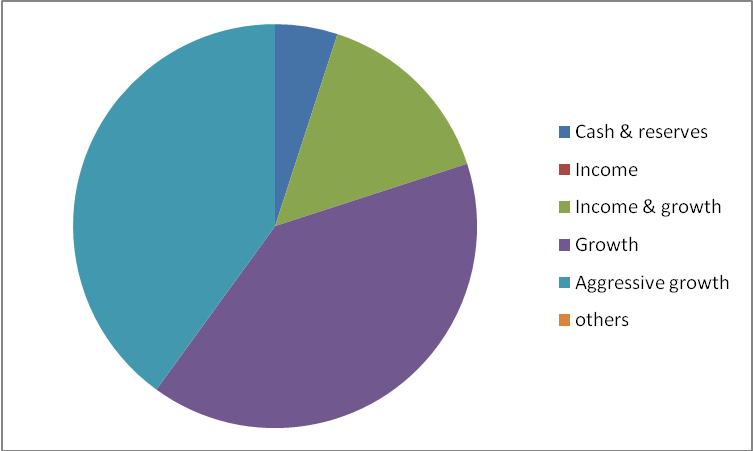

Philip needs to invest the money in profitable investments. The current and suggested asset allocation is shown in the table below.

Pie Chart of Investment Portfolio

Summary of the Findings

Overall, the findings suggest that the cautious approach of Mr. Philip has resulted in low profits to him. There is a large amount lying in the bank account that could be invested in equities. Mr. Philip can surely bare some high risk stocks since he does not have any major financial obligations and earning a fixed income from his job or direct earnings (Dayananda, Irons, Harrison, Herbohn, & Rowland 2002: Gary, Brinson, Randolph and Gilbert 1986: Gary, Brinson and Gilbert 1991). The current portfolio is not bad although the amount lying in the bank account could also be invested. Mr. Philip needs to change his risk taking strategy and start being flexible, keeping in mind that even if he incurs a loss, he can still back it by profits in other securities that from the investment matrix (Bull 2007: Callan and Johnson 2002: Carducci and Wong 1998: David 2003).

My recommendation would be to invest in the stocks of Drax since it would be profitable in near future. On the other hand, the Severn Trent shares needs to be held right now and wait for some time until the falling prices from past month rise again (Loomes and Sugden 1982). As per the news in the market, there is no need to switch the investments from OEIC to Fidelity China Special Situations Investment Trust, since the news in the market regarding the latter is not good and the investments made will not be profitable. The OEIC currently has performed well. From the time when Mr. Philip invested in the stocks of OEIC three years ago, it has given return of 12.54 per cent.

Mr. Philip alongside his investments must also make long-term goals and make after retirement plans. The money he would need on average to meet his income and other financial obligations. This would help him to invest in long-term assets alongside the short-term investments, so that future profits could be utilized after retirement.

Ratios are computed to analyze the financial position of Philip. From the calculations, it is evident that Philip has very high liquidity amounting to 8.61. It shows that Philip is in a position to meet his obligations which fall due within a year. In addition, we can also deduce that Philip puts plenty of liquid assets idle. Return on assets is at 8.42%. This indicates that Philip receives dismal returns from his assets. He needs to consider venturing into more profitable areas. However, this depends on his risk appetite. The net profit margin of Philip is high.

Assumptions made in the analysis

Other than the information provided in the case study, there are some other assumptions that are made in the analysis. The assumptions are summarized in the table below.

Conclusively, the financial planning process enables an individual to plan for his earnings with an aim of converting finances to wealth. The process comprises of six basic steps. These are, establishing and identifying a relationship with the client, gathering client data including goals, analyzing and evaluating the financial status of the client, coming up and presenting financial planning recommendations and alternatives, implementing the financial planning recommendations, and monitoring the implementation of the recommendations.

References

Bailey, J. & Kinerson C. (2005). Regret avoidance and risk tolerance. Financial Counseling and Planning, 16:1, 23-28.

Barber, B. & Odeon, T. (1999). The courage of misguided convictions: The trading behavior of individual investors. Financial Analysts Journal, 1: 3, 18-28.

Bekkers, N., Doeswijk, R., & Lam, W. (2009). Strategic Asset Allocation: Determining the Optimal Portfolio with Ten Asset Classes. Journal of Wealth Management, 12:3, 61-77

Bhargava, A. (2010). An econometric analysis of dividends and share repurchases by U.S. firms. Journal of the Royal Statistical Society, 17: 3, 631-656.

