The article by Apostolou et al. reports a study aimed at assessing the relative importance of management fraud risk factors as perceived by a sample of 140 auditors. The sample consisted of 43 Big Five auditors, 47 internal auditors, as well as 50 auditors from local or regional organizations; the 25 risk factors (or “red flags”), the relative importance of which was assessed, were taken from the Statement of Auditing Standards #82 (1-2). It is stressed that, according to a number of researchers, understanding the relative importance of the named factors is critical if the system of standards that are utilized to perform the fraud risk assessment process is to be made more effective (Apostolou et al. 2). Therefore, the main research question that the study was aimed at answering might be formulated as follows: “According to the opinions of practicing auditors, what is the relative importance of the 25 risk factors of management fraud as identified by the Statement of Auditing Standards?”

The authors utilized the Analytic Hierarchy Process in order to carry out the assessment of the data gathered from the selected sample of auditors. However, it is apparent that the authors did not formulate any hypotheses pertaining to the importance of the named factors, for all the factors were regarded as approximately equal in the Statement of Auditing Standards #82 (qtd. in Apostolou et al. 1). And yet, to assess the findings of the test and compare the relative importance of the factors as they were perceived by the different groups of respondents, the authors conducted a number of multivariate analyses of variance (MANOVAs) (Apostolou et al. 15), for which null hypotheses and research hypotheses can be formulated; these will be discussed below.

