Executive Summary

The company selected for review is Waste Management, Inc., which is a leading company in the waste management industry. The waste management industry has been growing at a rapid pace. However, there are few companies that operate in the U.S., and they specialize in different forms of waste management. The financial analysis performed in this report highlights the company’s strengths and weaknesses, which must be taken into consideration by the management to formulate its future strategies.

The main weaknesses indicated in the analysis were the company’s high debt position and poor liquidity. On the other hand, it is highlighted that the company had strong profitability and effective asset management. The company’s stock traded at higher price multiples, which implied that the capital market’s participants expected the stock price to increase in the coming periods.

The Industry

It is clear that Waste Management, Inc. operates in the U.S. waste management industry. A brief overview of the industry is provided in the following.

History

The history of waste management in the U.S. indicates that garbage collection and disposal was very difficult. Mostly, landfills were used to unload millions of tons of garbage collected from different parts of the country. However, the problem became severe in the 1990s when the country’s landfills refused to accept any additional waste. Since then, the government, through private partnerships, have focused on recycling, and these companies recycle almost 20 million tons of waste and garbage every year.

Challenges

There are major challenges faced by the industry, including the rapid growth of waste generation that makes it challenging for companies and municipal authorities to manage, collect, and transport to waste management companies. The price competition between companies has made it difficult to earn extra cash for further investment.

Outlook

The waste management industry is valued at $73 billion per annum. It has experienced significant growth in the last few decades. The growth of the industry is directly correlated to consumer spending, which is anticipated to accelerate in the coming periods. Therefore, it could be stated that the main factors of growth include an increase in consumer spending and economic activity, which generates high volumes of waste that have to be managed. Moreover, the emphasis on recycling has increased significantly in the last few years as municipal lands do not allow hazardous materials to be disposed of without recycling.

Current Position

Currently, the industry has 2,879 businesses performing different activities. The industry grew by 2.7% in the last five years.

Influences

The major influences including consumer spending, economic growth, government regulations, public-private investments, collection and transport networks, consumer behavior, and new technologies.

The Company

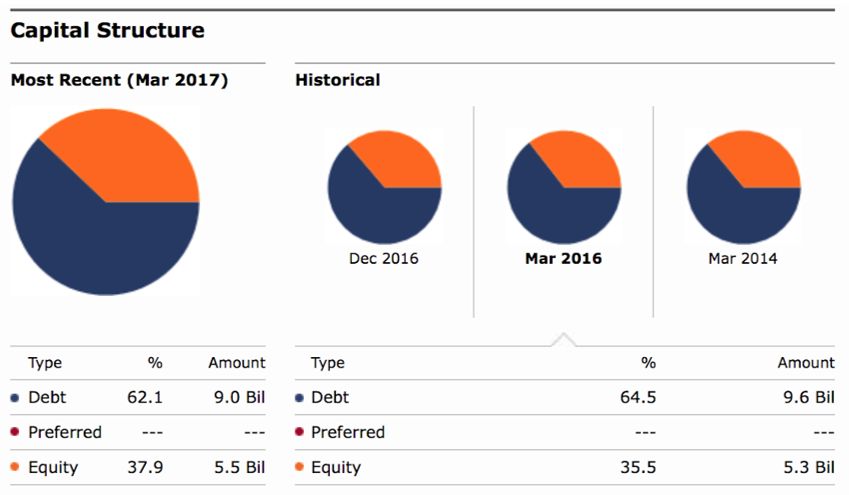

Waste Management, Inc. is a leading waste management company operating in the U.S. The company was established in 1971, and its head office is located in Houston, Texas. The company experienced significant growth in the last four decades. Its main strategy is to acquire other businesses and implement new and better technologies to improve the efficiency of its operations. The company’s last reported sales were $13,609 million, and its capital structure comprises debt and equity, as indicated in the following figure.

Challenges

The company’s annual report for the year ended 2016 indicated that it faced several challenges, including the following.

- Declining oil prices, which has lowered the cost of manufacturing plastic rather than recycling it.

- Lack of consumer understanding and knowledge of recycling procedures.

- The limited capacity of solid waste landfills.

- Declining profit margins.

- The limited investment in new projects and technology.

Time Trend, Peer Group Analysis

The financial analysis of Waste Management, Inc. (WM) is based on financials reported by the company in the last five years. Moreover, the analysis compares the company’s financial performance with its closest competitor i.e. Republic Services, Inc. (RSG). The report also provides values of industry averages, which are calculated as averages of ratio values of RSG and Stericycle, Inc. as the industry averages were not available.

