Starbucks Coffee Company

Transactions

- Company: Starbucks

- Quantity: 20

- Date: 12/30/2013

Buy/Sell: Buy.

Reason/Decision

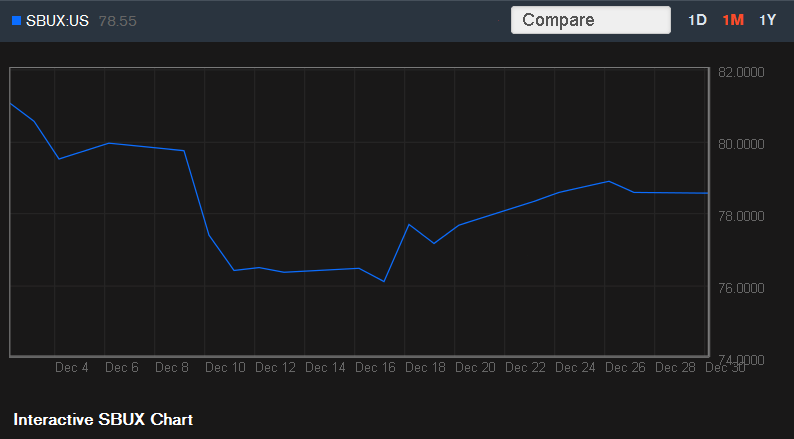

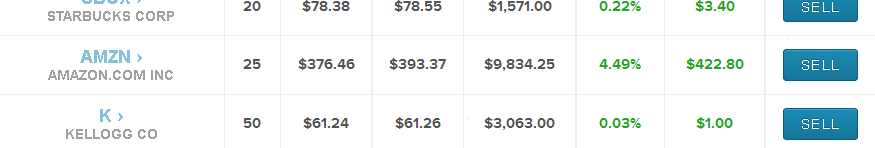

When examining the initial position of Starbucks at 10 am on 12/30/2013, a sudden drop in share price was noted from its previous close of $78.79 to 77.80. Based on an examination of recent news stories involving Starbucks, there were no relevant news items that would have indicated that such a sudden drop in share price was imminent. Another issue that should be noted is that Starbucks is currently within its 4ht quarter which, when considering this higher levels of consumer spending, should be indicative of a price increase in stock rather than a decrease.

In order to gauge the current direction of the stock price, a 1 monthly analysis was conducted starting from December 4 to December 28. What was shown was that despite a sudden drop in value on the 14th, the stock price was recovering towards its previous levels on December 4. Taking into consideration the sudden drop in stock price that happened on the 30th, this became indicative of a possible buy opportunity since all other indicators such as a declining stock price trend line or an impact on their supply chain were not noted.

Kellogg Company

Transactions

- Company: Kellogg’s

- Quantity: 50

- Date: 12/30/2013

Buy/Sell: Buy.

Reason/Decision

During the early half of the 12/30/2013 trading day, a sudden spike in the initial opening price was noted which is indicative of a possible increase in the price of the stock during the day. Sure enough, a period of volatile up and down trading was noted but the trend line did show that the potential price of the stock would increase significantly by the end of the day. Sure enough, the end of the trading day did show that from a starting price of $60.98, the stock ended at 61.30.

Other reasons behind the purchase of 50 Kellogg’s shares were due to an article that stated that the company was going to cut 7% of its global workforce. What this is indicative of is the implementation of more efficient production processes resulting in a more streamlined and cost-effective method of operation. This was a signal indicating that the company became more proactive towards efficient operations which would result in better long-term profits (Chernoff, 8). As such, this creates a buying opportunity in the long term as the company continues to utilize better methods of operation.

