Abstract

Amour is a company that specializes in sportswear and high-performance apparel. The company has experienced significant growth in market size and revenue generation from the process of sales from different sports gear tailored to suit different user needs. Under Amour operates in a highly competitive environment with Nike and Adidas being the greatest rivals. An analysis of the company operations shows that its strategic issue is reflected in the local market concentration, international market penetration strategies, innovation, and outsourcing production activities, which present significant challenges that need to be addressed to maintain its market leadership. The company’s financial statements indicate significant increases in profits and positive prospects in revenue growth and market expansion due to a broad base of product offerings and distribution networks. By exploiting existing expansion and product development opportunities, the company can increase its revenue base by focusing on the success factors such as using innovation and new technologies, investing in research and development, using strong distribution networks, and applying excellent promotional and marketing strategies. Under Amour could optimize its generic strategy by focusing on product customization to suit different market segments for competitive advantage as well as focusing on its grand strategy by directing its efforts on new product development and international market penetration.

Introduction

The case study presents a startup entrepreneurial idea that was converted into a business opportunity by Kevin Plank who formed the Under Amour performance apparel company in 1996 (Gamble, Peteraf, & Thompson, 2015). In its earlier years, the company gained a significant market share because of a broadening demand for its wide range of product offerings. By directing its efforts towards achieving its growth strategy, the company gained a wide market share by investing in product offerings for men, women, and the youth. The company has specialized in sportswear and recreational activities leading to superior profitability. The industry is characterized by Nike and Adidas that have a significant market share as well as a threat from new entrants.

The company continuously revises its product lines, marketing, promotional, and branding strategies to sustainably remain competitive in the market. To address the problem, the investigation focused on establishing the key strengths which include superior product performance, high-quality products, a broad range of sportswear and footwear products, and a strong brand image in the local North American market as well as international markets, which include European soccer and rugby teams such as the Welsh Rugby Union and Hannover 96 and Tottenham Hotspur football clubs, among others.

The goal was to meet the increasing product demands and widen the market share due to the global increase in disposable income and population growth (Babin & Zikmund, 2015). The company used its excellent inventory management systems based on wholesale distributions, direct to customer sales, and product licensing strategies. This underpins the company’s competitive advantage and growing market share. The strategy issue represents the area of focus.

Strategic Issue

In theory, the factors that define strategic issue must be addressed for the Under Armour Company to achieve what is outlined in the mission statement, which reads as follows “to make all athletes better through passion, design, and the relentless pursuit of innovation” (Gamble et al., 2015, para. 5). The company’s outlook shows strong growth prospects in the domestic and international markets. This is due to the positive financial performance as indicated by the annual statements that reflect the objective of the universal guarantee of performance and empowerment of athletes. This is demonstrated in rapid growth in the IPO shareholder value of 2.6 million. The leadership formulates top-notch product development policies and generates new and innovative product offerings such as apparel tailored with specific market needs I mind by continuously adopting new strategies for completive advantage.

According to the case study, the problems and strategic challenges that arise include a high concentration in the domestic market in sales as exemplified in the U and A-brands. Making entries into the international market without proper proprietary rights could be a source of exposure of her products to competing firms which can violate property rights and make cheaper substitutes (Verhoef, Kannan, & Inman, 2015).

Here, the company relies on third-party distributors such as Dome corporations, outlet malls, and First XV rugby store, making the distribution channels costly because suppliers exploit and overcharge and because there is no direct control from the company.

To sum up, the capacity for innovation and product development policies demonstrated by the company is challenged by high saturation of domestic markets and the threat of substitution emerging from proprietary rights issues. The following strategic issue question arises: Should Under Armour acquire proprietary product rights, new distribution channels, and allocate more money to finance expansion for sustained innovation, growth, and international market penetration?

External Environment

This chapter provides a detailed analysis of the attractiveness of the company, its capabilities along with valuable information and data that could resolve the question of the company’s industry competitiveness. Porter’s five forces model is used for competitive analysis in addition to focusing on the key company success factors as summarized in the industry characteristics and analyzed based on Porter’s five forces model.

Porter’s five forces

Competitive Rivalry

Under Amour’s industry’s rivalry players with a significant share of the market are Nike and Adidas. The level of competition varies between high and medium. Nike is the greatest rival with a 7.0% market share closely followed by Adidas, which has a 5.4% market share. However, some products sold by Under Amour with a 2.8% market share have not been patented in a market dominated by 25 brands.

