Currently, the United States is promoting a monetary policy that is conducive to the business market and encourages open entrepreneurial relationships. According to Miranda-Agrippino and Rey (2020), this incentive principle implies reducing domestic credit, increased opportunities for open trading, and moving away from international liquidity as a constraint. At the same time, despite the relatively loose monetary policy, the principles of fiscal regulation are more stringent. As Rickman and Wang (2020) state, increased tax requirements have a negative impact on the business of individual companies. One of the main reasons is the social hardship caused by the COVID-19 pandemic and, consequently, the government’s need to ensure a steady flow of funds to support the budget.

Monetary and fiscal policies can affect the production and sale of goods and services in different categories. For the target product Ibuprofen, one of the most popular Equate drugs, sales are consistently high (“Equate Ibuprofen tablets,” 2021). However, by analyzing the aforementioned principles of financial and tax regulation, one can cite the potential impacts of these policies on Equate’s business. For instance, Brinca et al. (2020) mention the concepts of supply and demand shocks and note that prices are often dependent on demand fluctuations. With regard to Ibuprofen by Equate, the current monetary and fiscal policies do not put pressure on product manufacturing or hold back sales, largely due to the drug’s affordable price. At the same time, changes in these regulation principles can affect supply and demand. If tighter fiscal regulations are imposed, Equate will have to respond by raising the price. The supply figure will decline since the organization will have to spend more on purchasing raw materials and manufacturing.

Nevertheless, one should take into account the prescription of the medication in question. In the face of the COVID-19 pandemic, this drug is being actively marketed because the drug has antipyretic and analgesic properties. Thus, the demand for it is unlikely to fall as consumers will need the medication. Since Ibuprofen by Equate is one of the most affordable products in its market, demand will remain, although potential changes in price and production costs are possible.

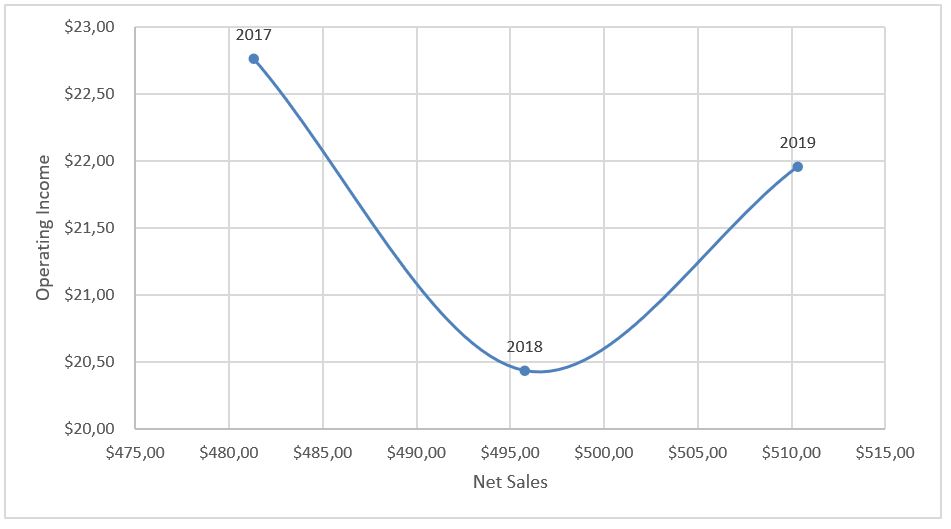

To determine how successful the performance indicators of Walmart and its sub-brand Equate have been recently, individual variables need to be analyzed. As the parameters for the assessment, net sales and operating income will be analyzed over the past three years, and as a source, Walmart’s annual and latest report will be applied (“2020 annual report,” 2020). These data are valuable factors in demonstrating real sales outcomes.

Based on the official data, net sales have grown not very quickly but steadily over the past three years (all data will be in millions). In particular, in 2017, this parameter was $481,317, in 2018 – $495,761, in 2019 – $510,329 (“2020 annual report,” 2020). As one can see, the growth was almost flat, and the dynamics of the increase remained. The situation is different for the operating income variables over the past three years. In 2017, this figure was $22,764, in 2018 – $20,437, in 2019 – $21,957 (“2020 annual report,” 2020). Fluctuations in the data indicate unstable rates, which indicates distinctive income shares.