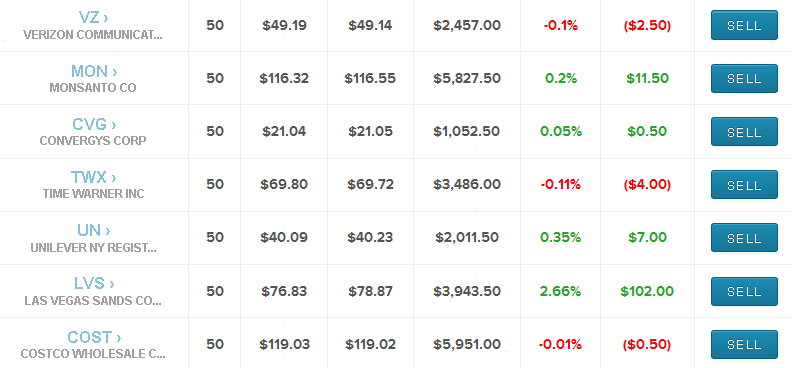

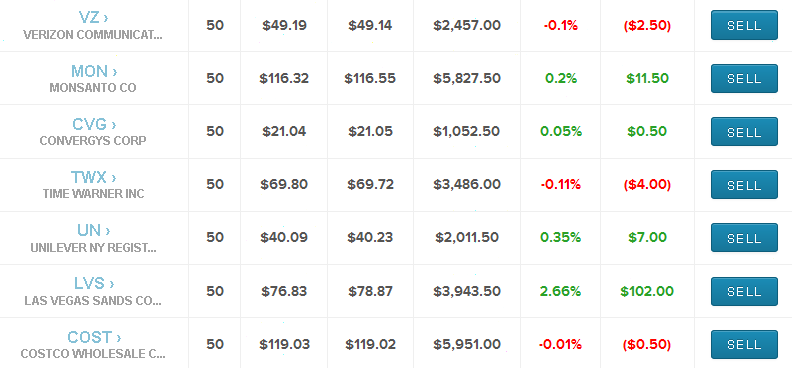

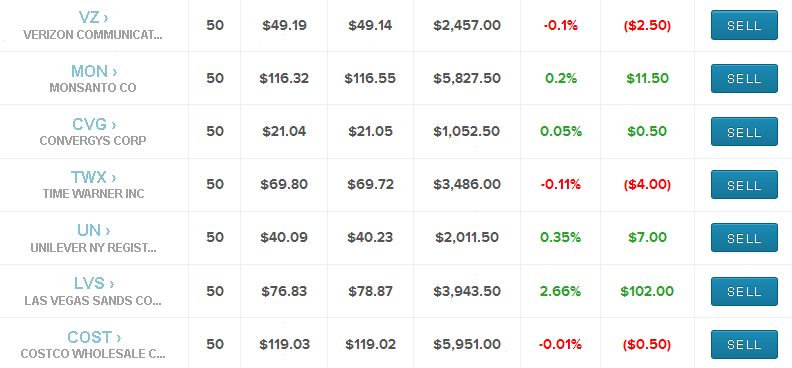

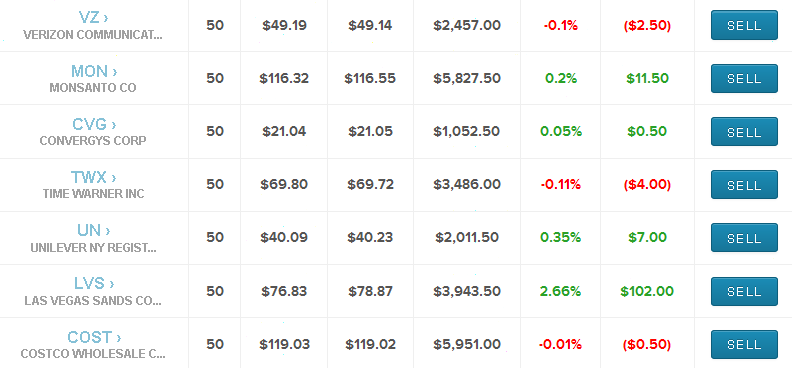

Verizon Communications Inc.

Transactions

- Company: Verizon

- Quantity: 50

- Date: 12/30/2013

Buy/Sell: Buy.

Reason/Decision

Based on a recent article that stated that Verizon and T-mobile were going to swap unused airwaves, this creates a good buying opportunity for either Verizon or T-mobile. The reason behind this is quite simple, by swapping unused airwaves either company will be able to increase the amount of coverage they have which would result in more subscribers to their service. More subscribers equate to higher profit levels for the companies involves which would translate into higher stock prices in the long term. It is based on this justification that stock in Verizon was bought.

The Monsanto Company

Transactions

- Company: Monsanto

- Quantity: 50

- Date: 12/15/2013

Buy/Sell: Buy.

Reason/Decision

While a report indicating that the patent filings for agricultural seeds have gone up substantially may not seem connected to Monsanto, what you have to take into consideration is that the company is one the world’s largest in terms of creating new types of seed crops and owns a vast majority of the patents being filled. Taking this into consideration, this makes the company all the more valuable since it will be poised to control access to all seed crops in the future.

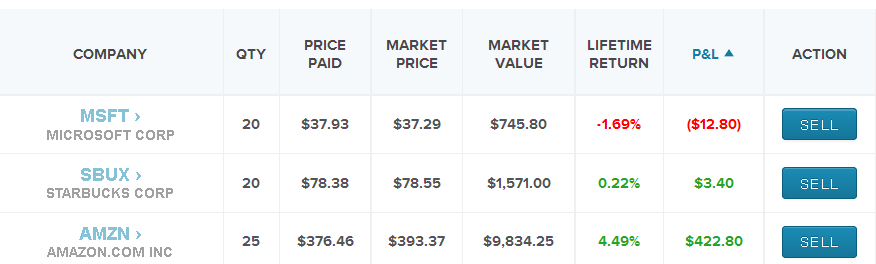

Amazon.com, Inc.

Transactions

- Company: Amazon.com

- Quantity: 25

- Date:

Buy/Sell: Buy.

Reason/Decision

Based on the recent article above and the current rate of Christmas shopping behavior among U.S.-based consumers, it can be seen that many Americans chose to shop online for the various Christmas gifts that they would be giving. This shows how online shopping has shifted from merely being a novelty to being a mainstream method of consumer purchasing. The obsession over convenience has manifested itself through the growing number of E-commerce consumers with Amazon.com bringing in an estimated $250 million during its 4th quarter sales alone. This makes the company quite valuable due to the sheer amount of profit is made and the increase in the number of consumers that continue to go to the website on an annual basis.

