Introduction

When valuing a business or accompany a number of assumptions among them include (i)

A buyer would not pay more for an asset than it would cost to acquire or create some other asset that would provide equal or greater economic utility to the owner. (ii) A buyer would not pay more for an asset than the present value of the future benefits the asset is expected to deliver to the owner after adjusting the time value of money and the risk of realizing those future benefits when expected.

When preparing valuation reports the following assumption s and limiting is taken into account.

- Information, estimates, statement of facts that are contained in the report are from reliable sources and the appraiser has not independently verified the sources.

- The information from the company is assumed accurate in all aspect.

- The evaluation report cannot be used for any other purpose intended for. The evaluation report once taken into a number of factors the approaches to estimating the value of a firm is stated. In this case, l has undertaken different approaches to estimating the value of a unit share of Tesco.

When valuing this company l will use a number of valuation methods. Among the methods that are commonly used include those involving fair market value investment value and book values. Fair market value can be defined as that value which a buyer will be willing to buy a property from a willing seller when both are not under any compulsory conditions and bought have reasonable knowledge about the company property under sale.

Investment value is that value of a company at attributable to a particular seller for investment decisions. This is normally used during mergers and acquisitions where an individual requester requests for valuation.

Book value is that valuation, which is recorded in the books, that is the value of the balance sheet is taken as the value of the company.

When carrying out valuation of Tesco Company limited. I will use the following fundamental in estimating the value.

- Income approach.

- Market approach.

- Asset approach.

Market Value

Market value approach is used in many ways. It uses the market value of assets of the company. It considers valuation best on discounted future earnings. Cash flow, dividends, and other streams of benefits. A company that is going concerned uses this. The approach has two methods discounted economic income method the value of the business in this method is divined as the present value of financial benefits. Ownership and perpetuate. This method uses the future benefits or cash flows.

Capital markets methods this method considers a multiple earnings, cash flows, book value, dividends, and revenue to come up with the market price of the company.

Using market capitalization

Value = CF/r

This equivalent to share price X no. of shares

Number of shares = 35,519,739

Price of a share at 31st December, 2007 = 28.67

The value of the company is = 28.67 X 35,519,739 = 1,018,350,917

Using the market valuation the share price the company is valued at 1,018,350,917.

Book Value

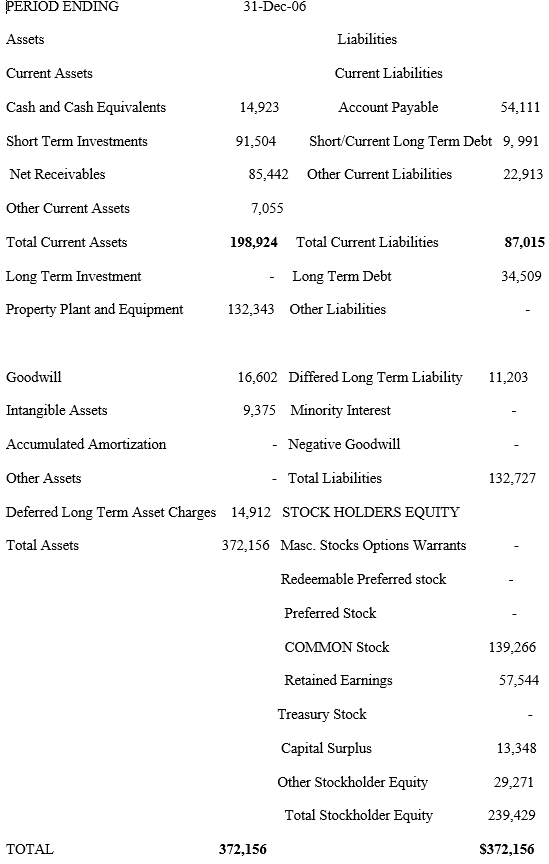

The book value uses the asset approach or net worthy of the company, is the value of shareholders equity as stated in the balance sheet. Looking at the Tesco Company in the table below. The value of the company using the book value will be equal is 210,158,000. This is after other stockholder Equity and the value is for year 2006.

