Introduction

The transport sector has become the focus of attention among policymakers because it contributes to a great amount of environmentally destructive greenhouse gas emissions and also consumes a large portion of a country’s petroleum expenditure.

Because of this, most governments around the world are considering shifting to electric vehicles as alternative means of transportation. The motivation comes in the form of tax exemptions, government subsidies, or consumer price incentives. In the United Kingdom, they focused on enhancing technology-neutral measures like stern vehicle GHG emission standards, while in China the government has instituted a number of programs to entice consumers to purchase what they call NEVs or new-energy vehicles (Mangram 294).

Electric cars can help reduce CO2 emissions and improve air quality, but these are difficult to introduce in the market since they are a threat to the gas-powered auto industry; that is why some states have difficulty promoting development of electric cars. Tesla CEO Elon Musk (qtd. in Stringham, Miller and Clark 86) argues that new entrants trigger innovation and barriers in the auto industry could be overcome.

Tesla has been in the forefront of providing the world with luxury electric vehicles and has encountered various challenges in its entry in a very-stiff competitive car industry. But the automobile industry is quite immune to the threat of new entry and starting competitors like Tesla. According to Michael Porter, barriers to entry may include economies of scale, learning curves, factors in distribution, and other financing problems.

Economies of scale have tremendously grown after World War II due to automation and mergers and acquisition (M&As). In the nineteenth century, there were six leading car manufacturers – General Motors, Ford, Chrysler (plus AMC/Jeep), Honda, Nissan, and Toyota – but the same is still true these days in the age of globalization and high technology (Stringham, Miller and Clark 85). Tesla is still a young competitor against a 150-year-old internal combustion engine (ICE) car industry (Mangram 289).

This paper attempts to analyze the success (or failure) of Tesla cars in its entry in the competitive car industry and how the driving public, both in the United Kingdom and China, has accepted it as a necessary means of transportation.

Literature Review

Technology Innovation

Much of the progress of science has been motivated by deep interest in change. This interest is not abstract but with deep practical value. If changes are seen, people take aims to study so that they may be understood. If changes are understandable, they may probably be foreseen. Research in economics and management has been dealing with thoughts of social, industrial, and technical change at successively finer levels of resolution, seeking first to understand, and then to shape the circumstances and activities that bring about wide ranging changes.

One of the key features throughout this dissertation is the impact of change in society, particularly in the car industry. This will provide explanations on theories of technology transitions, management of niches, and various learning as part of a product development process. The literature on transformational product which came to dominate the technology or design paradigm made the reasonable assumption that the best-performing design will capture the largest share of the market (Peterson 7).

Early car designers had little constraint in terms of infrastructure or institutions to guide their choice of technology. Vehicles powered by internal combustion engines (ICEs), steam engines, and electric motors were all produced in roughly similar numbers, with clear advantages and disadvantages. Battery electric vehicles (BEVs) were the perfect city car, but lacked range. ICE vehicles had greater range but required dangerous hand-crank to start. Steam vehicles had the best performance at low speeds but took up to 45 minutes for the boiler to reach operating temperature (Hidrue 31).

There are various technical alternatives under the EV sector that include Battery Electric Vehicles, Fuel Cell Vehicles, Hybrid Electric Vehicles, Plug-in Hybrid Electric Vehicles, and much more. The electric vehicles industry is already a mature industry. It is global in scope but it provides examples of pronounced differences between regions in terms of market age, size, tastes, and landscape conditions.

The industry is undeniably in the midst of technology regime transition, a transformation that many would say is long overdue (Peterson 35). Moreover, the car industry is also under immense pressure from regulatory requirements for efficiency and emissions, economic changes due to global uncertainty in the price of gas, and changes in market structure because of the entry of the China market, which introduced both new producers and consumers and is undergoing its own shifts because of massive urbanization (Peterson 34).

It is a great advantage for the EV sector that the petrochemical industry has experienced decades of increasing price volatility and supply uncertainty. Negative criticisms for the automotive industry include GHG-producing manufacturing processes, CO2 emissions, pollution of the environment, which are all associated with global warming, added with increasing global attention.

