Business Model Analysis

Key Partners

Volkswagen has diverse partners around the globe, which help to handle inbound and outbound logistics as well as outside projects. Volkswagen group consists of several brands, including Volkswagen Passenger Cars, Audi, ŠKODA, Bentley, Porsche Automotive, Volkswagen Commercial Vehicles, Scania Vehicles and Services, MAN Commercial Vehicles, and many other companies that provide financial services (Volkswagen AG 2019a).

All the logistics is provided by Volkswagen Group Services, including logistics planning, material logistics, and automobile logistics (Volkswagen Group Services n.d.). The company has also partnered with RIO, the digital brand of the TRATON GROUP, to digitise logistics services (Volkswagen AG 2019b). Volkswagen has also recently partnered with Ford and Amazon to build a charging network for electric cars (Roshan 2019). The company is considered a valued partner for any organization all over the world.

Key Activities

The principal activity of the company is automobile production and distribution. According to the annual report, the company’s business can be divided into two spheres: automobile services and financial services (Volkswagen AG 2019a). Volkswagen Group produces and sells passenger cars, commercial vehicles, and power engendering machines (Volkswagen AG 2019a). The financial services include leasing, dealer and customer financing, insurance, fleet management, and mobility offering (Volkswagen AG 2019a). The company also invests in research and development (R&D) that has a positive impact on the company’s growth.

Key Resources

The company has an extensive production infrastructure that utilizes the latest research findings from the R&D department. According to 2018 annual report, the company has 120 production locations that produce around 11 million vehicles (Volkswagen AG 2019a). The company also utilizes to level human resources to deliver value to its customers since one of its aims to be among the best employers worldwide. By the end of 2018, the company employed 664,496 people, which is 3.5% more than in 2017 (Volkswagen AG 2019a). Volkswagen is strict to its employees to avoid internal misconduct, which cost the company 30 billion euros in 2015 (Rauwald 2019). The company also uses top quality materials and equipment as well as financial resources for providing various services.

Customer Relations

The customer relationships are still in the recovering stage after the diesel scandal in 2015. That year the Environmental Protection Agency (EPA) found that Volkswagen’s cars sold in the US had software that could detect when the engine is being tested to demonstrate improved results on carbon dioxide emission levels (Hotten 2015). The scandal had a tremendous impact on trust from customer, which resulted in considerable sales drops, the results of which were felt even in 2017 (Boudette 2017). However, today, the company had reached the level of sales before the scandal and regained the trust of customers (Volkswagen AG 2019a). Apart from minor complaints about aftersales service (Brignall 2019), the review of recent press and reports showed no sign of problems with customer relations.

Channels

The company uses all available marketing channels to keep a strong brand portfolio (Bhasin 2017). The company sells the products using an extensive dealership network worldwide, which helps to keep operation costs down (Bhasin 2017). In short, the marketing and sales channels adhere to the top quality standards.

Customer Segments

Volkswagen operates in 12 different brands, which allows efficient segmentation and individual targeting. Volkswagen assesses the need of its clients and caters for all the customer segments according to demographic, psychographic, geographic segmentation variables (Bhasin 2017). Since the mission of the company is “mobility of everyone” (Bhasin 2017, para. 8), it tries to make products for all the people.

Cost and Revenue Structure

The cost structure of the company is diverse depending on the brand. Even though some of the cheaper brands, like Volkswagen Passenger Cars, are more cost-driven than others, overall, the cost structure is value-driven (Volkswagen AG 2019a). The revenue structure is non-recurring since the primary income source is selling automobiles; however, the analysis of income last three year’s statements demonstrates that the company tries to put a greater emphasis on recurring revenue, such as aftersales services (Volkswagen AG 2017; Volkswagen AG 2018; Volkswagen AG 2019).

Value Proposition

The success of the company is a result of a well-balanced value proposition canvas described above since the company outperforms the majority of its competitors in all the fields. The key to success is customer-centricity because, after the diesel scandal in 2015, the company realized the economic impact of negative public relations (Boudette 2017). Volkswagen also does not leave the buyer after selling a car; they offer a wide variety of aftersales services that aim to increase customer satisfaction (Volkswagen AG 2019). The company caters for all segments of potential clients, which has a positive influence on the company’s image (Bhasin 2017).

