Proposal

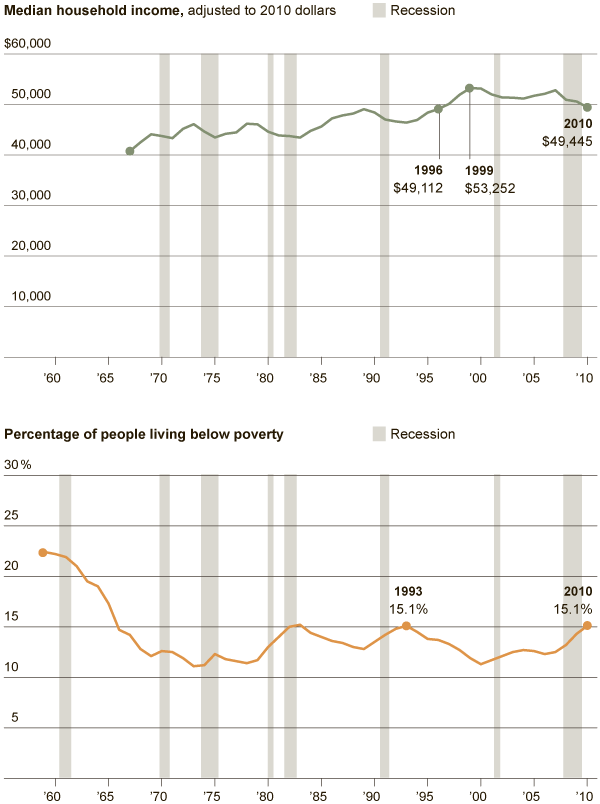

In the US, 15.1% of the total population lived under poverty, and the total number of people living under the poverty line was estimated to be 46.2 million (US Census Bureau, 2013). The poverty rate in the US is the highest since 1965. Low-income families in the US were 10.4 million in 2011, which is 31.2% of the working families in the country (US Census Bureau, 2013). The richest 20% of the population took away 48% of the total income, while the lowest 20% took only 5% of the income in the US (US Census Bureau, 2013). Therefore, a large share of 47% of the income is present in the US, which goes to the middle 60% of the population. A comparison of the US savings with that of China showed that in 2005 the Chinese saved 32% of their income while an average American saved only 2% of his income (Jin, 2012). This discrepancy provided a huge opportunity to induce potential earners to invest, as recent trends have shown that there has been a considerable fall in the spending and consumption pattern of Americans. Therefore, many Americans with low savings and low income can save a good amount of their income for retirement. As a rule of thumb, anybody above the poverty line can try to save 10% of their income. Assuming this, we propose the setting up of the micro-investment company.

Prism Microfinance Investment Service is a microfinance company that helps in planning and investment to small individual investors. The aim of the company is to provide access to finance and investment even to the poorest section of society. This service will help the low-income economic class to save as well as invest their money and expect good returns. Therefore, the business will operate in the US, catering to the urban poor. The reason for undertaking this business plan is to help the increasing number of urban poor in the US to invest, for they usually do not get an opportunity to invest with the bigger banks or financial service providers. The main aim of the company would be to help low-income Americans to save as much they can on lucratively high return investment plans and provide financial products that would help them save in the short term, and invest in small amounts as the economy hit with a recession the consumption in the US economy reduced considerably, increasing the disposable income with the average American, and hence greater room for savings. The aim of the company would be to induce the lower income group people to invest in more lucrative investment opportunities, which they are unable to avail for high return investment plans usually tend to charge higher entry load.

The company will be an online microfinance company, providing loans to low-income group people as well as help them invest their small savings in fetching the maximum possible return. The loans will be forwarded to those small entrepreneurs hailing from low-income families who do not have the opportunity to lend capital from big investors. Further, the company will also help provide small investors with information and expertise as to how they can save their money with little risk and an adequate return.

The business plan will provide an overview of the microfinance market both from the perspective of the lender and the investment and savings service and provide an essential overview of the market of such an industry in a developed country like the US. Apart from this, the business plan provides a marketing and financial plan to show the viability of such a business in the US.

