Rationale for the Stock

Volkswagen (VW) is among the most attractive companies for long-term investments since it fits the majority of criteria for picking stocks for long-term investments. According to Benzinga Editorial, a company should adhere to six essential principles to be suitable for long-term investments (1).

First, VW has a straightforward business model, which includes building vehicles, selling them, and providing after-sales services (Volkswagen AG, 2). Second, the company is among the best in the automobile market, taking second place in the global market share after Toyota (Statista, 3). Third, the company demonstrates a steady increase in revenues during the past three years (Volkswagen AG, 4).

Fourth, VW is a large-cap company since it has more than 130 warehouses, 120 production locations, and a sizeable fleet that can respond to any changes in demand (Volkswagen AG, 5). Fifth, the company has a favorable dividend policy, paying €4.80 per ordinary share and €4.86 per preferred share (Volkswagen AG, 6). Finally, the company is recovering after a well-known diesel scandal in 2015, which led to more than $30 billion in losses (Boudette, 7). However, adherence to all the six criteria is not the only reason for picking the stock.

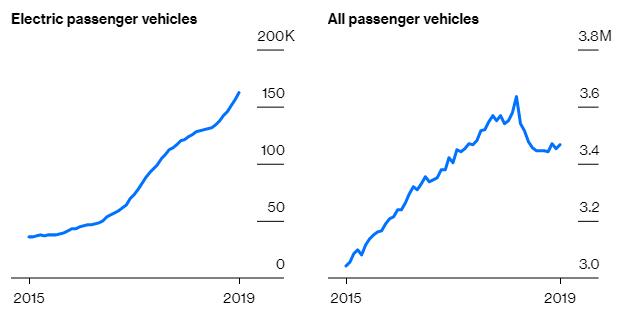

Growing environmental concerns are pushing the governments and provoking the public to support “green” companies. After the diesel scandal, VW has set ecological sustainability as its top priority, and, as a result, it has set the goal to become the world’s largest electric vehicle (EV) producer by 2025 (Matousek, 8). This seems like a rational approach, as the EV market continues growing steadily, while the automobile industry experienced a considerable pullback in 2017 (Bullard, 9).

Figure 1 below juxtaposes the graphs of EV sales with all passenger vehicle sales during the past four years. The chart makes it clear that the EV industry is a promising market, and VW is expecting EVs to comprise 40% of its global sales. Considering the reasons listed above, investing in VW seems to be rational in order to preserve and multiply the assets.

Client Description

My client is a 38-year old white male living in the US. He has a wife and two children, and he paid out his real estate mortgage and has considerable savings for a middle-class family. His goal is to save enough for college for both of his children while having an additional source of income. He has a very low risk tolerance and prefers holding his money in a bank rather than investing in a steady-growing company. However, he has a personal interest in cars, and he drives a VW Jetta. He is also an environmental activist and thinks about buying an EV.

Stock Appropriateness

The chosen stock is appropriate for the client since it adheres to his personal preferences. First, the client has a strong association with a brand and is concerned with the environment, which would help him to decide to move his assets from a bank account to stock shares. Second, VW is a low-risk investment, which is vital for the client. Finally, investing in VW shares would help to achieve both of the client’s goals since VW will pay dividends and multiple the investments, as the share price is expected to grow.

Suggested Source List for the Final Assignment

Volkswagen AG. 2019. Volkswagen Annual Report. Web.

Nathaniel Bullard. 2019. China Is Winning the Race to Dominate Electric Cars. Web.

Florian Bart, Christian Eckert, Nadine Gatzert, and Hendrik Scholz. 2017. Spillover Effects from the Volkswagen Emissions Scandal: An Analysis of Stock, Corporate Bond, and Credit Default Swap Markets. Web.

Chnar Abdullah Rashid. 2018. Efficiency of Financial Ratios Analysis for Evaluating Companies’ Liquidity. Web.

Hitesh Bhasin. 2019. SWOT analysis of Volkswagen. Web.

Sources

Benzinga Editorial. 2012. Six Rules to Follow when Picking Stocks. Web.

Volkswagen AG. 2019. Brands and Business Fields. Web.

Statista. 2019. Global Car Market Share of the World’s Largest Automobile OEMs in 2018. Web.

Volkswagen AG. 2019. Income Statement. Web.

Volkswagen AG. 2019. Sales and Marketing. Web.

Volkswagen AG. 2019. Dividend. Web.

Neal E. Boudette. 2017. Volkswagen Sales in U.S. Rebound after Diesel Scandal. Web.

Mark Matousek. 2019. Electric Vehicles are a Tiny Piece of the Global Car Market, but Volkswagen Is Making a Huge Bet on Them. It Doesn’t Have a Choice. Web.