In the midst of this backdrop, Tesla enters the scene with much optimism. Tesla produced its first Roadster for $110,000 from 2008 to 2012, but it is hoping to provide its customers low-cost EVs. CEO and Board Chairman Elon Musk indicated that their goal was to “drive the world’s transition to electric mobility by bringing a full range of increasingly affordable electric cars to market” (qtd. in Stringham, Miller and Clark 86). Musk further stated that within 12 years after its first production, Tesla has created one of the top-selling full-sized luxury cars in the U.S. and a market capitalization greater than Fiat Chrysler and half of Ford or General Motors.

Tesla’s Competitive Advantage

With more than 3,000 full-time employees and more than 30 stores globally and counting, Tesla leads in introducing battery electronic vehicles (BEVs). Tesla has also conducted a distinct marketing strategy where customers can buy cars online, very different from the traditional way of selling cars which is through dealership. Elon Musk is hopeful that Tesla will be able to address EV needs of the demanding sector at a very reasonable cost.

Tesla’s introductory prices for their Roadster and Model S have been reduced to $35,000 base price for every EV (Levin, Zhang and Mohan 4). This is commendable, considering that a conventional lithium-ion that can power an EV can cost as much as $15,000 (Mangram 292). Tesla advances from the traditional ways in terms of how it retails its flagship product in a number of ways. It distributes the Model S under the luxury Tesla brand via direct-to-customer online sales, rather than negotiated, retail price just like how Apple sells iPhone. Tesla’s business model is revolutionary compared to how the other industry rivals like Chrysler, Ford and General Motors market their product.

Tesla has been relatively successful with the battery technology. Lithium-ion batteries can cost to as much as 50% of the cost of the vehicle. Ramsey (qtd. in Mangram 292) indicates that the cost of a lithium-ion for a single vehicle can cost approximately $15,000. Thus, the battery cost is a major factor of the BEV price. The U.S. Department of Energy has aimed for the BEV battery cost reduction by as much as 70%, and believed it has been attained.

Tesla sales are supported by factory-owned stores and galleries staffed by “Tesla product specialists” who provide information on the product to interested customers. Rather than a destination unto themselves, many of these outlets are located in high-traffic locations such as metro area shopping malls. Also, Tesla operates factory-owned service centers that typically support customers in much the same way as traditional dealerships. In addition to service and maintenance and warranty and repair services, centers double as a showroom staffed by Tesla product specialists available to offer test drives for a limited selection of on-hand vehicles (Sringham, Miller and Clark 87).

Tesla also has deployed and currently operates a proprietary national network of Tesla-branded “Supercharger” stations (Cahill 30). These high-powered stations can deliver 170 miles of range in as little as 30 minutes, or more than twice as fast as the industry standards. The company also offers adapters that allow its customers to tap into the national infrastructure of roughly 10,000 industry standard chargers (Cahill 30).

Tesla introduced a strategy by making alliances with some of the giants in the industry, which allowed it to pull through with expertise and infrastructure of other firms, instead of continuously innovating; nevertheless, its engineers recognize that innovation is needed to make them highly competitive. The engineering firm Lotus helped in enhancing Tesla’s products. Tesla also purchased a plant once used by General Motors and Toyota and transformed this into an effective, high-tech factory. Tesla has created an infrastructure to deal with distribution, service, and charging centers and motivated other car manufacturers to enter the sector (Stringham, Miller and Clark 87).

Lotus Engineering helped in boosting Tesla’s goal and objectives as the former assisted in design analysis and supply chain. Lotus also helped Tesla with design, engineering, and technology and also acted the role of product assembler of Roadster. The collaborative effort led to the design of the chassis. The Roadster is a state-of-the-art EV which accelerates immediately to 60 miles in just 3.6 seconds and can reach up to 130 mph.

