Introduction

In the modern world of business, companies are forced to engage in stiff competition to survive in the market. Due to this, enterprises need to conduct a thorough analysis of the industry they are a part of to be able to adapt to the changing demands of the market and the challenges posed by their rivals. In this paper, a scrutiny of the external environment in the tourist industry in UAE will be conducted.

The analysis of the macro-environment and Porter’s five forces analysis will be carried out; a strategic group map for certain representatives of the industry will be drawn, and the key success factors will be named. Finally, the industry’s profile and attractiveness will be summarized. In the paper, it will be demonstrated that the tourist industry in UAE provides numerous opportunities and benefits to the players that already exist in it, but it may be difficult to enter for new enterprises.

Macro Environment Analysis

Political

UAE is comprised of seven emirates, each with its own Emir at the head; the Supreme Council of Emirs is the highest authority in UAE. There are no political parties. The political situation is rather stable and carries no threats to the tourist industry due to potential or ongoing conflicts (Santander Trade Portal, 2016).

Economic

The UAE’s economy is largely based on oil trade; the country contains vast reserves of crude oil. The tourism industry and the banking sector alleviate harm from falling oil prices (Santander Trade Portal, 2016). The country’s leadership favors the tourism industry and invests money into it (particularly, in Dubai).

Social

The country has quite a favorable social situation. Poverty rates are reported to be very low; the income of the population is among the highest in the world, but there exist differences between different emirates and between various social strata. Crime rates are reported to be very low (“PESTEL/PESTLE Analysis,” 2016). The literacy rates are nearly 95%; women are declared to have equal rights with men, and to more often enroll in post-secondary education institutions than males; the health care delivery system is stated to be undergoing improvements currently (Embassy of the UAE, 2015). The official state religion is Islam.

Technological

It is stated that the leadership of the UAE is concentrating on advancing the technological development of the country while preserving its natural environment (U.A.E. Trade & Commercial Office, 2014). The country is advancing research in technology and life sciences, and investing profoundly into the technological development; a good indicator of this is the fact that UAE is planning to launch its spacecraft to Mars in 2021 (The Official Portal of the UAE Government, n.d.).

Demographic

The UAE is a multiethnic society. The indigenous population of the country accounts for only ≈20% of the total population; the rest are immigrant workers, mostly male, mainly from Asia. The sex ratio is 2.19:1.0 (male:female, 2014 estimate). The population is nearly 5.6 million; it is highly urbanized (84.4%, 2011). The median age is 30.3 years; life expectancy is high (77.09 years, 2014 est.) (IndexMundi, n.d.). On the whole, the demographic situation is favorable.

Strategic implications

The above factors point to the fact that the Miral Company is going to benefit from a consistent increase in the number of customers. The political and economic environment of the UAE can be deemed as rather favorable for attracting tourists and, therefore, increasing the profit margins of the entrepreneurship. The technological advance of the state also serves as the premise for attracting tourists as the application of the latest technological advances will allow improving the quality of the services provided to a considerable extent.

The social context of the UAE can also be deemed as rather favorable for at the Miral Company as it provides the background for a positive experience and can be used to make people’s holidays pleasurable. Specifically, the diversity of the state can be viewed as an evident asset as it creates prerequisites for a safe environment and allows for a positive cross-cultural experience.

Porter’s Five Forces Analysis

The threat of new entrants

The hotel industry in the UAE has been growing and advancing for some time, and now, having entered “the stage of maturity,” it is rather established (“UAE Tourism Industry,” 2012). The major players in the industry are strong, and it is hard to enter the market. Similarly, other tourist attractions such as malls, beaches, and often parks, enjoy popularity as the places for tourists to frequent in the UAE.

The retail industry, which malls belong to, and the recreation industry, which parks and beaches factor in, have also reached the maturity stage, therefore, providing a plethora of opportunities for tourist attraction – as a recent report states, its profits have grown by 10% (UAE ranked eighth most attractive retail market globally, 2015).

The threat of substitute products or services

It might be hard for customers to find providers of substitute services in the industry because there are not many alternatives to hotels and resorts in principle; renting apartments is also costly. Thus, customers are probable to choose between different hotels. On the other hand, it is easier for clients to find substitutes for a particular amusement service.

Bargaining power of customers

The bargaining power of the clients in the tourist industry is not very high because there are many customers. For instance, it is stated that the UAE had the highest hotel occupancy rate in the Middle East in 2015 (Basit, 2016). Because of this, clients cannot drive the prices down, for there is an abundance of demand for tourist industry services. The same can be said about the retail industry. However, the high diversity rates weaken the bargaining power of buyers significantly. Therefore, the overall rates can be deemed as moderate.

Bargaining power of suppliers

The suppliers of the tourist industry include real estate building companies, interior designers and decorators, food suppliers, etc. There exist a large number of suppliers who can provide the members of the industry with the necessary goods, which means that the bargaining power of suppliers is relatively low, for the tourism businesses can easily switch to other suppliers if needed. Likewise, the retail industry and the recreation one feature a large variety of suppliers, who are ready to provide their services at a relatively low price.