Microsoft Corporation

Transactions

- Company: Microsoft

- Quantity: 20

- Date: 11/27/2013

Buy/Sell: Buy.

Reason/Decision

Near the end of 2013 it was reported that Microsoft (MSFT) had purchased the mobile phone business of Nokia Inc. for $7.2 billion. While Nokia did retain its enterprise services division (i.e. mobile support and I.T. development), the sale is indicative of Microsoft’s aggressive entry into the mobile sales market. This signaled an excellent “buy” opportunity in the market given the potential that combining the experience of Nokia in mobile device development and manufacturing with Microsoft’s extensive software development capabilities. By buying Nokia, Microsoft effectively addresses its market penetration issues and makes it a potentially competitive player in the mobile smartphone industry.

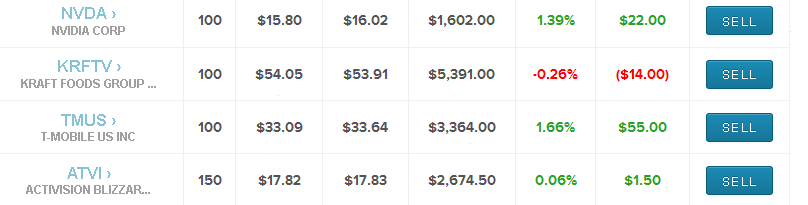

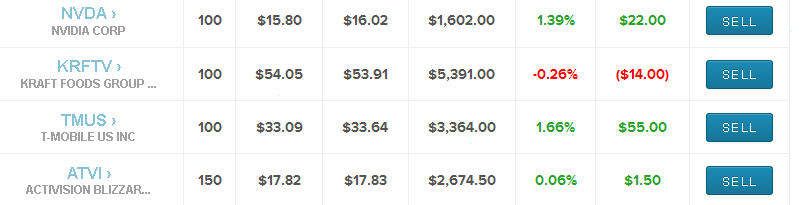

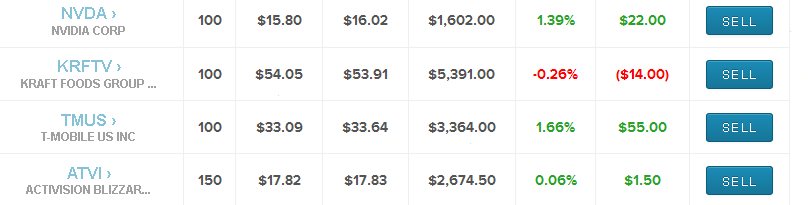

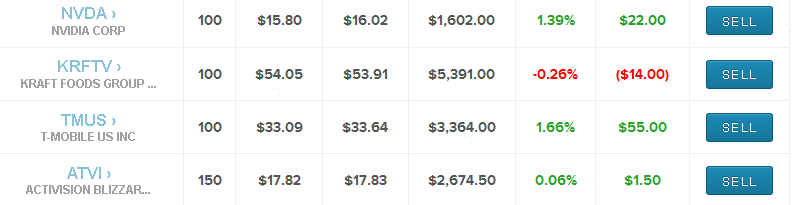

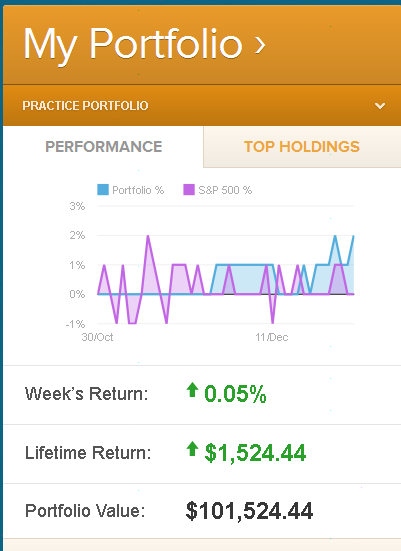

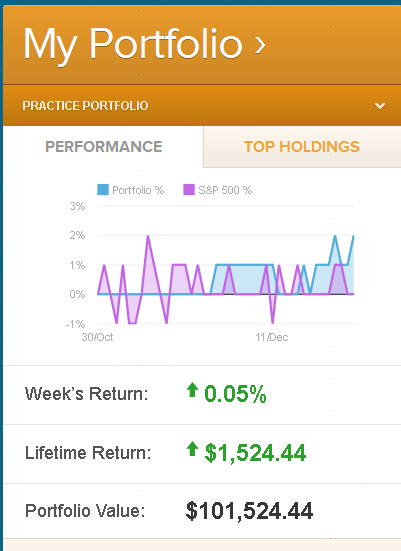

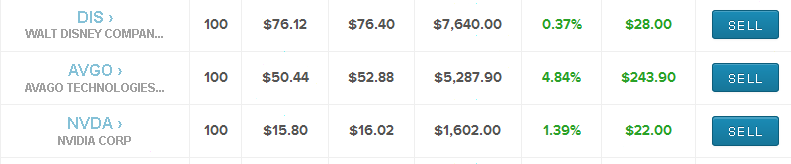

Nvidia Corporation

Transactions

- Company: Nvidia

- Quantity: 100

- Date: 12/30/2013

Buy/Sell: Buy.

