Introduction

The Philips curve shows the relation between the rate of inflation and the unemployment rate of a country (Hoover). The theory of the Philips curve is pioneered by William Philips in 1958, who showed the relation between wage inflation and unemployment are inverse in his paper. The idea of Philips was accepted widely, and it was considered as one of the major economic theories before 1970 when stagflation proved the Philips theory as an inefficient theory.

However, the theory is being used widely around the world as it helps analysts to measure the actual relation of a country’s unemployment with the inflation of that particular country. Even today, the importance of the Philips curve is very high, as economists still use it to justify a country’s inflation level under different economic situations. In 2014 Daly and Hobjin researched wage inflation during the recession to find out the impact on the unemployment rate, and they have concluded that downward rigidities of wage bend the Philips curve.

They also concluded that the bending of the Philips curve happens in two different ways- during inflation, the unemployment rate has more impact on the curve, and after the recession, wage inflation takes the movement to reduce the effect of unemployment. As an economist, it is very significant to understand how the Philips curve is formed and how the selected variables are used to calculate the Philips curve.

On the other hand, in 1962, Arther Malvin Okun proposed an empirical relationship between the growth of unemployment rate and the real GDP growth of a country, his model is not derived from any theory rather, the model is proved empirically, and it is known as the Okun’s law. Okun’s law states that an increase in the 1% unemployment rate usually has a 2% or higher negative impact on the real GDP of a country. As it is explained in the paper, the theory is more focused on all collective factors of GDP growth, which includes changes in labor force participation, changes in the hours worked, changes in the output due to the changes in the total working hours, etc.

Because of the use of mathematical approximation, Okun’s law was proved to be very useful for economists for managing the unemployment rate of an economy, helping them to estimate the approximate cost of maintaining an expected level of unemployment rate in the country. Okun’s law has become the basis of forecasting the economic conditions, especially unemployment and country output.

Due to the empirical applications of the model, many researchers have been adopting Okun’s law ever since the model was proposed by Okun. Ball et. al have concluded in their paper that professional forecast believes the Okun’s law given that the data have an acceptable error. Their study finds that Okun’s law is consistent as they found the relationship between the unemployment rate and the output growth rate is negative, as proposed by Okun in 1962 (Ball et al..12).

In this paper, we will use the standard theory of William Philips to measure the Philips curve of Turkey using 25 years of available data of the country. We also will examine the relationship between the inflation and unemployment rate in the context of the economic progression of Turkey during the last 25 years, starting from 1990 to 2016. The paper will also measure the impact of Okun’s law in the context of Turkey, considering the unemployment data and GDP growth of the country in the last 25 years. Finally, the paper will provide a comprehensive conclusion on the relationship between unemployment, inflation, and the economic growth of a country like Turkey.

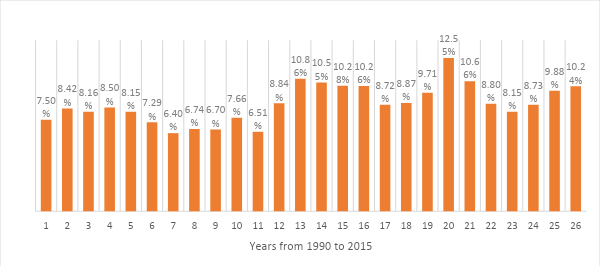

The following table and bar charts are exhibiting the unemployment rate of Turkey for the last 25 years of time. The data is collected from the databank of the world bank, which is accessible to everyone around the world. As the data is published by the world bank, there are many reasons to perceive the data to be accurate; for our calculation of Philips curve and Okun’s law, we will be assuming that the collected data is error-free and qualified enough to be used in the calculation of Philips curve and Okun’s law.

A link to the data site is provided for further verification. The world bank developing report is published each year, which is considered to be a great source of studying the economic, social, and environmental state of different countries around the world. The world bank claims the development report is used by many multilateral and bilateral organizations around the world. The development report of the world also used

By many scholars, a business organization to analyze different economic factors to support their decisions. And the data used for preparing the report is a very accurate representation of the current picture of different social and economic aspects of countries around the world.

The bar chart is showing a systematic fluctuation of the unemployment rate, suggesting the lowest unemployment rate (6.51%) in the year 2001, which then rose above 8% and never to drop below that level while the data is showing a maximum unemployment rate (12.55%) in the year 2010 (see fig.1).

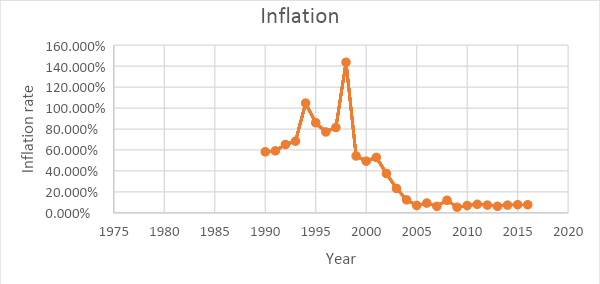

From the inflation data of turkey, we can find that inflation was very high during the 90s. In 1998 the inflation rate was significantly noticeable as the year is exhibiting the highest level of inflation (143.6%) in the past 25 years, after that pick the inflation started to drop as we can assume that probably the government has started to control its inflation after 1995 and in the year 2004 the inflation rate dropped drastically and showing a controlled movement in either direction since then. In the year 2009, we can observe the lowest level of inflation (5.40%)( see fig.2).

