Introduction

The American newspaper industry has been an integral part of the country’s media landscape for centuries, providing the public with vital information and news. Today, the United States of America is a leader in the information field. The American media landscape is highly diverse.

The American newspaper, both print and electronic, is, first and foremost, a business and is of a strictly commercial nature. However, with the rise of digital media and changing consumer habits, the industry has faced significant challenges in recent years. Thus, it is essential to analyze the supply and demand factors affecting the newspaper industry, study the industry’s market structure, and draw conclusions about the industry’s current state and prospects.

Demand and Supply Analysis

The American newspaper industry has faced considerable difficulties in recent years due to changing consumer habits and the rise of digital media. As a result, demand for newspapers has been declining, and publishers have had to adjust their supply to stay afloat. On the demand side, the aging of the population has resulted in a decline in the number of traditional newspaper readers (Angelucci & Cagé, 2019).

Younger generations are increasingly turning to digital media for their news, and many readers have become accustomed to accessing news online for free. This has contributed to a decline in the number of subscriptions and single-copy sales, which are critical sources of revenue for newspapers. In addition to demographic changes, the COVID-19 pandemic has significantly impacted demand for newspapers (Angelucci & Cagé, 2019). With lockdowns and social distancing measures in place, many people have turned to digital media to stay informed, which has further declined print sales.

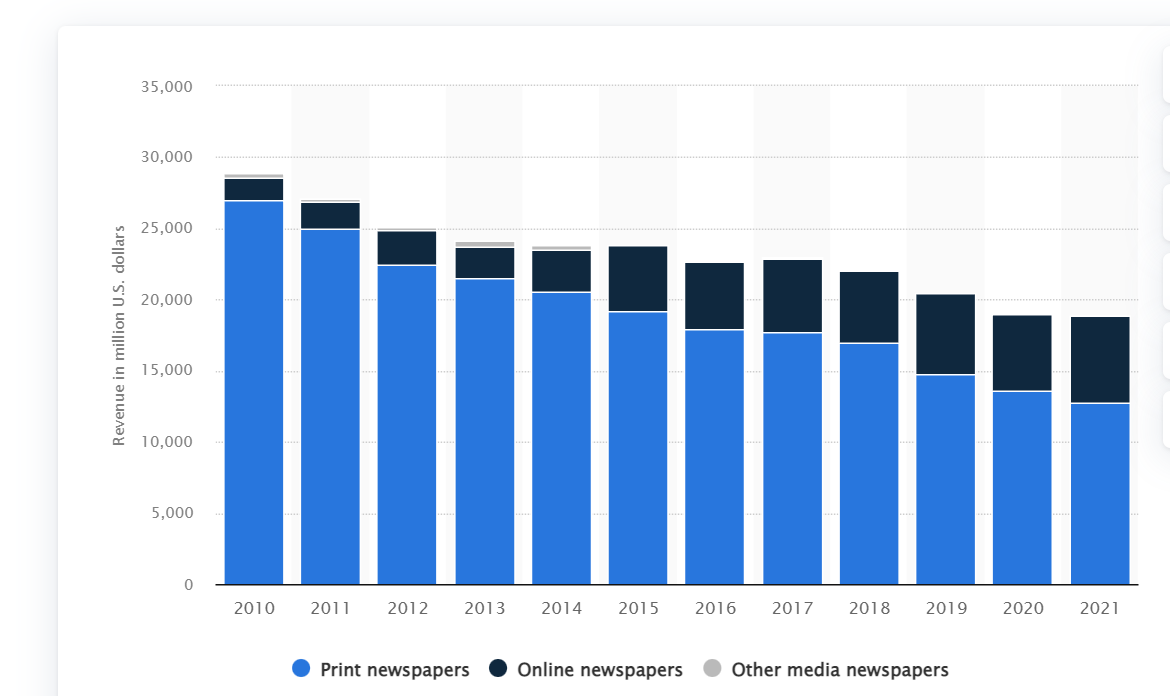

Figure 1 shows a decline in revenue, dropping from over $25 million in 2010 to around $15 million in 2018 (Statista, n.d. a). This decline has been driven by reduced advertising revenue as advertisers focus on digital media (Statista, n.d. a). As a result, newspaper publishers have had to find new revenue streams, such as subscriptions and digital advertising.