Reason/Decision

The decision to buy 100 shares of Nvidia stock was in part due to two separate factors, the first was the release of a news article indicating a surge in sales of video game hardware and the current stock performance of the company on the day itself. Nvidia is one of the most well-known graphic card makers in the world and has a contract with Sony in producing the now popular PS4. With the current Christmas season seeing a spike in PS4 purchases, this would of course result in higher profits for Nvidia seeing as Sony would inevitably order more video cards in order to meet demand.

The second reason for buying Nvidia stocks was due to the sudden changes noted in the value of the stock itself. Bolstered by the positive news regarding increased video game hardware sales the price of the stock itself surged on the 30th which created an excellent buying opportunity given the potential for Sony to order even more hardware from Nvidia.

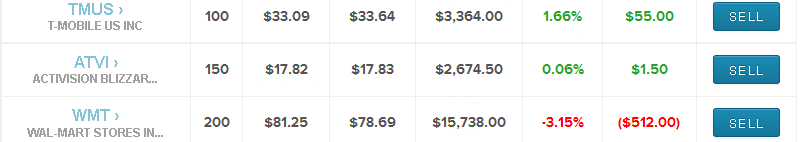

Activision Blizzard, Inc.

Transactions

- Company: ATVI (Activision-Blizzard)

- Quantity: 150

- Date: 12/30/2013

Buy/Sell: Buy.

Reason/Decision

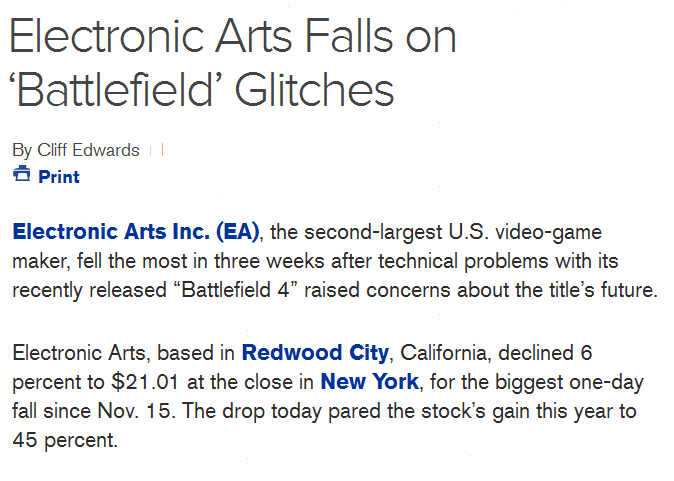

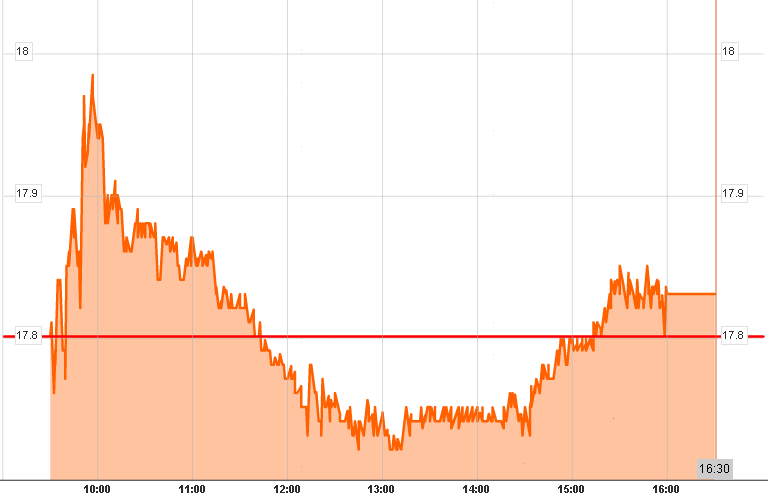

Electronic Arts (EA) is one of the current leading competitors of Activision-Blizzard; however, with the release of recent news indicating that one of EA’s flagship series, Battlefield 4, was released with considerable glitches in the game, this signaled that investors were very likely to switch to Activision-Blizzard as their primary gaming company of choice given the lackluster performance of EA at the present.

Confirmation of this news was seen in the sudden spike in EA stock value during the day. With increased investor interest in ATVI along with its future lineup of games, this increased the value of the stock, and, as such, 150 shares were bought to take advantage of the stock momentum.

Convergys Corporation

Transactions

- Company: Convergys

- Quantity: 50

- Date: 12/30/2013

Buy/Sell: Buy.

Reason/Decision

It has recently been reported that Convergys has been expanding in the Philippines resulting in up to 45,000 Filipino employees in its current global workforce. The continued expansion of the company in the Philippines can be considered as a positive sign since this indicates that Convergys is now better able to address the outsourcing concerns of its clientele by providing the necessary cheap workforce to save them considerable amounts. This makes the company more attractive in terms of stock valuation since the more call center employees it has, the more money it can make through its various outsourcing services

Time Warner, Inc.

Transactions

- Company: Time Warner

- Quantity: 50

- Date: 12/30/2013

Buy/Sell: Buy.