Development of their first product cost more and took longer than they anticipated. In the first four years, Tesla produced 2,500 Roadsters and it made Tesla move toward their next stage, refining the technology and making it more affordable for the ordinary customer. A larger-scale production for Model S was the next move and partnerships with Daimler, Panasonic, and Toyota. The automaker Daimler provided $50 million and Tesla’s role was to provide the drivetrains for the former’s speed cars. In 2010, Toyota invested $50 million and Tesla also bought Toyota’s Fremont, California plant for $42 million (Stringham, Miller and Clark 93).

The Tesla Innovation

Tesla’s latest model, the P90D, reaches a smashing speed of 60 miles per hour in just 2.6 seconds. This is only surpassed by the Porsche, Lamborghini, Ferrari, which are really expensive for the ordinary car enthusiast nowadays. Michael Barnard argues that the Tesla P90D is much quicker than the internal combustion engine (ICE) vehicles, and this can also be true for other Tesla models. He further points out that Tesla is quicker than the others in reaching the 155 mph (Barnard par. 4). Barnard considers this faster.

Electric motors are much better than gas engines in many ways. In addition to environmental advantages, Tesla’s electric motors have the capacity to create a maximum torque “at zero rotations per minute,” which means it can continue producing an equal amount of torque on all rotation levels. This is contrast to the capacity of the ICEs, which have very low torque from start to end but only have high torque at its center curve (Barnard par. 5).

Another advantage of electric motors is the inherent characteristic of electrons to get fast to the electric motor than gas to the piston. Electrons’ movement in a wire is almost automatic as they go directly to drive the electric motor, whereas in the ICE process the fuel passes through several stages, i.e. from the fuel pump to the injector, then drive the piston to generate torque (Barnard 6). This creates time even for just a fraction of seconds.

The model P90D is driven by two electric motors, generating speed for the two sets of wheels – the front and the rear wheels, unlike the ICE which only has one motor. ICEs may be fast but Teslas are quick. In addition, Teslas have very high horsepower output, pumping out 762 to keep the car moving forward even as air resistance is growing. Erberhard and Tarpenning (qtd. in Mangaram 293) posit that horsepower for BEVs is immediately available and can reach up to 3,500 rpms.

ICEs have limited horsepower within short rotation per minute (rpm) and must increase revolutions to reach a peak (Mangaram 292). Luxury sedans can reach a horsepower of 650, which is lower than BEVs’ capacity (Barnard 7). Regarding efficiency, BEVs are six times more efficient and do not produce CO2 emissions. In terms of mechanical properties, BEVs are much simpler, with fewer parts, and needs no transmission (Mangram 292).

Customer Behavior

As a firm is penetrating a sector and updating its products, it has to focus on customer behavior and see what they really want. Blank and Dorf (qtd. in Stringham, Miller and Clark 89) indicated that entrepreneurs should continually get out of the building to talk with customers and identify their needs. This is a matter of need or want because the need is constantly answered, but what is addressed is the customer’s want. As Musk (qtd. in Stringham, Miller and Clark 89) states, “Put yourself in the shoes of the consumer and say why would you buy it as a consumer?” This is the philosophy that has kept Tesla successful in penetrating a competitive industry.

CEO Musk explains that the manager must be humble enough that he/she does not know everything, and must admit mistakes for the sake of the customer. A common practice in Silicon Valley is for firms to test out ideas for product features and potentially improve them using iterative design. This is what Tesla has been following (Stringham, Miller and Clark 90). Blank and Dorf (qtd. in Stringham, Miller and Clark) have recommended scientific product development and breaking ideas into hypothesis, testing hypotheses, and learning along the way.

Tesla has always been an innovator, especially in transforming ideas into product; this is what carmakers should be. Tesla’s battery breakthrough of having a single charge and the car capable of a range of 300 miles could propel a high market share for the firm (Mangram 291).

