Introduction

In any given market, the process of resource allocation is the responsibility either of the market forces or of government through its interventions in the price mechanism. Each of these two forces plays an important role in resource allocations if allowed at their most appropriate times otherwise they become a bothers in the price determination process.

The market mechanism heavily depends on the market forces of supply and demand in determining the prevailing prices of a commodity while on the other had the central allocation system determines the prices regardless of these market forces. Economists have come up with arguments in support and against these two players in the determination of market prices.

However, one thing is clear; that the two forces are important in the economy thus best practice calls for the application of both mechanisms. This paper examines each of the two mechanisms, their roles, and their advantages and disadvantages. Finally, this paper relates these to a real scenario in UAE with the aim of establishing the sectors of the economy, and industries that fall under either mechanism.

Market mechanism

This mechanism asserts that the prevailing market prices must result from the operations of the forces of supply and demand. This imply that the market must obey the law of supply and demand, which states that, when no one has the power to set prices, the interactions between the forces of supply and demand is the sole determinant of the prevailing market prices (Fischer and Rudiger 1983).

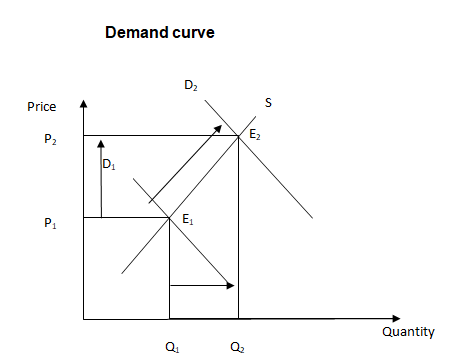

This means that, as the demand increases (shift of demand due to increased consumption) with the supply held constant, the prices of that particular commodity will go up. The vice versa of this is true, that as the supply increases with the demand held constant, the prices will decrease. The following illustrations show the relationships

The shift in demand from D1 to D2 with the supply remaining constant will trigger an increase in price from P1 to P2 and an increase in quantity from Q1 to Q2. This will push the equilibrium from E1 to E2.

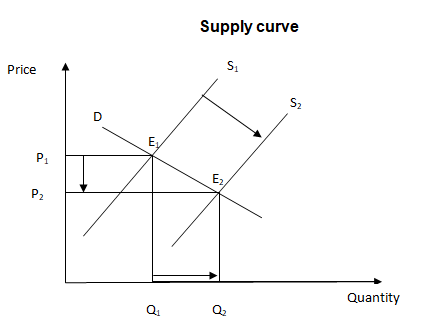

Considering the illustration below, and increase in the supply (shift due to increased production) with the demand held constant will result to a drop in prices from P1 to P2 and an increase in quantity from Q1 to Q2. This will push the equilibrium point from E1 to E2

The role of price

Under this mechanism, pricing acts as an incentive to both the consumer and the producer. Thus, the role of price is to regulate the level of production. When the prices are high, this becomes an incentive for the producers to produce more but it discourages consumption from the consumer side (Myers 2004). Low prices increase the demand of a product.

However, it forces producers to reduce their output due to their fear of incurring losses in their business. The ultimate result of this is that the forces will reach a point of equilibrium whereby, these forces push the price at equilibrium at a certain level of production and consumption (Barkley 1991).

Besides, this method ensures the economy operates efficiently with the satisfaction of consumers being at the least cost possible and thus avoiding the wastage of resources.

The role of government

Initially, the market mechanism advocated for a Lassize faire mechanism in which case, the government had no role assigned to it in the economy. This meant that the government was to stay out of the economy (Hahnel 2002; Barth and Caprio 2007). However, economists agree that even in the Lassize faire system, the government had a role to play.

Some of the activities of the government activities like maintaining law and order, provision of public goods, defense from external threat and enforcement of contracts and private rights are important for the market mechanism to play its role. For this reason in the market mechanism, the role of the government is strictly restricted to the above-mentioned tasks.

Non-price influences

It is important to note that the determination of the market supply and demand is not solely dependent on the price but there are other influences. However, in this mechanism, their importance is of less weight as compared to prices and thus the assumption is that they are constant (Brabant 199; Ollman 1997).

The phrase ceteris paribus, which constantly appears in economics, refer to this. Other factors that influence demand include availability of compliments and substitutes and their corresponding prices, changes in consumer purchasing power because of increased income, and the changes in consumer preferences. All these factors play a role in demand determination.

Just like the determination of demand, other factors besides price are important in the determination of the supply. Again, these are of less weight in the role and the assumption is that they are constant in the equation.

These factors include the availability of raw materials, competition from substitute producers and in case the production of a particular good is dependent on a producer good, then the availability of that particular good become a determinant in the supply chain.

It is important to note that economic growth will lead to a permanent shift in the supply curve and thus the market mechanism focuses more on the short run as opposed to the long run.