Executive Summary

This paper is a business plan to start-up a microfinance company in the US. The paper presents all the requirements for setting a financial service business in the US and also presents the need to set up such a business. As American poverty, especially in the urban areas, has been increasing, and more and more people are found to live without any banking facility, there emerges a need to cater to the financial need of the poor. The inequality of income distribution and the availability of proper banking facilities to these households are scant even in a developed country like the US. This discrepancy provides a great opportunity to induce potential earners to invest, as recent trends have shown that there has been a considerable fall in the spending and consumption pattern of Americans. Therefore, many Americans with low savings and low income can save a good amount of their income for retirement. As a rule of thumb, anybody above the poverty line can try to save 10% of their income. Assuming this, we propose the setting up of the micro-investment company. Our company addresses this need.

Our microfinance company is a for-profit social organization that looks both at the business as well as the social welfare point of view of the business. Many microfinance companies operate as a profit-making venture; they have become successful ventures. Our company aims to be a part of those esteemed organizations.

The paper presents the business plant of the marketing plan, operational and organizational plan, the financial plan, and the sales and revenue forecast for the organization. The introduction presents the rationale of making such an organization, and then an overview of the organization is given in an organizational overview. The market analysis presents secondary research on the microfinance market in the US and the prospects, risks, and opportunities that the market holds for our company. Then the paper presents the financial performance of the company as expected for the first 12 months and then for five years. It also presents a break-even analysis of the company. In the end, the paper presents the exit strategy.

Introduction

In the US, 15.1% of the total population lived under poverty, and the total number of people living under the poverty line was estimated to be 46.2 million (US Census Bureau, 2013). The poverty rate in the US is the highest since 1965. Low-income families in the US were 10.4 million in 2011, which is 31.2% of the working families in the country (US Census Bureau, 2013). The richest 20% of the population took away 48% of the total income, while the lowest 20% took only 5% of the income in the US (US Census Bureau, 2013). Therefore, a large share of 47% of the income is present in the US, which goes to the middle 60% of the population. This discrepancy provided a huge opportunity to induce potential earners to invest, as recent trends have shown that there has been a considerable fall in the spending and consumption pattern of Americans. Therefore, many Americans with low savings and low income can save a good amount of their income for retirement. As a rule of thumb, anybody above the poverty line can try to save 10% of their income. Assuming this, we propose the setting up of a microfinance company targeting the urban poor in the US.

Company Description

Prism Microfinance Investment Service is a microfinance company that helps in planning and investment to small individual investors. The aim of the company is to provide access to finance and investment even to the poorest section of society. This service will help the low-income economic class to save as well as invest their money and expect good returns. Therefore, the business will operate in the US, catering to the urban poor. The main aim of the company would be to help low-income Americans to save as much they can on lucratively high return investment plans and provide financial products that would help them save in the short term, and invest in small amounts. As the economy hit with a recession, the consumption in the US economy reduced considerably, increasing the disposable income with the average American, and hence greater room for savings. The aim of the company would be to help people from the lower-income groups to invest in more lucrative investment opportunities, which are unavailable to them.

Mission Statement

The mission of the company is to avail of finance to small start-up entrepreneurs from low-income families and help low-income families to invest in the right place to fetch the highest possible in the urban areas of the United States of America.

Company goals and objectives

The goal of the company to reach out to the underprivileged section of urban America and help them to invest their hard-earned money at the right place as well as help them to start-up their businesses.

The objective of the company would be to attain the maximum number of customers invest with us, through our daily investment scheme of a very small amount. Further, we would like to have more than a thousand people investing with us in the first year and invest in more than hundreds of small-start-ups.

Business philosophy

The most important aspect of the business is our philosophy to help those who are unable to avail of any other form of financial services. Low-income constrains their living standards greatly, and they find it very difficult to save or invest. We intend to provide extensive service to the low-income urban population to help them invest a small amount of their income and turn it into lucrative savings. The company is an online microfinance company providing loans to low-income group people as well as help them invest their small savings in fetching the maximum possible return. The loans will be forwarded to those small entrepreneurs hailing from low-income families who do not have the opportunity to lend capital from big investors. Further, the company will also help provide small investors with information and expertise as to how they can save their money with little risk and an adequate return.

