Executive Summary

Industry Overview

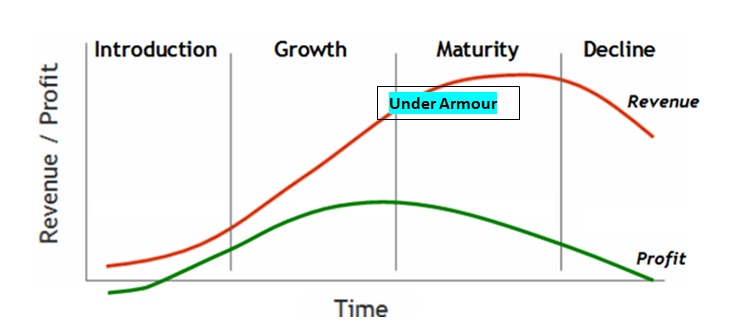

As of early 2018, the sports apparel, athletic and outdoor footwear, and related accessories industry is estimated at $250 billion. There are many niches within the field that are occupied by specialized firms, but Nike, Adidas, and Puma may be considered the biggest competitors in the market. The industry is steadily growing at approximately 4.3% annually, and by 2020 it is projected to hit $283 billion. The companies compete with generally similar products that achieve identical price and performance levels by employing a variety of different proprietary technologies. The industry has stopped growing explosively and established several large players that dominate the market, placing it in the early maturity stage of the product cycle.

The economic and sociocultural aspects of the industry are of the highest significance to a company. Countries other than the United States offer significant opportunities for a firm that is seeking to expand and enlarge its profits. Athletic apparel and footwear manufacturers are also closely linked with sports, signing promotional deals with players, and the popularity of the entertainment branch is essential to their marketing. The technological aspect is of moderate significance, as innovative ideas and technologies always emerge but generally fail to secure an advantage for any one company. The legal and political environments are not significant due to the lack of regulation on apparel and footwear manufacturers. The environmental aspect is also generally not substantial due to the public’s disinterest and the generally low pollution of the manufacturing methods employed in apparel and footwear production.

Substitution and rivalry are active within the industry, as many companies sell similar products to whatever offering a company may choose to field. There is generally no cost to switching, though shoes that fit a particular foot type well may secure the loyalty of a consumer base. New entrants can enter the market without significant difficulty and present a competitive offering, a factor that contributes to the large number of participating firms. The variety of choices enables buyers to approach selection carefully, and the ability to try a shoe and determine whether it fits the foot comfortably allows them to make informed choices. As such, buyer power is high, unlike that of the suppliers, who are numerous and interchangeable, offering similar products.

The driving forces in the industry include globalization, the popularity of various sports, technological innovation, and the number of niches that demand specialized products. Entering new markets is now easier for American companies than ever. The advances in information technology also allow various sports to reach people throughout the world and increase their popularity, promoting the associated apparel as a result. New technologies make athletic clothing more comfortable and useful, spurring firms to improve their offerings to match the latest advancements. Lastly, the unique requirements of many sports and occupations mean that many markets can be taken over by a new offering that matches the needs of the participants.

Company Overview

Under Armour is not a market leader, and its competitive strength is currently lower than that of firms such as Adidas and Nike. Its weaknesses are in lacking consumer loyalty compared to the more prominent brands, an inability to secure promotional deals due to financial constraints, and the perceived value that is lagging behind some of the competitors. However, Under Armour has a unique selling point in its ownership of the world’s most popular fitness service and its integration into the firm’s products, which is unmatched by other companies.

2017 was not a good year for Under Armour financially, as the company did not show the high growth figures that characterized its operations for the 26 quarters before. The firm still grew, exhibiting a CAGR of 2.10% and an overall revenue growth rate of 25.70% between 2014 and 2017. The company’s gross profit margin remains significant at 44.98%, but its operating and net profit margins are -0.20% and -0.97%, respectively, showing a dangerous trend. Expedient action by the management is required to address the issue.

Under Armour utilizes a focused strategy based on differentiation, aiming to appeal to athletes and people with active lifestyles who are concerned about sweat and want to integrate fitness trackers conveniently. Its ownership of an application with 160 million users can contribute to the distinction heavily, as the tool can be used to promote physical Under Armour products, which would, in turn, make the program more popular through integration. Under Armour may also appeal to people who live in hot or cold climates by showing its product ranges that are designed for such environments.

