Introduction

Chinese market is one of the most attractive consumer markets with its high growth and increasing consumer demand. The global recession of 2008-10 succeeded to dampen the China euphoria partially as the country recovered quickly and headed for another upswing. The demand for automobiles, during the recession, declined considerably in developed countries like that in the US and UK, however, that of China increased significantly (Shen, 2009).

According to reports, US automakers like General Motors (GM) and Chrysler saw a double-digit fall in its sales in the US during the recession but experienced a sales increase in the Chinese market (China Daily, 2009). Other automakers like Honda, Toyota, and Volkswagen too experienced a rise in sales figures amid recessions in China. Apparently, the Chinese market remained almost immune to the recessionary pressure, while the automobile market in developed countries of North America and Europe tumbled down.

This increased the vitality of the China for international automobile makers who wanted to enter the market that was experiencing high growth rate. Therefore, the importance of the Chinese market for multinational automobile manufacturers is apparent. In order to understand this phenomenon better, the paper will undertake a case study analysis of Volkswagen in China and the marketing strategy that it undertook in the country, in the background of the economic recession.

The paper will specifically do an analysis of the marketing strategy of Volkswagen in China, especially during the recession in order to understand the importance of the Chinese market and the strategies to be taken during recession. The case study will present an analysis of the Chinese automobile market and the competitive landscape in the country during the recession. Then it will discuss the Volkswagen Company in China, its operations, and marketing strategy that it had undertaken and ascertain the reason behind such strategy.

Company Background – Volkswagen

Volkswagen, literally meaning car of the people in German, was founded in 1937 during the time of Nazi dictatorship in Germany (Volskwagen, 2010). The company is headquartered in Wolfsburg, Germany. The famous Beetle and Volkswagen bus car of the 1950s and 1960s brought international repute for the company (Datamonitor, 2010). Other iconic brands by the company were Golf, Touareg, and Scirocco.

The organization emerged as Volkswagen Group in 1986 when it included Audi and Seat into its stable. Other brands that were launched in 1988 by the company internationally were Bentley, Bugatti, and Lamborghini. The company acquired Skoda in 1986 (Datamonitor, 2010).

Volkswagen is a German automobile company that operates in 15 European, 6 countries in the Americas, Asia, and Africa (Datamonitor, 2010). Volkswagen group manufactures and sells many well-known brands like Volkswagen passenger cars, Audi, Bentley, Scania, Skoda, SEAT, and commercial cars. The company operates into three segments– passenger cars, commercial vehicles, and financial services.

Volkswagen started spreading its operations internationally in 1952 with the opening of its operations in Canada and in America in 1955. The company extended its operations in Mexico, Sweden, Brazil, etc (Datamonitor, 2010). The expansion strategy of the company was through acquiring of a local automaker and then capturing the local market. Volkswagen began its China operations in 1982, as then entered into a contract with Shanghai Tractor and Automobile (Datamonitor, 2010). In 2005, the company began two joint ventures in China – Volkswagen FAW Engine and Shanghai Volkswagen Powertrain (Datamonitor, 2010).

The financials of the company are divided into four geographic segments – North America, South America/South Africa, Asia, and Europe (Volskwagen, 2010). The group’s passenger car division is divided under two entities – Audi and Volkswagen (Volskwagen, 2010). These groups are responsible for their respective product portfolio in all their operations. The global market share of the car market that is held by Volkswagen is 10.3 percent in 2008 that increased to 11.3 percent in 2009 (Madslien, 2009; Volkswagen, 2010).

The carmaker essentially had its strongest hold in Western European markets where it enjoyed 18 percent market share. However, its production base is more international than BMW that sells double the number of cars internationally. Volkswagen produced 40 percent of its cars overseas and two-thirds of the cars manufactured by them were sold in Germany. The reason for the shift in production abroad was due to the increasing cost of production in Germany that became the costliest place to produce cars. The present case studies Volkswagen operations in China where it had its pioneering presence since the 80s.

Plan of the Paper

The paper is divided into four sections. First is the literature review that studies various literatures related to marketing in cross-cultural context and in recession. Further, the literature review also studies the effect the recession had on the Chinese economy. The second section studies the methodology and provides overview of the research design. This section also presents the aim and objective of conducting the study and the research questions. The third section provides a case study of Volkswagen China with specific reference to the economic recession of 2008-10. The fourth section provides generalization for the analysis done through the case.

Literature Review

The literature review will deal with the impact of the financial crisis on the global economy and that on the automobile industry specially. This will provide a background to the actions of the automobile companies due to recession that will be discussed second. Then the importance of China as an automobile market will be discussed. The literature review, in the end, will discuss the marketing strategy that Volkswagen had taken in Chinese market until the recession.

Global Recession and China

The global recession has brought forth a brightening view of the Chinese market to international players. With the recession, when rest of the developed countries have shown reduced consumer confidence and subsequently lower demands, China is a market that has flouted all rules of the recession and has expanded its consumer demand, retail sales and industrial production (Political Risk Services, 2009). During the recession when rest of the developed countries faced a slowdown in GDP, the GDP of China continued to grow.

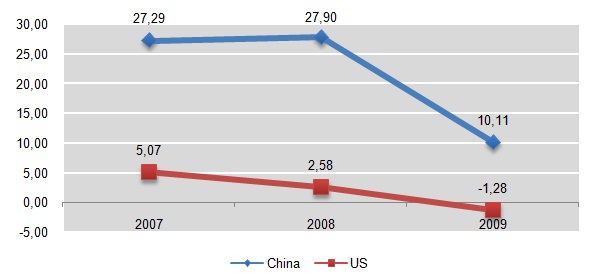

Figure 1 demonstrates that the Chinese economy during the recession of 2007-09 had been growing at a much faster rate than the US economy. In 2009, the GDP growth rate became negative indicating a shrinking economy, while that of China, though fell substantially, and was still growing at 10.11 percent. The Chinese economy fell in the fourth quarter of 2008 however, it is observed that the figures compared to other developed nations was still better (Balfour, 2009) This huge growth potential that China showed even during the recession changed the focus of the country and helped it to sustain and even increase its industrial production.

A SWOT analysis of the Chinese economy would demonstrate that strengths and weaknesses of the economy that has emerged during the period of recession. The strengths of the Chinese economy lie in its high growth rate. China is the fastest growing economy in the world and the Chinese government has successfully lifted millions of its population out of poverty. The huge trade surplus of the country and large foreign exchange reserve provides a strong cushioning against external shocks like the recent recession.

Consequently, the Chinese economy did not face a huge set back due to the aftershocks of the global economic recession of 2007. Further, economic policy taken by the government is lucrative and supports the growth process. A few of the weaknesses of the Chinese economy are related to environmental problems in the country that is a consequence of high growth of the economy. Rapid growth and high level of industrialization has left the environment badly exploited. The export led growth process of China makes it vulnerable to recession. Further, private consumption of the industrial produce remain weak at only 40 percent of the total GDP.

Therefore, a weakening of the market in the developed countries will affect the Chinese economy considerably. Some of the opportunities that the Chinese economy holds is the expected rise in the middle class of the country, with an increase in private consumption. Further rapid urbanization process in China will be a major driver of growth for the less developed rural areas of the country. Further, as the Chinese industry move up in the value chain, China will foster international brands with its own technology and innovations.

Some of the threats that the Chinese economy is exposed to global recession of 2007-09 will hinder China’s above 10 percent growth rate. It will also increase unemployment in the country’s export sector creating imbalances. Further high inflation of food prices may become structural due to rapid industrialization and loss of farmland. Therefore, the Chinese economy has been facing risks due to the global recession, and it is expected to hinder the country’s growth process (BMI, 2010).

According to the BMI risk ratings for emerging economies, china holds a position in the top 20 spot securing its growth prospects and buoying its invest prospects. The Chinese economy has already begun to recover from the blow of the recession. However, the Chinese government has brought into place well planned and implemented crisis management policies specifically to counter the global recession (Schuman, 2010). However, there is impending fear of real estate bubble and increasing inflation that is why the Chinese government has tried to constrain money supply in the economy (Yu, 2008; Economist, 2010).