Liquidity

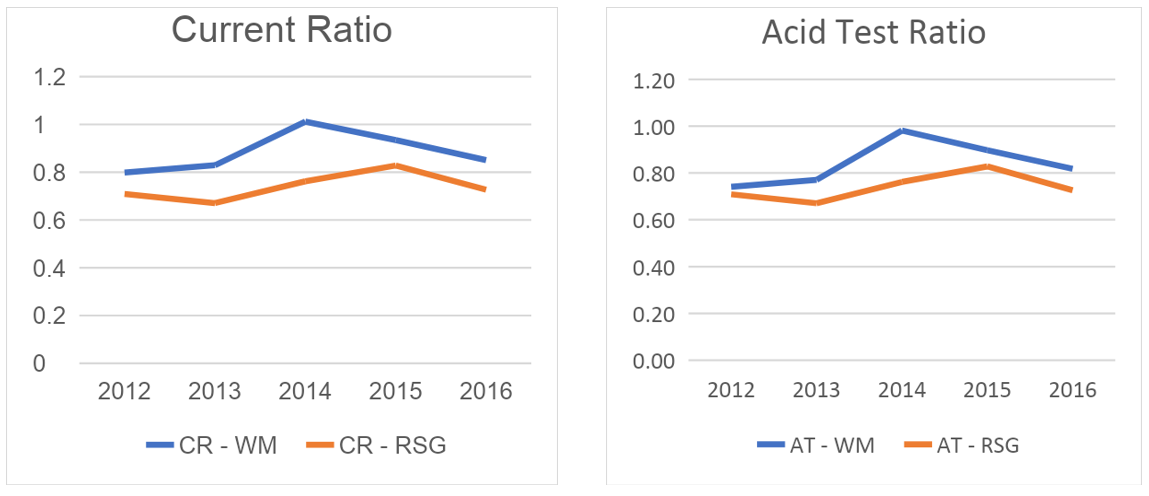

The liquidity analysis indicates that the company’s liquidity position remained weak in the last five years. The major reason for this was the high values of accrued liabilities and borrowing. The values of both current and quick ratios were less than one, which indicated that WM and RSG had a similar financial position with current liabilities more than its current assets.

Table 1: Liquidity Ratios – WM.

Table 2: Liquidity Ratios – RSG.

Furthermore, the analysis indicates the low-liquidity trend was common in the industry as industry averages were also similar.