The careful choice of partners and using a subsidiary company, Volkswagen Group Services, for logistics help to cut the cost of production and sales (Brown 2012). Moreover, Volkswagen offers financial services, such as loans and leases, to provide diverse purchase alternatives for the clients (Brown 2012). In short, the secret of the company’s success is in addressing the needs of all segments of customers with the best value for money.

Value Chain Analysis

Framework

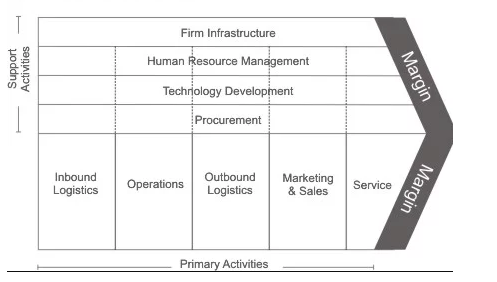

Value chain analysis is one of the most important tools to detect the strengths and weaknesses of an organization. Porter’s value chain is a concept described in 1985, which is still relevant today (MindTools n.d.). The framework describes the economic logic through primary and secondary activities demonstrated in Figure 1. The framework seems acceptable for performing Volkswagen’s value chain analysis.

Primary Activities

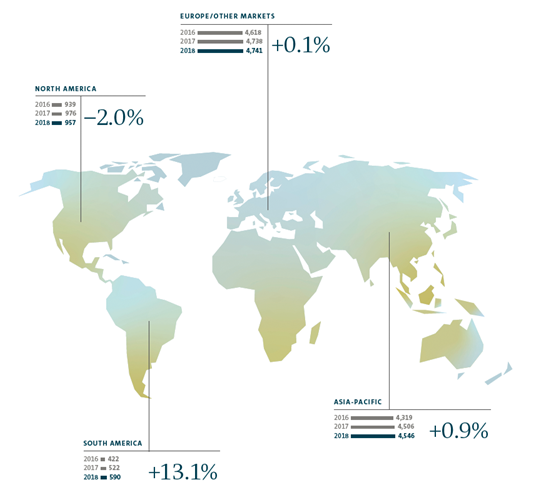

Inbound logistics of the company is well organized primarily using the services of Volkswagen Group Services. Suppliers deliver the parts to the manufacturing plants where they are stored in large hubs (Volkswagen Group Services n.d.). All the deliveries are made on Just In Time (JIT) bases, meaning that suppliers are penalised for early or late deliveries. Additionally, Volkswagen Group Services utilizes the MTM (Methods-Time Measurement) method for planning deliveries. Outbound logistics is also well-organized, which helps a steady increase in the number of deliveries annually. Figure 2 demonstrates the number of shipments worldwide, which includes delivery to dealerships, distributors and clients. Outbound and inbound logistics structure help to save money on deliveries and storing parts, which, in turn, helps to offer the best value for price to customers.

As for operations, the production lines also work on JIT bases. The internal transport carries all the needed parts to the production lines to optimize the cost and time of manufacturing. The slogan of the sales and marketing team is “customer delight” which means that the company aims at exciting customers on a new level (Volkswagen AG 2019a). Moreover, the marketing strategy sees publicity as its top priority to regain the trust of the customers after the diesel scandal in the US (Volkswagen AG 2019a). The company also provides high-quality services in all divisions using an advanced customer relations management system, that keeps all the clients satisfied with purchases and provided service. In conclusion, the primary activities emphasise customer centricity, which helps the company to increase sales by delivering just the right products and services.

Secondary Activities

Volkswagen is one of the leaders among its competitors in terms of infrastructure. The company has more 130 warehouses, 120 production locations, and a sizeable fleet that can respond to any changes in demand (Volkswagen AG 2019a). The company supports human resource strategy “empower to transform,” which includes the principle of long service, excellent training opportunities, and prioritizing employee rights (Volkswagen AG 2019a).