Bhargava, A. (2011). Executive compensation, share repurchases and investment expenditures: Econometric evidence from U.S. firms. Review of quantitative Finance and Accounting, 23, 56-98

Bull, R. (2007). Financial Ratios: How to use financial ratios to maximize value and success of your businesses. Alabama: Elsevier.

Callan, V. & Johnson, M. (2002). Some guidelines for financial planners on measuring and advising clients about their levels of risk tolerance. Journal of Personal Finance, 1:1, 31-44.

Carducci, B. & Wong A. (1998). Type A and risk taking in everyday money matters. Journal of Business and Psychology, 12, 355-359.

David, E. (2003). Financial analysis and decision making: Tools and techniques to solve. New York: McGraw-Hill books.

Dayananda, D., Irons, R., Harrison, S., Herbohn, J., & Rowland, P. (2002). Capital budgeting: Financial appraisal of investment projects. London: The Press Syndicate of the University of Cambridge

Digital Look, (2012). Equity Options: Protect and Enhance Share Portfolio. Web.

Gary,P., Brinson, L., Randolph, H., & Gilbert L. (1986). Determinants of Portfolio Performance. Financial Analysts Journal, 2: 6, 23-56.

Gary,P., Brinson, S., & Gilbert, L. (1991). Determinants of Portfolio Performance II: An Update. Financial Analysts Journal, 47, 3-11

Grable, J. & Joo, S. (2000). A cross-disciplinary examination of financial risk tolerance. Consumer Interests Annual, 46, 21-32.

Hanna, S., Gutter, M., & Fan, J. (2001). A measure of risk tolerance based on economic theory. Financial Counseling and Planning, 12:2, 53-60

Cordell, D. (2002). Risk tolerance in two dimensions, Journal of Financial Planning, 23: 4, 18-27

Kline, P. (1993), The Handbook of Psychological Testing. London: Routledge.

London South East, (2012). Latest Finance and Stock Market News. Web.

Loomes, G. & Sugden, R. (1982). Regret theory: an alternative theory of decision under uncertainty, Economic Journal, 92: 1, 805-824.

Maginn, J., Tuttle, D., McLeavey, D., & Pinto, J. (2005). The portfolio management process and the investment policy statement in Managing Investment Portfolios: A Dynamic Process edited by J. Maginn and D. Tuttle. Charlottesville VA: CFA Institute.

Meir, S. (2000). The 93.6% Question of Financial Advisors, Journal of Investing, 9:1,16-20

Randolph, H. (2006). Response to Letter to the Editor, Financial Analysts Journal, 62:1, 8-15

Roger, G. & Paul, D. (2000). Does Asset Allocation Policy Explain 40%, 90%, or 100% of Performance? The Financial Analysts Journal, 12, 34-41

James, B. (2003). The coefficient of determination, Shiken: JALT Testing & Evaluation, SIG Newsletter, 7:1, 56-61

MarcRandolph, H. (2005). Determinants of Portfolio Performance – 20 Years Later. Financial Analysts Journal, 61:5, 89-96

Roszkowski, M., Davey, G., & Grable, J. (2005). Insights from psychology and psychometrics on measuring risk tolerance. Journal of Financial Planning, 1, 34- 41

Roszkowski, M., Delaney, M., & Cordell, D. (2004). The comparability of husbands and wives on financial risk tolerance. Journal of Personal Finance, 3:3,129-144.

Rust, J. & Golombok, S. (1989). Modern Psychometrics, London: Routledge.

Shefrin, H., & Statman, M. (1985).The disposition to sell winners too early and rise losers too long: theory and evidence. Journal of Finance, 40:3, 777-790

Snelbecker, G., Roszkowski, M., & Cutler, N. (1990). Investors risk tolerance and return aspirations and financial advisers interpretations: a conceptual model and explanatory data. Journal of Behavioural Economics, 19:4, 377-393.

Thomas, P. (2006). The Difficulty of Selecting Superior Mutual Fund Performance. Journal of Financial Planning, 12, 34-41

Vance, D. (2003). Financial analysis and decision making: Tools and techniques to solve. New York: McGraw-Hill books.

Vandyck, C. (2006). Financial ratio analysis: a handy guidebook. Alabama: Trafford Publishing.

Weiss, L. (1998). How to understand financial analysis. Paris: Fointanebleau.

William, J. (1997). The Asset Allocation Hoax. Journal of Financial Planning, 4, 31-44