Keynesianism and the global recession

In the recent studies by economic researchers on economic equilibriums, it has been revealed that effective demands play a crucial role on global economics. The needs and desires of traders to engage in trade in specific markets considering that some of their trading activities in other markets are constrained is referred to as the theory of effective demand (Green 1980).

The theory, also referred to as Keynesianism, proposed by a renowned British economic expert John Maynard Keynes highlighting regulation of market as well as increasing government incentives to trade as well s the financial sector as a result of short fall of created by constrained markets. Keynesianism has been proposed as one of the effective ways of mitigating any economic turbulence that may arise.

This theory has also been proposed as one of the solution of the global economic downtown by a number of economists. However, Keynesianism has had shortfalls in a number of times in the history of the evolution of the world economy. The failure of this theory can be traced back during the Great Depression in the 1930s American.

Despite the government efforts to provide incentives to the economy, low productivity still affects the rate of economic growth. During the global economic melt down several economists suggested Keynesianism as a way of circumnavigating the crisis. However, this did not provide solution due to a number of factors. The government intervened and provided incentives to manufacturers.

As such manufactures tended to increases their production levels. Meanwhile the fear that the global economy was at its knees created panic amongst manufacturers who opted to lay off workers to cushion against the productions costs. Many of the workers resulted to saving thus reducing spending either in anticipation of loosing jobs or after loosing jobs.

Therefore overproduced goods did not finds ready markets. Therefore Keynesianism other than providing a solution was a catalyst that aggravated the global economic crisis by reducing normal effective demand and creating a state provoked demand (DiLEO 2009).

However, Keynesianism is not a total failure in addressing matter of global economic concern. This theory has been effective in addressing and supporting recovery from the global economic down turn. Keynes suggested government intervention has been adapted in more creative ways of mitigating the effects as well as aiding counties as well as the global economy come out of the crisis.

From the problem identified from the shortcoming of the initial application of Keynesianism, consumption and not production became the key towards sustained economic growth. Governments as well as financial institution such as the World Bank and the IMF engaged to measured intervention at two levels.

To begin with, government as well as the financial institution supported and provided funds for investment in infrastructure, reduced interest rates as well as providing credit to support further investment in the manufacturing industry. Governments with encouragement from the World Bank and the IMF created the necessary framework that made its easy for manufacturers to access credit.

This was seen as the incentive to provide rescue to the manufacturing industries already at its knees. In addition to this many of the leading world government have embarked on efforts to strictly control of inflation rates. This is aimed at stabilizing liquidity in these ceconomies and thus provides a stable economic recovery environment.

Secondly, the government embarked on what was seen as Keynesian social security method of sustaining an economy. Governments were encouraged to redistribute wealth in terms of income especially to the low income earners. This notion was not infirmed by the empathy that Keynes had on the low income earner but on the inability of the economy to sustain optimum consumption rate. Actually the situation was called the under consumption of the economy.

This had to be done in two ways. One of the ways was to avoid all efforts to cut wages of the lower income earners. Secondly the governments had to pursue full employment of its citizens as a way of curbing the rate of inflation. This as aimed at creating what Keynes called the aggregate demand aimed at boosting consumption of the already produced goods.

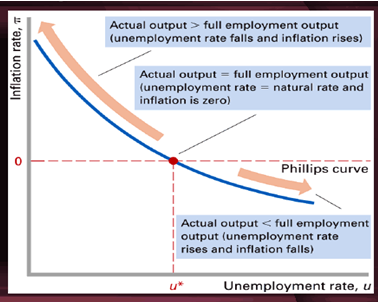

These moves have been seen in countries such as USA with very consistent efforts done to reduce unemployment rates (Ge and Liu 2010). However some economists feel that the unemployment the rates of inflation have to be kept at equilibrium as seen in the figure below.

Source: Claar and Klay 2007.

The return of Keynesianism

Keynesianism was first put to test during the 1930s Great Depression. It largely failed to counter the effects of that financial crisis in America as well as the ripple effects in many parts of the world lead by Europe and Japan. Furthermore the busting of the economic boom in the 1960s, the theory failed to provide any sufficient counter measures.

However in the current economic situation especially focuses on the period during and after the global economic recession, Keynesianism is slowly finding a comeback.