Battery Electric Vehicles (BEVs) Success Factors

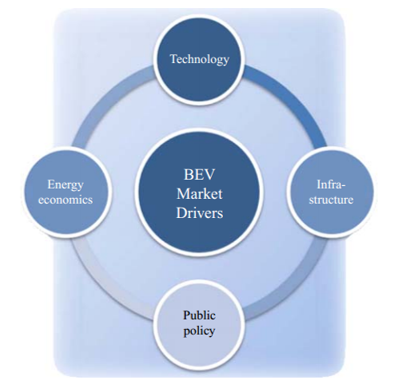

Electric vehicles will attain a competitive position in the market based on these market drivers: 1) technological improvements, particularly in the battery technology and car performance; 2) infrastructure developments, with a focus on recharging stations; 3) public relations improvement and policy; and 4) economic factor, such as price of electricity and gas (Mangaram 291). The figure above explains it further.

One great example is how Tesla’s Roadster model was created. The company asked car designers to draw their own concept of an electric car, or what an EV car should look like. They evaluated the different sketches. Higher green sticky notes were placed on the best they selected. They then chose Barney Hatt, who became the best designer they asked to submit his next proposal (Stringham, Miller and Clark 90).

Tesla in the United Kingdom

The UK government has given full support for the proliferation of electric vehicles in the country. It is already in the fourth generation; meaning, electric vehicles are as old as ICEs (internal combustion engine vehicles). Electric vehicles are attached to high-technology and computerized system to make the car run as fast as it could (Mom 45).

Tesla started with very little capital and a low-volume product, the Roadster. Without many products to boast of and with little capital, success could only be attained through timing. Tesla co-founder Martin Eberhard (qtd. in Stringham, Millier and Clark 92) indicated that their goal was to bring the Roadster “to the market quickly and efficiently,” which was done with the help of partner firms.

Tesla stresses that its culture is to “move fast” and have more innovations and create a direct feedback loop to stimulate development. The company labored hard, gave out what it could to provide what the public wanted. Quickly bringing their first cars to market helped Tesla show to consumers and investors that relatively high-performance electric cars are possible (Mangram 292).

Tesla’s Debut in China

When Tesla’s “Model S” was introduced in China in 2014, there was still some policy controversy within government circles and the consuming public over how to deal with economic sustainability, i.e. economic growth coupled with environmental protection. However, there was a growing sentiment over penchant for luxury items by a sector of the Chinese market, which allowed Tesla to penetrate and promote its low-emission vehicles. Tesla first sold 1,000 cars of Model S for its first two months of operations in the world’s largest consumer (Marro, Liu and Yan par. 1).

EV manufacturers in China have many challenges to meet, including government policies and a changing infrastructure, and taxes. However, the government has promoted the use of electric vehicles in some government offices and the private sector. The number of EVs in China’s roads has still to increase because this is very limited. In January 2014, Tesla announced a drop in the China market (Marro, Liu and Yan par. 2).

In China, electric vehicles are termed NEVs (new-energy vehicles) but have been a rather old concept among Chinese policymakers. Since 2001, NEV enhancement has been part of China’s Five-Year Plan to support the growth of the use of EVs, including pilot areas in Shanghai and Shenzhen. This gained momentum and crucial growth in 2010 when NEVs were typified as strategic emerging industry, giving manufacturers the chance to acquire investment subsidies.

BY 2012, the government announced the program, “Notice on Energy Conservation and New Energy Vehicle Industry Development (2012-2020),” giving an impetus for the manufacture and marketing of no less than 500,000 electric and hybrid cars by 2015. Government people even prompted that this had to increase by 2 million in 2020 (Marro, Liu and Yan par. 3).

Challenges are ongoing as the expected half a million NEVs was not met. In 2013, only 17,624 NEVs were produced, which is just 0.1 percent of the total car sales. The target number of NEVs to be produced in 2015 has remained unresolved, in stark contrast to the U.S. manufacture of EVs which reached 96,000 units in the same period (Marro, Liu and Yan par. 4).