Reason/Decision

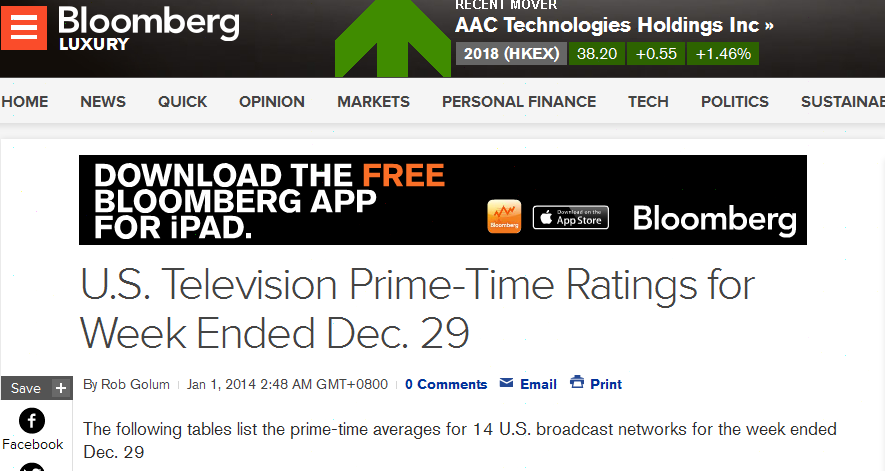

Based on an examination of the current U.S. Primetime TV network ratings, the channels owned by Time Warner consistently ranked at the top 2 or top 4 channels within the U.S. and is indicative of the development of a good channel lineup. This translates into the company being a viable investment choice since good channel programming equates to high rates of income from television commercials and sponsorships. The better a particular channel does, the more likely it is in setting premium prices for the content they deliver. When taking into consideration the results of the December 29 primetime rating, it can be seen that Time Warner has consistently ranked on the top which means that it is relatively stable in terms of delivering the type of content that consumers want. As such, as a long-term investment, the company is definitely via and 50 shares were bought as a result.

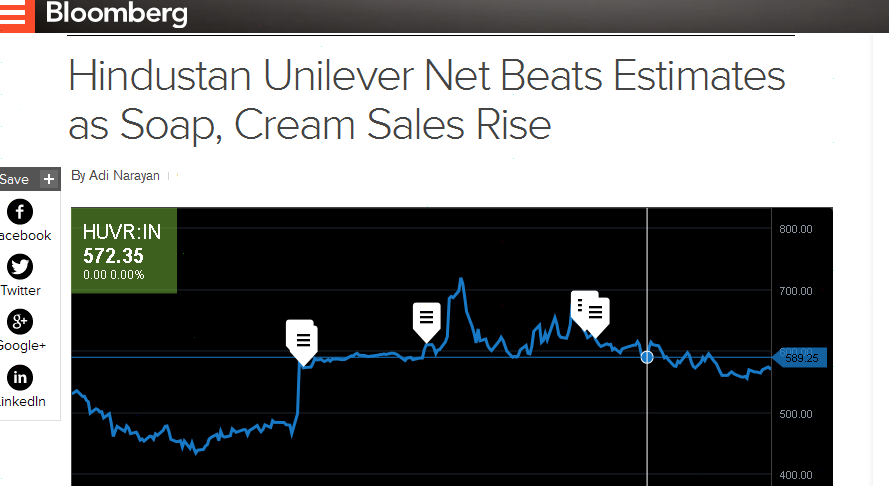

Unilever PLC

Transactions

- Company: Unilever

- Quantity: 50

- Date: 12/30/2013

Buy/Sell: Buy.

Reason/Decision

The headline of the article speaks for itself as Unilever has exceeded the expectations of analysts involving the sale of one of its product lines. Taking this into consideration, this makes Unilever rather attractive as a stock pick due to its diverse lineup of products and the fact that one of its recent products did better than expected.

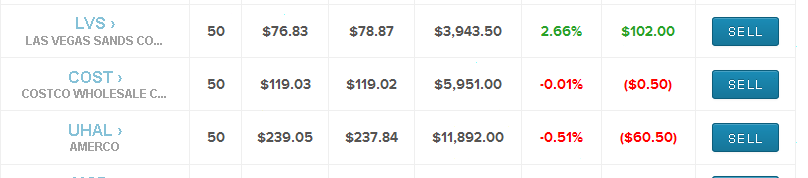

Costco Wholesale

Transactions

- Company: Costco

- Quantity: 50

- Date: 12/30/2013

Buy/Sell: Buy.

Reason/Decision

An examination of recent market data involving Costco showed that the company is roughly in line with the analysis of analysts regarding the increase in the value of the company’s stock. While the article featured above did show that Costco’s net income did miss the initial valuation developed, this was inherent because of the discounts the company offered to consumers. Taking this into consideration, Costco is still viable as an investment and 50 shares were bought as a result.