During the recession, the fall in the growth rate of the Chinese economy was due to the global recession. The reason was due to the close connectedness of the economy to the international market. Due to this, the international and local companies operating in china wanted to shift their focus of their trade from developed countries to the Chinese economy. This led to the “brutal fight for domestic market” (Balfour, 2009). Therefore, the recession has brought forth China as the destination for the marketers as all companies want a share of the increasing purchasing power of the buoying Chinese middle class.

Culture and Marketing

Marketing strategy varies with changes in the market of the product. The reason for this is due to the changes in the cultural component of the market. Culture is the inherent character of a society that arises from social norms, standards, and practices. Therefore, the influence of cultural on global marketing and promotion claims special concern for all companies.

In order to understand what the cultural fit marketers look for, it is essential to understand what culture is. Taylor has defined culture as “that complex whole which includes knowledge, beliefs, arts, morals and law, customs and any other capabilities and habits acquired by man as a member of that society” (Taylor, 1891) culture is also defined as an “embodiment of … values, symbols and meanings into material objects and ritualized practices” (Banerjee, 2008, p.313). Hofstede (2001) has mentioned that it is important to understand the nature of national culture as it affects all areas of management practices. Therefore, the cultural differences affect the way a company operates in an economy and how it reacts to the external environmental changes in the market. Therefore, the question related to the action taken by companies in different cultures due to changes in the economy (Deleersnyder et al., 2009).

According to the Deleersnyder et al. (2009) research conducted by study in 37 countries and found that due to changes in the economy, there is a tendency in companies operating in all countries to change their strategic outlook and decisions. They have found in case of advertisements that the “average co-movement elasticity” remains same for all countries; however, some form of media like print is more sensitive to business cycles changes compared to others like radio and television (Deleersnyder et al., 2009, p.634).

Therefore, their study reinforces the fact that “companies’ marketing behavior is systematically related to the cultural and economic context in which they operate.” (Deleersnyder et al., 2009, p.634) Therefore it can be intuitively deduced from the study that due to changes in the economic condition, as in case of recession, there is expected to be changes brought in managerial decision making, especially related to marketing, which however, is culturally bound.

Understanding cultural differences in marketing is an important aspect of branding of products in international setting. The dilemma to remain local in marketing strategy or to employ a global, standardised strategy has always been faced by multinational corporations. Hofstede and Mooij (2010) believe that understanding national cultures and their differences is important to point out the different aspects of marketing and advertising of the products in global environment. Therefore, acultarization of the brand and the brand culture becomes a daunting task for global marketers.

Mooij & Hofstede showed that cultural differences may affect the nature of advertisement and promotional campaign as the target segment of customers, their beliefs and values change with change in national culture (Mooij & Hofstede, 2010). Therefore, cultural differences in marketing must be considered while understanding the pulse of a new natural culture. They point out that in a culture where there exists high power distance the need to consume luxury goods is high in order to establish the superior status. In a highly masculine and individualistic society, the need to show off one’s success is high while it may be low in case of collective societies. Therefore, they want to emphasize that with changes in the degree in the dimensions of culture, there is a difference in perception of the people within the culture:

Collectivism is not about subordinating oneself to the group. The latter is the typical description from an individualistic view of the person. The group itself is one’s identity. Power distance is about accepting and expecting inequality – it is a two-way street. Female nudity in advertising should not be confused with sex appeal, as researchers from masculine cultures may assume. There is no relationship with masculinity. (Mooij & Hofstede, 2010)

Cultural differences affect the way a product should be marketed in different countries. For instance in case of Asian market, it is essential to understand the customer demand and requirement as the nature of the society is very different from that of the European or American culture.

Marketing in Recession

Marketing strategy of companies are bound to change with changing environmental conditions, especially during “turbulent times” (Kotler & Caslione, 2009). Therefore a few areas that the marketers must be aware of during recession are that hard times brings forth touch financial situation for consumers who in order to sustain within their disposable income, have a tendency to shift towards lower prices products (Kotler & Caslione, 2009). Further, there is a tendency to postpone discretionary purchase like furniture or automobile, expensive vacations, etc. therefore, it is advised that companies who sell discretionary products are “forced to budget downward, reduce inventory, and possibly lay off workers” (Kotler & Caslione, 2009, p.188).

According to Kotler & Caslione (2009) the best strategy that companies in recession must take are to let go of the segments, customers, geographic locations, or products that are losing money in order to streamline their marketing process and increase margins. Therefore, the main idea is to stream line the product portfolio and marketing mix of the company during recession.

Schultz (2009) points out that during times of “limited economic growth” it is not possible to expect a lot out of marketing. He point out that in such times marketing, branding, or market positioning become obsolete concepts and cannot be fully utilized. Therefore, changes in the economy, climate, and other external conditions are expected to change the way marketing is done and is expected to transform it. Therefore, marketing, according to Scultz must come beyond positioning and branding.

Quelch (2007) mentions eight factors that companies in recessionary environment should follow. First, he states that researching the customers during recession is important as the price elastic changes with changing economic environment and crunching of disposable income of consumers. The focus of marketers should shift to family values as recession brings forth hard times when friends and family remain closest. He therefore states, “Look for cozy hearth-and-home family scenes in advertising to replace images of extreme sports, adventure, and rugged individualism. Zany humor and appeals on the basis of fear are out.” (Quelch, 2007)

Quelch differs from Kotler, Schultz, and advices the companies to maintain their marketing spending even during recession and not to cut advertisement or promotion cost – “It is well documented that brands that increase advertising during a recession, when competitors are cutting back, can improve market share and return on investment at lower cost than during good economic times.” (Quelch, 2007, p.1)

The theory of increasing advertising expenditure during recession finds empirical support through the research of Tellis and Tellis (2009) and Srinivasan, Rangaswamy, and Lilien (2002). These researches support proactive marketing during the recession in order to grab greater market share. Revamping the product portfolio during the recession is necessary such that non-performing brands are pruned, while the best offers can be provided to the customers.

Therefore, it can be concluded that recession is a time to do intelligent marketing rather than remain dormant. Companies must do away with non-performing brands, promotions, segments, targets, etc. they must take a closer look at their marketing mix and decide the best possible options for the recession.

Methodology

Case Study

The reason for research identifiable from the literature review is the marketing strategy that a company takes during recession. The choice of research method is done after the research problem is identified (Baharein & Noor, 2008). The main aim of the research is to create knowledge of the successful marketing tactics during recession.

The aim of the paper is to gather facts and then construct various meaning that can be possibly associated with the development of theory. Therefore, for this research a case study method is adopted to gather information regarding the company in recession and then understand the strategy taken to become successful. Thus, the first question that arises is what a case study is. Yin suggested that case represents an event, object, entity, or a unit of analysis (Yin, 1989).

Usually a case is a contemporary event or occurrence that is studied in the real life context through empirical enquiry from various sources (Yin, 1989). Further, it must be noted that case study is usually not a study of an entire organization. Instead, it focuses on a particular issue or unit of analysis. This particular research, aims to understand the marketing strategy of Volkswagen China during the recession economic recession.

Many believe that case studies are not suited for scientific research as the scope of generalization is limited. Flyvbjerg (2006) point out that case study is generally believed to be a pilot study used for generation of hypothesis and a case study cannot be of utility in themselves. He points out that case studies can be used for scientific research as well as can be generalized. He points out that generalization is possible for human affairs as well as natural sciences (Flyvbjerg, 2006).

Bonoma (1985) pointed out that case sturdy research is a useful tool that can be adopted by marketers and describes the four steps for case study research. According to his definition of case study, it is “a description of management situation” (1985, p.203). The case study research like other forms of qualitative research can employ both interviews and observation along with other sources of data collection such that it allows “perceptual triangulation” and help to portray a “fuller picture of the business unit under study” (p.203). These data may include financial data, data on region of operation, industry data, market performance data, competitive data, etc. he points out that case basically tries to provide the researcher’s interpretation of the “event, information, and reality” (p.204).

Further, mixing of qualitative and quantitative data for analysis within a case study is also possible (Kaplan & Duchon, 1988). Therefore, the interpretation is based more on interpretation of the researcher rather than on “objective reality” (p.204). Therefore, he suggests that the first stage is to understand the background of the research problem that he terms as the “drift stage”. This is when the researcher conceptualizes the problem. Then in the design stage, the events are unraveled. Then in the third stage, the generalization of the research is done wherein predictions or recommendations based on the research is done. The fourth stage explores the limitations of the research conducted and the problems that led to generalization of the research.