Strategic Issues

How can Under Armour enable sustainable growth and become profitable in the conditions of heavy competition, a slowing in the expansion of the industry, and the closure of traditional distribution pathways such as brick-and-mortar retail stores?

Robust Options

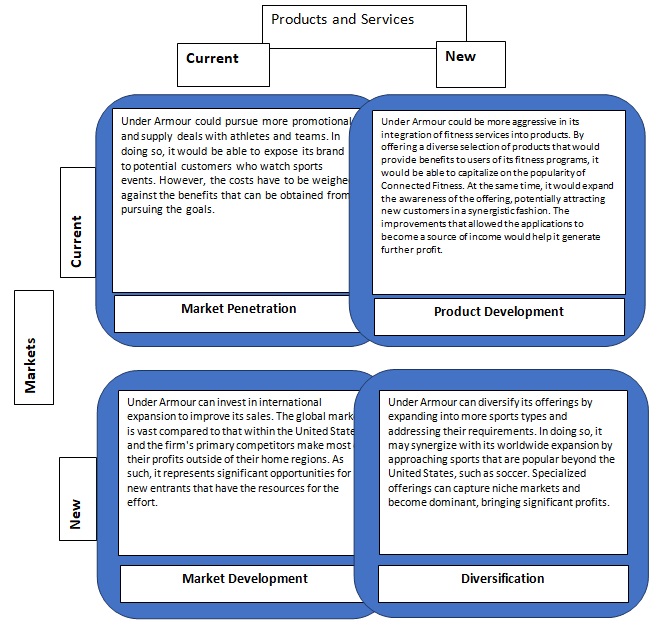

- Under Armour can attempt to secure more deals with athletes and teams to supply them with equipment and collaborate on product lines.

- Under Armour can increase the integration of its fitness services into the product and appeal to the market that is using its application without purchasing the company’s equipment.

- Under Armour may increase its efforts to expand into markets other than the United States.

- Under Armour can attempt to enter the market for more varieties of sports, seeking to satisfy their specific requirements.

Clear Recommendation(s)

The primary recommendation for Under Armour is to improve the integration of its fitness service into the company’s offerings. The investment has become profitable recently, and the firm should capitalize on its financially successful idea. The primary reason why pursuing this strategy is desirable is the inability of the competition to offer services that can compete with the product. They may choose to partner with less popular services or offer products with weakened integration.

The other strategies can also lead to considerable success, but they are more challenging to implement and not as reliable. Both promotion deals and international expansion are costly endeavors, straining Under Armour’s already insufficient budget. The development of specialized equipment for various sports is also a significant investment that is not guaranteed to pay off and requires time and effort for market penetration after it is completed.

Implementation Strategy

Under Armour has presented “smart shoes” that integrate fitness services already, giving it a sound base for promotion and data collection. The company should collect data on their popularity and the primary consumer complaints. Then, it should improve upon any issues discovered and work on integrating the functionality in most of its other offerings at a minimal cost. Under Armour should conduct extensive marketing demonstrating the advantages of its services when compared to competing products and fitness-tracking accessories. After the designs are finalized, the company should begin collecting data on their performance and issues and start iterating the designs to eliminate any concerns and make them as appealing to the consumers as possible.

Projected Results from Implementing Recommendation

The innovation is unlikely to allow Under Armour to return to the growth rates it experienced before 2017 immediately. The first generation of smart products, in particular, is likely to meet with significant criticism due to issues that were not discovered during production. The second generation, as well as the ones that follow, should eliminate most of the concerns and offer a unique product that will differentiate Under Armour from the competition and attract a significant consumer base. The revenue generated from the sales is likely to allow it to expand further and invest in traditional strategies. In the best case scenario, Under Armour will eventually become a global company and increase its sales many times over, becoming a high-profile rival to market leaders such as Nike and Adidas.

