- Introduction

- Background of the Company

- Emirates NBD’s HRM Activities to Managing its Staff

- Theoretical Perspective HR During and After Merger

- Rationales of the Topic

- Theoretical review of the leadership approach to manage people

- Details of Approach Taken By the Emirates NBD

- Evaluation of the Emirates NBD Leadership Approach

- Appropriate recommendations grounded in evaluation

- Reference List

Introduction

To investigate with the nature and practice of human resource management in an organisation, this paper has organised with the HRM strategy of the Emirates NBD Bank PJSC as the author of this paper has a saving account in this financial institution and a lot of friends and family members are working there.

Background of the Company

The Emirates NBD was organised as the most dominant in the GCC region in 2007 by merging two leading banks of UAE named Emirates Bank International (EBI) and National Bank of Dubai (NBD) and turned into the banking champion with around 141 branches and 740 ATMs and conducting retail and wholesale banking with dynamic financial performance.

As a socially responsible financial institution in the UAE, Emirates NBD is serving the local communities with charity, education, and environment by upholding the cultural heritage of UAE through its 8,000 employees originated from 50 different countries, as a result the company evidenced turned into the biggest and most culturally diversified organisation in this region UAE.

The mission of the company has aimed to deliver value-added management solutions that would finally create exceptional value for its customers, employees, and shareholders while the vision of the company is to turn into the marvellous Service provider in the financial industry along with the property market (Emirates NBD 2013).

Emirates NBD’s HRM Activities to Managing its Staff

The Gulf News (2012) and the Reuters (2012) reported that the largest bank of UAE Emirates NBD would conduct fire 15% of its employees; the board of management has confirmed this job cutting with the intention to attain a huge cost saving and the employees have already noticed to move the organisation.

During the merger of EBI and NBD in 2007, the employees have evidenced huge redundant due to both the hard and soft approach, but five years later in the post-merger era such decision generated fear, uncertainty and instability to the workplace environment and the threatening workforce engaged to demonstrate their highest performance to rescue themselves from this pressure.

The Oracle (2013) explored that the bank has decided to integrate Oracle technology to reduce HR cost by integrating different software solution and it has already adopted ‘Oracle E-Business Suite Release 12’ that assist the company an automated process for workforce planning, recruitment, training, payroll, performance measurement and more than an HR team performs.

At the same time, the integration of new technology is a positive attribute of an organisation, but cost-saving through employees’ layoff is a syndrome inherited from the merger process, therefore, it is essential to investigate the theoretical outlook to the HR perspectives in the post-merger stage

Theoretical Perspective HR During and After Merger

Schuler and Jackson (2003) argued that in the present age of globalisation merger is enormously applied to reinforce and sustain the market position allowing it as a relatively speedy and resourceful path to enter into the new markets, incorporating with new technologies along with organisational innovation though there is no assurance to succeed a merger.

On the other hand, the majority of the mergers became unsuccessful in achieving their stated goals and objectives as the process involved with abundant of social costs, numerous job cuts, omitted income of the communities, and decrease taxes in the operating country, such social costs would be tolerable to the stakeholders while the merger results in triumphant outcomes.

The cause of merger letdown lies beneath the financial issues along with market factors even as previous studies demonstrated that most of the mergers comedown due to deficiency of systematic approach to the diverse dynamics of human resource management and its amalgamation in the pre and post-merger stage where culture, leadership, and communication have also significant effect (Bhaskar 2012).

Bhaskar (2012) pointed out that at the pre-merger state the HR specialists of the acquiring organisation would analyse the soft and hard aspects of the organisation that indented to merged, the hard aspects incorporated with staff member’s compensation, bonus, pension, health insurance and dismissal reimbursement while the soft factors incorporated with culture, performance measurement decision-making process and organisational values.

At the post-merger stage, the HR issues become the focal point in order to establish a HR strategy for the combined employees and designing their organisational role, position, pay structure, communication integrating with the new vision and objective of the merger while skills, capabilities, engagement would be taken into account for decision making (Bhaskar 2012).

Rationales of the Topic

Emirates NBD (2007) pointed out that the objectives of merger between the Emirates Bank International (EBI) and National Bank of Dubai (NBD) was to boost financial strength and capabilities in order to become top leader of financial industry both in the domestic market and GCC region by highest utilisation of the organisational resources through a cost-effective measures.

