Tesla’s Internal Resources and Competencies

Tesla is one of the leading producers of electric cars and components in the world. To examine internal factors contributing to the development of the competitive advantage, it is necessary to employ the concept of the core competencies. Core competencies are “the bases upon which an organization… distinguishes from competitors” (Johnson, Scholes & Whittington 2008, p. 13).

As for the internal resources and competencies that became the company’s competitive advantage, it is possible to note that the use of “a single manufacturer system” monitoring performance and providing remote services have contributed greatly to Tesla’s development (Porter & Heppelmann 2014, p. 5). This connectedness enables the company to reduce costs and ensure the continuous flow of resources. The company produces vehicles at reasonable prices, but their cars can surmount larger distances compared to Tesla’s competitors. This is one of the major competitive advantages of the company.

The focus on innovation is another peculiarity and core competence that can allow Tesla to remain a top manufacturer of electric cars. It is necessary to add that the company patented hundreds of innovations that make it the leader in the industry. The company sells components to many companies developing effective alliances. The innovative approach has enabled Tesla to be more competitive than its peers. For instance, the company does not simply promise a smaller negative footprint but offers a “net positive” impact (Laszlo 2015, p. 103). More so, the company was one of the producers of such cars, which is also its competitive advantage as the corresponding image is created.

The use of sophisticated and effective software is another competence creating a competitive advantage for the company. Tesla products can be characterized by the latest advances in technology as their vehicles are equipped with software that enables the driver to receive a wide range of data, which makes the driving experience easy and enjoyable (Porter & Heppelmann 2014). For instance, apart from the ability to control various processes such as motor functioning or battery voltage management, each vehicle can be connected to the owner’s mobile device, which is rather popular among consumers.

Finally, the company uses effective strategies to maintain its leading position. For instance, Tesla is sharing some of its technological advances and innovations with its competitors (Schulze, MacDuffie & Taube 2015). More so, the company also shares its charging infrastructure (which is one of its competitive advantages) with its competitors. It is clear that this strategy may lead to some short-term losses but will result in significant benefits for Tesla in the long run. The company will create a set of specific standards its competitors will have to comply with, which will help Tesla remain the leader in the industry.

Therefore, Tesla’s major resources and competences are connectedness, innovation, knowledge. The company produces electric cars that are operated with the help of sophisticated software, which makes driving enjoyable and quite multifaceted. The car manufacturer’s charging network is extensive, which also creates a competitive advantage. The use of effective strategies has led to the accumulation of significant resources that, in their turn, contributed to the creation of competitive advantage.

External Environment and Tesla’s Entrepreneurial Activities

To consider Tesla’s entrepreneurial activities and the way they are affected by the external environment, it is necessary to define the concept. There are various definitions of the term, but the major characteristic feature of the entrepreneurial activity mentioned by scholars is the focus on innovation, new products, and business opportunities (Bessant & Tidd 2011).

It has already been acknowledged that the automotive industry is changing significantly as fuel-driven cars are being slowly replaced by electric vehicles. Calabrese (2016) emphasizes that the future of electric cars is bright even though oil barons still have significant power over the automotive industry. Governments start investing more in environmentally-friendly technologies as they try to address various environmental issues. Besides, the comparative scarcity of fossil fuels has forced people to consider alternative ways to obtain energy and use it.

The modern automotive industry is characterized by the focus on innovation and addressing particular needs.