Bargaining Power of Suppliers

The fact that Under Amour has the manufacturing capabilities for various product offerings has ripple effects on the supplier power. This is achieved by diminishing supplier abilities to bargain for better prices, suggesting the low ranking for this force. In addition, the company’s policy of outsourcing the manufacturing of apparel and other sportswear in India, Mexico, and Asian countries attract low costs of labor, taxes, and other production costs. An assessment of the company’s primary sources of raw materials shows that it obtains them from 27 companies distributed across 16 countries. The bargaining strategy is based on a broad base of suppliers with strong competition among themselves, which gives Under Amour better bargaining capabilities.

Buyer’s Bargaining Power

An assessment of the bargaining power of the customers is estimated to be medium. This is because most of the products have a strong presence in North America’s retail stores where the company has its largest share. The products’ presence has had a strong positive influence on the perceptions of suppliers. This has facilitated an increase in demand for the products.

Threat of New Entrants

A strong brand, large market share, brand loyalty, and the high initial investment cost are very strong barriers to entry. Besides, the costs of brand advertisement and endorsement are also high. Despite the promising advantages, modern machinery is cheap to acquire and branding by the use of social media and other outlets provides an emerging environment that increases the threat of new entrants.

In addition, most of the products lack patents, making it easy for firms that want to exploit the opportunities in the market to make entries with rebranded products. Besides, the readily available technologies for sports apparel production make it easy for new companies to enter the market despite the presence of Under Amour’s high-quality products. In addition, the company uses petroleum-based products, which is another serious threat because of the fluctuating oil prices.

Threat of Substitute Products

This force can be classified as medium. The sports industry is global in nature and provides the potential for different companies to grow. This has prompted many companies to invest in the production of substitute products because of the wide range of product offerings and the availability of technology that has made manufacturing of sports apparel cheaper and more efficient. Companies are able to produce more attractive sports apparel with low switching costs. Besides, the demand for footwear and the increase in the youth population provides new investment opportunities.

Key Success Factors

This section provides a detailed analysis of the underlying key success factors that enable Under Amour to remain competitive and to prosper against rival firms.

Innovation and technologically advanced products

Growth in the industry has been propelled by the use of technology, investment in continuous product innovation, success in the provision of the right apparel to the target market, and the ability to demonstrate that the customers are highly valued. The company has invested in the production of innovative products by living to its promise of ensuring that the products are authentic.

In addition, the company has introduced a wide range of products such as the three lines of gear for cold weather, Heat Gear, and Cold Gear, among others. Besides, the company’s innovation is evident in the multiple benefits that arise from the consumption of the products, which constitutes the company’s market growth factor.

Effective marketing and promotional strategies

Retail marketing and promotional activities such as the utilization of increased floor space as well as the use of concept shops, in-store fixtures, and product displays constitute some of the best promotional activities that Under Amour has used to be successful. The company’s products do not have hidden requirements. The ability to work with different retailers and the ability to work in the international markets count for success in the industry.

Distribution network

The company has incorporated branded retail outlets, branded storefronts, and other marketing strategies to reach the market and meet consumer needs and expectations. Besides, the use of more product lines coupled with better and more efficient distribution networks contributed significantly to the success of the company.

Research and development

The sports apparel industry has significantly grown in the number of substitutes, new entrants, and the availability of technology. To counter the effects that come with the changes, the company has invested significantly in research and development to produce high-quality products to address the changing needs and expectations of the market.

Industry Profile and Attractiveness

Due to significant population growth, the global markets for athletic footwear projected to grow from the US$75 billion in 2012 to the US$18 billion in 2018 (Gamble et al., 2015). However, the market for footwear and athletics was expected to reach the US$181 billion mark in 2018 from the US$135 billion in 2012, with Under Amour having 17% in footwear and 4% in the apparel market shares, respectively (Gamble et al., 2015). The industry is dominated by major players such as Nike and Adidas.

However, Under Amour has a significant market share compared with her main rivals, which has grown dynamically. For example, in 2012 revenue from direct direct-to-customer sales hit the 27% increase compared with the 23% revenue growth in 2012. Besides, a net 2.4% revenue growth was recorded in 2012 from the sale of licenses alone. By 2013, the distribution of apparel had hit 12% net revenue. The company generated 59% of its revenue outside North America (Gamble et al., 2015).