On the supply side, publishers have had to adjust their strategies to cope with declining demand. One response has been a wave of consolidation in the industry, as major publishers have acquired smaller papers to reduce costs and gain market share. This consolidation has led to a high degree of concentration in the industry, with a few large companies dominating the market. Publishers have expanded their income sources through digital subscriptions, advertising, and additional services (Angelucci & Cagé, 2019). While this strategy has helped them attract a broader audience and create new revenue streams, it has not fully compensated for the drop in print sales.

To cope with declining demand, publishers have also had to cut costs, reduce staff, and decrease the frequency of publication. Many newspapers have moved from daily to weekly publication, and some have even ceased print publication altogether. As a result, the quality and quantity of news coverage have decreased, diminishing the perceived value of print newspapers among readers (Angelucci & Cagé, 2019). The decline in demand for newspapers has had significant consequences for the industry. Many newspapers have struggled to remain profitable, and some have gone out of business.

Elasticity

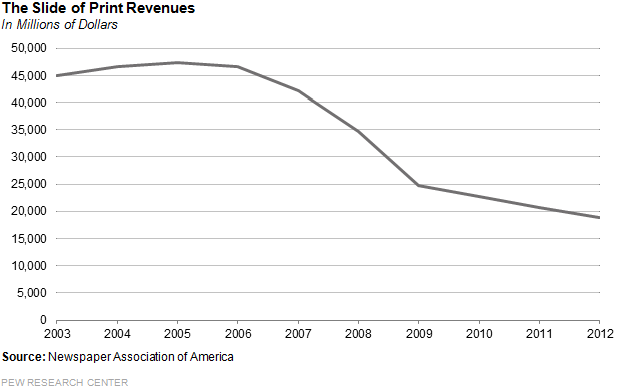

Figure 2 demonstrates the elasticity of the US newspaper industry. Accordingly, the decline in demand for printed newspapers has led to a gradual decline in profits and, consequently, in the price of newspapers. Thus, from 2007 to 2012, newspaper prices fell rapidly, indicating their elasticity (Pew Research Center, n.d. b). In general, elasticity refers to the responsiveness of demand or supply to changes in price (Pattabhiramaiah, Sriram, and Sridhar, 2018).

In the case of the American newspaper industry, the elasticity of demand has been a significant factor contributing to the decline in print sales. The demand for newspapers is relatively elastic, meaning that consumers are sensitive to changes in price. As a result, when publishers raise the price of newspapers, demand tends to decline. This is particularly true in the case of print newspapers, where consumers have a range of substitutes available, including online news sources and social media.

Demographic changes and the rise of digital media have further amplified the elasticity of demand for newspapers. Younger generations are less likely to purchase print newspapers, and many consumers have become accustomed to accessing news for free on the Internet. As a result, publishers have had to lower prices or offer discounts to entice consumers to purchase print newspapers (Pattabhiramaiah, Sriram, and Sridhar, 2018). The elasticity of demand for newspapers has also had implications for advertising revenue. As print sales have declined, so too has the value of print advertising, which has historically been a critical source of revenue for newspapers. As a result, the quality and volume of news coverage have decreased, since publishers have been forced to cut costs and lay off staff.

In response to these challenges, publishers have had to focus on increasing the elasticity of supply by reducing costs and increasing efficiency. This has triggered a wave of industry consolidation, with larger publishers buying smaller newspapers to expand their market share and cut expenses (Pattabhiramaiah, Sriram, and Sridhar, 2018). Publishers have also diversified their revenue streams by offering digital subscriptions and other services, allowing them to reach a wider audience and generate new sources of revenue (Pattabhiramaiah, Sriram, and Sridhar, 2018).

However, the elasticity of demand for newspapers remains a significant challenge for the industry. As digital media continues to grow in popularity and younger generations become a larger share of the market, demand for print newspapers will likely continue to decline. This will pressure publishers to adapt their business models and find new ways to reach audiences.