The intensity of competitive rivalry

There is an intensive competitive rivalry in the industries because of the existence of a large number of service providers, and it is difficult to provide something which one’s rivals can’t currently offer or easily copy. For example, there are 534 hotels in Dubai alone (TripAdvisor, 2016). Besides, in the hotel industry, there exists a high level of customer loyalty, which is an advantage for the existing businesses and a challenge for the newcomers.

Strategic implications

Due to the high competitive rivalry and the difficulties with entering the market, it may be recommended to start a tourist business in the UAE by purchasing or merging with the existing business. It will also be difficult but important to offer products or services which explicitly stand alone from the alternatives present in the market. In other words, it is expected that the firm will have to face rather tough competition.

The fact that the company has not yet taken the position of a leader in the target environment may cause problems with the further adjustment to the environment of the target market and the rivalry rates in it. Therefore, it will be necessary to come up with a unique marketing strategy that will help set the company aside from a range of similar ones. The above goal can be achieved by designing a brand product and a brand image that will help make the entrepreneurship more recognizable and, therefore, target a larger population.

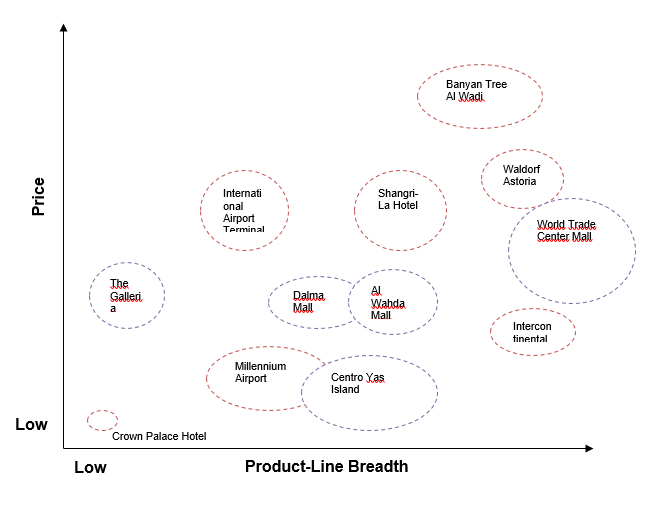

Strategic Group Map

A strategic group map for the hotel industry in UAE can be found in Appendix 1. It was drawn based on the data collected from a hotel’s website (“Hotels in the United Arab Emirates,” 2016). There is an abundance of hotels in the country, but only a manageable number of Emirati hotels have been chosen for this assignment.

The vertical axis of the strategic group map represents the minimal price of a stay at the hotels; at the time of the map’s creation, the minimal prices of the chosen hotels varied from $68 to $427. The horizontal axis represents the product-line breadth; in this case, the number of amenities listed in the hotels’ and malls’ web pages on the website was taken into account (“Hotels in the United Arab Emirates,” 2016). The chosen hotels were grouped according to their position on each of the axis; if some hotels were close on both axes, they were considered part of a single group.

Strategic implications

It is clear that not all the positions of the map are equally attractive (for instance, despite the low prices in Crown Palace Hotel, its position is less attractive than that of Centro Yas Island and Centro Sharjah). From the map, it can be seen that a new enterprise entering the market should try to provide clients with the number of amenities that are not less than the average; this should be done almost regardless of the price of the new hotel’s services.

The above information means that the Miral Company will have to struggle to be able to take the niche that has not yet been filled, i.e., providing high-quality services for moderate prices. Seeing that a range of firms already targets the specified area, Miral will have to be very creative with its quality management and service design strategies to succeed. The use of a strong TQM approach, particularly the adoption of the Six Sigma framework, should be viewed as an option.