To us, the most important aspect of our business is to reach out to the underprivileged and help them to start up their own business. Further, doing our work with integrity is the utmost priority of our business so that our clients always receive the best possible service.

Our target market would be the urban poor in America. In the US, 15.1% of the total population lived under poverty, and the total number of people living under the poverty line was estimated to be 46.2 million (US Census Bureau, 2013). The poverty rate in the US is the highest since 1965. Low-income families in the US were 10.4 million in 2011, which is 31.2% of the working families in the country (US Census Bureau, 2013). The richest 20% of the population took away 48% of the total income, while the lowest 20% took only 5% of the income in the US (US Census Bureau, 2013). Therefore, a large share of 47% of the income is present in the US, which goes to the middle 60% of the population. Our target is that the bottom 60 percent of the population who are, many a time, unable to avail of the loan or investment schemes offered by the big financial houses.

The microfinance industry is nascent in the US, though it has been very successful in developing countries like India or Bangladesh. It is highly competitive; however, in the US, the potential for this service is huge. Historically, the US has experienced small non-bank lenders since the early seventies. In 2011 there were 962 community development financial institutes operated in the US. However, a very small number of these institutes offered micro-loans to small entrepreneurs (Responsibility, 2013). The global microfinance industry posted a growth of 20% in 2012, and it is expected that the industry will continue to grow (Responsibility, 2013). The expected growth rate of the industry is very high. The demand for the products is also high, as in the US. There are a large number of the population who are unbanked and do not have access to proper credit or savings facilities. 26% of the poorest 20% of America and 15% of the total population are unbanked, i.e., they do not have proper banking facilities and have to rely on cash transactions of more expensive means of a credit (The Economist, 2013).

Further, we believe that the industry will grow phenomenally with its online presence and would boost the profits of the company further. In the long run, the industry is expected to gain further through mergers and acquisitions and become as strong as the banking industry. The company will operate with the greatest efficiency, and when the right opportunity arrives would take the plunge to transform its business process to suit the growing needs of microfinance.

The important strength of the company is its target market and the yet unexploited market, for there are still more than 2 million Americans who belong to the low-income groups in the urban areas who are unbanked and have to rely on expensive options like payday loans. The core competency of the company would be its model to help the poorest of the poor to save, help the aging population of America to save and manage their money to live a hassle-free retired life, and start-up entrepreneurs who have no capital to start with. Helping these three groups of underprivileged clients, the company will gain its growth.

Success Factors

The factors that would define the success of our company are –

- There is an increasing requirement of a microfinance company in the US, where a large group of people lives around the poverty line.

- The unavailability of the banking or other financial services to a large number of urban populations points to the need for a financial institution that caters to the gap.

- The need to save individuals but the inability to save monthly is a problem that most of the low-income people face. As our financial service would provide savings facilities for individuals daily, it would become easier for anybody to save the smallest amount that they can afford.

- Giving high returns at the least possible risk.

- Loans to small start-ups that are unable to fetch capital from conventional means.

Strength of the Company

The main competitive strength of our company would be accessibility. Loans would be processed even for very small amounts like $10, and payment mode would be flexible. The interest rates would be best in the market. Further for those who would like to save or invest with us, would get assured interest on their savings.

The experience that we would require is to understand the market need and financial lending and investment market. The company will be started as a sole proprietorship. We choose this form of business as it would be easier to mold the requirements and make the product offerings of the company to suit the needs of the target customers.

Products and Services

The products that we intend to begin with are ticket loans, deposits or savings, and investments.

Loans to Small Start-up entrepreneurs

The main offering will be to start-up businesses. Entrepreneurs from low-income families do not have access to bank loans to start up their business. Our company will provide loans in small amounts to such start-ups. The loans would range from $1000 to $10,000 for start-ups. The interest charged on them would be best in the industry. The loan cycle would be shorter from 1 to 2 years duration.

The loans given in this category are to businesses and are

- Start-up loan

- Working capital loan

- Business Expansion loans

Loans to Individuals

There are many people in the low-income group who cannot access proper medical facilities or education due to the unavailability of medical insurance or educational loans. Our company will help those who need loans for medical, insurance, or other such necessary these loans will be provided from an amount of $500 to $5000. The medical loans would have a shorter duration from 1 to 2 years, while the education loans will have a slightly higher duration from 3 to 4 years.