Industry Diagnostic Analysis

Appendix A: Dominant Economic Characteristics

- Industry: Sports and Outdoor Apparel, Underwear, and Footwear in the United States and Worldwide

- Market Size: $250 Billion as of 2018

- Scope of Competitive Rivalry: Global and International

- Market Growth Rate: Estimated 4.3% annual growth, reaching $283 billion in 2020

- Stage in Product Life Cycle: Early-Maturity Stage

- Number of Companies in Industry: 25 significant brand-name competitors in various market segments such as apparel and footwear. Nike, Adidas, New Balance, Polo Ralph Lauren, Salomon, and Footjoy are notable industry and niche leaders.

- Type of Customers: Consumers seeking high-quality athletic and lifestyle apparel that caters to specific needs and environments, such as the mitigation of hot or cold temperatures

- Key Differentiations: Technology, Dryness, Weight

Market Opportunities:

- Capitalize on the usage of fitness tracking services embedded in the girl’s “smart” products

- Expand international presence and sales throughout the world, particularly in countries such as China

- Sign more deals with athletes and sports teams to promote the brand to consumers

- Expand direct online sales by offering better prices and competitive shipping options

External Threats:

- A company has to compete with numerous firms, some of which may eclipse it in terms of size, while others are leaders of their niche markets with sizable experience.

- The closure of large retail chains can damage wholesale distribution results.

The market for sports apparel, athletic footwear, and related accessories was estimated at $250 billion in 2018 and projected to continue growing at a rate of 4.3% per year. It is in the early maturity stage, and large industry-leading companies such as Nike, Adidas, and Puma exist in the environment.

Appendix B: PESTEL Analysis

Political: Little Significance

A lack of significant regulation from any government bodies except for the laws that constrain every business

Economic: Very Significant

Countries other than the United States offer substantial economic opportunities

Sociocultural: Very Significant

Promotional deals with athletes offer significant marketing opportunities because sports are highly popular

Technological: Moderate Significance

Online fitness services that integrate with smart products are becoming more popular among consumers

Environmental: Little Significance

- Most consumers are not aware of the methods used to produce apparel and footwear

- The manufacturing procedures are not significantly harmful to the environment

Legal: Little Significance

There are few or no regulations related to footwear

Market Opportunities

- Countries other than the U.S. offer significant expansion opportunities for the brand

- Consumers are showing an increased demand for integrated fitness services

External Threats

The closure of retail chains harms the manufacturers’ ability to distribute their products.

The economic and sociocultural aspects of the industry are the most significant due to the opportunities offered by the countries outside of the United States and the popularity of sports that can be used to promote products. The technological aspect is of moderate significance due to the emergence of Internet-based fitness services that can be integrated into products. The other factors are of little relevance because of the lack of stringent regulations and consumer awareness of the influence of apparel manufacturing on the environment.

Appendix C: Driving Forces

- Increasing Globalization

- Popularity of Sports

- Number of Niches

- Technological Innovation

Market Opportunities

- Expand within the industry through international sales

- Become a market leader in the emerging fitness program market

External Threats

- Traditional means of retail are failing, forcing a shift to direct sales

- There is heavy competition in the industry, and it is challenging to create a product that will be a clear market leader

The international market presents significant opportunities for companies that want to expand beyond their original operating regions. Various sports are also becoming more popular, allowing industry participants to capitalize on athlete deals. The number of different disciplines and their associated requirements enable a firm to secure the market for a given sport with a specialized. However, the same type of shoe may not fit all people, and few, if any, products will gain the approval of an overwhelming majority of consumers. Lastly, the popularity of fitness applications among people with active lifestyles allows a company that keeps up with innovations to gain a significant advantage.

Appendix D: Five Forces Analysis

Substitutes: Strong

- Switching is not associated with extra costs

- The quality is comparable, though offerings are significantly different

Rivals: Strong

Under Armour has to compete with companies that are much larger or more highly specialized

Threat of New Entrants: Strong

Under Armour is a relatively new company, and others can enter the market with specialized offerings

Buyer Power: Strong

- Numerous options available for any purchase

- Consumers are price sensitive and know what fits them

Supplier Power: Weak

- There are multiple alternative suppliers available

- Supplier product is not highly differentiated

Market Opportunities

International expansion

External Threats

- Retail stores are closing, leading to difficulties with regards to maintaining the sales volume

- There are many substitutes within the industry of similar quality

The sports apparel and footwear industry has many participants who offer high-quality products, and so substitutes and rivals are powerful. New companies also have little difficulty entering as long as they introduce an innovative technology or approach. Due to these considerations, buyers are influential, as they have a broad array of choices and can determine what fits them best. Unlike them, suppliers are weak due to their similar products, high numbers, and inability to enter the market themselves due to a lack of relevant technology.