Asset Management

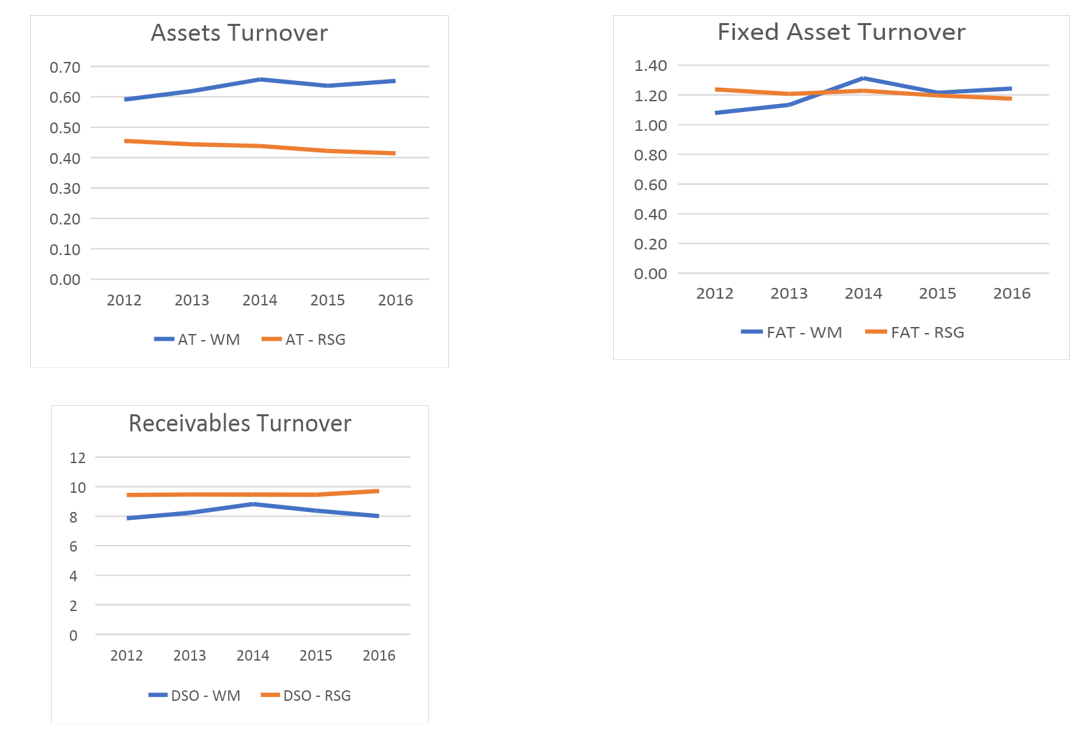

The analysis of the company’s asset management had mixed results. The industry is highly capital intensive, and companies, including WM rely on advanced technologies for increasing their output. The total asset turnover remained close to $0.6 per $1 in assets, and its value was more than RSG. The value of days’ sales outstanding ratio did not change much in the last five years as the company reported slow growth in its sales. However, the company took a longer time than RSG to receive cash for its credit sales. The fixed asset turnover indicated that the company’ generated more than $1.2 in sales for every $1 in fixed assets, which was similar to RSG. The inventory turnover was not calculated because both companies did not have any inventory.

Table 3: Asset Management Ratios – WM.

Table 4: Asset Management Ratios – RSG.

Furthermore, the analysis indicates the company’s effectiveness of asset management was similar to other participants in the industry as values of industry averages were similar.

Debt Management

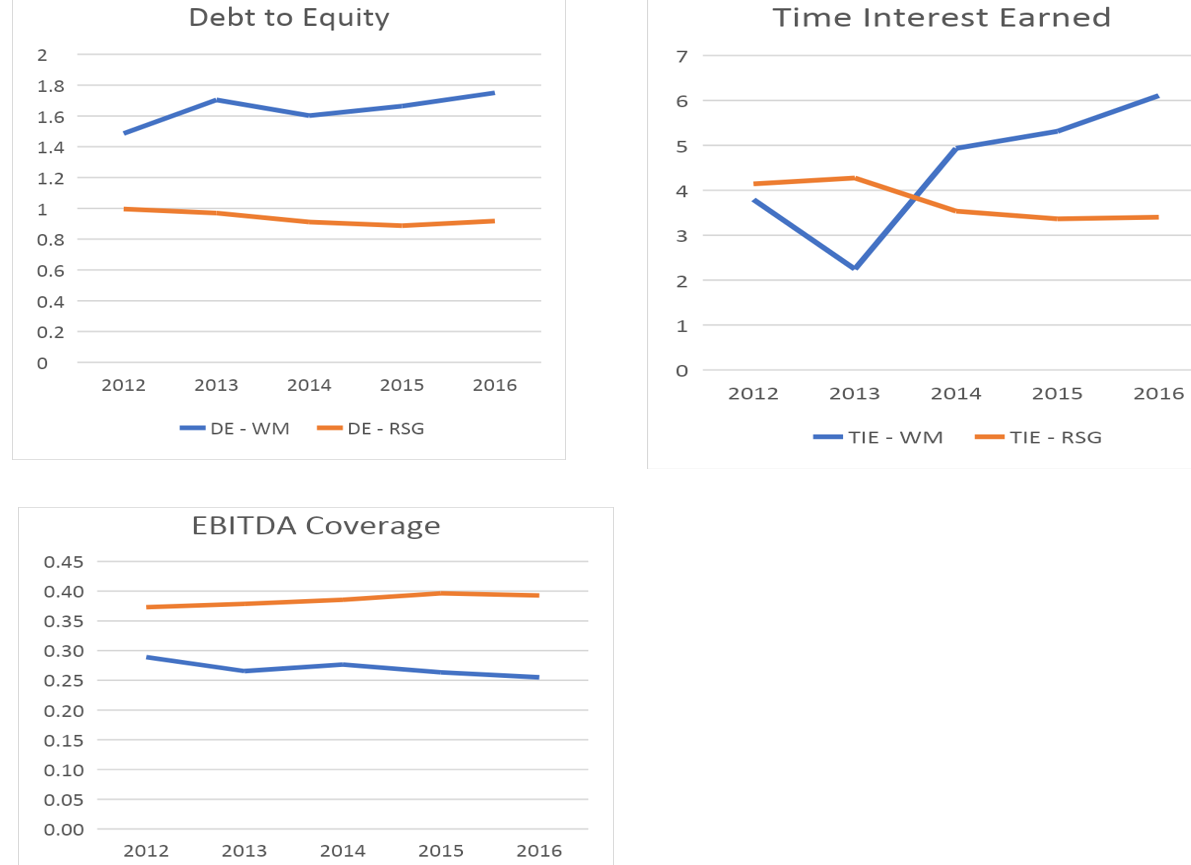

The debt management of the company is assessed by calculating the values of three key ratios. The analysis indicates that the company was highly leveraged as the debt-to-equity ratio value remained above one. It raises major concerns regarding the company’s ability to finance its operations through equity funding. However, it could be noted that the company generated a high operating profit, which was sufficient to meet its interest obligations.