China has also initiated significant steps in shoring up charging stations to boost consumer demand for NEVs. In May 2014, the country’s State Grid initiated plans to privatize the country’s distributed power grid and EV charging equipment market in order to promote the construction rate of charging stations. Beijing, Shanghai, Shenzhen and Guangzhou made their own moves by constructing NEV-related infrastructure and other power-distribution centers. The National Government also announced that government agencies purchasing vehicles should include at least 30 percent battery-powered, hybrid or non-polluting vehicles (Marro, Liu and Yan par. 9).

Methodology

Selling EVs to the international market is crucial to Tesla’s advancement. Tesla’s performance in China, a large and emerging market, is still to be seen. Government policy towards EVs also influences consumer behavior in their buying decision. China has different environmental laws that may hamper the entry of EVs into this large market.

This dissertation attempts to compare consumer behavior and decision making towards EVs particularly Tesla between UK and China consumers. In doing this, this Researcher applied qualitative research using social media. Eleven participants from China were foreign students in the UK and another 15 participants were British nationals, all contacted through social media. All questionnaires were coursed through social media by way of Skype.

Quality studies have to be conducted with the use of the qualitative approach and in this case, we used open-ended questions to allow the participants to express their views on the particular issue about Tesla’s electric vehicles. The qualitative approach addresses the limitations of quantitative research which has many variables. Qualitative research relies on alternative constructs that exactly repeat the expectations of the qualitative paradigm but can be trusted because it has dependability and credibility. In a qualitative study, the researcher can explain the contexts in which the research occurs (Mukhopadhyay and Gupta 85).

The Questionnaire

There were only 10 questions forwarded to the participants through Skype. The participants were UK and Chinese students interviewed online.

These are the questions.

- Are you aware of the presence of Tesla cars in China/UK?

- Have you driven an electric vehicle? What are the advantages and disadvantages of electric vehicles?

- How long have you known and how is this patronized in your country?

- What are the challenges for Tesla vehicles and for the entire EV industry in China/UK?

- What are the factors that motivate Chinese/UK consumers to prefer EVs than internal combustion engine vehicles?

- What is the behavior of the Chinese/UK consumer toward Tesla EVs?

- Are you aware of government programs to promote purchase of EVs in China/UK? What are these programs and policies?

- Is there encouragement for EV production in China/UK coming from the private sector? Please explain.

- Can you suggest measures for the development of battery electric vehicles in China/UK?

- What is the future of electric vehicles in your country?

Analysis

Consumer behavior is influenced by many factors, such as the business environment, the regulatory factors, branding, and many other environmental factors.

When asked of their penchant for electric vehicles, both types of participants had different responses because they have different motivations.

Most participants agreed in saying that a hindrance to the sector’s growth in China and the UK is the high cost and the expensive base price, including the battery cost, and influences customer decision-making and demand. However, most Chinese consumers have prioritized energy conservation and environmental protection in purchase of products, including cars. It is almost similar with the UK situation, albeit in the UK context electric vehicles are more available and cheap than in China.

There is also the lack of charging stations in China. China’s State Grid Corporation, which controls the country’s power system, had built only about 400 charging stations. In the same year, the U.S. had more than 20,000 charging stations. This makes EV manufacture and use unattractive to the China market. In the UK, there are more charging stations available for the EV consumers.

One participant who had a particular knowledge about NEV sales indicated that in 2013 and 2014, NEV sales had a higher increase of more than 300 percent and NEVs had become more attractive to Chinese consumers. Another participant added that there has also been an introduction of national policies promoting and subsidizing the production and sale of NEVs. One of these policies involved four central ministries which provided plans for NEV use and release of RMB 35,000 – 60,000 ($5,656-$9,696) for citizens who purchased NEVs. The participant added that national subsidy will continue up to 2020, but will be reduced each year.

