Opportunities and Barriers for Global Corporations’ FDI Activity in Kuwait

Every nation can benefit from Foreign Direct Investment (FDI). It suits a country’s economic development and raises citizens’ living standards (Liang et al., 2021). Regarding these potential benefits of FDI, it is a possible opportunity to help Kuwait develop its economic system and identify barriers preventing the country from leveraging the significant benefits of FDI. The government has made tremendous strides to enhance its FDI inflows.

For example, Oredoo Company was a Kuwait telecom company named Wataniyah. Now, it is owned by Qatar as part of the country’s overseas investment (Alduwailah, 2018). The Kuwait International Airport Terminal 2 is also a significant project to promote overseas investment in the country. The project was intended to increase the airport’s capacity and support the growing demand for air travel into the country. Ultimately, it will enhance enconimic growth by providing a reliable transport system, a positive sign to promote overseas businesses.

The Growing Importance of Foreign Direct Investment (FDI) in Kuwait: An Analysis of Official Statistics

A country’s economic growth is a multifaceted process that relies on several factors and capabilities to attain substantial growth for its population. Every economy must embrace several investment platforms and diversify resources to succeed (Liang et al., 2021). However, this is not the case in Kuwait. It is a small oil country located in the Middle East. Oil has been the primary resource that drives the state of Kuwait’s economy.

It has relied on this for several years with little developments that cannot support drastic economic growth, with evidence showing that oil holds over 50% of the country’s GDP (Gelan et al., 2021; Jaber, 2022). At the same time, it is the country’s leading export, with over 90%, and the country’s top government revenue source, accounting for about 90% (Gelan et al., 2021; Jaber, 2022). This overreliance on oil and gas has also impacted its ability to promote the development of the private sector.

The fluctuation of oil prices and reliability to sustain Kuwait’s economic growth and sustainability are at risk. Kuwait’s heavy reliance on oil makes any fluctuation and changes to its revenue growth a significant threat that can impede Kuwait’s economic growth at any moment (Shehabi, 2022). The pandemic impacted the overall economic conditions of the entire globe, exposing individuals to lower issues of lower income to reduce their purchasing power.

By April 2020, studies showed that the oil demand was falling drastically, decreasing by about 30% from what was observed a year later (Shehabi, 2022). This massive drop has not occurred in the history of oil demand. In addition, the pandemic disrupted the typical mobility of this product from producers to customers, enhancing the difficulty for customers in accessing them in their various sections. Consequently, there is a high rise in prices due to low supply, with 2020 receiving the lowest prices due to the impact of COVID-19.

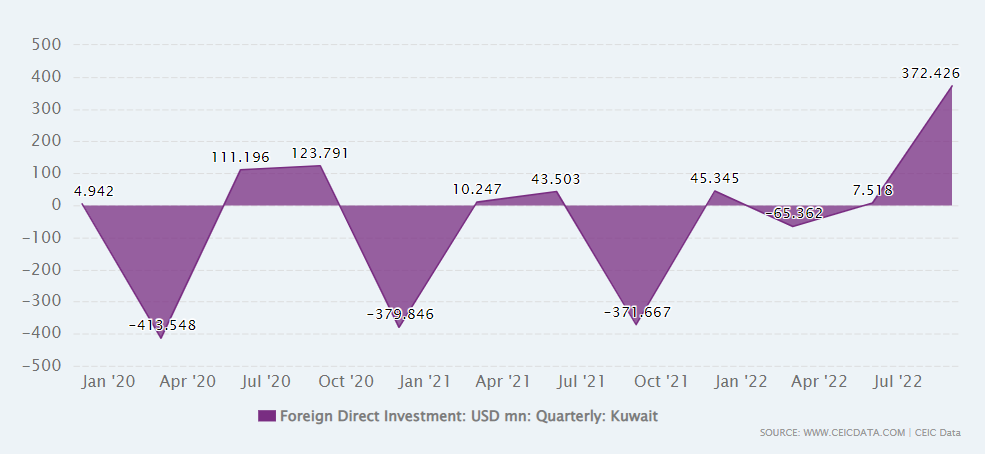

FDI inflows can help diversify the economy and reduce the country’s dependence on oil for economic growth. There has been significant progress in exploring this sector as the Kuwait Direct Investment Promotion Authority (KDIPA) indicates that the FDI inflows in Kuwait were rising significantly but had recently experienced a significant fall. By 2019, it stood at about $2.49 billion, a drop from $ 2.6 billion in 2018, as seen in Figure 1 below (KDIPA, 2021). Nevertheless, the country’s FDI inflows have been alternating, making it hard to predict how it will be in the coming time. For example, the country’s FDI inflow showed a drastic change between 2014 and 2015, where it stood at about $4.0 billion in 2014 but later reduced to nearly $ 1.0 billion in 2015 (KDIPA, 2022). Given the far-reaching effects of demand and oil price changes, such oscillations must be eliminated and made steady for the nation.

The Impact of Global Corporations’ FDI on the Kuwaiti Economy

The Umm Al Hayman Wastewater Project is a noteworthy overseas venture in Kuwait. Its primary aim is to initiate and oversee a sanitation facility with its associated facilities, which will seek to process and recycle wastewater in Kuwait’s southern areas. The project’s ownership framework involves 10% of the Investment Authority’s stake, 40% participation from strategic investors, and 50% owned by the Public Securities Commission (UAHPC, n.d.). This initiative highlights the Kuwaiti government’s eagerness to cooperate with foreign investors on significant infrastructure endeavors.

Currently, there is no substantial diversification in Kuwait’s FDI inflows. In terms of sectors, most of the country’s FDI is converging in the oil and gas sectors (Shehabi, 2022). It still relies heavily on oil and gas more than other revenue sources. Also, the country has not shown a substantial outcome regarding equity ownership, as foreign companies hold a lower percentage of equity ownership (KDIPA, 2021). This is a potential threat and a call for more diversification to enhance the company’s equity ownership. Moreover, the country’s sources of FDI inflows are limited, with only countries from the Gulf Cooperation Council (GCC), like Saudi Arabia, Qatar, and the United Arab Emirates taking center-stage in the country’s FDI inflows.

References

Alduwailah, F. Y. (2018). Impact of CRM resources and capabilities on business performance in the mobile telecommunications industry: A resource-based view (Doctoral dissertation, Brunel University London).

Gelan, A., Hewings, G. J., & Alawadhi, A. (2021). Diversifying a resource-dependent economy: Private–public relationships in the Kuwaiti economy. Journal of Economic Structures, 10(1). Web.

Jaber, H. (2022). The role of foreign aid in the transformation of Iraq’s Society and economy. International Journal of Management and Economics, 58(2), 218–232. Web.

KDIPA. (2021). Be part of Kuwait’s vision and invest in Kuwait. Web.

KDIPA. (2022). KDIPA annual report 2022. Kuwait Direct Investment Promotion Authority. Web.

Liang, C., Shah, S. A., & Bifei, T. (2021). The Role of FDI Inflow in economic growth: evidence from developing countries. Journal of Advanced Research in Economics and Administrative Sciences, 2(1), 68–80. Web.

Shehabi, M. (2022). Modeling long-term impacts of the COVID-19 pandemic and oil price declines on Gulf oil economies. Economic Modelling, 112. Web.

UAHPC. (n.d.). Umm Al Hayman (UAH) wastewater treatment project. Web.