In this category the loans that are given are

- Emergency loans

- Medical loans

- Educational loans

- Home improvement

- Consumer loans

- Fixed asset loans

Savings Options

Our microfinance company will provide consumers will opt to save their money on a daily, weekly, bi-weekly, or monthly basis with the assurance of competitive risk-free returns. Many people, as they do not have a banking facility, they do not have the option to save their money. Keeping their money with us will not only keep it safe but also fetch interest on their savings. The longer the period they keep their money, the higher would be returning that they fetch. The moderately high interest that we give on a small amount of savings would help us to retain customers.

Competitive Advantage

The factors that would provide a competitive advantage to our business is the accessibility of the low-income households to a credit and savings facility without going through the hassle of too much paperwork and regulations. Most of the unbanked people do not have access to loans or savings options as they are thought non-creditworthy. The hassle to go through the paper works makes it almost impossible for many to get access to the financial schemes offered by banks or other financial institutions. The competitive advantage that we would have over and above others is our accessibility and fast delivery of service.

Market Analysis

Microfinance Industry

Target Market

The microfinance industry in the US had started with the community development finance institutions (CDFIs) in the 1970s (CGAP, 2011). However, the concept of “microfinance emerged in the US only in 2010 (see figure 1). The demand for the products of microfinance services in the US is high due to its increasing rate of poverty. In 2010, people living under the poverty line in the US increased to 46.2 million (New York Times, 2011). Further, due to the recessionary pressure, the median income of households has shown a 7% decline to $49,445 in 2010 (New York Times, 2011).

Data suggests that 8.2% of American households are unbanked, and the number of adults who have no banking facility closes to 10 million, which has increased from the 2009 survey (FDIC, 2012). The research also shows that 20.1% of the households are under-banked, and 29.3% of households do not have a savings account, and 10% have no checking account (FDIC, 2012). Therefore, there is a large market, which is expected to increase due to the deteriorating recessionary pressure. Therefore, the company has access to a large number of people who need microfinance to help them come out of the credit crunch that they face.

Another important statistic, which boosts the need for a microfinance organization, is the high number of businesses (88%), which can be categorized as micro-businesses (CGAP, 2011). The reason for such a large number of people remaining unbanked is due to the lack of the minimum fund required to open a bank account or lack of documentation or poor credit history. This makes the families turn to the AFS providers whose transactions in the US are $320 billion annually (CGAP, 2011). However, as microfinance institutes, these problems can be solved very easily. This shows the need for a microfinance service in the US to cater to this segment of society. Therefore, the total size of the market that we are aiming at is 10 million households in the US.

Presently there are other players in the market. However, microfinance companies have different objectives and product offerings. We intend to capture at least 10% of the market in the first two years of our operation.

Growth Potential

The global microfinance industry is growing at a rate of 3% (Lahaye et al., 2012).

The alternate non-banking finances, like pre-paid cards and the present financial institutes in the microfinance sector, have grown by 19% (FDIC, 2013). The market is expected to grow further, as the recessionary pressure will exert more pressure on the living standard of the low-income households in America would need credit. Recent research shows that microfinance institutes have increased by 45% since 2010 (Brom, 2012).

Threats to the Business

The threats imminent on the business are government regulation, which may cause interference in the sector with subsidized loans, which may reduce demand for our products. Lack of government control over the sector can be a deteriorating factor in our organization, as this may lead to biased judgment towards the sector. Another possible threat that the company may face is over-indebtedness and high portfolio risk (Brom, 2012). As there is, a high risk of competition from different sectors leads may include the organization in the microfinance sector apprehensive of their performance. However, we are confident we will be able to handle the rising competitive pressure from the banks and other microfinance institutions.

