Introduction

Within just a few decades, the telecommunication industry attained dramatic growth on a global scale. Nowadays, various communication technologies provide multiple benefits for users at both individual and business levels. Besides those advantages, advanced telecommunications are observed to stimulate economic growth. As noted by Ameen and Willis (2016), “the mobile industry is the second source of wealth after the oil industry in the Gulf countries” and, in 2011 alone, it allowed them to receive revenues of 78 billion USD (p. 1). In addition, greater mobile penetration is positively correlated with an increase in GPD rates (Ameen & Willis 2016; Zain & PwC 2014).

Noteworthily, the UAE is currently one of the leaders in the Gulf region in terms of citizens’ use of communication and mobile technologies (Ameen & Willis 2016). Thus, the industry provides a plethora of opportunities for the country to stimulate further economic development.

The UAE telecommunications sector is chosen for the analysis not just because of its significant role in the economy but also since it has recently been underperforming. For example, major UAE mobile enterprises reported a decrease in revenues since 2015 (Ameen & Willis 2016). Besides, the 2017 financial statistics show that the UAE telecommunication sector was the primary downward dragger of the country’s share price index (Department of Economic Development 2018).

Researchers identify the unfavorable regulatory environment and the government’s centralized influence on the sector as the major reasons for its unsatisfactory performance (Kovacs 2014; Ameen & Willis 2016). To understand how the country may strengthen the contribution of telecommunications to its economy, the present paper will mainly aim to analyze the sector from the perspective of the theories of competition and monopoly. Along with legal factors, such determinants of competitiveness as price, quality, and value of services will also be evaluated. The results of the literature review and sector analysis will be utilized to formulate specific recommendations for the improvement of the selected sector’s performance.

Theoretical Background

Similar to the airline, railroad, electricity, and alike industries, telecommunications is characterized by a network effect. This feature implies that “the value of the good is proportional to sales” (Enhan 2016, p. 8). In other words, if new customers would want to enter an already existing network of services offered by a telecommunication company (for instance, mobile communication services), the latter will be able to provide the service without any extra costs for itself or other network users.

According to Enhan (2016), the network effect is considered to maximize benefits in case the network has an unlimited capacity (or an unlimited number of users) and when it is operated by only one enterprise. For this reason, the telecommunication industry has been traditionally viewed as a natural monopoly and was strictly regulated in virtually every country in the world (Enhan 2016). However, the present-day telecommunication sector is more dynamic than ever before and may utilize many diverse means through which services can be provided. In their turn, the methods of service delivery define the overall quality and value of services rendered. These characteristics make contemporary global telecommunications a highly competitive industry.

Nowadays, competition is the major driving force in international markets. It is defined as “a struggle of conflicting interests” and “a process of rivalry between firms … seeking to win customers’ business over time” (Enhan 2016, p. 15). Competition is considered to automatically stimulate economic growth and, therefore, can benefit consumers and all other stakeholders much more than monopolies and all governmental regulations (Enhan 2016). According to the model of perfect competition, to attain the maximum benefits, the market should have sellers that are too small to control it entirely and are perfectly aware of the market prices and other relevant market information (Enhan 2016).

Moreover, a market with perfect competition must be characterized by a full flow of resources available to sellers and the homogeneity of products (Enhan 2016). One of the main impacts of perfect competition is low product prices because rivals aim to reduce costs in order to benefit customers (Enhan 2016). Conversely, since in the monopolistic market the output is entirely controlled by one enterprise, the prices tend to be higher.

Monopolies and competitive markets are also different in terms of their impacts on the quality of services and goods. Perfect competition is associated with greater innovation, which sellers may use as a strategy to attract potential consumers (Enhan 2016). On the contrary, monopoly producers may be less interested in innovation since the volume of their sales normally does not depend on the quality of services and goods to a large extent.

