Introduction

The United Arabs Emirates (hereafter referred to as the UAE) was formed in 1971 as a result of a merger by seven states which included Abu Dhabi, Ash Shariqah, Al Fujayrah, Abu Zaby, ‘Ajman, Umm al Qaywayn and Dubayy (Index Mundi para. 1). Abu Dhabi is the capital city of the UAE.

Over the past few decades, the UAE has undergone a significant economic transformation. Some of the factors which have contributed to the country’s economic growth over the past 3 decades relate to availability of sufficient oil resource and global finance (Index Mundi para. 1).

During the 21st century, the UAE’s Gross Domestic Product (GDP) is ranked at par with those of the leading West European countries. However, during the period ranging from 2008 to 2009, the country’s economic growth was adversely affected as a result of the collapse in real estate prices and the decline in oil prices.

This situation forced a number of activists to petition the government to undertake a greater political responsibility. Over the years, the UAE has continuously adopted a moderate foreign policy stance which has enabled it to play a significant role in the economic transformation of the gulf region (Central Intelligence Agency para. 1).

This paper is aimed at conducting an analysis of the UAE’s economy on the basis of various components such as its demographics, language, currency, political system, and predominant industries. The paper also analyzes the UAE’s economy on the basis of various economic factors such as nominal GDP, GDP per capita, unemployment and budget deficit. A description of the behavior of these economic indicators for a period of 20 years is also conducted.

The paper also entails a historical analysis of the relationship between real GDP and labor productivity, real economic growth and labor productivity, real GDP and unemployment. A historical analysis of the relationship between inflation and real economic growth, inflation and money supply growth and unemployment and money supply growth is also conducted. Finally, the paper gives the relationship between the accounts in the balance of payments, average interest rates and the government budget balance.

Demographics

The UAE’s society is relatively cosmopolitan which is evidenced by the composition of its population. Approximately 19% of the country’s population are Emirati while 50% are South Asian and 23% are Iranians and Arabs. The remaining 8% of the population are composed of expatriates from different countries such as East Asians and Westerners.

The official language in the UAE is Arabic but some of the common languages spoken in the Emirates include Urdu, Hindu, English and Persian. Muslim is the major religion in the UAE with 96% of the citizens being Muslim while Hindu and Christians are only 4% (Central Intelligence Agency para. 5). The UAE has a national currency which is referred to as the UAE Dirham commonly abbreviated as AED (Central Intelligence Agency para. 6).

Over the past decade, the UAE has undergone a significant population growth. The UAE’s population growth is estimated to be 3.282% (Central Intelligence Agency para. 6).

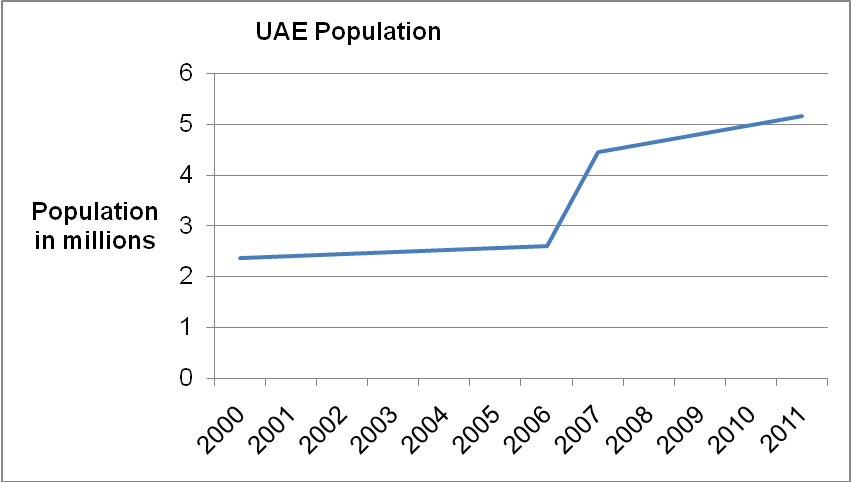

In 2000, the UAE’s population was estimated to be 2, 369,153. During the period ranging from 2000 to 2006, the population of the Emirates grew at a steady rate from 2,369,153 to 2,602,713. However, from 2006 to 2007, the country’s population increased from 2,602,713 to 4,444,011 as illustrated by Figure 1. From 2006 to 2011, the population growth rate has been steady as illustrated by Figure 2. The population increased from 4,444,011 in 2007 to 5,148,664 in 2011.