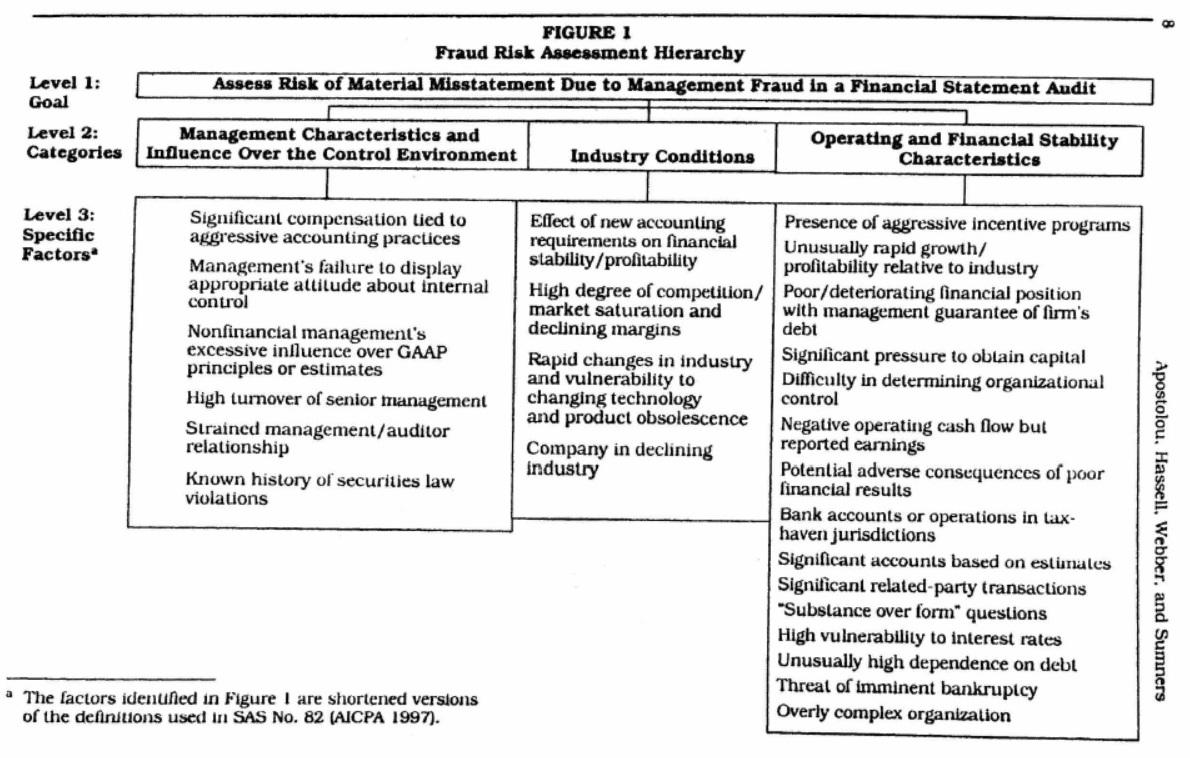

As a method, the author employed the Analytic Hierarchy Process, which is a mathematical tool that allows for systematic decision-making aimed at solving complex problems and is based on a hierarchical model that assesses the given decisions by assigning the coefficients of their relative importance as identified by the analyst and assessed by the subject via comparing them pairwise (Apostolou et al. 4-6). The method carries out the comparison on three levels. On the first levels, the goal of the comparison is formulated. On the second level, the categories of assessed factors are specified; the respondents make pairwise comparisons of the importance of these categories.

On the third level, the specific factors are weighted by the subjects; they make pairwise comparisons of all the specific factors (Apostolou et al. 7). The method produces not only the coefficients of the relative importance of the compared factors but also an inconsistency ratio, which estimates the inconsistency of answers provided by the respondents. This is needed due to the fact that daily judgments made by people very often do not meet the criterion of consistency; it is also stressed that because of this, a certain degree of inconsistency is acceptable for a model (Apostolou et al. 7).

The grouping of the 25 factors the relative importance of which was weighted is displayed in fig. 1 below.

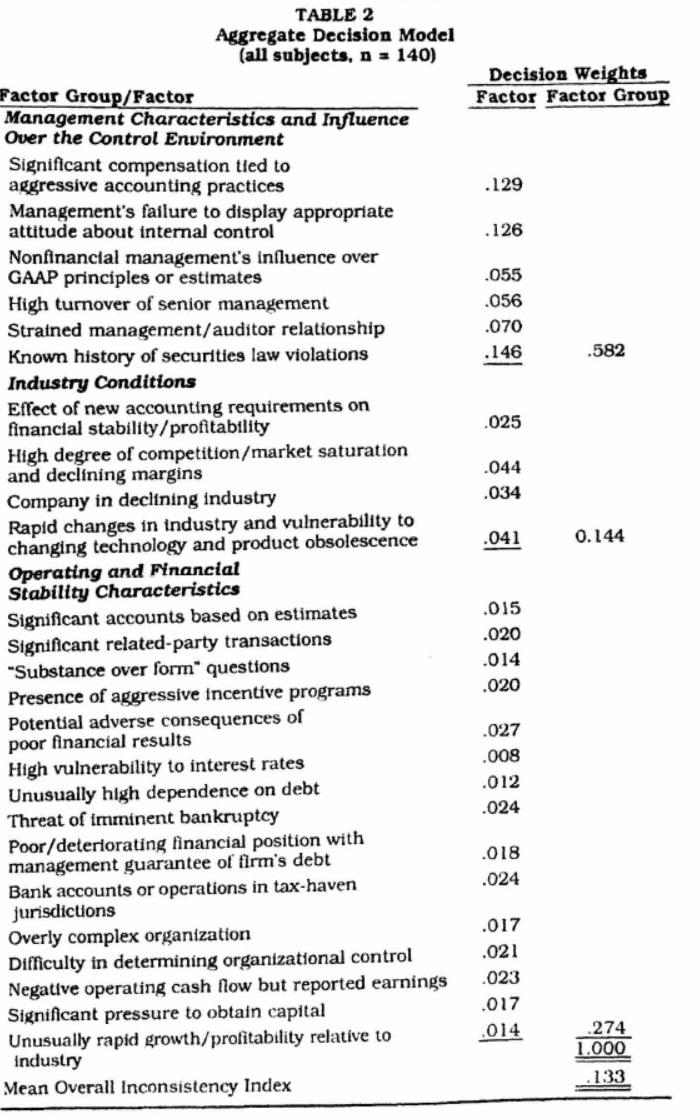

The overall results of the analysis can be found in fig. 2 above. These findings indicate that the respondents assigned the greatest importance to the group of factors which was labeled as “management characteristics and influence over the control environment”; on the whole, out of the 100% of the total possible weight of factors, this group of factors accounted for approximately 58.2% of the weight of the model (Apostolou et al. 11). Simultaneously, the category “industry conditions” was responsible for 14.4% of the total weight of the importance of factors in the model, whereas the category “operating and financial stability characteristics” accounted for 27.4% of the total weight (Apostolou et al. 11). It is interesting to observe that, while the “management characteristics…” category consisted only of 6 factors, it weighed more than twice as much as the category “operating and financial stability characteristics,” which comprised 15 factors; in addition, it weighed nearly four times more than the “industry conditions” category, which consisted of four factors (Apostolou et al. 11).