Appendix E: Key Success Factors

- Brand Recognition

- Promotional Deals

- Perceived Value to Customers

- Fitness Services Integration

- Sports Teams Partnerships

Market Opportunities

- Expansion within the industry through brand recognition

- Secure additional promotional and supplier deals with athletes and teams to improve consumer awareness

- Capitalize on active fitness service engagement

External Threats

Retail store closures are hurting sales.

Under Armour has to be able to compete with large firms such as Adidas, Nike, and Puma in terms of brand recognition to succeed in the global market. To do so, it should secure more promotional deals with athletes, especially those who participate in sports that are popular worldwide. It should also continue signing supplier deals with teams at all levels to improve awareness among its target demographic of young, athletic people. Under Armour should also differentiate its products by offering consumers considerable perceived value that would attract their interest. Its traditional strong points of adaptability and sweat removal are significant factors, but improved integration of its popular Connected Fitness offerings will also be beneficial.

Appendix F: Competitive Analysis

Competitor: Nike

- Sells: Athletic apparel and footwear

- Market Share: 27%

- Strengths: Brand Power, Advanced Technology, Many Promotional Deals

- Weaknesses: High Prices

Competitor: Adidas

- Sells: Athletic apparel and footwear

- Market Share: 10%

- Strengths: Brand Power, Diverse Selection of Products, Many Promotional Deals

- Weaknesses: High Prices

Competitor: Adidas

- Sells: Athletic apparel and footwear

- Market Share: 5%

- Strengths: Low Prices, Advanced Technology

- Weaknesses: Low Numbers of Promotional Deals

Internal Diagnostic Analysis

Appendix G: Weighted Competitive Strength Analysis

Internal Strengths

- Under Armour uses fitness services to a considerably higher degree than its competitors

- Under Armour puts considerable emphasis on promotional deals, though its efforts are limited by the occasional inability to outbid larger companies

Internal Weaknesses

The brand is not as well known as those of prominent competitors, and the offerings may not be as diverse.

Under Armour is third in this analysis due to its lack of a brand loyalty emphasis. Adidas takes first place due to its focus on a diverse lineup and perceived value of footwear that can be used for general outdoors activities. It has a small lead over Nike, which focuses on sports products and aggressively pursues promotional deals. Both are significantly ahead of Under Armour and Puma, which are close together. However, Under Armour obtains an advantage based on its fitness service integration, which is significantly ahead of every other company in the comparison.

Appendix H: Financial Analysis

Growth

- CAGR: 2.1%

- Growth Rate in Revenue (2014-2017): 25.70%

Profitability

- Gross Profit Margin for 2017: 44.98%

- Operating Profit Margin for 2017: -0.20%

- Net Profit Margin for 2017: -0.97%

- Net Return on Assets for 2017: -0.91%

- Return on Equity for 2017: -2.39%

Sustainability

Liquidity Ratios

- Current Ratio: N/A

- Quick Ratio: N/A

- Inventory Turnover: N/A

- Days in Inventory: N/A

Debt Ratios

- Debt-to-Asset Ratio: .20

- Debt-to-Equity Ratio: .39

- Times Interest Earned: -0.2985

Internal Strengths

The company is still growing, though the rate has slowed compared to previous years.

Internal Weaknesses

The company is operating at a loss.

Under Armour continues growing, but the rate has slowed compared to previous years. However, it is operating at a loss, representing a danger to its continued sustainability and shareholder attitudes. Investor dissatisfaction may lead to further damage to the company, preventing it from recovering from the current issues. The trend is especially likely to manifest because the firm has been reporting stable and significant growth along with considerable profits in previous years, and the sudden failure to maintain the trend is concerning. Swift and expedient action to improve profitability by expanding sales or reducing expenses is necessary to retain Under Armour’s position.

Appendix I: Product Life Cycle Analysis

Internal Strengths

Under Armour continues growing, albeit at a slower pace than optimal

Internal Weaknesses

The company is approaching its peak, after which it will begin declining and become unprofitable.