Balance sheet

The approach serves as a number of approaches because the figure in the book of account depends on the methods or policies adopted while preparing financial statement. This means the figures does not match with the market value. In that, regard the more book value modern method called adjusted book value method ids adopted. This is where appraiser tries to overcome the shortcomings through the adjusting figures. This will be possible if we had different figures for stock fixed assets. For example if account receivable was 92,500,000 inventory 82,000,000 long term 10,000,000 and others remain the same then the book value for the company is approximately 218,000,000

This approach is among the best approaches to be used since it considers the true value of the asset.

Price Earnings Ratio Multiple

The price-earnings ratio (P/E) is the market price of a company’s share of common stock in the stock exchange divided by its earnings per share. The resultant Multiply is multiplied by the net income and the value for the business is attained. However if the company’s common stock is not traded in the stock exchange, then companies from the same industry earnings are used which is subjective. This valuation approach uses earnings per share of the company in the calculation of the value of the company as follows;

The value of the company is calculated as = Price Earnings Ratio X Earnings

We use earnings that net profit after tax and interest. The company EPS IS

= Total Earning = 20.30 (available from 2006 financial statements)

Number of shares

We should look at it price. The price in use is the price of 31 December 2007, which was 28.67.

Therefore the price earnings ratio is = price per share

Diluted EPS

This means that the P/E RATIO = 28.67

20.30

= 1.412

The value of the company using is 1.41 x 1570 million = 2,217,335,000.

The company is listed in the stock exchange there figures from other companies are irrelevant.

Dividend valuation model

This method uses the earnings that are paid out to the shareholder. It is usually good when there are constant or regular cash flows to the shareholders. The value of the shareholders is taken to be the net present value of the dividends that are expected to be obtained. The case like of Tesco co. the cash in form of dividends will be calculated as

Equity = DPS/Ke-g

DPS = Dividends per share and must be distributed dividends the year before.

Ke = required rate of return to equity.

G = growth of dividends

From the records of the company, they issued dividends of 8.63 in the year in 2006.

The company growth will be calculated as follows

Dividends 2006 – dividends 2005 = 8.63 – 8.25

Dividends 2005 8.25

= 0.38 x 100 =4.6%

8.25

The company Ke will be calculated as follows

Ke = Rf + (Rm – Rf) ß

Assumptions RF = risk free rate

Rm = market rate which is the vale of S & P 8%

Rf = risk free rate 4.56% (assumption)

Po = D1/ke -g

Ke = 4.56 + (8– 4.56) 1.3= 9.032%

Therefore the value of equity =8.63(1.046)/0.09032-0.046=203.67

The value of the company will be no. of shares X valuation per share

203.67 X 35,519,739 = 7,234,566,190

Using the dividend growth model which is cash flow paid out to the shareholders ,the value of the shares will be 7,234,566,190 as compared to the current market capitalisation prevailing in 31st December 2007 which was 1,018,350,917. for an investor will expect higher value for his shares which is 203.67,therefore he will invest. Comparing the two models price earning ratio and the dividend model values, the shares higher than the price-earning ratio.

Therefore, I will advice the investor to invest in the company when using the two models.

Share Value Analysis

In valuing, the share using share value analysis we calculate return on capital employed , economic value added and share value added.

EVA (Economic Value Added)

This is the measure of the company’s ability to return economic profits. EVA estimates the company’s economic profit by which it exceed the minimum rate of return on the investors funds. It shows how much the investor is going to get from the company securities as compared to the risk of investing in other companies. It shows the performance of a company and the effectiveness of the company will return on the shareholders funds.

