The last few centuries have seen the coffee industry grow to become one of the most lucrative economic sectors in the world. Supported by rising demand for the product in many global markets, coffee is emerging as one of the most popular drinks in the world that are enjoyed by millions of people spanning across different cultures. At a microanalytical level, each country has its unique social political, and economic dynamics that affect the industry. Such is the case in the UAE because coffee is increasingly being perceived as a popular brand, mostly in highly metropolitan areas, such as Abu Dhabi and Dubai (Al Hilal Group, 2016).

This paper explores the demand and supply of coffee in the UAE market by investigating unique forces affecting the local industry, including (but not limited to) a rising demand for the product, the pricing trend, and the role of culture and technology in the market. Thus, key sections of this research paper will explain the pricing trends of coffee in the market, how UAE residents are coping with an increased demand for the product, and the effects that external market forces will have on the industry. However, before delving into the details of this analysis, it is essential to understand the current demand and supply trend of coffee in the UAE.

What is the Current Demand, Supply Trend, and Situation of Coffee in the UAE?

According to the Al Hilal Group (2016), the UAE coffee market is set to grow by approximately 30% in the next five years buoyed by the increased dominance of the UAE as a key supply point in the Middle East coffee market and a growing appreciation for the café culture in the country. Similarly, according to the findings of the Al Hilal Group (2016), the UAE is emerging not only as a consumer market but also as a re-export hub in the Gulf region (its re-export business is defined by the export of coffee beans and refined coffee products).

Reports show that the demand for coffee in the country is set to increase amid the growing popularity of the product among many UAE residents. Relative to this assertion, the Al Hilal Group (2016) reports that 82% of the UAE population drink coffee every day. Loosely translated, this figure amounts to about 3.5 billion coffee cups consumed every day (Bhasin, 2018). Similarly, more than 4,000 tea and coffee houses operate in the UAE as a response to this growing “coffee culture.”

According to Zaki (2018), the UAE coffee market is highly organized, and companies that subscribe to this structure of organization (including the leading coffee brands – Caffe Nero, Cafe Bateel, Caribou Coffee, Costa Coffee, Dunkin Donuts, Gloria Jean’s Coffee, Krispy Kreme, and Blends and Brews, Starbucks, and Tim Hortons) control about 82% of the market (Research and Markets, 2018).

Over the years, there has been a shift from a traditional coffee market to a modern one, where customers have shown an increased preference for cafés that have good ambiance and customized services. The demand for coffee in the UAE today has also been characterized by an increased preference for certain brands of coffee such as single-origin and Arabica coffee (Research and Markets, 2018). The preferences have also stretched into how coffee is brewed because certain customers often prefer the” dry” method of preparation, as opposed to the “wet” method (Research and Markets, 2018).

The high demand for coffee in the UAE is concentrated in highly metropolitan areas, such as Dubai and Abu Dhabi. In these zones, the sale of cold beverages has surpassed all other segments of the market because of the hot and dry climatic conditions of the Middle East (Bhasin, 2018). Many coffee outlets in the region are also embracing the importance of target marketing because most of them are expanding their product outreach programs to appeal to specialized groups, such as children and health-conscious people. There has also been a rise in the demand for specialized beverages, such as “green coffee.” This demand is supported by increased awareness about coffee making in the UAE and the entry of international coffee brands into the market.

According to recent statistics, UAE coffee consumers spend more than $121 million to purchase this product (Al Hilal Group, 2016). Internationally, the UAE sits at the center of a vibrant global coffee supply chain. According to Bhasin (2018), the country accounts for 8% of the total sales of coffee globally (or $6.5 billion in total sales annually). Comparatively, it is reported that the global coffee industry is supported by a consumer expenditure of more than $85 billion (Research and Markets, 2018).

Reports that are specific to the UAE show that its total consumer spending numbers could increase by up to a third in the year 2030 (Al Hilal Group, 2016). Alternatively, independent reports support the growth in demand for coffee in the UAE because they affirm the existence of a huge space demand for coffee products from suppliers and traders in the Middle East (Al Hilal Group, 2016).

What is Usually the Price Level and Price Trend of Coffee in the UAE Market?