Research Design

This section describes the research design that will be adopted for analyzing the case study. The case study will be developed using the four-stage framework presented by Bonoma (1985) in designing a case study research in marketing.

Research Problem Identification

The first stage of the research would be to identify the problem area or the issue to be studied. This is done in the aim and objective section. This will lead to the research questions that will be answered through the case analysis. once the research problem is identified the case will emerge on the second stage.

Data Collection

The second stage of case study research is to collect relevant data for analysis. Data for case study research can be collected from various sources. One major source for case study research is to collect data from the organization under study, especially through their documents and reports. These form the plethora of primary documentations required for the study.

Further data can also be collected from newspapers, magazines, company reports, company newsletters, text books, etc. for this research, the data is primarily collected from industry reports, company websites, and company reports like annual reports and financial documentations, government statistical databases, etc. further information is collected from conference reports, newspapers, journals, and magazines. For this research data collection will be done at three levels – (1) macro level data of country and industry, (2) data on the company and competitive data, and (3) company presentations, reports, promotional campaigns, interviews of top management on marketing plans and issues of the company.

Theory Building

This stage will analyze the data and develop a framework for generalization of the research. In this part, the paper will try to point out the specific strategies that companies selling discretionary goods can adopt during recession. Further, the case will also demonstrate the differences in marketing due to changes in cultural setting.

Limitations

This section will demonstrate the limitations of the research and areas that has not been properly analysed. Further, this section will also identify gaps in research and the areas that can be used for further research.

Aim and Objective

Volkswagen started its operations in China at a very early stage when the rest of the automakers did not realise the hidden potential in the country’s market. The paper aims to understand the marketing strategy of Volkswagen in China, especially those taken by the company during the recent economic crisis. The paper is a case study analysis to understand the marketing and operational strategies of Volkswagen taken in China that resulted in the success of the company in the Chinese market.

The main aim of the paper is to understand the strategies suited for expansion in an emerging market for a multinational automotive company during the time of recession, when the developed markets of the world are under recession. The research paper will look into the condition of the Chinese market that helped Volkswagen to have high growth and the policy related opportunities that the country provided to the company’s success.

Further, the paper would try to ascertain the strategies that were taken by the company against the competitors in China, and the strategy for marketing and sales used for different brands of the company. During the recessionary period, due to declined market demand in developed countries, the major automakers of the world turned towards the emerging market. One of their main attractions was the Chinese market as it boasted of the fastest growing automotive market.

Evidently, there was an increase in competition for Volkswagen during the recession as most of the international players fought for a share of the Chinese pie. Therefore, understanding the competitor strategy of Volkswagen in a market where it had been a dominant player is important. Therefore, the strategy undertaken by Volkswagen to counter increased competition in the Chinese market during recession is done in the paper.

The strategy undertaken by the company to manage its supply chain and manufacturing in china played a vital role in cutting its costs in the Chinese market, and localization of its manufacturing firms. The paper aims to understand the operational strategy undertaken by Volkswagen during the recession that helped it to meet increased demand in China. Further, the paper will also try to understand the sales strategy of Volkswagen.

Broadly, the main objective of the paper will be to understand the marketing strategy taken by Volkswagen in China during recession. On a more precise note, the aim is to ascertain the particular marketing strategy in terms of marketing mix (i.e. 4 Ps), generic strategy, and competitor strategy undertaken by the company in China during the recessionary period of 2007 to 2009. This case study of Volkswagen would help us to understand how growth in China helped Volkswagen to increase its sales figure.

Research Questions

The research questions that the paper aims to answer are as follows:

- What was the marketing mix adopted by Volkswagen in China during 2007-09?

- What was the strategy adopted by Volkswagen to counter increased competition in the Chinese market during the period?

- What was the operational strategy of Volkswagen during the recession?

- What was the reason for expansion adopted by Volkswagen in China market, when all the rest of the major automobile companies were downsizing their operations?

Case Study Analysis

Automobile Industry in 2008-10 Recession

The automobile industry was severely affected due to the 2008-10 recession (OECD, 2009). During the recession, demand for cars fell significantly, thereby increasing the problem of excess production capacity, a problem that was already faced before crisis, and deepening further after the recession. Automobile industry by nature is capital intensive, and has a high capital to labor ratio. According to the OECD report, the production of automobiles has shifted to Asian countries (OECD, 2009).

From 2000 through 2007 the share of the US and Japan in global production of automobile fell from 40 to 30 percent. The recession may help to accelerate and intensify this structural shift in production of the global automobile industry. The reason for the shift is due to market saturation in developed countries and high production cost. The Asian countries with emerging, unexploited market and low production cost pose a lucrative target for companies. Due to the increased concentration of the global players over a few emerging markets, there has been a spur of mergers and acquisitions and joint ventures emerging in order to gain economies of scale.

The automobile sector cycles moves with the traditional business cycle (OECD, 2009). Further there is a high correlation found between car sales figures and private consumption. Therefore, with the recent recession, as private consumption fell sharply in developed nations, sale of cars also reduced. According to OECD: “The correlation coefficient has increased significantly in the past decade in the United States, Germany, and Canada. It was broadly stable in Japan, Italy and the United Kingdom, while it declined markedly in France.” (OECD, 2009, p.92) Therefore, the 2008-10 recession has severely affected the global automobile industry.

The average fall in car sales in all OECD countries was by 20 percent from September 2008 through January 2009 (OECD, 2009). In Europe however, the fall in car sales has been more for big, luxury cars, and the sale of small cars has not been hit so much. Further the production adjustment done by automobile makers in countries making more than 1 million units annually shows that in countries like the US, France, Italy, Spain, and the UK the production of cars fell sharply. In the US, production from 2007 to 2008 fell by 19.4 percent and that in Italy by 23.4 percent. In 2008-09, the production fell further in the US by 33 percent and in UK by 13 percent. However, in emerging markets like India, China, and Brazil car production increased by 6.8, 5.6, and 7.1 percent respectively in 2007-08.

Therefore, the developed countries were in trouble in terms of car sales and shrinking of maturing market. due to low consumer confidence in the US and UK, the demand for automobiles also fell sharply, thereby increasing excess capacity and putting big car makers of US like GM, Chrysler, and Ford in bankruptcy. The recession shifted the focus of the automobile industry from developed countries, which were the largest market for cars to emerging markets as they emerged through the recession as the largest buyers of cars.

The importance of China among the emerging countries was greater as it became the largest automobile consumer toppling the US and therefore becoming the apple of the eye for the recession hit auto industry. Further the market for cars in G7 countries have saturated. Developing countries like India, China, Mexico, etc. are expected to rise.

As in case of China, the car ownership level was very low. The income levels of the population have risen but the income elasticity of cars is very high compeered to developed nations. This combination of increasing income, low car ownership, and high-income elasticity indicates that the trend of car sale in China is expected to rise. According to OECD data, “Actual sales are also rising rapidly in line with the trend, increasing from approximately 4 million in 2005 to around 7 million in 2008.” (OECD, 2009, p.106) Therefore, the significance of China for auto industry is self-evident.

Country Level Analysis

Political

For the last 59 years, China has been under a single party (Communist Party of China) rule that led to consistent political decisions taken by the government. The success of the government lies in its one party rule, wherein the government need to go through the grind of conventional democratic negotiations. Further, the Chinese government has its focus on equitable growth since 1986, which has helped the government to establish free market policies and gain high growth rate.

Further HU Jintao has framed policies that would reduce the income gap between the rich and poor population of China in order to facilitate all round development. Since 2007, the country’s political presence in the international arena has increased as China entered into political ties with Poland, Finland, and few African countries (Datamonitor, 2008). Further, the pre-existing ties between China and the UK, USA, and Russia have been strengthened.

The Chinese political ties with the US has been improving, indicating a more cordial approach for trade, energy, and security issues. Further, China being one of the largest members of APEC (The Asia Pacific Economic Co-operation) is recently aiming for a free-trade agreement between the member countries. Such a free trade agreement will be helpful for China as APEC is mostly a trade-based organization. Free trade agreement between the ASEAN members (coming into force in 2015) will also benefit the Chinese government and trade situation in the country. Therefore, the increase political ties worldwide have helped China to become a more prominent political figure in the world.