Approximately 78.7% of the population are composed of individuals aged between 15-64 years. Of these, 2,968,958 are male while 1,080,717 are female. On the other hand, 20.4% of the citizens are aged between 0-14 years while 0.9% of the population are represented by individuals aged over 65 years. By 2005, the UAE’s population was estimated to be 5,148,664 (Central Intelligence Agency para. 6).

Figure 1

Political System

Since its formation, the United Arab Emirates has managed to establish a distinctive national identity as a result of consolidation of the federal status of the seven states that form the UAE (Emirates para. 1). As a result, the UAE has managed to develop a substantial degree political stability.

The UAE’s political system is unique in that it is a combination of modern and traditional systems. By merging the two systems, the Emirates has been able to maintain, adapt and preserve the best traditions. The ultimate effect is that the UAE has succeeded to develop an effective administrative structure (Emirates para. 1). Prior to formation of the UAE, each of the states had their own political system.

To ensure success of the new state, the leaders decided to form a provisional constitution that outlined the allocation of powers to the new federal institutions. Through constitutional review, a federal system was instituted in 1996. The UAE’s federal system of government is composed of the following:

- A Supreme Council

- Cabinet (Council of Ministers)

- Federal National Council

- Parliamentary Body

- An Independent Judiciary

- Council of Ministers

Each of the UAE’s state has its own ruler which makes it to be loose alliance. On the basis of the 1971 provisional constitution, each of the seven emirate states has reserved a number of powers and rights such as those related to control of minerals and revenues. The resultant effect shows that development of federal powers has been relatively slow (US Department of State para. 13).

Through the constitution, the UAE has established the position of the President and the Vice President who are required to serve for a 5 year term. The Council of Ministers is headed by the Prime Minister.

The Federal National Council (FNC) is composed of 40 members some of which are appointed by the rulers while others are elected by an electorate which is selected by state rulers (US Department of State para. 13). The Cabinet is selected by the President in consultation with the Supreme Council. Additionally, each of the six states has its own local government (Emirates para. 6).

Predominant Industries

In an effort to attain economic growth, the UAE adopted the concept of diversification of its economy. As a result, the United Arab Emirates has attained rapid industrial development. Diversification of industries in the UAE has played a critical role in the economic success of the country. There are a wide range of industries within the federation. The most important industries in the UAE include the chemical fertilizer industry, cement industry, oil and gas, aluminum, steel and cable industries.

The UAE’s chemical fertilizer industry is a core component of the country’s economic growth. The industry’s growth arose from the foundation of the Abu Dhabi National Oil Company (ADNOC). In its operation, the industry produces approximately 1,050 metric tons of ammonia and more than 1,500 metric tons of urea. The chemical fertilizer plant was formed in 1998 as a result of a merger between International Technical Trading Company of the UAE and SQL of Chile.

The cement industry is ranked amongst the oldest manufacturing companies in the United Arabs Emirates. Al Ittihad Cement Company was the 1st cement factory. Other factories have been constructed at Dubai, Fujairah, Ajman, Al Ain, umm al-Qaiwain and Sharjah. By December 1998, there were 9 cement factories within the UAE.

One of the plants specializes in the production of Portland cement and another produces white cement. The capacity of 8 plants that specialize in the manufacture of Portland cement is estimated to be 9 million tones. The cement factories have provided direct employment to approximately 2,999 citizens. This represents an investment of approximately Dh 1.8 billion.

Oil and gas are the major contributors to the UAE’s Gross National Product (GNP) and hence the country’s economic growth. On a regional scale, the UAE is ranked as the 3rd largest producer of natural gas and the 4th on a global scale. The UAE has a substantial amount of oil and gas reserves which enables it to meet its domestic and international demands. Abu Dhabi oil sector accounts for 85% of the total oil produced in the UAE.

One of the factors which made Abu Dhabi to be a major oil producer is that it has both onshore and offshore oil fields. Abu Dhabi National Oil Company is charged with the responsibility of formulating oil production policies. However, oil production is conducted jointly with other international companies. The daily oil production within the UAE is estimated to be 2 million barrels. The most renowned gas and oil sectors in the UAE are located at Fujaira, Sharjah and Dubai.

The aluminum industry is also a significant component of the UAE’s economy. The aluminum industry in the Emirates also contributes to the growth of other industries such as the aerospace and automotive industries. This arises from the fact that the success of these companies depend on the availability of aluminum for them to operate effectively.

One of the largest players within the industry is Dubai Aluminum Company. The firm produces more than 861,000 metric tons of metal. The UAE has a sufficient amount of aluminum to meet both the local and international demand. Moreover, the United Arab Emirates exports aluminum to more than 40 countries.