However, besides product variety, price and quality/value of services play a decisive role in increasing and decreasing customer satisfaction (Nekmahmud & Rahman 2018). Clearly, in the context of perfect competition, dissatisfied users may simply switch to another operator. At the same time, it can be argued that in the context of monopoly, customer dissatisfaction is likely to result in a reduced rate of service use and, therefore, smaller revenues.

The UAE Telecommunication Sector

As was mentioned previously, today, the UAE telecom market is strictly regulated by the government. Every legal, managerial, and practical aspect of the sector is currently addressed by the Telecommunications Regulatory Authority (TRA). Among the major responsibilities of the agency are quality monitoring, sector promotion both within and outside the UAE, establishment, and implementation of the relevant regulatory framework, and so forth (Yallapragada 2017).

Moreover, the UAE telecommunication sector is now exempted from compliance with the 2012 competition law that is aimed to combat monopoly practices in the country and promote market openness (Kovacs 2014). It means that the government’s intervention in the industry is now high and, at the same time, there is no legal ground for the sector to foster more rivalry.

There are only two dominating mobile network operators in the country, Emirates Telecommunication Corporation (Estilat) and Emirate Integrated Telecommunication Company PJSC (Du). The Ministry of Finance owns 60% of the former organization’s shares and, at the same time, 80% of Du’s shares are owned by the authorities (Kovacs 2014; Ameen & Willis 2016). As noted by Kovacs (2014) although the presence of two major players in the market officially makes it a duopoly, the UAE telecom sector is still substantially monopolized. Besides, various measures are undertaken to make sure that Du and Estilat remain dominant players.

For example, restrictions on the use of such Voice Over Internet Protocol applications as Skype and Face Time are currently implemented and, as a result, customers have no choice but to use the expensive international call services offered by the two local enterprises (Ameen & Willis 2016). While it is obvious that the existing regulatory framework aims to maximize the profits of the UAE telecom corporations, the industry currently experiences the negative effects of monopoly on its competitiveness.

Pricing can be viewed as the primary problem in the UAE telecom sector. According to Kovacs (2014), internet provision in the country is among the most expensive yet slowest in the world. For instance, as for the 2014 rates, the price for an 8 Mbit/second package equaled USD 82 (Kovacs 2014). As noted by Ameen and Willis (2016), Du and Estilat have to pay a 50% royalty fee due to specific tax regulations imposed on these two enterprises by the government, and this fee can be responsible for high prices of the services to a substantial degree. Since the country has a high GDP level, locals tend to have more than a single mobile device and still widely use them (Ameen & Willis 2016).