Besides, revenue generation was projected to be US$500 million due to the sale of the innovative product line and charged cotton products. Typically, the competitor such as Nike invested US$2.4 billion in 2011 for marketing alone. This demonstrates the fact that the company has significant threats from external competitors.

In conclusion, aside from the presence of several major competitors, the external environment can be considered favorable for Under Armour due to the low bargaining power of buyers and suppliers, low to the medium threat of new entrants, and a high degree of alignment between the company’s capabilities and the identified key success factors.

Table 1. Macro-environment.

Company Situation

This section details Under Amour’s financial performance between 2009 and 2013 to show the trend in its growth and profitability prospects. The profit margin, which is also the gross profit or sales ratio, constitutes the financial accounting tool to assess the profitability of the company which is discussed in this section. Besides, a SWOT analysis is performed for the company to assess the prospects of sustainability, market expansion, and areas of optimization in order to maintain its market share and expand for competitive advantage.

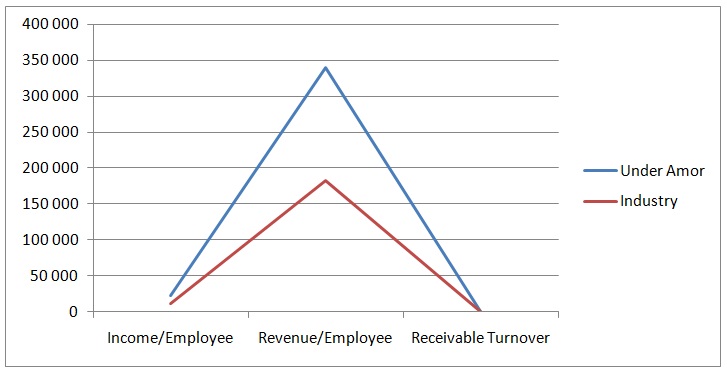

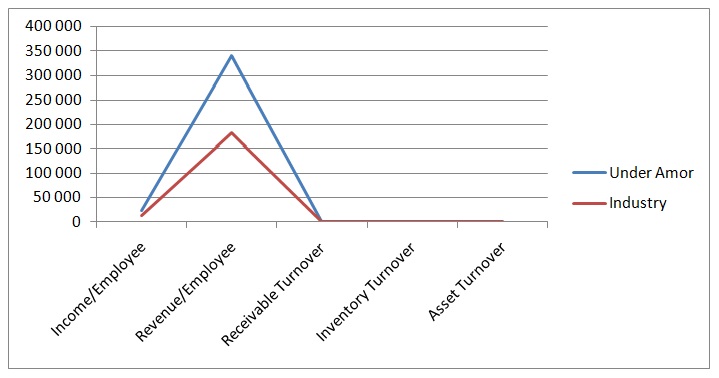

Financial Analysis

A snapshot of the financial performance based on the quarterly revenue between 2010 to mid-2013 shows 33.9% change in the third quarter in 2011 compared to 25.5% change in revenue in 2012. However, the data for 2013 which is not available. A brief analysis of the financial status shows very strong positive improvements due to the significant increases in revenue through the successive years.

Table 2. Financial status.

