Volatility refers to sudden, unpredictable price movements of a security or market. In their article “Volatility‐managed portfolios,” Moreira and Muir (2017) explore this concept with regard to managed portfolios. The main point that the authors are trying to convey is that it is possible to increase monthly returns for mean-variance investors by using the suggested approach of volatility timing when managing portfolios. In this study, a number of tests were conducted to evaluate the reliability of this strategy and explore it from different perspectives to obtain a comprehensive view. Overall, the authors come to the conclusion that volatility-managed portfolios can be implemented in real-time, suggesting significant risk-adjusted returns.

The authors support their main point by offering a detailed overview of their data, analysis, and test findings. In particular, Moreira and Muir (2017) utilize monthly and daily data regarding an excess market return, as well as value, momentum, size, profitability, and investment factors. The authors also implement currency returns information for their analyses and provide an extensive description of the data used for this study. Furthermore, Moreira and Muir (2017) explain the portfolio formation process that is central to this research and its findings. They perform it by scaling an additional return by its conditional variance’s opposite, which leads to a monthly increase or decrease in the portfolio’s risk exposure based on the variation of the conditional variance’s measure (Moreira & Muir, 2017). The analysis focuses on the assumption that volatility is significantly variable and persistent. The researchers support their main point by simplifying the construction of the portfolio and using the past month’s realized variance. In this regard, it is evident that such a strategy can be implemented by a real-time investor without relying on particular parameter estimation.

Another approach that supports the authors’ main point is using some of the sophisticated variance forecasting models to diversify the research findings and provide a broader outlook on the problem. Furthermore, Moreira and Muir (2017) utilize an empirical methodology to produce a time-series regression model of the volatility-managed portfolio. In this regard, the authors note that volatility timing drives up Sharpe ratios compared to the original factors. Moreira and Muir (2017) implement the analysis for all elements one by one resulting in single-factor portfolios, which are beneficial for displaying the relationships between risk and return, which is critical for the suggested strategy. The research findings are supported by statistically significant intercepts that can be observed in most cases. The authors emphasize that the proposed approach can be available to an average investor in real-time, which makes the findings particularly practical. Another essential finding that supports the main point is that the results are consistent for all the factors investigated in every regression.

Furthermore, the researchers explain that their method is based on the idea of taking more risks when volatility is considered low, which means that the largest losses occur during this time. In reality, such failures typically happen during the time when volatility is high, which is an undesirable scenario for the proposed strategy. In other words, Moreira and Muir (2017) support their major point by emphasizing that market crashes and worst losses do not intercept, providing such examples as the Great Recession, the Great Depression, and the stock market crash of 1987. In this regard, this method differs from profitable options strategies as it adjusts risky decision-making accordingly to the market.

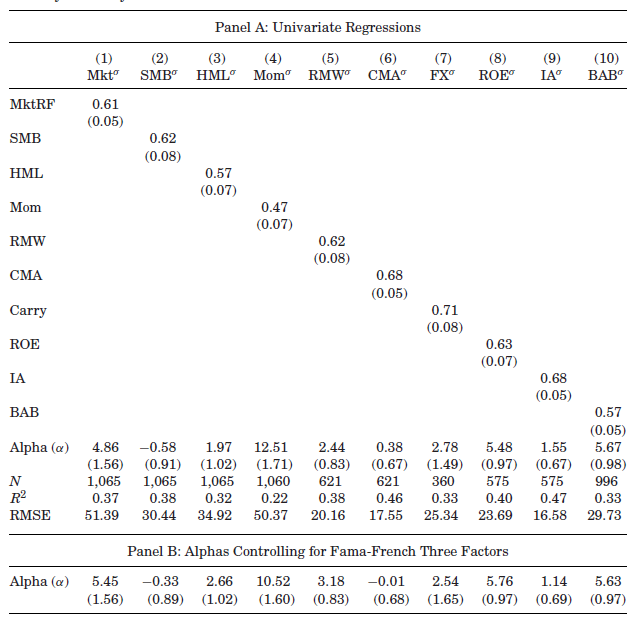

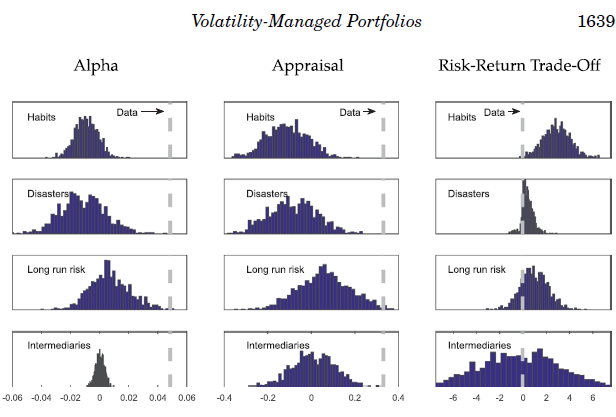

Tables play an essential role in representing the research data in a concise and illustrative manner. In particular, Table 1 by Moreira and Muir (2017) is displayed below, providing readers with an overview of data regarding regression runs on the volatility-measured portfolios. In this regard, this table presents a foundation for conclusions regarding the proposed strategy. The intercepts are statistically significant and positive in most cases. Furthermore, Table 1 allows the reader to see that the results are consistent for the original factors, as well as the other three factors in each regression (Moreira & Muir, 2017). As can be seen, such data provide additional support for the main point of the author’s study. Finally, Figure 1 is critical for displaying the research findings and providing data for interpretation. Moreira and Muir (2017) report that 1000 simulations were performed for various equilibrium models, which diversifies the results. The figure provides the results in the form of a histogram for simulations of each model.

Table 1: Volatility-Managed Factor Alphas

Note. This figure demonstrates the results by providing the distribution models of the moments recovered from the simulations.

In my view, this research provides particular value for investment managers as it offers a new approach to risk management in portfolios. In particular, Moreira and Muir (2017) argue that an average investor can apply this strategy in real-time. These models show positive results for international stock market indices and are found to be less affected by volatility shocks. Therefore, investment managers can apply the volatility-scaled strategy when handling clients’ portfolios to maximize returns while minimizing risks.

Reference

Moreira, A., & Muir, T. (2017). Volatility‐managed portfolios. The Journal of Finance, 72(4), 1611-1644.