Volkswagen aims to be an attractive employer, which has highly competent and dedicated employees (Volkswagen AG 2019a). The company provides the best working conditions, maintains an exemplary corporate culture, and orients on employees while emphasising operational excellence. The procurement strategy, TOGETHER-2025 aims at safeguarding the supplies, helping create competitive and innovative products, and optimize cost structures. It involves using all the strengths to deliver products with high customer value and optimum cost structures that meet the needs of the market (Volkswagen AG 2019a). As for technology development, the company invests significant amounts in promoting innovation at all levels. In conclusion, Volkswagen uses its infrastructure, human resources, and technology to anticipate and address customer needs.

Supply Chain Map

Figure 3 below demonstrates Volkswagen’s outbound and inbound supply chain map.

Analysis of Electric Vehicle Risks

Electronic Vehicle Market Overview

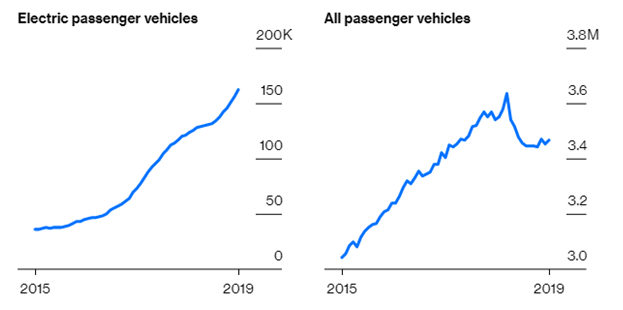

The electric vehicle (EV) industry is a rapidly growing market that attracts many automobile manufacturers around the globe. According to Virta (2019), the EV fleet grew by 2 million cars in 2018. While the all passenger car market is trailing at 3.5 million sales per month for the last 12 months, EV sales are growing steadily from 125,000 to 162,000 a month (Bullard 2019). Figure 4 provides a better understanding of the EV market by juxtaposing it to global passenger vehicle sales.

Experts forecast further growth of the market from $129,671.56 million in 2018 to $359,854.56 million by the end of 2025 at a Compound Annual Growth Rate of 15.69% (Valuates Reports 2019). LG Chem, a South Korean battery maker, expects EV sales grow from 3% to 15% of all passenger vehicle sales by 2024 (Paul 2019). In other words, the EV market is booming, providing start-ups and well-known vehicle manufacturers to find new ways of serving customers.

There are many factors that can both facilitate and slow down the growth of the EV industry. The primary driving force of the market is growing environmental concerns among communities and governments. People want to stay environment-friendly and reduce carbon dioxide emissions to the atmosphere (Valuates Reports 2019). At the same time, governments apply stringent laws and regulations on vehicle emissions, which are going to increase in the future (Valuates Reports 2019). Moreover, due to the growth of oil prices, many people turn to renewable energy sources to improve financial sustainability. However, the primary barriers to the development of the market are the need for considerable R&D investments and the lack of infrastructure, such as charging stations. The attractiveness of the market identified by Gissler et al. (2016) is visualised in Figure 5 below.

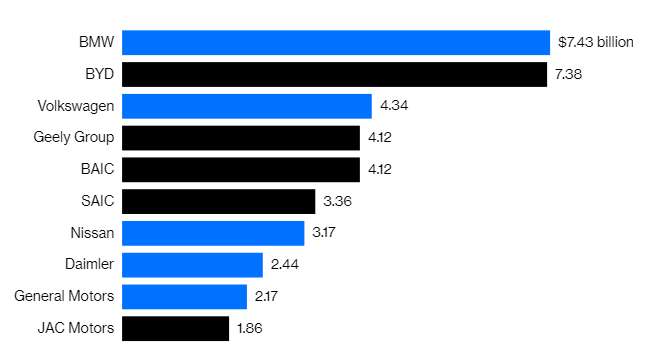

German and Chinese manufacturers are competing for being the leaders of the industry, and China is currently winning the race. Figure 6 provides a list of companies competing in the sphere according to their revenues from electric passenger vehicle sales published by Bloomberg (Bullard 2019). The figure demonstrates that BMW is closely followed by BYD, a Chinese manufacturer. However, BYD receives up to 40% of its revenues from selling EVs, while BMW and other German car manufacturers continue to make money out of vehicles running on gasoline and diesel (Bullard 2019). The champion in the industry remains Tesla Inc., as it has sold more than 250,000 cars in 2018, which exceeds the sales of BMW by more than 100% (Wagner 2019). However, the situation may change if the EV market continues growing.