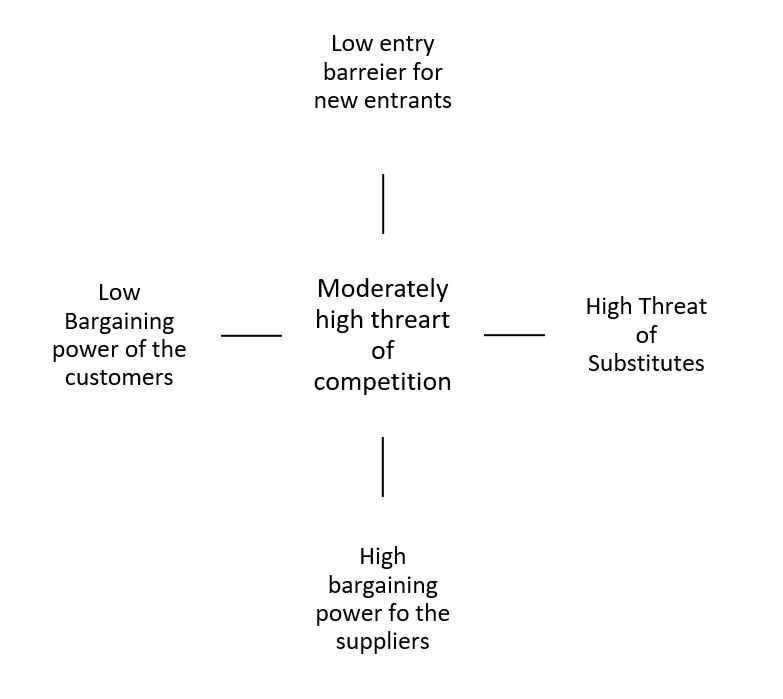

An analysis of the industry using Porter’s five forces model shows that the entry barriers for the industry are low. As there is no government regulation regarding the control of the entry of new entrants in the industry, a high growth prospect always allures new companies to enter the market and make it more competitive.

The threat of the existing companies is also high as these companies have already created a base in the market, and enjoy a greater market presence and share. They would use their first mover’s advantage to hamper the business of a new company in the sector.

The bargaining power of the customers is low, which is a good sign as they cannot dictate the price at which the products are to be sold in the market. As in the case of microfinance companies, they cannot dictate the rates at which they are willing to take the loan or the return of interest they expect from their invested money.

The concern regarding the cost of funding is deep because, for a financial institute to give out loans, one requires large capital. The people who supply the capital tot eh business are the suppliers. As there are few suppliers in the market, they have great power over the sector and can dictate their terms. Though this problem was not apparent, this may become a threat later, as has been observed in other countries:

In Nicaragua, several MFIs plan to form a consortium that can be listed on the stock market as a strategy to reduce dependence on foreign funding. In Ecuador, MFIs are planning to source local funds through bond issues or securitization. Several respondents mentioned that MFIs that can mobilize savings would have an advantage over those which cannot. (Brom, 2012, p.7)

Recessionary pressure and the economic shocks may become a threat to the company if the proper mechanism to face them is not put to place.

Customers

The target customers are those individuals with annual income less than $35000, which comprises 35% of the population, and the household income less than $450000, which comprises 40% of the American households (American Community Survey, 2012). 17% of the total population has no health coverage; therefore, they may require loans for medical expenses (American Community Survey, 2012).

The age of the targeted clients is based on the products and their insurance status. For instance, the medical loan is targeted specifically to elderly individuals who do not have medical insurance and have to rely on high-interest loans to cover their bills. Therefore, the age of this target client is above 55 years.

The education loans are targeted to the younger generations who have good grades and education records but no money to enter college or any other educational facility. Therefore, the target age for this product is 18 to 25 years.

Further, for the new start-up business, we will specifically help low-income families. Their age has to be above 18 and below 35 years.

Therefore, for most of the products, the age group targeted is above 18 and below 35 years, except for one product where the target group is over 55 years.

As we aim to cater to the urban poor, the location of our clients would be the urban poor population beginning with New York and Chicago. We will not cater to the rural areas.

There are no specific educational barriers to get our loans, except for those who want to start-up a business, and those seeking educational loans will have to show a good academic record and a High School certificate.

The initial size of the firm will be small, with only 50 employees operating in the office. However, we will employ hundreds of agents who would reach out to our clients. The agent’s payment would be commission based.