If one goes into more detail, it is worth pointing out that three factors from the “management characteristics” group accounted for 40.1% of the total weight of all the assessed factors (Apostolou et al. 12). More specifically, the factor labeled “known history of securities law violations” weighed as much as 14.6% of the total model, which is more than the whole “industry conditions” set of factors (Apostolou et al. 12). Next, the factor “significant compensation tied to aggressive accounting practices” weighed 12.9%, whereas the factor “management’s failure to display appropriate attitude about internal control” accounted for 12.6% of the total weight of the model (Apostolou et al. 12). Other very important factors include “strained manager/auditor relationship” (7%), “high turnover of senior management” (5.6%), and “nonfinancial management’s influence over GAAP principles or estimates” (5.5%) (Apostolou et al. 12). It should be noted that the overall inconsistency index was 13.3%, which ought to be acceptable due to the fact that the assessment judgments were made by people rather than derived from some formal theoretical procedures (Apostolou et al. 7).

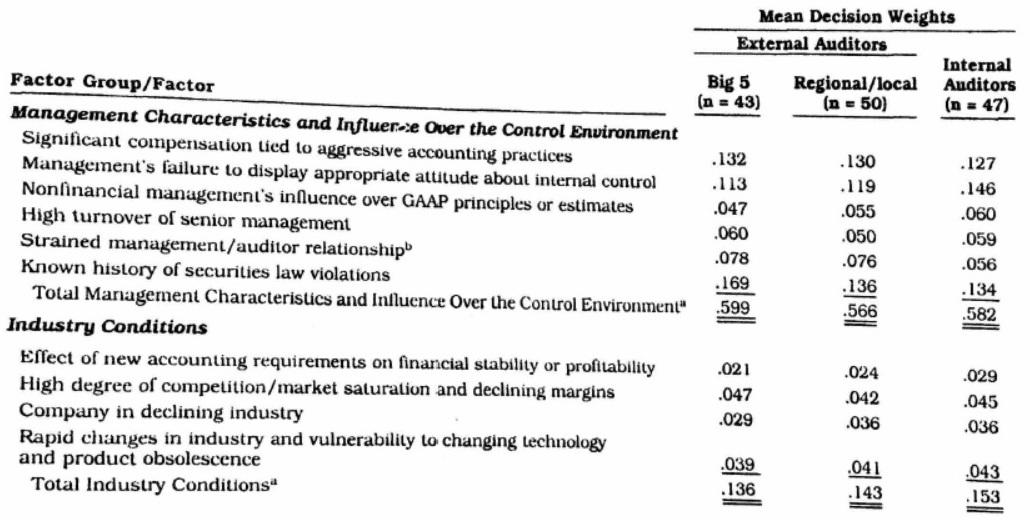

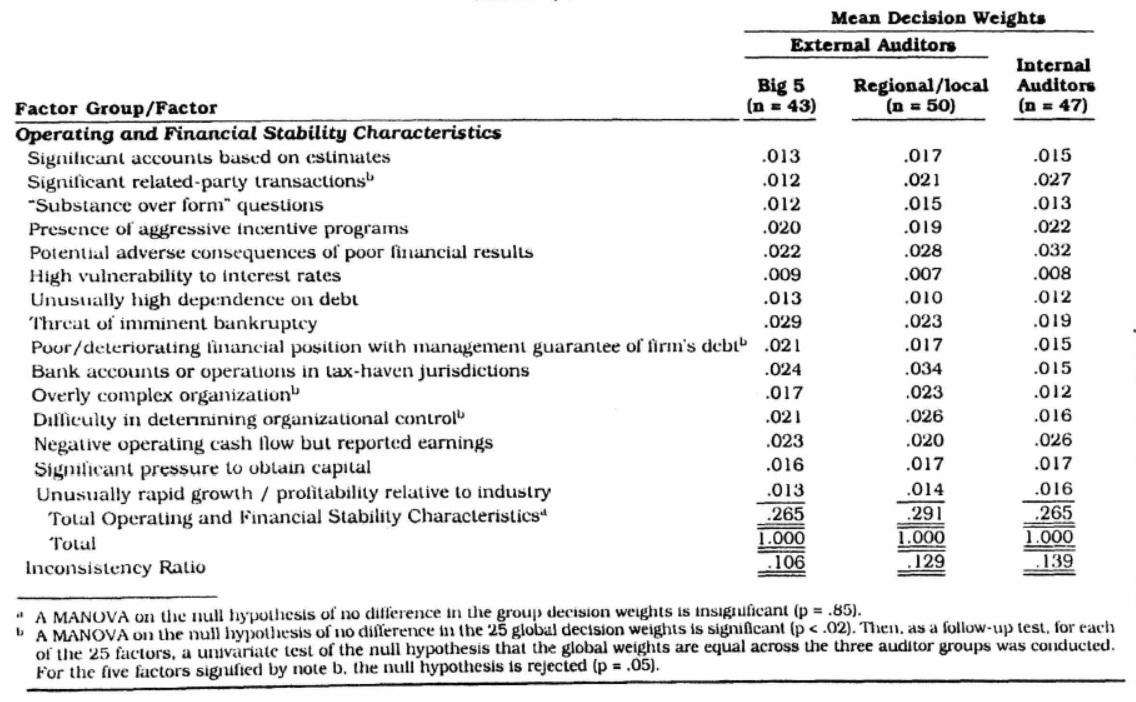

Apart from these general results, the authors of the article also provide the output of the analysis for separate groups of auditors (Big Five auditors, internal auditors, and auditors from local or regional organizations). These findings can be found in fig. 3 and 4, which are provided below.

From Fig. 3 and 4, it might be possible to assume that the preferences of the three groups of auditors were often similar. In order to better assess this claim, the authors of the article carried out a MANOVA comparing the weights of the three categories of factors among the three different groups of the auditors who were the respondents of the study (Apostolou et al. 15). The null hypothesis of the test was that there was no difference in the preferences of the three groups of auditors pertaining to the categories of factors. The null hypothesis was not rejected (p=.85), so the mean preferences of the different auditors did not differ significantly (Apostolou et al. 15).