Another method of encouraging use of NEVs by the Chinese consumers, according to another Chinese participant, was by way of tax exemptions and removal of fees. For example, in September 2014 the government removed the ten percent purchase tax on locally made NEVs, and this has to continue up to 2017. Other local governments like Shanghai have ventured on providing free licensing plates for new Tesla vehicles, which has been considered a significant incentive due to the cost of Shanghai license plates that amount to about $74,000 (equivalent to $11,959). Other local governments have made their own initiatives by offering tax incentives which can run to as much as RMB 60,000 (equivalent to $9,696), or a subsidy of RMB 120,000 ($19,395) for every purchase of NEV.

NEVs as a means of transportation in government agencies is now prioritized in China because of its sustainable development programs. One participant argued that this was one of the efforts of the new government of President Xi Jinping in dealing with environmental issues due primarily to China’s economic growth. President Xi is opposed to the policies of the previous administration which opted for rapid economic growth, while Xi prioritized quality GDP growth.

Participants from the UK revealed that electric vehicles have a bright future as many British are environmentally friendly and would like to drive in energy-saving vehicles but effective vehicles. Purchase of Tesla cars can be done online. In contrast to China, Tesla cars are readily available for everyone and easy to purchase. Tesla’s showroom is provided online, just like how Apple sells iPhones.

Conclusion

Tesla’s overall strategy is ambitious and may be unsurpassed as it enters the established industry. By 2020, the company will build a unique Gigafactory to surpass current world production of lithium-ion battery cells of 500,000. Battery cells limit electric vehicle manufacturing but management hopes that Tesla will be the frontrunner in introducing low-cost lithium-ions to the public. Diversifying is a major challenge of global corporations in this age of globalization.

But Tesla, according to analysts, will be able to increase profitability in electric vehicle (EV) production, and counter the barrier to entry in the car industry by increasing production of battery packs and powertrain components (Levin, Zhang and Mohan 3).

Tesla still has a long way to go as the electric vehicle for the future. It has made strides in China and the United Kingdom but more challenges are to be encountered along the way. In the online surveys conducted, British and Chinese consumers have been supportive of Tesla cars.

Works Cited

Barnard, Michael. Why are Teslas Quicker than Gas Cars?. 2015. Web.

Cahill, Eric Christopher 2015, “Distribution Strategy and Retail Performance in the U.S. Market for Plug-in Electric Vehicles: Implications for Product Innovation and Policy”. PhD thesis, University of California Davis, 2015. ProQuest Dissertation & Theses Full Text.

Hidrue, Michael 2010, “The Demand for Conventional and Vehicle-To-Grid Electric Vehicles: A Latent Class Random Utility Model”. PhD thesis, University of Delaware. ProQuest Dissertation & Theses Full Text.

Levin, Harris, Shiwei Zhang and Vijay Mohan 2014, Tesla Corporation Client Report: DangerZone Reporting. Web.

Mangram, Myles Edwin. “The Globalization of Tesla Motors: A Strategic Marketing Plan Analysis.” Journal of Strategic Marketing, 20:4 (2012): 289-312. Academic Search Premier. Web.

Marro, Nick, Hengrui Liu and Yu Yan. Opportunities and Challenges in China’s Electric Vehicle Market. 2015. Web.

Mom, Gijs. The Electric Vehicle: Technology and Expectations in the Automobile Age, Baltimore, Maryland: The Johns Hopkins University Press, 2013. Print.

Mukhopadhyay, S. and R. Gupta. “Survey of qualitative research methodology in strategy research and implication for Indian researchers.” Survey of Qualitative Research Methodology in Strategy Research, 18.2 (2014): 109-123, EBSCOHOST database. Web.

Peterson, Eric 2014, “The End of the ICE Age: Technology Search, Concept Selection, and Niche Development in Electric Vehicles for the US Automobile Market 1980-2011”. PhD thesis, Rensselaer Polytechnic Institute, New York, 2014. ProQuest Dissertation & Theses Full Text.

Stringham, Edward Peter, Jeniffer Kelly Miller and J.R. Clark. “Overcoming Barriers to Entry in an Established Industry: Tesla Motors.” California Management Review. 57.4 (2015): 85-103. Academic Search Premier. Web.