Competition

Microfinance companies face a high degree of competition from other microfinance companies and other financial institutions like banks, mutual funds, insurance agencies, etc. competition is both from the substitutes of the products that we offer as well as from similar competing organizations. The leader in the microfinance in the US is Accion. However, one advantage that we have over Accion is that it concentrates solely on lending money; however, our product offerings deal with savings, educational loans, and other social activities. The competitor analysis is done in the following table.

Table 1: Competitor Analysis

The differences between our organization and the three major organizations operating in the microfinance industry are presented in table 1. The table shows that competitors operate mostly internationally. US Accion operates in certain parts of the US, like Miami in Florida, Atlanta, Boston, and New York. All these are mostly urban areas and where target the same group of people as we intend to do. Opportunity Fund operates internationally. The revenue earned is highest by Opportunity Fund that amounts to $7,567, 573 (Opportunity Fund, 2012), and for US Accion, it was $6,194,039 (US Accion, 2012).

Sales and Revenue

A twelve-month sales forecast has been presented in table 7 (Appendix), which shows that the sales are expected to increase constantly over the 12 months for the company. The sales forecast shows a definitive increase in the revenues earned by the company as there will be the inclusion of greater clientele in the loans and savings divisions of the company. Our expectations for the first year are realistic, and we have aimed at not more than 2000 clients in the whole year. These clients will have requirements at various rates, and therefore, an average expected estimation is provided in the table.

Organization

The Services

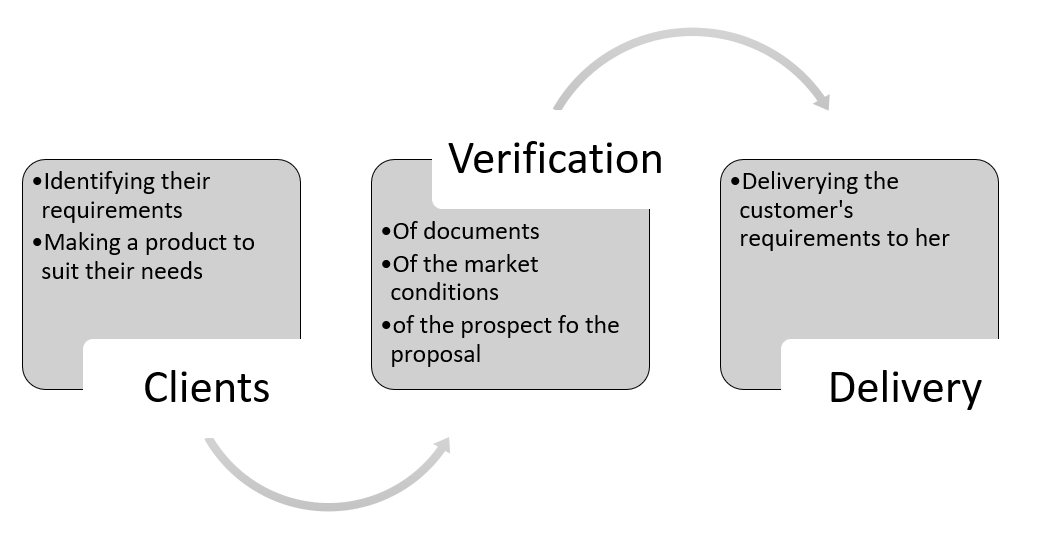

The main function of the teams would be to produce tailor-made services for our clients. Not two people have the same requirement. Their financial conditions and their requirements may vary so much that a completely new product would be produced at the time of delivering it. We understand that difference in the needs of our clients and would endeavor to satisfy their specific requirements.

Location

The location of the company would be in urban areas of the US. Therefore, we will be headquartered in New York City. This will be beneficial in two ways – 1) we will be close to our potential investors, and 2) we will be close to our potential clients. Initially, we intend to start our operations in two cities New York and Chicago. Therefore, we will require a decent size office in New York to accommodate 30-40 employees and a smaller city office in Chicago with a capacity to accommodate just ten employees. Apart from this, we will hire hundred of agents in both the cities to reach out to the clients, and they will be paid on commission. The initial cost to set up all these would be around $30,000-$50,000.

Another important task would be identifying the investors who would be willing to participate with us in our social, financial endeavor. We will have to get a license from the Federal Reserve and the Small business association to start our business.