EV Market and Volkswagen

Volkswagen realises the current trend of the EV market and plans to adapt its business model to the new realities approaching. According to Figure 6, Volkswagen takes fourth place in the world in revenues from EV sales (Tesla Inc. is not included in the diagram). However, the company plans to dominate the market in the nearest future by investing more than $30 billion in EV R&D and production, which equals to its combined profits for the last three years (Matousek 2019). In China alone, it aims at producing 600,000 units a year by 2022, while Tesla plans to build only 150,000 vehicles (Hanley 2019).

China is one of the most promising markets, so Volkswagen partnered with FAW for a joint venture in Foshan, China (Dixon 2019) and built a factory in Anting (Volkswagen AG n.d.) to achieve the set goal. Additionally, the company has strengthened its brand design and introduced several new models in China (Volkswagen AG 2019e). Considering the news, that Volkswagen has finished a conversion of a factory in Zwickau (Volkswagen AG 2019c), and plans to build new factories in Chattanooga, TN (Roberson 2019; Volkswagen AG n.d.), and Rwanda (Volkswagen AG 2019d), it will have factories on four continents.

Potential Risks

There are two significant risks the company may face while trying to achieve superiority on the market. On the one hand, the demand for EV vehicles may drop for one of two reasons. First, there is not enough infrastructure for EVs, since the charging stations are rare.

Even though the EV charging market is growing fast due to a steady increase in demand, there is a possibility that the companies will not be able to deliver enough charging stations for continuous growth. Volkswagen understands the problem and actively invests in building relevant infrastructure (Roshan 2019). Second, there is a possibility of the emergence of new types of fuels that can lead to EVs being less cost-efficient and environment-friendly (Science Daily 2019). Even though the chances of such a turn of events seem to be slim, Volkswagen needs to control for all the possible risks.

On the other hand, the company may fail to deliver value to their customers due to fierce competition. As stated above, BMW, Tesla, and BYD forestall Volkswagen in terms of revenues from EV sales. However, Volkswagen seems to have controlled for such risks since it invested in the improvement of its presence in China. Moreover, BMW’s ambitions are not as far-reaching as Volkswagen’s, since the BMW Group expects electrified vehicles to account for between 15-25% of sales (BMW Group n.d.), while Volkswagen intends for electric vehicles to comprise 40% of its global sales (Matousek 2019). If the company is not able to fight the competition or the demand will stop growing, it will make the company rethink its strategy while suffering from considerable financial losses and damaged reputation.

Changes in Business Model

If EVs assimilate, Volkswagen will be among a few European companies that will not have to make drastic changes in its business model. The company’s business model is to build vehicles, sell them, provide aftersales service, and offer financial services. The only difference would be that Volkswagen would need to produce and sell more electric cars and less fossil fuel-run vehicles. Therefore, the company would have to partner with battery producers to make sure to get the best price, as batteries are 30% of the EV’s costs (Volkswagen AG 2019a).

After the diesel conflict, the company identified being environment-friendly as its top priority (Matousek 2019). As a result, it has already made all the necessary preparations for the alteration of its business model to embrace the changes (Volkswagen AG 2019a). In order to build more EVs and decrease the production of traditional cars, the company will have to convert some of its plants to building EVs. Volkswagen, however, has a vast experience in the matter, since the Zwickau plant has successfully been converted to building EVs. In short, while Volkswagen will have to make several changes in its business model, the analysis shows that the company is ready for them.

Damages in Case of Adverse Events

While the company is ready to face the rise of the EV market, its preparedness to the failure of EVs is limited. In case of such events, the company will lose the invested $30 billion, and most of the money it is planning to invest in EVs. While this seems to be unbearable cost, the company will lose even more from other adverse events. Decreased demand will lead to fewer sales, which, in turn, will cause increased spending on warehousing of inventory and vehicles.