At the first phase of it has evidenced that the merged management has aligned to cutting remarkable jobs as an implication of their cost-saving strategy, at the same time Emirates NBD engaged in providing training for skills development and improving leadership quality (Emirates NBD 2013).

During the merger, most of the leadership in diverse department were expatriates, but in the post-merger era the company has been keeping continuous effort to developing the leadership from the UAE Nationals replacing the expatiates, for instance, Wahed Al Fahim a manager of Wholesale Banking has promoted as the Group Deputy CEO of the bank (Emirates NBD 2009).

Similar leadership development initiatives also evidenced in the consumer banking, wealth management, and IT department where the lower level to management team members jumped to the top level without experiencing the mid-level positions; therefore, the process of leadership development in the Emirates NBD under question mark and necessitate to have a study in this regard.

Ghad (2012) pointed out that Emirates NBD in order to improve the capacity building skills of its team members has initiated a ‘Managerial Leadership Program’ with the collaboration and direct supervision Harvard Business School that organised participation focused learning scheme to generate leadership capabilities integrating with the business model of the bank.

Most importantly, the training scheme generally addressed three major issues such as ‘personal leadership, ‘team leadership’, and ‘execution leadership’ next to peer-to-peer learning method conducted by the specialist moderators from Harvard, but failed to integrate the existing senior leadership involvement in this workshop (Satyam 2013; and Ghad 2012).

As a result, the leadership development program of Emirates NBD turned into an academic discussion rather than skills transfer from the senior management leaders; consequently, leadership development scheme exists with huge gaps (Satyam 2013; and Ghad 2012). Thus, to address the existing leadership gaps in the operation of Emirates NBD, it is rational to conduct a study with ‘Leadership approach to managing people in the post-merger situation of Emirates NBD’.

Theoretical review of the leadership approach to manage people

To assess the nature and practice of human resource management and leadership approach to manage people at the post-merger situation of Emirates NBD, it is essential to discuss different leadership style, such as autocratic, situational, participative, and transformational leadership approach.

Autocratic Leadership Approach

This is one of the oldest and rigid styles; moreover, this approach based on the centralisation of power for which the leaders have full control over all decisions (Cherry 2013; Withers 2013; Lester 2013; and Weihrich & Koontz 2010). The decisions of the leaders do not reflect the opinion of the groups as the managers seek to wield absolute power over the employees (Cherry 2013; Withers 2013; Satyam 2013; and Weihrich & Koontz 2010).

In addition, the leaders provide more attention on the task accomplishment though they would like to inspire the employees by punishing poor performers along with gratifying top performers; however, the managers direct all the work methods and processes (Cherry 2013; Withers 2013; Robbins & Judge 2004; and Weihrich & Koontz 2010).

However, this approach gives the opportunity to take prompt action to minimise financial risks; however, Emirates NBD had not followed this approach at the time of restructuring the human resources considering disadvantages to the employees.

Participative Leadership Style

This approach is also known as democratic leadership; however, the leaders of the modern era follow this approach in some extent considering the fact that it helps to motivate the employees to meet the missions and vision of the company (Cherry 2013; Withers 2013; Robbins & Judge 2004 and Weihrich & Koontz 2010). However, the main features of this approach include:

- Consider the feedback and opinion of the stakeholders:

- Encourage the associates by sharing the ideas though the leaders enjoy the decision-making power (Cherry 2013; and Withers 2013);

- Help the employees to balance family and work-life (Withers 2013; Robbins & Judge 2004 and Weihrich & Koontz 2010);

- The employees get the opportunity to share their thoughts to higher productivity (Cherry 2013; Lester 2013; and Withers 2013);

- Top management teams trust the staff and give freedom (Lester 2013)

Situational Approach of Leadership

At present, most of the leaders of the organisations focus on this approach in order to meet the challenge of extensive competition due to the effect of globalisation (Robbins & Judge 2004; and Weihrich & Koontz 2010). In addition, consultants and the researchers have suggested to the leaders to take measure in accordance with the needs of the subordinates, customers and stakeholders of the companies (Robbins & Judge 2004; Withers 2013; and Weihrich & Koontz 2010).

The behaviour of the management would vary for the different situation taking into account external and internal factors, attitudes of the subordinates, organisational culture, and diversity management and so on (Robbins & Judge 2004; and Weihrich & Koontz 2010). Here, it is essential to note that the leaders are taking into consideration present position of the organisation to motivate the employees; therefore, this style can play vital role to shape the Emirates NBD bank for the future development.