Key Success Factors

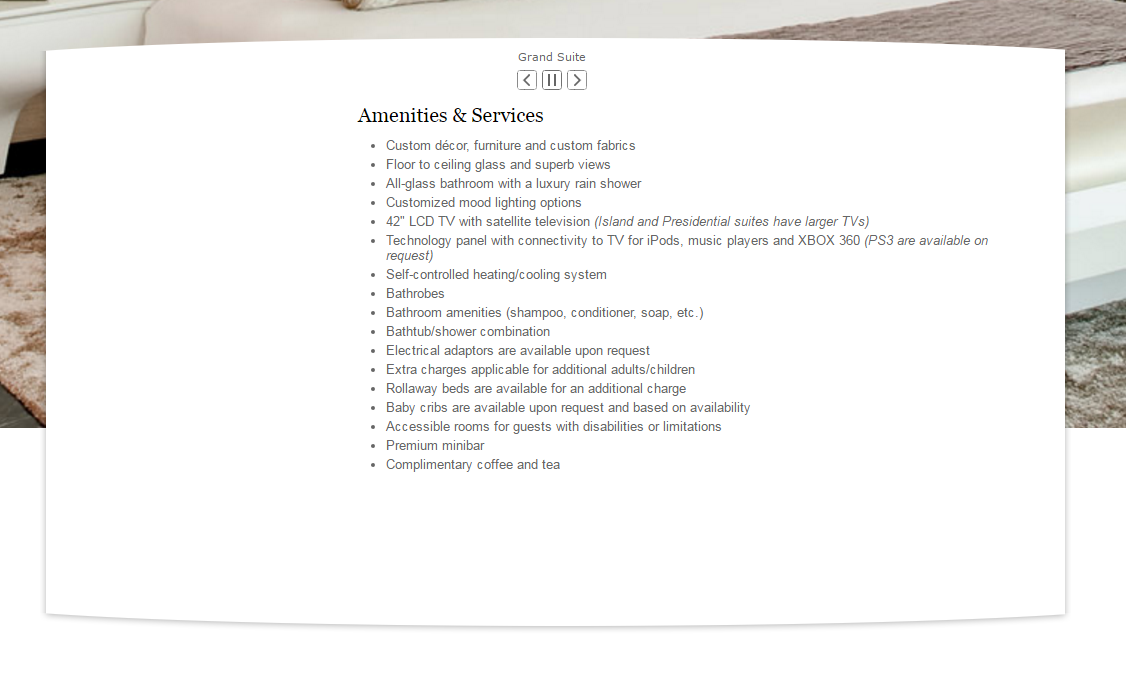

A list of five key success factors (chosen from the list provided by Gamble, Peteraf, and Thompson (2014, p. 63)) can be found in Appendix 2. The importance of the first factor is determined by the abundance of businesses related to the tourist industry (hotels in particular) in UAE and the need to provide services that would stand alone from the rest. The second factor is essential because tourists usually wish to gain courteous service for the money they pay, and can easily switch to another provider if the service appears unsatisfactory from the courtesy.

The third factor is crucial because customers need to find information about the business in question in a situation when there is much supply of the services of this type in the market, and choose to purchase services from this business and not its numerous rivals. The fourth factor is paramount for many enterprises in the industry, primarily for hotels, because clients need to be able to book accommodation easily. Finally, the fifth factor matters because the customers will choose services that are located near places where they enjoy spending their time (for instance, a hotel should be located near the beach).

Strategic Implications

Both new companies and the existing business should focus on the named factors to successfully compete in the market. The fact that the tourists seek the services of the finest quality implies that, by creating a strong brand image and continuing its current quality management approach, the entrepreneurship is likely to increase its profit margins significantly. While it would be wrong to expect that the company will be able to compete with the UAE corporate giants, it is still reasonable to assume that it will be able to meet the customers’ demands successfully. Therefore, the firm will be able to take a very specific niche in the target environment.

Industry Profile and Attractiveness

To sum up, it should be noted that the tourist industry in the UAE is developing rapidly, and is enjoying numerous benefits thanks to the state authorities’ desire to diversify the economy. The macro-environment in UAE is favorable for the industry of the tourism; any business is likely to enjoy multiple benefits from it, including the abundance of clients, and perhaps even the support of the local and state authorities.

The industry is rather attractive to the incumbents because of several factors, the large numbers of tourists in the UAE being one of them. However, it might be hard for new firms to enter the industry as a result of the high competitive rivalry and the need to offer products that stand alone from the rest of what is supplied in the market. No significant challenges for the industry are apparent; even despite the world economic crisis, the hotel occupancy rates in UAE are extremely high. Therefore, the industry remains highly attractive for the current player’s thanks to the possibility to make high profits even despite a large number of rivals in the existing market but may be difficult to enter for new enterprises.

References

Basit, A. (2016). UAE hotels record highest occupancy rate in Mideast. Web.

Embassy of the UAE. (2015). Social and cultural. Web.

Gamble, J. E., Peteraf, M., & Thompson, A. Jr. (2014). Essentials of strategic management: The quest for competitive advantage (4th ed.). New York, NY: McGraw-Hill Education.

Hotels in United Arab Emirates. (2016). Web.

IndexMundi. (n.d.). United Arab Emirates demographics profile 2014. Web.

PESTEL/PESTLE analysis of Dubai. (2016). Web.

Santander Trade Portal. (2016). United Arab Emirates: Economic and political outline. Web.

The Official Portal of the UAE Government. (n.d.). Science and technology. Web.

TripAdvisor. (2016). United Arab Emirates hotels. Web.

UAE ranked eighth most attractive retail market globally. (2015). Web.

UAE tourism industry. (2012). Web.

U.A.E. Trade & Commercial Office. (2014). Environmental technology and services. Web.

Appendix 1

Hotels in UAE: a strategic group map. Based on the data from a hotels website (“Hotels in United Arab Emirates,” 2016).

Appendix 2: Yas Island Options

Appendix 3

Key success factors (Gamble et al., 2014, p. 63):

- “Breadth of product line and product selection.”

- “Courteous, personalized customer service.”

- “Clever advertising.”

- “Strong e-commerce capabilities.”

- “Convenient location.”