Therefore, it could be suggested that the company relied on external borrowing to take advantage of the low cost of borrowing. It applies to RSG as well because its ratio values were similar, which indicated a highly leveraged position. The values of EBITDA coverage ratio indicated that the company had a strong position as it had sufficient EBITDA to pay its interest expense.

Table 5: Debt Management Ratios – WM.

Table 6: Debt Management Ratios – RSG.

Furthermore, the analysis indicates that the values of the company’s solvency position were lower than the industry averages.

Profitability

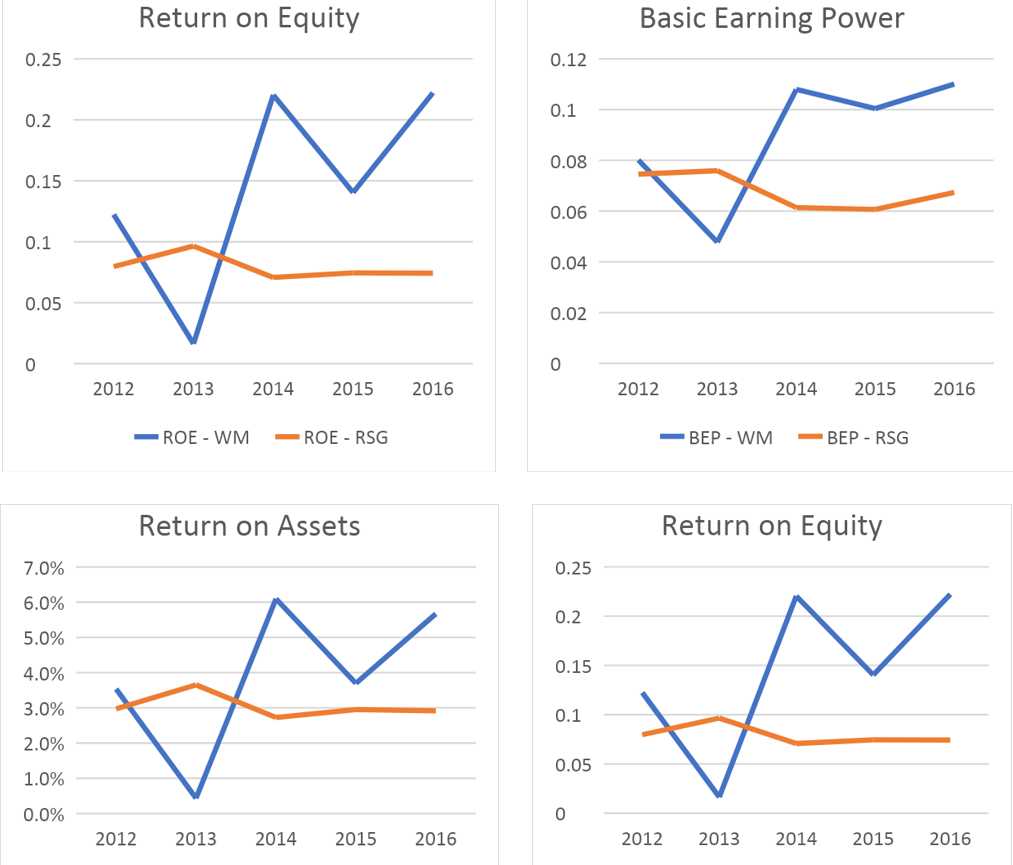

The company’s profitability analysis indicated that it had high-profit margins in 2016. However, it could be noted that the company had a fluctuating position in the last five years as its net income decreased significantly in 2013 and later improved in 2014. Moreover, the company experienced another major dip in 2015. It clearly suggested that the nature of the industry is cyclical. The company’s profit declined as its recycling business was affected by low oil prices.

The values of all profitability ratios including NPM, BEP, ROA, and ROE reflected that the tough market conditions and competitive forces did not allow the company to grow in a consistent manner. On the other hand, it could be noted that RSG had a stable position as the values of profitability ratios showed sufficient growth in the last five years. However, its profitability remained weaker than WM.

Table 7: Profitability Ratios – WM.

Table 8: Profitability Ratios – RSG.

The analysis also indicated that the company had better profitability than other companies in the industry.