Today, a cup of coffee in Dubai is estimated to cost about $16 (Crompton, 2017). In the past five years, there have been marginal changes in this price because it has moved within a 10-percentile range (Al Hilal Group, 2016). However, historical records show that the price of coffee between the 1970s and the 2000s have oscillated between $50/LB and $20/LB (Crompton, 2017). Experts estimate that there are more price volatilities reported today than in the past (Crompton, 2017). For example, the 2012 price was $225/LB, and in 2014, it had dropped by more than 100% to be $100/LB. In 2016, there was another marginal increase in the price of the same community to $164/LB (Crompton, 2017).

Relative to other global capitals of the world, the cost of coffee in the UAE is deemed high because some of the world’s most expensive cities, like Singapore, charge the same price for the product (Crompton, 2017). In 2010, the price of Arabica coffee had increased by up to 125% because of poor harvests in some of the major coffee-producing nations (Al Hilal Group, 2016). In this analysis, it is important to point out that Arabica and Robusta are the main types of coffee produced and marketed in the world. The Arabica coffee is the most popular in the UAE and it is considered more heat-sensitive than the Robusta brand. Based on its fickle nature, experts project an increase in its price (Research and Markets, 2018).

The future trend of coffee prices in the UAE is set for a marginal increase because there is a proliferation in the number of wealthy expatriates in the country. This projected increase in price is also supported by the fact that the UAE does not produce coffee.

Therefore, its supply is subject to a global movement in the prices of the commodity. This statement also means that the prices of coffee are vulnerable to the seasonality of the product because, during summer periods, there is a dip in prices reported among major consumer markets, and during the cold periods, the price often increases (Research and Markets, 2018). The above statement is partly explained by a recent report, which showed that the price of coffee in the UAE is set to increase shortly because of poor harvests in some of the major coffee-producing nations (Crompton, 2017).

The projected increase in the price of coffee in the UAE is also expected to be supported by an increased wave of speculation among coffee traders around the world about the commodity’s price (Crompton, 2017). The incremental trend is also expected to be buoyed by higher demand for the product and a tighter supply of coffee beans by major players in the value chain (Research and Markets, 2018). The growing middle class in China and some emerging nations are also set to increase the price of coffee in the UAE because coffee is consumed more than other types of beverages, such as tea, in the country. This trend is supported by a report, which showed that the global demand for coffee increased by 2.4% in the past year because of an increased demand from middle-class customers in Asia (Al Hilal Group, 2016).

Broadly, the future price of coffee in the UAE is subject to movements in coffee prices around the world. Based on the analysis of several research studies that have investigated this matter in-depth, the price of coffee appears to vary dramatically across different years and seasons. For example, in one month, up to an 80% movement in price could be reported (Crompton, 2017). Additionally, the production of coffee in Brazil, which is the world’s largest producer of coffee beans, has been on the decline because of perennial dry conditions. This could potentially increase the price of coffee in the UAE further.

Experts are now trying to assess how much cost increment customers will shoulder when prices increase because of the volatilities. Although the café culture in the UAE is growing, it is still essential to understand that coffee is still considered a luxury product for most UAE residents (and around the world). In this regard, it will be interesting to find out how many price increments consumers will be willing to accommodate in the long-term.

The Rise of Café Culture and Technological Knowhow and Its Impact on the Demand and Supply Side of Coffee

Over the years, two forces have been driving the growth of the UAE coffee market – a café culture and technology. These two forces are likely to spur the next phase of growth in the market. For example, supporting the culture underpinning the consumption of coffee in the UAE has been a trend that has seen coffee outlets move from malls into neighborhoods. According to Zaki (2018), people in the UAE are not only loving coffee but the entire experience of consuming it as well.

This is why several coffee restaurants have taken a keen focus on sprucing up their restaurants to provide the right ambiance for their customers. People are flocking into these restaurants for work meetings and social purposes and most of them engage in coffee drinking as part of the experience. These trends are shoring up the demand for the product because it is not about the beverage anymore, but a pastime that most people have embraced.