There are political problems in the country related to Taiwan due to the boundary issue between Mainland China and Taiwan. Taiwan does not recognize Chinese government and there has been a constant verbal as well as military threat from China to Taiwan. Another volatile situation is Tibet that led to Chinese condemnation from other countries that led to great amount of negative publicity. Further, internally, there is a lack of coordination between the central and local Chinese authorities as there is a clash of interest between the two. This situation has led to higher inventory, unsold products, and rise of inflation in the country. The reason for this is lack of a federal government structure in the country (Datamonitor, 2008).

Economic

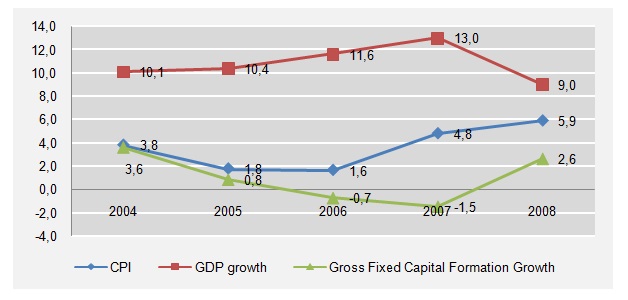

China is one of the fastest-growing economies in the world and one of the largest potential markets for multinational brands. The GDP growth of the country has been consistently around 10 percent since 2004 through 2008 (see figure 2). Therefore, the Chinese economy remained fundamentally strong even with the adverse effect of the recession. The gross fixed capital formation had started to fall since 2004 as it fell from 3.6 percent in 2004 to 0.8 percent in 2005. It became negative in 2006 at -0.7 percent and -1.5 percent in 2007. However, it again rose in 2008 to 2.6 percent.

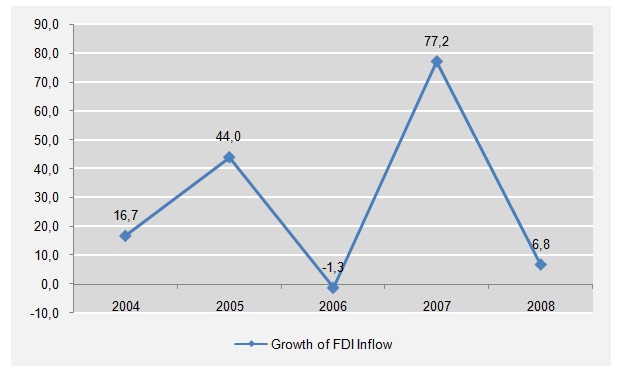

The flow of FDI into the economy has been very high, with actual FDI being around $60 billion in 2005 (OECD, 2010). The growth in FDI was maximum in 2007 at 77.2 percent and then fell to 6.8 percent in 2008. The FDI growth was negative in 2006 at -1.3 percent. The country had a positive trade balance with the export exceeding imports $101 billion. Therefore, the country rides a vehicle of high growth rate. China has the largest FDI flow in the world (Datamonitor, 2008).

The GDP growth rate was very high in China and the high growth rate was attributable to large foreign investment. The rate of investment constantly increased relative to the rate of consumption. In 2000, the 73 percent of the production was consumed with investment of just 25 percent and there was no export. In 2005, the situation changed completely, with consumption decreasing to 33 percent and investment increasing to 49 percent and export increased to 18 percent. Therefore, the economy was on a path of high growth rate and a consistent growth rate of around 10 percent is indicative of economic strength of the country.

However, there are areas of concern for the economy. First, is the huge gap in per capita income level of the urban and rural population. In 2005, the FDI growth rate was at 44 percent. The increasing income gap in urban and rural population is a sign of weakness for the economy and indicate a lack in full round development of the country. As observed earlier, the GDP growth was consistent at around 9 percent; however, there is a greater growth in the energy consumption in the country.

In 1985-2000, GDP growth was at 9.5 percent and the energy consumption growth was at 4.6 percent. However, in 2001-05, the consumption rate of energy went up to 10.7 percent and the GDP growth rate was at 9.5 percent. Thus, there was an increase in the growth of energy consumption, while GDP growth of the economy remained almost stable.

The Chinese government has encouraged favourable policies that led to economic reforms in 1978 and 1986 that led the country to become of the strongest economic powers in the world. The country is presently a socialist market economy and follows a three-step development program that began in 1987. The first two steps were to doubling and quadrupling the GNP and the third step (yet to be achieved) is to increase the per-capita GNP to the levels of developed countries.

The economic analysis demonstrates that the Chinese economy has been experiencing a very high growth rate. However, it faces certain problems related to income inequality in urban rural population and increased energy consumption that may create certain problems.

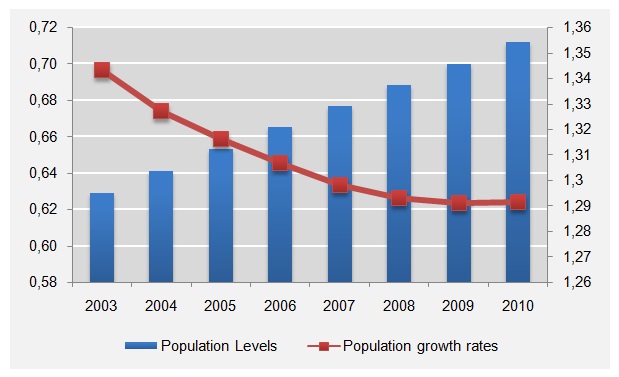

Social

One of the major problems of China has been its increasing population. The population of the country has been rising and is the largest populated country in the world. The Chinese government had adopted a one-child policy that officially allowed married couples to have only one child. This policy remarkably reduced the birth rate that was at 3 percent in 1970s to 0.6 percent in 2007 and to 0.6 in 2010 (OECD, 2010). In 1970s there were on an average 5.4 children per family that went down to 1.7 children per family indicating the success of the policy initially undertaken.

The life expectancy of the Chinese population has increased considerably and there has been a decline in infant mortality. The average life expectancy of the country increased from 32 years in 1950s to 74.4 years in 2006 (Datamonitor, 2008). Further infant mortality rate reduced from 32 deaths per 1000 births to 22.12 deaths per 1000 births from 1950 to 2006 (Datamonitor, 2008). Therefore, there has been a betterment in the health care services available to the Chinese population.

Poverty has also declined considerably in the country, with the percentage of population below poverty line decreasing from 64 percent in 1970s to 10 percent in 2004 (Datamonitor, 2008). The per capita income of the Chinese population is $1740 that is the highest in Asia. Further, with the Chinese growth plan, the developmental benefits are expected to trickle down further to the bottom of the pyramid.

A few of the problems that the Chinese social system is plagued with are gender differences, migration to urban areas, backwardness of the rural China, aging population, and increasing unemployment among graduate population of the country. The male female gender gap is affecting the social structure of the Chinese community. China has a male female ratio of 128:100, and it is actually higher among the “floating population” i.e. the migratory population of China. This has led the government to ban selective abortion of female fetus and provide cash incentive to only girl child families.

The floating population creates a serious concern for social imbalance, as there is a large chunk of the society migrating from rural underdeveloped areas to the more developed urban areas of China. The migration may be attributable to serious lack healthcare amenities in rural areas that have led to the migration. China has a high number of unemployment, especially graduate unemployment. The one child policy of China has created many problems with aging population as well as a gender imbalance in China. In 2007, 7 percent of the Chinese population is over 65 years of age (Datamonitor, 2008).

Technological

Technological changes in China have been ushered through great emphasis laid on research and development by Chinese government. One reason for high emphasis on technology is due to the political leaders coming from technology and research background. The gross domestic expenditure on research and development in China was 1.34 percent of GDP in 2005 that increased to 1.44 percent of GDP in 2007. The number of researchers in the country increased from 1.47 percent of the population in 2005 to 1.85 percent of the population 2007. One reason for such high research outcome in China is due to large number of research and development institutes in the country. However, some hindrances to the process of technological advancement are lack of IPR protection of new inventions.

Government interference in the research and development area may prove to be a major impediment in the technological development of China. As the country has a communist form of government, centralization of all matters related to technology raises government interference in research.

Figure 5: Brief comparison of average annual salaries of researchers (Datamonitor, 2008).

Further low salary provided to researchers in China may become a major hindrance to the development of new technologies in the country. Table 1 demonstrates that the salaries of Chinese researchers are lowest amounting to only $3956 per annual.

