Introduction

Generating income from shares is one of the popular ways of doing business nowadays. Investors select companies that might demonstrate sustainable and significant growth in the future. Buying shares requires spending money from the budget, while income might not be immediate.

This means that people have long-term plans that might help them acquire better positions in the future. In such a way, they consider the time value of money and how it changes. It can be compared to education and additional courses necessary for career growth. It requires additional investing and spending; however, in the future, it can generate dividends necessary for the increased quality of life and well-being. In such a way, education can be compared to the changes in the value of money and investing to acquire desired dividends and benefits.

Thus, to become an educated person, individuals have to work hard during a prolonged period of time. Moreover, it requires additional financial investment as respected colleges or other educational establishments have comparatively high tuition fees. At the same time, the knowledge and skills acquired during the process are highly appreciated by employees, meaning they offer the chance to build a successful career. Moreover, if a person has numerous skills and extensive knowledge, he/she becomes more appreciated by potential employers. This means that the value of knowledge and efforts put into acquiring education will increase over time. Having achieved a particular stage, education becomes valuable and brings dividends, meaning its value is critical.

Calculating the Value of Education

Analogy with Time Value of Money

In such a way, the process of acquiring education can be compared to the ideas of the time value of money. The time value formula can be presented in the following way:

FV=PV*(1+i/n)nxt (Cote, 2022)

PV, or present value – can be viewed as the effort and money required to start the education process. In such a way, the initial value is effort, basic knowledge, and money that start the process of acquiring education.

FV, or future value, is the final product or knowledge and skills necessary to build a successful career and become a specialist who will be appreciated.

The years in education can be considered periods of time necessary for the value to increase. Usually, around 4-6 years are needed to cultivate the necessary knowledge and evolve.

Finally, payments are real payments that include tuition fees and other spending on living, food, and materials essential for learning.

Thus, the formula above shows that the time value of money can be compared to becoming an educated person. The sum of money existing at the moment and available for investing has a more significant value compared to the same sum in the future (Brigham & Ehrhardt, 2019). It is one of the core principles of financing which is applicable to real-life situations. Investing in education today is more important as it creates the basis for the future and can help to acquire numerous dividends.

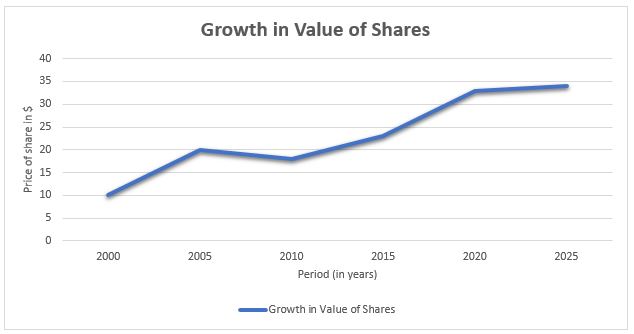

The time value of money can also be understood by analyzing stocks and how they work. As stated previously, investors might select spending money on options that do not seem too attractive or reliable at the moment; however, over time, their value can grow, which will bring them extra dividends, and they will acquire money from the shares bought previously at lower prices:

The graph shows oscillations in the price of a share over time. It can differ in various years; however, if the investment is wise, the price per share will grow and bring specific dividends to the shareowner (O’Shea, 2023). It illustrates the time value of money as the sum spent at the moment can potentially generate more benefits than the sum spent in the future.

Analogy with Investment in Shares

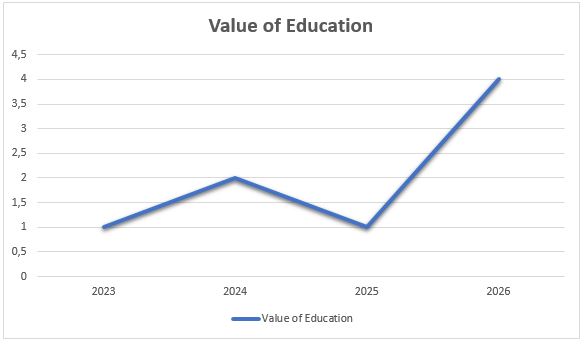

Acquiring education can be compared to buying shares of a certain company and expecting their prices to grow. For instance, becoming a shareowner can be compared to becoming a student. It requires an initial investment, such as tuition fees. Additionally, in the course of development, more financing might be required. However, the overall value of education will grow over time, which is essential. In such a way, the graph of the change in the value of education might be similar:

In such a way, the graph is similar to the previous one. This means that the value of education might change over time because of the significant sums required to study in college or attend extra courses. However, in the end, it will rise critically because of the ability to work and build a career.

Conclusion

Altogether, making wise investment decisions is essential for the modern world. The time value of money is one of the central concepts of the modern world. It explains that the future value of money can be realized by considering the present value, rate, time, and number of compounding periods. In most cases, a sum present at the moment has a higher value than a sum that should be paid in the future. The same can be compared to the process of education. Investing in acquiring knowledge means acquiring additional dividends in the future, which are necessary for a higher quality of life.

References

Brigham, E., & Ehrhardt, M. (2019). Financial management: Theory & Practice (16th ed.). Cengage Learning.

Cote, C. (2022). Time value of money (TVM): A primer. Harvard Business School. Web.

O’Shea, A. (2023). What are stocks and how do they work? Nerdwallet. Web.