The case study called “Theatre Budget” is focused on a confusing situation facing the Board of Directors of the theatre and the Vice President for Administration Janet Dobbs whose proposed budget for 2002 was rejected. The main source of clash is the difference in views of the team of accountants and the team of artists who generally have opposite perspectives on the purposes of the theatre budget.

As an accountant, Dobbs approached the budget proposal practically and tried to take into consideration the expenditures and the revenues of the organization carefully. One of her main concerns was the growing debt of the theatre which could not be ignored in order to avoid serious financial problems. Dobbs decided to reduce the expenditures of the theatre which caused a wave of dissatisfaction from the side of the artists who felt pressured by the shrinking opportunities.

The budget proposed by the Vice President for Administration had a number of positive aspects. The most noticeable advantage of the 2002 budget is its new expenditure item which is the debt reduction. This aspect is of high importance for the theatre as the organization is having an issue generating enough income to cover its capital needs and operating costs. Dobbs’s practical approach allowed the organization to start minimizing its financial issues.

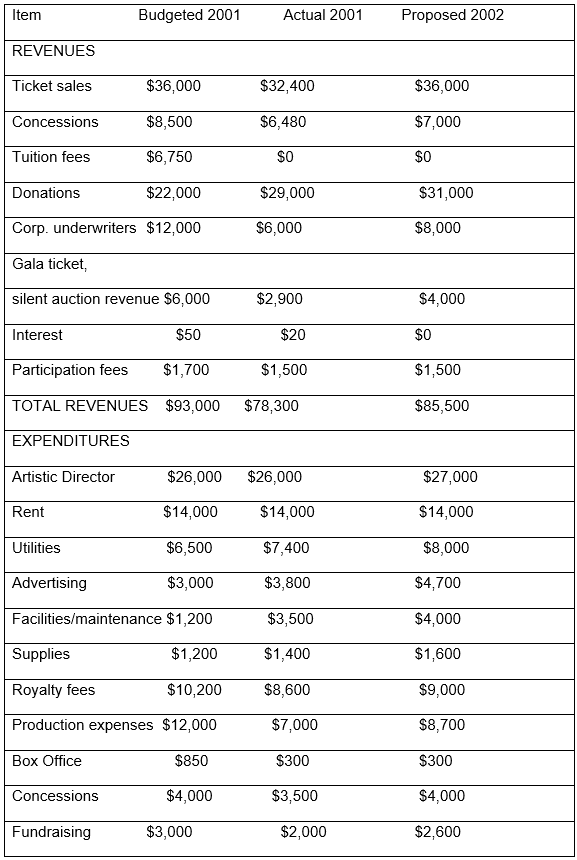

It was rather clever to introduce the Board of Directors to the end of year balances and demonstrating the debt and its growth possibility. Finally, from the point of view of an accountant it was practical to estimate the actual numbers instead of creating unrealistic projections and increasing the numbers artificially. It is visible in the scale of ticket sales revenue where the budgeted number was over three thousand dollars higher than the actual revenue. The same tendency is observed in the cases of concessions, corporate underwriters, gala ticket and silent auction revenue. The budgeted numbers exceed the actual revenues by thousands of dollars.

Dobbs found this very confusing and corrected the future budget estimations adjusting them and making them more realistic. This way, the budget proposed by Dobbs showed total revenue which was almost five thousand dollars higher than the actual revenue of the previous year. Besides, when it comes to the expenditures budget, Dobbs relied on the same strategy and used the actual data instead of the approximate numbers.

One of the main disadvantages of the budget was the way Dobbs presented it to the Board of Directors. First of all, since she was working with artists the proposition should have been conducted in a more creative manner. For example, the numbers of the actual revenues and expenditures of the theatre should have been presented before the budgeted ones in order to provide a clearer comparison and contrast and the positive changes.

Instead, Dobbs treated the numbers and estimations practically, without taking into consideration the characters and professions of her audience. A team of accountants would be impressed by the approach towards calculations demonstrated by Dobbs, but the team of artists was shocked because the first and most important aspect they paid attention to was the ten thousand dollar difference between the previous and new budgets which immediately made them feel like their needs were not going to be met in 2002. Dobbs failed to explain the practical side and the math behind her estimations. Artists naturally are used to improvisation and they feel the need for space to improvise. The criticism of the proposed by Dobbs budget mainly considered the lack of such space and too tight revenue projections.

One of the directors, Roberts Mackie, chair of the costume committee did not appreciate the estimations presented by Dobbs because their practicality looked rather pessimistic to her. Mackie was convinced that higher numbers would encourage the managers to pursue more complex goals and show better progress. The total expenditures number was also confusing for the Board of Directors. Besides, all of them agreed that the artistic director of the theater had to be given a raise which the practical accountants did not include into the budget trying to maximize the debt coverage estimates. As a result, the budget was rejected and Dobbs was asked to work out another plan for the year of 2002.

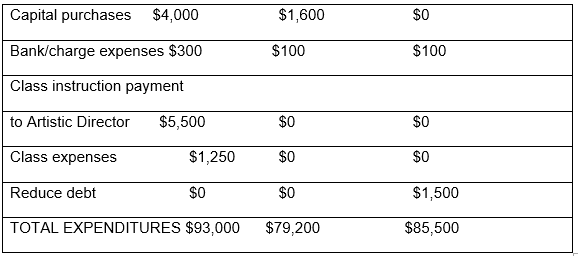

Below is an altered version of the 2002 budget for the theater. This version takes into consideration the comments of the Board of Directors. The revenue estimates were changed. Namely, the projected revenues for ticket sales, donations, and gala ticket and silent auction revenues were adjusted and increased. These changes are to be emphasized during the new budget presentation as the stimuli for the future performance.

At the same time, in the expenditure table the costs for advertising were maximized by seven hundred dollars. This expenditure can be viewed as an investment which will increase the number of potential viewers and attract more capitals coming from ticket sales. This is the best way to address the sales issue since the price for the tickets cannot be increased in 2002 according to the decision of the Board of Directors. One more adjustment of the similar character was introduced to the costs for fundraising. This will be a way to improve the income coming from donations. Production expenses and concessions costs were increased as the quality raisers. Finally, all of the members of the Board of Directors agreed that the artistic director of the theater needs to get a raise; this condition was an important one to fulfill in the new budget. The salary of artistic director was raised by one thousand dollars.

The expenses were taken from the debt reduction expenditure which will estimate one and a half thousand dollars less than in the initial version of the budget. During the presentation it is important to emphasize that the new budget’s total revenue project is over seven thousand dollars higher than the actual revenue of the previous year, which is a significant progress.

Spreadsheet