Due to the abundance of made cars, the company will have to halt production, which may lead to mass employee layoffs. The dismissals will negatively influence the company’s image and employee satisfaction. Since the company relies on the loyalty of its employees and customers, the company’s value chain will suffer from significant changes and the company will have to control for all the adverse events. However, in the past, the company has demonstrated tremendous potential from recovering after reputation damages (Boudette 2017); therefore, it may be able to control for all the possible adverse events.

As for value proposition, the decline in EV demand would mean that the company failed its central task of being customer-centric. While the company will continue offering all the services, it will not be able to serve all segments since 40% of the production capacity will produce EVs by 2030 (Matousek 2019). The company will have to spend money to conversion from EV production or sell the unneeded equipment and release the employees to make sure that the company is still profitable. However, such changes will have a definite negative impact on Volkswagen’s value proposition.

Reference List

Berkelmans, G, Berkelmans, W, Piersma, N, van der Mei, R & Dugundji, E 2018, ‘Predicting electric vehicle charging demand using mixed generalized extreme value models with panel effects’, Procedia Computer Science, vol.130, pp. 549–556.

Bhasin, H 2017, ‘Marketing strategy of Volkswagen – Volkswagen marketing strategy’, Marketing91. Web.

BMW Group n.d., Electrification Strategy. Web.

Boudette, N 2017, ‘Volkswagen sales in U.S.: Rebound after diesel scandal’, New York Times. Web.

Brignall, M 2019, ‘VW’s aftersales service fails over a faulty new car’, The Guardian. Web.

Brown, C 2012, ‘VW has a (value) proposition for you’, Business Fleet. Web.

Bullard, N 2019 ‘China is winning the race to dominate electric cars’, Bloomberg. Web.

Dixon, T 2019, ‘Volkswagen announces pre-production at Chinese electric vehicle factory’, Clean Technica. Web.

Gissler, A, Raab, C, Tix, M & Merk S 2016, Electric vehicle market attractiveness. Web.

Hanley, S 2019, ‘Volkswagen plans to dominate electric vehicle manufacturing in China’, Clean Technica. Web.

Hotten, R 2015, ‘Volkswagen: The scandal explained’, BBC News. Web.

Matousek, M 2019, ‘Electric vehicles are a tiny piece of the global car market, but Volkswagen is making a huge bet on them. It doesn’t have a choice’, Business Insider. Web.

MindTools n.d., Porter’s Value Chain. Web.

Paul, G 2019, ‘Top automakers like Volvo, Ford, and Toyota are racing to capture the growing electric vehicle opportunity’, Business Insider. Web.

Rauwald, C 2019, ‘VW fired 204 staff for breaching rules in compliance crackdown’, Bloomberg. Web.

Roberson, B 2019, ‘Electric vehicle efforts get into high gear with big news from Tesla, Volkswagen, China’s BYD’, Forbes. Web.

Roshan, KL 2019, ‘Ford partners with Volkswagen, Amazon to build charging network for cars’, Reuters. Web.

Science Daily 2019, ScienceDaily, Rockville, MD. Web.

Valuates Reports 2019, Electric Vehicle market overview. Web.

Virta 2019, The global electric vehicle market in 2019: Statistics & forecasts. Web.

Volkswagen AG 2017, 2016 annual report. Web.

Volkswagen AG 2018, 2017 annual report. Web.

Volkswagen AG 2019a, 2018 annual report. Web.

Volkswagen AG 2019b, RIO digitizes Volkswagen Group logistics. Web.

Volkswagen AG 2019c, ‘Countdown to production start: Conversion of Zwickau plant to electric car factory began in 2018’, Volkswagen Newsroom. Web.

Volkswagen AG 2019d, ‘First for Africa: Volkswagen and Siemens launch joint electric mobility pilot project in Rwanda’, Volkswagen Newsroom. Web.

Volkswagen AG 2019e, ‘Volkswagen strengthens brand presentation in China: MEB roadmap, new models and new brand design’, Volkswagen Newsroom. Web.

Volkswagen AG n.d., Volkswagen to manufacture electric cars on three continents. Web.

Volkswagen Group Services n.d., Logistics. Web.

Wagner, A 2019, Tesla – Statistics & facts. Web.