The steel industry is also a core component of the UAE’s economy. The country has a number of steel plants, such as Ducast, International Quality Steel, Haji Siddique Foundry and Eurogulf Steel Industries.

Economic Indicators

In 2010, the UAE experienced a growth in the level of net exports, investment and private consumption. As a result, its nominal GDP increased from Dh 780 billion in 2009 to Dh 843 billion in 2010. The International Monetary Fund (IMF) projected that the UAE’s nominal GDP will increase from $1.084 billion in 2010 to $1.402 billion in 2011 (MSN para. 1).

With regard to GDP per capita, the UAE has a relatively high GDP per capita compared to other countries. GDP per capita of a country is obtained by dividing a country’s national output by its population. In 2010, the UAE’s GDP per capita was estimated to be $ 49,600. In 2011, the UAE’s GDP per capita increased to $66,626. This represents a significant growth in the country’s GDP per capita (Index Mundi 1).

Currently, the UAE has a relatively low rate of inflation. However, the rate of inflation has been fluctuating over the past 3 years. In 2008, the UAE’s rate of inflation was 12.3% while in 2009 and 2010, the rate of inflation was 1.6% and 0.9% respectively. However, in 2011, the rate of inflation increased to 4.5%.

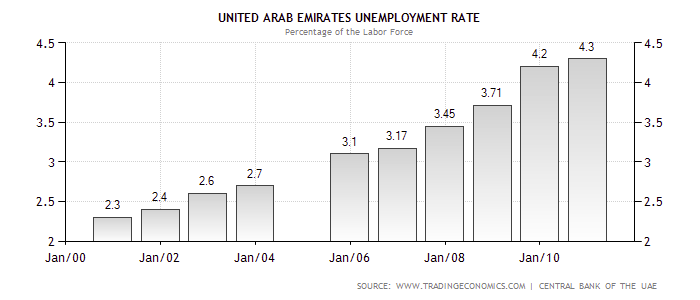

Prior to attainment of its independence, the UAE’s economy was mainly driven by fishing and agriculture. The discovery of oil in the 1970s led to a significant economic growth. Currently, oil accounts for more than 35% of the country’s GDP. The UAE is ranked amongst the countries with the lowest rate of unemployment in the world.

However, over the past decade, the Emirates has experienced an increment in the level of unemployment as illustrated in the chart below. By the end of 2010, the UAE’s rate of unemployment was reported to be 4.3%.

In 2009, the UAE had a relatively high budget deficit which amounted to Dh 126.5 billion. The high budget deficit arose from the slum in oil prices which was experienced in 2009. Additionally, the high budget deficit was also a result of an increment in the government spending with regard to development (UAE Interact 1).

In an effort to improve the country’s economic growth, the UAE’s government reduced its budget deficit to Dh 84.9 billion in 2010. In 2011, the UAE’s government projected that it would reduce its budget deficit with a margin of 53% by the end of 2012. If this is achieved, the country’s budget deficit will amount to Dh 1.82 billion (UAE Interact 1).

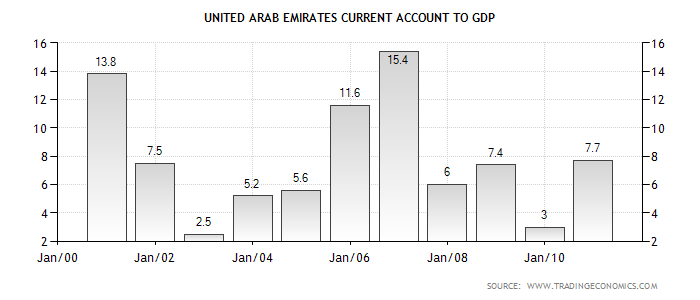

The percentage of the UAE’s balance of payment in relation to GDP is relatively low. By the end of 2010, the UAE’s balance of payment as a percentage of GDP was 7.7%. The chart below illustrates the trend in the country’s balance of payment as a percentage of GDP from 2000 to 2010.

Over the past 20 years, these economic indicators have been fluctuating as a result of changes in internal and external factors such as globalization and industrialization. Additionally, the changes in these indictors have also arisen from adoption of various economic policies. For example, from 1980 to 2010, the UAE’s average balance of payment as a percentage of GDP has been relatively stable at 9.36%.