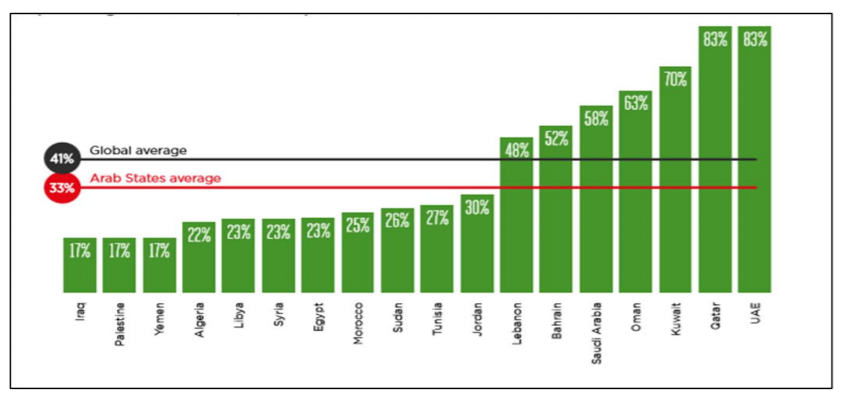

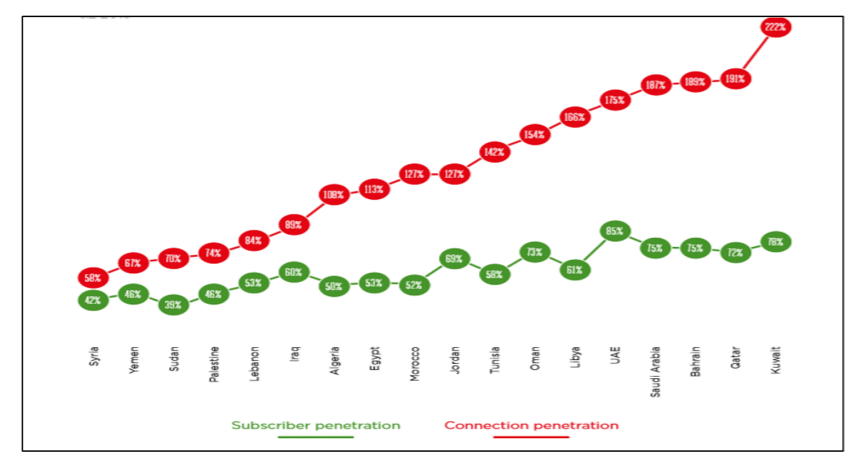

In fact, the UAE’s rates of mobile phone adoption (Figure 1) and mobile penetration (Figure 2) are among the most elevated in the MENA region (Figure 1), especially among young people (Ameen & Willis 2016). However, it is observed that excessive service costs are of big concern for the consumers of the UAE communication services and can contribute to their dissatisfaction since many individuals perceive mobile and internet prices as unfair (Yallapragada 2017; Kovacs 2014). It is valid to say that by changing the regulatory framework, it will be possible to offer more affordable prices and, thus, add more customer value to telecom services and products.

The quality of services and products is another weak point in the UAE telecommunication sector. According to Kovacs (2014), the country strives to promote itself as a hub for information, communication, and telecommunication technologies and undertakes efforts to comply with high international standards. Therefore, innovation and research, and development activities are taking place in the telecommunications sector at this stage.

Nevertheless, the results of a survey conducted by al Khaleej newspaper indicated that approximately 60% of users were dissatisfied with service and product quality, about 22% said that they were good enough, and only 18% agreed that the quality of services was acceptable (Kovacs 2014). Along with price fairness, the quality of service is regarded as one of the major sources of competitive advantage both within and outside the telecom sector (Yeboah & Ewur 2014; Yallapragada 2017). The main issue for Du and Estilat in terms of service quality is that they may be insufficiently motivated to improve it since they bear relatively low risks of financial loss due to almost non-existent competition in the market.

Considering the importance and positive effects of competition on the markets, the best potential solution to the problems of excessive pricing and service quality in the UAE telecommunication sector is its liberalization and deregulation. Besides that, to increase the efficiency of services and diversify them, it may be important to promote private-public partnerships and stimulate private and foreign investment (Ameen & Willis 2016). These recommendations, as well as their possible favorable impacts and suitability to the UAE context, will be discussed in the following section of the paper.

Summary and Recommendations

Research evidence, as well as the UAE’s functioning laws, indicate that the country is in the process of opening and deregulating its diverse markets. The telecommunications sector is not an exception: the establishment of Du in 2006-2007 was, in fact, the government’s attempt to bring more competition in the industry (Kovacs 2014). Unfortunately, this strategic move did not lead to the desired results because the competition law is still less influential in the sphere of local telecommunications. Instead, to improve the situation, it is essential to ensure that the sector-specific regulations become weaker as part of the liberalization process.

As such the deregulation and liberalization of any market involve three major factors. They are the removal of privileges that certain firms may enjoy, the development of an independent regulatory authority and a legal framework that outlines obligations of all the players in the market, and, lastly, the implementation of the competition law that guarantees the openness of the market (Enhan 2016).