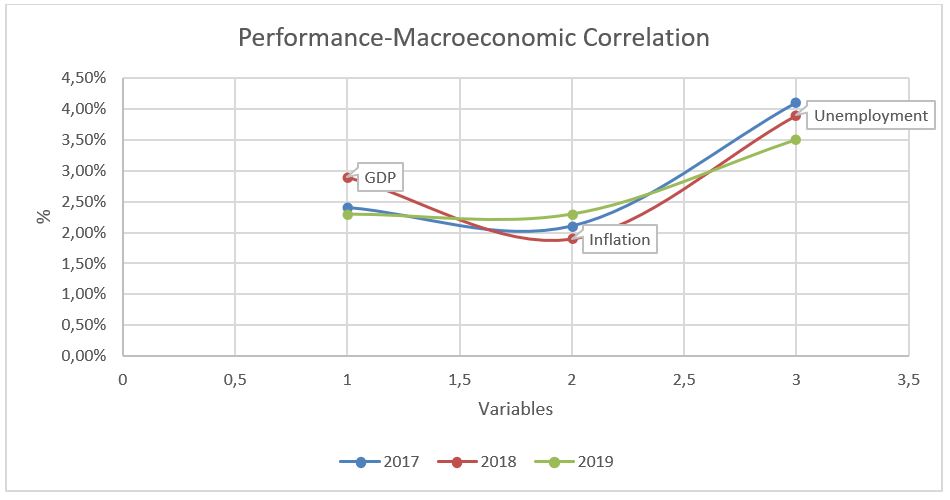

The comparison of the proposed performance variables with such macroeconomic variables as GDP, inflation, and unemployment over the past three years can help highlight specific correlations. As a source for collecting macroeconomic data, the article by Amadeo (2020) will be utilized, and in Table 1, the relevant correlation of the variable in question will be given. The visual display of these indicators can help compare performance and macroeconomic variables.

The analysis of the proposed correlation can help find the appropriate relationship among the proposed variables. Thus, based on the data in Table 1, one can assume that, despite a low inflation rate in 2018, the company’s operating income was below than in the previous year. The drop in unemployment growth, in turn, had a positive effect on both operating income and net sales. Finally, GDP growth over three years can also be compared with the company’s high operating income.

The current monetary and fiscal policies in the United States can affect the company’s financial performance in the short term. Based on the obtained data and analyzed correlations, the share of net sales is growing steadily. An open market and an emphasis on domestic manufacturing are positive aspects of improving financial productivity. With regard to operating income, the probability of a decline in this parameter is high, which, in particular, is due to stricter requirements based on the current fiscal policy. Higher tax liabilities and strong reporting are potential disincentives for gaining high operating income. Moreover, the company needs to control the price market and pay attention to competitive factors to prevent the aforementioned supply or demand shocks. As a result, the current monetary policy can have a favorable effect on performance indicators, while fiscal regulations, conversely, can worsen the corresponding parameters in the short term as per the current outcomes.

References

2020 annual report. (2020). Walmart. Web.

Amadeo, K. (2020). US real GDP growth rate by year compared to inflation and unemployment. The Balance. Web.

Brinca, P., Duarte, J. B., & Faria-e-Castro, M. (2020). Is the COVID-19 pandemic a supply or a demand shock?Economic Synopses, (31), 1-3. Web.

Equate Ibuprofen tablets, 200 mg, pain reliever and fever reducer, 500 count. (2021). Walmart. Web.

Miranda-Agrippino, S., & Rey, H. (2020). US monetary policy and the global financial cycle.The Review of Economic Studies, 87(6), 2754-2776. Web.

Rickman, D., & Wang, H. (2020). US state and local fiscal policy and economic activity: Do we know more now?Journal of Economic Surveys, 34(2), 424-465. Web.