The economic value added is arguably the most important measure of performance as compared to other methods. This valuation system uses some parameters. The parameters used in calculating economic value added is the opportunity cost of capital invested in the business, net operating profit after taxes, the company’s book value of capital. This can also be described as a return on net assets i.e. net income divide by net assets. In some cases this can be represented in terms of figures which has not been expressed in the form of percentage. EVA measures the shareholders wealth whether increased or decreased.

Therefore, the net assets of this company as per the year 2006 are 213,452,000 and the net income for the same period is 1570,000,000. Thus the shareholders value increased 1570, 000,000/213452, 000 =7.35 times

ROCE (Return on Employed Capital)

ROCE is the most useful way of evaluating the company’s ability to meet liabilities. A company with a higher ROCE will show that the company is an asset generator not a cash consumer. A company with a low ROCE will be filled as a cash consumer and will be a risk investment for any investor. This is measured through the returns of the capital. It is earnings before tax and interest divide by the operating capital employed by the company.

ROCE is very useful to both investors and creditors. It is important to creditors because, the creditors will know how much is being returned from the capital employed by the company. Many companies have used ROCE as a valuation method but of late, they have started in improving the methods because it has been seen as an incompetent way of measuring the company’s performance

From our case Tesco company limited,ROCE will be as follows

ROCE = return on capital/capital employed

=1570000/239429 =6.56times

Many factors affect ROCE and EVA of the company. Among the factors that affect these, include the purchase of fixed assets during the year using the existing funds. The fixed assets include property and equipment plant and land. The change in intangible assets, which is not purchased, will not affect the company’s ROCE and EVA. Another factor affecting ROCE and EVA is an acquisition much as and takeovers. When a company buys shares of another company ROCE and EVA will change drastically.

SVA (Shareholders Value Added)

Shareholders value added is the net change of the shareholders funds during the year through the sales not additions of capital. SVA is derived by considering the projected sales of the company – expenses and you arrive at net operating profit before interests then subtract adjusted tax from the interest expense and you will arrive at a figure, which will be invested, from the capital charged during the year. This is called shareholders value added. In Tesco most companies has been using this methods in evaluating the performance of their companies but the method itself has many disadvantages as it does not measure the company’s performances.

Many factors affect ROCE, EVA and SVA. These factors are internal and external and they include the management decisions, which are corporate governance, market demand for the products for example. A company operating in the personal computers generates a lot of revenue as compared to a company operating in retail like Tesco

Other methods that we have not used are discussed below

Cash Flow Discounting Method

There are three cash flow to be considered in this approach. This includes free cash flow, equity cash flow and dept cash flow. This method assists the company to know the true value of the company through discounting the cash flows and estimating using the risk. They involve detailed but careful forecast for each period and for each financial item. In discounting the cash flows, a suitable discount less is determined which is very important. In my case here. Tesco am assuming those figures of discounting. The formulae

V = CF1 + CF2 +Can +Vern

(I+K) (I+K) 2 (I+K) n

Where CFi = Cash flow generated by the company in the period i

Vn = Residual value of the company in the year n

K = appropriate discount rate for the cash flow risk

VR = n = CF n (1+g)/ (k-j)

In Tesco, I have decided to use free cash flow and interest for the purposes of this assignment. Free cash flows are the operating cash flows. This is generated from operations. Indoor for to calculate the financial cash flow the following information is for calculation.

Therefore when calculating the value of the company we know the financing portion which is interest paid. In order to calculate the free cash flow, we must ignore financing of the company operation and concentrate on the financial return of the company assets after tax, viewed from the perspective of a going concern, taking into account each period the investments required for the business continued existence. Finally, if the company had no debt, the free cash flow would be identical to the equity cash flow, which is another cash flow variant used in valuations and which will be analyzed below.

The Equity Cash Flow

Subtracting from the free cash flow the interest and principal payments (after tax) made in each period to the debt holders and adding the new debt provided calculate the Equity Cash Flow (ECF). In short, it is the cash flow remaining available in the company after covering fixed asset investments and working capital requirements and after paying the financial charges and repaying the corresponding part of the debts principal (in the event that exists debt.). This can be represented in the following expression.