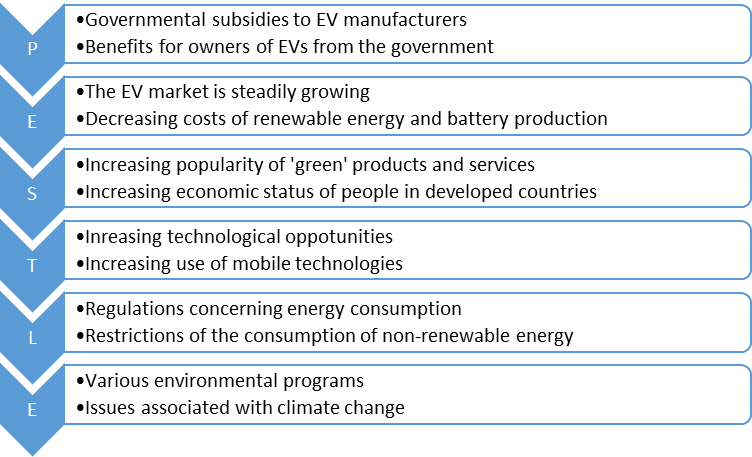

For instance, Priestley (2015) states that driverless cars are the future of the industry, and Tesla is one of the companies working in this direction. Some researchers and practitioners expect these types of vehicles to be dominant between 2020 and 2040 (Priestley 2015). This trend can facilitate the development of the entrepreneurial activities of Tesla as the company is quite ready for such innovations. Tesla already has powerful batteries as well as efficient software. It also has the necessary experience in developing successful partnerships, which is important for the development of the company. It is possible to use the PESTLE framework to analyze external factors (see Figure 1).

As has been mentioned above, governments support environmentally sustainable technologies, which is an important factor contributing to the development of entrepreneurial activities of the company. For instance, the US government has launched a variety of incentives that support producers of environmentally-friendly products, such as cars with low or zero emissions of hazardous gases (Karamitsios 2013). These incentives include funding of various projects, additional benefits for manufacturers, assistance in the development of the charging infrastructure, and so on. Interestingly, governmental incentives are also addressed at consumers who can receive loans from the government or even get a vehicle as a present or some kind of benefit.

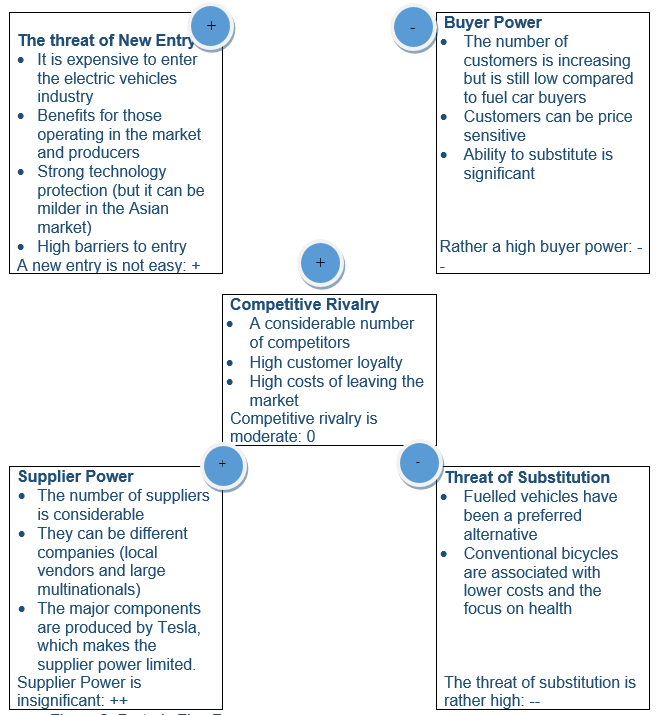

This factor has a significant positive effect on the development of the company that can receive some funding. More importantly, the market is increasing, and electric vehicles are becoming consumers’ choices. Electric cars are becoming a norm, and Tesla is regarded as one of the pioneers and major innovators in the industry. These are favorable factors for the development of the company, and Tesla can continue its development of innovative products. It is necessary to note that when using Porter’s Five Forces, it is clear that the company’s external environment is associated with certain risks as the buyer power and threat of substitution are high (see figure 2).

Therefore, it is possible to note that Tesla is in a favorable environment as the automotive industry is changing, and these transformations are the focus of the company. Thus, the development and use of environmentally-friendly products can be regarded as major concerns of governments, companies, and customers. More so, people seek for innovation and are ready for such novelties as driverless cars. All these changes positively affect the company’s entrepreneurial activity as Tesla is capable of addressing the needs and wants of customers.