Legal

China has a decentralized court system with more than 300 laws that cater to the economic sector. Further mediation committees resolve maximum of civil and minor criminal cases at almost zero cost. Further, there are 800 thousand committees in both rural and urban areas. The Chinese government has a clear and smooth process for the flow of FDI. It takes a new company n90 days at the maximum to enter the Chinese market. There are problems related to maintenance of independence of judges, as there is excessive control over judiciary of senior politicians and bureaucrats. Further, there is a dearth of qualified judges in Chinese courts.

Environmental

China has a high degree of pollution with CO2 emission from fuel combustion amounting to 6028 and according to OECD; China could surpass the US in its carbon dioxide emission rate (OECD, 2010). Further, OECD study shows that 300 million people in China drink contaminated water and 190 million people have water related illness. Therefore, China is in midst of an economical crisis (OECD, 2010).

PESTLE analysis shows that the Chinese market is lucrative and best for cost effective production. The process of doing business in China is easy and hassle free for multinationals, and the consumer market strength and potential is very high. Further, the economic analysis demonstrates that the recession had minor effect on the Chinese economy and failed to deter its growth streak. Chinese economy continued to grow even during the recessionary period. The stability in the political arena due to one party rule has brought in stability in economic decisions of the government and the government policies even during the recession remained friendly towards multinational corporations.

Industry Level Analysis

Chinese Automobile Industry During Recession

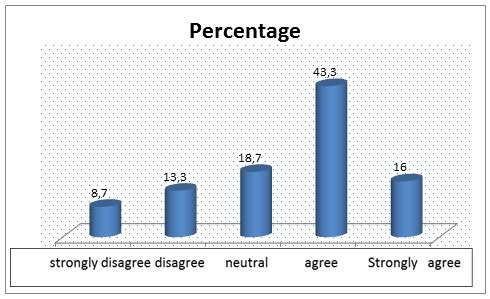

Chinese automotive industry had its inception in 1950s, however, rapid development and modernization was ushered in only in the 1990s. The value added in the Chinese industry by the automobile sector in 2002 was $19.1 billion, an amount that is 50 percent higher than the previous year (Zhu et al., 2007). The global recession created the world’s largest retail market in China (Sullivan, 2010). Chinese auto sales have surpassed the sales of the US during the recessionary period of 2007-09 (Sullivan, 2010). The production and sales data of the Chinese automotive market is shown in figure 6.

Figure 4 demonstrates that the Chinese automotive sales continued to increase from 2000 through 2009. The year on year sales growth was maximum in 2001 at 37 percent and 2002 at 35 percent. Then growth in sales fell to 15 percent and then rose to 25 percent in 2006. However, due to recessionary pressure the sales growth fell to 22 percent in 2007 and 7 percent in 2008, again increasing in 2009 to 45 percent.

Figure 7 provides a comparison in the sales of automobiles in EU (15), China, and the USA. The figure shows that the year on year sales growth in China has been greater than EU and US since 2000. However, during the recent recession, the sales growth of both EU and the US became negative with sales growth falling to -18 percent in the US and -11.8 percent in the EU in 2008, whereas that in China was 7 percent. This indicates that the Chinese automobile market was enjoying growth while the automotive market in developed markets of the world was shrinking.

The Chinese market for automobiles is increasing constantly. This paper analyzes the new passenger car segment of the Chinese market. In 2009 the Chinese new car market generated total revenue of $98.7 billion and it grew at a compound annual growth rate of 17.3 percent from 2005-09 (Datamonitor, 2009). The sales volume increased at a compound annual growth rate of 22.1 percent from 2005-09.

The sales volume in the Chinese market increased at an average annual rate of 23 percent from 2001-06 and it increased by 25 percent in 2007-09. However, the compound annual growth rates in 2001-06 period in the US was -0.7 percent and that in EU by 0.3 percent. The annual growth rate in the US and EU during the period of the recession (2007-09) was negative at -14.3 percent and -11.4 percent respectively. During the recession when the rest of the developed world was facing a decelerated growth in automobile sales, sales in China was increasing at an annual average of 25 percent, making it one of the most attractive automobile markets.

Porter’s Five Forces Analysis of the Chinese Automobile Industry

The Chinese market for automobile has a large number of buyers as the buying power of the Chinese population has been increasing steadily. Even though buyers have very low switching cost, they are highly price sensitive. Further, with high level of innovation and product differentiation in the automobile market provides greater choice to buyers thereby increasing their buying power. Automobile manufacturers in China have invested heavily on building their brands that reduces the buying power of the Chinese customers.

Due to global recession, price for raw materials as well as other products has been increasing, therefore increasing supplier power. However, recession had reduced the threat from new entrants. Threat from substitutes had increased, as there has been an increasing demand for used cars and public transport. Further consolidation in the automobile industry of China had left few players in the market, thereby increasing competition among rivals therefore resulting in decline of market share for individual companies. Therefore, the automobile industry in China is highly competitive with buyers and suppliers have high buying and selling power. There is also threat to the market from substitutes and new entrants.

Volkswagen in China

This section is dedicated to understand the company level performance, market, portfolio strategy of the company during 2007-09. In China Volkswagen operates in three entities – Volkswagen Group China, and in joint venture with FAW VW and Shanghai Volkswagen Automotive Company (SVWC). SVWC is headquartered in China and is held by Volkswagen AG, VW, and SAIC (Volskwagen , 2010). This unit produces products like the Passat, Touran, Polo hatchback, Polo saloon, Gol, etc. FAW-Volkswagen produces sedans like Sagitar, Golf, Bora, Jetta, Caddy, and Audi (Volskwagen , 2010). This section will provide overall understanding of the company operations in China.

Background of Volkswagen in China

Volkswagen was the first western automaker that entered the Chinese market. The VW office was first opened in Beijing in 1985. The journey began with successful joint ventures with SAIC was formed Shanghai Volkswagen Automotive (SVW).initially Volkswagen enjoyed almost a monopoly in the taxi and government car demand for almost 20 years. Volkswagen remained the leader in the Chinese car market until 2005 (Som, 2007).

The strategy to target the taxis and government cars in China was a lucrative strategy in order to credibility and brand recognition in the Chinese market. This strategy provided high volumes of sales, thus creating economies of scale for the company. The taxis were revamped, thus helping Volkswagen to introduce new cars. In 1988, the taxis were usually made up of red colored VW Santanas. In 2000, the taxis in Shanghai underwent another revamp and now the model has been changed to Passat B5.

Volkswagen China plays a crucial part in garnering a high growth rate of the company in 2008-09. In 2010, Volkswagen has sold more cars than its competitors in China (Soh, 2010). The growth rate of vehicle sales in china increased by 32.4 percent in 2009 (Volskwagen, 2010). Volkswagen brand has a very strong market in china, as it boasts of a 28 percent of its total sales is in China (Soh, 2010). Among the emerging markets, china has a 19 percent share of auto market worldwide, and Volkswagen has a share of 33 percent of the Chinese auto market (Soh, 2010). In 2009, Volkswagen delivered 1,118 thousand units to the Chinese market. It enjoys a dominant market share of 13.2 percent and had the largest sales in 2009 in mainland China (Soh, 2010). In Hong Kong, it has a market share of 10.5 percent (Soh, 2010).

Volkswagen started its china operations in 1978. From 1984 to 2009, the company has invested €7.8 billion (Vahland, 2010). The turnover of the company in 2009 was €20 billion in China. This shows that the financial success of the company in its China operations. Until 2004, it was compulsory for multinational corporations to enter China through joint ventures. For this Volkswagen relied on two partners – FAW and SAIC.

The company has a joint venture with two companies in China i.e. FAW Volkswagen Automotive Co. Ltd. (FAW set up in 1990) and Shanghai Volkswagen Automotive (SVW set up in 1984) to look into the china manufacturing operations for the company. SVW is a joint venture with 40 percent share of Volkswagen AG and 10 percent by Volkswagen China Investment Company. At present, there are 19000 employees in SVW plants. FAW-VW has an employee strength of 11,700 and 20 percent of its stakes are with Volkswagen AG, 10 percent with Volkswagen China Investment Company, 10 percent with Audi AG, and 50 percent with FAW.