However, the country’s balance of payment as a percentage of GDP reached its historical high in 1980 when it averaged 25%. On the other hand, the UAE balance of payment as a percentage of GDP reached its lowest level in 1994 when it averaged 0.1%. If the UAE experiences a high balance of payment as a percentage of GDP, its competitiveness in the international market declines (Trading Economics 1). This arises from the fact that the competitiveness of its products in the international market can be negatively affected.

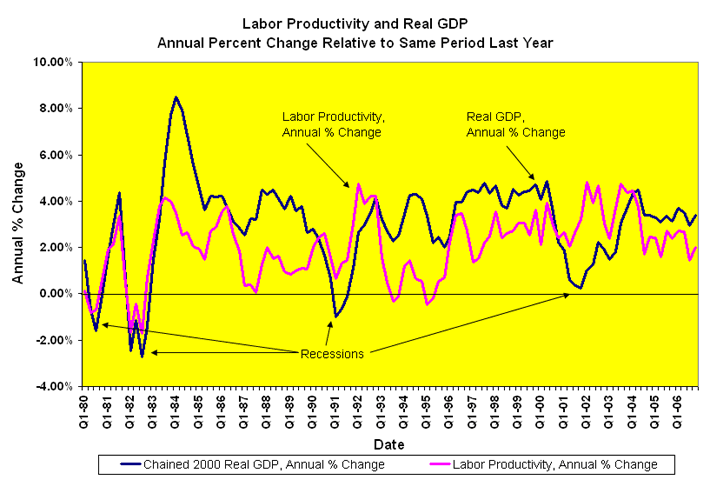

Real GDP and Labor Productivity

There is a direct relationship between real GDP and labor productivity (Arnold 360). According to Arnold (360), growth in labor enables an individual or a firm to increase the level of its output. The resultant effect is that the probability of an increment in the level of real GDP is enhanced. The chart below illustrates the relationship between Real GDP and labor productivity.

Arnold (360) further asserts that change in average labor productivity is dependent on whether the additional workers are productive compared to the existing ones. Therefore, if the additional workers are less productive, the average labor productivity will decline. On the other hand, if the additional workers are more productive, then labor productivity will increase.

Arnold (360) asserts that it is only an increment in labor productivity that can result into an increment in real GDP. Based on this relationship, it is important for economies to focus on how to improve their labor productivity. One of the ways through which they can attain this is by investing in education and training. Additionally, labor productivity can be also enhanced by increasing the level of capital investment.

Real GDP and Unemployment

The relationship between unemployment and real GDP has been evaluated by a number of economists such as Arthur Okun. Okun asserted that there was an indirect relationship between real GDP and unemployment (Bell 135). In his study, Okun showed that the level of unemployment in the US during the postwar period reduced with 1% for every 2.2% growth in real GDP. Okun illustrated the indirect relationship using the formula K= (Ya-Yu)/dU.

Where:

- Ya= actual economic growth.

- Yu= unemployment stabilizing growth rate.

- dU= change in the unemployment rate.

Another study conducted in Australia during the 1990s revealed that to stabilize the rate of unemployment with a margin of 1%, real GDP was to grow with a margin of 3.5% (the required rate of growth) plus 2.15% which represented the Okun coefficient. Therefore, real GDP had to grow with a margin of 5.65% annually. This relationship indicates that in order to reduce unemployment, the rate of real GDP growth has to be relatively high (Bell 135).

Real Economic Growth and Labor Productivity

One of the factors that contribute to a country’s economic growth is labor. Through combination of labor and capital, a country is able to create output. To increase labor productivity, it is imperative that each individual increases his or her level of output. This stimulates the rate of growth in a country’s labor productivity. The resultant effect is that a country’s rate of economic growth is enhanced. This means that there is a direct relationship between the rate of a country’s real economic growth and labor productivity.

Inflation and Real Economic Growth

According to Li (1), a country’s economic growth is adversely affected by high rate of inflation. However, the relationship between inflation and real economic growth is complex. For example, studies conducted by Easterly and Bruno in 1998 revealed that there was a nonlinear relationship between real economic growth and the rate of inflation. Findings of the study showed that at low rate of inflation, the nature of relationship was neither positive nor significant.

Li (1) further asserts that high rates of inflation have a significant and adverse effect on a country’s rate of economic growth. Additionally, studies conducted by Easterly and Bruno also revealed that some countries experienced high rates of inflation of up to 20% and 30% while their economic growth was not adversely affected.

However, when the rate of inflation exceeds a certain critical level, the rate of economic growth is adversely affected (Li 2). Inflation increases the level of uncertainty in an economy hence reducing the level of investment. The resultant effect is that the country’s economic growth is reduced.