Strategic Choices

Tesla is one of the leading manufacturers of electric cars and components in the world. One of the reasons for this success is the focus on entrepreneurial concepts (innovation, new business opportunities, and so on). The company may choose various strategies to increase its entrepreneurial opportunities. It is possible to analyze two strategic choices the organization can make to achieve this aim. To ensure these strategies’ effectiveness, it is necessary to apply SAF criteria.

One of the possible ways to continue Tesla’s entrepreneurial activities is to invest in the development of electric scooters and bicycles. At that, it can be a good idea to focus on the Asian market through the acquisition of some local manufacturers (for example, Ya Bao Jinan) or the development of partnerships with such companies (Freyssenet 2016). This strategy will enable the company to diversify its product range, expand into new markets, explore new businesses and technological opportunities.

When applying the Ansoff Matrix, the strategy can be linked to such areas as market penetration and diversification (see Figure 3). The analysis of this option using the tool mentioned above shows that this strategy is associated with moderate risks. However, the strategy is worth implementing as the market is ready for this kind of product while the use of the safest area (acquiring local companies or entering partnerships) will reduce the risk.

Figure 3. Ansoff Matrix.

The evaluation of the strategy with the use of SAF criteria reveals its effectiveness and benefits for the company. In terms of the suitability criterion, the development of electric scooters and bicycles is an effective or even logical choice. The analysis of the external factors shows that customers, as well as governments, positively view these products. It is expected that electric vehicles will become mainstream within decades (Priestley 2015).

Therefore, the development of such widespread vehicles as scooters and bicycles can help the company engage more people in the use of electric vehicles (Latest research on electric motorcycles and scooters market size 2016). People often prefer this means of transport for urban settings and short distances. More so, it can be vital to enter the Asian market with this product as electric scooters and bicycles are specifically popular in Asian countries (including China).

Scooters and bicycles are a popular type of transport in Asia, but these vehicles are powered by environmentally-unfriendly resources (Freyssenet 2016). There is a shift towards greener options in China, which is an opportunity for manufacturers of green technologies. The charging infrastructure will be suitable for all the electric vehicles so the company may develop its network of charging points.

As for the acceptability component of the analysis, it is possible to expect significant acceptance of the strategy among the stakeholders involved. Thus, the company will develop a new line, which is associated with opportunities for employees (who may receive a promotion, realize their ideas, and so on).

As for external acceptance, customers are likely to be interested in buying new products. As has been mentioned above, people are choosing scooters and bicycles for short distances, and the focus on environmental issues will make electric vehicles the best option (Freyssenet 2016). Chinese consumers are also becoming more environmentally conscious, which will make electric scooters and bicycles widespread in the region. The strategy is likely to translate into considerable financial gains due to this acceptance on the part of customers.

Finally, as to the feasibility criterion of the evaluation, the strategy is also successful if implemented properly. Tesla has significant resources that can be used to produce a new type of vehicle. However, there are still certain limitations. The company does not have the necessary equipment as well as professionals. It is possible to invest in this area, but it will be associated with the allocation of considerable funds. Therefore, it is possible to develop a certain alliance with a manufacturer of scooters and bicycles in Asia. Tesla will be able to save funds and come up with a new product.

Another strategic option that can increase Tesla’s entrepreneurial opportunity is associated with an increase in investment in the Chinese market. The company can focus on the development of its supercharger network and dealer expansion in the region. The use of the Ansoff Matrix can help evaluate the strategy (see Figure 3). The option is efficient as it can be placed in one of the safest quadrants of the matrix. Thus, the development of superchargers and dealers network will make electric vehicles more accessible, which is important for growth.

When using the SAF criteria, it is possible to note that the strategy is potentially beneficial for the company. As far as the suitability criterion is concerned, Schmitt (2016) notes that the market of electric vehicles is growing, and such giants as Mercedes and Volkswagen start paying more attention to this region and this market. This can be a certain challenge as the competition will grow. However, it is also a good opportunity for the company to develop and increase its presence in the region.