From the graphical representation of the inflation and unemployment rate of turkey it can be said that the Philips curve of the country should give us an inverse relation, as we can see from the data when inflation rose the unemployment of the country reduced or vice versa.

Table 1. Economic Information of Turkey (1990-2016).

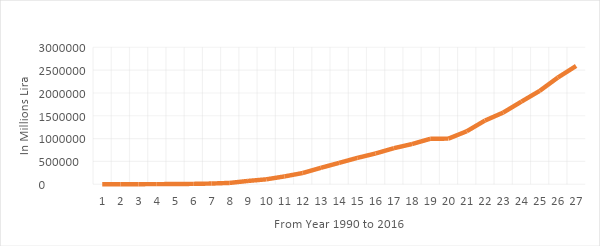

Despite the movement of inflation, we can observe a consistent growth in the GDP of Turkey for the last 25 years, and the trend of the growth is consistently showing the lowest GDP (393 million Lira) in the year 1990 and the highest GDP (2590517 million Lira) in the year 2016( see fig.3). Moreover, the data is representing that there were negative changes in the GDP of the country which help us assuming that probably the Okun’s law is less effective on the output growth of Turkey, and if our assumption proved to be true then we will further explore to identify the reasons that helped to offset the Okun’s law.

Philips Curve of Turkey

Using the LINEST function in the Excel we tried to estimate the coefficients of the Philips curve and the result of the linear regression model in the excel is given back the following equation, Unemplyment rate Y = – 0.02815x + 0.0996

Where X is the inflation rate in the economy. This is the simplest version of the model which does not consider the changes in the unemployment rate with the relation to inflation rate changes. The following table is representing the descriptive statistics of the model received from the LINEST function in the excel.

Table 2. LINEST Output.

The slope of the equation is showing an inverse relationship between the inflation and the unemployment rate is inverse, which means an increase 1% inflation rate has a negative effect of around 2% on the unemployment rate of Turkey and vice versa. The result is successfully suggesting that the theory of Philips is helpful in measuring the unemployment rate or even forecast the unemployment rate of a country.

Coibion and Gordonichenko tried to find out the significance of the Philips curve after the great depression and concluded that the great depression experienced deflation which is why unemployment rate had to go down, otherwise the Philips curve is still helpful in forecasting the inflation effect on the unemployment and therefore the economic condition of a country (230). The standard error of the slope is not very significant (.0061) which is not even 1% so the result can be considered very authentic, similarly, the standard error of the intercept is very low (.0033) to be taken into consideration.

From the R2 coefficient, it can be asserted that the model is showing an inverse relation between 75% variations are explained by the determinant of the coefficients. That means there are some other variables that have an impact on the unemployment and the model is not very reliable. The coefficient of determination is showing that only 47% of variations are explained to the fit which is not a reliable score. The model needs further exploration.

The F statistic of the model is 21.22 while there is the degree of freedom of 24. The regression of the sum of squares is also pointing towards a result that is very insignificant, and the residual value for the sum of square is representing a very low score, however, it shouldn’t have any substantial impact on the model. Therefore, it can be concluded from the analysis of the regression model that the model is successfully representing the law of Philips but the variations in the model is not perfectly explained by the variation of the inflation data only, which compels us to assume that there are some other variables that have impact on the unemployment rate changes in Turkey.

Changing the Philips Curve to Measure the Natural Output with the Sacrifice Ratio

Measuring the changes in the inflation in response to the changes in the unemployment rate we find the model changes into the following equation-

Δπ = -2.90374x-0.01699361

On the contrary we have learned that changes in inflation is the function of, Δπ=α (yt – y). Now, if we assume that the yt – y = 1 then we get Δπ=α

Here, the changes in the natural unemployment rate is considered as x in the first equation that is derived from the regression function. Replacing the x by 1 we get α value which is for the case of Turkey = -2.921so the standard Philips curve model is, Δπ = -2.921 (yt – y).

Table 3. Y = a + bx.

The slope of the model is suggesting a negative relationship between the inflation and the unemployment rate, in other words for increasing 1% inflation the sacrifice of 2.92% unemployment is required or vice versa. The standard error of the slope is showing a considerable error, suggesting there could be a serious error in the estimation of the model or selection of the variables.

The R2 value is clearly suggesting that the model is incorporating an explanation of 2% outcome only which is clearly explaining the model is not only dependent on the unemployment changes there are some others variables that have serious impact on the unemployment rate of the country. And the F statistic and residual errors of the sum of squares are pointing towards the illogical shape of the Philips curve.