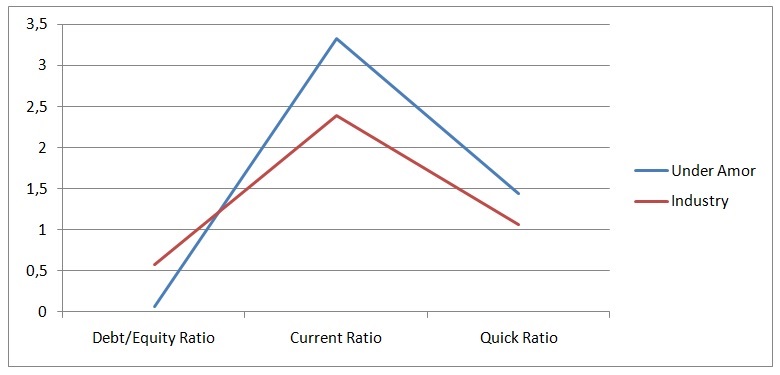

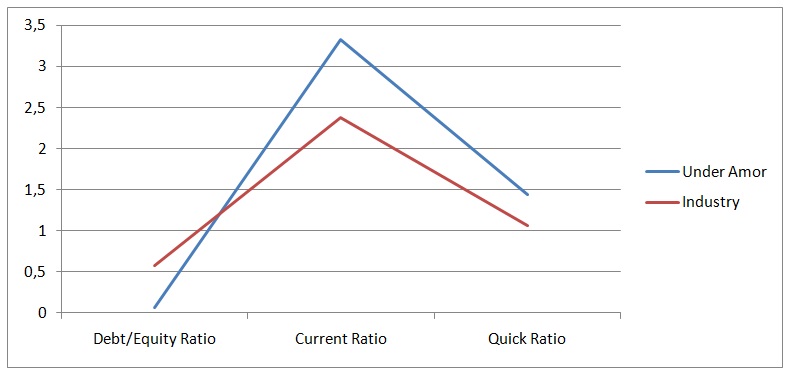

An assessment of the profit margin ratio shows that the company has a debt/equity ratio of 0.06 against the industry value of 0.58. This measures the company’s financial leverage. The reported value is very low which indicates that the company does not rely heavily on borrowing and is a low-risk venture. Besides, it shows that the company does not depend on borrowing for financing its operations and expansion activities.

On the other hand, the current ratio is 3.33, which indicates that the current total assets compared with the total liabilities are low. Typically, the company has a strong ability to pay any accruing debts on short term and long term obligations. However, when compared with the Quick Ratio, which is equivalent to 1.45, the results indicate a very strong ability of the company to meet its obligations either in the short term or in the long term.

Comparatively, the quick ratio is a better indicator of the liquidity capabilities of the company as opposed to the use of the current ratio. The results lead to the conclusion that the company has a very strong financial performance outlook. The detailed results can be found in the appendix.

SWOT Analysis

Strengths

The company’s good market and growth strategies provide an accurate reflection of the behavior of the market share that has shown significant positive performance and improved profitability. Leadership capacities are demonstrated in the case study because of the good strategic choices that have a positive impact on the growth of the company. The company has an increasing line of performance products, high market penetration rate, and global presence because of an increase in the market size in the foreign territories, and ever increasing and positive effects of brand awareness. Examples include the protective gear, ski vests, and other Under Amour gear apparel.

Innovation is a term that is embedded in the mission statement which is driven by the concepts of new and unique products designed to meet varying customer needs and expectations (Ngai, Tao, & Moon, 2015). The company provides specific market segments with specific footwear and apparel that fit into their needs for different climatic conditions. Examples include the provision of wide variety of shirts aimed at the broadening demand for the company’s products in the local and international markets.

Focus on meeting changing industry needs, use of innovative technologies, new product offerings, and better focus on research and innovation for sports apparels and footwear in an additional strength. This is made possible and exemplified in the provision of diverse product mix for different weather conditions such as the three lines of apparel and the footwear product for men, women, and youth. In addition, the company has sports accessories such as gloves, custom-molded mouth guards, and kneepads. The company also uses high-performing players to market its products.

The broad brand portfolio is based on innovation and the ability to respond to different market needs and expectations. The specific focus has shifted from football and expanded into the production of devices as well as investing in new product design and development methods.

Because of the rapid growth in the market and the use of new product development strategies, the revenue has shown significant growth with the net profits increasing drastically. Under Armour has healthy financial statements. The company has a quality assurance team to verify the quality of raw materials for the manufacture of its products in Asia, Mexico, Middle East, and South America.

Weaknesses

Outsourcing fabric production and the company’s pricing policy, which hurts its growth prospects. This is because its products have a high price compared to substitute offerings by rival firms. Raw materials are manufactured by third party companies. The company is not geographically dispersed because over 90% of the products sold in North America. Penetrating into other markets presents a wide range of costly and time-consuming challenges to address.

Opportunities

A critical analysis indicates a global increase in disposable incomes in addition to an increase in demand for its footwear and sports products that could present a ripe opportunity for the company to exploit. The company has excellent distribution channels, product diversification, excellent space for inventory management, quality assurance, and source manufacturing capabilities, which can be exploited to generate the competitive advantage of the company.