Importantly, Tesla’s products are popular in China, and such new offers as Model X are expected to be a hit of sales (Soo 2016). At that, the development of the market of electric vehicles is also associated with the development of the infrastructure that can cover vast territories of Asia. Therefore, Tesla can gain a lot from the development of its supercharger network. People in more areas will have access to electric vehicles, which can lead to growing sales as well as various opportunities for further entrepreneurial activity.

When analyzing the acceptability criterion, it is necessary to note that the strategy may be associated with some challenges. As to the financial component, it is clear that the company will have to invest significant funds to implement the strategy. However, there is still a lack of governmental support provided to foreign manufacturers, and it could lead to larger revenues. The Chinese government subsidizes heavily local manufacturers providing them with various incentives creating a favorable business environment for them, which can be an obstacle for a foreign organization (Masiero et al. 2016).

As far as the domain of stakeholders’ acceptability is concerned, it is possible to note that the strategy’s outcomes can be quite controversial. On the one hand, there is a shift towards green technologies in China (Masiero et al. 2016). Nonetheless, Chinese car buyers still focus on such aspects as the price and quality. Therefore, it is important to be ready that this strategy will be beneficial in the long run, and no short-term benefits are likely to be gained. It can be necessary to develop a partnership with a local company specializing in electric vehicle manufacturing, which will help in gaining governmental support.

Finally, the feasibility criterion of the evaluation helps to identify an important aspect to be taken into account. The development of the supercharger network and dealer expansion in China will require considerable resources that are rather scarce in the period of certain financial constraints the global economy is experiencing. The company reports the rise in sales, but they are lower than expected, which shows certain vulnerability (Ramsey 2016). The company should wisely allocate funds. Therefore, it is important to start the development of the supercharging network in the areas where the interest to electric vehicles, as well as sales, is growing.

On balance, the two strategies mentioned can help Tesla to increase its entrepreneurial opportunities through growth and innovations. The strategies are associated with some challenges, but they can be addressed easily if the strategies are implemented properly. Therefore, the company should consider developing electric scooters, building partnerships with Chinese companies, and expanding to the Asian market.

Reference List

Bessant, J & Tidd, J 2011, Innovation and entrepreneurship, John Wiley & Sons, Chichester.

Calabrese, G 2016, ‘Innovative design and sustainable development in the automotive industry’, in G Calabrese (ed), The greening of the automotive industry, Springer, New York, pp. 13-32.

Freyssenet, M 2016, ‘The second automotive revolution is under way: scenarios in confrontation’, in G Calabrese (ed), The greening of the automotive industry, Springer, New York, pp. 304-323.

Johnson, G, Scholes, K & Whittington, R 2008, Exploring corporate strategy, Pearson Education, London.

Karamitsios, A 2000, Open innovation in EVs: a case study of Tesla Motors, Master of Science Thesis, KTH Industrial Engineering and Management. Web.

Laszlo, C 2015, ‘Sustainability for strategic advantage: the shift to flourishing’, in SA Mohrman, EE Lawler & J O’Toole (eds), Corporate stewardship: achieving sustainable effectiveness, Greenleaf, Sheffield, pp. 94-112.

Masiero, G, Ogasavara, M, Jussani, A & Risso, M 2016, ‘Electric vehicles in China: BYD strategies and government subsidies’, RAI: Revista de Administração e Inovação, vol. 13, no. 1, pp. 3-11.

Porter, ME & Heppelmann, JE 2014, ‘How smart connected products are transforming competition’, Harvard Business Review, pp. 1-23.

Priestley, T 2015, ‘The car industry will change forever. But nobody is prepared for it‘, Forbes. Web.

Ramsey, M 2016, ‘Tesla Motors reports global sales rose in latest quarter‘, The Wall Street Journal. Web.

Schmitt, B 2016, ‘EVs in Europe: hopes up, sales down‘, Forbes. Web.

Soo, Z 2016, ‘Tesla confident it can hold pole position in Hong Kong’s electric vehicle market‘, South China Morning Post. Web.