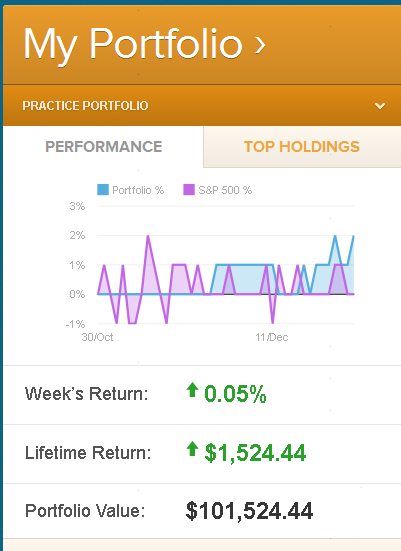

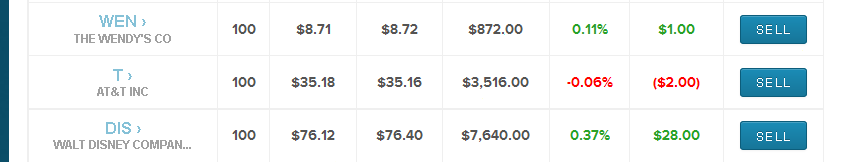

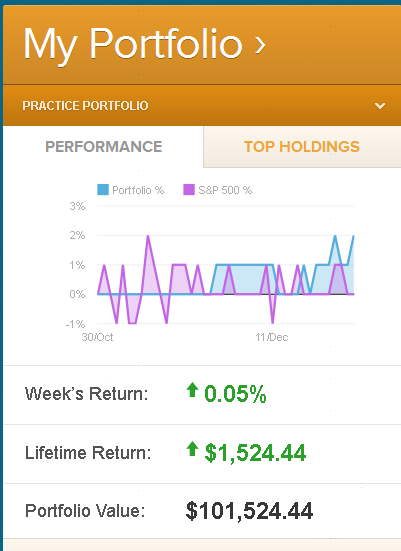

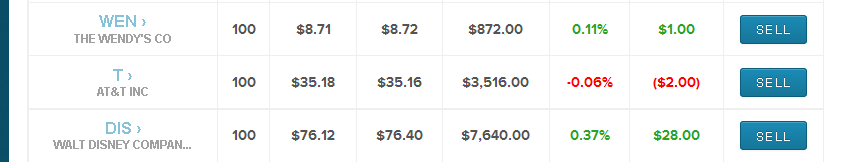

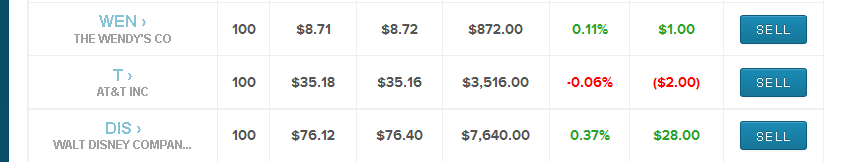

The Walt Disney Company

Transactions

- Company: Disney

- Quantity: 100

- Date: 12/30/2013

Buy/Sell: Buy.

Reason/Decision

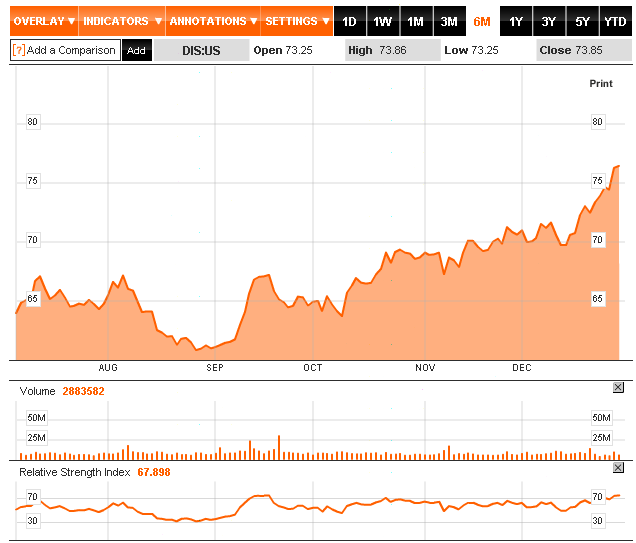

One of the first reasons as to why Disney was chosen as a stock pick was simply because it was the holiday season and it is during this time that the purchase of Disney-related goods usually increases significantly resulting in higher company profits and stock values. The second reason is seen below which is realted to the MACD and RSI of the stock based on the examination of various analysts.

As it can be seen, the sheer amount of volume related to the amount of stock traded about the previous 6 months of the year shows a progressive incline approaching the month of December. What this is indicative of is that other investors are aware that the value of Disney will go up after the month of December after its earnings report is released which should show relatively high numbers given the influx of earnings during the Christmas season. This was considered as sufficient enough impetus to invest in Disney within the short term, at least until the period leading up to the release of its yearly earnings report (Nickell, 86).

AT&T Inc.

Transactions

- Company: AT&T

- Quantity: 100

- Date: 12/30/2013

Buy/Sell: Buy.

Reason/Decision

Recently, AT&T agreed to sell a portion of its landline unit (i.e. in Connecticut) which also included its landline and TV services to FTR (Frontier Communications Corp.). This deal netted the company approximately $2 billion and enabled it to focus more on its wireless business which is considered more important than its aging landline, internet and TV-based services. Acquiring $2 billion in additional capital, this enables the company to potentially give out more in stock dividends which would increase the price of the stock. Other possible uses range from investing more into developing its wireless communication infrastructure to developing its current customer service operations. Either way, by getting rid of “dead weight” and focusing more on its strengths, the company has in effect become a more viable investment vehicle that justifies purchasing more of its stock.