Volkswagen in China began its operations in 1978. In 1984, the company started doing business in china through a joint venture with Shanghai Automotive Industrial Corporation (SAIC) and formed Shanghai Volkswagen Automotive (SVW). It has many of its manufacturing units spread across different cities in China. In 2009, Volkswagen had joint ventures with 16 companies in the country (Vahland, 2010). It created joint ventures to network supply accessories to the automobile plants. One of the main factors that facilitated the success of Volkswagen in China was its ability to nurture and maintain long-term joint venture relation with its partners.

The company sold cars under three brand categories. First were the Volkswagen group of brands that consisted of Volkswagen, Skoda, Bentley, and Bugatti. Audi brand group has two car brands i.e. Audi and Seat, and the other group is Volkswagen commercial vehicle group. The paper will concentrate only on the Volkswagen brand of cars sold in china. For the Volkswagen brand cars, both FAW and SVW were used as operational and distribution channels in China.

Volkswagen’s Marketing Strategy in China

Volkswagen had aggressively marketed its automobiles in the Chinese market due to its immense potential. However, the company saw a rise in competition in the market due to the increased the fast growth opportunity that attracted other companies. However, Volkswagen continued to concentration the Chinese market with introducing 10 new models in 2007-09 (CSC, 2009). Therefore, there were changes in its strategy during the recession, in order to counter competition, manage external pressure, and market conditions.

Unlike many of its competitors, like Toyota who reduced their global production due to recession, Volkswagen continued with its expansion plans, especially for the Chinese market (CSC, 2009). Volkswagen continued with its plans to introduce better technology products into the Chinese market even during the recession. This demonstrates a strategy that is different from other automakers, and therefore, must be studied in order to draw the elements of success in the company’s plans.

Volkswagen China enjoyed undisputed market share until 2000 when it has a market share of 53 percent in China. However, with opening of the market and the lucrative market proposition in China, other international brands entered the market, and the VW market share slipped to 24 percent in 2004 and finally to 16.5 percent in 2009 (See figure 8).

Brand portfolio

The overall brand portfolio of Volkswagen AG is presented in the following figure.

Figure 10 present the brand portfolio of Volkswagen AG. Volkswagen has 8 brands in its world worldwide market. In China, the company has 6 out of these 8 brands. These brands are marked in dark green in the figure – Audi, Lamborgini, Volkswagen, Skoda, Bentley, and Commercial vehicles. In this paper, only Volkswagen brand is discussed.

In China, Volkswagen group works in joint venture with FAW and SVW. Audi operates in alliance with FAW and caters to the luxury, premium market of the country. The target customers are the rich and the brand proposition is “prestige and excellence” (Volskwagen , 2010). The differentiating factor of Audi in the luxury car segment is its sporty appeal and progressive style and sophistication. The distribution in China is through one dealer i.e. FAW.

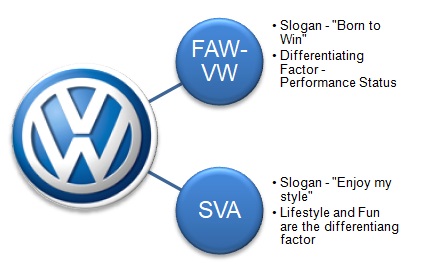

Volkswagen brand operates in China through two joint ventures – one with FAW and the other with SVW. Through FAW Volkswagen manufactures and distributes original Volkswagen cars, while through SVW it manufactures cars made specifically suited for Asian conditions. The target customers for FAW-VW are prestige and performance, while SVW-VW targets at lifestyle and fun for Chinese populace. The slogan for FAW-VW is “Born to win” indicating the performance panache of the cars. The slogan also indicates at the performance based differentiating factor of the cars. the slogan of SVW-VW is “Enjoy my style”. The core value of the brand lies in its appeal to lifestyle and fun figment in the brand. For Volkswagen, the company operates through dual dealers in China.

The Skoda brand of Volkswagen is distributed through single distribution channel i.e. SVW. The differentiating factor of Skoda cars are based on its functionality and intelligence. The target customers look for efficiency and life in Skoda cars and therefore are called “Smart buy” in the Chinese market. The brand slogan is “Simply Clever” indicating that utility and functional nature of Skoda cars. the company sales channel in China is through single dealer network.

Competition Analysis

Figure 10: Competitor Analysis of Volkswagen in China (Datamonitor, 2009; Datamonitor, 2008; Pricewaterhouse Cooper, 2009; Bloomsberg, 2010).

Table 2 presents a tabular comparison of the performance of top competitors of Volkswagen China. The companies have been chosen from the companies who have the maximum market share after or above Volkswagen China. The comparison shows that the largest automobile company of China is FAW with profit margin of 20.8 percent and 21.8 percent in 2007 and 2008 respectively. It has the largest market share in Chinese passenger car market. The company produces passenger cars, commercial vehicles, luxury coaches, etc.

The profit margin of FAW even during the recession (in 2008) was 81 percent higher than that of Volkswagen. Further, the market share of FAW remained constant at 23.6 percent in 2008, whereas that of Volkswagen increased marginally. The other automakers like Toyota and GM who alternately held the third and fourth position in the Chinese automobile market, held only 8.3 and 7.5 percent market share.

Toyota in China produces conventional engine vehicles and hybrid vehicles. The product portfolio of Toyota comprises of small vehicles ranging from mini to compact vehicles, mid-sized cars, luxury, sports, and speciality cars (Datamonitor, 2009). Daihatsu is the subsidiary with which Toyota has alliance to sell compact and mini vehicles in China. The financial performance of Toyota in 2008-09 has been bad with the company reporting a net loss of $4223 million.

General Motors (GM) was one of the largest automakers of the world before the recession hit in 2007. The Asia Pacific operations of the company is one of the most profitable ventures and has different brands of products like the Buick, Cadillac, Chevrolet, Daewoo, Holden, Opel, and Saab (Datamonitor, 2008). In China GM has subsidiary and joint venture with Shanghai GM, CAMI Automotive, Suzuki Motors, New United Motor manufacturing, SAIC-GM-Wuling Automotive Company, and CAMI Automotive (Datamonitor, 2008). Therefore, FAW is the largest competitor of Volkswagen in China where it holds the second largest market share.

Product Portfolio of Volkswagen AG in China

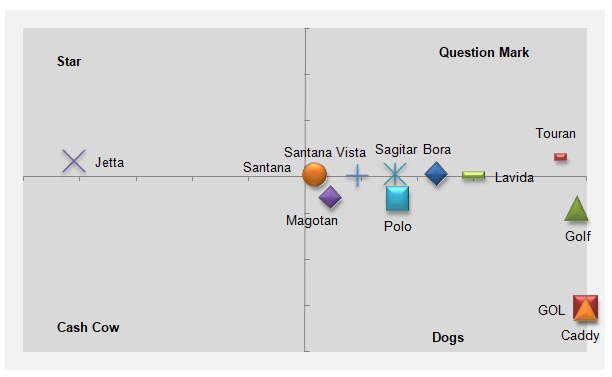

BCG analysis analyzes the three brands under Volkswagen Group China i.e. Volkswagen, Audi, and Skoda. The sales figures for 2007 and 2008 are derived and the rate of change is calculated. The sales growth is then measured relatively on the overall growth of the total market of cars in China. This step provided the related market growth of the brands in China. The BCG analysis of Volkswagen brands in China are discussed further in the next paragraph.

The BCG analysis, shows that of the three brands belonging to the group, Volkswagen (VW) brands have high relative growth and high market share. This shows that the growth VW brand is greater than the growth of the Chinese automobile market. VW is evidently the most profitable product in the portfolio of the company, with little investment required to develop the market as VW market has already matured in China. The market share of Volkswagen is largest in the country in passenger vehicle segment. This however, does not include commercial vehicles. The strategy that Volkswagen must for its VW brand is product development.

In case of VW, development of new products has become essential as the market for VW has matured and without new product introduction, there would be a stagnation in the sales growth, and therefore, may reduce market share. Therefore, the best option is to introduce new products using the technology available in the market, therefore, increasing the chance of gaining greater market share in the Chinese market. If new products were not developed, then there would be chances of the brand moving to the fourth quadrant i.e. Dogs, and therefore ruining the brand. As the overall automotive market of China is expected to grow, it would be wise to introduce new products. However, if Chinese market shows any sign of slowdown, then the best option would be to retrench.

