Introduction

Marketing is both an art and a science; it is an evolving discipline that embraces a wide variety of concepts guidelines approaches and ideas. An effective financial marketing campaign results from the proper execution and balance of variety of disparate elements. It is a process by which decisions are made in a totally interrelated changing business environment on all activities that facilitate the exchange in order for the targeted group of customers to be satisfied and for the defined objectives to be accomplished (Hisrich, 2000, p. 3)

The main objectives of every firm or industry are to maximise a profit. A profit is given by revenue minus total cost. The amount of profit that a firm makes is dependent on two things: total sales and the price of the product. A firm can increase profits by either reducing number of units sold per item and increase unit price per item or reduce prices per unit and increase sales. This is according to the law of demand that states, “… the higher the price, the lower the demand of goods and services, and the lower the price, the higher the demand keeping all other factors constant” (Lamp, 2007, p. 68). This means that for a firm to make more sales of a product, it must lower the price of that product.

Consumer

A consumer is the end user of a product or service, or an individual who buys a product to consume or a final user. Consumer seeks to maximise his/her utility from consumption of a commodity. Utility is defined to be the satisfaction gained by consuming a good or service. Consumer maximises utility if the amount of money is equal to the value of the good purchased. A consumer is the most important part of the external environment of an industry that seeks to maximise profit. Without a consumer, there is no market and therefore no need of marketing (Hutt 2012, p. 19).

Financial service

These are service offered in the finance sector of every economy. The major players in this sector are banks, financial institutions, non banking financial institutions, deposit taking financial institutions, investment institutions, etc. They facilitate and coordinate financial market and control the level of circulation of money in every economy across the globe. There is a great need to enhance the operations of these industries for a better economy as the economy growth highly depends on the financial services sector. In order to do a good marketing, we need to understand the consumers and their needs.

Marketing is widely recognised as being a key success for any organisation irrespective of its size or the sector of the economy in which it operates. At one level, it is a generic term used to describe a range of distribution (Mike and Walkin 2001, p. 1)

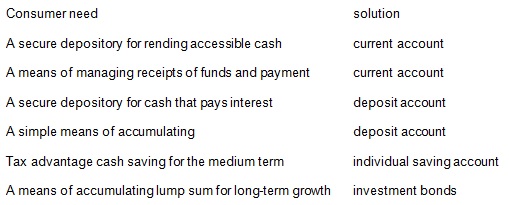

In marketing, it is necessary to understand the consumer’s needs in order to offer solutions to consumer problems. Some of consumer financial needs and solutions are as follows:

Things to consider while marketing financial services

- What is the product? – This is the consideration of what to produce, e.g. the product missing in the market.

- How will it be produced? – These are the cost effective mechanisms of production to ensure minimum cost.

- Who is likely to buy the product? – This is the identification of market gap and the consumer needs in the market.

- What is the competition level in the market? – This is the number of the firms in the market that sells similar commodities.

- Any laws and regulations affecting it? – These are the control measures of the government, e.g. in sale of alcohol government restrict the sale of alcohol to a person under the age of 18 years.

- Will the product be profitable? – This is the cost benefit analysis done before introducing product in the market.

- How to communicate the product in the market? – This is deciding the best mode of advertising the product (Roy 2005, p. 3).

Goals of Financial Services Marketing

Market confidence is one of the reasons as to why financial services marketing are important to ensure confidence in the financial service sector of every economy. Consumer requires financial service provision in which they bestow their trust. This helps to avoid financial crisis in an economy.

To create public awareness, public awareness is necessary for the general public to have knowledge of existence of such services. Public needs to know which institution offers what services, because different institution offers different products, e.g. investment bank offers a loan for investment, whereas depository institutions only take deposit for a given period of time as agreed upon by the customer and the institution.

Consumer protection: financial services marketing is done to enhance consumer protection by giving consumers information regarding different financial institutions. Consumer will be aware of a non-performing institution to avoid them.

Reduction of financial crimes is done to reduce the extent to which it is possible for a business to be used for the purpose connected to financial crime.

Financial Services Marketing Concept

These concepts include, market segmentation; this involves dividing market in to small segments to be able to offer services according to segment needs. Another concept is the market targeting; this is the ability to identify market niche, and the population that requires the service such as creating an account for children only.

Positioning is the ability to position a financial firm in strategic position, having considered all the surrounding factors (Hutt, 2012, p. 195).

According to Lamp (2011), Office Suppliers, Inc. maintains its FILEX brand to differentiate its products from those of the competitors. This strategy protects the company from losing market share to competitors. The company is therefore able to improve the brand value of its products by improving their quality and pricing criteria. This strategy keeps the business in the target markets and secures a substantial market share for future success of the company (Lee, 2005). OSI’s offers a variety of products to satisfy customers’ needs and wants. The products include indexing systems, file markers, file folders, and file labels. The products vary in type, color, and size to satisfy the different tastes and preferences of consumers and to provide the business with competitive advantage. OSI’s has a wide distribution system that extends to local stationers, regional stationers, and Business Center, Inc. The regional stationeries are more than 10 and make up 40% of OSI’s total sales. The local stationers consisting of more than 40 retail and wholesale make up 30% of total sales. The Business Center, Inc makes up 30% of the total sales in its more than 150 stores (Harrel, 2008).