The main goal of these practices is to ensure the entry of new competitors and secure their rights, such as equal access to resources needed for production and profitability. As noted by Enhan (2016) when a substantial number of new players appear in the market, the traditional regulation that favors monopoly turns obsolete in a natural way and then becomes more adaptable to changes. It is also worth noting that besides a direct effect on the sector’s competitiveness and economy, re-regulation and deregulation (or, in other words, a decline in the government’s involvement in the sector) may have a set of indirect positive impacts.

The maintenance of regulation is usually costly, as well as the deterioration of services under excessive governmental intervention (Enhan 2016). Thus, by deregulating the telecom sector, the UAE government can decrease both the administrative costs and the risks linked to ineffective management.

An increase in the number of mergers, partnerships, and foreign investments can be very beneficial for the UAE telecom sector. Based on the present-day trends, the adoption of new technologies by telecommunication companies is the major source of their competitive advantage and a necessary precondition for growth (Forbes 2018). While governmentally-owned telecom enterprises may lack the internal resources needed to adopt those technologies effectively, collaboration with more tech-savvy partners may allow them to access knowledge and talents needed to succeed in any innovation endeavors (Carbonara & Pellegrino 2019).

It is also recommended to invest in and cooperate with firms operating within the niche markets that are not traditionally connected with telecom services (for example, security and healthcare) because this practice leads to greater diversification of services and expansion of networks (Forbes 2018). Considering the UAE’s goal of becoming a telecommunications hub, innovation is of significant importance for it. It is valid to presume that by promoting more partnerships with diverse players, it will realize its vision much more feasibly than by using governmental interventions alone.

The proposed recommendations seem to be suitable to the UAE context because, as part of its vision for development, it already aims to increase overall market openness, extensively invests in research and development, and strives to be an innovation and excellence leader. However, one of the major challenges associated with the liberalization of the telecommunication sector is that this inherently democratic process may be more appropriate to environments where the political structures are less hierarchical than in the UAE. To overcome this obstacle, the country may prefer to use the privatization approach instead of complete liberalization.

The former strategy may lead to similar positive outcomes in terms of the telecom sector’s better competitiveness and greater profitability while also will correspond with the UAE’s traditional political and economic systems.

Reference List

Ameen, N & Willis, R 2016, ‘An investigation of the challenges facing the mobile telecommunications industry in United Arab Emirates from the young consumers’ perspective’, in 27th European Regional Conference of the International Telecommunications Society (ITS), Cambridge, United Kingdom, pp. 1-22.

Carbonara, N & Pellegrino, R 2019, ‘The role of public private partnerships in fostering innovation’, Construction Management and Economics, pp. 1-17.

Department of Economic Development 2018, Dubai economic report 2018. Web.

Enhan, L 2016, Competition and regulation in the telecommunications industry, Doctoral Dissertation, Universitat Autònoma de Barcelona, Barcelona. Web.

Forbes 2018, ‘Beyond connectivity: three strategies for telecom growth’. Web.

Kovacs, JR 2014, Economic and legal analysis of the United Arab Emirates’ telecommunications market, PhD Thesis, Central European University.

Nekmahmud, A & Rahman, S 2018, ‘Measuring the competitiveness factors in telecommunication markets’, in D Khajeheian, M Friedrichsen & W Mödinger (eds), Competitiveness in emerging markets, Springer, Cham, Switzerland, pp. 339-372.

Yalllapragada, P 2017, ‘Determinants of customer satisfaction in the mobile telecommunications services among the university students in Dubai’, Advance Research Journal of Multidisciplinary Discoveries, pp. 5-11.

Yeboah, J & Ewur, GD 2014, ‘Quality customer service as a competitive advantage in the telecommunication industry in the western region of Ghana’, Journal of Education and Practice, vol. 5, no. 5, pp. 20-30.

Zain & PwC 2014, The socio-economic impact of mobile telecommunication in the MENA region: Zain’s 30th anniversary thought leadership report. Web.