Wendy’s

Transactions

- Company: Wendy’s

- Quantity: 100

- Date: 12/30/2013

Buy/Sell: Buy.

Reason/Decision

One of the most exciting tidbits of news on the month of December, at least from this report’s point of view, is the anticipated drop in bacon prices within the next few months. While this may not seem to be relevant to investing in Wendy’s on the surface, what must be taken into consideration is that a lot of the items at Wendy’s such as its Baconator, Texas-style Baconator, Bacon mushroom melt and other similar bacon-inspired food items will be that much cheaper to make next year as compared to this year. This will result in significant cost savings for the company which will translate into larger profit margins. Other aspects that were taken into consideration prior to investing in the company on the 30th involved the growing value of the stock and the fact that the company’s products are actually quite popular.

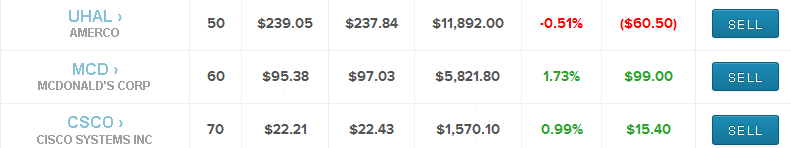

Cisco Systems, Inc.

Transactions

- Company: Cisco

- Quantity: 70

- Date: 12/31/2013

Buy/Sell: Buy.

Reason/Decision

When examining the initial opening day valuation of Ciscon on the 31st, a sudden dip in valuation was noted without sufficient external factors to justify the sudden devaluation of the stock. It was due to this, that it was interpreted as a possible buying opportunity within the stock. The performance of the stock throughout the latter half of the day justified this valuation wherein from a starting value of 22.25 it subsequently increased to 22. 43

Further justification for the purchase of more Cisco stock came in the form of the Bloomberg article shown above which indicates that Cisco will be adding 1,700 more jobs within Ontario. What this indicates is that there is a considerable demand for the company’s products and services which will result in greater long-term profits (Frost et al., 437-483). This will of course result in a much higher stock valuation for the company in the coming months as the increase in the number of workers helps it to meet demand.

T-Mobile International AG

Transactions

- Company: T-Mobile

- Quantity: 100

- Date: 12/30/2013

Buy/Sell: Buy.

Reason/Decision

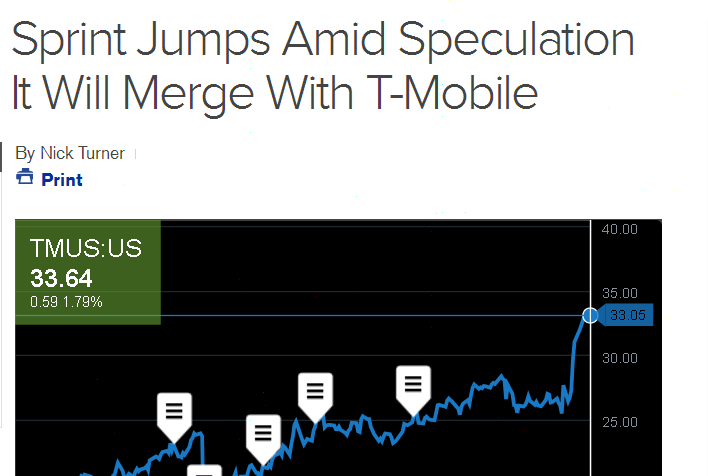

One of the current “hot topics” so to speak has been the possible merger between T mobile (which is the 4th largest mobile carrier in the U.S.) with Sprint (which is the 3rd largest mobile carrier in the U.S.). A combination of the two companies would create a telecommunications network that would easily rival the top two phone companies in the U.S. (AT&T and Verizon). Taking this into consideration, along with the latest news articles detailing a possible merger, an investment of 100 shares into T-mobile was implemented.

Kraft Foods

Transactions

- Company: Kraft Foods Group

- Quantity: 100

- Date: 12/30/2013

Buy/Sell: Buy.

Reason/Decision

Recently, Kraft Foods Inc. Authorized the implementation of a stock buyback program. This was in part due to the company consolidating its current operations by streamlining its supply line and laying off workers earlier this year. As a result, the company was able to operate more efficiently resulting in it developing the capacity to buy back some of the shares it previously has within the stock market. This is good news since a buyback program is almost always indicative of good internal fundamentals within a company. As a result, Kraft Foods Inc. became more viable as a potential long-term investment vehicle resulting in the purchase of 100 shares of stock in the company.

The U-Haul Holding Company (AMERCO)

Transactions

- Company: AMERCO

- Quantity: 50

- Date: 12/27/2013

Buy/Sell: Buy.