The company has a strong brand name and high-quality products that provide leverage in the market for expansion and exploitation of available opportunities. Technology can leverage the company’s position and ability to make new market entries. Besides, Under Amour has an excellent inventory system for quick product delivery.

There is the positive outlook in the company’s market growth and size because of the increase in revenue from the US, which is the company’s primary market. The company has focused on the youth and female consumers and manufacturing products that address specific needs of each market segment in the US as well as outside of the country.

Threats

Despite the low labor costs, the company transports its footwear and other sports products from five countries, which are the destination manufacturing points. This leads to increases in inventory costs and other supply chain-related management issues and expenses. There is an increase in competition on new product development, product identity, and customer support services.

The identified positive trends in financial performance coupled with several identified strengths such as distribution channels, inventory management practices, quality assurance, and multiple instances of innovative products that address the needs and expectation of the target audience create significant potential for competitive advantage. On the other hand, low market diversification, high cost of new markets penetration, supply chain expenses, and the emerging threat of competition undermine its long-term performance.

Recommendations

The problem with the Under Armour Company identified in the strategy issues section includes different problems associated with the strategic growth and development of the company. This raises the questions on how the company intends to strengthen its market concentration, patent rights, and financing of distribution of the products in international markets.

Strategy Recommendations

The recommendations are based on both the generic and grand strategies.

Generic strategy

The recommended approach is to broaden local and international market size by optimizing the technology and innovation for high-quality products as well as improve its brand portfolio. Besides, there is a need to optimize the positive market outlook because of significant growth of market share and positive revenue generation. The rationale is that the company has several strategies in place which include quality assurance backed by the use of high-tech specialty fabric.

According to Goi (2015), this could enable the company to manufacture high-quality products based on a limited number of suppliers that have been evaluated and known to provide high-quality raw materials. Besides, the company should invest in substitute products that are customized and priced to meet the marketing needs of different customer strata for competitive advantage.

Grand strategy

The generic strategy could require investments in broad product offerings, technology, and innovation for differentiated and high-quality products to address the market needs of the broadening target market that includes market needs of women, men, and the youth (Ngai et al., 2015). There is need for the company to optimize its inventory and supply chain systems to improve market penetration and presence in international markets in Africa, China, and Asian countries.

Besides, the company can capitalize on global demand to increase its market share and revenue generation. In addition, Goi (2015) notes that there is the need to increase the marketing strategy based on the use of effective promotional strategies by targeting professionals, high-performing athletes, and making effective agreements with sports teams and individual athletes. Drastic market growth and positive financial performance could be the expected outcome.

Objectives

In line with the strategic analysis, the strategic objectives include:

- Establishing effective brand management strategies through innovation and technology

- Managing the marketing, promotion, and branding of the range of sportswear and footwear products

- Managing inventory and company supply chain systems

- Identifying and formulating effective retail marketing and product presentation as well as market penetration strategies

Strategic Justification

It is suggested for the company to adopt the recommended strategies for competitive advantage. According to Ngai et al. (2015), through investment in effective and low-cost inventory systems the company is able to reduce the cost of inventory which has a ripple effect on pricing instead of the current operations and inventory system.

On the other hand, involvement of third-party retail outlets makes the products expensive. Adopting new technologies could enable the company to be more innovative and produce high-quality products that are customized to different markets and customer needs and expectations.

The implementation of the suggested strategies and objectives will enable the company to produce high-quality, low-priced, and competitively-priced products for better competitive advantage. This approach is expected to address the identified weaknesses, position the company at a strategic advantage against rival firms, and increase its market share.

References

Babin, B. J., & Zikmund, W. G. (2015). Exploring marketing research. Boston, MA: Cengage Learning.

Goi, C. L. (2015). Marketing Mix: A review of ‘P’. The Journal of Internet Banking and Commerce, 1(1), 2005-2012.

Gamble, J., Peteraf, M. A., & Thompson, A. A. (2015). Essentials of strategic management. New York, NY: McGraw-Hill.

Ngai, E. W., Tao, S. S., & Moon, K. K. (2015). Social media research: Theories, constructs, and conceptual frameworks. International Journal of Information Management, 35(1), 33-44.

Verhoef, P. C., Kannan, P. K., & Inman, J. J. (2015). From multi-channel retailing to omni-channel retailing: Introduction to the special issue on multi-channel retailing. Journal of Retailing, 91(2), 174-181.