ECT=FCT-(interest payments x (I-T) – principal repayments +new debt

When making projections, the dividends and other expected payments to shareholders must match the equity cash flows.

This cash flow assumes the existence of certain financing structure in each period, by which the interest corresponding to the existing debt is paid the installments of the principal are paid at the corresponding maturity dates and funds from new debt are received. After that the remains a certain sum which is the cash available to the shareholders, which will be allocated to paying dividends or buying the back shares.

When we restate the equity cash flow, we are valuing the company equity (E), and therefore, the appropriate discount rate will be the required return to equity (Ke. To find the company total value (D+E), we must add the value of the existing debt (D) to the value of the equity.

Capital cash flow

Capital cash flow (CCF) is the term given to the sum of the debt cash flow plus the equity cash flow.

The debt cash flow is composed of the sum of interest payments plus principal repayments. Therefore CCT=ECF+DCF+ECF+I-^D I=DKd

It is important not to confuse the capital cash flow with the free cash flow.

Calculating the value of the company as the unleveled value plus the discounted value of the tax shield

In this method the company value is calculated by adding two values on the other hand the value of the company assuming that the company has no debt and, on the other hand, the value of the tax shield obtained by the fact that the company is financed with debt.

Demand a higher equity: The value of the company without debt is obtained by discounting the free cash flow, using the rate of required return to equity that would be applicable to the company if it were to be considered as having no debt. This rate (Ku) is known as the unleveled rate or required return to assets. The required return to asset is smaller than the required return to equity if the company has debt in its capital structure as, in this case, the shareholders would bear the financial risk implied by the existence of debt and would demand a higher equity risk premium. In those cases where there is no debt, the required return to equity (Ke=Ku) is equivalent to the weighted average cost of capital (WACC), as the only source of financing being used in capital.

The present value of the tax shield arises from the fact that the company is being financed with debt, and it is the specific consequence of the lower tax paid by the company as a consequence of the interest paid on the debt in each period. In order to find the present value of the taxi shield, we would first have to cultivate the saving obtained by this means for each of the years, multiplying the interest payable on the debt by the tax rate. Once we have obtained these flows, we will have to discount them at the rate considered appropriate. Although, the discount rate to be used in this case is somewhat controversial, many authors suggest using the debts market cost, which need not necessarily be the interest rate which the Consequently, the APV condenses into the following formula

D + E = NP V (FCF;Ku) + Value of the debts tax shield.

This method is called APV (Adjusted present value).

Calculating the value of the company s equity by discounting the equity cash flow

The market value of the company equity is obtained by discounting the equity cash flow at the rate of required return to equity for the company (Ke). When this value is added to the market value of the debt, it is possible to determine the company total value.

The required return to equity can be estimated using any of the following methods.

Gordon constant growth valuation model

Ke = Div 1 / p 0+g Div 1 = dividends to be received

In the following period = Div 0 (1+g)

P 0 = shares current price. g = constant, sustainable dividend growth rate

For example, if a shares price is 200 dollars, it is expected annual growth is 11%.

Ke = (10/200) + 0.11 = 0.16 = 16%

The capital asset pricing model (CAPM), which defines the required return to equity in the following terms.

Ke = R + B (Rn – RF)

RF = Rate of return for risk – free investments (Treasury Bonds)

B = shares beta R n = expected market premium or equity premium.

Thus given certain values for the equity beta, the risk – free rate and the market risk premium, it is possible to calculate the required return to equity.