Transformational Leadership Style

Hall, Johnson, Wysocki & Kepner (2001) stated that this approach helps companies change and transform the people by considering motives of the subordinates, satisfying their needs, and valuing the employees of the organisation.

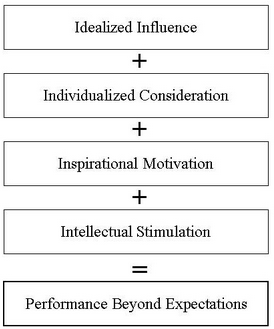

However, the CEO of Walmart had applied this approach with intent to appreciate employees with praise and performance level of the employees to make the company successful in competitive business environment (Withers 2013; and Hall et al., 2001). In addition, there are mainly four factors to transformational leadership (Robbins & Judge 2004; Weihrich & Koontz 2010; Hall, et al. 2001); however, the following figure gives more details:

The leaders who follow this approach always consider collective vision by communicating with the employees to reflect the opinion of them on the decisions regarding the development of the staff and company; in addition, the leaders inspire the workforce to be more innovative to attain organizational objectives, and values (Hall, et al. 2001).

However, the main objective of this approach is to boost organizational performance, empower the employees, and listens to all viewpoints (Robbins & Judge 2004; Weihrich & Koontz 2010; and Hall, et al. 2001); therefore, the management of Emirates NBD can consider this approach in some extent.

Details of Approach Taken By the Emirates NBD

Emirates NBD (2009) pointed out that during the merger, the top management leadership were organised with twelve directors equally came from Emirates Bank International and National Bank of Dubai, under the chairmanship and direct supervision of Ahmed Humaid Al Tayer while the leadership team composed with top banking sector executives like Rick Pudner, Sanjay Uppal, Shahzad Shahbaz and Joyshil Mitter.

Although the full members of the board of directors are UAE nationals, but the merged board of directors appointed all the top executive leaders from expatriates due to their exceptional leadership attributes in the banking sector with successful record of accomplishment.

In every case of merger and acquisition, there is evidence of restructuring the human resource by reducing the number of employees, in case of Emirates NBD engaged to restructuring its HR with the aim to retain best talents from the two organisations who are most proficient to match the shifting dynamics and capable to carry out new objectives.

Ghad (2012) pointed out that the most outstanding approach for leadership development taken by the Emirates NBD was ‘Managerial Leadership Programs’, at the first phase the MLP has offered to the selective employees of the bank and conducted by the most proficient management professionals from the Harvard Business Publishing.

The MLP was designed to provide leadership attribute among the participants by learning and doing from mutually from the theoretical perspectives as well as practical implication and the learners were obliged to teach their learning outcomes to their co-workers at the workplace.

MLP provided the trainee leaders with depth insight of the leadership competence to analyse the banking sector’s business model, process of constructing a business plan, designing strategy, improve communication skills with appropriate direction and motivation to pursue the organisational objectives and to attain further potentiality for individual performance.

The MLP program mostly exposed with three major components of leadership first one is ‘Personal Leadership’ that addressed technical, psychological, and moral enlargement of the participants to progress individual persistence, skill, and performance with strong technical know-how, positive attitude to the co-workers and self-awareness to uphold the short and long-run organisational objectives of the Emirates NBD.

The next model of Emirates NBD leadership development program integrated the ‘Team Leadership’ by differentiating the leadership and management it urged that managers manage organisational tasks while leader leads people organising them into different groups providing planning and direction to efficiently influence the team members within a positive approach to motivate team members to uphold organisational objectives.

The third approach of leadership at Emirates NBD training program presented ‘Execution Leadership’ that is a leadership action model pointed it as a hard work every day performed duty and a psychological engagement for lifelong hardworking that ultimately motivate the group members to achieve settled goals by avoiding all for inconsistencies and hypocrisy.

Evaluation of the Emirates NBD Leadership Approach

Following the merger, the management of Emirates NBD has aimed to restructure its human resource combining the members of both the previous banks with intention to retain best talents and layoff the unskilled and stringent employees who are not competent uphold the changing dynamics of the organisation.

There are some risks associated with the downsizing or layoff initiatives of Emirates NBD, most of the employees are afraid that anyone could lose his job due to the impact of merger, thus it is essential for the bank to place a clear understanding among the employees to rescue them from survivable syndrome and to ensure smooth performance of HR.