Financials

The financial statement (see Appendix, Table 2) shows the balance sheet of our company. In the first year, the balance sheet is expected to look this way. The balance sheet is strong in the first year.

Figure 5: Investments

There are three investors whom we have identified interested in investing in our project. They will help us to set up as well as finance our loaning division. Further, the company has already started paying back the investors every month and will complete the payments by 2015.

Figure 6: Property

The property has been purchased on the company accounts. Therefore, the main expense that the company had incurred was the amount of money spent on the purchase of the real estate to set up the office. However, our investors financed 70% of the cost.

The main component in the balance sheet of a financial service organization is the cash equivalents. This is so because they have to deal in cash, and therefore having a large amount of cash in hand is essential. In this respect, our company has a strong cash flow, from our funding as well as funding from our investors. The assets of the company are strong enough to start a new business where we can immediately start giving small loans to the clients as well as rely on our investors to give larger loan amounts.

Start-up Expenses and Capitalization

The start-up cost of our company is presented in table 3 of the Appendix. The start-up cost demonstrates that there would be three sources of investments for the company, which would amount to 90 thousand dollars. Loans would be taken from two banks, amounting to $1000 thousand. The initial capital that we have in the gathered is to start-up the business as well as has enough capital to start lending. Further, our target would be gathering as many savings accounts possible from our target customers to roll our business.

In our business, cash is the most important product that we offer to our clients. Therefore, the cash flow needs to be uninterrupted all the time. Keeping this in mind, we have taken loans from two banks, and three investors want to participate in our business with investments amounting to $90 thousand. Therefore, with the cash that we have and the additional cash that is pumped into the business through bank loans and investor’s cash, we have a healthy cash flow for the start-up of the business.

Financial Plan

The financial plan of the business is presented through the 12-month profit and loss projection and the break-even analysis. These demonstrate that the company is expected to operate in a very lucrative manner over the first 12 months period. The company is expected to break even when it has done business with 3400 clients, and the company is expected to attain a positive balance sheet in the first years of its operations. The details of the financials are presented in Appendix tables 4 and 5.

The five-year profit projection shows that our business is expected to grow at an average rate of 19%, where the growth of the company is expected to rise every year (see table 6 in Appendix).

Exit Plan

As this is a financial service company, the exit strategy has to be very strong. The exit strategy of the company would either merge with another company or sell the company to another potential buyer. Development of partnerships with other companies or creating local linkages may also help the company to rejuvenate. In case the company is incurring continuous losses, we will have to announce solvency and take at least a year to close our accounts.

Further, the company will have a constant surveillance system to gauge the performance of the company, which would indicate any prior indication of the need to exit the business. A proper system to monitor growth and threats to the business would help the company to make the right decision in case exit becomes necessary. To exit the market, we propose that we would either sell our business to the competitors or any other institutions that are posing a threat to our business to have the employees and our clients a base where they can fall back.

References

AMERICAN COMMUNITY SURVEY (2012) 2011 American Community Survey 1-Year Estimates. Web.

BROM, K. (2012) Market Outlook 2012: Perspective of Microfinance Association Leaders. Web.

CGAP (2011) Unbanked in America. Web.

FDIC (2012) 2011 FDIC National Survey of Unbanked and Underbanked Households. Web.

FDIC (2013) FDIC – Statistics on Depository Institutions Report. Web.

JIN, K. (2012) Why Are Savings Patterns So Different? Web.

LAHAYE, E., RIZVANOLLI, R. & DASHI, E. (2012) Current Trends in Cross-Border Funding for Microfi nance. Web.

NEW YORK TIMES (2011) Income and Poverty Rate at 1990s Levels. Web.

OPPORTUNITY FUND (2012) Annual Report 2012. Web.

RESPONSIBILITY (2013) Microfinance Market Outlook 2013. Web.

THE ECONOMIST (2013) Margin calls. Web.

US ACCION (2012) Annual Report 2012. Web.

US CENSUS BUREAU (2013) Poverty. Web.

Appendix

Table 2: Expected financial Statement for Year 1

Table 3: Start-up cost

Table 4: Break Even Analysis

Table 5: 12 month Profit and Loss Projection

Table 6: Five Year Profit Projection

Table 7: 12 month sales forecast