Market Structure

The American newspaper industry is characterized by a highly competitive market structure, with numerous players vying for market share. However, the market structure has changed significantly over the years due to various factors, including technological advances, changing consumer preferences, and industry consolidation (Martin & McCrain, 2019). Traditionally, the newspaper industry was dominated by local and regional newspapers, with a few national papers catering to a broader audience.

However, with the rise of digital media, the market structure has become more fragmented, with numerous online news sources competing for readership. Consequently, traditional newspaper publishers have been compelled to modify their business models to stay competitive. One of the key trends in the newspaper industry’s market structure has been consolidation (Statista, n.d. b).

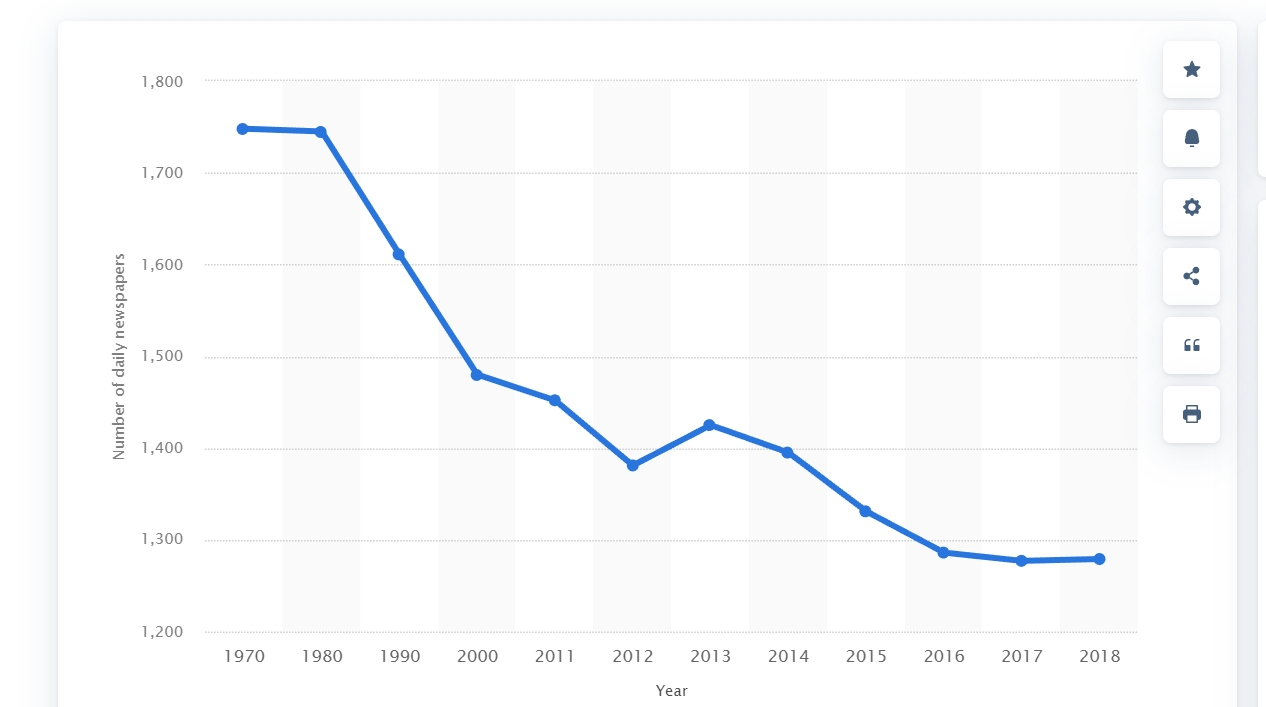

Over the past few decades, larger publishers have acquired smaller newspapers to gain market share and reduce costs. This has led to the emergence of a few dominant players, such as Gannett, which owns over 250 newspapers nationwide. The graph below shows the trend of newspaper consolidation in the United States between 1970 and 2018 (Statista, n.d. b).

