Abstract

Over past three decades, Japanese Yen has fluctuated significantly against the U.S dollar. It was stronger during the 80s to the early 90s, but this value has been deteriorating since mid 90s to date.

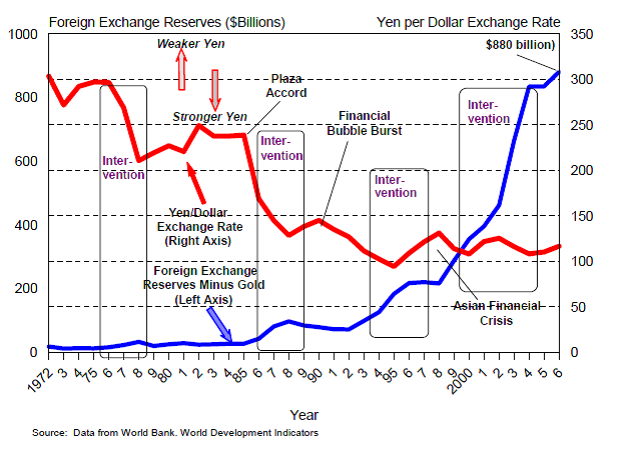

Japanese government intervened in many occasions in their foreign exchange market to attain unjust advantage in the global world market. However, these interventions were only felt in the short run but failed to avert the direction of the Yen in the long-run. In addition, these interventions had negligible effect on the prices of Japanese commodities in the U.S market.

Introduction

The current global financial market is dominated by allegations that some countries are trying to manipulate their exchange rates using unjust means. The major culprit at the present is China, although the same allegations were made against Japan (Vikas & Yan 2006). Governments often intervene in the currency market by buying foreign exchange-mostly the major global currencies- in order to increase the demand for these currencies and consequently their values relative to their domestic currency.

On the other hand, they can sell these major foreign currencies to reduce their demand in the currency market thus increasing the value of their domestic currency. In the case of Japan, it has often bought U.S. dollars from its local exporters in exchange for their domestic currency (Japanese Yen) and utilizes the dollars to purchase American securities and liquid assets (Cashin et al. 2004).

U.S government has a lot of interest in the global currency manipulations, interventions and unjust alignment, since it has considerable repercussions on their economy. Unfair manipulation of the exchange rates to underrate global currencies can raise the US trade deficit, increase their dependency on foreign investors to finance this deficit, thus affects their interest rates and their competitive advantage in the global trade.

Japan has always timed when the dollar’s value is declining relative to Yen to purchase U.S securities and liquid assets. The main aim of doing this was to stabilize the value of Yen and preventing the prices of their exports from increasing in US markets and to maintain their exports’ profitability (Vikas & Yan 2006).

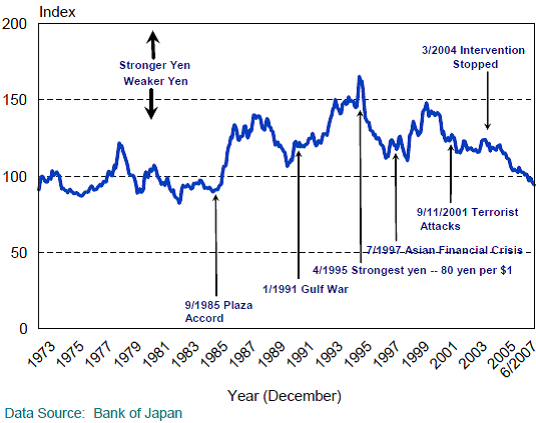

Yen’s ascension started significantly started after the signing of the Plaza Accord in 1985 by the major industrial economies at that time. It marked two distinct periods. The first part was between 1980s to early 90s where recession led to a very strong yen. The second section lies between mid 90s to date where the real exchange rate of the Yen has been depreciating significantly resulting to a deteriorated balance of trade between Japan and U.S (Rasmus & Hutchinson, 2003).

Japanese Interventions in the Foreign Exchange Market

Global financial analyst argued that Japan has undervalued their currency more than 20%. If this is the case, then it gives Japanese manufacturers upper hand pricewise over their American competitors. The greatest victim of the Yen undervaluation is the U.S automobile industry.

The headquarter of the U.S automobile industry claimed that these gave price advantage of approximately 4000 dollars per car manufactured in Japan as compared to U.S . It enhanced the sale of Japanese cars in the American market. Figure 1 shows the trend of the Japanese real effective exchange rate relative to the dollar from 1973 to 2006 (Vikas & Yan 2006).

International economists argue that currency interventions for large economies with floating exchange rates such as Japan only works for a short run and have diminutive effect on the long run. Some experts believe that even without manipulations, Japans share of the foreign exchange will still remain since it earns by investing in the US securities and other liquid assets.

In 2006, Japan earned more ($40 billion) on its total investment in US than what the US earned on its investment in Japan. Japanese government interventions in the currency market took place in late 70s to 2004. Since then, Japanese government has never intervened very much in the foreign exchange market to affect the value of the dollar as illustrated in figure 2 (Vikas & Yan 2006).

Currency Values and Trade

This section explains the impact of the yen-dollar exchange rates on the imports and exports. Theoretically, Japanese interventions in the foreign exchange market was aimed at undervaluing Yen, thus makes their exports cheaper. This should have enabled Japan to either reduce the price of their exports or maintain it while making more profits.

Lower export prices and higher import prices result into surplus in the balance of trade and therefore increase economic growth. In reality, the functioning of the foreign exchange market is different from the theoretical perspective. To be specific, the long-run relation between government interventions and foreign exchange market is difficult to demonstrate practically (Koujianou & Knetter 1997).

Japanese automobile manufacturers and other exporters to the U.S. market do not adjust their prices in response to short-run fluctuations in the exchange rates. There prices are set according to the prevailing commodity market conditions and long-run financial market conditions.

For example, between 1994 to early 1995, Japanese Yen rose by 34% against the dollar meaning that the prices of Japanese goods in U.S. market should have followed the same trend. However, Toyota sticker prices only appreciated by 2% while the prices of Sony TV sets dropped by 15%.

Conclusion

Since early 70s to date, the value of Japanese Yen has fluctuated significantly against the U.S dollar. The value of Yen was relatively stable during 70s to early 80s. Yen’s ascension started significantly after the signing of the Plaza Accord in 1985 by the major industrial economies at that time. The fluctuations in the value of yen forced the Japanese government to intervene in the foreign exchange market. However, these interventions only succeeded in the short run but failed to avert the direction of the Yen in the long-run.

References

Cashin, P., Luis F. C., & Ratna, S. 2004. Commodity Currencies and the Real Exchange Rate. Journal of Development Economics, vol. 75, pp. 239-68.

Koujianou, G. P., & Knetter, M. M. 1997. Goods Prices and Exchange Rates: What Have We Learned? Journal of Economic Literature, vol. 35, pp. 1244-1270.

Rasmus, F., & Hutchinson, M.M. 2003. Effectiveness of Official Daily Foreign

Exchange Market Intervention Operations in Japan. National Bureau of Economic Research Working Paper 9648, p. 1-5.

Vikas, K., & Yan, I. 2006. Real Exchange Rates and Productivity: Evidence from

Asia. Mimeo: University of Hong Kong Press.