Under Armour appears to have exited the growth period of the product life cycle and entered the early stages of the maturity stage. Accordingly, its expansion rate has fallen, as it is approaching the peak of its potential. As the company progresses through the cycle, it will eventually stop growing and begin declining. As such, it is the task of the management to extend the maturity stage and ensure the survival of the company for a period that is as long as possible. It is likely impossible to return to the growth stage, as Under Armour is not introducing any innovative and disruptive products. As such, the firm is unlikely to match its prior growth statistics, but it can continue expanding at a slower rate.

Appendix J: Go-to-Market Strategy

Go-to-Market Strategy: Focused Strategy Based on Differentiation

Uniqueness Drivers

- Brand Recognition

- Fitness Service Integration

- Product Traits

Internal Strengths

- Integrated technology offering that is mostly unmatched by the competition

- Utilization of technologies that cater to specific needs and can be employed in various products

Internal Weaknesses

- Inability to secure sufficient quantities of promotional contracts due to financial limitations

- Competing products offer traits that are absent in Under Armour goods, though they lack some features, as well

Under Armour seeks to appeal to specific segments of the population that would benefit from its apparel’s and footwear’s materials and properties. As such, it tries to give its products a stylized, technological appearance to underline their complexity and incentivize consumers to familiarize themselves with the advantages of choosing the brand. It also differentiates itself from the competition by integrating its highly popular fitness applications into footwear and accessories. Doing so enables several benefits that cannot be matched by the majority of other sports apparel companies at little to no extra product cost. As such, it creates a significant advantage, mainly due to the current trend of increasing Internet usage.

Appendix K: Resources and Capabilities Analysis (VRINE)

Internal Strengths

- Recognizable Brand

- Fitness Service

Internal Weaknesses

- The distribution channels are being harmed and not expanding adequately to offset the losses

- The cost of the products provides no competitive advantage

Over time, Under Armour has developed a recognizable brand and claimed a significant portion of the market share. It should leverage this advantage to obtain further growth, though it will have to compete with other recognizable trademarks, partially offsetting the gain. However, its ability to offer integrated fitness services is unmatched in the industry. The fact that Under Armour owns the most popular fitness application in the United States enables it to provide services that cannot be imitated by the competition. They may partner with other companies to substitute the service, but the quality will likely be lower. As such, Under Armour may use the advantage it has to differentiate it from the variety of similar offerings that characterize the industry.

Appendix L: SWOT Analysis

Internal Strengths

- Access to popular fitness services that cannot be matched by the competition

- Unique technologies that address many of the concerns of the customer base and are adaptable

- A recognizable brand that can be used to sell products to consumers

- Sustained growth despite the damage sustained in 2017

Internal Weaknesses

- The products are priced in the same range as those of the competition, and reducing the costs is a challenging task.

- Lacking ability to distribute products via online retail due to insufficient attention paid to the subject

- Poor reputation among investors due to the bad publicity associated with the CEO’s devotion to the firm

Market Opportunities

- Expand into other countries to tap into populated markets with significant purchasing power

- Create offerings for specific popular sports that are disregarded by many manufacturers and secure a leading position

- Secure more promotional and supplier deals with athletes and teams, especially in regions outside of the United States

External Threats

- The competition is powerful and well-established, with excellent reputations among consumers

- Brick-and-mortar retail chains are suffering due to the emergence of online marketplaces, hurting traditional product sales

- Investor reactions to Under Armour’s poor performance are causing its shares to drop further

- Most of the company’s products can be substituted by other offerings, as they do not distinguish themselves sufficiently

Biggest Threats

- The number of possible substitutes that make it challenging to continue growing

- Closure of existing distribution channels before new ones can be established and expanded enough to compensate for the loss

Biggest Weaknesses

- Product costing that does not provide Under Armour with a significant advantage over the competition

- Difficulty in competing with platforms such as Amazon in terms of product costing and delivery standards

Strategic Issue

How can Under Armour maintain its growth and possibly return it to the high numbers it had shown previously in the highly competitive environment of the sports apparel industry, where prices are homogeneous, and there is not much differentiation between the offerings, in the circumstances of failing brick-and-mortar retail enterprises and an inability to compensate for the loss in sales?

Perspective Appendix

Appendix M: Growth Analysis