In addition, the integration of most modern ERP solution through ‘Oracle E-Business Suite Release 12’ would generate a tremendous cost-saving by automating its staff planning, recruitment, payroll, training, and performance appraisal, at the same time such automation would reduce the necessity to have large HR team, which may generate further job cuts in the organisation.

At the same time, the technological progress reduce the insolvents in the operation and Emirates NBD has nothing to do from the business viewpoint, but from its corporate social responsibility, the bank could provide some opportunities for replacement or self-employment for the laid-off employees.

Undoubtedly, the leadership development approach of Emirates NBD through ‘Managerial Leadership Program’ is an admirable step that makes greater dynamics of the leadership, but promoting the lower lever team members to the top managers without touching the mid-level is not appreciating.

Appropriate recommendations grounded in evaluation

From the above discussion, it can be said that the leaders face many challenges to managing people of the Emirates NBD because the employees of two companies are joining and working on a new environment for the merger; therefore, this report suggests the leaders the possible ways to managing people of this organisation:

- The leaders of this company should select proper processes for Human Resource Planning in order to determine the demand of human resources to perform the task of personal banking, priority banking, business banking, and so on; at the same time, they need to assess supply of the employees, required qualification, and so on;

- The management team of Emirates NBD had not concentrated more on the research to develop diversified working environment for which they failed to enhance mental strength of the employees inn some extent; so, they should allocate budget to conduct more research on the employees to bring cultural change successfully;

- At the same time, the top management should focus more on the organisational culture to remove distinctiveness of different kinds of humorous practices with the people of different social and cultural background since more than 60 percent of the total workers have come from foreign countries. In this case, the management should respect the cultural divergences to develop a good job place environment;

- In addition, it is essential to prepare a plan to focus on knowledge-based education programme for the employees to deal with advance technology to compete with international players in the marketplace;

- On the other hand, this bank had taken many initiatives in order to reduce the number of workers, such as, adopt new technology to serve the purpose of human resource department. However, the leaders of this bank should more careful before making decisions related with downsizing or layoff as the employees face mental pressure to loss their job; in addition, they must have to take measure to save the staff from the trauma of the job terminations and the concept of survivor syndrome at the time of downsizing of the bank;

- Most importantly, the management should give more power to the employees to deal with different problems in the spot for which Emirates NBD will be able to satisfy more customers;

- The executives must concentrate on the communication and motivation process, career objective, training programmes, thoughts of the employees, feedback and so on;

- The leadership approaches of this bank should be more liberal and democratic to ensure the rights of the human resources and respect their opinion in case of decision-making.

Reference List

Bhaskar, A. U. 2012, ‘HR as Business Partner during Mergers and Acquisitions’, Human Resource Management International Digest Journal, vol. 20, no. 2. Web.

Cherry, K. 2013, What Is Autocratic Leadership? Web.

Emirates NBD 2007, EBI and NBD Merge to Form Emirates NBD Creation of a UAE Champion. Web.

Emirates NBD 2009, Emirates NBD promotes 4 UAE National Management Members to key leadership positions in the Group. Web.

Emirates NBD 2013, About Emirates NBD. Web.

Ghad, A. A. 2012, Emirates NBD Partners With Harvard Business Publishing In Leadership Development. Web.

Hall, J. Johnson, S. Wysocki, A. & Kepner, K. 2001, Transformational Leadership: The Transformation of Managers and Associates. Web.

Lester, C. N. 2013, Leadership Styles – a key to effectiveness. Web.

Reuters 2012, Emirates NBD plans 15% job cut this week. Web.

Robbins, S. & Judge, T. 2008, Essentials of Organizational Behaviour, Prentice Hall, London.

Satyam, M. 2013, Emirates NBD Bank’s Upgrade Automates Workflows, Streamlines Human Resources Management, and Makes Employee Performance Analysis 80% Faster. Web.

Schuler, R. S. & Jackson, S. E. 2003, HR issues, activities and responsibilities in mergers and acquisitions. Web.

The Gulf News 2012, Emirates NBD plans to cut as many as 700 jobs. Web.

The Oracle 2013, Emirates NBD Leads Human Resources Technology Revolution Across the United Arab Emirates. Web.

Weihrich, H. & Koontz, H 2005, Management a Global Perspective, Tata McGraw-Hill, New Delhi.

Withers, J. 2013, What Is Autocratic Leadership? Web.