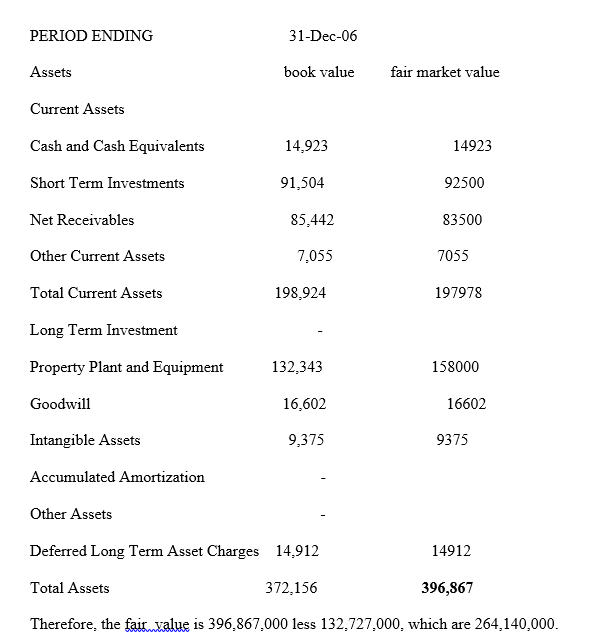

Balance sheet

When valuing the company a number of factors affect the value of equity of company. These factors include growth, required rate of return to equity, the interest rate risk and many others. A number of variables, which the company has no control over, affect looking at required rate of return. This includes the risk free interest rate, equity risk that is operating risk and financial risk. This factors which affect the company we can further look at them as return on investment ,growth rate ,risk free interest rate ,operating risk, financial risk and market risk premium.

This factors are general and have not affected our valuation.we have used a few of our factors in the analysis.those we have used include

- Market risk premium which has the following perceived errors in valuing- (i) the required market risk premium is assumed to be equal to historical equity premium. In my case, I have used an assumed risk premium, which was arbitrary picked. (ii) The required market risk premium is assumed zero and the required market premium is assume to be the expected risk premium.

- Beta-we have used an assumed beta of 1.3 which has assisted has to calculating the market premium although not into perfection

- We have also used required rate of return or weighted average cost of capital, which is arbitrary and assumed. We have not considered the value of debt capital.

Valuation of companies has been based on the purposes of valuation.for valuation to be carried out one need to know why the company is being valued. For valuation meant for liquidation, a different approach to be used as compared to sale. Many people have argued the prices of stock reflect the future expectations of rational investors. This is called fundamental analysis which uses earnings per share and dividends per share as dividends as the main fundamental parameters.

Many have argued that the share price of a company does not depend on any formal or rational valuation rule but depends on the state of euphoria, pessimism and other factors.

Keynes has put this argument forward. This theory has been in use and actuary is the determining factor of valuing the share.

In summary using the market valuation the share price the company is valued at 1,018,350,917.The value of the company using the book value will be equal is 210,158,000

The value of the company using the adjusted book value will be equal is 218,000,000

The value of the company using P/E is 1.41 x 1570 million = 2,217,335,000.

Using the dividend growth model, which is cash flow, paid out to the shareholders, the value of the shares will be 7,234,566,190 and the fair value is, which 264,140,000 are.

In conclusion, the company is a good investment within the industry of retail. This is because all the methods of valuations have given positive results. There I will advice the willing investor to put his money in this investment, as it will be viable.

References

Buddle. r.and Wallace,j. (1997) Does EVA TM bat earnings?Evidence on association with stock returns and the firm values.

Revolution in Corporate Finance, Second Edition, Oxford: Blackwells Roudntable”, in Stern, J and Chew, D (Eds) The Revolution in Corporate Finance, Third Edition, Malden, MA: Blackwells

The Revolution in Corporate Finance, Third Edition, Malden MA: Blackwells.

Froud, J., Haslam, C., Johal, S., Williams, J and Williams, K 9(1998) “Caterpillar: Two Stories and an Argument”, Accounting, Organizations and Society, vol 23, no 7, pp 685 – 708.

Biddle, g., Bowen, R and Wallace, J. (1997) “Does EVA TM Beat Earnings? Evidence on Associations with Stock Returns and Firm Values”, Journal of Accounting and Economics.