Introduction

Walmart has consistently implemented its policies and has undergone significant improvements throughout its performance. Specifically, the company has maintained its exceptionally cheap pricing policy while accepting the need to promote employee engagement (Nilufer, 2020). However, while having achieved tremendous success in the retail industry, Walmart needs to evolve further to maintain its competitive advantage. Since expansion should be seen as the most viable and reasonable solution for Walmart currently, an appropriate financial plan must be deployed. Specifically, the company will have to introduce a policy for sustainable and cost-effective management of its financial resources so that it could seek available investment options.

Business Case

Description

The case under analysis involves Walmart and its attempts to expand beyond its current range of influence by venturing into new markets. The foray into an entirely new economic setting is always fraught with risks, primarily those associated with unforeseen costs caused by the lack of understanding of and insight into the specifics of the target environment. However, by performing a thorough market analysis identifying core threats and opportunities in relation to its financial capacities, Walmart will be able to enter the target setting successfully.

Type of Business

The company under analysis operates in the retail industry on a global level. The organization’s current business model can be described as a multinational corporation, namely, a C corporation (Pandey et al., 2021). The specified structure allows the organization to maintain profitability while expanding continuously and embracing new opportunities. Walmart’s current business model can be described as partially brick-and-mortar (Pandey et al., 2021). On the one hand, the company still has a substantial chain of retail stores; on the other hand, Walmart has embraced the opportunities of the online economy and e-commerce (Pandey et al., 2021).

Sources of Funding

The company’s capital structure has a combination of debt and equity in its framework, which introduces a certain extent of flexibility into its financial approach and the development of a financial model appropriate for the target context. The company’s current sources of funding include equity and venture capital, as well as the opportunities associated with self-funding and the use of borrowing and community programs (Nilufer, 2020). The specified variety allows Walmart to retain its competitive advantage of offering the lowest prices in the retail industry.

Financial Plan

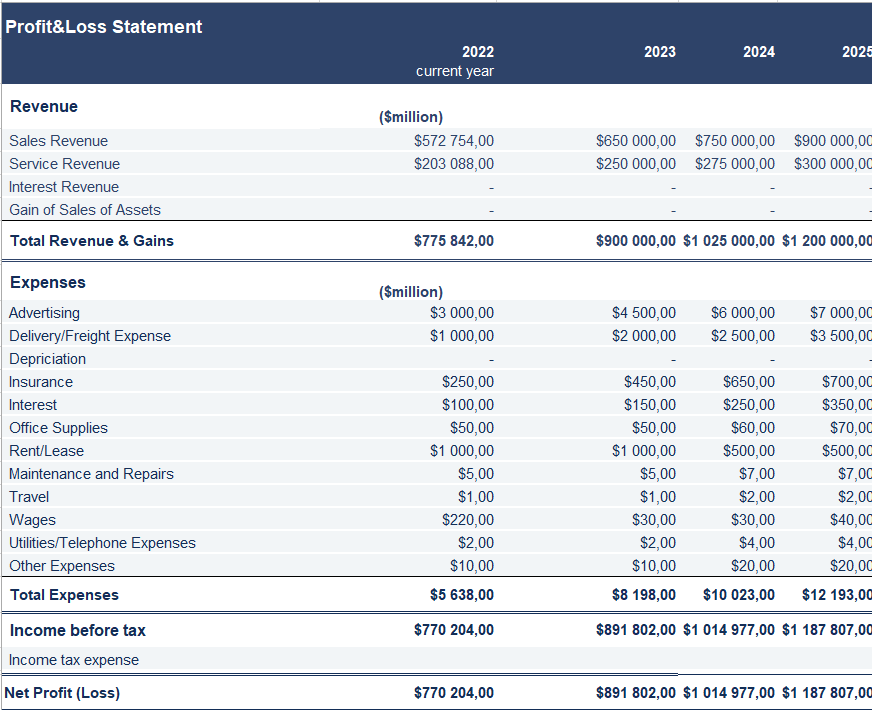

A Profit-And-Loss Statement for 3 Years

As Figure 1 above demonstrates, the company’s expenses are expected to rise, primarily due to the challenges associated with the availability of the required resources and the need for suppliers to increase prices. Currently, the advertising issue poses the greatest concern for the organization since the target markets are likely to have major retail organizations that have already established a strong presence and profound influence within the local economy. Therefore, Walmart will have to make extra efforts in order to appeal to the specified population.

Project Revenue

However, Walmart’s revenue is also expected to rise accordingly, therefore, allowing the organization to stay afloat. Specifically, it is assumed that the company will be able to multiply its revenue by at least 1.5 within the next three years. The specified change is expected to take place due to the increase in the company’s share and its gradual expansion into new markets. Namely, it is assumed that Walmart will enjoy success in the target markets as it expands further. Though minor issues are expected to occur while the organization adjusts to the new setting, the company is believed to be able to firmly establish itself in the new market.

Costs

At the same time, it can be predicted that the costs to be taken by the organization will also increase exponentially. Namely, the core costs to be considered will be associated with the necessity to hire new workers in the target markets. Additionally, the expenses related to a promotion campaign to attract the attention of the target population are to be taken into consideration as well. Finally, the supply costs are to be recognized as a crucial part of the expenses that Walmart will take in the new market setting. Specifically, the organization will have to build a local supply chain from scratch, identifying new suppliers and building connections with them, which will require a substantial amount of resources. Finally, attracting new staff members will suggest that the organization will need to offer appropriate reward systems with sufficient salaries and benefits.

Conclusion

By promoting the policy of financial sustainability and a cost-efficient approach to the management of the firm’s resources, Walmart will be able to address the challenges associated with expansion into other markets. Particularly, investment opportunities and the options for minimizing risks while allocating resources in the way that benefits the organization most will be explored. Additionally, the proposed framework will help Walmart to address the issue of indirect costs, some of which may turn out to be barely predictable. In turn, the proposed framework will allow the company to reduce the threats of failing to identify investment options or attracting new customers within the expected amount of time.

References

Nilufer, N. (2020). Critical assessment on business strategy from aviation to retail industry during COVID-19 Pandemic: A Walmart Case. International Journal of Business Ecosystem & Strategy (2687-2293), 2(2), 8-14.

Pandey, R., Dillip, D., Jayant, J., Vashishth, K., Nikhil, N., Qi, T. J., & Qhi, L. Y. (2021). Factors Influencing Organization Success: A Case Study of Walmart. International journal of Tourism and hospitality in Asia Pasific (IJTHAP), 4(2), 112-123.