Audi brand is in the fourth quadrant marked Dogs. The brand enjoys a low growth as well as low market share in a market. However, analyzing the brand in respect to the overall market will be erroneous as Audi is essentially a luxury car brand and fall in the category of Mercedes Benz and BMW. If the other three luxury car brands producing in china are considered i.e. Mercedes and BMW, Audi has the largest sales in luxury brands car.

While considering for the luxury brands in China, Audi falls in the Question Mark quadrant, indicating a very high growth market for luxury cars in China. Further, this indicates that the luxury brand cars is a high growth segment in Chinese market, but the share of luxury brand cars like Audi is low in overall market share. The methods that can be employed for growth of this brands are through greater market penetration, as luxury car brands were growing in the Chinese market even when the developed countries were experiencing recession. Therefore, the market for luxury automobiles must be developed in order to increase the market share.

Skoda is a brand that is observable in the Question mark quadrant of the BCG matrix. Here Skoda is taken to be car belonging to the same category as VW with same product portfolio. The Skoda is a brand that has high growth in the market but has very low market share. Therefore, the only strategy that can be opted for the brand is to increase market penetration. The BCG analysis shows that the best brand in Volkswagen China portfolio is VW that has the largest market share in the passenger car segment. The analysis presents that for VW brand product development is the key for greater success.

Volkswagen Sales and Performance in China

China has been a major market for Volkswagen for many years. In 2009, the geographical segment wise sales figures are presented in the figure below. The sales of Volkswagen vehicles in China only have been 18 percent. This shows that Volkswagen has always concentrated on the Chinese market, while other major automakers like Toyota, GM, and Ford have concentrated on the mature markets like the US.

The sales performance of Volkswagen China has been better than other regions as in China the company increase sales as well as market share even during the recession. In this section, a comparison of growth of Volkswagen in China and that in developed market of the Americas and Europe is done in order to understand the effective growth of the company.

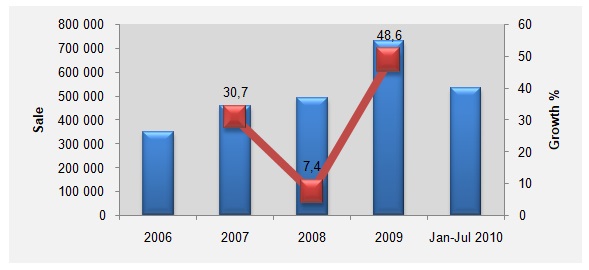

Figure 13: Comparison of Sales in EU, USA, and China.The Chinese market is observed to be growing faster than the developed countries during the recession. Figure 9 demonstrates that the sales growth of Volkswagen in China had fallen in all three geographical areas, however, the sales growth had become negative in the US, and EU whereas in China it still remained positive. Further, the Chinese auto market started to recover from 2008, whereas the automobile markets of the US and EU still showed negative growth that deepened further.

Table 1: Volkswagen Group China Performance.

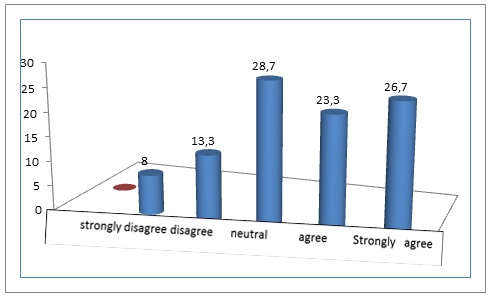

The sales figure of SVW since 2006 is presented in the following figure. The figure shows that the sales of SVW continued to increase from 2006 through 2009. The sales figure grew from 2006-07 by 30.7 percent. However, the sales growth fell drastically to 7.4 percent in 2008. The reason for the fall in the sales of car sale was probably the fall in export of automobile, increased competition from other international brands like Toyota, GM, and Honda, and global recession. However, sales picked up in 2009 when it grew by 48.6 percent. The half-yearly sales figure of 2010 shows that SVW had already sold 534364 units in China.

The overall performance of Volkswagen group china shown in the above table demonstrates that the group had been enjoying a leap in sales and profit even during the recession. The recessionary phase increase the sales figure by 36.7 percent and the turnover increased by 44 percent. Thus, even though the market share of Volkswagen declined considerably in China, VW remains the market leader in car sales in China mainland.

Brand Portfolio

This section will discuss the different brands of Volkswagen in China and about their positioning in the Chinese market. The Volkswagen brand cars are sold in China through two dealers i.e. SVW and FAW-VW. The two joint ventures of Volkswagen aim at two different segments of customers.

As in case of SVW, Volkswagen makes cars that are more tuned for Chinese conditions. These cars are made specifically keeping in mind the need of the Chinese customers. Therefore the slogan used by SVW is “Enjoy my style” implying the Asian characters imbibed in the cars. The differentiating factor of these cars is their sporty, fun, and lifestyle appeal. On the other hand, the cars made by FWA are cars that keep in mind the more conservative European style. The cars are designed and made in accordance with the European needs and thereof provide a more western feel to it. These cars stress on performance and therefore, the slogan used is “Born to win”.

Volkswagen differentiates between its own brands in order to minimize cannibalization.

The BCG matrix shows in China market, the only brands that is performing successfully during 2008 was Jetta that had a high market share as well as high rate of growth. The other brands like Santana, Bora, Lavida, and Touran were in the question mark quadrant. This implies that the brands are operating in a high growth market as is China, but they have a low market share. Usually a new product that is launched in a high growth market will be considered to be a question marks. In this case, brands like Sagitar, Touran, Bora, and Golf are new brands and therefore, require time to gain market share.

These are in question mark section as the Chinese market is a high growth market, these brands, if not accompanied with proper marketing can become cash sink. The strategies that companies adopt in case of recession are new product development, and market development. Further, it can be observed that the sales for Volkswagen cars are more than that of older models. The development of market is important for Volkswagen in China as the market in the eastern mainland is getting saturated. The aim of the products present in this segment is to increase their market share as they have a high growth potential in a growing market, but without proper marketing, the brands will be swept down to Dogs.

The other brands like GOL, Mogotan, Golf, and Caddy are present in the fourth quadrant i.e. Dogs. These brands typically have low market share and low growth rate. In this case, some brands like GOL have very low market share as well as growth. Such non performing brands should be discontinued. Whereas, others like Polo, Mogotan, or Golf can be revitalized as there is moderately growth high, but they enjoy very low market share. Proper positioning and targeting of the market can help in promoting these brands further in the Chinese market.

Segments and Target Market

The Chinese market segmentation is done on basis of two criteria – value orientation based on traditional to modern values and social status that is segregated into three categories i.e., high, upper, and middle. According to this segmentation, there are seven customer segments in Chinese automotive market. First is the traditional middle class buyer who is price and quality conscious. This segment wants low budget cars that are durable. The second segment are small families with modern values but belonging to middle class status. These customers want versatility and economy in their discretionary purchase.

The third group belongs to the traditional value orientation group but belonging to the upper middle class status. These customers look for traditional luxury cars. Then there is a segment of nontraditional but not completely modern segment and belonging to the upper middle class look for prestige and competition in their purchase of automobiles.

The fifth segment is modern upper middle class female buyers who look for lifestyle appeal and technology. Then there is the higher-class segment with modern values. These customers look for modern appeal, performance and excellence in their cars. The last segment is the traditional higher income status group who looks for status and comfort in their purchase. Based on this segmentation Volkswagen China targets its customers.

The target market of Volkswagen is decided based on purchasing power of households and characteristics of the Chinese customer group. The target customers of Volkswagen is increasing among the age group of 26 to 35 years and 18 to 25 years. This shift indicates that there would be more young buyers looking for higher sporty, technology, and funk feel in their cars. Then there is an expected increase in female car purchasers in China.

The targeted customers mainly look for performance in cars, lower cost, and features and technology in cars. According to research, there is an increasing trend among Chinese buyers for 4-door sedans than hatchbacks (Jian, 2006). Therefore, the target customers for Volkswagen group would show certain shift in term of gender and age as there are more female and younger potential purchasers in the market.

Marketing Mix

The marketing mix of Volkswagen cars is presented in this section. Marketing mix is presented through four Ps i.e. Product, Price, Promotion and Place. This section will discuss the marketing mix of Volkswagen cars in China market and the various ways the company tackles these four Ps.