Market segment in the UAE

In an effort to liberate the market, the government has loosened the restrictions as regarding business set up and the requirements of obtaining necessary licenses to run a business. Furthermore, the government has set apart free zones in which foreign companies can setup companies and make profits. The UAE has furthermore taken measure necessary for liberating its foreign trade.

This is because it sees free trade as paramount for the improvement of production and increasing the country’s competitive advantage. By 2008, the non-oil exports for Dubai had increased by more than half (Bertelsmann Stiftung 2012). This is evidence of the improving market liberation, which over the time has given rise to the improved production and ultimately the growing economy.

Merits and Demerits

The market mechanism, like any other coin has its own benefits and flaws. One of the most outstanding benefits of the system is the efficient allocation of resources. The market forces work out that the societal needs and wants are satisfied at the least cost possible.

This calls for investors to innovate and employ the most efficient technology in the production process (Altvater 1993). The ultimate result is the improvement of the country’s production capacity due to technology advancement and thus giving the country a competitive edge over others.

Another benefit that this mechanism provides for the society is competition. Competition is an important tool in improving both the quantity and qualities of the products and services available to the society. The effect of the improved technology is that the quality and quantity of the product increases and thus, the mechanism is a basis for improved living standards.

Furthermore, increased production in the domestic market boosts the balance of payments and thus improves a country’s competitiveness in the international market. This will increase the country’s national income and the gross domestic income and ultimately per capita income. This means that, the amount of cash available per person in the country will increase and this is beneficial to the society as a whole.

Finally yet importantly is the fact that the mechanism brings potential users and producers together for mutual benefit. This means that since production is a function of demand, any sector in which investors speculate demand, which is the willingness to buy backed by purchasing power, they will invest in that sector with the aim of satisfying that demand at a profit.

This is useful in mobilizing a country’s resources into various sectors in which they are of need. This ultimately broadens the number of services available and thus boosting the quality of life in the society.

Despite all these merits, the mechanism has its own shortcomings, which includes the fact that the allocation process ultimately leads to winners and losers. Since resources are scarce, the market mechanism dictates that these resources are available to those who are willing and have the capacity to buy.

At this point, the mechanism seems to promote an increase in the gap between the poor and the rich; which is neither an economic nor a societal good. this will mean that even the most important resources like medical care and education will only be available to some, which threatens the country’s future.

Another issue that this system presents is that it does not address the issue of sustainable development well. In the quest for profit and minimizing cost, organizations may end up engaging in activities that are harmful to the environment and thus endangering the long-term sustainability of the economy (Bouman and George 1997).

Furthermore, firms may not adopt new eco-friendly technologies as they focus on cost minimization. This is majorly referred to as the wasteful competition in which, as firms fight to gain a competitive edge over their competitors, they adopt practices that are not friendly to either the employees or the environment. This may require government intervention to regulate the behavior of these firms for sustainable development.

Central planning

Under this system, it is the responsibility of the central government to govern the process of resource allocation, as opposed to the market mechanism, in which this responsibility is left to the fate of market forces.

The government under this mechanism becomes the central player in allocating resources and determining the production and as result; the allocation standard is “as needed” unlike the free market which on the basis of “capacity to buy.” This ensures that important resources are available to all as opposed to the sharing among the rich in the free market economy.

One of the most important characteristic of these types of the economy is the fact that the government is involved directly in setting the prices of commodities. The whole idea of central planning is producing for the need of the people as opposed to producing for profits as in the market economy.

The role of price

As opposed to the free market, economy where price is an incentive to both investors and consumers, under central planning the role of pricing is to endure that resource allocation and investments focus on the particular areas that the government considers of most need.

Actually, the prices in some instances may go as below as zero, meaning that the government provides some of the services free of charge. This discourages investors into those sectors and therefore the most characteristic feature of those sectors is the existence of monopolies.

The role of government

The government’s interventions in the market may be because of malicious intentions of the top or those near the top governance seats to suit their own selfish purposes. On the other hand, the central planning may be crucial in serving the nations purposes by directing resources where they are of dire need. Some of the areas that the central planning system focuses are on production, investment, and distribution.

The system may focus on either of them of even the three of them (Bockman 2011; Grossman 1987). In its involvements, the government may have state owned firms in which it has full control and it directs its production under a macroeconomic plan.

There are two forms of this mechanism that the government can adopt, the command economy or the economic planning method. Under the first, the government becomes authoritative in line with production and it requires obedience from the firms (Carl 1947; Nove 1987; Boone 1998).

The second is quite different in that the government does not use a command line in directing production but instead direct production by offering incentives to the companies that would lure them into producing certain products or investing in a certain area. In either case, the government is able to achieve its macroeconomic goals.

Market segment in the UAE

Event though the United Arab Emirate has declared its state as market economy, it has not fully embraced the requirements of the free market economy. Restrictions still exist in the economic linearization an example being the failure to discontinue the exclusive agency distribution agreements, which allow particular families to have monopolies in some of the country’s economic sectors.

