Introduction

The report aims at presenting the outcome of the simulation game on the business strategy case. The aim of the simulation report is to draw out the key strategic issues and challenges encountered while running the fictitious company. Further, the report will discuss the models and frameworks used in the simulated environment. The report also presents the rational behind applying the models and strategies on the company and reflects on the experiences of going through the whole process.

Competitive Strategy

The generic strategy of the company is to achieve globally differentiated strategy. Denton Company focuses on selling their footwear to the mid and high range market. Their focus is to remain one of the top three market leaders with sustainable growth. For this, Denton has targeted a new revenue and profit increase of 10 percent annually.

They aim to have their S/Q rating above than the industry average and their rejection rate below 7 percent. Thus, the focus of the company remains on attaining certain goals related to the market and industry vis-à-vis its competitors. Further, their product is made for specific customers.

Denton does aim at keeping their cost low, as the advertisement cost, compared to its closest competitor, Company A, has a much lower cost spent on advertising. Further, the focus of the company remains with their wholesale, brick, and mortar market, with little attention paid to the Internet market segment. Their target market is specifically mid and high range footwear market, which shows differentiation and focus. Therefore, the generic strategy adopted by Denton is differentiated focus.

Industry Overview

Macro Environment

The footwear industry report shows that the company that dominates as the number one company of the industry is AAA Sports while Denton has the second position. It is a monopolistically competitive industry as most of the companies target a different market segment and focus their strategy and products, which are differentiated, on the consumer group they target. The footwear industry has three main geographic regions that the company targets – North America, Europe, and Asia Pacific.

Active and healthier lifestyle choices have provided a boost to the footwear industry. Other concerns that plague the footwear market is the rising concern for the increase in prices of raw materials. Further, there are certain concerns regarding the slowdown of the global footwear market. The market is segmented based on the distribution channels adopted by the companies. The distribution channels most prevalent in the footwear industry are the wholesale branded market and the online Internet sale.

PESTEL

A PESTEL analysis of the footwear market presents the complete socio-economic picture of the global footwear market. PESTEL is a tool that helps to determine the macro-environment of the company. The macro-economic factors that are out of control of the company provide opportunity or threat to the company.

Political environment globally is mostly stable. Denton operates in three major geographical regions – North America, Europe-Africa, Latin America, and Asia-Pacific region. Some political threats are related to globalization and expansion in foreign countries as some countries have laws in place that prohibit full-ownership of retail stores. This, in growing markets like India, can become a hindrance for growth to a footwear company.

Trade agreement with Asian countries and other less developed country ahs helped not only in development of market but also lowering the cost of production through outsourcing of production in these low labor cost countries (Cecchetti 2015: 10). Economic environment globally has been under severe stress due to the recession and economic slowdown experienced in North America and Europe (Hewitt 2012: 1). In both these regions, there has been a severe recession.

Though the economies are presently recovering from recession but the consumer demand is still low in these areas. However, Asia Pacific, especially India and China, the developing nations, have remained relatively immune to the economic recession, and have provided a growing market to the global footwear industry (Browne 2014: 1). Signs of economic recovery ahs been observed with strengthening of dollar that immediately makes US dollar stronger to other currencies.

However, some economic threats that affect the industry are the increase in interest rates. Further, there has been increase in pressure from the Chinese footwear market that occupied the lower end of the market (Dunoff & Moore 2014: 158). Social condition for the industry has been changing.

There has been a global change in footwear fashion that provides great opportunity for the industry. There are signs of sustainable development in the global footwear market due to the rising demand for innovative designs, increasing awareness of the consumers about healthy lifestyle, increase in population and rise in disposable income (Global Footwear Market 2013: 2).

Technological advancement in the footwear industry has become widely apparent with fragmented supply chain in different geographical regions, wit headquarters and operations distinctly separated from production and assembly locations (Cecchetti 2015: 150). Further, new technology is being introduced in footwear designing and making in order to provide greater customer satisfaction and innovative designing.

Environmental factors has become important as leather skinned from animals have become difficult to attain and tanneries have become scant. Therefore, use of natural and artificial raw material has become prevalent that helps in reducing cost of production. However, cost of production ahs continually increased in the footwear industry. Legal issues related to anti-dumping laws have become a boon to the footwear industry of North America and Europe. Thus, this safeguards footwear industry from the illegal imports.

From the PESTEL analysis, the opportunities that are observed are recovery of the global economy, changing taste and preference of the consumers and adoption of healthier and active lifestyle, Anti-dumping regulation and trade agreements that facilitates global trade, and adoption of fragmental, value optimizing supply chain (Pouncey et al. 2010: 6).