Product

Volkswagen cars in China are produced by two joint ventures i.e. FAW/VW and SVW/VW. The cars produced by these two companies are differentiated completely in order to prevent overlaps and cannibalization. FAW produces original Volkswagen cars and are responsible for the production and distribution of primarily sedan models of the VW. On the other hand, SVW is responsible for making “Asian Cars”, made specifically for China keeping in mind the Chinese customers and their demands. The differentiating factors for the cars made by these cars are different – for FAW it is Performance status, while that for SVW it is lifestyle and fun.

The SVW cars have a competitive cost structure and the brand has a Chinese appeal to it. The SVW presently produces 7 Volkswagen branded cars – Tiguan, Lavida, passat, Polo, Touran, Santana, and Santana Vista (Shanghai Volkswagen, 2010). These products are customized according to the Chinese customer preferences. The highest selling car from SVW stable in 2009 was Santana/Santana Vista, Touran (Soh, 2010). The placing of the products are with high price conscious Chinese customers who want more technology oriented, sporty vehicles. Therefore, the cars made by SVW are characterized by their sporty and fun appeal. The sale of new models like Passat, Toran, Lavida has been higher than older brands like Santana (Soh, 2010).

FAW produced cars are 6 Volkswagen brand cars – Jetta, SAgitar, Bora, Magotan, Golf, and CC. they produce more top end cars who differentiate themselves on performance status. The cars will be having a higher positioning indicating a target segment with higher income. The share of sales of new models like CC, Golf, New Bora, Sagitar has been gradually increasing while that of older model like Jetta has been falling.

Even though the share in sale for older car Jetta has been falling, the overall sales figure in 2009 for Jetta is higher than new models like Bora, Sagitar, Magotan, and Golf (Soh, 2010). This clearly demonstrates that the market for older models produced by both SVW and FAW has been reducing and the Chinese customers are gradually moving towards more new designs and technology models.

The main product strategy is to provide diversified product portfolio to the Chinese customers in order to meet their varied requirements. The cars are made to meet different taste and references, and to meet any need. The main marketing strategy of Volkswagen in China was differentiation. By offering a large variety of products, the aim of the group is to target the optimum number of Chinese customers. Further, the products of Volkswagen will cater to more local preferences, with newer models designed for the Chinese taste.

Earlier the design of Volkswagen cars was more European in style and essence. However, due to higher competition from Japanese carmakers like Honda and Toyota who are more attuned to Asian preferences, Volkswagen reacted by specifically making cars catering to Chinese taste. The Volkswagen cars compete on basis of quality and style in the Chinese market.

One of the problems with Volkswagen products for Asian market is that their product portfolio has more European style, luxury oriented cars, while Asian customers want smaller cars with good quality and performance. Therefore, the luxury cars of Volkswagen stable were losing against more Asia oriented vehicles of Hyundai and Honda. The product stable of Volkswagen has just one hatchback to offer – Polo and Mini.

However, the demand for smaller cars lower than 1-liter engine in China has increased just by 7 percent in 2007 and that for subcompact cars were up by 4 percent, whereas the sale for compact cars and sedans were up by 46 and 35 percent respectively (Roberts & Rowley, 2007). Earlier the sale of bigger car was boosted by a ban on driving of cars with smaller engines in many city centers. However, with lifting of that ban and a new tax on larger engines, and the recession have shifted the demand has predictably shifted to smaller cars.

Price

Till 2005, the prices for Volkswagen cars in China were high (Roberts et al., 2005). Until 2005, most of the auto, sales companies were state owned and the buyers in China did not worry about the prices. However, with liberalization of the sales for automakers, consumers wanted the best deal for their money, and therefore, became highly price conscious. With a buoying middle class, it is the common people who are buying cars in China and therefore they want good branded small cars that are price and quality efficient. Therefore, the demand for smaller cars has increased substantially.

Further, with the recession of 2008-10, and rising increase of inflation in China, there has been a fall in demand of cars in China (Ying et al., 2010). With inflation increasing to 2.9 percent in 2010, the demand for discretionary goods like automobile fell sharply. However, with high production level of the Chinese automakers and low sales, there was excess capacity with the carmakers, and therefore, most of the carmakers started giving price incentives to customers.

The pricing of other brands like Cherry is low at around $4000 making it an accessible price point for many middle class Chinese customers. The demand for smaller cars is high due to their lower pricing and therefore most Chinese companies have become proficient in making smaller cars.

The analysis of Volkswagen Group China sales by segment forecast is shown in the above figure. It demonstrates that the demand for smaller cars like Polo and Mini were expected to increase more than the other bigger higher end cars like Passat and Phaeton. The demand for more compact cars like Golf was also expected to increase considerably. Therefore, the demand for smaller cars and compact cars were expected to increase in the Chinese market and therefore the pricing strategy was done more competitively for the smaller cars while the luxury-oriented cars were targeted towards a more niche customer segment.

Promotion

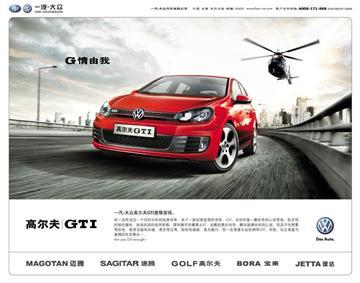

The promotions of Volkswagen are directly aimed towards their potential customer group. With change in the target, customers from traditional to modern and younger customers there are more promotions to attract this customer group.

As Volkswagen has a car for all age groups, one such car if Golf GTI targeting 25-35 year old men with a tag line “’Are You GTI Enough?”. The styling of the car and the personality is made to suit the target customer group. Even the campaign of Golf GTI is based on an “action-packed plot involving mystery, espionage and a spectacular car vs helicopter chase” (UTalkMarketing.com, 2009)

As there is an increase in female purchasers and customers looking for lifestyle appeal in their cars, Volkswagen has started promoting their Beetle on this appeal in China. The New Beetle was launched as a fashion brand with an appeal towards customers from all time (Fitzsimmons, 2008). Therefore the Beetle campaign was targeted towards plus 30 years consumer group who were style conscious and individualistic. Further Volkswagen also created a Chinese language website for the New Beetle along with other online campaigning methods.

Further, the red carpet launch TV commercial launch of CC put the car in the luxury car segment of China. The slogan of the car is “Glamour Comes Standard” demonstrating the luxury appeal of the car.

Promotional campaigns used by Volkswagen are through TV commercials, print media, online advertising, viral marketing, sporting events like Chinese grand prix, etc. online marketing has been used increasing by Volkswagen marketers in China in to appeal to the growing number of Netizens in China (Tiltman, 2008). In this line, SVW has launched a campaign called “MY SVW Club” where customers can write blogs to join the competition of blog writing (Forbes, 2007). Further, traditional marketing events and pre-sale launches of new brands played a crucial role in product positioning and reaching the target customer. Therefore, Volkswagen has aimed to create a versatile and diversified promotional campaign for its product portfolio.

Place

The production of Chinese Volkswagen through joint venture with FAW and SVW is done trough Changchun and Shanghai. Through this two-dealer network, Volkswagen aims to provide more than 20000 dealerships around the country. With increased synergies and partnership between the two joint ventures, Volkswagen aims to increase their supply chain performance by increasing their coordination. For this, on the production front, Volkswagen has bundled and created a common sourcing process for the company for both FAW and SVW in China.

Bundled purchasing volume in china will increase the possibility of one supplier platform in China and for carry over parts. This will reduce competition and increase synergies between the joint ventures. Further, it will also create economies of scale and increase localization of the products. Therefore, the company will have a common sourcing platform, two from each group thereby creating less competition and increasing synergy. This is expected to reduce cost by almost 40 percent (Koch, 2006).

Further Volkswagen initiated its South China Strategy 2018 to expand to he southern districts of China in Hong Kong (Volskwagen, 2009). The aim of targeting Hong Kong is to target the increasing purchasing power in the island. For this Volkswagen has created two new vehicle plants – one in Chengdu with the aim to reach out to western China and other two plants in Guangdong and Nanjing to target the southern China market.

Recommendations

From the above case analysis, it is evident that Volkswagen has been the monopoly leader in Chinese passenger car market till the end of 2000. However, once other competitors entered the market the market share of the company reduced drastically. The case analysis shows a distinct line between the Volkswagen strategy before and after the recession that hit the global economy in 2007.