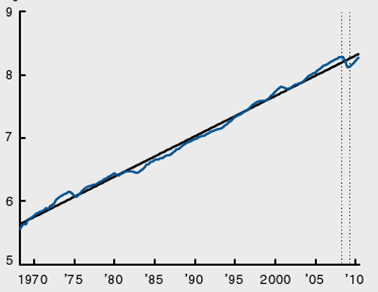

However it is a more moderated form of the initial Keynes theory of effective demand. In this case therefore, governments are almost involuntarily applying the theory especially in efforts to pump in more cash into their economies to contain negative effects of their economies such as the fall in global trade from 2008 to 2009 as seen in the figure below (DiLEO 2009).

Source: Crowley and Luo 2011.

From the late 2007, most of the government especially in the developed world had instituted efforts to instigate massive government interventions to the effects of the global economic recession. This had seen the return of Keynesianism to ply in the world economic affairs.

China, the World fastest growing economy injected about $580 billion input into its economy, as did Germany amidst the cynism from the country’s executive, injecting about 50 billion Euros. France, Britain and Japan followed suit by injecting 26 billion Euros, 12 trillion yens and 20 billion Euros respectively.

When the current US president Barrack Obama came to office, and much to the chagrin of the republicans he proposed and successfully implemented about $786 billion dollars as economic stimulus. In total the entire G20 had proposed a $5 trillion fiscal bailout and expansion plan.

It was hoped that this expansionist efforts would lead to at least 4% global economic growth rate. Such efforts were especially targeting to cover interest’s rates cuts, tax cuts as well as providing new credit to improve liquidity of these economies (Smith 2010).

Such approaches are informed by the notion that if the economies had to improve from the current crisis create by the global economic downturn, there had to be an improved system of money supply in all sections of economies.

If the credit supply system is affected then it means that there was to be a deflation which would largely affect the manufacturing industry in that the dramatic fall in prices of the manufactured goods would have meant greatly reduce income, profits, salaries and balance of trade.

The economic fathers of the current generation, in full knowledge that constrained credit supply system had lead to some of the historical economic hardships such as the Great Depression in America, hoped to avoid such an occurrence and as such sought to maintain a stable money supply system at all costs.

Such efforts had reflected Keynesianism in a number oaf ways. To begin with, the government through their central banks were concerting efforts to stimulate the manufacturing industries by avoiding any scenarios where low prices.

The global manufacturing industry avoided the crisis in that there were not any closures or winding up of any manufacturing industries in any of the countries the policy of expansions was instituted. Keynesianism seemed to work up to the extents.

The tax cuts as well as interest rates cuts had an impact in the income of the lower income earner as reduced tax mean that the earner had a little bit more money to spend. As such it boosted the spending power and as such the market for manufactured goods was maintained at a comfortable level.

The $5 trillion fiscal expansions project was a well calculated financial tool aimed at addressing an economic problem. However, to the global financial industry it was not very effective as many of the global financial institution such as banks and other credit institutions crumbled even after the plan was released.

In the US, Lehman Brothers collapsed even after the US government released the $ 786 billion financial package. Furthermore the G20 plan did not address the balance of trade as Keynes suggested as the way to overcome any instance of economic peril.

Actually by bailing out the economies of the develop countries this plan left the mid level economies as well as developing economies in great peril. While trade was stimulated in the first world, trade was in peril in the second and third world where such governments had no financial power to provide any economic expansion projects. This in effect created imbalances of global trade.

Moreover, by okaying the bail out plan the G20 members had dug deep holes in their financial coffers and as such were inadvertently creating their national current account deficits.

From this perspective the plan therefore was just a short term and an almost blind financial solution to a matter that was largely above the global economics. Due to the fact that the plan highlighted the realties of Keynesianism, some economies viewed it with a lot of skepticism as it did not provide any long term solution to the global economic crisis.

Reference List

Claar, V., & Klay, J. 2007. Why Keynesianism failed. Web.

Crowley, M. and Luo, X. 2011. Understanding the Great Trade Collapse of 2008–09 and the Subsequent Trade Recovery. Web.

DiLEO, P. 2009. The return of Keynes?ISR. Web.

Ge, C. and Liu, Z. 2010. The Global Economic Crisis in the Perspective of Keynesian Business Cycle Theory. School of Economics and Management, Tsinghua University, Beijing. Web.

Green, J. 1980. On the Theory of Effective Demand. The Economic Journal. Web.

Smith, D. 2010. The Age of Instability: The Global Financial Crisis and What Comes Next. London: Profile Book Ltd.