The threats that have been identified are dampened demand for consumer goods in North American and European markets, increasing competition from Chinese manufacturers, rising cost of raw material, and environmental issues related to tannery.

Porter’s Five Forces Analysis

The footwear industry is fairly fragmented with the market dominated by large companies like AAA Sports and Denton. The fixed cost for retail operations is low and therefore, there are opportunities for new entrants in the industry.

Buyers’ power in the industry is moderate. This is because of the shift in the fashion trends and availability of wide variety of footwear. This creates high degree of differentiation in the footwear market. The high degree of differentiation of the product allows companies to target a different subsection of the market. This, therefore, increases the market power of the companies. However, due to low switching cost, consumers can easily switch between products. Thus, the buyers’ power is moderately high in the footwear market.

Most of the branded footwear companies are global players who source their products from low coast manufacturing locations. The global players in the footwear market provide highly differentiated products such as high-end designer products.

As there are a number of available vendors and manufacturers in the low cost manufacturing locations, it is easier for footwear companies to switch between producers. Further, they enjoy the economic advantage over the suppliers due to currency difference. Therefore, overall the power of suppliers or footwear companies is moderately high in footwear industry.

New entrants in the footwear industries are high. The growing popularity of online sales provides both threat and opportunity for new entrants as they can reach a large customer group with little investment. Further, fixed cost in retail operations is footwear industry is low. Large number of low-cost manufacturers in the market also makes cost of production low. Therefore, the threat of new entrants in the footwear industry is considered strong.

Threat from substitutes in the footwear industry is low, as footwear is considered a necessity, and substitutes in the market are limited. In less developed countries there is a trend to use the same shoe by repairing or wearing second hand shoes. This trend limits the sale of footwear.

Footwear industry is highly fragmented. Large players mostly dominate market but there is a high degree of rivalry. However, small companies can co-exist in the market, as the fixed cost of operations is not very high. There is moderately high pressure from rival competitors in footwear industry.

Main Opportunity and Threats

The main opportunities identified from the PESTEL and the Five Forces analyses are as follows:

- Signs of recovery of the global economy will help the global footwear industry.

- Changing consumer preference and adoption of healthier and active lifestyle increases the demand for footwear.

- Anti-dumping regulation safeguards larger companies from unregulated small companies from China who illegally swarm the western market with low-priced products providing stiff competition to high end branded footwear.

- Low threat from substitutes is an opportunity for the footwear industry.

The threats for the footwear industry are as follows:

- High degree of competition from new entrants increases competition in the market.

- Rising cost of raw material and labor is a concern for the footwear industry.

- Low consumer demand in Europe and North America is a concern for the footwear industry.

Company Overview

Background of the company

Denton Footwear ranks second in the global footwear industry in terms of investor expectation score and the best in industry score. Best in industry score measures the performance of the company relative to the best performing company in the industry. This respect Denton assumes second position.

Mission and Vision

The vision of Denton is to provide high quality and comfortable athletic shoes to its customers, remain among the top three market leaders in the international athletic footwear market, and retain sustainable growth.

The mission of the company is to increase its net revenue and profit by 10 percent annually. They aim at maintain their S/Q rating, which is currently at 6 and reject rate below 7 percent.

Markets/regions of Operation

Denton operates in four geographic regions – North America, Europe, Latin America, and Asia-Pacific. Based on distribution channel, Denton is present in two different markets – online Internet market and the wholesale market.

Number of firms competing in the industry

The company, which is the closest competitor of Denton, is Company A that produces, markets, and operates in similar geographic segment and targets same set of customers.

Competitive position of the company

Denton provides stiff competition to its closest rival Company A. it operates in the major markets in the world and provides more number of designs than company A. the prices of the product of Denton is higher than Company A’s products which makes its position a bit lower and reduces their demand in the market segment.

Main potential strength and weaknesses

The main strengths of Denton are its relatively lower marketing expenses compared to their revenue (13%), which is much higher for Company A (17.5%). Current ratio of Denton is higher than that of Company A. in the Internet segment, Denton provides free shipping while the rest of the industry does not.

The company has S/Q Ratings higher than the industry average in all the four geographic segments. The company provides 35 models or designs in the four geographic segments, which is higher than the industry average of 217 to 230. The celebrity appeal of the company’s brand is higher than the other competing companies in the industry. The retail outlet size of Denton stores is bigger than the industry average in the four regions.

The weaknesses of Denton lie in its higher cost to revenue ratio, which is marginally higher than its main rival is. Further, net profit, as a ratio of revenue is also higher for Company A. Company A ($947,899 thousand) has higher revenue than Denton ($665,724 thousand).