Reason/Decision

AMERCO is basically a holding company that owns the U-Haul service and various real estate ventures. Given its diversified service portfolio, the company does seem like a viable investment given the need for diversified income services should one underperform. One of the latest news stories that justify investing in the company comes in the form of U-Haul expanding into Haines City, Florida. This is good news since the expansion of a company into new locations is indicative of higher consumer numbers in the future which will definitely have a positive impact on company profits. It is still relatively unknown how such an expansion will impact the company as a whole, so a conservative purchase of 50 shares was made.

McDonald’s Corporation

Transactions

- Company: McDonald’s

- Quantity: 60

- Date: 12/30/2013

Buy/Sell: Buy.

Reason/Decision

It is the assumption of this investment report that happy customers and proper employee policies result in good long-term operational performance. It is based on these this that the entrance of McDonald’s into the mobile application marketplace through the use of a smartphone program that enables customers to purchase menu items and pick them up at the store while in transit makes this particular service particularly viable in terms of penetrating new consumer markets and increasing the market share of the company. By utilizing this particular means of reaching out to consumers, it can be expected that McDonald’s will be able to increase its current performance numbers which would also increase the price of the stock itself. Not only that, based on an examination of various analysts, it can be seen that McDonald’s stock has been known to be relatively stable and increases on a yearly basis due to the sheer amount of consumers it has in the global marketplace.

Las Vegas Sands Corporation

Transactions

- Company: Las Vegas Sands

- Quantity: 50

- Date: 12/30/2013

Buy/Sell: Buy.

Reason/Decision

The decision to invest in Las Vegas Sands is in part due to its plan to expand into Japan should the country’s lawmakers agree to legalize casinos within the country. Presently, Las Vegas Sands is ranked as one of the most diverse resort owners in the world. It has a wide variety of beaches, hotels, and has an employee population that is well known throughout the world as being hospitable to guests and as a bonus most if not all of the local workers speak and understand English. This makes it an ideal tourist destination for a wide variety of tourists from all around the world. With the current growing global gambling market, more people are choosing to travel internationally which makes Las Vegas Sands a potentially viable investment choice in order to capitalize on this new behavior. Should Japan’s lawmakers agree to legalize casinos in Japan and if Las Vegas Sands expand properly into the country, this will result in higher revenues for the company resulting in a better stock value outlook in the long term.

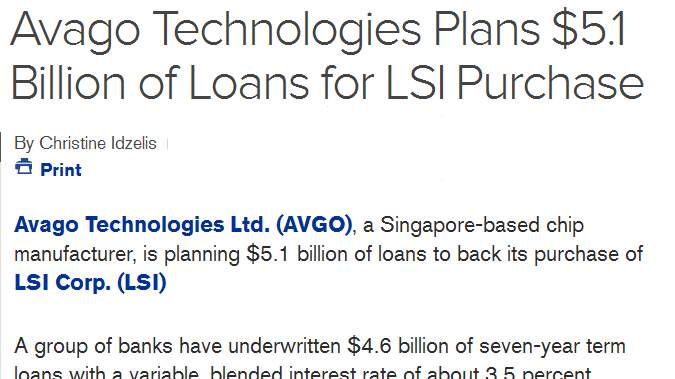

Avago Technologies

Transactions

- Company: Avago Technologies

- Quantity: 100

- Date: 12/16/2013

Buy/Sell: Buy.

Reason/Decision

The decision to invest in Avago Technologies was brought about through an examination of its business model and how it chooses to address the current issue of the desire for companies to reduce costs while at the same time increasing their production capacity. It has recently been announced that the company is going to purchase chip manufacturer LSI in order to improve its overall product portfolio. This is indicative of a good valuation given the potential for Avago to not only improve its operational performance but also enable the company to expand into different markets resulting in higher long-term profits. It is expected that other investors would have the same idea regarding the current state of the stock and it is very likely that the stock price should increase considerably in the upcoming months. This makes it viable as an investment pick for the mid to short term depending on how well the company integrates LSI into its main retinue of product offerings.

Walmart Inc.

Transactions

- Company: Walmart

- Quantity: 200

- Date: 11/27/2013

Buy/Sell: Buy.

Reason/Decision

With the release of reports on the latter half of November of more American’s filing for unemployment claims, this is indicative of two specific factors:

- Consumer spending will be lower

- Consumers will be going for more affordable consumer goods.

Wal-Mart, with continued expansion within the U.S. as well as the ubiquitous knowledge of the brand as an affordable choice among local consumers, makes it a viable investment choice in the upcoming months as consumers cut back on their spending habits. Relatively unknown food retailers do not stand as much of a chance against Wal-Mart and, as such, make it viable in the long term due to sheer brand recognition and the fact that it is currently the largest retailer in the world. It should also be noted that due to the current holiday season, the performance of the company is going to improve resulting in higher profits during the 4th quarter.

Works Cited

Chernoff, Joel. “Lessons Learned From The Survivors.” Pensions & Investments 31.4 (2003): 8. Print.

Frost, Carol Ann, Elizabeth A. Gordon, and Andrew F. Hayes. “Stock Exchange Disclosure And Market Development: An Analysis Of 50 International.

Exchanges.” Journal Of Accounting Research 44.3 (2006): 437-483. Print.

Nickell, Joe Ashbrook. “Get Smart.” Ziff Davis Smart Business 15.5 (2002): 86. Print.