Furthermore, the government owns most of the private companies thus the ruling families are highly involved in the country’s economic activities not to mention that only a thin line exists between the public and the private companies. As Bertelsmann Stiftung (2012) notes, the state is moving from a monopoly which is controlled by the government to a duopoly with the same controller.

Merits and demerits

One of the most obvious advantage of the system is the fact that the decision maker basis their decision on the citizen. During the decision making process, the interests of the citizen come at the forefront and thus is superior in this matter as compared to the market mechanism in which decision-making has profitability as the base line (Myant 2010; Flanagan 1998).

Sometimes competition may not be profitable, especially if it encourages deterioration of working conditions and depletion or destruction of the environment or an ecosystem. Economic planning becomes important at this point because it eliminates this destructive competition and thus preserving the environment and its citizens.

Another advantage is that it helps avoid organizational and industrial unrests. Since the government sets and pays out wages, industrial unrests like strikes in this case are non-existent. The focus given to quality of life by this system gives the impression that under this mechanism, the needs of the employees are the base line for decision-making.

Despite having such advantages, the planned economy has its own failures and pitfalls. Chief among the disadvantages is the fact that it is a deterrent to work. The fact that people under this system receive payments even when they are no working means that they get less motivated with time and therefore, the system is associated with much inefficiency in the production or any channels the government regulates.

This replicates in the firms these people work in form of underperformance ad later in the economy as slow-paced economic growth (Magill 1991). In the case of the services industry, the quality of services deteriorates and therefore consumers end up dissatisfied.

Another disadvantage is that the market participants have no a variety of choice and there is inefficient allocation of resources. Under this mechanism, the producer produces goods and services under directions and thus the number of products available leaves the consumer with no varying choices to make (Xuesheng and Schweitzer 1998).

This means that even if the products or services are poor, the consumer will have no choice but accept the poor quality product. The planners cannot forecast the consumer’s and therefore, there are often overproduction and underproduction in which case consumer needs go unsatisfied.

Conclusion

As the United Arab Emirates endeavor to liberate its market in order to spur economic growth and its macroeconomic goals, it is important to note that neither of these two mechanisms is perfect and therefore, the government should adopt a way of employing a mixed economy. A mixed economy allows the government to intervene at the weaknesses of the free market mechanism and prevent its dangers from happening.

This is the most practical approach that many countries have practiced for decades and it still stands out to be the best practice.

The policy under the mixed economy is that the government should intervene only when allocating resources that are meant for the benefit of all, or when providing important services, which participants in the market cannot provide, or when preventing harm that participants in the market may cause to the environment.

Bibliography

Altvater, E. (1993) The Future of the Market: An Essay on the Regulation of Money and Nature After the Collapse of Actually Existing Socialism. Sudbury: Jones and Bartlett Publishers.

Bertelsmann S. (2012) Shaping Change: Strategies for development and transformation. German: Bertelsmann Stiftung.

Bockman, J. (2011) Markets in the name of Socialism: The Left-Wing origins of Neoliberalism. Stanford: Stanford University Press.

Boone, P. (1998) Emerging from Communism Lessons from Russia, China, and Eastern Europe. Cambridge, MA: MIT Press.

Bouman T. O., and David G.B. (1997) Sustainable Forests: Global Challenges and Local Solutions. Haworth Press.

Brabant, J.M. (1991)The Planned Economies and International Economic Organizations. Cambridge: Cambridge University Press.

Carl, L. (1947) Theory of National Economic Planning. Second edition. Los Angeles: University of California Press.

Fischer, S. and Rudiger H. (1983) Economics. New York: McGraw-Hill.

Flanagan, R.J. (1998) “Institutional Reformation in Eastern Europe.” Industrial Relations: A Journal of Economy and Society, pp. 180- 200

Grossman, G. (1987) “Command economy,” The New Palgrave: A Dictionary of Economics. London: Palgrave Macmillan.

Hahnel, R. (2002) The ABC’s of Political Economy. London: Pluto Press.

James R.B., and Gerard C. (2007) China’s Changing Financial System: Can It Catch Up With, or Even Drive Growth. USA: Networks Financial Institute.

John B. (1991) Comparative Economics in Transforming World Economy. Cambridge, MA: MIT Press. Kennedy P. The Rise and Fall of the Great Powers. NY: Cornell Press.

Magill, F. N. (1991) Survey of Social Science: Economic Series. Pasadena. CA: Salem Press.

Myant, M. (2010) Transition Economies: Political Economy in Russia, Eastern Europe, and Central Asia. Oxford: Wiley-Blackwell.

Myers, D. (2004) Construction Economics. UK: Spon Press.

Nove A. (1987) “Planned economy,” The New Palgrave: A Dictionary of Economics. London: Palgrave Macmillan.

Ollman, B. (1997) Market Socialism: The Debate Among Socialists. UK: Routledge.

Xuesheng, L., and Stuart 0. S. (1998) “The Health Market: China’s Medical-Care System Is Undergoing Reforms that Could Have. Lasting Effects on the Nation’s Pharmaceutical Market.” China Business Review pp. 37-50.