Decision Made

Key decision made each year

In year 11, the key decisions made by the company undertook cost cutting measures. In North American and Asia-Pacific plants, there was a decline in incentive per pair paid to the workers. Further, total compensation paid to the workers declined from year 10 to year 11 even though there was an increase in the number of workers employed.

Most of the company’s production is concentrated in Asia-pacific as the investment is highest in the region. The market share of the company in year 11 globally reduced from 8.3% to 7.6% though there was an increase in profit margin. The region where the company lost its market share is Asia-Pacific and Latin America.

In year 12, the number of pairs produced by Denton remained unaltered. Incentive per pair paid to the workers increased in Asia-pacific region from $0.20 to $0.50 but remained unaltered in North American plants. Total compensation paid to the workers increased in year 12.

In year 12, Denton undertook workers cut as the number of workers employed was reduced from 549 to 540 in North America and 1666 to 1599 in Asia-Pacific plant.

Overall, market share of the company again reduced from 5.7% in year 11 to 5.5% globally. This year, the company gained its market share in North American region and lost market share in Europe, Latin America, and Asia-Pacific region. There was a decline in the total operating profit margin. However, the company gained operating margin in the wholesale market in year 12.

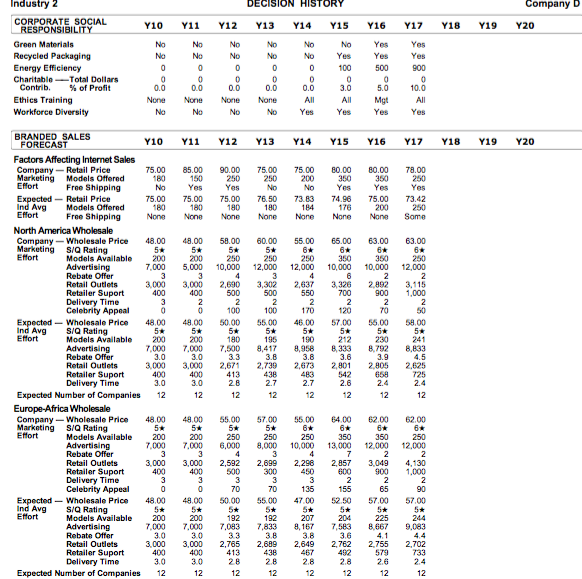

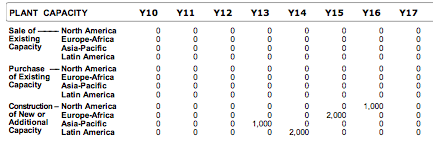

In year 13, the company initiated new construction in the Asia-Pacific plants increasing the plant capacity from 4000 to 5000. In the Internet market segment, Denton has increased its operating profit margin from 20.4% in year 12 to 30.8% in year 13 (see table 1).

However, in the wholesale segment there was a marginal increase of only 2.7% in operating profit margin. The company gained market share in Internet market in year 13, indicating that the company had concentrated on the online market that is expected to reach greater number of customers globally.

Workers incentive and total compensation was increased in North American plants in year 14. Continuing their focus on the online marketing segment, Denton increased the total regional advertising expenditure. They changed the allocation of advertisement expenditure based on each segment’s percentage of total branded pairs sold in the region.

Further, the company allocated the celebrity endorsement based on the branded pairs sold in each segment. EPS declined from $6.49 in year 13 to $3.22 in year 14. The company gained in both wholesale and Internet market share in year 14.

In year 15, Denton opened a new plant with capacity of 2000 pairs of shoes in Europe and Africa region and another plant with capacity of 2000 pairs in Latin America, increasing their total plant capacity to 11000 pairs (see table 2). This is a major expansion drive in the last five years.

Operations begun in the Latin American plant while the Europe-Africa plant was not started in year 15. The incentives per pair paid to workers in North America and Asia-Pacific plants increased to $2 per pair, which increased the cost of production of each pair of shoe, considerably. In terms of market share, there was a marginal decline in the market share of Denton in the Internet market while there was a marginal increase in the wholesale market.

Key Decisions

The key decision of Denton was to achieve globally differentiated brand that would set the company’s footwear apart from its rival brands based on such attributes such as higher S/Q rating, more models or styles available under the brand, greater celebrity appeal, higher main-in rebates, or a bigger network of retail outlets. The company has successfully established a generic differentiated strategy as they provide different set of services and higher number of styles than their rivals and industry average.

Further, due to the company’s higher concentration on advertising and celebrity status, marketing and advertising budget is much higher than the industry average. The company scores higher in the celebrity appeal index in all the four regions. Denton offers higher rebate to its customers. In addition, online supply and distribution of Denton is faster making its more efficient to cope with the growing Internet market.