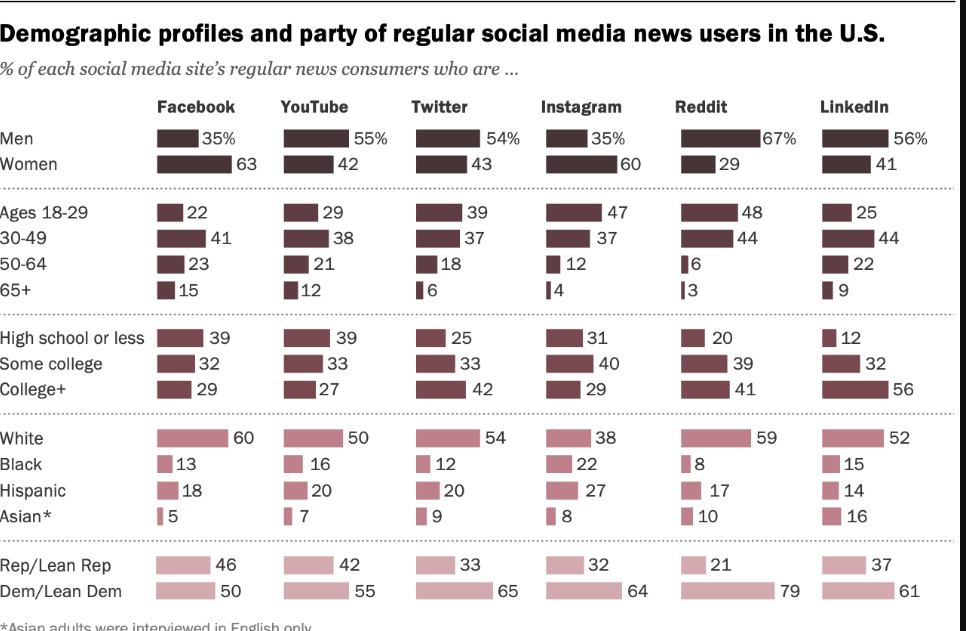

The graph shows a clear trend of consolidation in the industry, with daily newspapers declining from over 1700 in 1970 to around 1300 in 2016. This consolidation has implications for industry competition, as larger publishers have gained greater market power and the ability to set prices (Statista, n.d. b). Another trend in the market structure of the newspaper industry has been the rise of digital media. The graph below shows the percentage of U.S. population who reads news online by age group.

The graph shows a clear trend of younger generations relying heavily on online sources for news, with over 80% of adults aged 18-29 getting news online (Pew Research Center, n.d. a). This trend has led to a shift in the industry’s market structure, with digital publishers such as Twitter and Facebook gaining market share and disrupting traditional players.

Conclusion

In conclusion, the market structure of the American newspaper industry has changed significantly in recent years, with consolidation and the rise of digital media having a significant impact (Martin & McCrain, 2019). While traditional players have had to adapt their business models to remain competitive, new players have emerged, challenging the dominance of larger publishers. The industry will likely continue evolving in response to changing market conditions as publishers seek new ways to reach audiences and generate revenue in an increasingly digital media landscape.

Consequently, the American newspaper industry has experienced substantial transformation in recent years, as consolidation and the growth of digital media have reshaped its market structure. Historically, the industry was led by local and regional newspapers, with only a handful of national publications serving a broader readership. However, publishers still have opportunities to adapt and thrive by diversifying revenue streams and offering innovative digital services. The industry’s high degree of concentration presents both challenges and opportunities for publishers. Still, ultimately, the industry’s success will depend on its ability to adapt to changing market conditions.

Reference List

Angelucci, C. and Cagé, J. (2019) ‘Newspapers in times of low advertising revenues’, American Economic Journal: Microeconomics, 11(3), pp. 319-64.

Martin, G. J. and McCrain, J. (2019) ‘Local news and national politics’, American Political Science Review, 113(2), pp. 372-384. Web.

Pattabhiramaiah, A., Sriram, S. and Sridhar, S. (2018) ‘Rising prices under declining preferences: the case of the US print newspaper industry’, Marketing Science, 37(1), pp. 97-122. Web.

Pew Research Center. (no date a) News use across social media platforms in 2020. Web.

Pew Research Center. (no date b) The newspaper industry overall. Web.

Statista. (no date a) Newspaper publishing revenue in the United States from 2010 to 2021, by media type. Web.

Statista. (no date b) Number of daily newspapers in the United States from 1970 to 2018. Web.