Introduction

This paper highlights the successes of Applebee’s Grill and Bar, which is an American company, based in Kansas. The company mainly operates through franchises and it has a presence in 16 countries around the world (Zimbio, Inc., 2011).

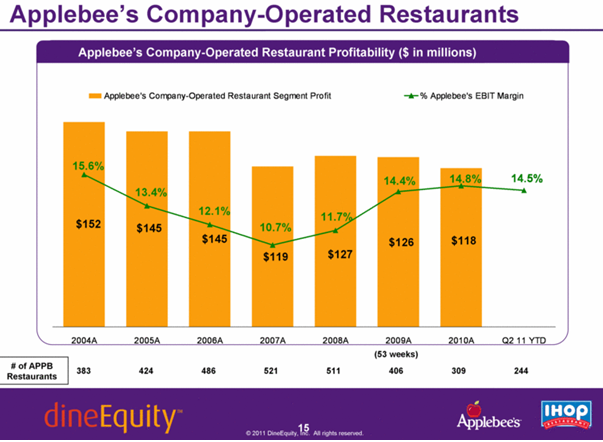

Applebee’s Grill and Bar has in the past maintained a fair degree of success, based on its existence in the competitive food-chain industry, which is dominated by market-leaders such as McDonald. Except for the sales-dip experienced by the company during the 2007/2008 global financial crisis, the following graph shows the profitability margin for the company over the last few years.

Source: Zimbio, Inc., 2011.

To assess the company’s success, this paper explains the company’s strategies from an economic and fiduciary perspective. Also, this paper highlights how the company’s pricing strategy affects its success.

Key Success Factors

Economic

Applebee’s Grill and Bar is part of a wider umbrella group of the Applebee’s group. This company is characterized by various business segments which have enjoyed a good financial performance over the last few years.

Since Applebee’s Grill and Bar is part of a wider group of companies, it enjoys a strong financial muscle from the umbrella company and therefore, it can undertake most of its operations without a lot of financial strain (Zimbio, Inc., 2011). The company’s franchise strategy also accounts for most of the company’s financial revenue.

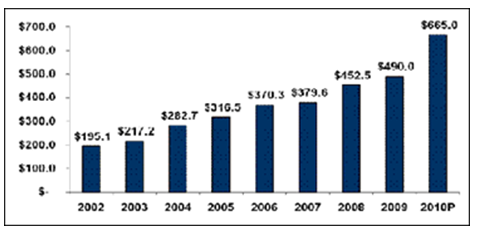

Experts estimate that Applebee’s generates more than 40% of its revenues from franchise royalties alone (Zimbio, Inc., 2011, p. 12). Dine Equity, which operates most of Applebee’s restaurants, reported that, in the year 2007, it accumulated close to 54% of its revenues from franchise royalties (Zimbio, Inc., 2011).

In comparison, the company-run restaurants only accounted for close to 7% of the company’s total revenues. The following graph shows the incremental contribution of the company’s franchise revenue over the past few years.

Source: New York Media LLC, 2011.

From this analysis, we see that, Applebee’s franchise businesses account for most of the company’s profits.

Fiduciary

Applebee’s enjoys a very strong brand portfolio which accounts for a significant part of the company’s success. The company’s strong brand portfolio is analyzed under the fiduciary section of this study because, through the company’s brand, Applebee’s establishes a strong relationship with its customers, regarding what it can do for them and the quality at which it can offer its products to the market.

Applebee’s enjoys a very positive, distinctive and durable brand perception in the market because of its strong brand portfolio (Zimbio, Inc., 2011). This attribute is intertwined by the company’s guarantee of offering its customers good quality products. Also, this attribute, coupled with the American heritage that the company possesses, strikes a good cord between the company and its customers.

In fact, the company’s heritage in the American food market traces its history to 1980 when the company started business (Zimbio, Inc., 2011). As a result, most of the company’s customers have maintained good faith with the company for many generations.

In fact, some of the company’s consumers still frequent the company’s overseas branches because they believe the same quality of products and services are still offered in these outlets. Indeed, this attribute has ensured repeated purchases by the company’s customers.

Applebee’s research and development strategy has also seen the company transcend to new heights of success because it has ensured the company still maintains a good relationship with its consumers. This attribute has not only ensured that the company enjoys increased sales; it has also ensured that the company maintains a good relationship with its customers (New York Media LLC, 2011).

For instance, through research and development, the company has oriented itself with the latest consumer trends and preferences; thereby, ensuring the company provides goods and services which meet consumer demands.

Pricing

Applebee’s bar and grill has been known to have a relative pricing strategy. Its products are never considered too expensive or too cheap (New York Media LLC, 2011). However, the company’s pricing perception is dependent on the market. Nonetheless, the company is known to operate during peak and off-peak hours where varied prices are reported.

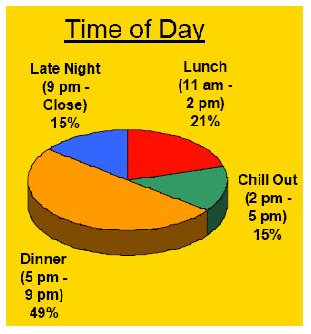

For example, the company runs a happy-hour program which starts from 3pm to 6pm (during weekdays) and 10pm to midnight (on Fridays) (New York Media LLC, 2011). During these hours, most of the company’s products are served at half the price. The following chart shows the company’s price-cuts during various periods.

Source: New York Media LLC, 2011.

The above chart shows that the company runs a very flexible pricing strategy. This strategy complements the company’s success because it reflects the needs of most of its customer groups.

This pricing model is also sustainable in the long-term because the company can be able to maximize profits from whichever time period it operates. Moreover, profit maximization is also guaranteed by the company’s ability to meet the pricing needs of its customers (New York Media LLC, 2011). This means that, the company can still be relevant to its customers, regardless of the economic situation. This flexibility therefore guarantees the company’s future success.

Conclusion

This paper explains that, Applebee’s success is motivated by a combination of several economic and fiduciary factors. Economically, the company gains from the excellent performance of its diverse business portfolios and the financial background it enjoys from the company’s umbrella group.

Applebee’s bar and grill also benefits from its strong brand portfolio which sustains its sales. These factors, coupled with the company’s flexible pricing strategy guarantees its future success.

Reference List

New York Media LLC. (2011). Applebee’s neighborhood Grill & Bar. Web.

Zimbio, Inc. (2011). Goldman Sachs Buys Applebee’s Franchise. Web.