The pricing criterion of OSI’s ensures high profit margins of more than 35%. These high profits help the business to grow fast. OSI’s offers high brand recognition and quality of its products to attract and maintain potential customers, such as Business Center, Inc. The company is consistent in producing large volumes of products to ensure their availability to customers. OSI’s reduces the costs of operation as possible while maintaining the quality to reduce the prices of its products. This creates high profits and competitive advantage for the business. OSI’s invests most of its resources in new and existing product development to ensure strong brand value and image in the target markets. The company also invests in advertising and other promotional activities to communicate to potential consumers about its products, locations, and new product features. This attracts potential consumers to purchase its products increasing its market share, profits, and sales (Lamp, 2007).

Social Economic Activity of Financial Service

Financial service sector has a key role to play and where its activities have significant implication on economic wellbeing. They include the following.

The management of the risk

The important aspect of how financial service organisation furthers the cause of economic development is through the means to manage risk.

Health insurance and life assurance are the effective means of enabling individual and organisation to take a risk associated with economic advertisement (Ennew and Nigel 2007, p. 9)

Steps in Financial service marketing

The first step is establishing objectives. Objectives of this type of marketing should be in a light of a going concern. This means that the marketing should show that there is no intention of closing down in the near future. There are several types of objectives to consider the common ones, such as corporate objectives and marketing objectives (Hisrich 2000, p. 3)

Pricing

As we have seen at the beginning, price is a crucial factor in determining the sales of a product. In marketing determining, a fair price is a crucial role in making profit. Fair price attracts customer while high price drive them away (Tina, 2006).

Planning

It involves planning on how to carry out the whole process of marketing. It uses strategies such as advertising, giving free samples, promotions, and offering after sales services.

Cost analysis

This is determining the cost of advertising 1 unit of a product as compared to revenue gain.

When marketing services of your financial institutions, you should clearly explain to customers the critical services available, such as lending and credit, which involves explaining clearly on such loans as unsecured loans, secured loans, mortgages, remortgaging, overdrafts, and release schemes.

Unsecured loans

They are type of risky loans offered without requirement for a collateral, mostly given by microfinance institutions to poor customers who cannot access collateral. Its advantages are no need for a security, low interest rate charged, and highly accessible.

Secured loans

These are the financial services offered by banks; for one to access this type of a loan, one requires a collateral; the amount received is limited to the market value of collateral (Lee 2005, p. 106).

Mortgages

This type of a loan is offered to individuals who want to own a house.

Remortgaging. It applies where homeowners wish to replace an existing mortgage with one from another lender.

Overdraft

This is a short-term loan usually lend overnight and earns a higher interest rates. Skills learnt and application: Having learnt marketing, I have gained professional techniques of marketing such as advertising, quality customer services, and fair pricing. These skills should be used to make good sales for the company.

Conclusion

Financial services in any economy are of crucial importance for a smooth running of the economy. For efficient provision of these services, we require efficient financial institutions. Marketing is essential for the efficient operation of the institutions. The skills learnt in this course are crucial in application of marketing. Several benefits are accrued to the firms that conduct professional marketing as a strategy to enhance their sales. These benefits include increased sales, gain consumer confidence, and establish a well known market for their products (Wessels, 2006).

On the government side, government makes extensive use of financial services instruments as a means of managing public finances. All countries use government bonds as a means of controlling money supply in the economy. Government achieve this goal through the use of financial institutions and banks (Ennew and Nigel 2007, p. 11)

The financial service has a vital role to play in safeguarding the prospect for economic development across the globe. It is necessary for firms to employ the means of marketing in order to maximise sales.

List of References

Ennew, C & Nigel, W 2007, Financial service marketing: An international guide to principle and practice, Elsevier Limited, London.

Harrel, G 2008, Marketing: Connecting with customers, Chicago Education Press, Chicago.

Hisrich, R 2000, Marketing, 2 ed. Barons Education Services, New York.

Hutt, M 2012, Business Marketing Management: B2b, Sage Publication, California.

Lamp, C 2007, Marketing, Cengage Learning, New York.

Lamp, C 2011, Essentials of marketing, Cengage Learning, New York.

Lee, M 2005, Principles of advertising: A global perspective, Routledge, London.

Roy, R 2005, Marketing planning for financial services. Gower Publishing, London.

Tina, H 2006, Financial marketing: Business and economics, Pearson Education Printing, New Jersey.

Wessels, WJ 2006, Economics, Barons Education Services, Scotland.