Another MANOVA testing the null hypothesis of no difference in the preferences about separate factors among the three groups of auditors was also carried out. This time, the null hypothesis was rejected at p=.02, and evidence was found to support the alternative hypothesis that the three groups of auditors had different preferences regarding the 25 management fraud risk factors. A number of univariate tests (ANOVAs on the transformed variables and Kruskal-Wallis test on the non-transformed variables) displayed significant (p<.05) differences in the preferences of the three groups of auditors regarding 5 out of 25 management fraud risk factors (Apostolou et al. 15).

Even though the authors do not provide the effect sizes, they simply state that the practical difference between the preferences, even though it was statistically significant, was not large; the greatest difference was 3.5%. The researchers conclude that all three groups of respondents approximately equally evaluated the relative importance of the three categories of red flags, even though there were very small differences in a number of individual management fraud risk factors (Apostolou et al. 15). On the whole, the authors state that there were no practical differences between the relative importance of the 25 individual red flags (Apostolou et al. 17).

The authors’ contribution to the management fraud risk audit is considerable due to the fact that it allows for the creation of more precise and effective protocols that are to be used by practicing auditors. As was noted above, the Statement on Auditing Standards considers it a difficult task to assess the relative importance of these factors, leaving the practicing auditors without concrete guidelines (qtd. in Apostolou et al. 1). It is clear that the results of the discussed study have a major practical application, for they permit practicing auditors to more easily and effectively conduct their analysis by letting them know which factors should be looked at first.

Work Cited

Apostolou, Barbara A., et al. “The Relative Importance of Management Fraud Risk Factors.” Behavioral Research in Accounting, vol. 13, no. 1, 2001, pp. 1-24.