Introduction

Economics is a social science, which is concerned with the distribution of scarce resources amongst limited, competing and insatiable wants of consumers. The invisible hand principle was coined by Adam Smith; a classical economist, to elucidate how the market regulates itself in a capitalistic setting (McConnell and Brue 1).

The aforementioned resources are usually employed in the production of goods, and provision of services to the myriad types of markets; where producers and consumers interact.

Incidentally, due to competition in these markets; there is always friction between producers and consumers which is occasioned by the need of producers to exercise their desire of profit maximization, and the consumer’s need to attain maximum utility per commodity purchased.

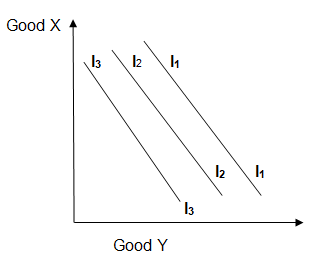

This is tantamount to the consumer, being on the highest possible indifference curve; as indicted by a rational consumer yearning to be on indifference curve I1 in the graph below.

Graph One

In the preference map above, a consumer operating on indifference curve I1 is a utility maximizing agent; choosing to be where there is optimum combination of commodity X and Y.

Producers on the flipside, gravitate towards maximizing their profits by minimizing their production costs. The invisible hand therefore, is natural equilibrating component of the market, which provides a middle ground between producers and consumers with regard to their welfare.

The Circular Flow of Income

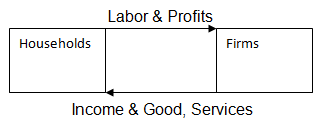

Seemingly, the primary constituents of the economy in a macroeconomic perspective are the household and the firm. In a circular flow of income mechanism, there is always exchange of services, products and income between these two agents. The invisible hand principle assumes that; there is no government intervention in the market where these agents interact, to counter market imperfections.

Diagram: Showing Economic Exchange between Households and Firms.

The Price Mechanism

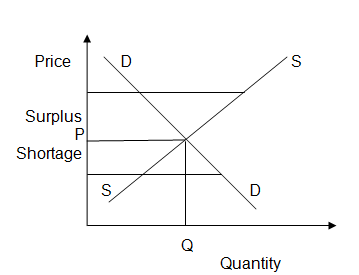

Ordinarily, the basic microeconomic principle with regard to equilibrium between demand and supply, is the price mechanism; where demand and supply automatically self- correct to attain a price and quantity that is ideal to both producers and consumers.

In situations where demand exceeds supply, there is shortage and where supply exceeds demand there is a surplus. The invisible hand is mandated with the task of equilibrating demand and supply in the market.

Graph Two

The Free Market, Command and Mixed Economies

Much as we may acknowledge the existence of free market economies, in reality there is no way that an economy can function smoothly with the reliance on the invisible hand exclusively; without the government’s input (Suntum 10).

In practice most economies that purport to be free market economies, are typically mixed economies where both the invisible hand and the state play dual roles; in ensuring that, consumers are cushioned from high prices set by producers.

Additionally, producers are able to produce in a fair and conducive environment. Therefore, a mixed economy is an amalgamation of the command economy’s government intervention, and the free market economy’s invisible hand.

Conclusion

The invisible hand plays a very pivotal role in the free market economy, in the regulation of demand, supply and price in the market. Much as we would love the market to regulate itself, there always seems to be some market imperfections that are usually not anticipated.

The invisible hand cannot address all the market imperfections; therefore, some intervention by the state in the economy, ensures that there is a level playing field for all producers, and that the consumer is cushioned from exorbitant prices, that might be charged by unscrupulous producers.

Works Cited

McConnell, R., Campbell, and Brue, L., Stanley. Economics: Principles, Problems and Policies. New York: McGraw-Hill, 2007. Print.

Suntum, V., Ulrich. The Invisible Hand: Economic Thought Yesterday and Today. New York: Springer, 2005. Print.