Reasons for the Decisions

The main reasons to have undertaken those decisions was to establish the company as a brand that makes and provides differentiated products to the customers. Footwear is a very competitive industry with high threat of new entrants. Therefore, a company has to provide differentiation as an offering that would appeal to the customers.

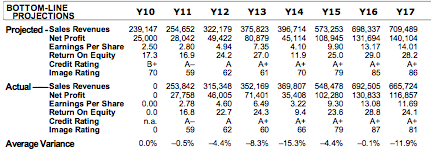

Estimated Results

The target at the end of year 15 was to achieve $80 as a price for its Internet products and Denton has achieved that target. The projected earnings per share (EPS) were $12 by the end of year 15 and ROE of 19%. By the end of year 15, the company achieved an EPS of $9.30. The company failed to gain larger market share in four regions of its operations. In all the four regions, by the end of year 15, Denton had achieved greater success and had closed their difference in financial and marketing parameters with its main rival company A.

Company’s Place in Industry

In year 11, the competitive position of Denton was much lower than company A that was the market leader in most of the wholesale segment and company C in the Internet segment in all the four regions. The only competitive advantage Denton provided was free shipping in Internet market and 350 models available in the wholesale market. In year 12, Denton concentrated on the Internet market, as this was the growing market.

The competitive strengths that it derived in this year were higher S/Q rating, large number of models offered, free shipping, and celebrity appeal. However, higher retail and wholesale prices and high advertisement cost remained a weakness for the company.

In year 13, 14, and 15, Denton’s performance vis-à-vis to its main rival, Company A improved significantly in all the four regions. Its position especially improved in the Asia-Pacific and North American market. However, high retain and wholesale prices remained a weakness for the company.

Denton’s Performance in Relation to its Competitors

The company was at the lower portion in the competitive matrix with most if its competitors reaming above Denton. However, by year 15 the company’s performance improved considerably, as it expanded operations and market, which helped Denton to reach closer to its rival Company A in the competition matrix.

Market Share

The overall revenue of the company increased considerably, indicating a higher demand for the products sold by the company by the end of year 14 and 15. The market share of Denton increased from 4.9% in Internet sales in year 11 to 10.9% in year 15.

Retail coverage increased with increase in retail outlets from 3000 in year 11 in North America and Europe-Africa to 3320 and 2857 in year 15 respectively. In both Asia-Pacific and Latin America, the retail coverage increased from 1500 in year 11 to 1641 and 1544 in Asia-Pacific and Latin America respectively.

Investor’s Expectations

In the initial years of operation, the investor’s expectation did not match the company performance. However, by year 15, the company had outperformed investor’s expectations.

Results

The overall performance of the company from year 11 through year 15 has been good. The company increased its production capacity, introduced certain corporate responsibility measures, and increased its revenue, operating margin, and market presence in all the four markets (see table 3). By year 15, Denton demonstrated considerable improvement in market share and competitive position.

Reflection

The performance of Denton was much better after introduction of the strategic framework and models. The increase in production capacity and increase in advertisement cost helped improve the performance of the company. The competitive performance of Denton improved in all the market regions and in both Internet and wholesale markets.

Underlying Strategic Principles

The underlying strategic principle to achieve this growth was global differentiation. The company endeavored to provide differentiated products and services. This helped the company to achieve greater competitive advantage.

Key Learning Points about Strategy

The best possible way to achieve a winning strategy is to improve performance and overall operational efficiency. A winning strategy will not be able to achieve greater productivity and performance for the company if the operations of the company remained stalled at one place.

Conclusion

The overall performance of Denton has improved from year 11 through year 15. Competitive position of the company relative to its closed competitor and industry leader has improved. Denton has achieved a greater market share and S/Q rating, which was targeted by the company. It has continually provided differentiated product as well as has improved its operational performance. It has expanded its operations and achieved greater success in all the four regions.

References

Browne, C. (2014) Why The “Great Recession” Only Had A Small Impact On China. Web.

Cecchetti, E. (2015) The new challenges facing the footwear market, countries and systems in comparison. Web.

Dunoff, J.L. and Moore, M.O. (2014) ‘Footloose and duty-free? Reflections on European Union – Anti-Dumping Measures on Certain Footwear from China’, World Trade Review, vol. 13, no. 2, pp. 149-178.

Global Footwear Market Will Reach USD 211.5 Billion in 2018: Transparency Market Research (2013). Web.

Hewitt, G. (2012) Eurozone falls back into recession. Web.

Pouncey, C., Hende, L.V.D., Buhart, J. and Weiniger, M. (2010) China challenges EU footwear anti-dumping duties before the WTO. Web.