Estimation of Okun’s Law

Although the Okun’s law assets that 1% changes in the unemployment rate is associated with 2% changes in the gross domestic production of a country, but Ball Laurence et. all found that the impact of 1% changes in the unemployment output varies country to country (Okun’s Law: Fit at Fifty? 3). The following equation is used to measure the Okun’s law,

Δu=a+bgyt

Where,

- a = the constant of the model

- Δu = changes ∈ the unemployment rate

- b = slope of the model

- gyt = growth rate of the GDP of Turkey

And from the regression analysis we find that the model represents the following result,

Δu = -0.0289 gyt +0.102

That means 1% change in the GDP growth rate in the Turkey will have positive impact of 7.3% impact on the unemployment rate and the relation will stay positive until the GDP growth rate is around 5% which means the country has a natural growth rate of 3.5%. After the natural growth rate, there will be a.5% negative impact on the growth rate for the 1% change unemployment in the Turkey.

Table 4.

The slope is suggesting a negative relationship between 2.9% but the constant of 10.19% is showing that the country has a good amount of floor to cover the natural growth. The R2 estimation is suggesting that not all the variations or good amount variations are covered by the model. Although the standard errors of the slope and intercept are displaying a minimal amount error in the model R2 is suggesting there are some more variables that might have the impact of the changes in the unemployment rate and therefore the growth rate of Turkey.

Standardization of Okun’s Law

Just like the dynamic world, the Okun’s law is also dynamic, since its inception in 1962 it has been adopted by many researchers who have been consistently suggesting a new dimension of the Okun’s law. The changes of the law have been helping the economists for taking more effective economic decisions and policymakers to come up with an effective policy. Zanin and Marra asserted in their article that Okun’s coefficient changes over time by means of the OLS rolling regression they have asserted it based on the findings of Moosa, Perman, and Tavera, and Knotek (93). The simple way of standardizing Okun’s law is to calculate the natural growth rate of the GDP and deducting it from the equation. In order to calculate that our above equation would be (assuming changes of unemployment rate as constant),

0 = -0.0289 gyt + 0.102

-0.102 = -0.0289 gyt

gyt = -0.102 / -0.0289 = 0.0353

Using the growth rate, we find the equation to be,

Δu = -0.0289 gyt + 0.1009

Δu =4.1398 (gyt – g)

Table 5.

The R2 of the model is suggesting that the 51% variations are explained by the model. Therefore, the model suggests that the GDP growth rate is not the only indicator of the unemployment rate in the country. The adjustment of the natural growth rate has reduced the intercept to an extent, apart from that rest of coefficients indicating a positive sign.

From the R2 results of the regression models, we have found that around 50% variations are explained by the model which is a considerable issue. The probable reason for the result could be the age wise relationship between the labor force members and the unemployment. Hutengs and Stadtmann studied the pattern of unemployment in more detail and found that younger age group’s participation in labor force increases the unemployment rate more comparable to the age group’s participation in the labor force (6).

We would like to conclude that the Philips curve and Okun’s law together can help analyzing an economy and forecasting the future growth of the economy. Both the Philips curve and Okun’s law have one common variable which is the unemployment rate, and these variables are interlinked to each other which work as economic indicators of a country.

From the result of the analysis it is found that the inflation has around 2% negative impact on the unemployment of Turkey, similarly, we found unemployment rate changes has around 2% or more impact on the output of Turkey. Which implies that 1% changes in the inflation rate of Turkey should have a negative impact of 4% or more on the gross domestic production rate.

Works Cited

Ball, Laurence et al. “Do Forecasters Believe In Okun’S Law? An Assessment Of Unemployment And Output Forecasts.” International Journal Of Forecasting, vol 31, no. 1, 2015, p. 12. Web.

Ball, Laurence, et al. “Okun’s Law: Fit at Fifty?” National Bureau of Economic Research, 2013, pp. 3. Web.

Coibion, Olivier, and Yuriy Gorodnichenko. “Is The Phillips Curve Alive and Well After All? Inflation Expectations and the Missing Disinflation.” American Economic Journal: Macroeconomics, vol. 7, no. 1, 2015, p. 230. Web.

Daly, Mary C., and Bart Hobijn. “Downward nominal wage rigidities bend the Phillips curve.” Journal of Money: Credit and Banking, Vol. 46, no. S2, 2014, pp. 51-93. Web.

Hutengs, Oliver, and Georg Stadtmann. “Age effects in Okun’s law within the Eurozone.” Applied Economics Letters, vol. 20, no. 9, 2013, pp. 821-825. Web.

Hoover, Kevin. “Phillips Curve.” The Concise Encyclopedia of Economics: Library of Economics and Liberty, 2008. Web.

The World Bank. “World Development Indicators.” Web.

Zanin, Luca, and Giampiero, Marra. “Rolling Regression Versus Time‐Varying Coefficient Modelling: An Empirical Investigation of The Okun’S Law in Some Euro Area Countries.” Bulletin of Economic Research, vol. 64 no. 1, 2012, pp. 91-108. Web.