As part of the culture that underpins coffee consumption in the UAE, it is important to point out that there is a strong preference for Arabica coffee, which has been traditionally associated with people’s hospitality (Bhasin, 2018). In other words, people often offer this type of coffee as a sign of their hospitality. By integrating coffee into the cultural makeup of the UAE society, there is a high probability that its demand would be sustained for a long time.

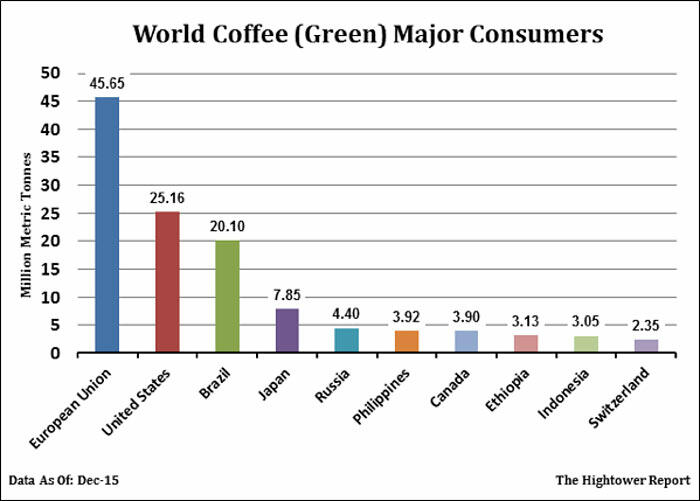

Researchers have drawn a comparison between this growing trend and western coffee consumption patterns, by saying that both of them are manifesting similar characteristics of a liking for the café culture (Zaki, 2018). This trend is partly brought about by globalization and the growing number of expatriates in the country (Zaki, 2018). According to Figure 1 below, countries that have a strong café culture account for some of the highest consumption rates in the world. This is true for Europe and America, which have a strong coffee culture and are the leading consumers of the beverage in the world.

Based on the above analysis, there is a correlation between having a strong café culture and an increase in coffee consumption. This analysis means that the growing café culture in the UAE could potentially elevate it to be one of the world’s major coffee consumers. This analysis has a strong bearing on the demand for the beverage because it means that it will increase in this regard.

The latter part of the analysis (technology advancement) draws attention to several structural changes, which have taken place in the UAE within the past couple of years. For example, some coffee establishments have tried to integrate innovation in the sale of coffee to keep up with people’s lifestyles, including setting up drive-in shops where customers do not have to get out of their car to purchase coffee (Comunicaffe International, 2018).

Technology will revolutionize the industry because it will provide employees with an opportunity to increase their sales by better targeting their customers. At the same time, technology provides them with an opportunity to mine quality data from their customers through online payment systems, apps, and virtual loyalty cards (Comunicaffe International, 2018). This trend also taps into the changing nature of the typical coffee buyer in the UAE who is increasingly tech-savvy.

From a supply-side perspective, technology advancement will increase the product’s supply because traders have a better understanding of product quality, quantity, prices, and market conditions (among other factors) that influence product supply. Therefore, efficient supply chain management means that the supply of coffee will improve in the future.

Conclusion

Based on the findings highlighted in this report, the rising demand for coffee in the UAE shows that it is not only a drink but also a part of people’s culture. The trend in the UAE is part of a wider movement in Asia and most parts of the developing world, which is defined by a growing middle class, which is shoring up the commodity’s prices. The longer this trend holds the more UAE coffee consumers would have to contend with high prices. Therefore, understanding the coffee price trends in the UAE largely depends on the ability to evaluate global patterns in the coffee industry.

References

Al Hilal Group. (2016). Growth assured for UAE coffee market. Web.

Bhasin, M. (2018). U.A.E.’s Coffee market is brewing thanks to robust consumer demand. Web.

Comunicaffe International. (2018). UAE coffee market to be led by rise of café culture and technologicaly. Web.

Cordier, J. (2016). Coffee market special: Playing a seasonal demand dip to put cash in your pocket now. Web.

Crompton, P. (2017). Why coffee costs so much in Dubai. Web.

Research and Markets. (2018). The UAE coffee chain market 2011-2021. Web.

Zaki, Y. (2018). How coffee culture has evolved in the UAE. Web.