Inflation and Money Supply

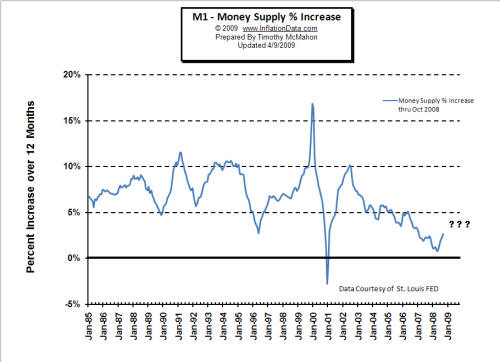

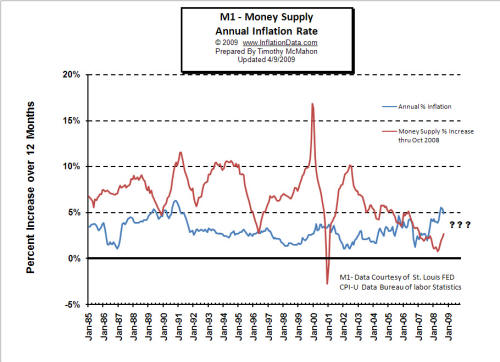

According to McMahon (para. 1), there is a direct relationship between the level of money supply and the rate of inflation. McMahon asserts that an increase in money supply (M1) results in an increment in the rate of inflation. The chart below illustrates the relationship between the rate of inflation and money supply in Australia during the period ranging from1985 to 2000.

Chart 1

Chart 2

From Chart 1, it is evident that the annual increment in money supply during the period from 1985 to 2000 ranged between 5% and 10%. In 2000, the level of money supply crashed before stabilizing. From Chart 2, the direct relationship between money supply and the rate of inflation is evident especially during the 1980s. However, during the 1990s, the relationship between money supply and inflation is not clear.

This arose from the political changes that the country undertook which affected the rate of inflation (McMahon para. 1). On the basis of the relationship between inflation and money supply, it is evident that in order for an economy to attain a stable rate of inflation, it is critical that it maintains the level of its money supply at a relatively low point.

Based on this relationship, if a particular economy adjusts its money supply, the result should be attainment of its natural unemployment rate. This means that in the long run, it is possible for the natural rate of unemployment to coexist with any inflation rate. Therefore, there is no tradeoff that exists between the rate of inflation and unemployment. However, this tradeoff is only evident during the short run (Kennedy 209).

There is also a strong relationship between the accounts in the balance of payments, average interest rate, and the government budget balance. If the balance in the current account is large, a country experiences high external indebtedness. Additionally, if the amount in the current account does not balance with that in the capital account, the average interest rate is affected.

A number of empirical studies conducted reveal that there is a direct relationship between the amount accumulated in the current account and the rate of interest that a particular government pays in order to clear its debt. Historically, it has also been proved that economies have high current account deficit experience currency depreciation from time to time.

Conclusion

The paper has given an analysis of the UAE on the basis of various aspects such as its demographics, population growth, predominant industries and political system. These factors make the UAE to be a viable investment destination. The resultant effect is that the country’s economic growth will be enhanced. Additionally, the UAE’s economy has been also analyzed on the basis of various economic indicators.

The paper also outlines the relationship between various economic variables such as real GDP and labor productivity, real GDP and unemployment, real economic growth and labor productivity, inflation and real economic growth, inflation and money supply and unemployment and money supply growth. Finally, the relationship between the accounts in the balance of payments, average interest rate, and the government budget balance is given.

Works Cited

Arnold, Roger. Macroeconomics. New York: Cengage, 2008. Print.

Bell, Stephen. The Unemployment Crisis in Australia. Which Way Out? London: Cambridge University Press, 2007. Print.

Central Intelligence Agency. The World Fact Book. Web.

Emirates. Government and Political System. 2011. Web.

IndeX Mundi. United Arab Emirates Economy Profile 2011. Web.

Li, Min. Inflation and Economic Growth: Threshold Effects and Transmission Mechanisms. Alberta: University of Alberta, 2008. Print.

McMahon, Tim. M1 Money Supply and Inflation: How Does M1 Relate to Inflation? 2009. Web.

MSN. IMF Raises GCC Growth to 7.8%. 2011. Web.

Trading Economics. United Arabs Emirates GDP per capita. 2011. Web.

UAE Interact. UAE Nominal GDP to Expand 8% in 2010. 2010. Web.

US Department of State. Background Note: United Arab Emirates. 2011. Web.