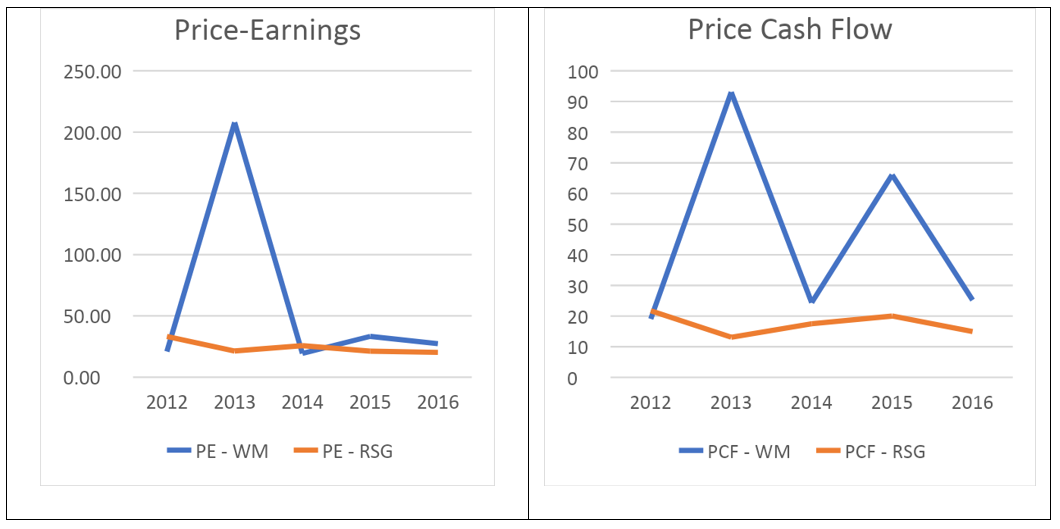

Market Value Evaluation

The market value ratios indicate that the company’s stock were traded at high multiples in the last five years. The stock market participants had positive views about the company and its ability to grow. The company leads the market, and it has a strong position in solid waste management market. Therefore, it could be expected that the stock price would further increase in the future. Similarly, RSG also had high price multiples, which indicated shareholders of both companies could gain from their holdings in their stocks.

Table 9: Market Value Ratios – WM.

Table 10: Market Value Ratios – RSG.

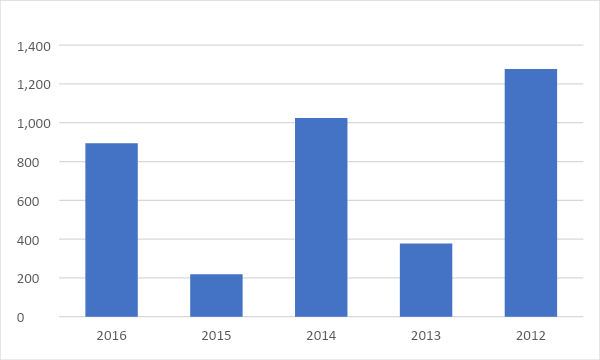

Free Cash Flow (FCF)

The FCF of WM fluctuated significantly as the company experienced major shifts in its profitability position. The company’s FCF was $1,277 million in 2016, whereas RSG had FCF of $936 million. Both companies invested heavily in acquiring new plant, property, and equipment. Moreover, they had a similar NOWC condition as their current liabilities were more than current assets.

Table 11: FCF – WM.

Table 12: FCF – RSG.

Conclusion

The analysis carried out in this report indicated that the U.S. waste management industry is a growing industry. The industry is currently facing various challenges including tough price competition and low profitability. However, the market is growing, and there are many opportunities for the existing companies to expand their business through acquisitions. Waste Management, Inc. is the leading solid waste management company. The financial analysis indicated that the company had weak liquidity and solvency in the last five years. Moreover, its profitability fluctuated significantly, which could be problematic for the company and its shareholders.

However, the company had strong free cash flows, which was a positive sign that indicated its financial strength. It could be expected that the company will generate better results in the coming periods based on its investment in capital equipment. It is recommended to buy the company’s stocks with caution.

References

2014 SEC Form 10- K – Republic Services. (2014). Web.

2014 SEC Form 10-K Waste Management. (2014). Web.

2017 SEC Form 10- K – Republic Services. (2017). Web.

2017 SEC Form 10-K Waste Management. (2017). Web.

Groden, C. (2015). The American recycling business is a mess: Can big waste fix it?Fortune. Web.

IBISWorld. (2016). Waste treatment & disposal services in the US: Market research report. Web.

Waste Management Inc WM. (2017). Web.

Waste Management, Inc. (WM). (2017). Web.